Professional Documents

Culture Documents

Debashis 2

Uploaded by

alok nayakOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Debashis 2

Uploaded by

alok nayakCopyright:

Available Formats

Bajaj Finance Ltd.

4th Floor, Bajaj Finserv Building,

Off Pune Nagar Road, Sakore Nagar, Pune 411014.

Payslip for month of November 2023

Emp.No. : 02010730 Bank Nm: STATE BANK OF INDIA. UAN : 100763165821

Emp.Name : Debashish Nayak Acc.No.: 33230497822 PRAN:

D.O.J. : 16.10.2021 EPF No.: PUPUN15498422200042269

Designation: MANAGER - DEBT MANAGEMENT SERVICES - RUR EPS No.: PUPUN15498422200042269

Sub.Sub.Dpt: RCD PAN No.: BAIPN6538B Tot.Days Paid Days LWP Arr.LWP

City : CUTTACK 30.00 30.00 0.00 0.00

NP Recov. PL Adj. Fin NP. Exc.Lev

0.00 0.00 0.00 0.00

Earnings (Current Month) Earnings (Cummulative) Deductions (Current Month) Deductions (Cumulative)

Basic Salary 11,250.00 House Basic Salary 78,750.00 Ee PF contribution 1,800.00 Ee PF contribution 14,400.00

Rent Allowance 5,625.00 Special House Rent Allowance 39,378.00 Professional Tax 200.00 Professional Tax 1,600.00

Allowance 15,012.00 Special Allowance 99,690.00 Income Tax 6,210.00 Income Tax 14,441.00

Statutory Bonus 2,512.00 Statutory Bonus 19,874.00 I care Deduction 100.00 I care Deduction 800.00

Monthly Incentive 14,062.50 Monthly Incentive 147,070.50 Medi (Topup Self-N.S 89.00 Salary Advance Reco 25,960.00

Penal Incentive 8,236.06 Cross Sell Incentive 5,800.00 Medi (Topup Self-N. 711.00

Rounding adjustment 0.44 Penal Incentive 69,699.18

Arr.Special Allowanc 37.00- Contest Incentive 14,000.00

Arr.Statutory Bonus 37.00

Total Earnings 56,698.00 Total YTD Earn. 474,261.68 Total Deductions 8,399.00 Total YTD Dedn. 57,912.00

Net Pay 48,299.00 FORTY-EIGHT THOUSAND TWO HUNDRED NINETY-NINE

*** INCOME TAX WORKSHEET FOR THE MONTH OF November 2023 (Projection is based on current month's salary to form the Taxable Gross)

Form 16 Summary Annual Exemptions Investment Details

Total Salary 611,857.68 Ee Ann PF contribution 21,600.00

P.TAX(incl.prev.er.) 2,400.00 Med.Insr.Prm.(Non Sr.Ctz) 711.00

Std. Deduction 50,000.00

Gross Tot Income 559,458.00

Agg of Chapter VI 22,311.00

Total Income 537,150.00

Tax on Total Income 19,930.00

Tax payable and surcharge 20,728.00 Annual Perks

Tax deducted so far 8,231.00

Net tax payable 12,497.00

Tax Deducted in Cur Month 6,210.00

This is system generated payslip and requires no signature.

You might also like

- Group 3: Quizzer On Installment SalesDocument33 pagesGroup 3: Quizzer On Installment SalesKate Alvarez100% (2)

- Cocolife Cancellation LetterDocument1 pageCocolife Cancellation LetterIanRoseAcelajadoAderes50% (2)

- Payslip 104883 112021Document1 pagePayslip 104883 112021arvindNo ratings yet

- Payslip May2017 SF396Document1 pagePayslip May2017 SF396abhilash H100% (1)

- Salary Slip XLXDocument2 pagesSalary Slip XLXDeepak50% (4)

- Employee Details Payment & Leave Details: Arrears Current AmountDocument2 pagesEmployee Details Payment & Leave Details: Arrears Current AmountVyas Keshini100% (1)

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Document1 pageVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (1)

- Sal FebDocument2 pagesSal FebHimanshu Sekhar SahuNo ratings yet

- TCS Salary SlipDocument1 pageTCS Salary Slipkrishna100% (1)

- Employee Details Payment & Leave Details: Arrears Current AmountDocument2 pagesEmployee Details Payment & Leave Details: Arrears Current AmountBipuri PavankumarNo ratings yet

- 3bdbf6dd-6c71-49c2-a618-4c7251a260cfDocument2 pages3bdbf6dd-6c71-49c2-a618-4c7251a260cfadilsgr0% (1)

- MR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDDocument1 pageMR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDSharanu HosamaniNo ratings yet

- Business Planning and Financial Forecasting PDFDocument30 pagesBusiness Planning and Financial Forecasting PDFsufijinnNo ratings yet

- Risk and Rates of Return ExerciseDocument61 pagesRisk and Rates of Return ExerciseLee Wong100% (2)

- Payslip PDFDocument1 pagePayslip PDFYogi’s iphone No ratings yet

- Chaitanya 1Document1 pageChaitanya 1rajendrarao5588No ratings yet

- Payslip 02Document1 pagePayslip 02rajendrarao5588No ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current Amountabhilash eNo ratings yet

- 2Document1 page2aditya kumarNo ratings yet

- OCT 2023 UnlockedDocument2 pagesOCT 2023 UnlockedSWADHIN KUMAR SAHOONo ratings yet

- Nov2019 60013470 PDFDocument1 pageNov2019 60013470 PDFParvinder SinghNo ratings yet

- Jul 2023Document2 pagesJul 2023NilanjanNo ratings yet

- 2D46D407Document1 page2D46D407Dhyan MothukuriNo ratings yet

- Razorpay Software P.L: Pay Slip For The Month of April 2021Document1 pageRazorpay Software P.L: Pay Slip For The Month of April 2021ARSHU . SNo ratings yet

- SalarySlip 8484236Document1 pageSalarySlip 8484236Vikram MaanNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAmrit RajNo ratings yet

- JuneDocument1 pageJuneRmillionsque FinserveNo ratings yet

- PayslipSalary Slips - 11-2020-1 PDFDocument1 pagePayslipSalary Slips - 11-2020-1 PDFSukant ChampatiNo ratings yet

- Payslip Jul2023 EDU - 01098Document1 pagePayslip Jul2023 EDU - 01098PrabhuNo ratings yet

- Payslip For: FEB-2022: Louis Berger SASDocument1 pagePayslip For: FEB-2022: Louis Berger SASMukhtar AhmedNo ratings yet

- Payslip 147988 202312-27Document1 pagePayslip 147988 202312-27SUNKARA ISNo ratings yet

- $valueDocument1 page$valueSureNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAnkur murarkaNo ratings yet

- Pay Slip July 2020...Document2 pagesPay Slip July 2020...laxman lucky100% (2)

- Fiserv November SalaryDocument1 pageFiserv November SalarySiddharthNo ratings yet

- Earnings Deductions MTH - Rate Arrears Total Earned Arrears Total DedDocument1 pageEarnings Deductions MTH - Rate Arrears Total Earned Arrears Total DedShubham GargNo ratings yet

- 'KS21596'NovDocument1 page'KS21596'NovRiya paiNo ratings yet

- Nikhil KotakDocument2 pagesNikhil Kotaknikhilkadam607No ratings yet

- Salary Slip FebDocument1 pageSalary Slip FebDee JeyNo ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- Ranjan KumarDocument2 pagesRanjan KumarRanjan KumarNo ratings yet

- Payslip Sep 2022Document1 pagePayslip Sep 2022GloryNo ratings yet

- Payslip For: JAN-2022: Louis Berger SASDocument1 pagePayslip For: JAN-2022: Louis Berger SASMukhtar AhmedNo ratings yet

- Bhakti Yoga by Swami VivekanandaDocument1 pageBhakti Yoga by Swami Vivekanandaindhar666No ratings yet

- Salary SlipsDocument2 pagesSalary SlipsshailNo ratings yet

- Dec Payslip - Rekrut IndiaDocument1 pageDec Payslip - Rekrut IndiafkadirNo ratings yet

- Nov Salary SlipDocument1 pageNov Salary Slipvarunyadav3050No ratings yet

- Fiserv January SalaryDocument1 pageFiserv January SalarySiddharthNo ratings yet

- Payslip October 2023Document1 pagePayslip October 2023rajusingh05071992No ratings yet

- India NOV 2021Document1 pageIndia NOV 2021Sunil YadavNo ratings yet

- 2023 11 qWIavwwVV0gWRmwVnoUpdgDocument1 page2023 11 qWIavwwVV0gWRmwVnoUpdgnsmankr1No ratings yet

- June 2023 PayslipDocument2 pagesJune 2023 Payslipgomathi7777_33351404100% (1)

- Employee Details Payment & Leave Details: Arrears Amount CurrentDocument2 pagesEmployee Details Payment & Leave Details: Arrears Amount CurrentRamesh yaraboluNo ratings yet

- Feb PayslipDocument1 pageFeb Payslipsaikumar padakantiNo ratings yet

- Pfeda Synthetics PVT LTD: Payslip For The Month of January, 2020Document3 pagesPfeda Synthetics PVT LTD: Payslip For The Month of January, 2020parvinderNo ratings yet

- Conneqt Business Solutions Limited: 318667 Bhushan JadhavDocument1 pageConneqt Business Solutions Limited: 318667 Bhushan JadhavBhushan JadhavNo ratings yet

- Payslip SepDocument1 pagePayslip SepBrajesh PandeyNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAkhila ChinniNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current Amountindhar666No ratings yet

- Payslip 10 2020Document1 pagePayslip 10 2020anil sangwanNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- References 5Document1 pageReferences 5alok nayakNo ratings yet

- Dev 2Document1 pageDev 2alok nayakNo ratings yet

- Methods of Birth ControlDocument8 pagesMethods of Birth Controlalok nayakNo ratings yet

- ReportDocument26 pagesReportalok nayakNo ratings yet

- References 5Document1 pageReferences 5alok nayakNo ratings yet

- PubertyDocument5 pagesPubertyalok nayakNo ratings yet

- Contents JituDocument1 pageContents Jitualok nayakNo ratings yet

- ID Correct Option ID ID Correct Option ID ID Correct Option IDDocument1 pageID Correct Option ID ID Correct Option ID ID Correct Option IDalok nayakNo ratings yet

- ScoreDocument4 pagesScorealok nayakNo ratings yet

- Ug CertifiacteDocument1 pageUg Certifiactealok nayakNo ratings yet

- The Hindu Review November 2022Document52 pagesThe Hindu Review November 2022Kurlapalli DevarajNo ratings yet

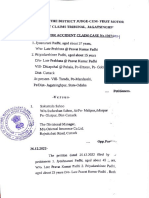

- S TSC 92212282621297Document4 pagesS TSC 92212282621297alok nayakNo ratings yet

- The Making of A Global World: I) The Pre-Modern World # Silk Routes Link The WorldDocument5 pagesThe Making of A Global World: I) The Pre-Modern World # Silk Routes Link The Worldalok nayakNo ratings yet

- TapScanner 12-27-2022-21 03Document7 pagesTapScanner 12-27-2022-21 03alok nayakNo ratings yet

- S TSC 92212092447580Document4 pagesS TSC 92212092447580alok nayakNo ratings yet

- Debashis 2Document1 pageDebashis 2alok nayakNo ratings yet

- The Rise of Nationalism in Europe: Shobhit Nirwan'SDocument13 pagesThe Rise of Nationalism in Europe: Shobhit Nirwan'Salok nayak100% (2)

- S TSC 92212201809081Document3 pagesS TSC 92212201809081alok nayakNo ratings yet

- CodingDocument31 pagesCodingalok nayakNo ratings yet

- What Is Project?: Unit - 2Document30 pagesWhat Is Project?: Unit - 2alok nayakNo ratings yet

- Steps of Unix Os InstallationDocument3 pagesSteps of Unix Os Installationalok nayakNo ratings yet

- Statement20221220225209 1Document1 pageStatement20221220225209 1alok nayakNo ratings yet

- Resident CertificateDocument1 pageResident Certificatealok nayakNo ratings yet

- ScannerGo 1643270551404Document10 pagesScannerGo 1643270551404alok nayakNo ratings yet

- DebuDocument1 pageDebualok nayakNo ratings yet

- RRRRRRDocument2 pagesRRRRRRalok nayakNo ratings yet

- Adobe Scan Dec 26, 2022Document5 pagesAdobe Scan Dec 26, 2022alok nayakNo ratings yet

- Class 1 - New (4 Files Merged)Document54 pagesClass 1 - New (4 Files Merged)alok nayak100% (1)

- AparupaDocument4 pagesAparupaalok nayakNo ratings yet

- Gold Export GhanaDocument3 pagesGold Export Ghanamusu35100% (4)

- IAS 20 - Accounting For Government Grants and Disclosure of Government Assistance (Detailed Review)Document8 pagesIAS 20 - Accounting For Government Grants and Disclosure of Government Assistance (Detailed Review)Nico Rivera CallangNo ratings yet

- Transaction StatementDocument2 pagesTransaction StatementSatya GopalNo ratings yet

- Indian Capital Market: Current Scenario & Road Ahead: Prof Mahesh Kumar Amity Business SchoolDocument44 pagesIndian Capital Market: Current Scenario & Road Ahead: Prof Mahesh Kumar Amity Business SchoolasifanisNo ratings yet

- Accounting For Debt Srvice FundDocument10 pagesAccounting For Debt Srvice FundsenafteshomeNo ratings yet

- Executive SummaryDocument2 pagesExecutive Summarycsaswin2010No ratings yet

- Ray, K - Crises, Crashes and Speculation. Hegemonic Cycles of Capitalist World-EconomyDocument20 pagesRay, K - Crises, Crashes and Speculation. Hegemonic Cycles of Capitalist World-EconomyEEMNo ratings yet

- Cee 5 PDFDocument38 pagesCee 5 PDFMUHAMMAD IRFAN MALIKNo ratings yet

- Business Plan: Silver Bear LodgeDocument28 pagesBusiness Plan: Silver Bear LodgeVaibhav AgarwalNo ratings yet

- Guide To Elliott Wave Analysis - RecogniaDocument5 pagesGuide To Elliott Wave Analysis - RecogniaIvonne TorrellasNo ratings yet

- Groww Nifty Total Market Index Fund KIMDocument37 pagesGroww Nifty Total Market Index Fund KIMG1 ROYALNo ratings yet

- Foreword: Equity Markets and Valuation Meth-OdsDocument124 pagesForeword: Equity Markets and Valuation Meth-OdsPaul AdamNo ratings yet

- Exchange Rate Exposure and Its Determinants Evidence From Indian FirmsDocument16 pagesExchange Rate Exposure and Its Determinants Evidence From Indian Firmsswapnil tyagiNo ratings yet

- CVP For Real Estate ProjectDocument2 pagesCVP For Real Estate Projectvivi lewarNo ratings yet

- Final Accounts - Trading, P&L and Balance SheetDocument3 pagesFinal Accounts - Trading, P&L and Balance SheetVivek Singh SohalNo ratings yet

- Valuation of Tangible AssetsDocument2 pagesValuation of Tangible AssetsNick ShahuNo ratings yet

- One Up On Wall StreetDocument4 pagesOne Up On Wall Streetok okNo ratings yet

- Cost CapitalDocument28 pagesCost Capitalaliashour123No ratings yet

- Mountain State With NotesDocument12 pagesMountain State With NotesKeenan SafadiNo ratings yet

- Far Compre DraftDocument27 pagesFar Compre DraftMika MolinaNo ratings yet

- Assignment 1Document3 pagesAssignment 1Nassir CeellaabeNo ratings yet

- Accountancy MSDocument13 pagesAccountancy MSJas Singh DevganNo ratings yet

- Fund Fact Sheets NAVPU Captains FundDocument1 pageFund Fact Sheets NAVPU Captains FundJohh-RevNo ratings yet

- Part A Answer All The Question 4 1 4Document3 pagesPart A Answer All The Question 4 1 4jeyappradhaNo ratings yet

- Chap 004Document30 pagesChap 004Tariq Kanhar100% (1)

- Dhani Finance PDF-2Document4 pagesDhani Finance PDF-2shaileshkumar443155No ratings yet