Professional Documents

Culture Documents

Provisional Interest Certificate - 56465233 - 221527539

Uploaded by

dinesh makwana0 ratings0% found this document useful (0 votes)

21 views1 pageThis document is a provisional interest certificate provided to Dinesh Makwana for the period of April 2023 to March 2024 for their home loan with IDFC FIRST Bank. It details that the total amount payable over this period is Rs. 330,023, including Rs. 320,466 in interest and Rs. 9,557 in principal. The document also notes that the interest and principal amounts are subject to change based on prepayments or changes to the repayment schedule.

Original Description:

Original Title

Provisional Interest Certificate_56465233_221527539

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a provisional interest certificate provided to Dinesh Makwana for the period of April 2023 to March 2024 for their home loan with IDFC FIRST Bank. It details that the total amount payable over this period is Rs. 330,023, including Rs. 320,466 in interest and Rs. 9,557 in principal. The document also notes that the interest and principal amounts are subject to change based on prepayments or changes to the repayment schedule.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views1 pageProvisional Interest Certificate - 56465233 - 221527539

Uploaded by

dinesh makwanaThis document is a provisional interest certificate provided to Dinesh Makwana for the period of April 2023 to March 2024 for their home loan with IDFC FIRST Bank. It details that the total amount payable over this period is Rs. 330,023, including Rs. 320,466 in interest and Rs. 9,557 in principal. The document also notes that the interest and principal amounts are subject to change based on prepayments or changes to the repayment schedule.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

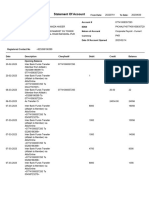

To,

DINESH HASTIMAL MAKWANA

Tuesday, October 31, 2023

FLAT NO 1102 ELEVENTH FLOOR WING BBUILDING TYPE

Loan Account No.: 56465233

MD ADDRESS 2 SUNCITY TOWNSPHASE I KANTI

REGENCY VASAI WEST

Provisional Interest Certificate 01-APR-2023 to 31-MAR-2024

This is to state that DINESH HASTIMAL MAKWANA , (Co-applicants: SANGEETHA MAKWANA ) has/have been provided a

Home Loan with Loan Account No.:56465233

The above loan is repaid in instalments comprising of Principal and/or Interest.

The total amount payable from 01-APR-2023 to 31-MAR-2024 is Rs. 330,023.00.

The break-up of this amount into Principal and/or Interest is as follows:

Payable from 01-APR-2023 to 31-MAR-2024

Total of EMI Amounts + Part-payments + PreEMI if any Rs. 330,023.00

Principal Component Rs. 9,557.00

Interest Component Rs. 320,466.00

1. The PAN Number of IDFC FIRST Bank Limited: AADCI6523Q

2. The Interest and Principal component figures are subject to change in case of prepayment, non-payment of EMI and/or change

in repayment schedule after April 2023.

3. The Interest and Principal amount payable during the period Apr 2023 to Mar 2024 is computed on the principal balance in your

loan account as on April 2023.

4. Deduction under all applicable sections of the Income-tax Act, 1961, in respect of Interest payable on borrowed capital, can be

claimed in accordance with and subject to fulfilment of conditions prescribed under the said section as well as under other

relevant sections or rules of the Income Tax Law. Further, deduction of Interest paid / payable for the pre-acquisition or pre-

construction period can also be claimed, in five equal instalments beginning with the year in which the house property is

purchased or constructed, in accordance with and subject to fulfilment of conditions as prescribed in section 24(b) of the

Income-tax Act, 1961 as well as under other relevant sections or rules of the Income Tax Law.

5. Deduction under Section 80C (2)(xviii) of the Income-tax Act, 1961, in respect of principal amount repayment, can be claimed in

accordance with and subject to fulfilment of conditions prescribed under the said section as well as under other relevant

sections or rules of the Income Tax Law.

6. Tax benefits u/s 80 C and 24(b) of Income Tax Act for deduction of taxable income can only be claimed for Home loans. Income

Tax Act for deduction of taxable income is not applicable for the Interest certificate provided for Loan against residential or

commercial property and any top up loans on residential or commercial property.

This is a system generated certificate and does not require any authorization.

IDFC FIRST Bank Limited

Registered Office: KRM Towers, 7th Floor, No. 1, Harrington Road, Chetpet, Chennai 600031.

Tel.: +91 44 4571 6400, CIN: L65110TN2014PLC097792, bank.info@idfcfirstbank.com,

www.idfcfirstbank.com

In case of any query, please call us on 1800-10-888.

You might also like

- Interest Certificate - 153123467Document1 pageInterest Certificate - 153123467Mahendra LakkavaramNo ratings yet

- Interest Certificate - 36185174 - 1054440Document1 pageInterest Certificate - 36185174 - 1054440ganeshbanger73No ratings yet

- Provisional Interest Certificate - 202415411Document1 pageProvisional Interest Certificate - 202415411fyersa1No ratings yet

- 4330467076170342677Document1 page4330467076170342677vamsi patnalaNo ratings yet

- 1690715737039Document1 page1690715737039Rishi JakarNo ratings yet

- Provisional Interest CertificateDocument2 pagesProvisional Interest Certificateashutosh sahuNo ratings yet

- Education Loan PDFDocument1 pageEducation Loan PDFmac martinNo ratings yet

- HL IT - Certificate - 621058739 FY 23-24 SampleDocument1 pageHL IT - Certificate - 621058739 FY 23-24 SampleGouravpurvi100% (1)

- Education Loan Interest CertDocument1 pageEducation Loan Interest Certshekismail mvjNo ratings yet

- SUSNEHADocument2 pagesSUSNEHAsusnehanalam47No ratings yet

- PHR051401998301-Final IT CertificateDocument2 pagesPHR051401998301-Final IT Certificateamjad.shaik0128No ratings yet

- 1682612446899Document1 page1682612446899JitendraBhartiNo ratings yet

- IT Certificate 622197149Document1 pageIT Certificate 622197149karimshiekNo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961senthil kumarNo ratings yet

- Car LoanDocument1 pageCar Loansatya.undapalliNo ratings yet

- MR Yogesh #4, Shiva Enclave, Zirakpur, Vill Bhabat, S.A.S NAGAR-140603Document1 pageMR Yogesh #4, Shiva Enclave, Zirakpur, Vill Bhabat, S.A.S NAGAR-140603yogeshNo ratings yet

- MR Shaik Mansoor Hussain H NO 87 1101 P 363 A, Ganesh Nagar, 4Th Class Colony, KURNOOL, KURNOOL-518002Document1 pageMR Shaik Mansoor Hussain H NO 87 1101 P 363 A, Ganesh Nagar, 4Th Class Colony, KURNOOL, KURNOOL-518002Shaik MansoorhussainNo ratings yet

- Premium Paid Certificate Sandip PatilDocument2 pagesPremium Paid Certificate Sandip Patilbebo03450% (2)

- HDFC 876Document1 pageHDFC 876Xen Operation DPHNo ratings yet

- NotesDocument1 pageNotessrinath330440No ratings yet

- Interest CertificateDocument1 pageInterest CertificateSuvajit ChakrabartyNo ratings yet

- Provisional Certificate 2018-2019Document1 pageProvisional Certificate 2018-2019RohanNo ratings yet

- HHLHYE00424239 Provisional (2019-2020)Document1 pageHHLHYE00424239 Provisional (2019-2020)sanjeevNo ratings yet

- For Indiabulls Housing Finance LimitedDocument1 pageFor Indiabulls Housing Finance LimitedWild RaacNo ratings yet

- Registered Address: HDFC Bank Ltd. HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai-400013Document1 pageRegistered Address: HDFC Bank Ltd. HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai-400013Khushi Jain100% (1)

- InterestDocument1 pageInterestsatya.undapalliNo ratings yet

- Home Loan AllDocument3 pagesHome Loan Allsumanpal78No ratings yet

- Web It CertDocument1 pageWeb It Certprashasya duttNo ratings yet

- Housing LoanDocument1 pageHousing LoanJeeva MNo ratings yet

- ITcertificateDocument1 pageITcertificateV N CharyNo ratings yet

- Chandra496 - Provisional Interest CertificateDocument2 pagesChandra496 - Provisional Interest CertificateChandrasekhar Nandigam100% (1)

- Interest Certificate - Manoj ThakurDocument1 pageInterest Certificate - Manoj ThakurDiksha PrasadNo ratings yet

- AXIS BANK HOME LOAN INTEREST CERTIFICATE For FY 2019-20Document1 pageAXIS BANK HOME LOAN INTEREST CERTIFICATE For FY 2019-20Harish Ghorpade67% (6)

- ProvisionalInterestCertificate IL10026977 202205111824Document1 pageProvisionalInterestCertificate IL10026977 202205111824Diksha PrasadNo ratings yet

- MR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021Document1 pageMR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021parmarkrishnarajsinh100% (1)

- ProvisionalInterestCertificate 856658 201902052347Document1 pageProvisionalInterestCertificate 856658 201902052347prateek mishra0% (1)

- 1622717782153Document1 page1622717782153Jaya BharathiNo ratings yet

- Monday, April 4, 2022: The Pre-EMI Interest Received From To Is Rs. 0Document1 pageMonday, April 4, 2022: The Pre-EMI Interest Received From To Is Rs. 0raghu I0% (1)

- DocumentDocument2 pagesDocumentkitchencloud2022No ratings yet

- CERTIFICATE For Claiming Deduction Under Section 24 (B) & 80C (2) (Xviii) of INCOME TAX ACT, 1961Document1 pageCERTIFICATE For Claiming Deduction Under Section 24 (B) & 80C (2) (Xviii) of INCOME TAX ACT, 1961Raman SharmaNo ratings yet

- 1708059296839Document1 page1708059296839pinjarissNo ratings yet

- Zxyzvyyyyy 1223Document1 pageZxyzvyyyyy 1223VIGNESHNo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961shubh chaurasiaNo ratings yet

- MMMMDocument1 pageMMMMParthiban ManiNo ratings yet

- Education Loan PDFDocument1 pageEducation Loan PDFBikram Mudi80% (5)

- To Whomsoever It May Concern Provisional Interest CertificateDocument1 pageTo Whomsoever It May Concern Provisional Interest CertificateSHOBHRAJ MEENA0% (1)

- HHLHYD00208643 ProvisionalDocument1 pageHHLHYD00208643 ProvisionalPranab PaulNo ratings yet

- Interest CertificateDocument1 pageInterest CertificatepankajgujjarNo ratings yet

- ELR008205284502-Final IT CertificateDocument1 pageELR008205284502-Final IT CertificateMarzook Suhail100% (1)

- Interest Certificate HDFCDocument1 pageInterest Certificate HDFCdavidgordan0207No ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) OF THE INCOME TAX ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) OF THE INCOME TAX ACT, 1961Sourabh PunshiNo ratings yet

- Hhlkal00211208 17-18Document1 pageHhlkal00211208 17-18RohanNo ratings yet

- 9473667098713233264Document1 page9473667098713233264Parth NayakNo ratings yet

- Opr 0004 YDocument1 pageOpr 0004 YsrgaurNo ratings yet

- MR Mangali Srinivas Plot No 96 Sy No 38, Sangareddy, Odf Colony, Sangareddy, MEDAK-502001Document1 pageMR Mangali Srinivas Plot No 96 Sy No 38, Sangareddy, Odf Colony, Sangareddy, MEDAK-5020019440777274mcnuNo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Potu RavinderreddyNo ratings yet

- Homeloan IT Lcertificate Mithun 2023Document1 pageHomeloan IT Lcertificate Mithun 2023yaligartechNo ratings yet

- Bhaveshpriyam@ PDFDocument1 pageBhaveshpriyam@ PDFDonally PatelNo ratings yet

- Bank Reconciliation Statement: (Date)Document14 pagesBank Reconciliation Statement: (Date)Eugene GuillermoNo ratings yet

- Chapter 7 LedgerDocument18 pagesChapter 7 LedgerJumayma Maryam100% (1)

- ACCOUNTINGDocument4 pagesACCOUNTINGMARIANo ratings yet

- Indian Income Tax Rates (AY 1998-99 To 2011-12)Document5 pagesIndian Income Tax Rates (AY 1998-99 To 2011-12)Himanshu0% (1)

- March 2019Document1 pageMarch 2019Anonymous 2uvubjzzNo ratings yet

- Rad 1 Be 79Document6 pagesRad 1 Be 79Harish ChandNo ratings yet

- View FileDocument2 pagesView FileKenny XNo ratings yet

- DBP v. LICUANANDocument1 pageDBP v. LICUANANErinNo ratings yet

- APGLI Bonus G.O 110Document2 pagesAPGLI Bonus G.O 110Praveena VemulapalliNo ratings yet

- PDF DocumentDocument4 pagesPDF Documentangye08vivasNo ratings yet

- Banking Law Reserach PaperDocument23 pagesBanking Law Reserach Papersarayu alluNo ratings yet

- Business and Accounting Studies - Grade 11 Worksheet 5: Record The Below Transactions in AccountsDocument2 pagesBusiness and Accounting Studies - Grade 11 Worksheet 5: Record The Below Transactions in AccountsDinukshiya SelvaduraiNo ratings yet

- Portion 349 State LeaseDocument2 pagesPortion 349 State LeaseSimon MertonNo ratings yet

- Andrei Suciu: Description Qty Unit Cost Amount TotalDocument1 pageAndrei Suciu: Description Qty Unit Cost Amount TotalAnonymous BkSvaau1No ratings yet

- Statement of AccountDocument7 pagesStatement of AccountHamza CollectionNo ratings yet

- Personal Finance SyllabusDocument4 pagesPersonal Finance Syllabusapi-233267531No ratings yet

- Creating A Personal Household AssignmentDocument5 pagesCreating A Personal Household AssignmentmrmclauchlinNo ratings yet

- Chapter 4Document12 pagesChapter 4Leonell Musca ManaloNo ratings yet

- Banking System Aasign 3Document9 pagesBanking System Aasign 3Ajithkumar S / CSENo ratings yet

- CH.3 Annuity PDFDocument29 pagesCH.3 Annuity PDFJenalyn MacarilayNo ratings yet

- Payslip 4 2023Document1 pagePayslip 4 2023Vijaykrishna OrganicsNo ratings yet

- Sample Form 34 - MOD LOSODocument3 pagesSample Form 34 - MOD LOSOahmad.zakiNo ratings yet

- Interest Rate Cap & FloorDocument5 pagesInterest Rate Cap & FloorACC200 MNo ratings yet

- LPC ReportDocument4 pagesLPC Reportaodmgmch1No ratings yet

- XXXXXXXXXX6781 - 20230615160830874376 (1) - UnlockedDocument16 pagesXXXXXXXXXX6781 - 20230615160830874376 (1) - UnlockedRajendra SharmaNo ratings yet

- VB Card Statement 2021-07-16 - 2021-08-15Document2 pagesVB Card Statement 2021-07-16 - 2021-08-15OKSANA DRUZHYNYNANo ratings yet

- Gen Math Problems For Math MazeDocument1 pageGen Math Problems For Math MazeErika Roxanne ColeNo ratings yet

- Hidden Credit Repair SecretsDocument19 pagesHidden Credit Repair SecretsDordiong89% (9)

- 2nd Summative Test in Math 6 Q3Document2 pages2nd Summative Test in Math 6 Q3RamilGalidoNo ratings yet

- Vamsi Krishna Loan Sanction Letter 456Document7 pagesVamsi Krishna Loan Sanction Letter 456Venkatesh DoodamNo ratings yet