Professional Documents

Culture Documents

Interest Certificate - Manoj Thakur

Uploaded by

Diksha PrasadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Interest Certificate - Manoj Thakur

Uploaded by

Diksha PrasadCopyright:

Available Formats

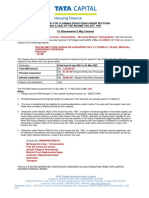

PROVISIONAL INTEREST CERTIFICATE

Under Section 24(b) & 80C (2) (xviii) of the Income Tax Act, 1961

For the period 01-Apr-2022 to 31-Mar-2023

Date : 22-May-2022

Dear Mr. Manoj Singh Thakur

F-61, First Floor, South City 2, Sector 49 Gurgaon, Haryana 122018

TO WHOMSOEVER IT MAY CONCERN

This is to certify that Mr. MANOJ SINGH THAKUR vide Prospect no. IL10015943 has/have been granted a Home

Loan of Rs.2900000.00 for the following property:

Flat No 35, Block D7, 3rd Floor, DDA Golf Link Apartments, Sector 23B, Dwarka, NEW DELHI, 110077

The above loan is repayable in EMI(Equated Monthly Installments) or Pre-EMI, comprising of the principal amount

and the applicable interest. The total amount of EMIs / Pre-EMIs payable from 01-Apr-2022 to 31-Mar-2023 is

Rs.158952.00 Below are the details for your reference:

Principal Component Rs.14294.54

Interest Component Rs.144657.46

Principal prepayment during the period Rs.0.00

Note:

1. Deduction in respect of the interest on the borrowed principal amount and repayment of the principal amount may be availed under section

24 (b) and 80C of the Income-tax Act, 1961 respectively subject to fulfilment of the conditions as per the prevailing Income Tax Laws.

2. Any benefits availed under Pradhan Mantri Awas Yojna (PMAY) scheme are not eligible for any tax claims/deductions.

3. In case of any discrepancy in the Certificate, the same to be reported within 30 days from the date of issuance of this letter.

This is a system generated letter and does not require signature.

You might also like

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) OF THE INCOME TAX ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) OF THE INCOME TAX ACT, 1961Sourabh PunshiNo ratings yet

- Education Loan PDFDocument1 pageEducation Loan PDFmac martinNo ratings yet

- Housing Loan (0363675100002233) Final Certificate - 2016-17 PDFDocument1 pageHousing Loan (0363675100002233) Final Certificate - 2016-17 PDFsikha singh50% (2)

- House ReceiptDocument1 pageHouse ReceiptArunNo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961senthil kumarNo ratings yet

- Home Loan ReceiptDocument1 pageHome Loan ReceiptJoshua Dcunha100% (1)

- Lac It Cert 832987 PDFDocument1 pageLac It Cert 832987 PDFManoj Kumar0% (1)

- ProvisionalInterestCertificate 856658 201902052347Document1 pageProvisionalInterestCertificate 856658 201902052347prateek mishra0% (1)

- Housing Loan (0363675100002233) Provisional Certificate-2017-18 PDFDocument1 pageHousing Loan (0363675100002233) Provisional Certificate-2017-18 PDFsikha singh67% (9)

- Monday, April 4, 2022: The Pre-EMI Interest Received From To Is Rs. 0Document1 pageMonday, April 4, 2022: The Pre-EMI Interest Received From To Is Rs. 0raghu I0% (1)

- Premium Paid Certificate Sandip PatilDocument2 pagesPremium Paid Certificate Sandip Patilbebo03450% (2)

- IT Certificate 622197149Document1 pageIT Certificate 622197149karimshiekNo ratings yet

- MR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074Document1 pageMR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074javedmonis07No ratings yet

- Zxyzvyyyyy 1223Document1 pageZxyzvyyyyy 1223VIGNESHNo ratings yet

- Bhaveshpriyam@ PDFDocument1 pageBhaveshpriyam@ PDFDonally PatelNo ratings yet

- Provisional Fy 20-21Document1 pageProvisional Fy 20-21Kedar YadavNo ratings yet

- To Whomsoever It May Concern Provisional Interest CertificateDocument1 pageTo Whomsoever It May Concern Provisional Interest CertificateSHOBHRAJ MEENA0% (1)

- HHLHYE00424239 Provisional (2019-2020)Document1 pageHHLHYE00424239 Provisional (2019-2020)sanjeevNo ratings yet

- ProvisionalInterestCertificate IL10026977 202205111824Document1 pageProvisionalInterestCertificate IL10026977 202205111824Diksha PrasadNo ratings yet

- Provisional Interest Certificate - 56465233 - 221527539Document1 pageProvisional Interest Certificate - 56465233 - 221527539dinesh makwanaNo ratings yet

- 4330467076170342677Document1 page4330467076170342677vamsi patnalaNo ratings yet

- ProvisionalInterestCertificate 856658 201902052347Document1 pageProvisionalInterestCertificate 856658 201902052347tdsbolluNo ratings yet

- Web It CertDocument1 pageWeb It Certprashasya duttNo ratings yet

- 7993761947155757203Document1 page7993761947155757203Sourav MohapatraNo ratings yet

- Interest CertificateDocument1 pageInterest CertificateSuvajit ChakrabartyNo ratings yet

- MR Mangali Srinivas Plot No 96 Sy No 38, Sangareddy, Odf Colony, Sangareddy, MEDAK-502001Document1 pageMR Mangali Srinivas Plot No 96 Sy No 38, Sangareddy, Odf Colony, Sangareddy, MEDAK-5020019440777274mcnuNo ratings yet

- ITcertificateDocument1 pageITcertificateV N CharyNo ratings yet

- MR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021Document1 pageMR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021parmarkrishnarajsinh100% (1)

- SUSNEHADocument2 pagesSUSNEHAsusnehanalam47No ratings yet

- IT Certificate 622228113Document1 pageIT Certificate 622228113riyaj.mulaniNo ratings yet

- HDFC TaxDocument1 pageHDFC TaxpritipjainNo ratings yet

- MR Shaik Mansoor Hussain H NO 87 1101 P 363 A, Ganesh Nagar, 4Th Class Colony, KURNOOL, KURNOOL-518002Document1 pageMR Shaik Mansoor Hussain H NO 87 1101 P 363 A, Ganesh Nagar, 4Th Class Colony, KURNOOL, KURNOOL-518002Shaik MansoorhussainNo ratings yet

- HL IT - Certificate - 621058739 FY 23-24 SampleDocument1 pageHL IT - Certificate - 621058739 FY 23-24 SampleGouravpurvi100% (1)

- For Indiabulls Housing Finance LimitedDocument1 pageFor Indiabulls Housing Finance LimitedWild RaacNo ratings yet

- HDFCDocument1 pageHDFCKulish JoshiNo ratings yet

- Interest Certificate - 36185174 - 1054440Document1 pageInterest Certificate - 36185174 - 1054440ganeshbanger73No ratings yet

- Provisional CertificateDocument1 pageProvisional CertificateNiklesh ChandakNo ratings yet

- HDFC 876Document1 pageHDFC 876Xen Operation DPHNo ratings yet

- Web It CertDocument1 pageWeb It CertRana BiswasNo ratings yet

- Interest Certificate HDFCDocument1 pageInterest Certificate HDFCdavidgordan0207No ratings yet

- Syamanthakam SK 2021-2022Document1 pageSyamanthakam SK 2021-2022ms poornimaNo ratings yet

- ProvisionalInterestCertificate H401HHL0453980Document1 pageProvisionalInterestCertificate H401HHL0453980Anita SainiNo ratings yet

- Tax Exemption Certificate 2023 2024Document1 pageTax Exemption Certificate 2023 2024Rehnuma TrustNo ratings yet

- Vher$er (CIN) LE5190MH20046011 48838Document1 pageVher$er (CIN) LE5190MH20046011 48838Venkatesh WNo ratings yet

- Loan 9923281112 30122022175927Document1 pageLoan 9923281112 30122022175927Mohit ChinchkhedeNo ratings yet

- Housing Loan 0363675100002233 Provisional Certificate 2017 18 PDFDocument1 pageHousing Loan 0363675100002233 Provisional Certificate 2017 18 PDFNeha JainNo ratings yet

- Home Loan AllDocument3 pagesHome Loan Allsumanpal78No ratings yet

- Interest Computation FY 23-24Document2 pagesInterest Computation FY 23-24tanooj999No ratings yet

- Housing Loan Interest Paid CertificateDocument1 pageHousing Loan Interest Paid CertificateSumit RoyNo ratings yet

- HomeloanDocument1 pageHomeloanSamrat MazumderNo ratings yet

- 2137163339215539595Document1 page2137163339215539595raval.sunil955No ratings yet

- 1690715737039Document1 page1690715737039Rishi JakarNo ratings yet

- HDFC 1Document1 pageHDFC 1Vivekananda PenumarthiNo ratings yet

- Provisional Certificate 2018-2019Document1 pageProvisional Certificate 2018-2019RohanNo ratings yet

- Provisional Letter CommDocument1 pageProvisional Letter CommShekharNo ratings yet

- Car LoanDocument1 pageCar Loansatya.undapalliNo ratings yet

- View CertificateDocument1 pageView CertificateadiNo ratings yet

- MR Yogesh #4, Shiva Enclave, Zirakpur, Vill Bhabat, S.A.S NAGAR-140603Document1 pageMR Yogesh #4, Shiva Enclave, Zirakpur, Vill Bhabat, S.A.S NAGAR-140603yogeshNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyNo ratings yet