Professional Documents

Culture Documents

ProvisionalInterestCertificate 856658 201902052347

Uploaded by

tdsbolluOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ProvisionalInterestCertificate 856658 201902052347

Uploaded by

tdsbolluCopyright:

Available Formats

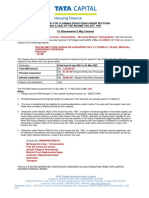

PROVISIONAL CERTIFICATE FOR CLAIMING DEDUCTION

Under Section 24(b) & 80C (2) (xviii) of the Income Tax Act, 1961

For the period 01-Apr-2018 to 31-Mar-2019

Date : 05-Feb-2019

Dear Mr. PRATEEK MISHRA,

540,WARD NO-15,, LUCKY VILLA,T-1,CCI COLONY, TEKARI-2,GIROD, Chhattisgarh, RAIPUR, 492001

Co applicant’s name(s): RASHMI MISHRA

TO WHOMSOEVER IT MAY CONCERN

This is to certify that Mr. PRATEEK MISHRA , RASHMI MISHRA vide Prospect no. 856658 has/have been granted a

Housing Loan Rs.840445.00 in respect of the following house property.

NEW RAIPUR DEVELOPERS,CLASSIC CITY, PLOT NO-J-12, GRAM-PARSULIDIH P.H.N.23,R.N.M.DHARSIWA-

1,BLOCK-DHARSIWA,, TAHSIL-RAIPUR, KHASRA NO-170/2,171/2,171/5,172/1,172/3,172/4,177/, RAIPUR,

492001, Chhattisgarh,INDIA, Chhattisgarh, RAIPUR, 492001

The above loan is repayable in Pre-EMI or Equated Monthly Installments (EMIs) comprising principal and interest.

The total amount of EMIs / Pre-EMIs payable from 01-Apr-2018 to 31-Mar-2019 is Rs.51200.00 The break-up of this

amount into principal and interest is as follows:-

Principal Component Rs.4055.43

Interest Component Rs.47144.57

Principal prepayment during the period: Rs.0.00

Note:

1. Deduction in respect of the interest on the borrowed principal amount and repayment of the principal amount can be claimed under section 24

(b) and 80C of the Income-tax Act, 1961 respectively subject to fulfillment of the conditions as per the prevailing Income Tax Laws.

2. Any benefits availed under Pradhan Mantri Awas Yojna (PMAY) scheme are not eligible for any tax claims/deductions.

3. In case of any discrepancy in the Certificate, the same to be reported within 30 days from the date of issuance of this letter.

This is a system generated letter and does not require signature.

You might also like

- ProvisionalInterestCertificate 856658 201902052347Document1 pageProvisionalInterestCertificate 856658 201902052347prateek mishra0% (1)

- ProvisionalInterestCertificate IL10026977 202205111824Document1 pageProvisionalInterestCertificate IL10026977 202205111824Diksha PrasadNo ratings yet

- Interest Certificate: Dharmendra Kumar SamtaniDocument1 pageInterest Certificate: Dharmendra Kumar SamtanideepNo ratings yet

- 4330467076170342677Document1 page4330467076170342677vamsi patnalaNo ratings yet

- MR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021Document1 pageMR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021parmarkrishnarajsinh100% (1)

- HHLHYD00208643 ProvisionalDocument1 pageHHLHYD00208643 ProvisionalPranab PaulNo ratings yet

- HHLHYE00424239 Provisional (2019-2020)Document1 pageHHLHYE00424239 Provisional (2019-2020)sanjeevNo ratings yet

- Zxyzvyyyyy 1223Document1 pageZxyzvyyyyy 1223VIGNESHNo ratings yet

- Provisional Letter CommDocument1 pageProvisional Letter CommShekharNo ratings yet

- PHR051401998301-Final IT CertificateDocument2 pagesPHR051401998301-Final IT Certificateamjad.shaik0128No ratings yet

- Interest Certificate - Manoj ThakurDocument1 pageInterest Certificate - Manoj ThakurDiksha PrasadNo ratings yet

- Home loan deduction detailsDocument1 pageHome loan deduction detailsDonally PatelNo ratings yet

- HDFC Home Loan Deduction StatementDocument1 pageHDFC Home Loan Deduction StatementArunNo ratings yet

- Lac It Cert 832987 PDFDocument1 pageLac It Cert 832987 PDFManoj Kumar0% (1)

- Interest Certificate - 36185174 - 1054440Document1 pageInterest Certificate - 36185174 - 1054440ganeshbanger73No ratings yet

- IT Certificate 622197149Document1 pageIT Certificate 622197149karimshiekNo ratings yet

- Provisional Certificate 2018-2019Document1 pageProvisional Certificate 2018-2019RohanNo ratings yet

- Loan Details SampleDocument1 pageLoan Details Samplekarthik dNo ratings yet

- Web It CertDocument1 pageWeb It Certprashasya duttNo ratings yet

- To Whomsoever It May Concern Provisional Interest CertificateDocument1 pageTo Whomsoever It May Concern Provisional Interest CertificateSHOBHRAJ MEENA0% (1)

- Web It CertDocument1 pageWeb It CertGuna SeelanNo ratings yet

- Provisional Interest Certificate - 56465233 - 221527539Document1 pageProvisional Interest Certificate - 56465233 - 221527539dinesh makwanaNo ratings yet

- Residential home loan EMI and tax deduction detailsDocument1 pageResidential home loan EMI and tax deduction detailsXen Operation DPHNo ratings yet

- Home LoanDocument2 pagesHome LoanRoshan LewisNo ratings yet

- Insurance Statement - Narender RawatDocument1 pageInsurance Statement - Narender RawatNarender Singh RawatNo ratings yet

- Provisional Fy 20-21Document1 pageProvisional Fy 20-21Kedar YadavNo ratings yet

- Interest Certificate: To Whomsoever It May ConcernDocument1 pageInterest Certificate: To Whomsoever It May ConcernfakeNo ratings yet

- ITcertificateDocument1 pageITcertificateV N CharyNo ratings yet

- Variable Rate Home Loan Interest DeductionDocument1 pageVariable Rate Home Loan Interest DeductionSelvakumaran GNo ratings yet

- Home Loan AllDocument3 pagesHome Loan Allsumanpal78No ratings yet

- 9473667098713233264Document1 page9473667098713233264Parth NayakNo ratings yet

- Education Loan PDFDocument1 pageEducation Loan PDFmac martinNo ratings yet

- Hhlkal00211208 17-18Document1 pageHhlkal00211208 17-18RohanNo ratings yet

- 80c-House Princ Phrxxxxxx8636Document1 page80c-House Princ Phrxxxxxx8636Sama UmateNo ratings yet

- MR Shaik Mansoor Hussain H NO 87 1101 P 363 A, Ganesh Nagar, 4Th Class Colony, KURNOOL, KURNOOL-518002Document1 pageMR Shaik Mansoor Hussain H NO 87 1101 P 363 A, Ganesh Nagar, 4Th Class Colony, KURNOOL, KURNOOL-518002Shaik MansoorhussainNo ratings yet

- Housing Loan (0363675100002233) Provisional Certificate-2017-18 PDFDocument1 pageHousing Loan (0363675100002233) Provisional Certificate-2017-18 PDFsikha singh63% (8)

- 369982633-Housing-Loan-0363675100002233-Provisional-Certificate-2017-18-pdfDocument1 page369982633-Housing-Loan-0363675100002233-Provisional-Certificate-2017-18-pdfNeha JainNo ratings yet

- AXIS BANK HOME LOAN INTEREST CERTIFICATE For FY 2019-20Document1 pageAXIS BANK HOME LOAN INTEREST CERTIFICATE For FY 2019-20Harish Ghorpade67% (6)

- MR Yogesh #4, Shiva Enclave, Zirakpur, Vill Bhabat, S.A.S NAGAR-140603Document1 pageMR Yogesh #4, Shiva Enclave, Zirakpur, Vill Bhabat, S.A.S NAGAR-140603yogeshNo ratings yet

- Web It CertDocument1 pageWeb It CertRana BiswasNo ratings yet

- DocumentDocument2 pagesDocumentkitchencloud2022No ratings yet

- ELR008205284502-Final IT CertificateDocument1 pageELR008205284502-Final IT CertificateMarzook Suhail100% (1)

- Provisional Certificate For The Financial Year 2016-2017: To Whomsoever It May ConcernDocument1 pageProvisional Certificate For The Financial Year 2016-2017: To Whomsoever It May Concernvarsha sekharNo ratings yet

- Input Tax Credit Cannot Be Denied To Purchaser Merely Because Seller Didnt Record Transaction in GSTR-2A Form - Kerala High CourtDocument9 pagesInput Tax Credit Cannot Be Denied To Purchaser Merely Because Seller Didnt Record Transaction in GSTR-2A Form - Kerala High CourtdeepakasopaNo ratings yet

- View CertificateDocument1 pageView CertificateGopal PenjarlaNo ratings yet

- REPLYDocument94 pagesREPLYabhiGT40100% (1)

- Car LoanDocument1 pageCar Loansatya.undapalliNo ratings yet

- Premium Paid Certificate Sandip PatilDocument2 pagesPremium Paid Certificate Sandip Patilbebo03450% (2)

- Housing Loan (0363675100002233) Final Certificate - 2016-17 PDFDocument1 pageHousing Loan (0363675100002233) Final Certificate - 2016-17 PDFsikha singh50% (2)

- JudgementbyjdateDocument27 pagesJudgementbyjdateBasanta Kumar SahooNo ratings yet

- 7993761947155757203Document1 page7993761947155757203Sourav MohapatraNo ratings yet

- Home Loan - Certificate - 2022-23Document1 pageHome Loan - Certificate - 2022-23cont2chandu100% (1)

- Education Loan Interest CertDocument1 pageEducation Loan Interest Certshekismail mvjNo ratings yet

- Car Loan Nagendra StatementDocument1 pageCar Loan Nagendra Statementnavengg521No ratings yet

- DocumentDocument1 pageDocumentkalyan0% (1)

- Provisional Certificate H404HHL0871998Document1 pageProvisional Certificate H404HHL0871998Prakash BattalaNo ratings yet

- Reply Letter - Lawyer NoticeDocument3 pagesReply Letter - Lawyer Noticemeghan googlyNo ratings yet

- HL IT - Certificate - 621058739 FY 23-24 SampleDocument1 pageHL IT - Certificate - 621058739 FY 23-24 SampleGouravpurvi100% (1)

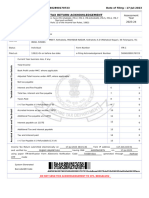

- CHALLANDocument1 pageCHALLANtdsbolluNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:500402890170723 Date of Filing: 17-Jul-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:500402890170723 Date of Filing: 17-Jul-2023tdsbolluNo ratings yet

- JR E-2 Girls NWT-04 10.07.23Document3 pagesJR E-2 Girls NWT-04 10.07.23tdsbolluNo ratings yet

- Proceedings of The Mandal Educational Officer, MP KothakotaDocument1 pageProceedings of The Mandal Educational Officer, MP KothakotatdsbolluNo ratings yet

- El's Proccedings of The Gazetted Head MasterDocument1 pageEl's Proccedings of The Gazetted Head MastertdsbolluNo ratings yet

- 27a Hydz03256b 24Q Q3 2023Document1 page27a Hydz03256b 24Q Q3 2023tdsbolluNo ratings yet

- Proceedings of The Mandal Educational Officer, MP KothakotaDocument1 pageProceedings of The Mandal Educational Officer, MP KothakotatdsbolluNo ratings yet

- 27a - Hydg04633g - 24Q - Q3 - 202324 GJC PBRDocument1 page27a - Hydg04633g - 24Q - Q3 - 202324 GJC PBRtdsbolluNo ratings yet