Professional Documents

Culture Documents

2023 11 26 - Statement

Uploaded by

Andrei AlbertoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2023 11 26 - Statement

Uploaded by

Andrei AlbertoCopyright:

Available Formats

Contact tel 03457 404 404

see reverse for call times

Text phone 03457 125 563

used by deaf or speech impaired customers

www.hsbc.co.uk

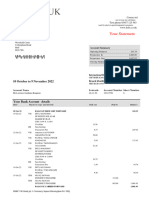

Your Statement

Mrs C Andrei

1a Connaught Street

Northampton

NN1 3BP

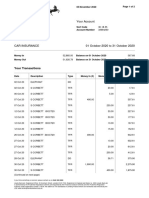

Account Summary

Opening Balance 3,123.61

Paymenta In 3,953.07

Paymenta Out 829.39

Closing Balance 3,334.45

.

International Bank Account Number

GB55HBUK40350494071328

27 October to 26 November 2023 Branch Identifier Code

HBUKGB4108L

Account Name Sortcode Account Number Sheet Number

Mrs Cristiana-Silvia Andrei 40-35-04 94071328 131

Your Basic Bank Account details

Date Payment Type and details Paid out Paid in Balance

A

26 Oct 23 BALANCE BROUGHT FORWARD . 3123.61

27 Oct 23 VIS W M MORRISON PETRO

NORTHAMPTON 68.86

30 Oct 23 ))) SPECTRUM NORTHANTS

NORTHAMPTON 3.00

))) LIDL GB NORTHAMPTO

NORTHAMPTON 10.82

31 Oct 23 ))) MCDONALDS 553

NORTHAMPTON 4.58

CR Stuart Delivery Lt

1977 98.71 3422.71

01 Nov 23 VIS E.ON NEXT

COVENTRY 20.00

))) Little Europe Nort

Northampton 24.00

02 Nov 23 ))) Brasov Supermarket

Northampton 24.00

05 Nov 23 BP ANDREI AM

Help 30.00

CR Uber BV 97.03 3442.34

06 Nov 23 ))) NYA*Shell

01942722333 1.00

))) Arman Grocery Ltd

Northampton 15.42

))) POUNDLAND LTD - 11

NORTHAMPTON 14.50 3345.31

07 Nov 23 VIS eBay O*25-10746-22

LONDON 59.95

BALANCE CARRIED FORWARD 3419.76

22 Abington Street Northampton NN1 2AN

Contact tel 03457 404 404

see reverse for call times

Text phone 03457 125 563

used by deaf or speech impaired customers

www.hsbc.co.uk

27 October to 26 November 2023

Your Statement

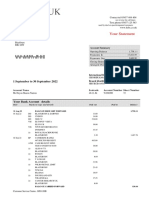

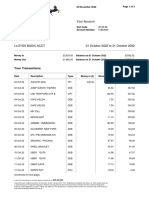

Account Name Sortcode Account Number Sheet Number

Mrs Cristiana-Silvia Andrei 40-35-04 94071328 132

Your Basic Bank Account details

Date Payment Type and details Paid out Paid in Balance

BALANCE BROUGHT FORWARD 3419.76

VIS eBay O*25-10746-22

LONDON 11.65

VIS eBay O*25-10746-22

LONDON 15.49

))) LIDL GB NORTHAMPTO

NORTHAMPTON 11.29

CR Stuart Delivery Lt

1102 29.81

VIS INT'L 0056269582

aliexpress

Luxembourg

EUR 13.78 @ 1.1464

Visa Rate 12.02

DR Non-Sterling

Transaction Fee 0.33

08 Nov 23 ))) POUNDLAND LTD - 22

NORTHAMPTON 2.50

10 Nov 23 ))) NYA*Selecta UK Ltd

01442840088 1.60

))) NYA*Selecta UK Ltd

01442840088 0.80

12 Nov 23 CR Uber BV 255.72 3446.63

13 Nov 23 ))) NYA*Selecta UK Ltd

01442840088 0.80

))) NYA*Selecta UK Ltd

01442840088 0.80

))) JKB Stores Ltd

Northampton 5.67

))) Tipoo Restaurant

Nottingham 31.20

))) JKB Stores Ltd

Northampton 3.68 3211.30

14 Nov 23 ))) JKB Stores Ltd

Northampton 7.86

))) JKB Stores Ltd

Northampton 5.98

))) SELECTA U.K. LIMIT

SOUTH RUISLIP 2448.47 3196.00

15 Nov 23 CR GXO LTD

SOUTH RUISLIP 0.90 747.33

17 Nov 23 VIS AMAZON

Gibraltar 40.00

VIS AMAZON

INTERNET 20.00

BALANCE CARRIED FORWARD 767.33

22 Abington Street Northampton NN1 2AN

Contact tel 03457 404 404

see reverse for call times

Text phone 03457 125 563

used by deaf or speech impaired customers

www.hsbc.co.uk

27 October to 26 November 2023

Your Statement

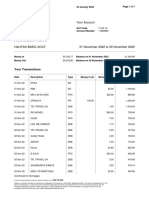

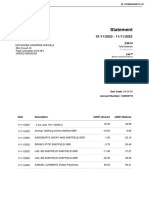

Account Name Sortcode Account Number Sheet Number

Mrs Cristiana-Silvia Andrei 40-35-04 94071328 133

Your Basic Bank Account details

Date Payment Type and details Paid out Paid in Balance

BALANCE BROUGHT FORWARD 767.33

VIS TEMU

INTERNET 20.00 747.33

18 Nov 23 BP Nicolae Robertino

Plm 30.00 717.33

19 Nov 23 CR Alberto Marian And 561.00

CR Uber BV 397.72 1,676.05

20 Nov 23 DD H3G 25.50

BP Newlyn

6557818 20.00

VIS AMAZON

INTERNET 60.00

VIS Temu.com

LONDON 11.00

))) Brasov Supermarket

Northampton 31.76

))) Arman Grocery Ltd

Northampton 8.82

))) Wellington Street

Northampton 2.20

))) Brasov Supermarket

Northampton 31.53

VIS E.ON NEXT

COVENTRY 10.00

))) LITTLE EUROPE

NORTHAMPTON 20.19

))) POUNDLAND LTD - 22

NORTHAMPTON 13.00

))) SAINSBURYS PETROL

WEEDON ROAD 60.88

))) ALDI STORES

NORTHAMPTON 28.52

VIS INT'L 0052516863

LC International L

08007316191 1.00

VIS INT'L 0052516864

LC International L

08007316191 1.00

VIS INT'L 0052516860

TESCO

GIBRALTAR 1.00

VIS INT'L 0052516861

TESCO

GIBRALTAR 1.00

BALANCE CARRIED FORWARD 852.65

22 Abington Street Northampton NN1 2AN

Contact tel 03457 404 404

see reverse for call times

Text phone 03457 125 563

used by deaf or speech impaired customers

www.hsbc.co.uk

27 October to 26 November 2023

Your Statement

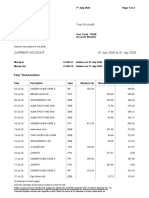

Account Name Sortcode Account Number Sheet Number

Mrs Cristiana-Silvia Andrei 40-35-04 94071328 134

Your Basic Bank Account details

Date Payment Type and details Paid out Paid in Balance

BALANCE BROUGHT FORWARD 853.65

VIS INT'L 0052516862

GIBRALTAR 1.00 852.65

21 Nov 23 ))) EURO SHOP

NORTHAMPTON 24.00

CR Stuart Delivery Lt

4097 13.34

VIS INT'L 0059748771

aliexpress

Luxembourg

EUR 13.78 @ 1.1435

Visa Rate 12.05

CR Non-Sterling

Transaction Fee 0.33 854.37

22 Nov 23 ))) NYA*Carlton Vendin

7776271968 1.00

))) NYA*Carlton Vendin

7776271968 1.00

))) Asia mini market

Northampton 26.60

))) SQ *SOPHIA'S FOOD

Thorneywood 2.00 823.77

23 Nov 23 ))) LITTLE EUROPE

NORTHAMPTON 16.00

))) T K MAXX

NORTHAMPTON 6.99

))) LIDL GB NORTHAMPTO

NORTHAMPTON 2.99

))) LIDL GB NORTHAMPTO

NORTHAMPTON 1.75 796.04

24 Nov 23 VIS LITTLE EUROPE

NORTHAMPTON 25.98

))) Nasze Deli

Northampton 23.67 746.39

26 Nov 23 BALANCE CARRIED FORWARD 746.39

Information abouth the Financial Services Compensation Scheeme

Your deposit is eligible for protection under the Financial Services Compensation Scheme (FSCS). For further information

about the compensation provided by the FSCS, refer to the FSCS website at www.FSCS.org.uk, call into your nearest branch

or call your telephone banking service. Further details can be found on the FSCS Information Sheet and Exclusions List

which is available on our website (www.hsbc.co.uk).

22 Abington Street Northampton NN1 2AN

Commercial Banking Customers Effective from 14 March 2020

Interest and Charges Monthly cap on unarranged overdraft charges

[Your] Business Banking Terms and Conditions cover how and when 1. Each current account will set a monthly maximum charge for:

we can charge our interest rates and charges. (a) going overdrawn when you have not arranged an overdraft; or

Details of Debit interest together with details of the interest rate we (b) going over/past your arranged overdraft limit (if you

pay and charge in full [for all accounts] are available in [our] Business have one).

Price List. All [our] business current accounts are non-interest bearing 2. This cap covers any:

when in credit unless we individually agree a rate with you.

(a) interest and fees for going over/past your arranged overdraft limit;

Overdrafts:

(b) fees for each payment your bank allows despite lack of funds; and

Arranged overdraft: Where you ask us for an overdraft before

making any transactions that takes your account overdrawn, or over (c) fees for each payment your bank refuses due to lack of funds.

your current arranged overdraft limit. Interest rates are individually The monthly cap on unarranged overdraft charges for the HSBC

agreed, for a period of 12 months, and are linked to the Bank of Advance Bank Account, HSBC Bank Account, HSBC Current Account,

England base rate. For details of our fees and charges, please refer Home Management Account and HSBC Graduate Bank Account is £20.

to our Business Price List – see Additional Information below. The monthly cap on unarranged overdraft charges is not applicable

Unarranged overdraft: When you make a payment that takes your to Bank Account Pay Monthly, Basic Bank Account, Student Bank

account overdrawn if you don’t have an arranged overdraft limit, or Account, Amanah Bank Account and MyAccount as these accounts

takes your account over your arranged overdraft limit. When you do not incur unarranged overdraft charges.

don’t have an arranged overdraft limit, we will charge our Business Unarranged overdraft charges incurred before 14 March 2020 may

Standard Debit Interest Rate on any balances. When you have an debit your account after this date (we’ll still give advance notice).

existing arranged overdraft limit and go over this limit, we will charge Charges incurred before 14 March 2020 won’t count towards the new

interest at the rate we have agreed with you on the balance of your £20 cap as they’ll relate to the previous month’s charging period.

arranged overdraft limit and will charge Standard Debit Interest Rate

on any balance over your arranged overdraft facility. In either of these Your debit card

circumstances, unarranged overdraft charges will be applied on each When you use your card outside the UK, your statement will show

working day that your account is overdrawn (if you don’t have an where the transaction took place, the amount spent in foreign

arranged overdraft) or you go over your arranged overdraft limit (if currency and the amount converted into sterling. We also monitor

you have an arranged overdraft). For details of our fees and charges, transactions to protect you against your card being used fraudulently.

please see our Business Price List and for information on our Interest Unless you agree that the currency conversion is done at the point of

Rates – see Additional Information below. sale or withdrawal and agree the rate at that time, for example with

the shopkeeper or on the self-service machine screen, the exchange

Your debit card rate that applies to any foreign currency debit card payments

For debit card charges and how foreign currency transactions are (including cash withdrawals) is the VISA Payment Scheme Exchange

converted to sterling please refer to the Business Price List. Rate applying on the day the conversion is made. For foreign

Additional Information currency transactions we will charge a fee of 2.75% of the amount

A copy of [our] Business Price List and the Business Banking of the transaction. This fee will be shown as a separate line on your

Terms and Conditions can be found on our website statement as a ‘Foreign Currency Transaction Fee’. Details of the

www.business.hsbc.uk/en-gb/gb/generic/ current VISA Payment Scheme Exchange Rates can be obtained from

legal-information. the card support section of hsbc.co.uk or by calling us on the usual

Information on our Interest Rates can be found on our website numbers. We will deduct the payment from your account once we

www.business.hsbc.uk/en-gb/interest-rates/interest-rates- receive details of the payment from the card scheme, at the latest, the

finance-borrowing. next working day. For cash machine withdrawals in a currency other

than sterling we will charge a Non Sterling Cash Fee of 2% (minimum

This information is also available in our branches, by calling

£1.75, maximum £5). This fee applies to all cash machines outside

03457 60 60 60 (lines are open GMT 8am to 10pm, Monday to

the UK, and to cash machines in the UK, if we convert the withdrawal

Sunday) or by textphone 0345 12 55 63. [Details of the interest

to Sterling for you. HSBC Advance customers are exempt from this

rate we pay and charge are also separately available through

fee. Some cash machine operators may apply a direct charge for

these channels.]

withdrawals from their cash machines and this will be advised on

To help us continuously improve our service and in the interests of screen at the time of withdrawal.

security, we may monitor and/or record your telephone calls with us.

Commercial and Personal Banking Customers

Personal Banking Customers Lost and Stolen Cards

Interest If any of your cards are lost or stolen please call 0800 032 7075

Credit Interest is calculated daily on the cleared credit balance and is or if you are calling from outside the UK, please call us on

paid monthly if applicable (this is not paid on all accounts, e.g. Basic +44 1442 422 929. Lines are open 24 hours.

Bank Account, Bank Account and HSBC Advance). For personal

Dispute Resolution

current accounts, overdraft interest is charged on the whole overdraft

If you have a problem with your agreement, please try to resolve

balance above any interest free amount. Debit interest is calculated

it with us in the first instance. If you are not happy with the way in

daily on the cleared debit balance of your account, it accrues during

which we handled your complaint or the result, you may be able to

your charging cycle (usually monthly) and is deducted from your

complain to the Financial Ombudsman Service. If you do not take

account following the end of your charging cycle.

up your problem with us first you will not be entitled to complain

Overdrafts to the Ombudsman. We can provide details of how to contact the

Arranged overdraft: Where you ask us for an overdraft before Ombudsman.

making any transactions that takes your account overdrawn, or over

Disabled Customers

your current arranged overdraft limit.

We offer a number of services such as statements in Braille or large

Unarranged overdraft: When you make a payment that takes your print. Please contact us by calling 03457 60 60 60 (lines are open

account overdrawn if you don’t have an arranged overdraft, or takes GMT 8am to 10pm, Monday to Sunday) or textphone 0345 12 55 63

your account over your arranged overdraft limit. to let us know how we can serve you better.

HSBC UK Bank plc, registered in England and Wales number 09928412. Registered office 1 Centenary Square, Birmingham B1 1HQ. Authorised by the

Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under reference number 765112.

RFB1898 MCP54585 ©HSBC Group 2019

You might also like

- 2022 11 09 - StatementDocument3 pages2022 11 09 - StatementlorenzoNo ratings yet

- 2022 09 30 - StatementDocument6 pages2022 09 30 - StatementGiovanni SlackNo ratings yet

- Account Statement From 1 Apr 2023 To 31 Oct 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Apr 2023 To 31 Oct 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceBhavik NasitNo ratings yet

- Countingup Statement 2023 07Document1 pageCountingup Statement 2023 07SophiaNo ratings yet

- Statement 62083085 GBP 2023-09-01 2023-12-12Document2 pagesStatement 62083085 GBP 2023-09-01 2023-12-12billweberichmillerNo ratings yet

- Statement 17-FEB-23 AC 73929213 19042852Document4 pagesStatement 17-FEB-23 AC 73929213 19042852FahimNo ratings yet

- Metro OctDocument3 pagesMetro Octinfo.familyemailNo ratings yet

- Statement 19-MAY-23 AC 73929213 21122322Document3 pagesStatement 19-MAY-23 AC 73929213 21122322FahimNo ratings yet

- Statement 19-APR-23 AC 73929213 21041533Document3 pagesStatement 19-APR-23 AC 73929213 21041533FahimNo ratings yet

- Statement For Telegram PDFDocument2 pagesStatement For Telegram PDFJhonel PilapilNo ratings yet

- NBS Bank Statement Dec 2022Document2 pagesNBS Bank Statement Dec 2022Eric CartmanNo ratings yet

- Statement 2023 10Document2 pagesStatement 2023 10n.i.fedorova32No ratings yet

- SCC Comunicados Ed 02ef11fc44216a3910a0c93714358Document4 pagesSCC Comunicados Ed 02ef11fc44216a3910a0c93714358srikanth829No ratings yet

- Nov Pay PDFDocument7 pagesNov Pay PDFRoland Lovelace OpokuNo ratings yet

- SantanderDocument1 pageSantanderKabanNo ratings yet

- Wise StatementDocument1 pageWise StatementSolomonNo ratings yet

- 2024 01 26 - StatementDocument2 pages2024 01 26 - StatementDaia SorinNo ratings yet

- PreviewDocument4 pagesPreviewandrealhepburnNo ratings yet

- SCC COMUNICADOS PI Batch0100151115e8f50a18381100 PDFDocument3 pagesSCC COMUNICADOS PI Batch0100151115e8f50a18381100 PDFVolodymyr BokovnyaNo ratings yet

- NBS Bank Statement Sep 2023Document2 pagesNBS Bank Statement Sep 2023Eric CartmanNo ratings yet

- GBP Statement: Balance SummaryDocument1 pageGBP Statement: Balance SummaryJan TanaseNo ratings yet

- BarclaysDocument2 pagesBarclayssteam2210721No ratings yet

- Statement 2023 5Document1 pageStatement 2023 5MasoomaIjazNo ratings yet

- Bank StatementDocument2 pagesBank StatementsaNo ratings yet

- Revolut EUR Statement MARCH 2023 PDFDocument1 pageRevolut EUR Statement MARCH 2023 PDFyusufabid1111No ratings yet

- Halifax Bank StatementDocument2 pagesHalifax Bank StatementNikki Ray (Shadow Clan)No ratings yet

- Statement 14-APR-23 AC 63755886 16042114Document6 pagesStatement 14-APR-23 AC 63755886 16042114Shauna DunnNo ratings yet

- Barclay BillDocument3 pagesBarclay Billafish110No ratings yet

- Statement 10 2020-1Document2 pagesStatement 10 2020-1jamalazoz05No ratings yet

- Account Statement - 2022 11 01 - 2022 11 17 - en - 2dd2eaDocument1 pageAccount Statement - 2022 11 01 - 2022 11 17 - en - 2dd2eaSer BanicaNo ratings yet

- Statement 2024 1Document1 pageStatement 2024 1xfzm99mr8rNo ratings yet

- Statement 10 2023Document3 pagesStatement 10 2023nvmanohar97No ratings yet

- Statement 2023 9Document2 pagesStatement 2023 9n.i.fedorova32No ratings yet

- Account Statement - 2022 04 01 - 2022 04 30 - en GB - 72261aDocument6 pagesAccount Statement - 2022 04 01 - 2022 04 30 - en GB - 72261acaitiewhiteman1993No ratings yet

- Nation Wide BankDocument1 pageNation Wide BankShaggy ShagNo ratings yet

- Documento M331 1Document8 pagesDocumento M331 1panificadorapmsNo ratings yet

- DocumenteDocument5 pagesDocumentemaxim caldarasanNo ratings yet

- Monzo Bank StatementDocument2 pagesMonzo Bank StatementAlpamis100% (1)

- Countingup Statement 2023 07Document1 pageCountingup Statement 2023 07SophiaNo ratings yet

- Statement: Foundation AccountDocument1 pageStatement: Foundation AccountFu YingNo ratings yet

- Statement 2022 10Document3 pagesStatement 2022 10VijayNo ratings yet

- Business Account Statement: MR John Doe 20 Sherwood ST, London W1F 7edDocument4 pagesBusiness Account Statement: MR John Doe 20 Sherwood ST, London W1F 7edarianitNo ratings yet

- Statement 2024 1Document5 pagesStatement 2024 1nahidahcomNo ratings yet

- Account Statement - 2024 01 01 - 2024 01 31 - en GB - 058232Document2 pagesAccount Statement - 2024 01 01 - 2024 01 31 - en GB - 058232stefanutcornel.davidNo ratings yet

- Statement: Account Number: 231355413Document2 pagesStatement: Account Number: 231355413saysandarNo ratings yet

- Statement 24-MAR-23 AC 83249816 26152728Document5 pagesStatement 24-MAR-23 AC 83249816 26152728Анастасия ГорбачNo ratings yet

- Document 28 PDF - RemovedDocument1 pageDocument 28 PDF - RemovedalysNo ratings yet

- SBSA Statement 2023-03-10Document42 pagesSBSA Statement 2023-03-10Maestro ProsperNo ratings yet

- BookDocument6 pagesBookusmanabid2009No ratings yet

- Business Bank Statement Lloyds Bank Bank - 231213 - 200928Document2 pagesBusiness Bank Statement Lloyds Bank Bank - 231213 - 200928snelu1178No ratings yet

- TM January StatementDocument7 pagesTM January StatementlicciNo ratings yet

- Statement: (Including Pots)Document2 pagesStatement: (Including Pots)saysandarNo ratings yet

- Statement: (Including Pots)Document2 pagesStatement: (Including Pots)sayma kandafNo ratings yet

- Revolut-EUR-Statement-1 Dec 2020 To 10 Dec 2020Document2 pagesRevolut-EUR-Statement-1 Dec 2020 To 10 Dec 2020Angel AspronNo ratings yet

- Attachment PDFDocument6 pagesAttachment PDFYILDRANo ratings yet

- Statement Statement: Albert Fisher Albert FisherDocument3 pagesStatement Statement: Albert Fisher Albert Fisherxxalias50% (2)

- 2020 April StatementDocument1 page2020 April StatementPOPESCU BERTHA-ANDREEANo ratings yet

- 447096602-Preview-Falix-Pdf - EkhaguereDocument5 pages447096602-Preview-Falix-Pdf - Ekhaguere13KARATNo ratings yet

- ViewEpsiiaEStatementDetail PDFDocument6 pagesViewEpsiiaEStatementDetail PDFsjeyarajah21No ratings yet

- 2024 01 26 - StatementDocument4 pages2024 01 26 - StatementAndrei AlbertoNo ratings yet

- 2024 01 26 - StatementDocument4 pages2024 01 26 - StatementAndrei AlbertoNo ratings yet

- 2020 04 30 - StatementDocument2 pages2020 04 30 - StatementMarian TomasNo ratings yet

- Payslip Alberto - Andrei 10 03 2022Document1 pagePayslip Alberto - Andrei 10 03 2022Andrei AlbertoNo ratings yet

- InsuranceDocument3 pagesInsuranceAndrei AlbertoNo ratings yet

- S1-1054/2 10kV Digital Insulation Tester: User ManualDocument24 pagesS1-1054/2 10kV Digital Insulation Tester: User ManualHoracio BobedaNo ratings yet

- Principles of Engineering Thermodynamics - SI Version 8th EditionDocument47 pagesPrinciples of Engineering Thermodynamics - SI Version 8th EditionanabNo ratings yet

- SECTION 33 05 13 Manholes: Revised 03/2012Document52 pagesSECTION 33 05 13 Manholes: Revised 03/2012FAISAL NAZEERNo ratings yet

- Practical Questions BookletDocument37 pagesPractical Questions BookletPrecious ChirangareNo ratings yet

- Artificial IntelligenceDocument6 pagesArtificial IntelligencesaraNo ratings yet

- 4401 SyllabusDocument1 page4401 SyllabusTony LeungNo ratings yet

- Progresive DPKDocument7 pagesProgresive DPKAmol WalunjNo ratings yet

- Apex CheatsheetDocument4 pagesApex CheatsheetAmit GangwarNo ratings yet

- Joshi - Quant Job InterviewDocument329 pagesJoshi - Quant Job InterviewPiciBivNo ratings yet

- Cat Reforming Part 2 3 PDF FreeDocument68 pagesCat Reforming Part 2 3 PDF FreeLê Trường AnNo ratings yet

- Shaker SK L180 SDocument1 pageShaker SK L180 SUPT LABKESDA KAB PADANG PARIAMANNo ratings yet

- GSMDocument38 pagesGSMapi-370641475% (8)

- Schoolwide Plan Worksheet: School Name: Pioneer Elementary Principal Name: Brenda Lopresto School Planning TeamDocument10 pagesSchoolwide Plan Worksheet: School Name: Pioneer Elementary Principal Name: Brenda Lopresto School Planning TeamChauncey Mae TanNo ratings yet

- jOB aNALYSIS POWERPOINTDocument34 pagesjOB aNALYSIS POWERPOINTdushyant12288No ratings yet

- Ok - Las-Q2 Oral - Com W1Document5 pagesOk - Las-Q2 Oral - Com W1Ruben Rosendal De AsisNo ratings yet

- Egcuwa - Butterworth Profile PDFDocument84 pagesEgcuwa - Butterworth Profile PDFsbuja7No ratings yet

- KL-710 Conventional Temprature Detector PDFDocument1 pageKL-710 Conventional Temprature Detector PDFghenriquezNo ratings yet

- 6 Bhel - Noida ElectricalDocument9 pages6 Bhel - Noida Electricaldeepti sharmaNo ratings yet

- Urban Bias in Community Development: Student: Tiongson Yvonne P. Instructor: Ar. Irene G. FlorendoDocument9 pagesUrban Bias in Community Development: Student: Tiongson Yvonne P. Instructor: Ar. Irene G. FlorendoYvonne TiongsonNo ratings yet

- Nelson 2010 StructuralDocument51 pagesNelson 2010 StructuralGustavo Mateo100% (1)

- Lesson Plan - The V LanguageDocument4 pagesLesson Plan - The V LanguageLê Thị Ái NhiNo ratings yet

- Chap1 Organizational Behavior 2020Document52 pagesChap1 Organizational Behavior 2020DarshanNo ratings yet

- Human Relations TheoriesDocument28 pagesHuman Relations TheoriesHarold100% (1)

- Manajemen Data Standar Pelayanan Minimal Rumah Sakit The Hospital Minimum Service Standard Data Management Sigid Nugroho Adhi Kori Puspita NingsihDocument10 pagesManajemen Data Standar Pelayanan Minimal Rumah Sakit The Hospital Minimum Service Standard Data Management Sigid Nugroho Adhi Kori Puspita NingsihririnNo ratings yet

- May DAY EVE LessonsDocument4 pagesMay DAY EVE LessonsFerdinand Pinon100% (1)

- Temporary Housing Kobe EarthquakeDocument18 pagesTemporary Housing Kobe EarthquakeMeenu100% (1)

- FINALS - Technology Integration Planning 2023Document3 pagesFINALS - Technology Integration Planning 2023Keziah O. BarrientosNo ratings yet

- BLUE COLLAR JOBS Vs WHITE COLLAR JOBS.Document2 pagesBLUE COLLAR JOBS Vs WHITE COLLAR JOBS.Nelson VersozaNo ratings yet

- OutputDocument5 pagesOutputCarlos FazNo ratings yet

- Module 5 Utilitarianism Part IDocument30 pagesModule 5 Utilitarianism Part IDenver Acenas100% (1)