Professional Documents

Culture Documents

Real Estate Mortage

Uploaded by

joeye louieOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Real Estate Mortage

Uploaded by

joeye louieCopyright:

Available Formats

REAL ESTATE MORTAGE

- A real estate mortage (REM) is an accessory contract executed by a debtor in favor of a creditor

as security for the principal obligation. The principal obligation is usually a simple loan or

mutuum described in Art. 1953, Civil Code. Obligation within the stipulated period.

(Bustamante vs. Rosel, 319 SCRA 413)

ELEMENTS OF PACTUM COMMISORIUM:

1. There should be a property mortgaged by way of security for the payment of the principal

obligation; and

2. There should be a stipulation for automatic appropriation by the thing mortgaged in case of

non-payment of the principal obligation within the stipulated period.” (Edrain vs. Phil. Veterans

Bank, 645 SCRA 75)

Section 1: Complaint in action for foreclosure

COURT WITH JURISDICTION TO HEAR ACTIONS FOR FORECLOSURE:

- It is the RTC that has jurisdiction to hear and decide actions for foreclosure of a REM. 9BO 129,

Russel vs. Vestil, 304 SCRA 738)

- For purposes of venue, an action for foreclosure of mortgage of real property is an action

affecting interest in real property and, therefore, is a real action. The venue of real actions is the

place where the real property involved, or a portion thereof is situated. (Sec. 1, Rule 4)

EFFECT OF DEATH OF THE MORTGAGOR/DEBTOR:

- The death of the mortgagor does not extinguish his debt. Such death does not also preclude the

foreclosure of any REM he may have executed prior to this death. (Rano, (2012), Civil Procedure

Vol. 2, p. 394)

REMEDIES OF THE MORTGAGEE/CREDITOR WHEN THE MORTGAGOR/DEBTOR DIES:

a. Creditor may abandon the security and prosecute his claim in the manner provided for

under Rule 86, and share in the general distribution of the assets of the estate:

b. He may foreclosure the mortgage by action in court, making the executor or administrator a

party defendant, and if there be a deficiency judgment after the sale of the mortgaged

property, he may claim the deficiency in the manner provided under Rule 86; or

c. He may rely upon the mortgage or other security alone, and foreclosure the same at any

time before it is barred by prescription, and in that event, he shall not be admitted as a

creditor, without the right to share in the distribution of the other assets of the state (Sec. 7,

Rule 86)

SPLITTING OF A SINGLE CAUSE OF ACTION:

- A creditor cannot file a civil action against the debtor for collection of the debt and subsequently

file an action to forclose the mortgage. This is an example of splitting of a single cause of action

which is prohibited under the ROC. (Danao vs. CA, 154 SCRA 446)

MODES OF FORECLOSURE OF REAL ESTATE MORTGAGE:

a. Judicial Foreclosure; and

b. Extrajudicial Foreclosure

Section 2: Judgment on foreclosure for payment or sale

JUDGMENT ON FORECLOSURE:

- If upon the trial in such action the court shall find the facts set forth in the complaint to be true,

it shall render a judgment containing the following matters:

a. Ascertainment of the amount due to the plaintiff upon the mortgage debt or obligation,

including interest and other charges as approved by the court, and costs;

b. Render judgment for the sum so found due:

c. Order that the same be paid to the court of to the judgment oblige within a period of not

less than ninety (90) days nor more than one hundred twenty (120) days from the entry of

judgment; and

d. Admonition that in default of such payment the property shall be sold at public auction to

satisfy the judgment. (Sec. 2, Rule 68)

-The judgment of the court on the above matters is considered final adjudication of the case

and, therefore, subject to challenge by the aggrieved party by appeal or other post-

judgment remedies.

EQUITY OF REDEMPTION:

- The period mentioned in the judgment of the court (Sec. 2, Rule 68) is the period within which

the mortgagor may start exercising his “equity of redemption,” which is the right to extinguish

the mortgage and retain ownership of the property by paying the debt. The payment may be

made even after the foreclosure sale provided it is made before the sale is confirmed by the

court. (GSIS vs. CFI, 175 SCRA 19)

RIGHT OF REDEMPTION:

-General Rule: In judicial foreclosures, there is no right of redemption but only an equity of

redemption which can be exercised prior to the confirmation of the foreclosure sale:

-Exception: There is a right of redemption in a judicial foreclosure if the foreclosure is in favor of

banks as mortgagees, whether the foreclosure be judicial or extrajudicial. (Huerta Alba vs. CA,

339 SCRA 534)

- This right of redemption is explicity provided under Sec. 1, Rule 47 of the General Banking Laws

of 2000. Therefore, if the mortgagee is a bank, the mortgagor may exercise a right of

redemption even if the foreclosure is judicially made pursuant to Rule 68, ROC. (Huerta Alba vs.

CA, supra)

PERIOD OF REDEMPTION IN EXTRAJUDICIAL FORECLOSURES:

-General Rule: the period of redemption is one year.

-Exception: Under the General Banking Act, when the mortgagor is a juridical person. The period

of redemption is “until, but not after” the registration of the certificate of sale with the Register

of Deeds, “which in no case shall be more than 3 months after foreclosure, whichever is earlier.”

(Sec. 47, General Banking Acts of 2000)

Section 6: Deficiency judgment

DEFICIENCY JUDGMENT; WHEN THERE IS NO DEFICIENCY JUDGMENT:

- If upon the sale of any real property as provided in the next preceding section there be a

balance due to the plaintiff after applying the proceeds of the sale, the court, upon motion, shall

render judgment against the defendant for any such balance for which, by the record of the

case, he may be personally liable to the plaintiff, upon which execution may issue immediately if

the balance is all due at the time of the rendition of the judgment; otherwise; the plaintiff shall

be entitled to execution at such time as the balance remaining becomes due under the terms of

the original contract, which time shall be stated in the judgment. 9Sec. 6, Rule 68)

RULE IN CASE THERE IS A SURPLUS INSTEAD OF A DEFICIENCY:

- It is the duty of the mortgagee to return to the mortgagor any surplus in the selling price during

the foreclosure sale. *Sulit vs. CA, 268 SCRA 441)

Section 7: Registration

REGISTRATION OF THE SALE:

- A certified copy of the final ord2er of the court confirming tha sale shall be registered in the

registry of deeds. If no right of r2edemption exists, the certificate of title in the name of the

mortgagor shall be cancelled, and 2a new one issued in the name of the purchaser. (Sec. 7, Rule

68)

- Where a right of redemption exists, the certificate of title in the name of the mortgagor shall not

be cancelled, but the certificate of sale and the order confirming the sale shall be registered and

a brief memorandum thereof made by the registrar of deeds upon the certificate of title. In the

event the property is redeemed, the deed of redemption shall be registered with the registry of

deeds, and a brief memorandum thereof shall be made by the registrar of deeds on said

certificate of title. (Sec. 7, Rule 68)

- If the property is not redeemed, the final deed of sale executed by the sheriff in favor of the

purchaser at the foreclosure sale shall be registered with the registry of deeds; whereupon the

certificate of title in the name of the mortgagor shall be cancelled and a new one issued in the

name of the purchaser. (Sec. 7, Rule 68)

Section 8: Applicability of other provisions

APPLICABILITY OF OTHER PROVISIONS:

The provisions of sections 31, 32 and 34 of Rule 39 shall be applicable to the judicial forclosure of real

estate mortgages under this Rule insofar as the former are not inconsistent with or may serve to

supplement the provisions of the lattetr. ( Sec. 8, Rule 68)

You might also like

- California Supreme Court Petition: S173448 – Denied Without OpinionFrom EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionRating: 4 out of 5 stars4/5 (1)

- Judicial Foreclosure PresentationDocument27 pagesJudicial Foreclosure PresentationjingoNo ratings yet

- Foreclosure of Real Estate Mortgage: A Step-by-Step GuideDocument31 pagesForeclosure of Real Estate Mortgage: A Step-by-Step GuideAbbeyBandolaNo ratings yet

- Additional Notes On Foreclosure of Real Estate MortgageDocument5 pagesAdditional Notes On Foreclosure of Real Estate MortgageMarisseAnne CoquillaNo ratings yet

- Alba Vs CA Case DigestDocument3 pagesAlba Vs CA Case DigestNElle SAn Full100% (1)

- Rule 68: Foreclosure of Real Estate MortgageDocument17 pagesRule 68: Foreclosure of Real Estate MortgageGaile UlayanNo ratings yet

- Rule 68 Foreclosure of Real Estate MortgageDocument12 pagesRule 68 Foreclosure of Real Estate Mortgagereese93No ratings yet

- A Research Paper On PartitionDocument15 pagesA Research Paper On Partitionlyka timanNo ratings yet

- SCA - Mortgage (2017)Document29 pagesSCA - Mortgage (2017)Peter AllanNo ratings yet

- Real Estate MortgageDocument5 pagesReal Estate MortgageEbot Gempis100% (1)

- Right of Redemption VsDocument3 pagesRight of Redemption VsIsaiah NepomucenoNo ratings yet

- Real Estate Mortage: Group 3Document19 pagesReal Estate Mortage: Group 3Janex TolineroNo ratings yet

- MortgageDocument20 pagesMortgagenorhainiNo ratings yet

- Mortgage Foreclosure and Redemption ExplainedDocument30 pagesMortgage Foreclosure and Redemption Explainednikka laygoNo ratings yet

- Foreclosure of Real Estate MortgageDocument13 pagesForeclosure of Real Estate MortgageTrudgeOn100% (1)

- Assignment of TPADocument21 pagesAssignment of TPAvaibhav chauhan50% (2)

- Rule 67 Expropriation RequirementsDocument9 pagesRule 67 Expropriation RequirementsPrincess FaithNo ratings yet

- Philippine National Bank VsDocument70 pagesPhilippine National Bank VsJacques Andre Collantes BeaNo ratings yet

- Mortgage Discussion For DummiesDocument23 pagesMortgage Discussion For DummiesMarko LopezNo ratings yet

- SPECPRO Tan NotesDocument12 pagesSPECPRO Tan NotesPaulo HernandezNo ratings yet

- Bicol Savings v. CA: Alia, The Following StipulationDocument2 pagesBicol Savings v. CA: Alia, The Following StipulationWhere Did Macky GallegoNo ratings yet

- Saved Laws For CredtransDocument6 pagesSaved Laws For CredtransTinn ApNo ratings yet

- BANKING LAWS Additional Supreme Court Doctrines On Real Estate Mortgage 01Document18 pagesBANKING LAWS Additional Supreme Court Doctrines On Real Estate Mortgage 01RaineNo ratings yet

- DefineDocument12 pagesDefinekirstyadriano3131No ratings yet

- Special Proceedings and Special WritsDocument63 pagesSpecial Proceedings and Special WritsjoliwanagNo ratings yet

- Abuzahra v. City of Cambridge, No. SJC-12920 (Mass. Feb. 17, 2021)Document21 pagesAbuzahra v. City of Cambridge, No. SJC-12920 (Mass. Feb. 17, 2021)RHTNo ratings yet

- A. Pactum Commisorium, Cite Specific Civil Code ProvisionDocument4 pagesA. Pactum Commisorium, Cite Specific Civil Code ProvisionEmmanuel YrreverreNo ratings yet

- Report CasesDocument33 pagesReport Casesangelica poNo ratings yet

- Cagayan de Oro v. CADocument3 pagesCagayan de Oro v. CAHurjae Soriano LubagNo ratings yet

- Settlement of Estate of Deceased PersonsDocument21 pagesSettlement of Estate of Deceased PersonsDan LocsinNo ratings yet

- Legal Research (Forclosure)Document2 pagesLegal Research (Forclosure)denjo bonilla0% (1)

- A Research Paper On PartitionDocument6 pagesA Research Paper On Partitionlyka timanNo ratings yet

- Jurado, 2009ed)Document8 pagesJurado, 2009ed)twenty19 lawNo ratings yet

- Real Estate MortgageDocument9 pagesReal Estate MortgageApril Roween AranzaNo ratings yet

- Credit Transactions Caltex Phils. Vs IAC, 74730 August 25, 1989Document12 pagesCredit Transactions Caltex Phils. Vs IAC, 74730 August 25, 1989Brenda de la GenteNo ratings yet

- Foreclosure of REMDocument10 pagesForeclosure of REMShanelle NapolesNo ratings yet

- Two Types of Mortgage Redemption Rights in the PhilippinesDocument14 pagesTwo Types of Mortgage Redemption Rights in the PhilippinesArvin GuevarraNo ratings yet

- Perez V PNBDocument5 pagesPerez V PNBZahraMinaNo ratings yet

- Mortagge NotesDocument7 pagesMortagge NotesJhannes Gwendholyne Gorre OdalNo ratings yet

- ForeclosureDocument19 pagesForeclosure'Joshua Crisostomo'No ratings yet

- Real Estate Contract DisputeDocument11 pagesReal Estate Contract DisputeNicorobin RobinNo ratings yet

- Judicial Foreclosure Real Estate MortgageDocument11 pagesJudicial Foreclosure Real Estate MortgageIanna Carmel QuitayenNo ratings yet

- Paper Presentation On Money Suits & Mortgage Suits.: FOR THE WORK SHOP-1, ON 23.03.2024Document127 pagesPaper Presentation On Money Suits & Mortgage Suits.: FOR THE WORK SHOP-1, ON 23.03.2024aditya gairNo ratings yet

- Transfer of Property ActDocument8 pagesTransfer of Property ActAnkush JadaunNo ratings yet

- Credit TransDocument11 pagesCredit Transrcmj_supremo3193No ratings yet

- Procedure of Extrajudicial ForeclosureDocument6 pagesProcedure of Extrajudicial ForeclosureRia Evita RevitaNo ratings yet

- 4expro, Foreclo PartitionDocument9 pages4expro, Foreclo PartitionPablo EschovalNo ratings yet

- How Are The Proceedings in An Action For Foreclosure Conducted?Document4 pagesHow Are The Proceedings in An Action For Foreclosure Conducted?xxsunflowerxxNo ratings yet

- Digest RosalesDocument3 pagesDigest RosalesmisterdodiNo ratings yet

- Optimum Development Bank Vs JovelanosDocument15 pagesOptimum Development Bank Vs JovelanosJerome ArañezNo ratings yet

- Mortgage Bond: Mortgage Is A Security Furnished by A Person For The Repayment of A LoanDocument2 pagesMortgage Bond: Mortgage Is A Security Furnished by A Person For The Repayment of A LoanUsmanFarisNo ratings yet

- Procedure For Judicial Foreclosure of Real Estate MortgageDocument3 pagesProcedure For Judicial Foreclosure of Real Estate MortgageJoel A. YbañezNo ratings yet

- Real Mortgage, Antichresis, Chattel MortgageDocument4 pagesReal Mortgage, Antichresis, Chattel MortgageJapon, Jenn RossNo ratings yet

- Explain Kinds of MortgageDocument41 pagesExplain Kinds of Mortgagetusharravi9No ratings yet

- 7 MedidaDocument11 pages7 MedidaAnonymousNo ratings yet

- Rule 68 Word DocsDocument2 pagesRule 68 Word Docsellaella031No ratings yet

- Spouses Ricardo Rosales and Erlinda Sibug Vs Spouses Alfonso and Lourdes SubaDocument3 pagesSpouses Ricardo Rosales and Erlinda Sibug Vs Spouses Alfonso and Lourdes Subakat perez100% (2)

- Monzon v. Sps. Relova and Sps. PerezDocument2 pagesMonzon v. Sps. Relova and Sps. PerezIsabel DoctoleroNo ratings yet

- REAL MORTGAGE ReportDocument46 pagesREAL MORTGAGE ReportMaritesCatayongNo ratings yet

- Rosales v. SubaDocument1 pageRosales v. SubasdfoisaiofasNo ratings yet

- Onett Developer TemplateDocument6 pagesOnett Developer Templatejoeye louieNo ratings yet

- Katarungang PambarangayDocument4 pagesKatarungang Pambarangayjoeye louieNo ratings yet

- Admin Law CasesDocument39 pagesAdmin Law Casesjoeye louieNo ratings yet

- RDO23A - Reply To Complaints Action Center Dated Nov 15 2023Document2 pagesRDO23A - Reply To Complaints Action Center Dated Nov 15 2023joeye louieNo ratings yet

- Cte - Zaragoza National High School Consumers CooperativeDocument2 pagesCte - Zaragoza National High School Consumers Cooperativejoeye louieNo ratings yet

- Case Digest,,,Cases Re Lecture For 2-2-23 Session BlsDocument19 pagesCase Digest,,,Cases Re Lecture For 2-2-23 Session Blsjoeye louieNo ratings yet

- JudicialStereotyping Session5Document32 pagesJudicialStereotyping Session5joeye louieNo ratings yet

- Torts and Damages Presentation and Case Digests ListDocument7 pagesTorts and Damages Presentation and Case Digests Listjoeye louieNo ratings yet

- C0 K 713 LZRWP EB2 GG 454Document13 pagesC0 K 713 LZRWP EB2 GG 454joeye louieNo ratings yet

- Assignment #1 Philosophy of LawDocument1 pageAssignment #1 Philosophy of Lawjoeye louieNo ratings yet

- Case Digests AgencyDocument27 pagesCase Digests Agencyjoeye louieNo ratings yet

- Case Digest,,,cases Re Lecture For 2-2-23 Session BLSDocument18 pagesCase Digest,,,cases Re Lecture For 2-2-23 Session BLSjoeye louieNo ratings yet

- Civil Law 1Document4 pagesCivil Law 1Skorpión ZüchterNo ratings yet

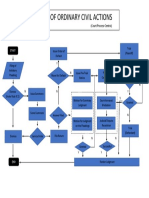

- Flow of Ordinary Civil ActionsDocument1 pageFlow of Ordinary Civil ActionsLove CodmNo ratings yet

- Fundamental Powers of The EstateDocument38 pagesFundamental Powers of The Estatejoeye louieNo ratings yet

- Honasan vs Panel of Investigating Prosecutors case digestDocument40 pagesHonasan vs Panel of Investigating Prosecutors case digestjoeye louieNo ratings yet

- Assignment in Corp Law (AOI)Document5 pagesAssignment in Corp Law (AOI)joeye louieNo ratings yet

- Case Digest,,,cases Re Lecture For 2-2-23 Session BLSDocument18 pagesCase Digest,,,cases Re Lecture For 2-2-23 Session BLSjoeye louieNo ratings yet

- Admin LAW SYLLABUS WesleyanDocument5 pagesAdmin LAW SYLLABUS Wesleyanjoeye louieNo ratings yet

- Pajuyo VDocument5 pagesPajuyo Vjoeye louieNo ratings yet

- Course Syllabus Legal Research and WritingDocument6 pagesCourse Syllabus Legal Research and Writingjoeye louieNo ratings yet

- Course Syllabus WesleyanDocument31 pagesCourse Syllabus Wesleyanjoeye louieNo ratings yet

- Fundamental Powers of The Estate UpdatedDocument204 pagesFundamental Powers of The Estate Updatedjoeye louieNo ratings yet

- R.A. No. 6770 The Ombudsman Act of 1989Document11 pagesR.A. No. 6770 The Ombudsman Act of 1989joeye louieNo ratings yet

- Final Examination Seat PlanDocument1 pageFinal Examination Seat Planjoeye louieNo ratings yet

- CasesDocument180 pagesCasesjoeye louieNo ratings yet

- C0 K 713 LZRWP EB2 GG 454Document13 pagesC0 K 713 LZRWP EB2 GG 454joeye louieNo ratings yet

- Revised Rule On Summary Procedure 1991Document8 pagesRevised Rule On Summary Procedure 1991joeye louieNo ratings yet

- R.A. No. 9165 Comprehensive Dangerous Drugs Act of 2002Document51 pagesR.A. No. 9165 Comprehensive Dangerous Drugs Act of 2002joeye louieNo ratings yet

- COL Final ExaminationDocument1 pageCOL Final Examinationjoeye louieNo ratings yet

- Personal Injury Liability Waiver FormDocument3 pagesPersonal Injury Liability Waiver Formirish sedilllNo ratings yet

- Principle of DhararDocument21 pagesPrinciple of DhararMahyuddin KhalidNo ratings yet

- Banking Module 2Document8 pagesBanking Module 2edhaNo ratings yet

- ARISTOTEL VALENZUELA y NATIVIDAD vs. PEOPLE OF THE PHILIPPINESDocument2 pagesARISTOTEL VALENZUELA y NATIVIDAD vs. PEOPLE OF THE PHILIPPINESalltimedeeerpNo ratings yet

- Sample Adverse ClaimDocument3 pagesSample Adverse ClaimIvn Maj NopuenteNo ratings yet

- Template - MoaDocument4 pagesTemplate - MoaAllan AguilarNo ratings yet

- Conditions of EngagementDocument4 pagesConditions of EngagementPRIYANKA SAINATH SNo ratings yet

- Lecture 3Document20 pagesLecture 3Grim 1118No ratings yet

- Law of AgencyDocument5 pagesLaw of AgencyKerrice RobinsonNo ratings yet

- 50 Cent - Schedules A-JDocument38 pages50 Cent - Schedules A-JMike Huseman100% (1)

- Implied Condition of Suitability in Baldry v MarshallDocument6 pagesImplied Condition of Suitability in Baldry v MarshallSiddhesh BhosleNo ratings yet

- For Scribd SPA EJSDocument2 pagesFor Scribd SPA EJSMarcus GilmoreNo ratings yet

- Labor Standards - Case Digest 1Document20 pagesLabor Standards - Case Digest 1RS100% (3)

- Cesar Raet, Et Al. vs. Court of Appeals, Et Al.Document2 pagesCesar Raet, Et Al. vs. Court of Appeals, Et Al.Dana Jeuzel MarcosNo ratings yet

- NHM - EoiDocument73 pagesNHM - Eoiha6820474No ratings yet

- Provision Contingent LiabilityDocument14 pagesProvision Contingent LiabilityAngelica IrincoNo ratings yet

- Public vs Private: Key DifferencesDocument7 pagesPublic vs Private: Key DifferencesVinay KumarNo ratings yet

- CIV LTD Gab OlandescaDocument50 pagesCIV LTD Gab Olandescajaenaanne100% (1)

- RTC Jurisdiction Easement CaseDocument2 pagesRTC Jurisdiction Easement CaseGenelle Mae Madrigal100% (1)

- Legal Aspect of BusinessDocument146 pagesLegal Aspect of Businesssumitkjham100% (1)

- Valerio vs. Refresca Case DigestDocument3 pagesValerio vs. Refresca Case DigestssNo ratings yet

- The Danish Liability For Damages ActDocument10 pagesThe Danish Liability For Damages ActKevin Cruz DomingoNo ratings yet

- Spa - Dtrak Reon 2Document4 pagesSpa - Dtrak Reon 2Marie CaballeroNo ratings yet

- Australian Securities and Investments Commission V KingDocument47 pagesAustralian Securities and Investments Commission V KingCourtni HolderNo ratings yet

- Syllabus - Civil Law (And Practical Exercises) - Bar Exams 2022Document11 pagesSyllabus - Civil Law (And Practical Exercises) - Bar Exams 2022NoemiNo ratings yet

- R92-97 CASE 2. Caniza vs. CADocument7 pagesR92-97 CASE 2. Caniza vs. CAJessica AbadillaNo ratings yet

- Property or Unit Registration Form: Bit - Ly/2WaknuqDocument2 pagesProperty or Unit Registration Form: Bit - Ly/2WaknuqEissa SamNo ratings yet

- 1991 US-Argentina BITDocument12 pages1991 US-Argentina BITCalMustoNo ratings yet

- End-User License AgreementDocument8 pagesEnd-User License AgreementMahboob IqbalNo ratings yet

- Basic Concepts of Contract of SaleDocument7 pagesBasic Concepts of Contract of SaleWesNo ratings yet