Professional Documents

Culture Documents

Debt Instruments 2

Uploaded by

Crizza DemecilloOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Debt Instruments 2

Uploaded by

Crizza DemecilloCopyright:

Available Formats

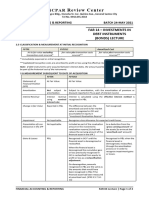

DEBT INSTRUMENTS

Financial Assets at Amortized Cost Financial Assets at Fair Value Through Other Financial Assets at Fair Value Through Profit Or Loss

Comprehensive Income

Requisites for The asset is held to Requisites for This is a “residual category” if none of

Classification collect its contractual Requisites for The objective of the business model is Classification the two previously mentioned (AC and

cash flows and Classification achieved both by collecting contractual FVOCI) business models apply or if any

The asset’s contractual cash flows and selling financial assets; of the two business model apply but the

cash flows represent and contractual cash flows are NOT SPPI for

‘solely payments of The asset’s contractual cash flows example if interest will include a profit

principal and interest’ represent SPPI. participation.

If the two requisites for the AC and

Profit or Loss Effective interest income Profit or Loss Effective interest (income) FVOCI category are met but the entity

Implications Impairments losses and Implications Impairments losses and reversal gains elects to measure debt instruments at

reversal gains Gain or loss on derecognition including FVPL to eliminate an “accounting

Gain or loss on reclassification adjustments (IAS 1) mismatch” because financial liabilities

derecognition are measured at FVPL.

OCI Changes in fair value due to subsequent

Statement of Measured at amortized measurement Profit or Loss Nominal interest (income)

financial cost Implications Direct transaction cost incurred on

position Classified as a non- Statement of Measured at fair value after amortization acquisition

current asset unless Financial for the effective interest Gain or loss on changes in fair value on

maturity is within 12 Position Cumulative gain or loss on fair value in subsequent measurement

months after the end of Equity Gain or loss on derecognition

the reporting period Since PFRS 5 excludes the scope for

financial assets, FVOCI are non-current Statement of Measured at fair value

asset unless maturity is within 12 months Financial Under the assumption the Financial asset

after the end of the reporting period. Position is held for trading, FVPL shall be

Note that both amortization is applied classified as a current asset (PAS 1)

Note that both amortization is applied under the effective interest

under the effective interest method

method before applying the FV measurement requirement for

before applying the FV measurement

the FVOCI classification

requirement for the FVOCI

classification

You might also like

- IND AS 1 Financial Statement RequirementsDocument47 pagesIND AS 1 Financial Statement RequirementsVinayak50% (2)

- Investment Banking ResumeDocument1 pageInvestment Banking Resumekari555No ratings yet

- Chapter 31Document6 pagesChapter 31LorraineMartinNo ratings yet

- Audit Specialized Industries Under 40 CharactersDocument61 pagesAudit Specialized Industries Under 40 CharactersCrizza Demecillo100% (2)

- Colt Industries FinalDocument31 pagesColt Industries FinalJoão Pedro Branco0% (2)

- Financial Asset Classification and MeasurementDocument2 pagesFinancial Asset Classification and MeasurementjoyjoyjoyNo ratings yet

- Investment in Debt SecuritiesDocument7 pagesInvestment in Debt SecuritiesRoma Suliguin0% (1)

- Philippine School of Business Administration: Integrated Review - Auditing BLD 2 Semester 2020-2021Document13 pagesPhilippine School of Business Administration: Integrated Review - Auditing BLD 2 Semester 2020-2021Thalia UyNo ratings yet

- Salient Differences Between IAS 39 and IFRS 9Document3 pagesSalient Differences Between IAS 39 and IFRS 9Dennis Velasquez50% (2)

- Module 4 - Financial Instruments (Assets)Document9 pagesModule 4 - Financial Instruments (Assets)Luisito CorreaNo ratings yet

- Financial Assets Classification GuideDocument8 pagesFinancial Assets Classification GuideKing BelicarioNo ratings yet

- Investments DiscussionDocument5 pagesInvestments DiscussionKathrine CruzNo ratings yet

- PFRS Updates: PAS 1, PAS 19, PFRS 9, PFRS 10, PFRS 11, PFRS 13Document74 pagesPFRS Updates: PAS 1, PAS 19, PFRS 9, PFRS 10, PFRS 11, PFRS 13Mara Shaira Siega100% (1)

- Investment NotesDocument12 pagesInvestment NotesLenrey CobachaNo ratings yet

- Lesson 12Document6 pagesLesson 12Jamaica bunielNo ratings yet

- PFRS 9 Financial Instruments GuideDocument11 pagesPFRS 9 Financial Instruments Guidejsus22100% (1)

- PFRS for SMEs vs Full PFRS: Key DifferencesDocument14 pagesPFRS for SMEs vs Full PFRS: Key DifferencesAnthon GarciaNo ratings yet

- Ia InvestmentsDocument11 pagesIa InvestmentsJhunnie LoriaNo ratings yet

- 1 IFRS 9 - Financial InstrumentsDocument31 pages1 IFRS 9 - Financial InstrumentsSharmaineMirandaNo ratings yet

- PPE NotesDocument4 pagesPPE Notesaldric taclanNo ratings yet

- SMEs - Key Differences Between Full PFRS and PFRS for SMEsDocument17 pagesSMEs - Key Differences Between Full PFRS and PFRS for SMEsDesai SarvidaNo ratings yet

- IA1 Financial Assets at Fair ValueDocument11 pagesIA1 Financial Assets at Fair ValueSteffanie OlivarNo ratings yet

- Understanding Equity Securities Classification and AccountingDocument9 pagesUnderstanding Equity Securities Classification and Accountingwingsenigma 00No ratings yet

- CPADocument7 pagesCPACaryl Haidee MarcosNo ratings yet

- smmeDocument9 pagessmmemicadeguzman.1313No ratings yet

- PFRS 9Document1 pagePFRS 9Ella MaeNo ratings yet

- FAR 04 Investment in Debt Instruments LectureDocument4 pagesFAR 04 Investment in Debt Instruments Lecturebyunb3617No ratings yet

- INVEST EQUITY SECURDocument42 pagesINVEST EQUITY SECURJhay AbabonNo ratings yet

- Financial Instruments - IFRS 9Document3 pagesFinancial Instruments - IFRS 9aubrey lomaadNo ratings yet

- UCP FAR 14 investment equity securitiesDocument12 pagesUCP FAR 14 investment equity securitieslois martinNo ratings yet

- Gtal - 2016 Ifrs9 Financial InstrumentsDocument11 pagesGtal - 2016 Ifrs9 Financial InstrumentsErlanNo ratings yet

- Lesson 12Document10 pagesLesson 12shadowlord468No ratings yet

- ADVACC NOTES - Business CombinationDocument5 pagesADVACC NOTES - Business CombinationAlyaNo ratings yet

- Unit Ii Learning Activities Accounting StandardsDocument8 pagesUnit Ii Learning Activities Accounting StandardsChin FiguraNo ratings yet

- IFRS 9 - ImpairmentDocument14 pagesIFRS 9 - ImpairmentIris SarigumbaNo ratings yet

- Putting IFRS 9 Into Practice Presentation By: CPA Stephen Obock February 2018Document38 pagesPutting IFRS 9 Into Practice Presentation By: CPA Stephen Obock February 2018syed younasNo ratings yet

- #14 Investments in Debt InstrumentsDocument5 pages#14 Investments in Debt InstrumentsMakoy Bixenman100% (1)

- Accounting for associates and financial instrumentsDocument29 pagesAccounting for associates and financial instrumentsHiền MỹNo ratings yet

- 9 - Separate Financial Statements PDFDocument6 pages9 - Separate Financial Statements PDFDarlene Faye Cabral RosalesNo ratings yet

- U.S. GAAP vs. IFRS: Business Combinations: Prepared byDocument5 pagesU.S. GAAP vs. IFRS: Business Combinations: Prepared bygabiNo ratings yet

- IFRS 9 and ECL Modeling Free ClassDocument43 pagesIFRS 9 and ECL Modeling Free ClassAbdallah Abdul JalilNo ratings yet

- Intercorporate InvestmentsDocument53 pagesIntercorporate InvestmentsAriyaNo ratings yet

- 6903 PPT Materials For UploadDocument13 pages6903 PPT Materials For UploadAljur SalamedaNo ratings yet

- Afm 1Document20 pagesAfm 1antrikshaagrawalNo ratings yet

- Financial InstrumentsDocument21 pagesFinancial InstrumentsTommaso SpositoNo ratings yet

- Ifrs 9Document42 pagesIfrs 9tariqNo ratings yet

- Financial Accounting - Investment in Equity Securities A Project of Barters PH Contributed By: Vince Anthony FeirDocument2 pagesFinancial Accounting - Investment in Equity Securities A Project of Barters PH Contributed By: Vince Anthony FeirIts meh SushiNo ratings yet

- EquityDocument2 pagesEquityKathreen Aya ExcondeNo ratings yet

- FINANCIAL ACCOUNTING - INVESTMENT IN EQUITYDocument2 pagesFINANCIAL ACCOUNTING - INVESTMENT IN EQUITYKathreen Aya ExcondeNo ratings yet

- Ind AS Summary Charts PDFDocument52 pagesInd AS Summary Charts PDFNitin P. Dhole100% (1)

- Group 3Document17 pagesGroup 3Wambo MonsterrNo ratings yet

- PFRS 9 - Financial Instruments (NEW)Document20 pagesPFRS 9 - Financial Instruments (NEW)eiraNo ratings yet

- SS - 5-6 - Mindmaps - Financial ReportingDocument48 pagesSS - 5-6 - Mindmaps - Financial Reportinghaoyuting426No ratings yet

- CfasDocument3 pagesCfasWinnie ToribioNo ratings yet

- H.08 Financial Assets ClassificationDocument16 pagesH.08 Financial Assets Classificationchen.abellar.swuNo ratings yet

- Final SummaryDocument6 pagesFinal SummaryAkanksha singhNo ratings yet

- IFRS 9 - Financial Instrument (Final) V2Document23 pagesIFRS 9 - Financial Instrument (Final) V2mfaisal3No ratings yet

- OCI and Its Treatment in LawDocument24 pagesOCI and Its Treatment in LawCA TanishNo ratings yet

- Differences between US GAAP, Indian GAAP & IFRSDocument7 pagesDifferences between US GAAP, Indian GAAP & IFRSrajdeeppawarNo ratings yet

- Ifrs 9Document80 pagesIfrs 9Veer Pratab SinghNo ratings yet

- IFRS 9 WebinarDocument18 pagesIFRS 9 WebinarMovie MovieNo ratings yet

- Bdo - Ifrs 9Document8 pagesBdo - Ifrs 9fildzah dessyanaNo ratings yet

- Investment in Equity Securities Summary - A Project of Barters PHDocument2 pagesInvestment in Equity Securities Summary - A Project of Barters PHIts meh SushiNo ratings yet

- Lesson 2.2Document1 pageLesson 2.2Crizza DemecilloNo ratings yet

- Lesson 2.3Document2 pagesLesson 2.3Crizza DemecilloNo ratings yet

- ThroughDocument2 pagesThroughCrizza DemecilloNo ratings yet

- Lesson 2.2Document1 pageLesson 2.2Crizza DemecilloNo ratings yet

- Lesson 2Document2 pagesLesson 2Crizza DemecilloNo ratings yet

- Graphs and charts of student dataDocument3 pagesGraphs and charts of student dataCrizza DemecilloNo ratings yet

- Lesson 2Document2 pagesLesson 2Crizza DemecilloNo ratings yet

- Lesson 2.3Document2 pagesLesson 2.3Crizza DemecilloNo ratings yet

- Name: Ira Kaye B. Padilla Subject and Section: BSA 2A-B42 Title: Process Costing Conceptual FrameworkDocument1 pageName: Ira Kaye B. Padilla Subject and Section: BSA 2A-B42 Title: Process Costing Conceptual FrameworkCrizza DemecilloNo ratings yet

- Less0n 1Document2 pagesLess0n 1Crizza DemecilloNo ratings yet

- Lesson 2Document2 pagesLesson 2Crizza DemecilloNo ratings yet

- Lesson 2.3Document2 pagesLesson 2.3Crizza DemecilloNo ratings yet

- Less0n 1Document2 pagesLess0n 1Crizza DemecilloNo ratings yet

- Kinds of Pronouns: Identifying Pronouns and Their FunctionsDocument16 pagesKinds of Pronouns: Identifying Pronouns and Their FunctionsCrizza DemecilloNo ratings yet

- Lesson 2.3.2Document3 pagesLesson 2.3.2Crizza DemecilloNo ratings yet

- Joint Process: Joint Product (Main Product) By-Product (Scrap)Document1 pageJoint Process: Joint Product (Main Product) By-Product (Scrap)Crizza DemecilloNo ratings yet

- Hega Etc - Feminism and The Women's MovementDocument32 pagesHega Etc - Feminism and The Women's MovementAntonio Ma. Reyes IVNo ratings yet

- Standard Costing: Manufacturing Overhead StandardsDocument2 pagesStandard Costing: Manufacturing Overhead StandardsCrizza DemecilloNo ratings yet

- First DayDocument1 pageFirst DayCrizza DemecilloNo ratings yet

- Cold Place Warm PeopleDocument1 pageCold Place Warm PeopleCrizza DemecilloNo ratings yet

- Physical EducationDocument1 pagePhysical EducationCrizza DemecilloNo ratings yet

- An Open Letter To MyselfDocument2 pagesAn Open Letter To MyselfCrizza DemecilloNo ratings yet

- First DayDocument1 pageFirst DayCrizza DemecilloNo ratings yet

- An Open Letter To MyselfDocument2 pagesAn Open Letter To MyselfCrizza DemecilloNo ratings yet

- Globalization: An Inescapable Worldwide PhenomenonDocument2 pagesGlobalization: An Inescapable Worldwide PhenomenonCrizza DemecilloNo ratings yet

- KringggDocument2 pagesKringggCrizza DemecilloNo ratings yet

- 5 6262722265062834313Document15 pages5 6262722265062834313AldrinNo ratings yet

- Globalization: An Inescapable Worldwide PhenomenonDocument2 pagesGlobalization: An Inescapable Worldwide PhenomenonCrizza DemecilloNo ratings yet

- An Open Letter To MyselfDocument2 pagesAn Open Letter To MyselfCrizza DemecilloNo ratings yet

- Bocconi PE and VC CourseraDocument15 pagesBocconi PE and VC CourseraMuskanDodejaNo ratings yet

- Mergers and Aquisition: University of Economics - Ho Chi Minh CityDocument7 pagesMergers and Aquisition: University of Economics - Ho Chi Minh CityNhân TrịnhNo ratings yet

- California State Teachers' Retirement System Private Equity Portfolio Performance AsDocument6 pagesCalifornia State Teachers' Retirement System Private Equity Portfolio Performance AsDan PrimackNo ratings yet

- Chapter 2 Business Combinations Part 2Document10 pagesChapter 2 Business Combinations Part 2Roselyn mangaron sagcalNo ratings yet

- Hostile Takeover Defenses-II: - Goutham G Shetty - Raghavendra BhatDocument43 pagesHostile Takeover Defenses-II: - Goutham G Shetty - Raghavendra BhatlijojohnisinloveNo ratings yet

- Dividends - and - Share - Repurchases - Basics - SlidesDocument19 pagesDividends - and - Share - Repurchases - Basics - Slideszaheer9287No ratings yet

- Investment Banking Course OutlineDocument4 pagesInvestment Banking Course OutlineVrinda GargNo ratings yet

- Corporate Restructuring Strategies ExplainedDocument26 pagesCorporate Restructuring Strategies ExplainedAmar Singh SaudNo ratings yet

- Introduction To Alternative Investments: Weekly Test - AIDocument96 pagesIntroduction To Alternative Investments: Weekly Test - AIRuchira GoleNo ratings yet

- Business Combinations TypesDocument22 pagesBusiness Combinations TypesrogealynNo ratings yet

- FicaDocument1 pageFicaHerman Du ToitNo ratings yet

- Barbarians at the Gate Corporate Governance IssuesDocument2 pagesBarbarians at the Gate Corporate Governance IssuesKrati BansalNo ratings yet

- Corporate Restructuring - Reconfiguration of A CorporationDocument18 pagesCorporate Restructuring - Reconfiguration of A Corporationishita pancholiNo ratings yet

- Management Buy-Out ExplainedDocument3 pagesManagement Buy-Out ExplainedRooma EjazNo ratings yet

- CH 6 - LBODocument23 pagesCH 6 - LBOVrutika ShahNo ratings yet

- Group 6 Bankruptcy and Restructuring at Marvel Entertainment GroupDocument9 pagesGroup 6 Bankruptcy and Restructuring at Marvel Entertainment Groupphamvi44552002No ratings yet

- Defence Against Hostile TakeoversDocument2 pagesDefence Against Hostile TakeoversAhmad AfghanNo ratings yet

- MindtreeDocument11 pagesMindtreeJay RathodNo ratings yet

- Elon Musk's $44B Twitter Takeover SagaDocument4 pagesElon Musk's $44B Twitter Takeover SagaFAIZAAN MARFANINo ratings yet

- Questions and AnswersDocument28 pagesQuestions and AnswersSamuel LeitaoNo ratings yet

- Private Equity Primer A Comprehensive Guide To Private Equity Investing 2022 1Document28 pagesPrivate Equity Primer A Comprehensive Guide To Private Equity Investing 2022 1suciusorin_smccNo ratings yet

- IBIG 04 Questions Files ToCDocument3 pagesIBIG 04 Questions Files ToCіфвпаіNo ratings yet

- Fabv 632 All PDFDocument62 pagesFabv 632 All PDFNageshwar SinghNo ratings yet

- Chmsc-Valcom 2 Sem. AY2021-2022 Module 1. Overview of Valuation Techniques Learning ObjectivesDocument7 pagesChmsc-Valcom 2 Sem. AY2021-2022 Module 1. Overview of Valuation Techniques Learning ObjectivesChristopher ApaniNo ratings yet

- Investment Banking: Relative Valuation and IPO PricingDocument4 pagesInvestment Banking: Relative Valuation and IPO Pricingrishabh jainNo ratings yet

- 104 QuizDocument25 pages104 Quizricamae saladagaNo ratings yet

- Winning Moves - PDF VersionDocument343 pagesWinning Moves - PDF VersionHichemNo ratings yet