Professional Documents

Culture Documents

Application Form For SD Payment

Uploaded by

rohitsaini.4everOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Application Form For SD Payment

Uploaded by

rohitsaini.4everCopyright:

Available Formats

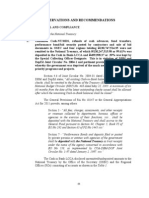

Stock Holding Corporation of India Limited

Registered office : 301, Centre Point, Dr. Babasaheb Ambedkar Road, Parel, Mumbai – 400012

VER 1.0 301014

Visit us at : www.shcilestamp.com

Form - 4 [See rules 24,26(2) & 29]

Application Form For e-Stamp Certificate /Additional e-Stamping Certificate

For Government of Punjab Date : / /20

ACC ACC Id

Document Description Article Stamp Duty Amount ` Indian Rupees only

Property Description / Property Address (not exceeding 100 characters)

(not exceeding 100 characters)

Consideration Amount (if any) `

Details of First Party and Second Party / Authorised Person

Name & Address of (name not exceeding 50 characters)

First Party

Phone

Name & Address of (name not exceeding 50 characters)

Second Party

Phone

Name & Address (name not exceeding 50 characters)

Purchaser/

Authorised Person Phone

Stamp Duty Paid by ( Tick) q 1st Party q 2nd Party

Stamp Duty Payment Details

Mode of Payment q Cash q Cheque q DD q Pay-Order q NEFT q RTGS q Account to Account Transfer

Cheque / DD / Pay-Order / NEFT / RTGS / Account Details Cash Deposit `

Bank Name Branch Name Cheque /DD /PO /UTR /REF/Account No. Deno. Pieces

1000 X

500 X

100 X

50 X

20 X

10 X

5 X

Rupees ( in Words ) : 2 X

1 X

Total

1. Please submit the duly filled and signed form along with stamp duty amount at the e-Stamping counter 2. Stamp Duty amount should be rounded off to the nearest Rupee.

3. The correctness of Article type and Stamp Duty amount cannot be confirmed at the e-Stamping counter 4. Once the e-Stamp is generated no modifications/changes are

possible, so carefully check the preview of the e-Stamp and only then sign the preview 5. Cancellation charges are applicable as levied by the State Government 6.While

generating Additional e-Stamp Certificate details of the base certificate cannot be changed

I have read and understood the above instructions and the above information furnished by me is true to the best of my knowledge, thus, the:

(i) e-Stamp Certificate of above amount may please be issued/or (ii) additional e-Stamp Certificate of the above amount, in continuation of previous

Certificate No. __________________________________ dated __________________ may please be issued.

Date : Signature of the Purchaser / Authorised Person :

(For Office use only)

To be filled by USER To be filled by SUPERVISOR

SUBIN Certificate Number IN

Acknowledgement of e-Stamp Certificate to be kept by the ACCs

The e-Stamp Certificate of ______________________________________has been received by Sh./Smt./_______________________________________________________

today on ______________.

Signature of the Purchaser / Authorised Person : ----------------------------------------------------------

---------------------------------------------------------------"-----------------------------------------------------------------------"-------------------------------------------------------------- "-----------------------------------------------------------------

SHCIL E-Stamping Receipt (To be filled in by the client)

Name of Stamp Duty

Stamp Duty Paid by q 1st Party q 2nd Party

Purchaser/Authorised Person

q Cash q Cheque q DD q Pay-Order q NEFT

Stamp Duty Amount ` Type of Payment

q RTGS q Account to Account Transfer

Cheque/ DD/ PO/ UTR/ REF/Account No. Date: / /20

Bank Name Branch Name

Counter Signature with Seal

Note: Once the e-Stamp has been generated, payment cannot be cancelled or refunded by SHCIL or ACC. The refund or allowance for 'spoiled' or 'misused' or 'not required for

use', e-Stamp Certificate can be made by the Collector of the District in accordance with Chapter-VII of Punjab e-Stamp Rules, 2014.

You might also like

- Washington Military ManualsDocument10 pagesWashington Military ManualsPALLIKARASNo ratings yet

- 236 References To 6MPriortoNurembergTrialDocument191 pages236 References To 6MPriortoNurembergTrialjai_mann1036100% (1)

- Rothbard On RevisionismDocument126 pagesRothbard On RevisionismLiberty AustraliaNo ratings yet

- Physical Science 1 1Document58 pagesPhysical Science 1 1Anonymous N0FZEkrSaeNo ratings yet

- An Outline of MLK Letter From Birmingham JailDocument1 pageAn Outline of MLK Letter From Birmingham JailTed StolzeNo ratings yet

- Deped Coa2011 Observation RecommendationDocument81 pagesDeped Coa2011 Observation RecommendationAnthony Sutton100% (7)

- Bank GuaranteeDocument100 pagesBank GuaranteeShubham Rustagi0% (1)

- Saudi Aramco Supplier Registration & Qualification SeminarDocument15 pagesSaudi Aramco Supplier Registration & Qualification Seminaral arabiNo ratings yet

- Water Quality. Digestion For The Determination of Selected Elements in WaterDocument28 pagesWater Quality. Digestion For The Determination of Selected Elements in WaterDinoNo ratings yet

- Reflection PaperDocument3 pagesReflection PaperZienna M. GualvezNo ratings yet

- Tombak-Onhsore Facilities Detail Design: National Iranian Oil Company South Pars Gas Field Development Phase 14Document15 pagesTombak-Onhsore Facilities Detail Design: National Iranian Oil Company South Pars Gas Field Development Phase 14rashid kNo ratings yet

- E StampDocument1 pageE StampSewak SinghNo ratings yet

- Application Ind 01Document1 pageApplication Ind 01Uma KolhatkarNo ratings yet

- Application Ind PDFDocument1 pageApplication Ind PDFUma KolhatkarNo ratings yet

- Power of Attorney: Agreement SectionDocument3 pagesPower of Attorney: Agreement Sectionreeta joshiNo ratings yet

- E Stamping Application FormDocument4 pagesE Stamping Application FormSales & Marketing Residential & CommercialNo ratings yet

- Credit Application FormDocument4 pagesCredit Application FormChay CruzNo ratings yet

- Phokophela: Loan Referral Application FormDocument1 pagePhokophela: Loan Referral Application FormPhokophela Sbongayena ShabalalaNo ratings yet

- 61816d14e254af52b91261eb All UPSTOX SIGNEDDocument4 pages61816d14e254af52b91261eb All UPSTOX SIGNEDBhushan TanavdeNo ratings yet

- Updated Background Check FormDocument4 pagesUpdated Background Check FormNitish BhardwajNo ratings yet

- Borang Ran Dealer Public Gold - BizmambauDocument2 pagesBorang Ran Dealer Public Gold - BizmambaubizmambauNo ratings yet

- Kyc Details Change Form For IndividualDocument1 pageKyc Details Change Form For IndividualUttam MehtaNo ratings yet

- Egov and EfpsDocument2 pagesEgov and EfpsMaricor Tambal67% (3)

- Egov and Efps PDFDocument2 pagesEgov and Efps PDFMaricor TambalNo ratings yet

- Manual On Boarding FormDocument1 pageManual On Boarding FormMahipal MeenaNo ratings yet

- Kyc Details Change Form For IndividualDocument1 pageKyc Details Change Form For IndividualSUPER HITZZNo ratings yet

- Hohm Energy Company Credit App To Be CompleterDocument1 pageHohm Energy Company Credit App To Be Completersolarfincorp2No ratings yet

- Lis PhiltowerDocument1 pageLis Philtowerleandro palenciaNo ratings yet

- Payment SlipDocument2 pagesPayment SlipMary AwuorNo ratings yet

- WPS Registration Booklet - Al Ansari ExchangeDocument17 pagesWPS Registration Booklet - Al Ansari Exchangeinfo.almanzoomaNo ratings yet

- Employee Joining Form AsianDocument2 pagesEmployee Joining Form AsianShri Ram Cyber CafeNo ratings yet

- Deduction Authorization FormDocument2 pagesDeduction Authorization FormKarlee WeaverNo ratings yet

- Perjanjian Kerjasama ESPAY Payment Gateway (Indo - Eng Version) With Newest ChannelDocument23 pagesPerjanjian Kerjasama ESPAY Payment Gateway (Indo - Eng Version) With Newest ChannelZaynull Abideen NoahNo ratings yet

- Cahaya Mandiri DataDocument1 pageCahaya Mandiri Datadock.valiantNo ratings yet

- Account Opening Form For Non-IndividualDocument6 pagesAccount Opening Form For Non-IndividualDeb Kumar SarkarNo ratings yet

- Customer Application FormDocument2 pagesCustomer Application FormErica AquinoNo ratings yet

- Power Finance Corporation LTDDocument4 pagesPower Finance Corporation LTDAritra BhattacharjeeNo ratings yet

- Address Update FormDocument2 pagesAddress Update FormRamesh babu BalasubramaniamNo ratings yet

- Bca Application Form: Alankit LimitedDocument3 pagesBca Application Form: Alankit LimitedCare pSwitchNo ratings yet

- Information Gathering Account Opening Jul 2021Document4 pagesInformation Gathering Account Opening Jul 2021sipho5mlnNo ratings yet

- KYC FormDocument2 pagesKYC FormDunamis Hortense Ekassi MbalaNo ratings yet

- Interview Record FormDocument4 pagesInterview Record FormbantiNo ratings yet

- D D M M Y Y Y Y D D M M Y Y Y Y D D M M Y Y Y Y: IFD Code: Independent Financial Distributor (Ifd) Registration FormDocument7 pagesD D M M Y Y Y Y D D M M Y Y Y Y D D M M Y Y Y Y: IFD Code: Independent Financial Distributor (Ifd) Registration Formdharam singhNo ratings yet

- REKYC Form Individual BOBDocument1 pageREKYC Form Individual BOBbhavin.hawkeyeNo ratings yet

- New Company Account Opening FormsDocument3 pagesNew Company Account Opening FormsChilanzi M'sonoiNo ratings yet

- Consumer KYC FormDocument1 pageConsumer KYC FormNihit GoyalNo ratings yet

- Edsa Centris Auto Loan Application Form: MG 80% 20% 60 MODocument4 pagesEdsa Centris Auto Loan Application Form: MG 80% 20% 60 MOJUNJUN PALOMARESNo ratings yet

- Customer Details: © Enterprise Software Solutions Lab (eSSL)Document1 pageCustomer Details: © Enterprise Software Solutions Lab (eSSL)Saravana KumarNo ratings yet

- Dragonpay Merchant Application Form LatestDocument1 pageDragonpay Merchant Application Form LatestDev So NicNo ratings yet

- Application For Telegraphic Transfer, Demand Draft, Foreign Currency Notes, PESONetDocument2 pagesApplication For Telegraphic Transfer, Demand Draft, Foreign Currency Notes, PESONetanastasia ongNo ratings yet

- CDF Onward TechnologiesDocument6 pagesCDF Onward TechnologiesBhavana PandeyNo ratings yet

- DRF FormDocument1 pageDRF FormsrinivasansscNo ratings yet

- SME Application Form HSBCDocument1 pageSME Application Form HSBCJamel TrishaNo ratings yet

- BGV FormDocument12 pagesBGV FormAmanpreet Singh0% (1)

- Form 990 Information Gathering Account Opening Form 2023Document4 pagesForm 990 Information Gathering Account Opening Form 2023Geney BothaNo ratings yet

- EPaycard - Customer Account Opening Form - 2015Document1 pageEPaycard - Customer Account Opening Form - 2015Drw ArcyNo ratings yet

- Landbank Landbank Link - Bizportal Merchant Payment Inquiry User Enrollment FormDocument1 pageLandbank Landbank Link - Bizportal Merchant Payment Inquiry User Enrollment Formcres gerard lagarasNo ratings yet

- India Distributor App 2011Document1 pageIndia Distributor App 2011HisWellnessNo ratings yet

- BOB Enrollment Form - ManualDocument3 pagesBOB Enrollment Form - ManualMaria AlvarezNo ratings yet

- Business Loan Application Form: (MM-DD-YYYY)Document1 pageBusiness Loan Application Form: (MM-DD-YYYY)Thannia OngNo ratings yet

- BGV FormDocument2 pagesBGV FormSree RahavanNo ratings yet

- Employee Infomation FormDocument2 pagesEmployee Infomation Formrohit.kedareNo ratings yet

- SIG CARD - Personal - 0Document1 pageSIG CARD - Personal - 0Badiday BadidayNo ratings yet

- Application For Vendor AccreditationDocument3 pagesApplication For Vendor AccreditationJohnArgielLaurenteVictorNo ratings yet

- Personal Account Application Form PDFDocument2 pagesPersonal Account Application Form PDFHugh O'Brien GwazeNo ratings yet

- Stock Holding Corporation of Indialimited: User Id Creation Form For Shcil UserDocument1 pageStock Holding Corporation of Indialimited: User Id Creation Form For Shcil UserRam nayan mishraNo ratings yet

- CHECK OFF FORM FINAL 2022 FinalDocument4 pagesCHECK OFF FORM FINAL 2022 FinalTadei MaotoNo ratings yet

- Customer Information SheetDocument3 pagesCustomer Information SheetMcAsia Foodtrade CorpNo ratings yet

- Client Masters Form (Download)Document2 pagesClient Masters Form (Download)rmalhotraNo ratings yet

- CABS ZEEPAY Application Form - Corporate-BusinessDocument3 pagesCABS ZEEPAY Application Form - Corporate-Businessdereck memeNo ratings yet

- Lembar Jawaban 1 UPK (Kevin J)Document12 pagesLembar Jawaban 1 UPK (Kevin J)kevin jonathanNo ratings yet

- Woodrod Wilson-Declaration of WarDocument7 pagesWoodrod Wilson-Declaration of WarAlexis IparraguirreNo ratings yet

- The Laws: Your High PriestessDocument7 pagesThe Laws: Your High PriestesscwhaleyjrNo ratings yet

- ECONOMICS ? SSC MTS 2022 G K ALL 57 Sets ECONOMICS Previous YearDocument234 pagesECONOMICS ? SSC MTS 2022 G K ALL 57 Sets ECONOMICS Previous Yearpawan nishalNo ratings yet

- Brigada Eskwela Certificate of AppreciationDocument5 pagesBrigada Eskwela Certificate of AppreciationFatima Jane DaquizNo ratings yet

- The Phantom Landlord - City Limits Magazine - March, April 2012Document52 pagesThe Phantom Landlord - City Limits Magazine - March, April 2012City Limits (New York)No ratings yet

- Indwdhi 20221130Document11 pagesIndwdhi 20221130Mohd HuzaifahNo ratings yet

- Spare Parts Catalog: 16 S 2230 TO Material Number: 1367.002.045 Current Date: 26.04.2017Document80 pagesSpare Parts Catalog: 16 S 2230 TO Material Number: 1367.002.045 Current Date: 26.04.2017Wang Sze Shian100% (1)

- Questions On MCDDocument3 pagesQuestions On MCDGaurav SaxenaNo ratings yet

- Board of Intermediate & Secondary Education, SargodhaDocument1 pageBoard of Intermediate & Secondary Education, SargodhaAllah Yar KhanNo ratings yet

- UW Psychology ReportDocument17 pagesUW Psychology ReportRaymond YoungNo ratings yet

- Pistol, Semi-Automatic, 9Mm: Operator'S Manual: Handling & Safety InstructionsDocument80 pagesPistol, Semi-Automatic, 9Mm: Operator'S Manual: Handling & Safety InstructionslaurNo ratings yet

- Cash Book WorksheetDocument4 pagesCash Book Worksheetanastasiarobinson21000No ratings yet

- Adamczuk v. HollowayDocument3 pagesAdamczuk v. HollowayMildred MendozaNo ratings yet

- Our Town November 13, 1926Document6 pagesOur Town November 13, 1926narberthcivicNo ratings yet

- JC 2012 01 Gad Plan Budget Ar Preparation MCW PDFDocument27 pagesJC 2012 01 Gad Plan Budget Ar Preparation MCW PDFCarmelaEspinoNo ratings yet

- Scrap BookDocument19 pagesScrap BookAshvin PatilNo ratings yet

- Borivau 11, Poladia Pandey Loan Ms. Hemshree: Racpc PMDocument5 pagesBorivau 11, Poladia Pandey Loan Ms. Hemshree: Racpc PMRikhil NairNo ratings yet

- Jim Green, SKSD Board Candidate QuestionnaireDocument6 pagesJim Green, SKSD Board Candidate QuestionnaireStatesman JournalNo ratings yet