Professional Documents

Culture Documents

Finance Act No.06 of 2022 (CGST)

Uploaded by

Santosh Kumar NahakOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance Act No.06 of 2022 (CGST)

Uploaded by

Santosh Kumar NahakCopyright:

Available Formats

10

AUBSP

6717062/2022/DC-CCT

6724369/2022/CC-CCT www.AUBSP.com

jftLVªh lañ Mhñ ,yñ—(,u)04@0007@2003—22 REGISTERED NO. DL—(N)04/0007/2003—22

सी.जी.-डी.एल.-अ.-31032022-234693

xxxGIDHxxx

CG-DL-E-31032022-234693

xxxGIDExxx

vlk/kkj.k

EXTRAORDINARY

Hkkx II — [k.M 1

PART II — Section 1

izkf/kdkj ls izdkf'kr

PUBLISHED BY AUTHORITY

lañ 6] ubZ fnYyh] cq/kokj] ekpZ 30] 2022@pS= 9] 1944 ¼'kd½

No. 6] NEW DELHI, WEDNESDAY, MARCH 30, 2022/CHAITRA 9, 1944 (SAKA)

bl Hkkx esa fHkUu i`"B la[;k nh tkrh gS ftlls fd ;g vyx ladyu ds :i esa j[kk tk ldsA

Separate paging is given to this Part in order that it may be filed as a separate compilation.

MINISTRY OF LAW AND JUSTICE

(Legislative Department)

New Delhi, the 30th March, 2022 / Chaitra 9, 1944 (Saka)

The following Act of Parliament received the assent of the President on the

30th March, 2022 and is hereby published for general information:—

THE FINANCE ACT, 2022

No. 6 OF 2022

[30th March, 2022.]

An Act to give effect to the financial proposals of the Central Government for

the financial year 2022-2023.

BE it enacted by Parliament in the Seventy-third Year of the Republic of India as follows:—

CHAPTER I

PRELIMINARY

1. (1) This Act may be called the Finance Act, 2022. Short title and

commencement.

(2) Save as otherwise provided in this Act,—

(a) sections 2 to 85 shall come into force on the 1st day of April, 2022;

(b) sections 100 to 114 shall come into force on such date as the Central

Government may, by notification in the Official Gazette, appoint.

CHAPTER II

RATES OF INCOME-TAX

2. (1) Subject to the provisions of sub-sections (2) and (3), for the assessment year Income-tax.

commencing on the 1st day of April, 2022, income-tax shall be charged at the rates specified

in Part I of the First Schedule and such tax shall be increased by a surcharge, for the

purposes of the Union, calculated in each case in the manner provided therein.

https://cutt.ly/CoAct https://www.aubsp.com/finance-act-2022/ https://cutt.ly/GSTact

11

AUBSP

6717062/2022/DC-CCT

6724369/2022/CC-CCT www.AUBSP.com

SEC. 1] THE GAZETTE OF INDIA EXTRAORDINARY 61

(ii) any notification issued under the Customs Act for appointing or assigning

functions to any officer shall be deemed to have been validly issued for all purposes,

including for the purposes of section 6;

(iii) for the purposes of this section, sections 2, 3 and 5 of the Customs Act, as

amended by this Act, shall have and shall always be deemed to have effect for all

purposes as if the provisions of the Customs Act, as amended by this Act, had been in

force at all material times.

Explanation. –– For the purposes of this section, it is hereby clarified that any

proceeding arising out of any action taken under this section and pending on the date

of commencement of this Act shall be disposed of in accordance with the provisions of

the Customs Act, as amended by this Act.

Customs Tariff

51 of 1975. 98. In the Customs Tariff Act, 1975 (hereinafter referred to as the Customs Tariff Act), Amendment

of First

the First Schedule shall,––

Schedule.

(a) be amended in the manner specified in the Second Schedule;

(b) with effect from the 1st May, 2022, be also amended in the manner specified

in the Third Schedule.

Excise

1 of 1944. 99. In the Central Excise Act, 1944 (hereinafter referred to as the Central Excise Act), the Amendment

Fourth Schedule shall, with effect from the 1st May, 2022, be amended in the manner specified of Fourth

Schedule.

in the Fourth Schedule.

Central Goods and Services Tax

12 of 2017. 100. In the Central Goods and Services Tax Act, 2017 (hereinafter referred to as the Amendment

of section 16.

Central Goods and Services Tax Act), in section 16, ––

(a) in sub-section (2),––

(i) after clause (b), the following clause shall be inserted, namely:––

“(ba) the details of input tax credit in respect of the said supply

communicated to such registered person under section 38 has not been

restricted;”;

(ii) in clause (c), the words, figures and letter “or section 43A” shall be

omitted;

(b) in sub-section (4), for the words and figures “due date of furnishing of the

return under section 39 for the month of September”, the words “thirtieth day of

November” shall be substituted.

101. In section 29 of the Central Goods and Services Tax Act, in sub-section (2),–– Amendment

of section 29.

(a) in clause (b), for the words “returns for three consecutive tax periods”, the

words “the return for a financial year beyond three months from the due date of

furnishing the said return” shall be substituted;

(b) in clause (c), for the words “a continuous period of six months”, the words

“such continuous tax period as may be prescribed” shall be substituted.

102. In section 34 of the Central Goods and Services Tax Act, in sub-section (2), for the Amendment

word “September”, the words “the thirtieth day of November” shall be substituted. of section 34.

https://cutt.ly/CoAct https://www.aubsp.com/finance-act-2022/ https://cutt.ly/GSTact

12

AUBSP

6717062/2022/DC-CCT

6724369/2022/CC-CCT www.AUBSP.com

62 THE GAZETTE OF INDIA EXTRAORDINARY [PART II—

Amendment 103. In section 37 of the Central Goods and Services Tax Act,––

of section 37.

(a) in sub-section (1), ––

(i) after the words “shall furnish, electronically,”, the words “subject to

such conditions and restrictions and” shall be inserted;

(ii) for the words “shall be communicated to the recipient of the said

supplies within such time and in such manner as may be prescribed”, the words

“shall, subject to such conditions and restrictions, within such time and in such

manner as may be prescribed, be communicated to the recipient of the said

supplies” shall be substituted;

(iii) the first proviso shall be omitted;

(iv) in the second proviso, for the words “Provided further that”, the

words “Provided that” shall be substituted;

(v) in the third proviso, for the words “Provided also that”, the words

“Provided further that” shall be substituted;

(b) sub-section (2) shall be omitted;

(c) in sub-section (3),––

(i) the words and figures “and which have remained unmatched under

section 42 or section 43” shall be omitted;

(ii) in the first proviso, for the words and figures “furnishing of the return

under section 39 for the month of September”, the words “the thirtieth day of

November” shall be substituted;

(d) after sub-section (3), the following sub-section shall be inserted, namely:––

“(4) A registered person shall not be allowed to furnish the details of

outward supplies under sub-section (1) for a tax period, if the details of outward

supplies for any of the previous tax periods has not been furnished by him:

Provided that the Government may, on the recommendations of the Council,

by notification, subject to such conditions and restrictions as may be specified

therein, allow a registered person or a class of registered persons to furnish the

details of outward supplies under sub-section (1), even if he has not furnished

the details of outward supplies for one or more previous tax periods. ”.

Substitution of 104. For section 38 of the Central Goods and Services Tax Act, the following section

new section shall be substituted, namely:––

for section 38.

Communication “38. (1) The details of outward supplies furnished by the registered persons

of details of under sub-section (1) of section 37 and of such other supplies as may be prescribed,

inward supplies and an auto-generated statement containing the details of input tax credit shall be

and input tax

credit.

made available electronically to the recipients of such supplies in such form and

manner, within such time, and subject to such conditions and restrictions as may be

prescribed.

(2) The auto-generated statement under sub-section (1) shall consist of––

(a) details of inward supplies in respect of which credit of input tax may be

available to the recipient; and

(b) details of supplies in respect of which such credit cannot be availed,

whether wholly or partly, by the recipient, on account of the details of the said

supplies being furnished under sub-section (1) of section 37,––

(i) by any registered person within such period of taking registration

as may be prescribed; or

https://cutt.ly/CoAct https://www.aubsp.com/finance-act-2022/ https://cutt.ly/GSTact

13

AUBSP

6717062/2022/DC-CCT

6724369/2022/CC-CCT www.AUBSP.com

SEC. 1] THE GAZETTE OF INDIA EXTRAORDINARY 63

(ii) by any registered person, who has defaulted in payment of tax

and where such default has continued for such period as may be

prescribed; or

(iii) by any registered person, the output tax payable by whom in

accordance with the statement of outward supplies furnished by him under

the said sub-section during such period, as may be prescribed, exceeds

the output tax paid by him during the said period by such limit as may be

prescribed; or

(iv) by any registered person who, during such period as may be

prescribed, has availed credit of input tax of an amount that exceeds the

credit that can be availed by him in accordance with clause (a), by such

limit as may be prescribed; or

(v) by any registered person, who has defaulted in discharging his

tax liability in accordance with the provisions of sub-section (12) of

section 49 subject to such conditions and restrictions as may be prescribed; or

(vi) by such other class of persons as may be prescribed. ”.

105. In section 39 of the Central Goods and Services Tax Act,–– Amendment

of section 39.

(a) in sub-section (5), for the word “twenty”, the word “thirteen” shall be

substituted;

(b) in sub-section (7), for the first proviso, the following proviso shall be

substituted, namely:––

“Provided that every registered person furnishing return under the proviso

to sub-section (1) shall pay to the Government, in such form and manner, and

within such time, as may be prescribed,––

(a) an amount equal to the tax due taking into account inward and

outward supplies of goods or services or both, input tax credit availed, tax

payable and such other particulars during a month; or

(b) in lieu of the amount referred to in clause (a), an amount

determined in such manner and subject to such conditions and restrictions

as may be prescribed. ”;

(c) in sub-section (9), ––

(i) for the words and figures “Subject to the provisions of sections 37 and

38, if”, the word “Where” shall be substituted;

(ii) in the proviso, for the words “the due date for furnishing of return for

the month of September or second quarter”, the words “the thirtieth day of

November” shall be substituted;

(d) in sub-section (10), for the words “has not been furnished by him”, the

following shall be substituted, namely:––

“or the details of outward supplies under sub-section (1) of section 37 for

the said tax period has not been furnished by him:

Provided that the Government may, on the recommendations of the Council,

by notification, subject to such conditions and restrictions as may be specified

therein, allow a registered person or a class of registered persons to furnish the

return, even if he has not furnished the returns for one or more previous tax

periods or has not furnished the details of outward supplies under sub-section (1)

of section 37 for the said tax period. ”.

https://cutt.ly/CoAct https://www.aubsp.com/finance-act-2022/ https://cutt.ly/GSTact

14

AUBSP

6717062/2022/DC-CCT

6724369/2022/CC-CCT www.AUBSP.com

64 THE GAZETTE OF INDIA EXTRAORDINARY [PART II—

Substitution of 106. For section 41 of the Central Goods and Services Tax Act, the following section

new section shall be substituted, namely:––

for section 41.

Availment of “41. (1) Every registered person shall, subject to such conditions and restrictions

input tax as may be prescribed, be entitled to avail the credit of eligible input tax, as self-assessed,

credit.

in his return and such amount shall be credited to his electronic credit ledger.

(2) The credit of input tax availed by a registered person under sub-section (1) in

respect of such supplies of goods or services or both, the tax payable whereon has not

been paid by the supplier, shall be reversed along with applicable interest, by the said

person in such manner as may be prescribed:

Provided that where the said supplier makes payment of the tax payable in

respect of the aforesaid supplies, the said registered person may re-avail the amount of

credit reversed by him in such manner as may be prescribed. ”.

Omission of 107. Sections 42, 43 and 43A of the Central Goods and Services Tax Act shall be

sections 42, omitted.

43 and 43A.

Amendment 108. In section 47 of the Central Goods and Services Tax Act, in sub-section (1),––

of section 47.

(a) the words “or inward” shall be omitted;

(b) the words and figures “or section 38” shall be omitted;

(c) after the words and figures “section 39 or section 45”, the words and figures

“or section 52” shall be inserted.

Amendment 109. In section 48 of the Central Goods and Services Tax Act, in sub-section (2), the

of section 48. words and figures “, the details of inward supplies under section 38” shall be omitted.

Amendment 110. In section 49 of the Central Goods and Services Tax Act,––

of section 49.

(a) in sub-section (2), the words, figures and letter “or section 43A” shall be

omitted;

(b) in sub-section (4), after the words “subject to such conditions”, the words

“and restrictions” shall be inserted;

(c) for sub-section (10), the following sub-section shall be substituted, namely:—

“(10) A registered person may, on the common portal, transfer any amount

of tax, interest, penalty, fee or any other amount available in the electronic cash

ledger under this Act, to the electronic cash ledger for,––

(a) integrated tax, central tax, State tax, Union territory tax or cess; or

(b) integrated tax or central tax of a distinct person as specified in

sub-section (4) or, as the case may be, sub-section (5) of section 25,

in such form and manner and subject to such conditions and restrictions as may

be prescribed and such transfer shall be deemed to be a refund from the electronic

cash ledger under this Act:

Provided that no such transfer under clause (b) shall be allowed if the said

registered person has any unpaid liability in his electronic liability register. ”;

(d) after sub-section (11), the following sub-section shall be inserted, namely:—

“(12) Notwithstanding anything contained in this Act, the Government

may, on the recommendations of the Council, subject to such conditions and

restrictions, specify such maximum proportion of output tax liability under this

Act or under the Integrated Goods and Services Tax Act, 2017 which may be 13 of 2017.

discharged through the electronic credit ledger by a registered person or a class

of registered persons, as may be prescribed.”.

https://cutt.ly/CoAct https://www.aubsp.com/finance-act-2022/ https://cutt.ly/GSTact

15

AUBSP

6717062/2022/DC-CCT

6724369/2022/CC-CCT www.AUBSP.com

SEC. 1] THE GAZETTE OF INDIA EXTRAORDINARY 65

111. In section 50 of the Central Goods and Services Tax Act, for sub-section (3), the Amendment

following sub-section shall be substituted and shall be deemed to have been substituted of section 50.

with effect from the 1st day of July, 2017, namely:––

“(3) Where the input tax credit has been wrongly availed and utilised, the

registered person shall pay interest on such input tax credit wrongly availed and

utilised, at such rate not exceeding twenty-four per cent. as may be notified by the

Government, on the recommendations of the Council, and the interest shall be calculated,

in such manner as may be prescribed.”.

112. In section 52 of the Central Goods and Services Tax Act, in sub-section (6), in the Amendment

proviso, for the words “due date for furnishing of statement for the month of September”, the of section 52.

words “thirtieth day of November” shall be substituted.

113. In section 54 of the Central Goods and Services Tax Act, –– Amendment

of section 54.

(a) in sub-section (1), in the proviso, for the words and figures “the return

furnished under section 39 in such”, the words “such form and” shall be substituted;

(b) in sub-section (2), for the words “six months”, the words “two years” shall

be substituted;

(c) in sub-section (10), the words, brackets and figure “under sub-section (3) ”

shall be omitted;

(d) in the Explanation, in clause (2), after sub-clause (b), the following sub-clause

shall be inserted, namely:––

“(ba) in case of zero-rated supply of goods or services or both to a Special

Economic Zone developer or a Special Economic Zone unit where a refund of tax

paid is available in respect of such supplies themselves, or as the case may be,

the inputs or input services used in such supplies, the due date for furnishing of

return under section 39 in respect of such supplies;”.

114. In section 168 of the Central Goods and Services Tax Act, in sub-section (2), the Amendment of

words, brackets and figures “sub-section (2) of section 38,” shall be omitted. section 168.

115. (1) The notification of the Government of India in the Ministry of Finance Amendment

(Department of Revenue) number G. S. R. 58(E), dated the 23rd January, 2018, issued by the of notification

Central Government on the recommendations of the Council, under section 146 of the Central issued under

section 146 of

12 of 2017. Goods and Services Tax Act, 2017 read with section 20 of the Integrated Goods and Services Central Goods

13 of 2017. Tax Act, 2017, shall stand amended and shall be deemed to have been amended retrospectively, and Services

in the manner specified in column (2) of the Fifth Schedule, on and from the date specified in Tax Act read

column (3) of that Schedule. with section

20 of

(2) For the purposes of sub-section (1), the Central Government shall have and shall Integrated

be deemed to have the power to amend the notification referred to in the said sub-section Goods and

with retrospective effect as if the Central Government had the power to amend the said Services Tax

Act,

12 of 2017. notification under section 146 of the Central Goods and Services Tax Act, 2017 read with retrospectively.

13 of 2017. section 20 of the Integrated Goods and Services Tax Act, 2017, retrospectively, at all material

times.

116. (1) The notification of the Government of India in the Ministry of Finance Amendment

(Department of Revenue) number G. S. R. 661(E), dated the 28th June, 2017, issued by the of notification

Central Government on the recommendations of the Council, under sub-sections (1) and (3) issued under

sub-sections

of section 50, sub-section (12) of section 54 and section 56 of the Central Goods and Services (1) and (3) of

12 of 2017. Tax Act, 2017, shall stand amended and shall be deemed to have been amended retrospectively, section 50,

in the manner specified in column (2) of the Sixth Schedule, on and from the date specified in sub-section

column (3) of that Schedule. (12) of section

54 and section

(2) For the purposes of sub-section (1), the Central Government shall have and shall 56 of Central

Goods and

be deemed to have the power to amend the notification referred to in the said sub-section Services Tax

with retrospective effect as if the Central Government had the power to amend the said Act,

retrospectively.

https://cutt.ly/CoAct https://www.aubsp.com/finance-act-2022/ https://cutt.ly/GSTact

16

AUBSP

6717062/2022/DC-CCT

6724369/2022/CC-CCT www.AUBSP.com

66 THE GAZETTE OF INDIA EXTRAORDINARY [PART II—

notification under sub-sections (1) and (3) of section 50, sub-section (12) of section 54 and

section 56 of the Central Goods and Services Tax Act, 2017, retrospectively, at all material 12 of 2017.

times.

Retrospective 117. (1) Notwithstanding anything contained in the notification of the Government of

exemption India in the Ministry of Finance (Department of Revenue) number G. S. R. 673(E), dated the

from, or levy

or collection

28th June, 2017 issued by the Central Government, on the recommendations of the Council,

of central tax in exercise of the powers under sub-section (1) of section 9 of the Central Goods and

in certain Services Tax Act, 2017, no central tax shall be levied or collected in respect of supply of 12 of 2017.

cases. unintended waste generated during the production of fish meal (falling under heading 2301),

except for fish oil, during the period commencing from the 1st day of July, 2017 and ending

with the 30th day of September, 2019 (both days inclusive) .

(2) No refund shall be made of all such tax which has been collected, but which would

not have been so collected, had sub-section (1) been in force at all material times.

Retrospective 118. (1) Subject to the provisions of sub-section (2), the notification of the Government

effect to of India in the Ministry of Finance (Department of Revenue) number G. S. R. 746(E), dated the

notification

issued under

30th September, 2019 issued by the Central Government, on the recommendations of the

sub-section (2) Council, in exercise of the powers under sub- section (2) of section 7 of the Central Goods

of section 7 of and Services Tax Act, 2017, shall be deemed to have, and always to have, for all purposes, 12 of 2017.

Central Goods come into force on and from the 1st day of July, 2017.

and Services

Tax Act.

(2) No refund shall be made of all such central tax which has been collected, but which

would not have been so collected, had the notification referred to in sub-section (1) been in

force at all material times.

Integrated Goods and Services Tax

Amendment 119. (1) The notification of the Government of India in the Ministry of Finance

of notification (Department of Revenue) number G. S. R. 698(E), dated the 28th June, 2017, issued by the

issued under

Central Government on the recommendations of the Council, under section 20 of the Integrated

section 20 of

Integrated Goods and Services Tax Act, 2017 read with sub-sections (1) and (3) of section 50, 13 of 2017.

Goods and sub-section (12) of section 54 and section 56 of the Central Goods and Services Tax Act,

Services Tax 2017, shall stand amended and shall be deemed to have been amended retrospectively, in the 12 of 2017.

Act, read with

manner specified in column (2) of the Seventh Schedule, on and from the date specified in

sub-sections

(1) and (3) of column (3) of that Schedule.

section 50,

sub-section (2) For the purposes of sub-section (1), the Central Government shall have and shall

(12) of section be deemed to have the power to amend the notification referred to in the said sub-section

54 and section

with retrospective effect as if the Central Government had the power to amend the said

56 of Central

Goods and notification under section 20 of the Integrated Goods and Services Tax Act, 2017 read with 13 of 2017.

Services Tax sub-sections (1) and (3) of section 50, sub-section (12) of section 54 and section 56 of the

Act, Central Goods and Services Tax Act, 2017, retrospectively, at all material times. 12 of 2017.

retrospectively.

Retrospective 120. (1) Notwithstanding anything contained in the notification of the Government of

exemption India in the Ministry of Finance (Department of Revenue) number G. S. R. 666(E), dated the

from, or levy

or collection 28th June, 2017 issued by the Central Government, on the recommendations of the Council,

of integrated in exercise of the powers under sub-section (1) of section 5 of the Integrated Goods and

tax in certain Services Tax Act, 2017, no integrated tax shall be levied or collected in respect of supply of 13 of 2017.

cases. unintended waste generated during the production of fish meal (falling under heading 2301),

except for fish oil, during the period commencing from the 1st day of July, 2017 and ending

with the 30th day of September, 2019 (both days inclusive) .

(2) No refund shall be made of all such tax which has been collected, but which would

not have been so collected, had sub-section (1) been in force at all material times.

https://cutt.ly/CoAct https://www.aubsp.com/finance-act-2022/ https://cutt.ly/GSTact

17

AUBSP

6717062/2022/DC-CCT

6724369/2022/CC-CCT www.AUBSP.com

SEC. 1] THE GAZETTE OF INDIA EXTRAORDINARY 67

121. (1) Subject to the provisions of sub-section (2), the notification of the Government Retrospective

of India in the Ministry of Finance (Department of Revenue) number G. S. R. 745(E),dated the effect to

notification

30th September, 2019 issued by the Central Government on the recommendations of the issued under

Council, in exercise of the powers under clause (i) of section 20 of the Integrated Goods and clause (i) of

13 of 2017. Services Tax Act, 2017, read with sub-section (2) of section 7 of the Central Goods and section 20 of

12 of 2017. Services Tax Act, 2017, shall be deemed to have, and always to have, for all purposes, come Integrated

Goods and

into force on and from the 1st day of July, 2017. Services Tax

read with sub-

(2) No refund shall be made of all such integrated tax which has been collected, but section (2) of

which would not have been so collected, had the notification referred to in sub-section (1) section 7 of

Central Goods

been in force at all material times. and Services

Union Territory Goods and Services Tax Tax Act.

122. (1) The notification of the Government of India in the Ministry of Finance Amendment

(Department of Revenue) number G. S. R. 747 (E), dated the 30th June, 2017, issued by the of notification

Central Government on the recommendations of the Council, under section 21 of the Union issued under

section 21 of

14 of 2017. Territory Goods and Services Tax Act, 2017 read with sub-sections (1) and (3) of section 50, Union

sub-section (12) of section 54 and section 56 of the Central Goods and Services Tax Act, Territory

12 of 2017. 2017, shall stand amended and shall be deemed to have been amended retrospectively, in the Goods and

manner specified in column (2) of the Eighth Schedule, on and from the date specified in Services Tax

Act read with

column (3) of that Schedule. sub-sections

(2) For the purposes of sub-section (1), the Central Government shall have and shall (1) and (3) of

section 50,

be deemed to have the power to amend the notification referred to in the said sub-section sub-section

with retrospective effect as if the Central Government had the power to amend the said (12) of section

14 of 2017. notification under section 21 of the Union Territory Goods and Services Tax Act, 2017 read 54 and section

with sub-sections (1) and (3) of section 50, sub-section (12) of section 54 and section 56 of 56 of Central

Goods and

12 of 2017. the Central Goods and Services Tax Act, 2017, retrospectively, at all material times. Services Tax

Act,

retrospectively.

123. (1) Notwithstanding anything contained in the notification of the Government of Retrospective

India in the Ministry of Finance (Department of Revenue) number G. S. R. 710(E), dated the exemption

from, or levy

28th June, 2017 issued by the Central Government, on the recommendations of the Council, or collection

in exercise of the powers under sub-section (1) of section 7 of the Union Territory Goods and of Union

14 of 2017. Services Tax Act, 2017, no Union territory tax shall be levied or collected in respect of supply territory tax

of unintended waste generated during the production of fish meal (falling under heading in certain

cases.

2301), except for fish oil, during the period commencing from the 1st day of July, 2017 and

ending with the 30th day of September, 2019 (both days inclusive) .

(2) No refund shall be made of all such tax which has been collected, but which would

not have been so collected, had sub-section (1) been in force at all material times.

124. (1) Subject to the provisions of sub-section (2), the notification of the Government Retrospective

of India in the Ministry of Finance (Department of Revenue) number G. S. R. 747(E),dated the effect to

30th September, 2019 issued by the Central Government, on the recommendations of the notification

issued under

Council, in exercise of the powers under clause (i) of section 21 of the Union Territory Goods clause (i) of

14 of 2017. and Services Tax Act, 2017, read with sub-section (2) of section 7 of the Central Goods and section 21 of

12 of 2017. Services Tax Act, 2017, shall be deemed to have, and always to have, for all purposes, come Union

into force on and from the 1st day of July, 2017. Territory

Goods and

Services Tax

(2) No refund shall be made of all such Union territory tax which has been collected, Act read with

but which would not have been so collected, had the notification referred to in sub-section (1) sub-section (2)

of section 7 of

been in force at all material times. Central Goods

and Services

Tax Act.

https://cutt.ly/CoAct https://www.aubsp.com/finance-act-2022/ https://cutt.ly/GSTact

You might also like

- Finance Act 2022 TaxcornerDocument147 pagesFinance Act 2022 TaxcornerHricha GandhiNo ratings yet

- Insertion of Section 10 A Suspending Initiation of CIRP For 6 MonthsDocument2 pagesInsertion of Section 10 A Suspending Initiation of CIRP For 6 MonthsDarshit RupdaNo ratings yet

- 1.F.3. Finance Act, 2021 Extracts On BenamiDocument3 pages1.F.3. Finance Act, 2021 Extracts On BenamiShivangi GuptaNo ratings yet

- RSA Legal - Union Budget Analysis - Indirect TaxDocument20 pagesRSA Legal - Union Budget Analysis - Indirect TaxshwetaNo ratings yet

- The Gazette of The Democratic Socialist Republic of Sri LankaDocument3 pagesThe Gazette of The Democratic Socialist Republic of Sri LankaAdaderana OnlineNo ratings yet

- Xxxgidhxxx Xxxgidexxx: Published by AuthorityDocument2 pagesXxxgidhxxx Xxxgidexxx: Published by AuthorityjonamjonamNo ratings yet

- Further To Amend Certain Tax Laws: LizirDocument14 pagesFurther To Amend Certain Tax Laws: Lizirsharif ud din KhiljiNo ratings yet

- Circular No 07 2022Document4 pagesCircular No 07 2022nitin DRINo ratings yet

- Circular 1 2023Document1 pageCircular 1 2023KunalKumarNo ratings yet

- Xxxgidhxxx Xxxgidexxx: Published by AuthorityDocument3 pagesXxxgidhxxx Xxxgidexxx: Published by AuthorityAmit KumarNo ratings yet

- Act 833Document43 pagesAct 833qabyllrafiqueNo ratings yet

- S.R.O 1587 (I) - 2022 23-08-2022 XWDISCOsDocument12 pagesS.R.O 1587 (I) - 2022 23-08-2022 XWDISCOsUbaidullah SiddiquiNo ratings yet

- AKTA 831 - BI - WJW015xxx BIDocument42 pagesAKTA 831 - BI - WJW015xxx BIWei LinNo ratings yet

- Act 20 of 2020Document8 pagesAct 20 of 2020Kriti KumarNo ratings yet

- Sectionwise Customs Analysis - Finance Bill 2022Document15 pagesSectionwise Customs Analysis - Finance Bill 2022AbhinavNo ratings yet

- Circular 25 2022Document1 pageCircular 25 2022NESL WebsiteNo ratings yet

- Government Gazette No. 48354Document1 pageGovernment Gazette No. 48354victoriaNo ratings yet

- Government Securities (Debt Market and Investment)Document34 pagesGovernment Securities (Debt Market and Investment)155-052 Danyal SiddiquiNo ratings yet

- Minimum Wages ActDocument117 pagesMinimum Wages ActsangeethaaNo ratings yet

- Circulars/Notifications: Legal UpdateDocument6 pagesCirculars/Notifications: Legal UpdateAnupam BaliNo ratings yet

- EDLI Notification 27058Document6 pagesEDLI Notification 27058ssvivekanandhNo ratings yet

- Eco Law Amendments and Additions in Study Material May 2023Document46 pagesEco Law Amendments and Additions in Study Material May 2023cakunalgarg0755No ratings yet

- Taxation and Other Laws Bill, 2020Document57 pagesTaxation and Other Laws Bill, 2020Shaman KingNo ratings yet

- Clarification On Holding of AGM1 20230925Document2 pagesClarification On Holding of AGM1 20230925Kushagra kundanNo ratings yet

- Inspector of FactoriesDocument4 pagesInspector of FactoriesSatheesh DhandapaniNo ratings yet

- 2020 AmendmentsDocument5 pages2020 AmendmentsAAKASH BATRANo ratings yet

- TheFinanceAct 2022Document43 pagesTheFinanceAct 2022Kenneth NgureNo ratings yet

- 202232113255192sro322 (I) 2022Document1 page202232113255192sro322 (I) 2022MuhammadIjazAslamNo ratings yet

- ValueAddedTaxAmendmentAct2022 PDFDocument17 pagesValueAddedTaxAmendmentAct2022 PDFDesmar WhitfieldNo ratings yet

- Combinepdf 20 CompressedDocument313 pagesCombinepdf 20 CompressedMumpe CydroneNo ratings yet

- 02 of 2020Document6 pages02 of 2020TELI TARIQ AZIZNo ratings yet

- Ord2015 0Document103 pagesOrd2015 0Sk vinayNo ratings yet

- The Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECDocument2 pagesThe Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECSatha SivamNo ratings yet

- UERCDocument366 pagesUERCAnil KumarNo ratings yet

- Islamabad Capital Territory (Tax On Services) Ordinance, 2001Document12 pagesIslamabad Capital Territory (Tax On Services) Ordinance, 2001Bilal KhanNo ratings yet

- BARCH ELIGIBILITY RELAXATION NOTIFICATIOnDocument2 pagesBARCH ELIGIBILITY RELAXATION NOTIFICATIOnabhijith sharmaNo ratings yet

- Amnesty Ordinance As Presented in NA 15 Dec 2020Document32 pagesAmnesty Ordinance As Presented in NA 15 Dec 2020Shaikh Abdulsaboor SapruNo ratings yet

- Power Point Presentation On Labour Cess LatestDocument41 pagesPower Point Presentation On Labour Cess LatestRajaNo ratings yet

- Press & Regn of Periodicals Act 2023 Comes Into ForceDocument15 pagesPress & Regn of Periodicals Act 2023 Comes Into ForceNayan Chandra MishraNo ratings yet

- Presenration TAX LAW (AMENDMENT) ORDINANCE, 2020Document49 pagesPresenration TAX LAW (AMENDMENT) ORDINANCE, 2020Asad Abbas MalikNo ratings yet

- ORDINANCE - 2021kl2200045632ssDocument98 pagesORDINANCE - 2021kl2200045632ssSk vinayNo ratings yet

- DG Circula 35Document4 pagesDG Circula 35QUADRANT MARITIMENo ratings yet

- Published by Authority: CG-DL-E-03082023-247816Document22 pagesPublished by Authority: CG-DL-E-03082023-247816sumasathish321No ratings yet

- The Workers' Welfare Fund Ordinance, 1971: PreliminaryDocument11 pagesThe Workers' Welfare Fund Ordinance, 1971: PreliminaryChad HarrisNo ratings yet

- DT Updates 03-10-22Document3 pagesDT Updates 03-10-22Anup SharmaNo ratings yet

- Compendium of Law&Regulations For-MailDocument281 pagesCompendium of Law&Regulations For-MailAmbuj SakiNo ratings yet

- Aca Amendment 2021Document2 pagesAca Amendment 2021muskaan nandwaniNo ratings yet

- 2021102812105615917sro1399 2021Document1 page2021102812105615917sro1399 2021MuhammadIjazAslamNo ratings yet

- E - Rickshaws Annexures - IUTDocument90 pagesE - Rickshaws Annexures - IUTANIL KUMARNo ratings yet

- Central Motor Vehicle Rules Amnd. Feb. 2018 (Notification) PDFDocument2 pagesCentral Motor Vehicle Rules Amnd. Feb. 2018 (Notification) PDFAjit BhosaleNo ratings yet

- UntitledDocument9 pagesUntitledYashwi AgarwalNo ratings yet

- Finance Act 2022Document147 pagesFinance Act 2022vikaskumar1No ratings yet

- The Covid-19 (Miscellaneous Provisions) Act 2020Document87 pagesThe Covid-19 (Miscellaneous Provisions) Act 2020Gamil PardhunNo ratings yet

- Electricity (A) Bill, 2022Document28 pagesElectricity (A) Bill, 2022BheemasenanNo ratings yet

- 07 29HouseVersionReidBillDocument104 pages07 29HouseVersionReidBillNational JournalNo ratings yet

- Amendment To Rubber Rules 2009Document5 pagesAmendment To Rubber Rules 2009Latest Laws TeamNo ratings yet

- Amnesty Ordinance 1 of 2020 15 Dec 2020Document16 pagesAmnesty Ordinance 1 of 2020 15 Dec 2020Shaikh Abdulsaboor SapruNo ratings yet

- Eco Law Amendments and Additions in Study Material Nov 2023Document47 pagesEco Law Amendments and Additions in Study Material Nov 2023Ankit GuptaNo ratings yet

- Electricity Amendment Bill - Compressed 1 9Document9 pagesElectricity Amendment Bill - Compressed 1 9Ulogo OluchukwuNo ratings yet

- Highlights of Union Budget 2018-19 Overview of The EconomyDocument7 pagesHighlights of Union Budget 2018-19 Overview of The EconomySantosh Kumar NahakNo ratings yet

- Highlights of Union Budget 2018-19 Overview of The EconomyDocument7 pagesHighlights of Union Budget 2018-19 Overview of The EconomySantosh Kumar NahakNo ratings yet

- Highlights of Union Budget 2018-19 Overview of The EconomyDocument7 pagesHighlights of Union Budget 2018-19 Overview of The EconomySantosh Kumar NahakNo ratings yet

- Highlights of Union Budget 2018-19 Overview of The EconomyDocument7 pagesHighlights of Union Budget 2018-19 Overview of The EconomySantosh Kumar NahakNo ratings yet

- Crude Oil 001Document14 pagesCrude Oil 001upendra1616No ratings yet

- Crude Oil 001Document14 pagesCrude Oil 001upendra1616No ratings yet

- End of Year Parent SurveyDocument2 pagesEnd of Year Parent SurveySantosh Kumar NahakNo ratings yet

- End of Year Parent SurveyDocument2 pagesEnd of Year Parent SurveySantosh Kumar NahakNo ratings yet

- End of Year Parent SurveyDocument2 pagesEnd of Year Parent SurveySantosh Kumar NahakNo ratings yet

- Business Plan TempletDocument4 pagesBusiness Plan TempletSantosh Kumar NahakNo ratings yet

- Syllabus OASDocument15 pagesSyllabus OASSantosh Kumar NahakNo ratings yet

- Family Law Tutorial 4Document5 pagesFamily Law Tutorial 4Elaine TanNo ratings yet

- Bouncing Checks NotesDocument3 pagesBouncing Checks NotesRyDNo ratings yet

- Banco Espanol V Palanca DigestDocument26 pagesBanco Espanol V Palanca DigestIvan Montealegre ConchasNo ratings yet

- Biography of George Storrs, 1883Document3 pagesBiography of George Storrs, 1883sirjsslutNo ratings yet

- The Unquiet Grave - Short Stories: M. R. JamesDocument4 pagesThe Unquiet Grave - Short Stories: M. R. JamesJorgeAlcauzarLopezNo ratings yet

- Julian Masters - Training To PleasureDocument167 pagesJulian Masters - Training To PleasureBill Staropoli71% (7)

- Review of Novel "Train To Pakistan""Document3 pagesReview of Novel "Train To Pakistan""Maryam KhalidNo ratings yet

- Partnership Case Digests COMPLETEDocument218 pagesPartnership Case Digests COMPLETEMaria Zola Estela Geyrozaga0% (1)

- Daily Express (12 Dec 2019)Document72 pagesDaily Express (12 Dec 2019)Strontium Etherium100% (1)

- Insurance Code". Commissioner". Chanrobles Virtual LawDocument9 pagesInsurance Code". Commissioner". Chanrobles Virtual LawDairen CanlasNo ratings yet

- EX Broker Carrier - PacketDocument17 pagesEX Broker Carrier - PacketJor JisNo ratings yet

- Petition For Expungement of Records (Alabama)Document6 pagesPetition For Expungement of Records (Alabama)ShamaNo ratings yet

- Ground Team Member Legal IssuesDocument23 pagesGround Team Member Legal IssuesCAP History LibraryNo ratings yet

- Bar Prep - Outline - Agency & Partnership - ShortDocument8 pagesBar Prep - Outline - Agency & Partnership - ShortAnonymous Cbr8Vr2SX100% (2)

- Animal Farm SummaryDocument1 pageAnimal Farm SummaryPI CubingNo ratings yet

- Bayan of San Vicente, Palawan, Filed With The Sangguniang Panlalawigan of Palawan An AdministrativeDocument2 pagesBayan of San Vicente, Palawan, Filed With The Sangguniang Panlalawigan of Palawan An AdministrativeRuby SantillanaNo ratings yet

- Coming Out Monologues 2011 ScriptDocument70 pagesComing Out Monologues 2011 ScriptGuia PeraltaNo ratings yet

- United States v. Brenton Holmes, 3rd Cir. (2010)Document3 pagesUnited States v. Brenton Holmes, 3rd Cir. (2010)Scribd Government DocsNo ratings yet

- Colt Cobra ManualDocument42 pagesColt Cobra ManualReginaldo AlvesNo ratings yet

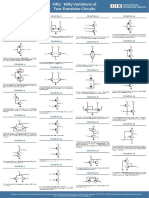

- Variations of Two-Transistor CircuitsDocument2 pagesVariations of Two-Transistor CircuitsKoushik TeslaNo ratings yet

- Past Perfect Simple and Past Perfect Continuous - ADocument2 pagesPast Perfect Simple and Past Perfect Continuous - AFatima VenturaNo ratings yet

- Tutorial 9 - Submission Form (BER 210)Document6 pagesTutorial 9 - Submission Form (BER 210)Lindokuhle SonoNo ratings yet

- Kids Camp Invitation Letter With Consent FormDocument3 pagesKids Camp Invitation Letter With Consent FormChynna Mei A. BongalosNo ratings yet

- Genealogy of The Vampires in The World of Darkness: This ListDocument511 pagesGenealogy of The Vampires in The World of Darkness: This ListMan George100% (7)

- 57 Interesting Facts About SudanDocument5 pages57 Interesting Facts About SudanIbrahimNo ratings yet

- Islamic CoinsDocument11 pagesIslamic Coinsmsciwoj_slaviaNo ratings yet

- Bapu Tyare Tame Yaad Avya New (E) ColourDocument78 pagesBapu Tyare Tame Yaad Avya New (E) ColourNanubhaiNaikNo ratings yet

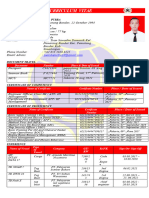

- Cv. Juanda1Document2 pagesCv. Juanda1robyNo ratings yet

- Notes List SeminarDocument86 pagesNotes List SeminarMuhammed Anas KNo ratings yet

- B3Globalcon Family of Companies Combating Trafficking in Persons (Ctip) Policy and Compliance PlanDocument10 pagesB3Globalcon Family of Companies Combating Trafficking in Persons (Ctip) Policy and Compliance PlanRonaldo TalibsaoNo ratings yet