Professional Documents

Culture Documents

202232113255192sro322 (I) 2022

Uploaded by

MuhammadIjazAslamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

202232113255192sro322 (I) 2022

Uploaded by

MuhammadIjazAslamCopyright:

Available Formats

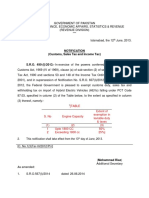

GOVERNMENT OF PAKISTAN

MINISTRY OF FINANCE, AND REVENUE

(REVENUE DIVISION)

*****

Islamabad, the lst March, 2022

NOTIFICATION

(CUSTOMS)

S.R.C.322(I)/2022.- In exercise of the powers conferred by sub-section (3)

of section 18 of the Customs Act, 1969 (IV of 1969), and in supersession of its amending

Notification No. S.R.O. 181(0/2022, dated the 18th February, 2022, the Federal

Government is pleased to direct that the following further amendment shall be made in

its Notification No. S.R.O. 840(1)/2021, dated the 30th day of June, 2021, namely: -

In the aforesaid Notification, for the paragraph 3A, the following shall be

substituted, namely:-

"3A. Regulatory duty on import of Pine nut (chilgoza) falling under PCT

code 0813.4030 and marble (crude or roughly trimmed) falling under PCT

code 2515.1100 shall be exempted and regulatory duty on import of ground

nuts in shell falling under PCT code 1202.4100 shall be reduced from 20%

to 10%, if imported from the Islamic Republic of Afghanistan.".

This Notification shall remain in force till the 30th day of June, 2022.

[0.No.6(2)/2021-CBI

(Dr. Muhammad Saeed Khan Jadoon)

Additional Secretary

You might also like

- 2022621116837291sro806 2022Document1 page2022621116837291sro806 2022MuhammadIjazAslamNo ratings yet

- 2021102812105615917sro1399 2021Document1 page2021102812105615917sro1399 2021MuhammadIjazAslamNo ratings yet

- Finance Act No.06 of 2022 (CGST)Document8 pagesFinance Act No.06 of 2022 (CGST)Santosh Kumar NahakNo ratings yet

- Csadd01 2023 453274Document1 pageCsadd01 2023 453274Manish DahiyaNo ratings yet

- Notificatiion (Sales Tax)Document1 pageNotificatiion (Sales Tax)Shoaib UsmanNo ratings yet

- Page 1 of 2Document2 pagesPage 1 of 2Hr legaladviserNo ratings yet

- Ex-II (Defence)Document2 pagesEx-II (Defence)haiderkhalid196No ratings yet

- Further To Amend Certain Tax Laws: LizirDocument14 pagesFurther To Amend Certain Tax Laws: Lizirsharif ud din KhiljiNo ratings yet

- csnt16 2022Document2 pagescsnt16 2022accountsNo ratings yet

- Circulars/Notifications: Legal UpdateDocument6 pagesCirculars/Notifications: Legal UpdateAnupam BaliNo ratings yet

- Circular CGST 193Document4 pagesCircular CGST 193Jaipur-B Gr-2No ratings yet

- GST Rate Fs Bricks Tiles EnglishDocument5 pagesGST Rate Fs Bricks Tiles EnglishdhananjayNo ratings yet

- The Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECDocument2 pagesThe Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECSatha SivamNo ratings yet

- Circular CGST 197Document5 pagesCircular CGST 197Jaipur-B Gr-2No ratings yet

- csnt01 2022Document1 pagecsnt01 2022accountsNo ratings yet

- 40-2022-Custom-Increase in GST Import Rate From 5% To 12%Document2 pages40-2022-Custom-Increase in GST Import Rate From 5% To 12%legendry007No ratings yet

- 20244181742450740sro 582 (I) 2024Document1 page20244181742450740sro 582 (I) 2024shaheer salehNo ratings yet

- Juvenile Justice System (Amendment) Act, 2022 MuneebBookHouse 03014398492Document2 pagesJuvenile Justice System (Amendment) Act, 2022 MuneebBookHouse 03014398492Muhammad Izhar AwanNo ratings yet

- Exemption From IGST & Compensation Cess To EOUs On Imports Extended Till 30.06.2022 - Taxguru - inDocument1 pageExemption From IGST & Compensation Cess To EOUs On Imports Extended Till 30.06.2022 - Taxguru - inCA Sriram KumarNo ratings yet

- HighLights ST FEDocument34 pagesHighLights ST FEShakir MuhammadNo ratings yet

- Trade Notice No 11-CGST & CX-MUMBAI Zone-2021 Dated 22september2021Document6 pagesTrade Notice No 11-CGST & CX-MUMBAI Zone-2021 Dated 22september2021Gautam jainNo ratings yet

- SI 2022-222 Customs and Excise (Suspension) (Amendment) Regulations, 2022 (No. 264)Document6 pagesSI 2022-222 Customs and Excise (Suspension) (Amendment) Regulations, 2022 (No. 264)tapiwaNo ratings yet

- Eco Law Amendments and Additions in Study Material May 2023Document46 pagesEco Law Amendments and Additions in Study Material May 2023cakunalgarg0755No ratings yet

- Notification (Customs, Sales Tax and Income Tax)Document1 pageNotification (Customs, Sales Tax and Income Tax)Farhan JanNo ratings yet

- (I) 20123Document80 pages(I) 20123Muddassir AliNo ratings yet

- Circulars/Notifications: Legal UpdateDocument6 pagesCirculars/Notifications: Legal UpdateAnupam BaliNo ratings yet

- Latest Updates in GSTDocument6 pagesLatest Updates in GSTprathNo ratings yet

- Trade Notice No 10-CGST & CX-MUMBAI Zone-2021 Dated 22september2021Document6 pagesTrade Notice No 10-CGST & CX-MUMBAI Zone-2021 Dated 22september2021Gautam jainNo ratings yet

- Eco Law Amendments and Additions in Study Material Nov 2023Document47 pagesEco Law Amendments and Additions in Study Material Nov 2023Ankit GuptaNo ratings yet

- Insertion of Section 10 A Suspending Initiation of CIRP For 6 MonthsDocument2 pagesInsertion of Section 10 A Suspending Initiation of CIRP For 6 MonthsDarshit RupdaNo ratings yet

- Circular No. 38 /2016-Customs: - (1) Notwithstanding Anything Contained in This Act ButDocument18 pagesCircular No. 38 /2016-Customs: - (1) Notwithstanding Anything Contained in This Act ButAnshNo ratings yet

- Claim of ITC As GSTR-2B Is Mandatory W.E.F. 01.01.2022Document3 pagesClaim of ITC As GSTR-2B Is Mandatory W.E.F. 01.01.2022ravindra kumar jainNo ratings yet

- Decoding Indian Union Budget Finance Bil PDFDocument7 pagesDecoding Indian Union Budget Finance Bil PDFkumarNo ratings yet

- Employee Law Alerts 2022Document3 pagesEmployee Law Alerts 2022Arpan ChadhaNo ratings yet

- Islamabad Capital Territory (Tax On Services) Ordinance, 2001Document12 pagesIslamabad Capital Territory (Tax On Services) Ordinance, 2001Bilal KhanNo ratings yet

- Notification No. 35-2021 - Central TaxDocument4 pagesNotification No. 35-2021 - Central TaxSIR GNo ratings yet

- Circular 1 2023Document1 pageCircular 1 2023KunalKumarNo ratings yet

- DGFT Notification No.08/2015-2020 Dated 4th June, 2015Document5 pagesDGFT Notification No.08/2015-2020 Dated 4th June, 2015stephin k jNo ratings yet

- ExtentionDocument4 pagesExtentionawaisidrees04No ratings yet

- GST Changes Effective From January 01, 2022Document9 pagesGST Changes Effective From January 01, 2022p.kunduNo ratings yet

- Circular 18-2023Document1 pageCircular 18-2023Advocate ChandraNo ratings yet

- Latest News and Development by MCA in August, 2022: Draft For Discussion Only 19.09.2022Document1 pageLatest News and Development by MCA in August, 2022: Draft For Discussion Only 19.09.2022Muskaan SinhaNo ratings yet

- Amnesty Ordinance 1 of 2020 15 Dec 2020Document16 pagesAmnesty Ordinance 1 of 2020 15 Dec 2020Shaikh Abdulsaboor SapruNo ratings yet

- 61397cajournal Oct2020 28Document4 pages61397cajournal Oct2020 28Anupam BaliNo ratings yet

- AMNPR3273M - Issue Letter - 1054531107 (1) - 23072023Document3 pagesAMNPR3273M - Issue Letter - 1054531107 (1) - 23072023prakash reddyNo ratings yet

- Sectionwise Customs Analysis - Finance Bill 2022Document15 pagesSectionwise Customs Analysis - Finance Bill 2022AbhinavNo ratings yet

- Notfctn 74 Central Tax English 2020Document1 pageNotfctn 74 Central Tax English 2020cadeepaksingh4No ratings yet

- Act No. 5 of 2022 The Finance Act 2022 Act No. 5 of 2022Document48 pagesAct No. 5 of 2022 The Finance Act 2022 Act No. 5 of 2022Mathias MhinaNo ratings yet

- GST CT 37 2023 1Document1 pageGST CT 37 2023 1cadeepaksingh4No ratings yet

- Circular 9 2021Document3 pagesCircular 9 2021Camp Asst. to ADGP AdministrationNo ratings yet

- Government of Pakistan Revenue Division Central Board of Revenue Islamabad, The 12th February, 2002 Notification (Income Tax) S.R.O. 97 (I) /2002.Document1 pageGovernment of Pakistan Revenue Division Central Board of Revenue Islamabad, The 12th February, 2002 Notification (Income Tax) S.R.O. 97 (I) /2002.Circle-international Trading-companyNo ratings yet

- Press Release 52 GST CouncilDocument6 pagesPress Release 52 GST CouncilCA Thirumalesu ENo ratings yet

- CBDT Has Notified That The Provisions of Section 206C (1G) Shall Not ApplyDocument1 pageCBDT Has Notified That The Provisions of Section 206C (1G) Shall Not ApplySRIKANTA ROUTNo ratings yet

- UntitledDocument2 pagesUntitledibrahim javedNo ratings yet

- Circular Refund 142 11 2020Document3 pagesCircular Refund 142 11 2020Gulrana AlamNo ratings yet

- Finance Act 2022 TaxcornerDocument147 pagesFinance Act 2022 TaxcornerHricha GandhiNo ratings yet

- Notification No 9 CustomDocument1 pageNotification No 9 CustomShubham MittalNo ratings yet

- Circular No 07 2022Document4 pagesCircular No 07 2022nitin DRINo ratings yet

- Sro 1864Document2 pagesSro 1864MuhammadIjazAslamNo ratings yet

- EXpress LHR 25octDocument12 pagesEXpress LHR 25octMuhammadIjazAslamNo ratings yet

- Dev 2022-23.docxDocument7 pagesDev 2022-23.docxMuhammadIjazAslamNo ratings yet

- DerivativesDocument7 pagesDerivativesMuhammadIjazAslamNo ratings yet

- Express Multan 01 JanDocument14 pagesExpress Multan 01 JanMuhammadIjazAslamNo ratings yet

- Express Multan 29 DecDocument12 pagesExpress Multan 29 DecMuhammadIjazAslamNo ratings yet

- No. HR-Manager-Admin-11024-31 Dated 2021-07-02Document1 pageNo. HR-Manager-Admin-11024-31 Dated 2021-07-02MuhammadIjazAslamNo ratings yet

- Administrative Officer, NPSL, Plot# 16, Sector H-9, Islamabad 051-9265163Document1 pageAdministrative Officer, NPSL, Plot# 16, Sector H-9, Islamabad 051-9265163MuhammadIjazAslamNo ratings yet

- No. HR-Manager Admin-11274-80 Dated 2021-07-06Document1 pageNo. HR-Manager Admin-11274-80 Dated 2021-07-06MuhammadIjazAslamNo ratings yet

- Psda Act 2019Document7 pagesPsda Act 2019MuhammadIjazAslamNo ratings yet

- Government of The Punjab Higher Education Department: No. DateDocument11 pagesGovernment of The Punjab Higher Education Department: No. DateMuhammadIjazAslamNo ratings yet

- In The Lahore High Court Lahore Judicial Department: Judgment SheetDocument27 pagesIn The Lahore High Court Lahore Judicial Department: Judgment SheetMuhammadIjazAslamNo ratings yet

- The Punjab Directorate of Monitoring Evaluation Planning Development Department Service Rules 2011 PDFDocument14 pagesThe Punjab Directorate of Monitoring Evaluation Planning Development Department Service Rules 2011 PDFMuhammadIjazAslamNo ratings yet