Professional Documents

Culture Documents

Indian Income Tax Return Acknowledgement 2021-22: Strike of Whichever Is Not Applicable

Uploaded by

Hussain YadavOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Income Tax Return Acknowledgement 2021-22: Strike of Whichever Is Not Applicable

Uploaded by

Hussain YadavCopyright:

Available Formats

Assessment Year

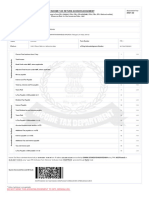

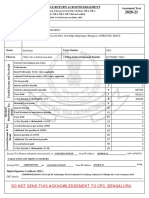

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT

2021-22

[Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3, ITR-4(SUGAM), ITR-5, ITR-6, ITR-7 filed and verified]

(Please see Rule 12 of the Income-tax Rules, 1962)

PAN ARWPA4337M

Name PEDDIGARIANJANEYULU

Address 11-104, PARVATHAIAH COLONY

, PEBBAIR, MAHABUB NAGAR509104

,

Status Individual Form Number ITR-1

Filed u/s e-Filing Acknowledgement Number 378228250280821

Current Year business loss, if any 1 V0

Total Income V 4,90,690

TaxableIncome and Tax details

Book Profit under MAT, where applicable 2 V0

Adjusted Total Income under AMT, where applicable 3 V0

Net tax payable 4 V0

Interest and Fee Payable 5 V0

Total tax, interest and Fee payable 6 V0

Taxes Paid 7 V0

(+)Tax Payable /(-)Refundable (6-7) 8 (-) V 850

Dividend Tax Payable 9 V0

Interest Payable 10 V0

DistributionTax details

Total Dividend tax and interest payable 11 V0

Taxes Paid 12 V0

(+)Tax Payable /(-)Refundable (11-12) 13 V0

Accreted Income as per section 115TD 14 V0

AccretedIncome & Tax Detail

Additional Tax payable u/s 115TD 15 V0

Interest payable u/s 115TE 16 V0

Additional Tax and interest payable 17 V0

Tax and interest paid 18 V0

(+)Tax Payable /(-)Refundable (17-18) 19 V0

Income Tax Return submitted electronically on 28-08-2021 15:23:43 from IP address and verified by PEDDIGARIANJANEYULUhaving PAN ARWPA4337M on 28-08-2021 15:23:43 using * paper

ITR-Verification Form /Electronic Verification Code CGZXYLBURI generated through Digital mode

System Generated Barcode/QR Code

ARWPA4337M01378228250280821497BCAB6733B456019106A9BF0D08580348859D6

* Strike of whichever is not applicable

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

You might also like

- Accounting For Joint and by ProductsDocument11 pagesAccounting For Joint and by ProductsImelda leeNo ratings yet

- Account Paper MCQ PART 1 UpdateDocument67 pagesAccount Paper MCQ PART 1 Updateshivam kumarNo ratings yet

- Suggested Answers in Taxation Law Bar Examinations 1994 2006 PDFDocument86 pagesSuggested Answers in Taxation Law Bar Examinations 1994 2006 PDFGregorio AustralNo ratings yet

- Reto S.A.Document9 pagesReto S.A.Nishant Goyal0% (1)

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruATSI InstituteNo ratings yet

- 2020 07 21 14 18 51 966 - 1595321331966 - XXXPA5493X - Acknowledgement PDFDocument1 page2020 07 21 14 18 51 966 - 1595321331966 - XXXPA5493X - Acknowledgement PDFVasanth Kumar AllaNo ratings yet

- ITR Acknowledgement FY 2019-20Document1 pageITR Acknowledgement FY 2019-20taramaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Home Office and Branch Accounting Testbankpdf PDF FreeDocument18 pagesHome Office and Branch Accounting Testbankpdf PDF Freekris mNo ratings yet

- CAPSIM Rehearsal QuizDocument2 pagesCAPSIM Rehearsal QuizAngela ZhangNo ratings yet

- Fixed Assets Management PDFDocument20 pagesFixed Assets Management PDFDnukumNo ratings yet

- Cash Flow Estimation and Risk Analysis: Answers To Selected End-Of-Chapter QuestionsDocument13 pagesCash Flow Estimation and Risk Analysis: Answers To Selected End-Of-Chapter QuestionsRapitse Boitumelo Rapitse0% (1)

- Group Financial Accounting PresentationDocument84 pagesGroup Financial Accounting PresentationAndoline SibandaNo ratings yet

- Roche Case StudyDocument10 pagesRoche Case Studyasfdga100% (1)

- Project Report On Financial Analysis of Nestle India Limited ProjectDocument65 pagesProject Report On Financial Analysis of Nestle India Limited ProjectSonu Dhangar76% (58)

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruShreedhar MurthyNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengalurunilnikNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruHussain YadavNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruHussain YadavNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, Bengalurutech bookNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruHussain YadavNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruKokila Sham100% (1)

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruHussain YadavNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruSHEETANSHU BHANDARINo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruanmolNo ratings yet

- Acknowledgement of Reliance JioDocument1 pageAcknowledgement of Reliance JioPranav BhakareNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, Bengaluruvijay choudharyNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruHussain YadavNo ratings yet

- Acknowledgement HamidDocument1 pageAcknowledgement HamidDIVYANSHU SHEKHARNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDIVYANSHU SHEKHARNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruBt3104 Tejus kawNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruHussain YadavNo ratings yet

- Acknowledgement Niket Panjiier Army LucknowDocument1 pageAcknowledgement Niket Panjiier Army Lucknowbeauty kumariNo ratings yet

- PDF 332384320310321 PDFDocument1 pagePDF 332384320310321 PDFSekharNo ratings yet

- RACS Itr 2020-2021Document1 pageRACS Itr 2020-2021Lakshay SharmaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruPradip ShindeNo ratings yet

- 2020 10 13 16 14 03 443 - 1602585843443 - XXXPS4444X - Acknowledgement PDFDocument1 page2020 10 13 16 14 03 443 - 1602585843443 - XXXPS4444X - Acknowledgement PDFPradip ShindeNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRas AgroNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAyush AgarwalNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRoshanjit ThakurNo ratings yet

- Ramavath A.Y 2020-21 Tax - AcknowledgementDocument1 pageRamavath A.Y 2020-21 Tax - AcknowledgementBhashya RamavathNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument8 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, Bengalurubhashkar yadavNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAdarsh KeshariNo ratings yet

- 2020 12 19 21 04 28 561 - 1608392068561 - XXXPM1087X - AcknowledgementDocument1 page2020 12 19 21 04 28 561 - 1608392068561 - XXXPM1087X - AcknowledgementSanjay KNo ratings yet

- PDF 575108620220920Document1 pagePDF 575108620220920amaresh kumar mallikNo ratings yet

- ITR V Ajesh SoniDocument1 pageITR V Ajesh SoniAditya AroraNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSACHIN MENEZESNo ratings yet

- 2020 11 28 13 48 32 813 - 1606551512813 - XXXPM2440X - AcknowledgementDocument1 page2020 11 28 13 48 32 813 - 1606551512813 - XXXPM2440X - AcknowledgementMadhu HarshithaNo ratings yet

- Return 2021Document1 pageReturn 2021rgd8b7kzr6No ratings yet

- 2020 07 22 22 44 18 838 - 1595438058838 - XXXPK9292X - AcknowledgementDocument1 page2020 07 22 22 44 18 838 - 1595438058838 - XXXPK9292X - AcknowledgementGautam MNo ratings yet

- Acknowledgement HauajwbwbajsjajaDocument1 pageAcknowledgement HauajwbwbajsjajaAnkush ManhasNo ratings yet

- Itrv 2020Document1 pageItrv 2020anand dNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAbhijeet NikamNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruVikash singhNo ratings yet

- PDF 298947820220321Document1 pagePDF 298947820220321savitakant13600No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurukingNo ratings yet

- Itr-V Bogpp6352h 2020-21 767088050301120Document1 pageItr-V Bogpp6352h 2020-21 767088050301120DEVIL RDXNo ratings yet

- ITR V Meenakshi SoniDocument1 pageITR V Meenakshi SoniAditya AroraNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruJhalak ThapaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurudarshilNo ratings yet

- 2020 12 15 12 04 44 882 - 1608014084882 - XXXPM7948X - AcknowledgementDocument1 page2020 12 15 12 04 44 882 - 1608014084882 - XXXPM7948X - Acknowledgementarpan mukherjeeNo ratings yet

- 2020 07 31 16 05 55 486 - 1596191755486 - XXXPK8367X - AcknowledgementDocument1 page2020 07 31 16 05 55 486 - 1596191755486 - XXXPK8367X - AcknowledgementSiva Jyothi KNo ratings yet

- 9 M - 28-Dec-2020 - 917355441Document1 page9 M - 28-Dec-2020 - 917355441Arihant SatpathyNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruVipin SaxenaNo ratings yet

- PDF 796371500091220Document1 pagePDF 796371500091220dimplevats1982No ratings yet

- Sarath 201-21 NewDocument1 pageSarath 201-21 Newbindu mathaiNo ratings yet

- Pranjal - Itr VDocument1 pagePranjal - Itr VPradnyesh GuramNo ratings yet

- Emailing PDF - 133712590080121Document1 pageEmailing PDF - 133712590080121Manisha JangidNo ratings yet

- 2020 12 28 19 53 31 299 - 1609165411299 - XXXPB6935X - AcknowledgementDocument1 page2020 12 28 19 53 31 299 - 1609165411299 - XXXPB6935X - AcknowledgementRenil BabuNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurusam kapoorNo ratings yet

- Narayanswamy Srinivas Murthy 11-Feb-2021 251755691Document1 pageNarayanswamy Srinivas Murthy 11-Feb-2021 251755691Nishanth SrinivasNo ratings yet

- Monopolistic Competitive Market in Religion: A Case Study of Hindu TemplesDocument5 pagesMonopolistic Competitive Market in Religion: A Case Study of Hindu TemplesCarmenCPCNo ratings yet

- Natco Nirmal Bang PDFDocument8 pagesNatco Nirmal Bang PDFN SNo ratings yet

- VIVA Topic For FInancial AccountingDocument4 pagesVIVA Topic For FInancial AccountingShakib Alam ApurboNo ratings yet

- FINACC - Balance Sheet Terms - 011218 A1Document6 pagesFINACC - Balance Sheet Terms - 011218 A1ventus5thNo ratings yet

- Accrued ExpenseDocument3 pagesAccrued ExpenseNiño Rey LopezNo ratings yet

- Chap1 PDFDocument31 pagesChap1 PDFSamarjeet SalujaNo ratings yet

- FinanceDocument48 pagesFinanceMimi Adriatico JaranillaNo ratings yet

- Aaaaa 1Document52 pagesAaaaa 1Kath LeynesNo ratings yet

- PFN1223 - Financial Management - Set C 2020Document14 pagesPFN1223 - Financial Management - Set C 2020alya farhanaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument5 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Farmson Pharmaceutical-R-09082018 PDFDocument7 pagesFarmson Pharmaceutical-R-09082018 PDFPradip ShindeNo ratings yet

- Deliverable 14 - Statutory Financial Statements Redachem Industries Maghreb V08042022Document3 pagesDeliverable 14 - Statutory Financial Statements Redachem Industries Maghreb V08042022Loubna MikouNo ratings yet

- Foxwood Company Data For 2014Document2 pagesFoxwood Company Data For 2014Vermuda VermudaNo ratings yet

- Week 7 Home Work ProblemDocument3 pagesWeek 7 Home Work ProblemSandip AgarwalNo ratings yet

- Corporate RestructuringDocument11 pagesCorporate RestructuringFazul RehmanNo ratings yet

- Classification of Deductible Expenses Section 212 Expenses:: Have AGI LimitationsDocument6 pagesClassification of Deductible Expenses Section 212 Expenses:: Have AGI Limitations张心怡No ratings yet

- Masco Oil and Gas Company Is A Very Large CompanyDocument1 pageMasco Oil and Gas Company Is A Very Large CompanyAmit PandeyNo ratings yet

- Contract Costing of Indian Security Force at BangaloreDocument17 pagesContract Costing of Indian Security Force at BangaloreShravani ShravNo ratings yet

- Acctg 104 Equity FinancingDocument54 pagesAcctg 104 Equity FinancingskzstayhavenNo ratings yet