Professional Documents

Culture Documents

Realising The Potential of Real Estate

Uploaded by

Kunal BawaneOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Realising The Potential of Real Estate

Uploaded by

Kunal BawaneCopyright:

Available Formats

PHD CHAMBER

OF COMMERCE AND INDUSTRY

Realising the potential

of real estate

2 Realising the potential of real estate

Contents

Section Page

Forewords 04

Sector landscape 06

Evolving regulatory framework 14

Financing real estate projects 16

Embracing technology 22

Realising the potential of real estate

Forewords

4 Realising the potential of real estate

Sumeet Abrol Saket Dalmia

Partner, Lead Advisory, President, PHD Chamber of

Grant Thornton Bharat Commerce and Industry

The Indian real estate sector has seen a V-shaped recovery The real estate sector is one of the oldest and globally most

braving a slump, surging ahead with expansion and recognised sectors. It is among the 14 major sectors in terms of

demonstrating astounding resilience throughout despite direct, indirect and induced effects in all sectors of an economy.

geo-political uncertainties, impending global recession, rising

interest rates and construction costs. The industry proved its In India, the real estate sector is the second-highest employment

prowess by registering a 68% y-o-y increase during 2022 and generator, after the agriculture sector, and has been

increased investment of 19% in FY21, clearly highlighting its contributing nearly 5%-6% to the Indian GDP. Going forward,

investment opportunities in India and globally. The government’s the real estate sector is likely to grow and contribute up to

continued focus was evident in the enhanced budgetary 15%-18% to the Indian GDP by 2030.

allocations to Pradhan Mantri Jan Arogya Yojana (PMJAY) and

In the Amrit Kaal, the real estate segments, including residential,

Smart Cities with a strong focus on ESG and sustainability in

retail, commercial, and hospitality, are likely to showcase

the built environment.

descent growth, as these are well prepared for further growth

As the industry continues to embrace technology, it will usher by improving corporate environment and the demand for office

in a significant shift in customer and investor experience, and space, as well as urban and semi-urban accommodation.

most importantly we will witness developers embarking on

The Indian real estate sector is expected to touch the USD

creating sustainable buildings using technology. AI and robotics

1 trillion mark by 2030, with affordable housing playing a

will bring in a paradigm shift in the approach of devising

significant role in the growth. The affordable housing segment

sustainable buildings and achieving economies of scale.

was granted the infrastructure status, and it has helped in

Today, the real estate sector is one of the highest contributors obtaining loans at preferential or lower rates, with the benefits

to Indian GDP and is projected to contribute 18% to the GDP being passed on to end-consumers as savings.

by 2030 as more segments such as warehousing, logistics,

A number of factors have contributed to this growth, including

industrial parks, data centres, student housing, co-living and

rapid urbanisation, the growing emergence of nuclear families,

senior assisted living fuel and usher in an era of growth.

rising income levels of population, new real estate developers

This report chronicles the story of the sector’s resilience and entering the sectors and availability of financial options for

takes a sneak peek at what the future holds for the sector as developers as well as home buyers.

India embarks on its journey through the Amrit Kaal to 2047.

The focus of the government has been on empowering every

stakeholder involved in the process, especially developers who

are capable of spurring the development of quality products

and infusing the much-needed stability in the market.

PHDCCI has organised the Real Estate Summit 2023 as a

prominent platform for all important stakeholders to share views

and discuss all such aspects and prospects to help the Indian

real estate sector to evolve and be future-ready. We understand

that this summit will play an important role and be an important

platform for the real estate sector going forward.

Realising the potential of real estate 5

01

Sector

landscape

6 Realising the potential of real estate

Sector performance

The real estate sector contributes around 6-7% to the GDP of

India, which is projected to be 13% by 2025. The Indian real

estate sector is expected to reach USD 1,000 billion by 2030.

The growth trajectory amidst the COVID-19 downturn and

geo-political uncertainties demonstrates the resilience of the Sector likely to

sector, as it continues to be the second-highest contributor to

the Indian economy.

contribute 13% to

GDP by 2025

Market size of real estate in India (USD billion)

1,200

1,000

800

600

400

650 1,000

200

0 120 180

2017 2020 2025F 2030F

Source: IBEF

Despite the unexpected setback in 2020, the RE sector bounced

back in 2022, recording significant growth across residential,

retail and office segments, and the upward trajectory is

expected to continue in 2023. During 2022, the sector reported

to witness an equity investment of USD 7.8 billion, 60% of which

was by foreign investors and the balance by Indian institutional

investors and developers.

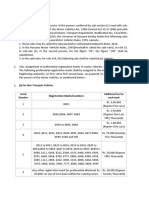

Year Office Logistics Retail Residential

(mn sq. ft.) (mn sq. ft.) (mn sq. ft.) (units)

2021 40.50 28.00 3.20 1,28,154

2022 56.50 31.60 4.70 2,15,666

Growth ~40% ~13% ~47% ~68%

Source: CBRE 2023 India Market Outlook, March 2023; JLL Residential Market Update, Q4 2022

Realising the potential of real estate 7

Key trends

With the opening of the Indian economy post the COVID-19 pandemic, the RE sector witnessed momentum in investments and

consumptions. It also marked a significant shift in consumer preference, product/service offerings and deliveries across

the segments.

Office segment 44% 40%

A remarkable shift was noted in the

During FY 20 -21, there During FY21-22, there

demand pattern, with domestic companies

was a slump in demand was an increase in office

accounting for nearly 50% of the leasing

with the net absorption absorption though the

demand in FY 22, mainly driven by

dipping by 44% hybrid work model

technology and co-working space providers.

Retail 71% 21%

Irrespective of global headwinds and

During FY 20, there During FY 22, increase

external uncertainties, leasing activity

was a massive hit by in office absorption

performed higher in 2022 due to well built

pandemic, with net

supply pipeline for 2023.

absorption dipping

by 2 mn sq ft

Logistics 4% 22%

Space take-up in 2022 almost touched the

During FY 22, decline Y-o-Y growth in space

2019 peak; supply addition picked up pace

on a Q-o-Q basis take-up in Q4 2022

in Q4. The demand was predominantly driven

by 3PL and e-commerce players, accounting

for almost 60% of the total demand in FY 22.

Residential 10% 46%

Post pandemic, the residential segment

10% decline on Sales in FY 22

bounced back with renewed confidence

Q-o-Q basis in FY 22

as buyer preferences shifted to bigger and

spacious homes. Despite rising interest

rates and geopolitical uncertainties, FY 22

registered a record increase of 68% sales

compared to FY 21 in major cities. Luxury

or premium segment contributed 50% of

this growth during last year.

Source: JLL report

8 Realising the potential of real estate

Emerging segments

The COVID-19 pandemic-induced lockdowns meaningfully altered the buyer’s perspectives, preferences and habits, and the

digitisation wave influenced the outlook for all. While newer sub-segments emerged within the existing RE segments, some of the

existing segments saw a renewed approach.

Co-working spaces Student housing

The millennial generation, hybrid work model, This segment has been largely unorganised and

technology start-ups and gig culture have triggered a fragmented. It may see some momentum as universities

demand for co-working spaces in Tier I and Tier II cities, and colleges reopen their campus, with students now

comprising almost 20% of the office segment. preferring low-density, clean accommodations with

amenities. The segment may attract investments from

• The co-working segment reported a valuation of private players.

USD 2.2 billion by 2022.

• India’s co-working space market is all set to pass

50 million sq. ft. by 2023.

Co-living and shared housing Data centres

Similar to co-working spaces, demand is expected to While data centres have been notified as infrastructure

increase for co-living and shared housing, which allows assets, with an expected capacity addition of 681

the resident to share space at an affordable price. megawatts by the end of 2024, it will also boost the

demand for real estate.

• As per research by JLL, India’s co-living market is

expected to increase at a strong CAGR of 17% in

the next five years to expand to a nearly

INR 1 trillion market.

Senior assisted living Warehousing

India’s aging population is expected to reach 320 The National Logistics Policy, which outlines a

million in 2050. With a change in India’s demographics, tech-enabled, cost-efficient and integrated logistics

the demand for senior-assisted living is expected to gain industry, will provide impetus to the RE sector. With an

traction as the population of financially independent, increasing focus on ‘Make in India’ and the growth of

upwardly mobile, educated senior citizens and e-commerce, warehousing is poised for growth as

returning NRIs continues to rise. multi-modal logistics parks and industrial corridors

gather pace.

Source: Coworkingers Statistics, The Financial Express

Realising the potential of real estate 9

Government initiatives

Over the last decade, various government policies and initiatives have directly or

indirectly contributed to the development of the Indian RE sector.

Real estate (Regulation and Foreign Direct Investment (FDI)

Development Act) RERA FDI policy has been considerably liberalised, permitting foreign

With the introduction of RERA, the largely unorganised RE investment in under-construction projects and for the operation

sector was brought within the ambit of the regulator, making of completed projects, subject to certain conditions.

the developer/builder/promoter/agents accountable and

answerable, thereby bringing in transparency. This has Make in India

increased confidence amongst the customers and investors. The ‘Make in India’ initiative has boosted the creation of

manufacturing facilities, resulting in the emergence of

Smart Cities Mission suburban areas and, consequently, housing colonies/projects.

The objective of the smart cities mission is to promote cities that

provide core infrastructure and give its citizens a decent quality Real Estate Investment Trusts (REITs)

of life, and a clean and sustainable environment through the SEBI introduced REITs as an investment vehicle in 2014 to raise

application of ‘Smart’ solutions, thus requiring the funds from investors to acquire, own and operate

adoption of technology to deliver energy-efficient and revenue-generating real estate assets directly or through

sustainability-focused solutions. special purpose vehicles. REITs are publicly listed, highly

regulated, and provide a steady return to investors.

Pradhan Mantri Awas The introduction of REITs enabled developers to monetise

Yojana (PMAY) revenue-generating real estate assets and utilise the funds for

the further development of new assets.

This initiative aims at providing ‘housing for all’. The government

has also given infrastructure status to ‘affordable housing’,

thus enabling developers to raise funds, including external

commercial borrowings. Interest subvention provided under

the PMAY has increased the demand for affordable homes.

Monetisation of non-core real estate

In 2022, the government set up the National Land Monetisation

Corporation to monetise non-core real estate assets held by

public sector enterprises.

10 Realising the potential of real estate

Progress on key initiatives

Pradhan Mantri

Smart Cities Mission

Awas Yojana - Urban

100

INR 1.20 crore Cities

2,243 5,627

Houses sanctioned

Ongoing projects Completed projects

INR 0.75 lakh crore INR 1.06 lakh crore

INR 1.10 crore

Houses grounded

41% 59%

INR 73.45 lakh INR 1.64 lakh Cr INR 0.39 lakh crore

Houses completed Total area based Total plan city

development cost solution cost

INR 2.02 lakh crore Completed projects Ongoing projects

Central assistance committed

INR 1.81 lakh crore investment in 7,870 projects

INR 1.44 lakh crore

Central assistance released

100 9.96 crore INR 2.05 lakh crore

Total winning Total urban Total cost of

INR 8.28 lakh crore proposals population impacted projects

Total investment

Source: PMAY (U) Source: Smart Cities Mission

Realising the potential of real estate 11

Amrit Kaal - Vision 2047

The vision for Amrit Kaal includes a technology-driven and knowledge-based economy with strong public finances and a robust

financial sector. In the journey to India@100, one of the focus areas is green growth, i.e., the efficient use of energy across

economic sectors, and amongst others, ramping up the virtuous cycle of investments and job creation through investments in

infrastructure acting as the guiding light or ‘saptarishi’. This vision of Amrit Kaal puts ESG and the circular economy at the centre

stage and sustainability at its roots.

The stock of green-certified buildings has witnessed a five-fold increase in 2022 compared to 2010. As a part of their short-term

goals on ESG, listed developers are targeting to increase their green portfolio by about 25% by 2025-2030 and increase the use

of renewable energy sources.

ESG Carbon footprint

ESG has assumed significance globally, as private investors Buildings leave a significant carbon footprint and account

have also committed to adherence to ESG. There are no for one-third of global energy consumption. With Indian cities

specific ESG laws in India, and regulations are limited to expected to add 416 million urban dwellers by 2050, urban

providing protections with no rules around controls and development is likely to impact carbon emissions significantly.

disclosures. SEBI has approved a regulatory framework for As part of its focus on green growth, the government should

ESG disclosures by top listed companies in India to undertake address this aspect and implement measures to promote a

sustainability reporting on 50 performance indicators. circular economy in the RE sector. The objective of sustainable

Separately, the Companies Act 2013 has specific provisions cities is to enable the real estate sector to follow the circular

around corporate social responsibility. This makes it imperative economy model, which facilitates the efficient use of resources

for India to introduce appropriate regulations for ESG with minimal waste. It can also mean creating buildings by

compliance, reporting and disclosure. using sustainable and reusable designs with recycled and

repurposed materials that are efficient to manage in

the long run.

12 Realising the potential of real estate

Realising the potential of real estate 13

02

Evolving

regulatory

framework

14 Realising the potential of real estate

RERA – the journey so far Affordable housing

(as of 9 April 2022) • During the last few years, the government has dedicated

significant efforts towards improving the housing situation

As per the Ministry of Housing and Urban Affairs in both rural and urban areas with the vision of ensuring

(MoHUA), 78,494 real estate projects have been ‘housing for all’.

registered, and 88,864 complaints have been • The Ministry of Housing and Urban Affairs began the

disposed of across the country till 9 April 2022 Pradhan Mantri Awas Yojana-Urban (PMAY-U) mission

in June 2015. The mission’s goal is to give eligible urban

recipients, including slum residents nationwide, pucca

The regulatory authorities of 28 states/UTs dwellings with essential facilities. The plan is administered

have operationalised their websites under the through four verticals: Beneficiary Led Construction (BLC),

provisions of RERA. (Arunachal Pradesh, Affordable Housing in Partnership (AHP), In-Situ Slum

Jammu & Kashmir, and Manipur are in process Rehabilitation (ISSR), and Credit Linked Subsidy Scheme

to operationalise) (CLSS), based on the eligibility requirements as per the

scheme guidelines. More than 120.45 lakh homes have

been approved as of 13 March 2023, of which more than

About 31 states/UTs have established a real 109.23 lakh are under completion and 72.56 lakh have been

estate regulatory authority (regular - 25, interim - finished and handed over to recipients.

06). Ladakh, Meghalaya, Sikkim and West Bengal • Given the commitment, several schemes, incentives

have notified the rules but are yet to establish and regulatory support from the government, massive

authority opportunities exist in an affordable segment, particularly in

Tier 2 and Tier 3 cities.

Around 28 states/UTs have set up a real estate

appellate tribunal (regular - 24, interim - 04).

(Arunachal Pradesh, Jammu & Kashmir, Ladakh,

Meghalaya, Mizoram, Sikkim and West Bengal Implementation of a single window

are in the process of establishing such tribunals) clearance mechanism for projects

is needed to smoothen the flow of

the supply and demand in the real

About 61,783 real estate agents have

registered under RERA across the country

estate sector, promote ease of doing

business, and attract investments.

Further, the real estate industry in

India is waiting for an industry status

In addition, to helping homebuyers of stalled projects, the

government established the Special Window for Completion to be granted. With industry status,

of Affordable and Mid-Income Housing (SWAMIH) investment the state and central government

fund, which funds stalled projects registered under RERA, agencies will consider real estate

including those that have been declared NPAs or are pending

as a distinct sector, with special

proceedings before the National Company Law Tribunal.

As of 17 March 2023, 310 proposals aggregating to INR 31,145 programmes and subsidies which will

crore have been approved under SWAMIH, benefiting around improve sectoral health and help real

1,91,367 homebuyers and unlocking projects worth estate players realise their promises

INR 83,188 crore.

of “housing for all”

Source: Real Estate (Regulation & Development) Act, 2016 [RERA] Implementation

Progress Report as on 9 April 2022

Realising the potential of real estate 15

03

Financing

real estate

projects

16 Realising the potential of real estate

FDI inflow (INR crore)

3,500

3,000

2,500 The numbers mentioned in the graph represent

Financing models for real estate development have evolved only townships, housing, built-up infrastructure

over the years keeping in perspective the exchange control,

2,000

and construction development projects

tax and regulatory environment. REITS have made a mark in 1,500

3,117

the commercial real estate space, as they gradually foray into 1,000

other segments. With rising interest rates and looming global 500

932 783

recession, fund raising continues to remain a priority alongside 0

2020-21 2021-22 2022-23

resolution of distressed real estate projects. (April-March) (April-March) (April-December)

Source: Department for Promotion of Industry and Internal Trade statistics

Deals scenario in real estate market

Deals value (INR Crore) • The decline in deal values can also be attributed to absence

6,000 of big-ticket transactions. While 2020-21 witnessed four

5,076 deals in the billion-dollar category and 13 high-value deals

5,000

(value above USD 100 million) , 2022-23 witnessed only two

4,000 deals in the billion dollar category and seven high-value

2,793 2,953 deals.

3,000

• While M&A volumes witnessed a declining trend since 2020,

2,000

the values shot up in the COVID-19 period owing to USD 1.4

796 759

1,000

364

billion deals in the infrastructure (airport) segment and USD

1.3 billion deals in the real estate development segment. This

0

2020 2021 2022 translated to a 55% increase in deal values from USD 2.9

Real estate Infrastructure management

billion in 2018-19 to USD 4.5 billion in 2020-21.

• Driven by Suraksha Realty’s acquisition of Jaypee Infratech

Source: Annual Dealtracker 2023

under the Insolvency and Bankruptcy Code (IBC) for USD

Number of deals 2.5 billion, the deal values recorded USD 2.7 billion for the

period 2022-Q1 2023 recording only 6 deals.

16 15

14 • Similar to M&A trend, PE/VC activity also witnessed a

14 13 13

12 declining trend with 47% in terms of volumes and 37% in

12 11

terms of values during the COVID-19 period as compared

10

to 2018-19. The PE activity in the sector further witnessed

8

a declining activity with a 21% decline in volumes and a

6

33% decline in values post COVID-19 (2022-23) compared

4

to 2020-21. Both commercial and residential development

2

segments remained active through the years but witnessed

0

a declining trend in terms of attracting private equity funds.

2020 2021 2022

• IPO and QIP activity took a major hit post COVID-19. While

Real estate Infrastructure management

the values peaked during COVID-19 majorly owing to the

Source: Annual Dealtracker 2023 IPO activity, deal values declined 87% post COVID-19 for

both IPO as well as QIP, witnessing only four deals raising

• Overall deal activity in 2020-21 saw a declining trend both USD 63 million compared to 15 deals raising USD 4.8 billion

in terms of deal volumes at 33% recording 54 deals and in 2020-2021.

deal values by 11% at USD 9.5 billion when compared to the

pre-COVID-19 years (2018-19). However, the above trend

further continued, and a significant decline was witnessed

in both volumes (46%) and values (36%) post COVID-19

(2022-present) recording only 29 deals valued at

USD 6.1 billion due to significant fall in M&A activity.

Realising the potential of real estate 17

Deal scenario in real estate

In values (USD billion) In volume

6 50

5.2 43

45

5 40

4

35

4

30

3 2.5 2.6 25

18

1.9 20

1.8

2 15 12 12

9

0.9 0.9 10 6

1 0.7 0.6 4 5

0.5 3

5 2 1 2

0.1

0 0

M&A PE IPO QIP M&A PE IPO QIP

2018-19 2020-21 2022-YTD 2018-19 2020-21 2022-YTD

2018-19: pre-COVID-19 2020-21: during COVID-19 2022-YTD: post COVID-19

Source: Annual Dealtracker 2023

Are REITs in the slow lane?

2014 2019 2020 2021

SEBI notifies Listing of Listing of Listing of

REITs regulations Embassy parks Mindspace REIT Brookfields REIT

(India’s first REIT)

• To date, there are three listed REITs, all holding commercial • REITs need to have a minimum asset size of INR 5,000 million,

real estate, and one registered REIT to hold retail assets. The with a minimum offer size of INR 2,500 million. This requires

total funds raised by REITs is INR 15,250 crore. Nexus Select the sponsor to identify a sizable asset portfolio before it can

Trust, a registered REIT to hold retail assets is expected to file be migrated into a REIT structure.

for initial public offering in 2023.

• The universe of eligible asset class which can be held

under a REIT covers buildings, warehouses, car parks and

hotels but excludes those falling within the purview of

‘infrastructure’, unless it forms part of composite real estate

projects. Mortgage REITs are not permitted in India.

18 Realising the potential of real estate

Performance of Indian REITs

Post the COVID-19 pandemic, globally, interest rates have been on the rise. New investments requiring debt funding can be

costlier in a rising interest rate regime. Further, yields offered by REITs are now in the same range as bank fixed deposits, making

REIT investments less attractive for investors.

Parameters Embassy REIT Mindspace REIT Brookfield REIT

Occupancy 86% 88% 88%

Area 43.6 mn sq. ft. 32 mn sq. ft. 18.7 mn sq. ft.

Sponsor stake 35.77% 63.22% 53.74%

Leverage (net debt/gross asset value) 27% 17.60% 32%

Debt cost 7.20% 7.50% 7.95%

Weighted average lease expiry (WALE) 7 years 7 years 6.8 years

Mark-to-market upside 17% 10.40% 18%

Distribution demographics

Dividend 42% 91% 2%

Interest 13% 9% 46%

Amortisation of SPV debt/repayment of

45% - 52%

shareholder loan

Annual dividend yield* 6.79% 5.93% 7.31%

Dividend per unit (Last 12 months in INR) * 21.36 18.9 20.3

NAV (in INR) * 314.95 318.76 277.68

Bengaluru – 74% Mumbai – 40% NCR – 67%

Mumbai – 10% Hyderabad – 40% Mumbai – 17%

Properties

Pune – 9% Pune – 17% Kolkata – 16%

NCR – 7% Chennai – 3% -

Taking cue from global experience and considering the REIT-able assets available in India, REITs will definitely take off as the

ecosystem evolves.

The tax conundrum

REITs have to mandatorily upstream cashflows received

from SPVs and this is typically in the form of interest,

dividend and loan repayment. REITs are regarded as pass- “As demand for commercial real estate returns to pre-COVID

through for tax purposes, and rent, interest and dividend levels and new emerging asset classes mature, REITs will

distribution from REITs is taxed in the hands of investors. become attractive. SEBI is contemplating micro-REITs, which

Loan repayment is not income for the REIT. The Finance will allow REITs to hold just a single asset or a diversified

Bill 2023 amended the provisions to bring to tax this portfolio, to increase supply and flexibility for investors. This

distribution. Effectively, the amendment brings to tax the relaxation in the asset size will make REITs an interesting

net distributions by REITs and InvITs (other than interest, proposition for mid-market players. Incentivising investors

dividend and rent) in excess of the unit capital as income investing in REITs, green bonds and developers of green

from other sources and distributions up to the unit capital buildings will give a further fillip to the sector.”

as capital gains in the year in which units are transferred.

Interestingly, for notified sovereign wealth funds and Shabala Shinde

pension funds, which invest in InvITs, this distribution, Partner, Tax,

which is in the nature of loan repayment, is exempt. Grant Thornton Bharat

Realising the potential of real estate 19

Distressed assets and their resolution

The industry plays a significant role in economic development, government approvals. Real estate cases constitute a large

in addition to generating employment for a large section of part of the cases referred to or admitted into the Corporate

the economy. The real estate sector, being cyclical and earlier Insolvency Resolution Process (CIRP) under Insolvency &

being non-regulated, has had its own share of challenges. Bankruptcy Code, 2016 (IBC/Code). The table below shows the

The sector has witnessed many cases of real estate developers break-up of total cases under CIRP and real estate cases under

and their underlying projects being stuck for various reasons, CIRP as of December 2022.

including liquidity issues, governance issues and a delay in

Particulars Closed

7,000

6,199

6,000 Appeal/ Withdrawal Approval of

Commencement

review/ under resolution

5,000 of liquidation

4,199 settled Section 12 A plan

4,000

20.73%

Total CIRP

3,000 894 793 611 1,901

20.36% 2,000 cases

2,000

1,285

855 21.50% Real estate

1,000 430 243 197 78 337

cases

0

Admitted Closed Ongoing Real estate

Total CIRP cases Real estate cases cases as a %

27.18% 24.84% 12.77% 17.73%

of total

CIRP cases

Source: Insolvency and Bankruptcy Board of India (IBBI) newsletter

• From the above statistics, it is evident that real estate

cases form a significant chunk of CIRP cases, with nearly

21% of the total admitted CIRP cases. Out of the total

cases numbering 2,298 rescued under the Code, there

are 518 cases pertaining to real estate corporates, which

are roughly 23% of the total cases rescued. While the

average of resolution plans, which have been approved in

the real estate sector is about 13% of total approved cases,

the success rate has been low due to various challenges

peculiar to the real estate industry.

• The Code was enacted in 2016, and in six years, it has

evolved after the stakeholders dealt with a large number

of CIRP cases. Various revisions have been introduced,

including those to specifically cater to the challenges

faced in distressed cases of the real estate sector.

20 Realising the potential of real estate

Listed below, in brief, are certain important amendments and orders that have been

passed post the enactment of the IBC

Claim of allotee (mainly homeowners) Fair representation of allottees in CIRP

The Hon’ble Supreme Court, through its order in Chitra Sharma The Code was amended to wherein the debt is owed to

v. Union of India, has clarified the claim of the allottee being financial creditors belonging to the allottees category, then,

adjudged as a financial creditor (FCs) with voting rights. the Interim Resolution Professional (IRP) shall file an application

to the Adjudicating Authority (AA), along with the list of FCs,

IBC v. RERA containing the name of insolvency professionals to act as their

Authorised Representatives (ARs). These ARs appointed by

The Hon’ble Supreme Court in the matter of Pioneer Urban

the AA shall be voting on behalf of the allottees. This was done

Land and Infrastructure Limited and Anr. V. Union of India has

as allottees may not be technically competent to deal in the

observed that the IBC should supersede RERA.

complex matters relating to the CIRP.

Joint application for initiating CIRP by Claim of authority’s dues

homeowners

The Supreme Court, in the matter of NOIDA v. Anand

The Code was amended such that a few disgruntled Sonbhadra, has provided a judgement to provide much-

homeowners are not taking undue advantage of the situation, needed clarity on the dues of the authority as a lessor and

and accordingly, a joint application for default on financial the authoritywas held not to be a financial creditor but an

debt, by minimum 100 allottees or 10% of the total number of operational creditor.

allottees in the same real estate project, was brought into the

code and The Hon’ble Supreme Court of India, through its order Project-specific CIRP

in the matter of Manish Kumar v. Union of India and Another,

has upheld the insertion of this revision. The National Company Law Tribunal (NCLAT) has given an

order in the matter of M/s. Supertech Ltd. v. Union Bank of India

& Anr. for project-wise insolvency resolution of the real estate

company. An amendment in the code in this respect is yet to be

introduced.

There are various other important orders by courts under Another positive intent by the government to resolve distressed

the regime of IBC and otherwise, which have enabled taking assets is reflected in the MCA discussion paper released in

necessary steps in the resolution of distressed assets under real January 2023 where MCA has invited comments from public

estate industry. for various matters pertaining to IBC including improving

outcomes in real estate cases.

The emerging investors’ interest can be seen in the successful

and ongoing CIRP cases. One such real estate CIRP case is

Jaypee Infratech Limited (JIL), which has more than 20,000

homeowners and its resolution plan has been recently “With the evolving landscape of CIRP, series of landmark

approved by NCLT. The resolution plan also considers raising judicial orders, various steps by the government to

debt and indicates expression of interest (EOI) received improve investment, and IBBI’s continued efforts to

from financial investors for such debt. This case also saw address the critical complex issues relating to real estate

participation by National Asset Reconstruction Company insolvency matters involving homebuyers, the probability

Limited (NARCL, the Bad Bank) in the form of assignment of of having successful resolutions in distressed assets in the

debt owed to lenders of JIL. real estate sector is likely to get improved, which will allow

for an established ecosystem for early and successful

The government of India has additionally taken further steps resolution of distressed real estate assets.”

to revive the distressed residential real estate projects by

incorporating an alternative investment fund named SWAMIH Surendra Raj Gang

Investment Fund, which has been mandated to provide last-mile Partner, Recovery & Reorganisation,

construction funding for stalled residential real estate projects Grant Thornton Bharat

pertaining to affordable housing/mid income category.

Realising the potential of real estate 21

04

Embracing

technology

22 Realising the potential of real estate

How digitisation can drive real estate sector. All these companies have harnessed

technology to offer innovative solutions to their clients and

real estate businesses have achieved considerable growth in revenue and

market share.

• To embark on a successful real estate tech journey,

businesses must consider implementing several essential

tenets of technology, such as an ERP solution, reporting

Digitising land records

solution, cloud computing, point solutions, building • The integration of technology in the real estate sector has

automation, CRM and tools to monitor compliances and been progressively growing over the past few years. As per a

digitally execute sales and lease agreements to maintain report by the National Association of Estate Agents, in 2020,

customer data confidentiality. 70% of estate agents employed social media platforms to

• An ERP solution can manage all aspects of a business, some extent for business purposes. The same report also

from sales and marketing to inventory and finances, and revealed that 44% of estate agents use automated tools

help businesses automate processes and gain operational for lead generation, while 35% utilise automated tools for

efficiency. A reporting solution can help businesses analyse customer relationship management.

data, generate insights and make informed decisions. • Not only the professionals, but the clients are also leveraging

Cloud-based solutions offer businesses the flexibility to technology in their everyday business activities. For

scale up or down as needed and access to their data instance, virtual tours and 3D property models have gained

from anywhere. Point solutions can help businesses tackle traction among clients who are searching for properties

specific challenges such as managing property listings, from remote locations. According to a survey by the National

handling transactions and conducting market research. A Association of Home Builders, 48% of home buyers used

leading commercial real estate digital leasing system helps virtual tours to view properties in 2021, an increase from

brokers and landlords to manage deal activity, identify just 19% in 2019. Furthermore, 58% of tenants said they

trends and quantify portfolio performance from their would rent an apartment without viewing it in person if the

desktop or mobile device. property had a virtual tour.

Success stories

In recent times, various firms have been able to implement

technology into their real estate businesses with impressive

outcomes.

• A large Indian commercial real estate firm has showcased

how technology can assist in the growth of businesses. They

provide a suite of digital tools for real estate professionals

to manage their businesses more efficiently. The suite of

tools includes customer relationship management (CRM),

property management, accounting, and sales automation

tools. These tools help professionals handle their clients and

listings, track their finances, and automate their workflows.

Consequently, the company has witnessed significant

revenue growth in a short span of two years, highlighting

how technology can transform the real estate sector.

• Similar real estate success stories include an American

online real estate marketplace that links buyers and sellers,

and a UK-based platform that provides property listings,

market data, and advertising for estate agents. Additionally,

a digital platform has emerged that allows homeowners

to sell their properties directly to the company without

the need for a traditional real estate agent. This platform

uses data analytics and machine learning algorithms to

determine the fair market value of a property, making it

possible for the company to make an instant cash offer

to the seller. E-commerce platforms are being used by

construction companies to purchase construction materials

online and mentoring platforms are being used by startups

to help build technology that addresses challenges in the

Realising the potential of real estate 23

Digital India Land Records The National Generic

Modernisation Programme Document Registration System

• In addition to the advantages of digitalisation for real estate • The Indian government’s efforts to digitise land records have

businesses, there are also initiatives to digitise land records extended to the National Generic Document Registration

in India. Launched in 2016, the Digital India Land Records System (NGDRS), an initiative launched in August 2020.

Modernisation Programme aims to digitise land records, The NGDRS enables the online registration of documents

minimise land disputes, and promote transparency in land- such as property deeds, significantly reducing the need

related transactions. The Ministry of Rural Development for physical paperwork and streamlining the registration

reports that as of September 2021, about 90% of land process. By providing a tamper-proof record of transactions,

records have been digitised across India. The programme the system increases transparency and reduces the risk

aims to digitise all land records in the country, making them of fraud in land-related transactions. The NGDRS has

accessible online to citizens and reducing the requirement been implemented in 29 states and union territories as

for manual record-keeping. Digitising land records will of September 2021, covering over 95% of the country’s

simplify the process of land acquisition, registration, and population, and has processed over 25 million registrations

transfer, making it more efficient, transparent and cost- so far. The introduction of the NGDRS not only simplifies real

effective. Additionally, it will assist in resolving land disputes estate transactions, but also promotes transparency and

and ensuring that landowners have undisputed ownership of reduces corruption in the sector.

their properties, which is beneficial for both individuals

and businesses.

“Technology has had a significant impact on the real estate

industry, allowing businesses to streamline their operations,

increase productivity, and provide greater value to their

customers. The industry has been steadily increasing its

adoption of technology, with many real estate professionals

already using automated tools to manage their tasks. Virtual

tours, 3D property models, AI, and blockchain technology have

also become increasingly popular in recent years. Virtual tours

that use AR and VR have provided clients with an interactive

virtual tour experience, while AI has helped agents and brokers

better predict the future rent and value of a property in a

specific market. The tokenisation of properties using blockchain

technology has also made buying and selling properties more

transparent and efficient. Furthermore, digitisation initiatives

in India, such as the Digital India Land Records Modernisation

Programme and the National Generic Document Registration

System, have helped reduce land disputes and promote

transparency in land-related transactions. Overall, technology

has brought significant improvements to the real estate

industry, allowing businesses to stay competitive and provide

better experiences to their clients.”

Pranav Kaushik

Partner, dGTL - Digital Transformation,

Grant Thornton Bharat

24 Realising the potential of real estate

Realising the potential of real estate 25

About PHDCCI

PHD Chamber of Commerce and

Industry (PHDCCI) has been working as

a catalyst for the promotion of Indian

industry, trade and entrepreneurship

for the past 117 years. It is a forward

looking, proactive and dynamic

PAN-India apex organisation. As a

partner in progress with industry and

government, PHDCCI works at the

grass roots level with strong national

and international linkages for propelling

progress, harmony and integrated

development of the Indian economy.

PHDCCI, acting as the ‘Voice of Industry

& Trade’ reaching out to more than

1,50,000 large, medium and small

industries, has forged ahead, leveraging

its legacy with the industry knowledge

across multiple sectors to take the

Indian economy to the next level.

At the global level, we have been

working with the embassies and high

commissions in India and overseas to

bring in the international best practices

and business opportunities.

26 Realising the potential of real estate

Acknowledgements

Authors Editorial review Design

Tanmay Mathur Vikas Kushwaha

Sumeet Abrol Akshay Kapoor

Partner, Lead Advisory,

Grant Thornton Bharat

sumeet.abrol@in.gt.com For media enquiries, write to

Shabala Shinde media@in.gt.com

Partner, Tax,

Grant Thornton Bharat

shabala.shinde@in.gt.com

Contributors

Surendra Raj Gang

Pranav Kaushik

Gaurav Khera

Eva Tewari

Realising the potential of real estate 27

We are

Shaping a Vibrant Bharat

A member of Grant Thornton International Ltd, Grant Thornton

Bharat is at the forefront of helping reshape the values in the

profession. We are helping shape various industry ecosystems

through our work across Assurance, Tax, Risk, Transactions,

Technology and Consulting, and are going beyond to shape a

more #VibrantBharat.

Our offices in India

Ahmedabad Bengaluru Chandigarh Chennai Scan QR code to see

our office addresses

Dehradun Delhi Gurgaon Hyderabad Kochi www.grantthornton.in

Kolkata Mumbai Noida Pune

Connect @Grant-Thornton-Bharat-LLP @GrantThorntonBharat @GrantThornton_Bharat

with us on @GrantThorntonIN @GrantThorntonBharatLLP GTBharat@in.gt.com

© 2023 Grant Thornton Bharat LLP. All rights reserved.

“Grant Thornton Bharat” means Grant Thornton Advisory Private Limited, the sole member firm of Grant Thornton International Limited (UK) in India, and those legal entities which are its related

parties as defined by the Companies Act, 2013, including Grant Thornton Bharat LLP.

Grant Thornton Bharat LLP, formerly Grant Thornton India LLP, is registered with limited liability with identity number AAA-7677 and has its registered office at L-41 Connaught Circus,

New Delhi, 110001.

References to Grant Thornton are to Grant Thornton International Ltd. (Grant Thornton International) or its member firms. Grant Thornton International and the member firms are not a worldwide

partnership. Services are delivered independently by the member firms.

You might also like

- Real Estate March 2021Document33 pagesReal Estate March 2021Prem PrakashNo ratings yet

- India Real Estate - Vision 2047 ReportDocument19 pagesIndia Real Estate - Vision 2047 ReportRed LubricantsNo ratings yet

- Shivam Real EstateDocument46 pagesShivam Real EstateTasmay EnterprisesNo ratings yet

- Real Estate-August 2022Document33 pagesReal Estate-August 2022Sumit RakshitNo ratings yet

- Ciril Report 2019Document44 pagesCiril Report 2019Aloka MajumderNo ratings yet

- Can REIT Address Expectations of Indian Real Estate Investors?Document7 pagesCan REIT Address Expectations of Indian Real Estate Investors?alim shaikhNo ratings yet

- JLL Construction Cost Guide India 2023Document26 pagesJLL Construction Cost Guide India 2023Mohit BhatiaNo ratings yet

- JLL Construction Cost Guide Book India 2022Document26 pagesJLL Construction Cost Guide Book India 2022svNo ratings yet

- Disruptions in Real Estate in IndiaDocument56 pagesDisruptions in Real Estate in IndiaDevasish Parmar100% (1)

- Market Trend and Forecast 22 - 30 - IBED ReportDocument33 pagesMarket Trend and Forecast 22 - 30 - IBED Report7 cloudNo ratings yet

- FICCI Vestian RE Investment ReportDocument32 pagesFICCI Vestian RE Investment ReportAbhishek MinhasNo ratings yet

- JLL Report of India Real EstateDocument32 pagesJLL Report of India Real Estatesaururja saururjaNo ratings yet

- The Modi EffectDocument17 pagesThe Modi EffectNilesh KumarNo ratings yet

- India Real Estate a Decade From Now 2024 11102 (2)Document40 pagesIndia Real Estate a Decade From Now 2024 11102 (2)c.k.sathiishNo ratings yet

- FICCI India Office Repurposed To Scaleup ReportDocument17 pagesFICCI India Office Repurposed To Scaleup ReportRitesh KurarNo ratings yet

- Indian Real Estate Poised for V-Shaped Recovery in Post-Pandemic EraDocument52 pagesIndian Real Estate Poised for V-Shaped Recovery in Post-Pandemic EraSiddhartha SanapathiNo ratings yet

- The Future of Real Estate in India: Demand, Supply and Financing OpportunitiesDocument3 pagesThe Future of Real Estate in India: Demand, Supply and Financing OpportunitiesPrashant PatilNo ratings yet

- Real EstateDocument33 pagesReal EstateAnjan MohapatroNo ratings yet

- Indian Real Estate-Will Awarding An Industry Status, Improve Its Prospects?Document19 pagesIndian Real Estate-Will Awarding An Industry Status, Improve Its Prospects?Kunal BawaneNo ratings yet

- FSM Sonamon 354Document30 pagesFSM Sonamon 354Yashu Sharma100% (1)

- RERA's Impact on Housing Loan IndustryDocument54 pagesRERA's Impact on Housing Loan IndustryShyam ChoudharyNo ratings yet

- Information MemorandumDocument38 pagesInformation Memorandumsun6raj18100% (1)

- EY Real Estate Investments Trends and Outlook - Jul19 PDFDocument28 pagesEY Real Estate Investments Trends and Outlook - Jul19 PDFBaniNo ratings yet

- Real Estate Investment in India:: Analysing The Near FutureDocument15 pagesReal Estate Investment in India:: Analysing The Near FutureVipin SNo ratings yet

- Management Accountant Nov 2019Document124 pagesManagement Accountant Nov 2019ABC 123No ratings yet

- Strategist Speaks - RealEstate&InfraDocument1 pageStrategist Speaks - RealEstate&InfraGarvitaNo ratings yet

- !! Architectural Services Market - 2022 - 27 - Industry Share, Size, Growth - Mordor IntelligenceDocument6 pages!! Architectural Services Market - 2022 - 27 - Industry Share, Size, Growth - Mordor IntelligenceAlexNo ratings yet

- Real Estate: February 2022Document33 pagesReal Estate: February 2022Prajwal DSNo ratings yet

- Coprorate Catalyst Breif Report of Real Estate of IndiaDocument15 pagesCoprorate Catalyst Breif Report of Real Estate of IndiaVivek KumarNo ratings yet

- Section F-Group 10 (Real Estate)Document21 pagesSection F-Group 10 (Real Estate)Meghwant ThakurNo ratings yet

- Real Estate For Aug 2013Document10 pagesReal Estate For Aug 2013piyush725No ratings yet

- Real Estate and ConstructionsDocument23 pagesReal Estate and ConstructionsNiti KamdarNo ratings yet

- Real Estate May 2023Document33 pagesReal Estate May 2023Varun KhannaNo ratings yet

- Mini Project-2 Report On Real Estate Submitted To Dr. A.P.J. Abdul Kalam Technical University, LucknowDocument25 pagesMini Project-2 Report On Real Estate Submitted To Dr. A.P.J. Abdul Kalam Technical University, LucknowAbhishek VermaNo ratings yet

- Indian Institute of Tourism and Travel Management: Business Plan (Real Estate)Document10 pagesIndian Institute of Tourism and Travel Management: Business Plan (Real Estate)atulbaNo ratings yet

- Industry ProfileDocument98 pagesIndustry Profileramjiraospeaking007100% (1)

- Real Estate India Report 2015Document11 pagesReal Estate India Report 2015PrannoyChakraborty100% (1)

- Economics 2 - Cia 4Document10 pagesEconomics 2 - Cia 4PranavNo ratings yet

- Real Estate Sector in IndiaDocument10 pagesReal Estate Sector in IndiaadvminalNo ratings yet

- Real Estate Industry Analysis: PESTLE, SWOT, Porter's 5 ForcesDocument10 pagesReal Estate Industry Analysis: PESTLE, SWOT, Porter's 5 Forcessaurabh yadav100% (2)

- KnightFrank - India Real Estate H2 2020Document150 pagesKnightFrank - India Real Estate H2 2020Swanand KulkarniNo ratings yet

- Decoding Housing For All 2022Document36 pagesDecoding Housing For All 2022Tanvi YadavNo ratings yet

- Real Estate: June 2020Document31 pagesReal Estate: June 2020yashNo ratings yet

- India Construction Sector Report 2021-2022Document86 pagesIndia Construction Sector Report 2021-2022Lavanya Subramaniam100% (1)

- IT/ITES GROWTH IMPACT ON REAL ESTATEDocument45 pagesIT/ITES GROWTH IMPACT ON REAL ESTATEsmartway projectsNo ratings yet

- RE Sector IssuesDocument7 pagesRE Sector Issuessahaye.vikramjitNo ratings yet

- Real Estate - Opportunities Challenges and Outlook - CAREDocument11 pagesReal Estate - Opportunities Challenges and Outlook - CAREbangaloretoonsNo ratings yet

- Prospects Challenges Indian Real Estate MarketDocument8 pagesProspects Challenges Indian Real Estate Marketshweta meshramNo ratings yet

- Case Study Final VersionDocument21 pagesCase Study Final VersionAnkit GangwarNo ratings yet

- Trends in Residential Market in BangalorDocument9 pagesTrends in Residential Market in BangalorAritra NandyNo ratings yet

- Infrastructure IndiaDocument35 pagesInfrastructure IndiaVikhyat SharmaNo ratings yet

- Data - File Real 1570374183 PDFDocument17 pagesData - File Real 1570374183 PDFanu sahaNo ratings yet

- Origin of The OrganizationDocument5 pagesOrigin of The OrganizationShreyas SharmaNo ratings yet

- Indian Real Estate Sector Funding OptionsDocument53 pagesIndian Real Estate Sector Funding Optionsshwetank daveNo ratings yet

- C&W India Real Estate Outlook 2009Document52 pagesC&W India Real Estate Outlook 2009rayvk18No ratings yet

- Master of Management Studies (MMS)Document80 pagesMaster of Management Studies (MMS)Gotam YogiNo ratings yet

- Real EstateDocument8 pagesReal EstateViswanathan BalaNo ratings yet

- A New Dawn for Global Value Chain Participation in the PhilippinesFrom EverandA New Dawn for Global Value Chain Participation in the PhilippinesNo ratings yet

- Private Sector Operations in 2019: Report on Development EffectivenessFrom EverandPrivate Sector Operations in 2019: Report on Development EffectivenessNo ratings yet

- WA 6 NPV, IRR and PaybackDocument7 pagesWA 6 NPV, IRR and PaybackUbong AkpekongNo ratings yet

- 2016 ORION Consolidated Audit ReportDocument112 pages2016 ORION Consolidated Audit ReportJoachim VIALLONNo ratings yet

- HRmanualDocument6 pagesHRmanualNaman KediaNo ratings yet

- CA Foundation Accounts Recodring of Transactions StudentsDocument57 pagesCA Foundation Accounts Recodring of Transactions StudentsRockyNo ratings yet

- End of Quiz: BCOST221: COST ACCOUNTING (BSA25) 2nd Sem SY 2021-2022 Enabling Assessment 3Document15 pagesEnd of Quiz: BCOST221: COST ACCOUNTING (BSA25) 2nd Sem SY 2021-2022 Enabling Assessment 3Kc SevillaNo ratings yet

- GROUP 2 - Fashion Industry - Term Paper (Section B)Document32 pagesGROUP 2 - Fashion Industry - Term Paper (Section B)Farah FirozNo ratings yet

- Tarea 1 - Ficha Bibliográfica-Hanai KishimotoDocument8 pagesTarea 1 - Ficha Bibliográfica-Hanai KishimotoHanai KishimotoNo ratings yet

- KL 39 H 3095 PDFDocument1 pageKL 39 H 3095 PDFSujith Raj SNo ratings yet

- Communication: Reyes, Zarah Mae MDocument7 pagesCommunication: Reyes, Zarah Mae MZarah Mae ReyesNo ratings yet

- Southwest Airlines Success: A Case Study Analysis: January 2011Document6 pagesSouthwest Airlines Success: A Case Study Analysis: January 2011Fabián RosalesNo ratings yet

- Vardhman Textiles LTD - 22Document280 pagesVardhman Textiles LTD - 22Mrigank Mahajan (IN)No ratings yet

- Copia de SustainableFashionandTextilesDesignJourneysbyKateFletcherEarthscan2008Document6 pagesCopia de SustainableFashionandTextilesDesignJourneysbyKateFletcherEarthscan2008martina torresNo ratings yet

- HRM - Term Paper - Mohammad SujonDocument24 pagesHRM - Term Paper - Mohammad Sujonishapnil 63No ratings yet

- The LatAm Tech Report 2023Document285 pagesThe LatAm Tech Report 2023rnraphaNo ratings yet

- Account Reconciliation Policy - Sample 2Document5 pagesAccount Reconciliation Policy - Sample 2Muri EmJayNo ratings yet

- Nature and Elements of LeadershipDocument45 pagesNature and Elements of LeadershipMARIA SHIELA LEDESMANo ratings yet

- D'amico International Shipping S.a., Q3 2019 Earnings Call, Nov 13, 2019Document11 pagesD'amico International Shipping S.a., Q3 2019 Earnings Call, Nov 13, 2019Chris WallerNo ratings yet

- Chapter 12 Exercises Indirect Method Cash Flow StatementsDocument2 pagesChapter 12 Exercises Indirect Method Cash Flow StatementsAreeba QureshiNo ratings yet

- Quantitative Decision Making and Optimization Models in Logistics & Supply Chain ManagementDocument3 pagesQuantitative Decision Making and Optimization Models in Logistics & Supply Chain ManagementGada NagariNo ratings yet

- Startup Law Deck - IntroductionDocument54 pagesStartup Law Deck - IntroductionDaniel RavicherNo ratings yet

- 5 Cross-Case Analysis and DiscussionDocument2 pages5 Cross-Case Analysis and DiscussionAtikah RamadhaniNo ratings yet

- Assessment 3 Choice and Change (Presentation)Document5 pagesAssessment 3 Choice and Change (Presentation)Vladimir Losenkov100% (1)

- Chapter 04 Testbank: of Mcgraw-Hill EducationDocument59 pagesChapter 04 Testbank: of Mcgraw-Hill EducationshivnilNo ratings yet

- CBSE Class 11 Business Studies Chapter 2 Forms of Business Organisations Important QuestionsDocument4 pagesCBSE Class 11 Business Studies Chapter 2 Forms of Business Organisations Important QuestionsShivam MutkuleNo ratings yet

- Philippine Income Taxation QuizDocument4 pagesPhilippine Income Taxation QuizRezhel Vyrneth TurgoNo ratings yet

- Admin-EvalDocument3 pagesAdmin-EvalDennisse PérezNo ratings yet

- Customer Satisfaction Towards Patanjali Ayurvedic ProductsDocument42 pagesCustomer Satisfaction Towards Patanjali Ayurvedic ProductsAnirudh Singh ChawdaNo ratings yet

- Chapter 2 - Project Life CycleDocument36 pagesChapter 2 - Project Life Cyclehailegebrael100% (1)

- An Insight Into M&a - A Growth Perspective (By Vinod Kumar & Priti)Document227 pagesAn Insight Into M&a - A Growth Perspective (By Vinod Kumar & Priti)Adeel AhmedNo ratings yet

- (Assignment) Finc 331 Project 1Document6 pages(Assignment) Finc 331 Project 1Nashon ChachaNo ratings yet