Professional Documents

Culture Documents

ECL Working - Final 2

Uploaded by

sgpOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ECL Working - Final 2

Uploaded by

sgpCopyright:

Available Formats

Summary of Work Done

We have; 1 The credit risk arises when the amount is overdue and in case of __________, the amount is overdue when the invoice is raised. So, we have accounted for the balances in the buckets (1-90 days) for the calculation of provision on trade debt balances.

Obtained the working of ECL as per IFRS 09 from client. 2 The Company considers trade debts balances in default when debtors are overdue for more than 365 days. Purchase - B (POF) balance amounting to Rs. 7,868,984 has been outstanding for more than 365 days which is not considered in ECL working.

Ensured the amounts with the aging analysis. 3 Error in formula for flow rate calculation.

Ensured the external factors rates used from external source, " www.imf.org".

Recalulated the amount of provision.

Discussed with client ffor any differences.

Particulars Amount in 000'

Provision as per GTAR 123,456,789

Provision as per Client 12,318,205

Difference - 111,138,584

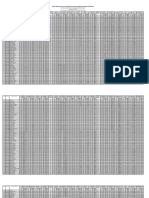

Recalulation of Provision for Doubtful Debts: ( Government Customers)

Day Group 30-Jun-23 31-Mar-23 31-Dec-22 30-Sep-22 30-Jun-22 30-Mar-22 31-Dec-21 30-Jun-21 30-Mar-21 31-Dec-20 30-Sep-20

Current 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789

0 - 30 days 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789

31 - 60 days 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789

61 - 120 days 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789

121 - 180 days 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789

181-365 days 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789

365 days and above 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789 123,456,789

Gross 864,197,523 864,197,523 864,197,523 864,197,523 864,197,523 864,197,523 864,197,523 864,197,523 864,197,523 864,197,523 864,197,523

Flow rate Average 30-Jun-23 31-Mar-23 31-Dec-22 30-Sep-22 30-Jun-22 30-Mar-22 31-Dec-21 30-Jun-21 30-Mar-21 31-Dec-20 30-Sep-20

1 - 30 days 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

31 - 60 days 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

61 - 90 days 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

91 - 180 days 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

181-360 days 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

360 days and above 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

Secured / Exposure at Adjustment to

FLOW RATE APPLICATION 30-Jun-23 Related default Flow rate flow rate Credit loss rate Provision

1 - 30 days 123,456,789 - 123,456,789 100.00% 100.8% 104.1% 128,474,708 0.50%

31 - 60 days 123,456,789 - 123,456,789 100.00% 100.8% 103.2% 127,455,067 1.82%

61 - 90 days 123,456,789 - 123,456,789 100.00% 100.8% 102.4% 126,443,519 0.05

91 - 180 days 123,456,789 - 123,456,789 100.00% 100.8% 101.6% 125,439,999 0.08

181-360 days 123,456,789 - 123,456,789 100.00% 100.8% 100.8% 124,444,443 13.33%

360 days and above 123,456,789 - 123,456,789 100.00% 100.0% 100.0% 123,456,789 28.57%

e

Macro economic adjustment to build in expected loss

Average Increase / Absolute

Particulars 2020 2021 2022 2023 Projected 2023 Link of GDP rate and Unemployment Rate %:

historic Decrease Change

Unemployment rate 6.6 6.3 6.2 7 6.525 6.400 (0.125) 0.125 www.imf.org/external/datamapper/LUR@WEO/PAK?zoom=PAK&highlight=PAK

GDP rate -0.9 5.7 6 0.5 2.825 3.500 0.675 0.675 www.imf.org/external/datamapper/NGDP_RPCH@WEO/PAK?zoom=PAK&highlight=PAK

Absolute change 0.800

a

Conclusion

Based on the results of our tests of recorded balances, we conclude that the above balances are fairly stated in relation to

the Financial Statements taken as a whole.

Audit Ticks:

a Trace to Supporting Documents

n Agreed to prior year working papers

b Traced to Last year Financial Statements

d Traced to General Ledger

e Recalculated

You might also like

- Discounted Cash Flow Template 14Document31 pagesDiscounted Cash Flow Template 14Hemant bhanawatNo ratings yet

- Mixed Model - Marketplace and E-Commerce - ENDocument35 pagesMixed Model - Marketplace and E-Commerce - ENOndieki Obare JuniorNo ratings yet

- Receivables ManagementDocument6 pagesReceivables ManagementJulienne AristozaNo ratings yet

- Arie Rate BGC Decem Brie 2017Document1 pageArie Rate BGC Decem Brie 2017Andrei RusalimNo ratings yet

- DMBD Bar Februari 2023Document362 pagesDMBD Bar Februari 2023aryaa lorenzoNo ratings yet

- 81 Procuremnt Status Reports - 20 October 2016 (Rev. 00)Document49 pages81 Procuremnt Status Reports - 20 October 2016 (Rev. 00)Zain AbidiNo ratings yet

- Tablice StatystyczneDocument21 pagesTablice StatystyczneQpel DvsbstrdNo ratings yet

- Tablas Distribuciones Z, X 2, F, TDocument6 pagesTablas Distribuciones Z, X 2, F, TLuisa Fernanda GarciaNo ratings yet

- Module 2b Allowance For Bad DebtsDocument14 pagesModule 2b Allowance For Bad DebtsChen HaoNo ratings yet

- IOT Cash Analysis (Excel)Document4 pagesIOT Cash Analysis (Excel)awais.muzaffarNo ratings yet

- InformeAdquirencia - 2023-01-11Document3,430 pagesInformeAdquirencia - 2023-01-11Adolfo Gahona ZuñigaNo ratings yet

- EPF Calculator - by AssetYogiDocument22 pagesEPF Calculator - by AssetYogiSuman MondalNo ratings yet

- 2 Table2BaywalkBkPARRptDocument1 page2 Table2BaywalkBkPARRptRui Wilson Pais ChikandeNo ratings yet

- Sweep Deposit Interest RatesDocument1 pageSweep Deposit Interest RatesReyansh MishraNo ratings yet

- FM Class Work - 29.09.2023Document41 pagesFM Class Work - 29.09.2023humna khanNo ratings yet

- Nehang 18.19Document300 pagesNehang 18.19KHALIDNo ratings yet

- NullDocument15 pagesNullhumna khanNo ratings yet

- #5Document5 pages#5Mariana GarzaNo ratings yet

- Cash FlowDocument71 pagesCash Flowpuput utomoNo ratings yet

- Tabela FatoresDocument6 pagesTabela FatoresMessias De Souza FerreiraNo ratings yet

- Calculadora Crédito PersonalDocument3 pagesCalculadora Crédito PersonalAmaury de la CruzNo ratings yet

- Budget 2018 - Final Approved by BODDocument118 pagesBudget 2018 - Final Approved by BODMuhammad SamiNo ratings yet

- 2011 Jumio PAUDocument3 pages2011 Jumio PAUnjyhbyp9vjNo ratings yet

- Sample Payroll Calculation - June 2020Document37 pagesSample Payroll Calculation - June 2020Htet NaungNo ratings yet

- Profesor Christian Lorca CruzDocument2 pagesProfesor Christian Lorca CruzkhgcjhkjNo ratings yet

- InformeAdquirencia-1 AL 15 MARDocument376 pagesInformeAdquirencia-1 AL 15 MAREliana Carrillo DuqueNo ratings yet

- Year 3 Expenses and Cashflow ForecastDocument1 pageYear 3 Expenses and Cashflow ForecastTully HamutenyaNo ratings yet

- SBG GLOBAL Reward 01 July v1Document23 pagesSBG GLOBAL Reward 01 July v1LalHmingmawiaNo ratings yet

- DMBD Bar January 2023Document212 pagesDMBD Bar January 2023aryaa lorenzoNo ratings yet

- Aging Report TemplateDocument2 pagesAging Report TemplateGolamMostafaNo ratings yet

- Tarifarios Mes de Enero 2021: Nominal Interest Rates DPF-ProposedDocument4 pagesTarifarios Mes de Enero 2021: Nominal Interest Rates DPF-ProposedGenesis CoronelNo ratings yet

- Ch17 Inventory Control TemplateDocument32 pagesCh17 Inventory Control TemplateJUAN ANTONIO LOPEZ SANCHEZNo ratings yet

- Ch17 Inventory Control TemplateDocument32 pagesCh17 Inventory Control TemplateJUAN ANTONIO LOPEZ SANCHEZNo ratings yet

- Zerodha SST MethodDocument30 pagesZerodha SST Methodvirendra.jibheNo ratings yet

- Tablero de IWOSDocument3 pagesTablero de IWOSCarlos NarroNo ratings yet

- Santierra T2B12L10 Nuvali Lot For SaleDocument5 pagesSantierra T2B12L10 Nuvali Lot For SaleJP ReyesNo ratings yet

- D NormalDocument1 pageD NormalLaura VelasquezNo ratings yet

- Forecast Costing MiningDocument59 pagesForecast Costing MiningOki AnriansyahNo ratings yet

- Date Area Date & Cluste HO Attempts, HO Attempts, HO Inter HO Intra SDCCH AttemDocument11 pagesDate Area Date & Cluste HO Attempts, HO Attempts, HO Inter HO Intra SDCCH AttemChinmyaDasNo ratings yet

- Adam - Monthly Cash Flow 2014Document9 pagesAdam - Monthly Cash Flow 2014Ismi RochaniNo ratings yet

- Tabela Normal Padr O25281%29Document1 pageTabela Normal Padr O25281%29António AnteloNo ratings yet

- Tariff Calculation - BOT Small HydroDocument4 pagesTariff Calculation - BOT Small HydroSuresh Thadikonda100% (1)

- Standard Normal Distribution TableDocument1 pageStandard Normal Distribution TableNam KhanhNo ratings yet

- Executive SummaryDocument6 pagesExecutive SummaryGio Densel GarciaNo ratings yet

- Employee Hours A Day Employee Days A Week Lazer Engraving Hours A Day Lazer Engraving Days A Week Resale Freight % Total PurchasesDocument6,198 pagesEmployee Hours A Day Employee Days A Week Lazer Engraving Hours A Day Lazer Engraving Days A Week Resale Freight % Total PurchasesManeeshNo ratings yet

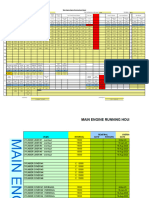

- ME Running Hour Report. 31 October 2023Document18 pagesME Running Hour Report. 31 October 2023Dominador TallecerNo ratings yet

- Fonderia Di Torino S.P.A Case Answers: Submitted To Sir Suresh Kumar RajputDocument4 pagesFonderia Di Torino S.P.A Case Answers: Submitted To Sir Suresh Kumar RajputUzair Ahmed SoomroNo ratings yet

- Special Offer Pricing Payment PlanDocument1 pageSpecial Offer Pricing Payment PlanKevin M. WahomeNo ratings yet

- Centroide e InerciaDocument1 pageCentroide e InerciaMarcelo PindoNo ratings yet

- Income Statement - Annual - As Originally ReportedDocument4 pagesIncome Statement - Annual - As Originally ReportedAnkurNo ratings yet

- Clinical - 2020 Batch Resit Student AttendanceDocument4 pagesClinical - 2020 Batch Resit Student Attendancedhruvjindal85No ratings yet

- Auto Supply Chain DataDocument27 pagesAuto Supply Chain Dataabcd_xyzxyzNo ratings yet

- Price HourDocument2 pagesPrice HourJohn ReyanNo ratings yet

- Estupiñan Erika CDC U3Document8 pagesEstupiñan Erika CDC U3wsergNo ratings yet

- Imovel Black Week 2022 ATÉ 7 DEZDocument2 pagesImovel Black Week 2022 ATÉ 7 DEZJefferson AlbuquerqueNo ratings yet

- Tabla Normal StandardDocument1 pageTabla Normal Standardvictoria2palomino2loNo ratings yet

- Kshitij Patil 044 Fin ModelDocument18 pagesKshitij Patil 044 Fin Modelkshitij patilNo ratings yet

- Tabela Distribuicao NormalDocument1 pageTabela Distribuicao NormalluislcarvalhoNo ratings yet

- Cost Accounting in The Tool Steel IndustryDocument18 pagesCost Accounting in The Tool Steel IndustrysgpNo ratings yet

- Cfa emDocument176 pagesCfa emfcccccccccccccNo ratings yet

- Diabetes Diet Chart bgr34 PDFDocument4 pagesDiabetes Diet Chart bgr34 PDFcet.ranchi7024No ratings yet

- 3 Eng Sa1uDocument16 pages3 Eng Sa1usgpNo ratings yet

- CBSE Class 3 English Practice WorksheetDocument2 pagesCBSE Class 3 English Practice WorksheetsgpNo ratings yet

- Promissory NoteDocument19 pagesPromissory Notejim100% (2)

- Cpcccm2007 - Task 2 v4.0Document3 pagesCpcccm2007 - Task 2 v4.0Aditya SharmaNo ratings yet

- Project Report On Branding Strategies of Samsung Mobile PhonesDocument59 pagesProject Report On Branding Strategies of Samsung Mobile PhonesRaghavWatts80% (5)

- SCORE Productivity Training Addis Ababa, Ethiopia: - Sustaining Competitive and Responsible EnterprisesDocument119 pagesSCORE Productivity Training Addis Ababa, Ethiopia: - Sustaining Competitive and Responsible EnterprisesAweke ZewduNo ratings yet

- Multiple Choice Questions On Manufacturing Process and Production EngineeringDocument3 pagesMultiple Choice Questions On Manufacturing Process and Production EngineeringrahmaNo ratings yet

- BOR Settlements RPRT Roh8-12 FY22Document10 pagesBOR Settlements RPRT Roh8-12 FY22Honolulu Star-AdvertiserNo ratings yet

- Manly Plastic IncDocument22 pagesManly Plastic IncLeah Balucan LalimNo ratings yet

- Product and Brand Management Notes-9-12Document4 pagesProduct and Brand Management Notes-9-12Makarand WathNo ratings yet

- BS Iso Iec 07811-9-2015Document12 pagesBS Iso Iec 07811-9-2015Amer AmeryNo ratings yet

- Beijing Cuts Interest Rates in Bid To Revive Economy: Three Headaches Sleeping Beauty The Big RetreatDocument26 pagesBeijing Cuts Interest Rates in Bid To Revive Economy: Three Headaches Sleeping Beauty The Big RetreatstefanoNo ratings yet

- Tax Invoice: Excitel Broadband Pvt. LTDDocument1 pageTax Invoice: Excitel Broadband Pvt. LTDMittal Galaxy100% (1)

- SF 7 2022-2023Document8 pagesSF 7 2022-2023Paaralang Sentral Ng KeytodacNo ratings yet

- Career Air Force-India (Candidate Section)Document1 pageCareer Air Force-India (Candidate Section)Aditya GaurNo ratings yet

- ISO#IEC TS 20000-11 2021 (E) - Character PDF DocumentDocument7 pagesISO#IEC TS 20000-11 2021 (E) - Character PDF DocumentSadqAlsoufiNo ratings yet

- Ex-8.1 List of Subsidiaries of Mitsui & Co.,LtdDocument8 pagesEx-8.1 List of Subsidiaries of Mitsui & Co.,LtdMohammadAminNo ratings yet

- Ade Siti Mariam 183112340350061Document2 pagesAde Siti Mariam 183112340350061Ade siti mNo ratings yet

- Cultural Environment in MarketingDocument7 pagesCultural Environment in MarketingAtreya ChakrobortyNo ratings yet

- New QTJ4-40B2 Production Line PDFDocument7 pagesNew QTJ4-40B2 Production Line PDFTwokir A. TomalNo ratings yet

- Corporate Law of Malaysia: Statutory Meetings in Malaysia CompaniesDocument14 pagesCorporate Law of Malaysia: Statutory Meetings in Malaysia CompaniesJitha RithaNo ratings yet

- IFC Federal Bank India Case StudyDocument13 pagesIFC Federal Bank India Case StudyAnchal katiyarNo ratings yet

- Unit II Analysis and Interpretation of Financial Statements Vertical Balance Sheet Balance Sheet As On 31/3/2022 Liabilities Rs. Assets RsDocument9 pagesUnit II Analysis and Interpretation of Financial Statements Vertical Balance Sheet Balance Sheet As On 31/3/2022 Liabilities Rs. Assets RsKirti RawatNo ratings yet

- SPP Doc 205-Post-Construction ServicesDocument10 pagesSPP Doc 205-Post-Construction ServicesKyle AradoNo ratings yet

- Accounting in Business Management Ashley N. Beckom Westwood College BUS501: Quantitative Business Analysis October 14, 2010Document6 pagesAccounting in Business Management Ashley N. Beckom Westwood College BUS501: Quantitative Business Analysis October 14, 2010abeckomNo ratings yet

- Introduction BBA 1110 - Unit One-1Document9 pagesIntroduction BBA 1110 - Unit One-1Lweendo SikalumbaNo ratings yet

- MA Thesis The Role of The Ombudsman in I PDFDocument159 pagesMA Thesis The Role of The Ombudsman in I PDFSweta ToppoNo ratings yet

- OOP Assignment 2Document18 pagesOOP Assignment 2ladvakishorNo ratings yet

- Bamboo Supply ChainDocument19 pagesBamboo Supply ChainPritomDuttaNo ratings yet

- Bartender Robar Case Study Zimmer BiometDocument2 pagesBartender Robar Case Study Zimmer Biometdimiz77No ratings yet

- Ind Nifty Financial ServicesDocument2 pagesInd Nifty Financial ServicesSongs TrendsettersNo ratings yet

- Leadership PracticeDocument25 pagesLeadership PracticeTahir AhmadNo ratings yet