Professional Documents

Culture Documents

IPM Instructions For Group Assignment 2023 - 24

Uploaded by

Diana AzevedoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IPM Instructions For Group Assignment 2023 - 24

Uploaded by

Diana AzevedoCopyright:

Available Formats

Investments and Portfolio

Management Escola de Economia e Gestão

Master in Finance

I

Instructions for group assignment (2023/2024)

Composition of the teams

Students should organize themselves into teams of 4/5 students.

Deliverables

‒ Each team should present, on December 11, 2023, an empirical paper on the performance of mutual

funds. Each team has up to 10 minutes to present the assignment. All team members should participate

in the presentation. The assignment should be written and presented in English.

‒ Until December 10, 2023, 14h, each team should go to Blackboard (in “Group Assignments/submission

of assignment”) and submit

1. A written report (pdf format). This document should not exceed 20 pages (excluding the cover

page, table of contents, and bibliography). The document should be written in English and with at

least 1.5 line spacing.

2. The file of the presentation (pdf format), which should not exceed 12 slides.

3. An excel file with all the data and calculations (including the time series collected and the time

series used as inputs in the regressions).

Objectives

Each team should evaluate a sample of actively managed mutual funds, using performance measures presented in

class (chapter 8 of the course program), namely alphas from single- and multi-factor models.

Access to data

This assignment will require students to collect data from Thomson Reuters Datastream. Students should therefore

fill the form https://forms.gle/Dq4z7ygkd9x5yf4p7 to request permission to access to this database.

NOTE: Datastream is available in remote access to the EEG’s server, as an excel add-in. It is very important that you

sign out of Datastream (in excel) before you finish your work, and that you log-off the server.

Content

The assignment involves:

• Identifying funds and choosing a sample of 10 open-end mutual funds [suggestion: choose US stock

funds investing domestically]. The mutual funds must have at least 5 years of historical data, ending

this year.

Suggestion to identify mutual funds:

‒ Yahoo Finance - https://finance.yahoo.com/screener/mutualfund/new

‒ https://www.morningstar.com/funds/screener-basic

‒ https://mutualfunds.com/equity-categories/

‒ Refinitiv Eikon

OBS: - Do not use different classes of the same fund

- Do not select index funds nor ETFs

Suggestions for types of mutual funds:

1. Value funds /growth funds

2. Small cap /large cap funds

3. Precious metals mutual funds

4. Technological mutual funds

5. Health sector mutual funds

6. Energy funds

7. ESG funds /Green funds

8. …

• Collecting data (with monthly frequency).

‒ Collecting the end of month time series of mutual funds (return series - total return index – RI

datatype) from Datastream.

‒ Collecting the end of month time series of the benchmark (market index- total return index - RI

datatype) from Datastream

‒ Collecting the risk-free rate: Datastream or Federal Reserve (US risk-free rate)

https://www.federalreserve.gov/datadownload/Choose.aspx?rel=H15 or Professor Kenneth

French’s website

‒ Collecting other risk-factors

Professor Kenneth French’s website. Please note that FF factors are in %. Also, if you use FF

factors, you must compute all fund and benchmark returns in a discrete way.

• Estimating the performance evaluation measures.

• Interpreting the results.

• Writing the paper and preparing the presentation.

Suggested structure of the paper

Title page

Table of contents

1. Introduction

2. Methods

3. Data

4. Empirical results

5. Conclusions

References

You might also like

- Nurse Role in Intravenous TherapyDocument53 pagesNurse Role in Intravenous Therapyapi-300218860100% (2)

- FMDocument499 pagesFMRajiv Kumar100% (1)

- Assign Brief Business Strategy QCFDocument8 pagesAssign Brief Business Strategy QCFDavid MarkNo ratings yet

- Technical Reference Guide iDX Release 3.0Document136 pagesTechnical Reference Guide iDX Release 3.0kira019100% (1)

- 8513-Financial ManagementDocument7 pages8513-Financial ManagementSulaman SadiqNo ratings yet

- Aluminium Rail CoachDocument7 pagesAluminium Rail CoachdselvakuuNo ratings yet

- Performance Evaluation and Attribution of Security PortfoliosFrom EverandPerformance Evaluation and Attribution of Security PortfoliosRating: 5 out of 5 stars5/5 (1)

- Sps. Ermino v. Golden VillageDocument2 pagesSps. Ermino v. Golden Villagejanine nenaria50% (2)

- Project and Sle Topics Sem VIDocument12 pagesProject and Sle Topics Sem VIMihir BhattNo ratings yet

- Project Guide (AFS 2013)Document2 pagesProject Guide (AFS 2013)syed HassanNo ratings yet

- BUSE 622 Syllabus - Fall 2013-14 - QADocument3 pagesBUSE 622 Syllabus - Fall 2013-14 - QAAbdulrahman AlotaibiNo ratings yet

- Acfrogcdl3c4pdigkeug8tqphwucojuss54 3e5zghxmcgs9rx Tms4rjm69jq-Utcbkujcorcjl4n0q17fblm69rggmgrnkraqy3dwsg E8 Xzqrx2qw4b1n6gqaf-Jvhyck7mwazfznybfqpw1Document3 pagesAcfrogcdl3c4pdigkeug8tqphwucojuss54 3e5zghxmcgs9rx Tms4rjm69jq-Utcbkujcorcjl4n0q17fblm69rggmgrnkraqy3dwsg E8 Xzqrx2qw4b1n6gqaf-Jvhyck7mwazfznybfqpw1Mansoor AhmedNo ratings yet

- Analytic Group AssignmentDocument6 pagesAnalytic Group AssignmentVIDHI MODINo ratings yet

- Aud689-Project Paper-Mac2023Document3 pagesAud689-Project Paper-Mac2023Aina AzizNo ratings yet

- Capital BudgetingDocument219 pagesCapital BudgetingprairnaNo ratings yet

- Assignment 1 FactorModels QEPMDocument6 pagesAssignment 1 FactorModels QEPMAnshulSharmaNo ratings yet

- Syllabus MGMT 650Document1 pageSyllabus MGMT 650Varkey JoseNo ratings yet

- FIN 377.1 - Portfolio Analysis and MGMT - K. KammDocument10 pagesFIN 377.1 - Portfolio Analysis and MGMT - K. KammsadiaNo ratings yet

- Comprehensive ProjectDocument47 pagesComprehensive ProjectRishiNo ratings yet

- Paper and Presentation FINC 2101 Fall 2021Document2 pagesPaper and Presentation FINC 2101 Fall 2021Youssef El-DeebNo ratings yet

- Applied Value Investing (Duggal) FA2016Document3 pagesApplied Value Investing (Duggal) FA2016darwin12No ratings yet

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Document8 pagesAllama Iqbal Open University, Islamabad (Department of Business Administration)apovtigrtNo ratings yet

- SAPM Assignment 1 NoticeDocument2 pagesSAPM Assignment 1 NoticeaviNo ratings yet

- Course Project Guideline (Salvato Automaticamente)Document12 pagesCourse Project Guideline (Salvato Automaticamente)guidoNo ratings yet

- Fin222 So s12019 Iicsj - ApprovedDocument13 pagesFin222 So s12019 Iicsj - ApprovedraphaelrachelNo ratings yet

- International Finance - Group ProjectDocument2 pagesInternational Finance - Group ProjectsadeeqabuNo ratings yet

- Bcom433 Inv and Port MGT NotesDocument102 pagesBcom433 Inv and Port MGT NotesramboNo ratings yet

- Finance Course Paper 2017-2018Document6 pagesFinance Course Paper 2017-2018Iryna HoncharukNo ratings yet

- CohortDocument11 pagesCohortPaul AsturbiarisNo ratings yet

- Course - Outline - Financial Management Deo203Document5 pagesCourse - Outline - Financial Management Deo203Iordanis EleftheriadisNo ratings yet

- 22.04. BOM. Final Exam. BOM2019Document6 pages22.04. BOM. Final Exam. BOM2019thisisDATNo ratings yet

- Security Analysis and Portfolio Management Term I Academic Year 2013-2014Document7 pagesSecurity Analysis and Portfolio Management Term I Academic Year 2013-2014Ishaan MakkerNo ratings yet

- 5540-Investment & Securities ManagementDocument8 pages5540-Investment & Securities ManagementMariam LatifNo ratings yet

- INTL 303 Syllabus - 2019 WinterDocument8 pagesINTL 303 Syllabus - 2019 WinterWilliam LattaoNo ratings yet

- Summer Training GuidelinesDocument27 pagesSummer Training GuidelinesAnKit SacHanNo ratings yet

- Summer Training GuidelinesDocument27 pagesSummer Training GuidelinesAnKit SacHanNo ratings yet

- Ensc1001 2015 Sem-1 CrawleyDocument4 pagesEnsc1001 2015 Sem-1 CrawleyDoonkieNo ratings yet

- Summer Training GuidelinesDocument19 pagesSummer Training GuidelinesDeepesh ShenoyNo ratings yet

- Bom. Final Exam - 2022Document7 pagesBom. Final Exam - 2022Huyền HoàngNo ratings yet

- FINA6132FD Derivatives Markets Syllabus FD 2023-24Document7 pagesFINA6132FD Derivatives Markets Syllabus FD 2023-24Hiu Tung LamNo ratings yet

- 23.04. IE. Form 1.exam Cover Page & Question - Giay Thi Rieng. IE2005-code 1.updatedDocument6 pages23.04. IE. Form 1.exam Cover Page & Question - Giay Thi Rieng. IE2005-code 1.updatedThu HuyềnNo ratings yet

- Personal Finance AssignmentDocument13 pagesPersonal Finance AssignmentarchibaldejosiahNo ratings yet

- FIN501 Assignment - GroupDocument4 pagesFIN501 Assignment - GroupSaaliha SaabiraNo ratings yet

- Pad 350Document3 pagesPad 350FELICIA DAPONG ANAK JOSEPHNo ratings yet

- MBAA 518 Online Syllabus 0515Document6 pagesMBAA 518 Online Syllabus 0515HeatherNo ratings yet

- Coursework Questions 2019Document13 pagesCoursework Questions 2019Leem Wi HongNo ratings yet

- ECON940 Assignment Manual Trimester 3 2022Document4 pagesECON940 Assignment Manual Trimester 3 2022Ganesh PoudelNo ratings yet

- GA GuideDocument6 pagesGA GuideSabrina NgoNo ratings yet

- Uos Outline Finc3017 Sem2 2014Document5 pagesUos Outline Finc3017 Sem2 2014suseeexNo ratings yet

- FIT9123 S2 2020 Assignment1 - ERP - Failure - Factors - SUBMITTED2Document8 pagesFIT9123 S2 2020 Assignment1 - ERP - Failure - Factors - SUBMITTED2OPTIMA ConsultingNo ratings yet

- Lean Production and Lean Construction Brief 2019 20 FinalDocument9 pagesLean Production and Lean Construction Brief 2019 20 Finalsikandar abbasNo ratings yet

- Annual Report ProjectDocument56 pagesAnnual Report ProjectJoan Frazzetto100% (2)

- ECON 331 Final Team ProjectDocument8 pagesECON 331 Final Team ProjectRobertNo ratings yet

- Project GuidelinesDocument20 pagesProject Guidelinesbatkrushnasahoo15No ratings yet

- In This ProjectDocument6 pagesIn This ProjectSalman KhalidNo ratings yet

- Merger & Acquisition D1UA511T Dr. Ruchi AtriDocument9 pagesMerger & Acquisition D1UA511T Dr. Ruchi AtriManan AswalNo ratings yet

- ITPM - Case Study Problem Package (AY1112 Oct Semester)Document10 pagesITPM - Case Study Problem Package (AY1112 Oct Semester)Alfonso Jevohn OoiNo ratings yet

- Acc 208-05 - Managerial Accounting Spring 2012 Syllabus - FoleyDocument13 pagesAcc 208-05 - Managerial Accounting Spring 2012 Syllabus - FoleyRamiro C Hinojoza FonsecaNo ratings yet

- MAF306 Group Assignment BREXIT 2017Document6 pagesMAF306 Group Assignment BREXIT 2017OreonaNo ratings yet

- CF - Group Project - L1112-6Document2 pagesCF - Group Project - L1112-6050610220911No ratings yet

- MAF307 - Trimester 2 2021 Assessment Task 2 - Equity Research - Group AssignmentDocument9 pagesMAF307 - Trimester 2 2021 Assessment Task 2 - Equity Research - Group AssignmentDawoodHameedNo ratings yet

- EIE3006 - Lecture 1 - Financial EconometricsDocument17 pagesEIE3006 - Lecture 1 - Financial EconometricsCheng Zi Neng BryanNo ratings yet

- Allama Iqbal Open University, Islamabad Warning: (Department of Business Administration)Document7 pagesAllama Iqbal Open University, Islamabad Warning: (Department of Business Administration)NadeemAdilNo ratings yet

- QP Assessment 3Document2 pagesQP Assessment 3meroshan segaranNo ratings yet

- Breast Cancer Awareness Thesis StatementDocument4 pagesBreast Cancer Awareness Thesis Statementhmnxivief100% (1)

- Alone and in CombinationDocument10 pagesAlone and in CombinationJose Mauricio Suarez BecerraNo ratings yet

- Supply Analysis of Ayungin in RizalDocument8 pagesSupply Analysis of Ayungin in RizalAiemiel ZyrraneNo ratings yet

- English and Filipino HeadlinesDocument5 pagesEnglish and Filipino HeadlinesGISELLE DIMAUNNo ratings yet

- Final Natural System of Success 2018Document3 pagesFinal Natural System of Success 2018Shailesh PillaiNo ratings yet

- Non-Enzymatic Glycosylation and Pharmaceutical Intervention: Monica MorganDocument44 pagesNon-Enzymatic Glycosylation and Pharmaceutical Intervention: Monica MorganYeraldith RojasNo ratings yet

- SG Chapter01 02Document30 pagesSG Chapter01 02bhuvi2312No ratings yet

- Hierarchy of Roads and PCUDocument19 pagesHierarchy of Roads and PCUShubham GoelNo ratings yet

- PFE 1 Measurement Activity SheetDocument3 pagesPFE 1 Measurement Activity SheetCamilla SenataNo ratings yet

- TroxerutinDocument3 pagesTroxerutincarlosNo ratings yet

- G2 Chapter 1 5 ReferencesDocument80 pagesG2 Chapter 1 5 ReferencesJasper SamNo ratings yet

- STUDIOBRICKS QUOTE ONE ONE PLUS Automized Quote10Document38 pagesSTUDIOBRICKS QUOTE ONE ONE PLUS Automized Quote10Brady WilliamsNo ratings yet

- 10 Philippines Herbal Medicine Approved by DOH (Pharmacology Topic)Document10 pages10 Philippines Herbal Medicine Approved by DOH (Pharmacology Topic)Neisha Halil VillarealNo ratings yet

- DigSilent Training Program - RwandaDocument5 pagesDigSilent Training Program - RwandaBUNANI CallixteNo ratings yet

- Ahmad Nazim Ali: Personal InformationDocument3 pagesAhmad Nazim Ali: Personal InformationNazim AliNo ratings yet

- "Lemko Experiences As Recalled by Teodor Doklia" (Yasiunka and Other Villages)Document31 pages"Lemko Experiences As Recalled by Teodor Doklia" (Yasiunka and Other Villages)TheLemkoProjectNo ratings yet

- Assignment-CA SIC2002Document6 pagesAssignment-CA SIC2002Baginda RamleeNo ratings yet

- Abstract 2 TonesDocument8 pagesAbstract 2 TonesFilip FilipovicNo ratings yet

- A Survey of Techniques and Challenges in UnderwaterDocument60 pagesA Survey of Techniques and Challenges in UnderwaterAjay SinghNo ratings yet

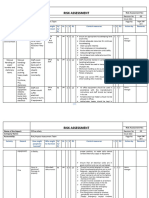

- RA-05-Office SafetyDocument5 pagesRA-05-Office Safetyamritha n krishnaNo ratings yet

- Operator CAB (Gas Spring) - (S - N A3NV11001 - A3NV25812, A3NW11001 - A3NW14002) - S650Document5 pagesOperator CAB (Gas Spring) - (S - N A3NV11001 - A3NV25812, A3NW11001 - A3NW14002) - S650ferneyNo ratings yet

- Liftingclampbrochureeng 09Document82 pagesLiftingclampbrochureeng 09Juan OchoaNo ratings yet

- Concept and Application of Gene Mapping in Animal BreedingDocument9 pagesConcept and Application of Gene Mapping in Animal BreedingLucio MotaNo ratings yet

- Contemporary Consciousenness As Reflected in Images of The VampireDocument18 pagesContemporary Consciousenness As Reflected in Images of The VampireMarielaNo ratings yet