Professional Documents

Culture Documents

Paper and Presentation FINC 2101 Fall 2021

Uploaded by

Youssef El-DeebOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paper and Presentation FINC 2101 Fall 2021

Uploaded by

Youssef El-DeebCopyright:

Available Formats

Final Project and Presentation

Business Finance

FINC 2101

Fall 2021

This is a group project, please work as a group of maximum four students.

Please note that you will prepare 2 documents, a research paper with the

EXCEL sheets and a PowerPoint presentation. While the paper will

receive the same grade for all group members, for the presentation each

student will be graded on an individual basis based on his/her ability to

answer questions and present (15%+5%for the presentation).

You can start to work on the research after we have finished the three

building blocks

Deadline for submission of the paper as a word document on Turnitin is 5th

of December 2021.

The presentation (PowerPoint or video or Prezi …etc.) will be on the 8th

and 12th of December. As we can only have 4-5 presentations per class

please note that you will need to register the date of your presentations

with Wesam Sherif and we will apply the first come first served approach.

Each presentation will take 10 minutes, and 5minutes for Q and A. Each

member of the group will be required to present and to answer questions.

Your ability to work as a team is part of the assessment.

All the data you will work on is downloadable from

https://finance.yahoo.com/

Please also note that you can get BLOOMBERG DATA from the financial

center at AUC, and make sure to use the AUC online library as well.

Please note that Wesam and I will always be glad to help and assist in all

the steps of your research.

Topic 1: Diversification is an essential concept and important rule of finance. In

your presentation prepare a brief literature review on the concept and

importance of diversification in Finance. In your application calculate the

return, standard deviation and CV of twenty stocks, then create at least 20

portfolios , portfolio one will include two stocks , then the second you will add

another stock so the portfolio will include 3 stocks ,then portfolio 3 will include

4 stocks then 5,6,7,8,9,10,11,12,13,14,15,16,17,18,19…..all 20 stocks (use

equal weights).Show how standard deviation decreases on average when we add

more stocks to the portfolio. What is the risk and return and coefficient of

1/1

variation of each of the portfolios, compare them and comment your results and

compare it with the theoretical review in the beginning of the paper. End your

paper with the lessons learned from this exercise and your conclusion?

Topic 2: Stock Valuation models are essential to facilitate decision making and

portfolio selection in Finance. In your literature review briefly explain the

importance of stock valuation, and the different types of models that you know.

In the application part compare two sectors (5-10 stocks for each sector) in

terms of their risk, return, coefficient of variation and beta. Compare the

performance of both sectors in 2020-2021 compared to 2019-2020(monthly

return -annual return) . Explain the main reasons for the upward or downward

trends that you see.

Topic 3: Review the literature to explain the main determinants that determine

the IPO price. Choose 10-20 recent IPOs (that occurred within the last five

years) and monitor the price and daily return over one year from the date of

issuance. Show whether the IPO price is undervalued or overvalued and explain

the difference of the monthly /six months/ and annual return in comparison with

the market index monthly /six months and annual return

2/1

You might also like

- Instant Download Ebook PDF Finance For Managers Uk Higher Education Business Finance PDF ScribdDocument52 pagesInstant Download Ebook PDF Finance For Managers Uk Higher Education Business Finance PDF Scribdmarian.hillis984100% (34)

- Iom 581 TTH Syllabus: Sosic@Marshall - Usc.EduDocument11 pagesIom 581 TTH Syllabus: Sosic@Marshall - Usc.Edusocalsurfy0% (1)

- NYP BM0075 Financial Analysis ProjectDocument10 pagesNYP BM0075 Financial Analysis ProjectKeo NgNo ratings yet

- Conversation Questions GenerationDocument3 pagesConversation Questions GenerationRania KuraaNo ratings yet

- Media Planning and StrategyDocument27 pagesMedia Planning and StrategyAbhishek Pratap Singh100% (2)

- Predictors of Board Exam Performance of The Dhvtsu College of Education GraduatesDocument4 pagesPredictors of Board Exam Performance of The Dhvtsu College of Education GraduatesKristine CaceresNo ratings yet

- SlyabusDocument7 pagesSlyabusLlyod Francis LaylayNo ratings yet

- BA303 Corp Fin Group Assignmt QsDocument2 pagesBA303 Corp Fin Group Assignmt QsThomasSamNo ratings yet

- BUSE 622 Syllabus - Fall 2013-14 - QADocument3 pagesBUSE 622 Syllabus - Fall 2013-14 - QAAbdulrahman AlotaibiNo ratings yet

- Investigating Entrepreneurial Ideas with Lean CanvasDocument4 pagesInvestigating Entrepreneurial Ideas with Lean Canvassue wongNo ratings yet

- 8513-Financial ManagementDocument7 pages8513-Financial ManagementSulaman SadiqNo ratings yet

- FIN201 Corporate Finance Unit GuideDocument11 pagesFIN201 Corporate Finance Unit GuideRuby NguyenNo ratings yet

- IB Semester 2 HandbookDocument17 pagesIB Semester 2 HandbookFranciscoJavierVazquezPachonNo ratings yet

- UT Dallas Syllabus For Entp6390.501.11s Taught by Joseph Picken (jcp016300)Document11 pagesUT Dallas Syllabus For Entp6390.501.11s Taught by Joseph Picken (jcp016300)UT Dallas Provost's Technology GroupNo ratings yet

- NUS Business School Investment Course OutlineDocument5 pagesNUS Business School Investment Course OutlinechocodwinNo ratings yet

- Updated - 421 - Governmental and Not-for-Profit AccountingDocument8 pagesUpdated - 421 - Governmental and Not-for-Profit AccountingJessika OrtegaNo ratings yet

- Continuous AssessmentDocument14 pagesContinuous AssessmentGracee GraceeNo ratings yet

- Country ReportDocument9 pagesCountry ReportD LVNo ratings yet

- Summer Training GuidelinesDocument19 pagesSummer Training GuidelinesDeepesh ShenoyNo ratings yet

- Comprehensive ProjectDocument47 pagesComprehensive ProjectRishiNo ratings yet

- Course Outline Iapm-Prof.p.saravananDocument6 pagesCourse Outline Iapm-Prof.p.saravananNicholas DavisNo ratings yet

- AF301 Group Project - RevisedDocument5 pagesAF301 Group Project - RevisedAPA chaudaryNo ratings yet

- STRATEGYDocument20 pagesSTRATEGYRayCharlesCloudNo ratings yet

- Syllabus (BUS 536)Document9 pagesSyllabus (BUS 536)pheeyonaNo ratings yet

- Materials Logistics Project 2020Document5 pagesMaterials Logistics Project 2020seif mamdouhNo ratings yet

- FIN 390 DeVry University Fixed Income Securities in Apple Inc Research PaperDocument3 pagesFIN 390 DeVry University Fixed Income Securities in Apple Inc Research PaperEassignmentsNo ratings yet

- Syllabus Corporate Finance Weekend CourseDocument5 pagesSyllabus Corporate Finance Weekend CourseMhykl Nieves-Huxley100% (1)

- Tds ThesisDocument4 pagesTds Thesismelissamooreportland100% (1)

- Seminar On Current Trends in IT Working Guideline@2021Document8 pagesSeminar On Current Trends in IT Working Guideline@2021Habtamu kelemNo ratings yet

- FINA6132FD Derivatives Markets Syllabus FD 2023-24Document7 pagesFINA6132FD Derivatives Markets Syllabus FD 2023-24Hiu Tung LamNo ratings yet

- How To Write A Fundable Program/project ProposalDocument21 pagesHow To Write A Fundable Program/project Proposalwondimu eredaNo ratings yet

- Ent530 Guideline and Template Oct 2021Document21 pagesEnt530 Guideline and Template Oct 2021ariq jeNo ratings yet

- Final Draft Minor Project - 1.guidelines - Revised - SVDocument12 pagesFinal Draft Minor Project - 1.guidelines - Revised - SVAnurag ShreeNo ratings yet

- Group assignment guidelinesDocument1 pageGroup assignment guidelinesTrang TranNo ratings yet

- 237 120091 1003041 HDocument16 pages237 120091 1003041 HAayush SuriNo ratings yet

- ACCT 354 Financial Statement AnalysisDocument4 pagesACCT 354 Financial Statement AnalysisWoo JunleNo ratings yet

- Financial Modeling Syllabus Spring 2015Document5 pagesFinancial Modeling Syllabus Spring 2015Siddhartha ThakurNo ratings yet

- Fnce103 Term 2 Annual Year 2014. SMU Study Outline David DingDocument5 pagesFnce103 Term 2 Annual Year 2014. SMU Study Outline David DingAaron GohNo ratings yet

- FM202 Assignment 2014 PDFDocument3 pagesFM202 Assignment 2014 PDFGrace VersoniNo ratings yet

- Umcdmt-15-1 Portfolio Assessment BriefDocument7 pagesUmcdmt-15-1 Portfolio Assessment BriefAnoofa AhmedNo ratings yet

- MGMT 383 ENTREPRENEURSHIP BUSINESS PLANSDocument8 pagesMGMT 383 ENTREPRENEURSHIP BUSINESS PLANSMasha ZelivinskiNo ratings yet

- Group Project Guidelines - Monsoon 2023 - UG - FAC 102Document3 pagesGroup Project Guidelines - Monsoon 2023 - UG - FAC 102Dhruv SidanaNo ratings yet

- MKT 102 SyllabusDocument9 pagesMKT 102 SyllabusYRNo ratings yet

- Final Project Outline Fall 2022 SemesterDocument5 pagesFinal Project Outline Fall 2022 SemesterMana PlanetNo ratings yet

- ALC 131 Tutorial Assignment 2 Group Work and Critical Thinking, Week 4, 8 March 2024 - FinalDocument10 pagesALC 131 Tutorial Assignment 2 Group Work and Critical Thinking, Week 4, 8 March 2024 - FinalkeemorodriquezNo ratings yet

- Project Guide (AFS 2013)Document2 pagesProject Guide (AFS 2013)syed HassanNo ratings yet

- FIN2303 Syllabus Ekkacha Feb1 PDFDocument7 pagesFIN2303 Syllabus Ekkacha Feb1 PDFsamuelifamilyNo ratings yet

- Internship Guidelines 2023-24Document3 pagesInternship Guidelines 2023-24raiji8675No ratings yet

- ACCT 581 SyllabusDocument11 pagesACCT 581 Syllabussavannah williamsNo ratings yet

- Group Project Oral Presentation 10% of The Total Mark (5% Oral Presentation Skills, 5% Content)Document2 pagesGroup Project Oral Presentation 10% of The Total Mark (5% Oral Presentation Skills, 5% Content)awdasfdsetNo ratings yet

- (Applying Busines Technology) SyllabusDocument5 pages(Applying Busines Technology) SyllabusP.P.No ratings yet

- BMA5008 RV 1213 Sem2Document4 pagesBMA5008 RV 1213 Sem2Adnan ShoaibNo ratings yet

- Assess Financial Condition of Shenzhen BankDocument2 pagesAssess Financial Condition of Shenzhen Bank钱智烽No ratings yet

- Australian College of Business & Technology: INB2102D - International Business Unit Outline - Trimester 1, 2017Document11 pagesAustralian College of Business & Technology: INB2102D - International Business Unit Outline - Trimester 1, 2017Aloka RanasingheNo ratings yet

- Managing Student Loan Repayment: A Budget and Payment Plan ProjectDocument4 pagesManaging Student Loan Repayment: A Budget and Payment Plan ProjectSravan KumarNo ratings yet

- Final Draft Minor Project - 1.guidelinesDocument11 pagesFinal Draft Minor Project - 1.guidelinesDevesh YadavNo ratings yet

- Bsib522 Icpc Coversheet RequirementsDocument16 pagesBsib522 Icpc Coversheet RequirementsNoor AssignmentsNo ratings yet

- BSIB522 Project Analyzes Economic SystemsDocument12 pagesBSIB522 Project Analyzes Economic SystemsNoor AssignmentsNo ratings yet

- s13 Man6636syllabusDocument12 pagess13 Man6636syllabusXiaomin DingNo ratings yet

- Team Assignment: 2010 - 2011 IfraDocument6 pagesTeam Assignment: 2010 - 2011 IfraPeng ChengNo ratings yet

- Sobe - Econ608.syllsp09Document5 pagesSobe - Econ608.syllsp09ammueast9290No ratings yet

- TOGAF® 9.2 Level 2 Scenario Strategies Wonder Guide Volume 1 – 2023 Enhanced Edition: TOGAF® 9.2 Wonder Guide Series, #4From EverandTOGAF® 9.2 Level 2 Scenario Strategies Wonder Guide Volume 1 – 2023 Enhanced Edition: TOGAF® 9.2 Wonder Guide Series, #4No ratings yet

- Introduction To Business Finance Fall 2021Document12 pagesIntroduction To Business Finance Fall 2021Youssef El-DeebNo ratings yet

- Solved Revision 2 Assignment FinanceDocument2 pagesSolved Revision 2 Assignment FinanceYoussef El-DeebNo ratings yet

- Done Revision 1 Assignment SolvedDocument8 pagesDone Revision 1 Assignment SolvedYoussef El-DeebNo ratings yet

- FINC 2101 Chapter Two: The Financial Market Environment Dr. Jasmin FouadDocument14 pagesFINC 2101 Chapter Two: The Financial Market Environment Dr. Jasmin FouadYoussef El-DeebNo ratings yet

- Assignment 7 DoneDocument6 pagesAssignment 7 DoneYoussef El-DeebNo ratings yet

- PORTFOLIODocument91 pagesPORTFOLIOYoussef El-DeebNo ratings yet

- FINC 2101 Chapter One: The Role of Managerial Finance Dr. Jasmin FouadDocument28 pagesFINC 2101 Chapter One: The Role of Managerial Finance Dr. Jasmin FouadYoussef El-DeebNo ratings yet

- Class Exercise 2 FINC 2101 Fall 2021Document2 pagesClass Exercise 2 FINC 2101 Fall 2021Youssef El-DeebNo ratings yet

- Be III Chemical MesraDocument10 pagesBe III Chemical MesraSingh AnujNo ratings yet

- Gonzales vs. Chavez, 205 SCRA 816, G.R. No. 97351 February 4, 1992Document36 pagesGonzales vs. Chavez, 205 SCRA 816, G.R. No. 97351 February 4, 1992Jeng GacalNo ratings yet

- CHAPTER 10:16 National Heroes Act: PreliminaryDocument10 pagesCHAPTER 10:16 National Heroes Act: Preliminarytoga22No ratings yet

- Palestine Polytechnic University College of IT and Computer EngineeringDocument7 pagesPalestine Polytechnic University College of IT and Computer Engineeringyaseen jobaNo ratings yet

- The Packaging Design & Development Process: Project Brief, Specification, & Asset CollectionDocument1 pageThe Packaging Design & Development Process: Project Brief, Specification, & Asset CollectionMehdi SalehiNo ratings yet

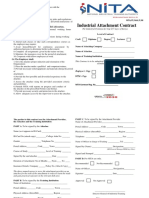

- Industrial Attachment ContractDocument2 pagesIndustrial Attachment ContractBrn Murgor100% (1)

- Philippines Criminal Law Review - Illegal Firearm PossessionDocument2 pagesPhilippines Criminal Law Review - Illegal Firearm Possessionvincent nifasNo ratings yet

- Grade 1 Week 3 WHLPDocument6 pagesGrade 1 Week 3 WHLPMary Rose QuimanjanNo ratings yet

- Business Trip: Advices and MotivationDocument16 pagesBusiness Trip: Advices and MotivationАннаNo ratings yet

- Job AnalysisDocument27 pagesJob AnalysisNiaz AhmedNo ratings yet

- Forensic Accounting by Makanju 2Document12 pagesForensic Accounting by Makanju 2Babajide AdedapoNo ratings yet

- Woolwich Town Centre MasterplanDocument111 pagesWoolwich Town Centre MasterplaniliosXvanillaXXNo ratings yet

- Profile Background Form: Please Fill All Details. Fields Marked With Are MandatoryDocument9 pagesProfile Background Form: Please Fill All Details. Fields Marked With Are Mandatorypooja singhNo ratings yet

- Select Best Concept for Product DevelopmentDocument47 pagesSelect Best Concept for Product DevelopmentK ULAGANATHANNo ratings yet

- Queen of All Saints Case StudyDocument2 pagesQueen of All Saints Case StudyOaga GutierrezNo ratings yet

- NGO and Rular Development PresentationDocument11 pagesNGO and Rular Development PresentationEfty M E IslamNo ratings yet

- District Manager Case Study PDFDocument27 pagesDistrict Manager Case Study PDFRoma BisoNo ratings yet

- Inclusion/exclusion of ARBsDocument16 pagesInclusion/exclusion of ARBsanneNo ratings yet

- Republic of The Philippines Department of Education Region V - Bicol Schools Division Office San Vicente - San Lorenzo Ruiz DistrictDocument7 pagesRepublic of The Philippines Department of Education Region V - Bicol Schools Division Office San Vicente - San Lorenzo Ruiz DistrictMaGrace Pancho MaganaNo ratings yet

- Strategic Management: Multiple Choice QuestionsDocument17 pagesStrategic Management: Multiple Choice QuestionsshailendraNo ratings yet

- Strat3, Mar1422Document4 pagesStrat3, Mar1422Sir nicNo ratings yet

- General notes on roof structure drawingDocument1 pageGeneral notes on roof structure drawingZaidNo ratings yet

- R J Intro Project Rubrics 1Document2 pagesR J Intro Project Rubrics 1api-508868123No ratings yet

- 34TH Nrm/a Victory Day AnniversaryDocument4 pages34TH Nrm/a Victory Day AnniversaryGCICNo ratings yet

- Civics: Give Short Answers of The Following QuestionsDocument3 pagesCivics: Give Short Answers of The Following QuestionsPrince GangwarNo ratings yet

- Right To Be ForgottenDocument6 pagesRight To Be ForgottenTazeen Ahmed R63No ratings yet

- English - G8 - Q2 - W3-4 - Samantha Bea GasingDocument10 pagesEnglish - G8 - Q2 - W3-4 - Samantha Bea GasingGennrick PajaronNo ratings yet