Professional Documents

Culture Documents

Accounting For Public Sector and Civil Societ

Uploaded by

Abdi Mucee TubeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting For Public Sector and Civil Societ

Uploaded by

Abdi Mucee TubeCopyright:

Available Formats

Rift Valley University

Department: Accounting and Finance

Department Accounting and Finance

Program BA degree in Accounting and Finance

Module Title Government and Non-profit Accounting

Module Non-Profit Sector Accounting

Module No and Module AcFn-3070

Code

Course Number AcFn3071

Course Title Accounting for Public sector and Civil society

ETCTS Credits 5

Contact Hours 3

Course Objectives and After successfully completing this course, the students should be able to:

Competences to be Identify characteristics and types of government and Not-For-profit organizations (NFP);

Acquired Understand the budgeting framework of governmental units and other non-profit organizations and help senior budget

officials of the same in developing budgets

Distinguish the legal and economic substance of transactions as opposed to the nature of transactions in business

organizations;

Record the transactions and present fairly the financial statements of governmental units and other non-profit

organizations in conformity with legal requirements and accepted accounting principles

Course Description The course is intended to introduce the accounting and reporting concepts, standards and procedures applied to governmental

units and not –for –profit (NFP) organizations. The course reflects the distinction between legal form of transactions as

opposed to the accounting system for business enterprises, and the substance of transactions.

WEEKS Course Contents Reading

2WEEKS 1. Overview of Financial Reporting for Governmental and NFP Entities

{1ST- 2ND } 1.1. Distinguishing characteristics of Governmental and Not- for- Profit entities.

1.2. Sources of financial reporting standards for Governmental and NFP entities in Ethiopia

1.3. Objectives of financial reporting in NFP entities

1.4. IPSAS versus IFRS

1.5. The Conceptual Framework for Public Sector Accounting [The IPSASB]

1.5.1. Objectives of financial reporting

1.5.2. Fundamental concepts

1.5.3. Recognition, measurement, and disclosure concepts

1WEEK 2. Principles of accounting and financial reporting of governmental entities

{3RD } 2.1. Activities of government

2.2. Summary statement of principles

2.3. Summary Accounting characteristics of fund types

2.4. Budgeting and uses of budget

2.5. Classification of budget

2.6. Approaches to budgeting

1WEEK 3. International Public Sector Accounting Standards [IPSAS]

{4TH } 3.1. Activities of Government

3.2. Summary statement of principles

3.3. Impairment of Non-Cash-Generating Assets [IPSAS 21]

3.4. Disclosure of Financial Information about the General Government Sector [IPSAS 22]

3.5. Revenue from Non-Exchange Transactions (Taxes and Transfers) [IPSAS 23]

3.6. Presentation of Budget Information in Financial Statements [IPSAS 24]

3.7. Cash Flow Statements [Cash Basis IPSAS]

1WEEK 4. Budgeting and Performance Reporting

{ 5TH } 4.1. Budgeting in the Public Sector

4.2. Classification of budget

4.3. Approaches to budgeting

4.4. Budgets and Outturn Reporting (IPSAS 24)

4.5. Performance Budgeting and Reporting

1WEEK 5. Accounting for General and Special Revenue Funds

{6TH- 7TH} 5.1. Definitions and purposes

5.2. Budgetary accounting

5.3. Revenue accounting

5.4. Expenditure accounting

5.5. Financial statements

1WEEK 6. Accounting for Capital Project Fund

{8TH- 9TH} 6.1. Definitions and purposes

6.2. Classification of general capital assets

6.3. Sources and uses of cash flows

6.4. Methods to acquire general capital assets

6.5. Illustration on capital project fund

7. Accounting for Debt Service Fund

7.1. Definitions and purposes

7.2. General long-term liabilities

7.3. Sources and uses of cash flows

7.4. Illustration on debt service fund

{10TH } 8. Accounting for Internal Revenue Funds

81. Accounting principles of proprietary funds

82. Financial statements of proprietary funds

83. Illustrative entry for proprietary propriety funds

84. Financial statements of proprietary funds

{11TH } 9. Accounting for Fiduciary Funds

10. Features of fiduciary funds

11. Accounting principles of fiduciary funds

12. Accounting for agency fund

13. Accounting for trust funds

{12TH } 10. Accounting for Other Not-for-Profit Entities

10.1. Characteristics of Non-governmental NFP organizations

10.2. Charities and societies law in Ethiopia

10.3. Financial reporting and accounting for NGOs

{14TH } 11. Accounting and Reporting for the Federal Government of Ethiopia

a. Historical overview of Ethiopian Government Accounting System

b. Federal Government Financial Management Structure

c. FGE Chart of accounts

d. Overview of IBEX and IFMIS

e. Basis of accounting

f. Legal Framework of FGE Financial Administration

g. Monthly Reports

h. Annual Financial statements

i. Federal Audit report

Assessment/Evaluation

The evaluation scheme will be as follows:

Mid Assignme Assign Quiz1 Final Total

nt 1 ment

20% 10% 15% 5% 50% 100%

Work load in hours Hours Required

Total

Assessm Tutorial Self- Assignm Advisi ECTS

Hrs

Lectures Lab ents s Studies ent ng

64 20 10 16 52 - - 162 6

Text and reference books Text Book:

Accounting for Governmental and Non-Profit Entities, 15th edition, by Wilson, Kattelus, Hay. McGraw-Hill/Irwin Inc.,

USA, 2010.

Aggestam-Pontoppidan, C. (2015). Interpretation and Application of IPSAS. John Wiley and Sons.

Freeman, R. J., Shoulders, C. D., Allison, G. S., Smith Jr, G. R., and Becker, C. J. (2014). Governmental and nonprofit

accounting: theory and practice. JPAEJOURNAL OF PUBLIC AFFAIRS EDUCATION VOLUME 20 NUMBER 3, 441.

Reference Proclamations

1. Proclamation No. 847/2014, Financial Reporting Proclamation, 2014.

2. Proclamation No. 621/2009, Charities and Societies Proclamation, 2009.

3. Proclamation No. 648/2009 The Federal Government of Ethiopia Financial Administration Proclamation

You might also like

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Civil SocietDocument4 pagesCivil SocietAbdi Mucee TubeNo ratings yet

- Wiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Course OutlineDocument3 pagesCourse OutlineMelkamu Dessie TamiruNo ratings yet

- Course Outlines of G&NFPEDocument6 pagesCourse Outlines of G&NFPEHirko DiribaNo ratings yet

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- Non-Profit Sector AccountingDocument3 pagesNon-Profit Sector Accountingsolomon asfawNo ratings yet

- Course Outline Governmental AccountingDocument6 pagesCourse Outline Governmental AccountingHibaaq Axmed100% (1)

- Financial Reporting Subject OutlineDocument6 pagesFinancial Reporting Subject OutlineAhmed ThoyyibNo ratings yet

- Course Outline - 1439404738ethiopian Government Accounting and Financial ManagementDocument3 pagesCourse Outline - 1439404738ethiopian Government Accounting and Financial ManagementOthow Cham AballaNo ratings yet

- The Conceptual Framework For Financial: ReportingDocument32 pagesThe Conceptual Framework For Financial: Reportingmoynul islamNo ratings yet

- Fundamentals of Accounting-I New Course OutlineDocument3 pagesFundamentals of Accounting-I New Course OutlineGedion100% (2)

- W2 Module 3 Conceptual Framework Andtheoretical Structure of Financial Accounting and Reporting Part 1Document6 pagesW2 Module 3 Conceptual Framework Andtheoretical Structure of Financial Accounting and Reporting Part 1Rose RaboNo ratings yet

- Acc 1Document28 pagesAcc 1manishNo ratings yet

- Financial Reporting Subject Outline 2Document6 pagesFinancial Reporting Subject Outline 2Gurinder SinghNo ratings yet

- Fundamentalof Accounting I Course OutlineDocument3 pagesFundamentalof Accounting I Course OutlineAbdi Mucee Tube100% (1)

- Fin 1 Module Midterm CoverageDocument67 pagesFin 1 Module Midterm CoverageRomea NuevaNo ratings yet

- Sample-195 Fin Report IPSASDocument32 pagesSample-195 Fin Report IPSASdbr trackdNo ratings yet

- FA FFA S24-J25 Syllabus and Study Guide - FinalDocument18 pagesFA FFA S24-J25 Syllabus and Study Guide - FinalCaglar CaferNo ratings yet

- Course Out Line TalilaDocument5 pagesCourse Out Line TalilatalilaNo ratings yet

- Conceptual and Regulatory Framework: Topic ListDocument40 pagesConceptual and Regulatory Framework: Topic Listnitu mdNo ratings yet

- Chapter 1 FrameworkDocument40 pagesChapter 1 Frameworkswarna dasNo ratings yet

- Yeager CPA - Govt AccountingDocument73 pagesYeager CPA - Govt AccountingShouvik NagNo ratings yet

- Financial Accounting and Reporting 03Document6 pagesFinancial Accounting and Reporting 03Nuah SilvestreNo ratings yet

- The Uniform Chart of AccountsDocument137 pagesThe Uniform Chart of AccountsElzein Amir ElzeinNo ratings yet

- TheUniformChartOfAccounts For Companies PDFDocument135 pagesTheUniformChartOfAccounts For Companies PDFJoebin Corporal LopezNo ratings yet

- Accounting Manual 2013-AmmendmentDocument38 pagesAccounting Manual 2013-AmmendmentEdward Otempong100% (1)

- Fundamentalof Accounting I Course OutlineDocument3 pagesFundamentalof Accounting I Course OutlineAbdi Mucee TubeNo ratings yet

- Acc 219 Notes Mhaka CDocument62 pagesAcc 219 Notes Mhaka CfsavdNo ratings yet

- Dps 103 Basic Financial Accounting PDFDocument129 pagesDps 103 Basic Financial Accounting PDFlizzy mandenda100% (1)

- Framework FOR Preparation AND Presentation OF Financial StatementsDocument34 pagesFramework FOR Preparation AND Presentation OF Financial Statementssamartha umbareNo ratings yet

- RBV2013 Conceptual FrameworkDocument32 pagesRBV2013 Conceptual FrameworkhemantbaidNo ratings yet

- Chapter 2 - Framework For Preparation and Presentation of Financial StatementsDocument34 pagesChapter 2 - Framework For Preparation and Presentation of Financial StatementsSumit PattanaikNo ratings yet

- Course Syllabus-Fundamentals of Accounting IDocument4 pagesCourse Syllabus-Fundamentals of Accounting ITewodrose Teklehawariat BelayhunNo ratings yet

- Government Accounting and Budgeting Module at Don Mariano Marcos Memorial State UniversityDocument36 pagesGovernment Accounting and Budgeting Module at Don Mariano Marcos Memorial State UniversityErika MonisNo ratings yet

- Institute of Chartered Accountants of Bangladesh Class Test-1 (Knowledge Level (Accounting) ) About Financial Statements Sl. Topic List TextDocument41 pagesInstitute of Chartered Accountants of Bangladesh Class Test-1 (Knowledge Level (Accounting) ) About Financial Statements Sl. Topic List TextPonkoj Sarker TutulNo ratings yet

- Advance Course OutlineDocument2 pagesAdvance Course OutlineAdugna MegenasaNo ratings yet

- Igfrs 1Document39 pagesIgfrs 1GANESH KUNJAPPA POOJARINo ratings yet

- Knowledge Level Icab Class Lecture Sv-1-170508024655Document32 pagesKnowledge Level Icab Class Lecture Sv-1-170508024655Md.HasanNo ratings yet

- Week 6 Lecture Notes (1 Slide) PDFDocument48 pagesWeek 6 Lecture Notes (1 Slide) PDFSharon LiNo ratings yet

- Week 1 Conceptual Framework For Financial ReportingDocument17 pagesWeek 1 Conceptual Framework For Financial ReportingSHANE NAVARRONo ratings yet

- Introduction To Accounting & Accounting Concepts and Policies IDocument24 pagesIntroduction To Accounting & Accounting Concepts and Policies IDanishevNo ratings yet

- Financial Management FrameworkDocument367 pagesFinancial Management FrameworkFarid AmiryNo ratings yet

- GASAB Exposure Draft 4 on Indian Government Accounting StandardDocument19 pagesGASAB Exposure Draft 4 on Indian Government Accounting StandardSrini VasanNo ratings yet

- Ifa 1&2 Afa 1&2Document254 pagesIfa 1&2 Afa 1&2Gena AlisuuNo ratings yet

- Fundamental of Accounting: Bestari Dwi HandayaniDocument9 pagesFundamental of Accounting: Bestari Dwi Handayaniferonikalarasati100% (1)

- SFAC No.8Document42 pagesSFAC No.8Rizky Ar100% (1)

- CPA Paper 13Document16 pagesCPA Paper 13sanu sayedNo ratings yet

- Gov AccDocument13 pagesGov AccZarah H. LeongNo ratings yet

- conceptual frameworkDocument10 pagesconceptual frameworkleeroybradley7No ratings yet

- Fge Group Assignment No.1&2Document6 pagesFge Group Assignment No.1&2Emebet TesemaNo ratings yet

- Unit 01 (8553)Document30 pagesUnit 01 (8553)naseer ahmedNo ratings yet

- Book Public Sector AccountingDocument458 pagesBook Public Sector Accountinghaider_shah88226775% (4)

- ICAEW Financial Accounting Conceptual and Regulatory Frame WorkDocument40 pagesICAEW Financial Accounting Conceptual and Regulatory Frame WorkhopeaccaNo ratings yet

- IPSASB CP - Elements Recognition Phase - 2Document68 pagesIPSASB CP - Elements Recognition Phase - 2Vaike ChrisNo ratings yet

- BBM 304 Study NotesDocument97 pagesBBM 304 Study Notesmuriithialex2030No ratings yet

- Module 001 Week001-Finacct3 Financial Statements and Conceptual Framework For Financial ReportingDocument10 pagesModule 001 Week001-Finacct3 Financial Statements and Conceptual Framework For Financial Reportingman ibeNo ratings yet

- Module 1 - Purpose, Scope and Limitation: - IntroductionDocument3 pagesModule 1 - Purpose, Scope and Limitation: - IntroductionCriselito EnigrihoNo ratings yet

- Solutions Manual Students Ed72011Document125 pagesSolutions Manual Students Ed72011Cheng Yuet JoeNo ratings yet

- Fundamentalof Accounting I Course OutlineDocument3 pagesFundamentalof Accounting I Course OutlineAbdi Mucee Tube100% (1)

- 1 The Nature, Purpose and Scope of AuditingDocument12 pages1 The Nature, Purpose and Scope of Auditingyebegashet100% (1)

- Fundamentalof Accounting I Course OutlineDocument3 pagesFundamentalof Accounting I Course OutlineAbdi Mucee TubeNo ratings yet

- Fa Ii Individual Assignment For Management StudentsDocument2 pagesFa Ii Individual Assignment For Management StudentsAbdi Mucee TubeNo ratings yet

- PDF Afa CH 2 - CompressDocument60 pagesPDF Afa CH 2 - CompressAbdi Mucee TubeNo ratings yet

- Or-Section 2Document5 pagesOr-Section 2Dev TailorNo ratings yet

- Fa Ii Chapter 1 InventoryDocument23 pagesFa Ii Chapter 1 InventoryAbdi Mucee TubeNo ratings yet

- DanialDocument56 pagesDanialAbdi Mucee TubeNo ratings yet

- CHAPTER 15 Intermediate Acctng 1Document58 pagesCHAPTER 15 Intermediate Acctng 1Tessang OnongenNo ratings yet

- Abraham Beyene RESEARCHDocument46 pagesAbraham Beyene RESEARCHAbdi Mucee Tube0% (1)

- Chapter 3 PayrollDocument16 pagesChapter 3 PayrollAbdi Mucee TubeNo ratings yet

- Fa I Chapter 4 Accounting SystemDocument10 pagesFa I Chapter 4 Accounting SystemAbdi Mucee Tube100% (1)

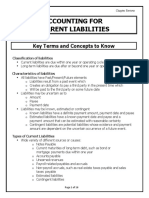

- Accounting For Current Liabilities: Key Terms and Concepts To KnowDocument16 pagesAccounting For Current Liabilities: Key Terms and Concepts To KnowReverie SevillaNo ratings yet

- Chapter 2, Accounting For Plant Assets and IntagiblesDocument20 pagesChapter 2, Accounting For Plant Assets and IntagiblesAbdi Mucee TubeNo ratings yet

- TP ContentsDocument9 pagesTP ContentsAbdi Mucee TubeNo ratings yet

- Accounting and Finance Carriculum New (2021)Document172 pagesAccounting and Finance Carriculum New (2021)Abdi Mucee Tube67% (3)

- Fund FinalDocument3 pagesFund FinalAbdi Mucee TubeNo ratings yet

- Budgetary Control: Part A: TheoryDocument9 pagesBudgetary Control: Part A: TheoryAditi TNo ratings yet

- Fundamentals of Accounting II Short Handout-1Document38 pagesFundamentals of Accounting II Short Handout-1Abdi Mucee TubeNo ratings yet

- Fa I Chapter 2Document4 pagesFa I Chapter 2Abdi Mucee TubeNo ratings yet

- Chapter 3 Current Liability PayrollDocument39 pagesChapter 3 Current Liability PayrollAbdi Mucee Tube100% (1)

- 4 5764766307975170385Document2 pages4 5764766307975170385Abdi Mucee TubeNo ratings yet

- InventoryDocument65 pagesInventoryAbdi Mucee TubeNo ratings yet

- Fund TestDocument1 pageFund TestAbdi Mucee TubeNo ratings yet

- Jafar ProposalDocument25 pagesJafar ProposalAbdi Mucee TubeNo ratings yet

- Europass CV TemplateDocument2 pagesEuropass CV TemplateAbdi Mucee Tube0% (1)

- Cost Two IIDocument65 pagesCost Two IIAbdi Mucee TubeNo ratings yet

- 1.1 Target and Minimum PricingDocument1 page1.1 Target and Minimum PricingAbdi Mucee Tube100% (2)

- Jafar ResearchDocument52 pagesJafar ResearchAbdi Mucee TubeNo ratings yet

- Accounting For CorporationDocument19 pagesAccounting For CorporationAbdi Mucee TubeNo ratings yet