Professional Documents

Culture Documents

ACCTING Pg. 217

Uploaded by

Now OnwooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCTING Pg. 217

Uploaded by

Now OnwooCopyright:

Available Formats

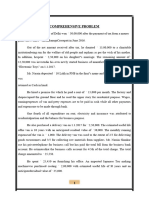

Problem #7

Preparing the Adjusting Entries at Year-End

Prepare the original and the adjusting entry for Christine Gamba Cargo under each of the following for the year

ending Dec. 31, 2022:

c. Paid P160,000 cash to purchase a delivery van (surplus) on Jan. 1. The van was expected to have a 3-year

life……….

Note: (160,000 – 10,000) / 3 = 50,000

Delivery Van 160,000 Depreciation Expense – Delivery Van 50,000

Cash 160,000 Accumulated Dep. – Delivery Van 50,000

d. Received an P18,000 cash advance for a contract to provide services in the future. The contract required a 1-year

commitment, starting April 1.

Note: (18,000) * (9/12) = 13,500

Cash 18,000 Unearned Service Revenue 13,500

Unearned Service Revenue 18,000 Service Revenue 13,500

e. Purchased P6,400 supplies on account. At year’s end, P750 of supplies remained on hand.

Note: (6,400 – 750) = 5650

Supplies 6,400 Supplies Expense 5,650

A/R 6,400 Supplies 5,650

f. Invested P90,000 cash in a certificate of deposit that paid 4% annual interest. The certificate was acquired on May

1 and carried a 1-year term of maturity.

Note: (90,000)(0.04)(8/12) = 2,400

Certificate of Deposit 90,000 Interest Receivable 2,400

Cash 90,000 Interest Revenue 2,400

g. Paid P78,000 in advance on Sep. 1 for a 1-year lease on office space.

Note: (78,000)(4/12) = 26,000

Prepaid Rent 78,000 Rent Expense 26,000

Cah` 78,000 Prepaid Rent 26,000

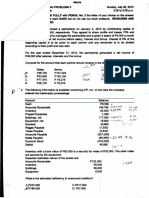

On June 30, 2022, the end of the fiscal year, the following information is available to Noel Hungria’s accountants for

making adjusting entries:

a. Mortgage Expense 120,000

Mortgage Payable 120,000

b. Wages Payable 192,000

Cash 192,000

c. NO ENTRY

d. Supplies Expense 41,950

Supplies 41,950

e. To solve for the Insurance Expense, the following equations should be followed:

- Since the beginning balance of 15,300 will expire in April, the whole balance would be already

considered as an expense.

- Since the amount of 29,000 will expire in a year, as the amount is bought on January 1, the following

should be computed: (29,000)(6/12) = 14,500

- Furthermore, the insurance on May 1st has three years of expiration. To solve further, the following

should be computed: [(33,660)/(3)](2/12) = 1,870

- Add: (15,300 + 14,500 + 1,870) = 31,670

Thus, the answer would be:

Insurance Expense 31,670

Prepaid Insurance 31,670

f. Depreciation Expense – Buildings 73,000

Accumulated Depreciation – Bldg. 73,000

Depreciation Expense – Equipment 218,000

Accumulated Depreciation – Eqpt. 218,000

g. Cash 210,000

Unearned Service Revenue 210,000

h. Accounts Receivable 35,000

Service Revenue 35,000

You might also like

- ACT1101, PRB, Midterm, Wit Ans KeyDocument5 pagesACT1101, PRB, Midterm, Wit Ans KeyDyen100% (1)

- Exercise. AdjustmentsDocument6 pagesExercise. AdjustmentsDavid Con Rivero79% (14)

- Comm 457Document4 pagesComm 457reetNo ratings yet

- Whatever - Ciclo ContableDocument6 pagesWhatever - Ciclo ContablemillionextupNo ratings yet

- Adjusting Entries Exercises - EditedDocument4 pagesAdjusting Entries Exercises - EditedCINDY LIAN CABILLON100% (2)

- Exercise Chapter 3Document7 pagesExercise Chapter 3leen attilyNo ratings yet

- CH 3 HomeworkDocument6 pagesCH 3 HomeworkAxel OngNo ratings yet

- Problem 1-10 (AICPA) : SolutionDocument3 pagesProblem 1-10 (AICPA) : SolutionElla Rence TablizoNo ratings yet

- Pengakun CH 09Document10 pagesPengakun CH 09nadia salsabilaNo ratings yet

- Financial Accounting and ReportingDocument1 pageFinancial Accounting and ReportingPaula BautistaNo ratings yet

- Tugas Kelompok Ke-1 (Minggu 3) : Case 1Document10 pagesTugas Kelompok Ke-1 (Minggu 3) : Case 1Kenny BagusNo ratings yet

- Ca5101 Adjusting Entries La 1Document13 pagesCa5101 Adjusting Entries La 1Michael MagdaogNo ratings yet

- Adjusting Entry - AnswerDocument8 pagesAdjusting Entry - AnswerReighjon Ashley C. TolentinoNo ratings yet

- Midterms Solutions - Pre-Test, SW, Assignment, DiscussionDocument12 pagesMidterms Solutions - Pre-Test, SW, Assignment, DiscussionGianna ReyesNo ratings yet

- Financial Accounting and Reporting: Exercise 1Document8 pagesFinancial Accounting and Reporting: Exercise 1Lenneth Mones0% (1)

- FAR - Midterms and FinalsDocument14 pagesFAR - Midterms and FinalsShanley Vanna EscalonaNo ratings yet

- Midterm Quiz 01 - Adjusting Entries From Accrual To Provision For Uncollectible AccountsDocument3 pagesMidterm Quiz 01 - Adjusting Entries From Accrual To Provision For Uncollectible AccountsGarp Barroca100% (1)

- Basic Accounting Equation Exercises 2Document2 pagesBasic Accounting Equation Exercises 2Ace Joseph TabaderoNo ratings yet

- PR 4 Completing The Cycle 2022 1Document1 pagePR 4 Completing The Cycle 2022 1smthlikeyouNo ratings yet

- FAR Adjusting Entries ExcerciseDocument3 pagesFAR Adjusting Entries ExcerciseSheena LeysonNo ratings yet

- FMA Assignment 01Document5 pagesFMA Assignment 01Dejen TagelewNo ratings yet

- Activity 6 - Adjusting Entries - Depreciation (Ans)Document5 pagesActivity 6 - Adjusting Entries - Depreciation (Ans)angela flores100% (1)

- Quiz 2 PrE3Document13 pagesQuiz 2 PrE3Lyca MaeNo ratings yet

- Adjusting Entries - Sample Problem With AnswerDocument19 pagesAdjusting Entries - Sample Problem With AnswerMaDine 19100% (3)

- Arab Final 90% Fall2021 (YS)Document8 pagesArab Final 90% Fall2021 (YS)ahmed abuzedNo ratings yet

- Go-Figure WorksheetDocument2 pagesGo-Figure WorksheetChris Marasigan0% (1)

- Adjusting Entries and Promissory NotesDocument6 pagesAdjusting Entries and Promissory Noteselma wagwagNo ratings yet

- ACCOUNTANCY SOLUTION PROJECT On FSDocument15 pagesACCOUNTANCY SOLUTION PROJECT On FSRiyasat khanNo ratings yet

- Accrual and PrepaymentDocument6 pagesAccrual and PrepaymentRia Athirah100% (1)

- SdsasacsacsacsacsacDocument4 pagesSdsasacsacsacsacsacIden PratamaNo ratings yet

- Adjusting Entries Christine Gamba CargoDocument5 pagesAdjusting Entries Christine Gamba Cargoelma wagwag100% (2)

- Group Assignment 1ST YR MBADocument5 pagesGroup Assignment 1ST YR MBASosi SissayNo ratings yet

- Individual Assignment 1 ACTDocument4 pagesIndividual Assignment 1 ACTKalkidanNo ratings yet

- Cpar Practical Accounting Ii Problems Oct 2010 Final Pre Board W SolutionsDocument14 pagesCpar Practical Accounting Ii Problems Oct 2010 Final Pre Board W SolutionsKyla MilanNo ratings yet

- (ACCT2010) (2017) (F) Midterm In5mue0 38655Document4 pages(ACCT2010) (2017) (F) Midterm In5mue0 38655Pak HoNo ratings yet

- BSA2201 BDD MBCarolino M8Activityno.2Document5 pagesBSA2201 BDD MBCarolino M8Activityno.2Earl Carolino100% (1)

- Accounting Finals Exam Reviewer Adjusting EntriesDocument4 pagesAccounting Finals Exam Reviewer Adjusting EntriesElleana DNo ratings yet

- Accounting Finals Exam Reviewer Adjusting EntriesDocument4 pagesAccounting Finals Exam Reviewer Adjusting EntriesElleana DNo ratings yet

- Far ReviewerDocument9 pagesFar ReviewerKathlen PilarNo ratings yet

- Institute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartDocument3 pagesInstitute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartSafi SheikhNo ratings yet

- Tibans Shoe Repair Shop Unadjusted Trial Balance For The Month Ended March 31, 2020 Acct. No. Accoun Title DR CRDocument33 pagesTibans Shoe Repair Shop Unadjusted Trial Balance For The Month Ended March 31, 2020 Acct. No. Accoun Title DR CRjoshuaNo ratings yet

- Dini Kusuma Wardani F0221073 Accounting Cycle For Service Company (Part III)Document29 pagesDini Kusuma Wardani F0221073 Accounting Cycle For Service Company (Part III)Dini Kusuma100% (1)

- Tutorial 11 Preparation of Financial Statements (Q)Document6 pagesTutorial 11 Preparation of Financial Statements (Q)lious liiNo ratings yet

- Intermediate Accounting 1 Problems and SolutionDocument26 pagesIntermediate Accounting 1 Problems and SolutionRAFALLO, ABMYR ROSE R.No ratings yet

- Accounting Exercises PDFDocument7 pagesAccounting Exercises PDFMoni TafechNo ratings yet

- ACC101 - Accounting CycleDocument3 pagesACC101 - Accounting CycleJade PielNo ratings yet

- Exhibit 7. Revenue and Expense RecognitionDocument6 pagesExhibit 7. Revenue and Expense RecognitionЭниЭ.No ratings yet

- Kieso Chapter 10Document6 pagesKieso Chapter 10Dian Permata SariNo ratings yet

- Fundamentals of Accounting Act001 - Eom - Sample PaperDocument4 pagesFundamentals of Accounting Act001 - Eom - Sample PaperCarl DavisNo ratings yet

- Adjusting Entries: Q1: Pass The Necessary Adjusting Entries For The FollowingDocument9 pagesAdjusting Entries: Q1: Pass The Necessary Adjusting Entries For The FollowingHassan AliNo ratings yet

- Docsity Solutions 2010 1insurance Expenseprepaid Insurance P 33Document7 pagesDocsity Solutions 2010 1insurance Expenseprepaid Insurance P 33Pau LeonsameNo ratings yet

- Review Problems With AnswersDocument5 pagesReview Problems With AnswersGelai BatadNo ratings yet

- Chapter 3new BOOK QuestionsDocument5 pagesChapter 3new BOOK Questionsgameppass22No ratings yet

- Cheating Is Strictly Prohibited. If Cheating Is Confirmed, The Student(s) Involved Will Automatically FAIL in This ExamDocument2 pagesCheating Is Strictly Prohibited. If Cheating Is Confirmed, The Student(s) Involved Will Automatically FAIL in This ExamHANNAH CHARIS CANOYNo ratings yet

- Soal Akuntansi OSN Ekonomi Dan PembahasaDocument6 pagesSoal Akuntansi OSN Ekonomi Dan PembahasaQurrotul AyuniNo ratings yet

- 162 001Document1 page162 001Christian Mark AbarquezNo ratings yet

- P2 QuizDocument7 pagesP2 QuizJay Mark DimaanoNo ratings yet

- CT 2 Liabilities PDFDocument8 pagesCT 2 Liabilities PDFMaria Corazon OrigNo ratings yet

- Mini-Case 1 Ppe AnswerDocument11 pagesMini-Case 1 Ppe Answeryu choong100% (2)

- BibleDocument2 pagesBibleNow OnwooNo ratings yet

- Accounting Mid2nd AnswersDocument12 pagesAccounting Mid2nd AnswersNow OnwooNo ratings yet

- RHISTDocument2 pagesRHISTNow OnwooNo ratings yet

- True or FalseDocument3 pagesTrue or FalseNow OnwooNo ratings yet

- GR.12 Final Week 3Document3 pagesGR.12 Final Week 3Now OnwooNo ratings yet

- ContempDocument4 pagesContempNow OnwooNo ratings yet

- AUDIODocument1 pageAUDIONow OnwooNo ratings yet

- JANUARY 2023:: Beginning Anew, Setting Up HabitsDocument1 pageJANUARY 2023:: Beginning Anew, Setting Up HabitsNow OnwooNo ratings yet

- Galatians 4Document1 pageGalatians 4Now OnwooNo ratings yet

- Research PrintDocument5 pagesResearch PrintNow OnwooNo ratings yet

- PROLOGUEDocument2 pagesPROLOGUENow OnwooNo ratings yet

- Accounting 121 Third QuarterDocument23 pagesAccounting 121 Third QuarterNow OnwooNo ratings yet

- Daniela Joy JDocument2 pagesDaniela Joy JNow OnwooNo ratings yet

- VictorianDocument1 pageVictorianNow OnwooNo ratings yet

- Parisian Store Is Engaged in Selling Furniture On Credit Term of 2Document3 pagesParisian Store Is Engaged in Selling Furniture On Credit Term of 2Now OnwooNo ratings yet

- The Interstellar Mind ColorDocument2 pagesThe Interstellar Mind ColorNow OnwooNo ratings yet

- 9gold Q4English CastillonDocument6 pages9gold Q4English CastillonNow OnwooNo ratings yet

- FinalDocument3 pagesFinalNow OnwooNo ratings yet

- 1Document2 pages1Now OnwooNo ratings yet

- San MiguelDocument2 pagesSan MiguelNow OnwooNo ratings yet

- Accounting Final ExaminationDocument4 pagesAccounting Final ExaminationNow OnwooNo ratings yet

- Accounting 121Document2 pagesAccounting 121Now OnwooNo ratings yet

- Projected SalesDocument1 pageProjected SalesNow OnwooNo ratings yet

- Applied Chemistry Quarter 4Document8 pagesApplied Chemistry Quarter 4Now OnwooNo ratings yet

- InternationalDocument14 pagesInternationalFunwayo ShabaNo ratings yet

- Magic Quadrant For G 734654 NDXDocument35 pagesMagic Quadrant For G 734654 NDXm.ankita92No ratings yet

- AGROVETDocument37 pagesAGROVETcaroprinters01No ratings yet

- What Is Enterprise Agility and Why Is It ImportantDocument4 pagesWhat Is Enterprise Agility and Why Is It ImportantJaveed A. KhanNo ratings yet

- Fundamentals of Business Law PDFDocument358 pagesFundamentals of Business Law PDFmikiyo90% (10)

- CH 05Document37 pagesCH 05Janna KarapetyanNo ratings yet

- Listening Test Unit 6Document2 pagesListening Test Unit 6Xuân Bách0% (1)

- Attempt All QuestionsDocument5 pagesAttempt All QuestionsApurva SrivastavaNo ratings yet

- Internationalization of Tata Motors: Strategic Analysis Using Flowing Stream Strategy ProcessDocument18 pagesInternationalization of Tata Motors: Strategic Analysis Using Flowing Stream Strategy ProcessHedayatullah PashteenNo ratings yet

- Pip Calculator - Forex Pip Calculator - Pip Value CalculatorDocument1 pagePip Calculator - Forex Pip Calculator - Pip Value Calculatorl100% (1)

- Inquiry Ali Vasquez The Florida Bar Re UPL Marty Stone MRLPDocument10 pagesInquiry Ali Vasquez The Florida Bar Re UPL Marty Stone MRLPNeil GillespieNo ratings yet

- Print - Udyam Registration CertificateDocument3 pagesPrint - Udyam Registration Certificatemanwanimuki12No ratings yet

- Kaizen: A Lean Manufacturing Tool For Continuous ImprovementDocument24 pagesKaizen: A Lean Manufacturing Tool For Continuous ImprovementSamrudhi PetkarNo ratings yet

- 3 Social-Commerce Benefits To Merchants: 130 Million UsersDocument8 pages3 Social-Commerce Benefits To Merchants: 130 Million UsersKomal PriyaNo ratings yet

- LESSON 2 - Facilities Layout and DesignDocument18 pagesLESSON 2 - Facilities Layout and DesignLawrence Joseph LagascaNo ratings yet

- FLIPKART Research ReportDocument18 pagesFLIPKART Research ReportHabib RahmanNo ratings yet

- Evolution of Accounting Standard in The PhillipinesDocument7 pagesEvolution of Accounting Standard in The PhillipinesJonathan SiguinNo ratings yet

- Project Cycle Management Report (AEPAM Pub.288)Document64 pagesProject Cycle Management Report (AEPAM Pub.288)Waqar AhmadNo ratings yet

- Evike Order 3939175Document3 pagesEvike Order 3939175Carlos CrisostomoNo ratings yet

- Notes On Intellectual Property (Ip) Law: Mylene I. Amerol - MacumbalDocument41 pagesNotes On Intellectual Property (Ip) Law: Mylene I. Amerol - MacumbalAlain BarbaNo ratings yet

- Sample Barangay BudgetDocument17 pagesSample Barangay Budgetnilo bia100% (4)

- A Review On Power Plant Maintenance and OperationaDocument5 pagesA Review On Power Plant Maintenance and OperationaWAN MUHAMMAD IKHWANNo ratings yet

- Project Control CycleDocument8 pagesProject Control CycleDilanwilldo100% (4)

- Capstone Project-Grainger and Bosch: Digital Marketing CampaignDocument25 pagesCapstone Project-Grainger and Bosch: Digital Marketing Campaignk.saikumar100% (1)

- ACT 141-Module 1-Assurance ServicesDocument98 pagesACT 141-Module 1-Assurance ServicesJade Angelie FloresNo ratings yet

- MAXIMUM Master Socket Set, 300-Pc, CRV, Nickel-ChDocument1 pageMAXIMUM Master Socket Set, 300-Pc, CRV, Nickel-Chbhattikulvir027No ratings yet

- Toppan Merrill Technology ListDocument2 pagesToppan Merrill Technology ListKilty ONealNo ratings yet

- Accenture Cover LetterDocument8 pagesAccenture Cover Letterafjwrcqmzuxzxg100% (2)

- MIFID Best-Execution-Hot-TopicDocument8 pagesMIFID Best-Execution-Hot-TopicPranay Kumar SahuNo ratings yet

- Steps in Forecasting ProcessDocument7 pagesSteps in Forecasting Processstephanie roswellNo ratings yet

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet