Professional Documents

Culture Documents

Img 0001

Uploaded by

Jai Soni0 ratings0% found this document useful (0 votes)

4 views1 pageOriginal Title

IMG_0001

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageImg 0001

Uploaded by

Jai SoniCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

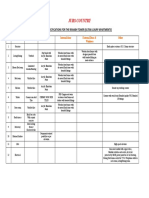

M/s Pataniali Avurved Ltd

lnvestment Declaration Format of the financial vear 2023-2024

Personal Details

1. Name of the Employee: JAISONI

2. Father's Name: GOPI KISHAN SONI

3. PAN of the Employee: CAVPS43O5P

4. Present Address: Above Sumukham Dental Clinic,

Gandhi Ashram Colony, Singhdwar, Haridwar

5. Contact No: +91-9982930481

6. Official Email id ja i.soni @patanjaliayurved.org

l. Employee Code: 60016268

8. Designation: AGM

9. Department: EXPORTS

] Tax Regime Option

1. Old Tax 7l

2. New Tax Regime

Note-l: New Tax regime is a default tax regime which was inserted for lower tax rates in which no

deduction & exemption allowed for any investment made by employee & no exemption allowed

for House Rent Allowances.

Note-2: As Per CBDT Circular No. 37014210612023-TPL dated 05th April 2023, it is compulsory to

opt out any ohe tax regime and tax will be deducted by employer under that tax regime. lf no

regime opt by employee than tax will be deducted under new tax regime.

Allowed Deduction and loss set off under old tax regime

A. Details for exemption of House Rent allowances

Sr.No. Particulars

1. Rent paid Per month : 20,000

2. Landlord Name. Kaushal Gupta

3. Landlord's PAN: ABVPD7450R (Compulsory in case Rent Paid more than Rs: /-PM)

4. Address of Rented Premises: Above Sumukham Dental Clinic, Gandhi Ashram Colony, Singhdwar,

Haridwar

5. Period: 1 year

You might also like

- Health Insurance PolicyDocument5 pagesHealth Insurance Policytaralsoni100% (4)

- Strictly Confidential March 06, 2019 Mr. Rohan Mahawar Emp. No. 22815 JaipurDocument4 pagesStrictly Confidential March 06, 2019 Mr. Rohan Mahawar Emp. No. 22815 JaipurKumar AnkitNo ratings yet

- Policy DocDocument6 pagesPolicy Dochiteshmohakar15No ratings yet

- Health Insurance Policy SUBHRANILDocument1 pageHealth Insurance Policy SUBHRANILsubhranil1No ratings yet

- Depends InsuranceDocument3 pagesDepends Insurancevasuakm8No ratings yet

- PolicyDocument6 pagesPolicyKushal BhatiaNo ratings yet

- Policy DocDocument5 pagesPolicy Docpankajmishraup86No ratings yet

- Policy DocumentDocument9 pagesPolicy DocumentMahesh ShindeNo ratings yet

- Policy DocDocument6 pagesPolicy DocmaterialNo ratings yet

- Policy DocDocument5 pagesPolicy Docvignesh raviNo ratings yet

- Sridhar Medical Policy SelfDocument5 pagesSridhar Medical Policy SelfSurya GoudNo ratings yet

- Policy ScheduleDocument4 pagesPolicy ScheduleTECH IN BANGLANo ratings yet

- Ravi of Medical Insurance - Self - 2023Document8 pagesRavi of Medical Insurance - Self - 2023Cut Copy PateNo ratings yet

- PolicyDocument8 pagesPolicyjoshiaruna539No ratings yet

- Health Insurance PolicyDocument8 pagesHealth Insurance PolicyAnant KumarNo ratings yet

- Policy DocDocument7 pagesPolicy DocBeneesh KoyilathNo ratings yet

- IDBI2019Document1 pageIDBI2019SRINIVASA REDDYNo ratings yet

- Policy 1Document7 pagesPolicy 1alokesenguptaNo ratings yet

- Null 7Document2 pagesNull 7ManiNo ratings yet

- Policy DocDocument4 pagesPolicy Dochiteshmohakar15No ratings yet

- Renewal Notice 231026 185701Document3 pagesRenewal Notice 231026 185701Mahanth GowdaNo ratings yet

- Health Insurance 1Document1 pageHealth Insurance 1shivarkp88No ratings yet

- Mahadeb Karmakar Health Policy 2023 - RenewalDocument4 pagesMahadeb Karmakar Health Policy 2023 - Renewaljobs.somabho.kNo ratings yet

- Rushikesh Balkrishna DateDocument5 pagesRushikesh Balkrishna DaterushikeshdateNo ratings yet

- G.dinesh KumarDocument4 pagesG.dinesh KumarSrinivasan NarasimhanNo ratings yet

- DS Policy Schedule 11250842406703 V1.0Document6 pagesDS Policy Schedule 11250842406703 V1.0citd trainingNo ratings yet

- 4A, Sara Industrial Estate Ltd. // Selaqui, Dehradun, Uttarakhand, India // Pin Code: 248197 // Te:+91-135-2698801/02Document2 pages4A, Sara Industrial Estate Ltd. // Selaqui, Dehradun, Uttarakhand, India // Pin Code: 248197 // Te:+91-135-2698801/02chauhanaakansha123No ratings yet

- Policy DocDocument5 pagesPolicy DocRahul ShawNo ratings yet

- ICICI COI IncomeProtect 445605Document5 pagesICICI COI IncomeProtect 445605sree koundinyaNo ratings yet

- PolicyDocument7 pagesPolicysachin savantNo ratings yet

- P 131124 01 2023 008806 Policy DocDocument4 pagesP 131124 01 2023 008806 Policy DockasturihospitalsecunderabadNo ratings yet

- DS Policy Schedule 11230074563901 V1.0Document5 pagesDS Policy Schedule 11230074563901 V1.0Soorya ArunthavamNo ratings yet

- Policy DocDocument6 pagesPolicy DocAnjanNo ratings yet

- Cashless Authorization Letter: Details of PatientDocument2 pagesCashless Authorization Letter: Details of PatientSunil GoelNo ratings yet

- Swathi Insurance InvoiceDocument7 pagesSwathi Insurance Invoiceswathisnow95No ratings yet

- 5984Document5 pages5984Cookies CremeNo ratings yet

- Mr. Manoj Soni Flat-102, Cm4 Supertech Cape Town Sec-74, Noida, Noida, Gautam Buddha Nagar, Uttar Pradesh, 201301 9625214037Document19 pagesMr. Manoj Soni Flat-102, Cm4 Supertech Cape Town Sec-74, Noida, Noida, Gautam Buddha Nagar, Uttar Pradesh, 201301 9625214037industryloyalNo ratings yet

- OL0000000001 Intermediary Code Name Phone No E-Mail Id: R MargabandhuDocument2 pagesOL0000000001 Intermediary Code Name Phone No E-Mail Id: R MargabandhusriharikosaNo ratings yet

- PF Withdrawal Claim FormDocument5 pagesPF Withdrawal Claim Formfaizan4033No ratings yet

- Nitesh 2022-23Document4 pagesNitesh 2022-23shambhuk2009No ratings yet

- Tejas Waghambare PolicyDocument6 pagesTejas Waghambare PolicyPrajakta JadhavNo ratings yet

- LILI Karmakar Health Policy 2023Document4 pagesLILI Karmakar Health Policy 2023jobs.somabho.kNo ratings yet

- Appoinment NitinDocument2 pagesAppoinment NitinSumesh SHNo ratings yet

- Manshu M Legal Notice1Document1 pageManshu M Legal Notice1Priya VermaNo ratings yet

- PDFDocument4 pagesPDFPranjal SharmaNo ratings yet

- PDFDocument4 pagesPDFPranjal SharmaNo ratings yet

- Health InsuranceDocument7 pagesHealth InsuranceRadhika Rampal100% (1)

- Policy DocDocument4 pagesPolicy DocSHREE GANESHNo ratings yet

- Star Health Cover NoteDocument3 pagesStar Health Cover NoteLakshya MittalNo ratings yet

- Burglary and Housebreaking Insurance PolicyDocument2 pagesBurglary and Housebreaking Insurance PolicyBasic LivingNo ratings yet

- Policy Doc PDFDocument4 pagesPolicy Doc PDFhiteshmohakar15No ratings yet

- Policy DocDocument5 pagesPolicy Docksjayasuriyaa3003No ratings yet

- DS Policy Schedule 11220020093207 V1.0Document5 pagesDS Policy Schedule 11220020093207 V1.0Manokar S100% (1)

- CCS Application FormDocument14 pagesCCS Application FormNasif FarhanNo ratings yet

- Abcl Proprietor-New IecDocument14 pagesAbcl Proprietor-New IecMehul ManiarNo ratings yet

- Star HealthDocument1 pageStar HealthpalanivelNo ratings yet

- One ThreeDocument5 pagesOne ThreeNaveen PNo ratings yet

- Policy DocDocument3 pagesPolicy Dochiteshmohakar15No ratings yet

- SBI Medical PolicyDocument80 pagesSBI Medical PolicyRajNo ratings yet

- AdmissionDocument2 pagesAdmissionJai SoniNo ratings yet

- Booked Малая Филевская 6к2Document1 pageBooked Малая Филевская 6к2Jai SoniNo ratings yet

- Booked Малая Филевская 6к2Document1 pageBooked Малая Филевская 6к2Jai SoniNo ratings yet

- Perfumes and Body Care ProductsDocument1 pagePerfumes and Body Care ProductsJai SoniNo ratings yet

- Basmati ReportDocument18 pagesBasmati ReportJai SoniNo ratings yet

- Gunanand Nautiyal - ResumeDocument1 pageGunanand Nautiyal - ResumeJai SoniNo ratings yet

- Naukri AnjaliKandpal (13y 0m)Document2 pagesNaukri AnjaliKandpal (13y 0m)Jai SoniNo ratings yet

- Naukri ShipraMittal (2y 2m)Document1 pageNaukri ShipraMittal (2y 2m)Jai SoniNo ratings yet

- Naukri RakshikaShrivastava (10y 0m)Document3 pagesNaukri RakshikaShrivastava (10y 0m)Jai SoniNo ratings yet

- Mrs. MeenakshiDocument2 pagesMrs. MeenakshiJai SoniNo ratings yet

- Naukri SAURABHASTHANA (17y 0m)Document3 pagesNaukri SAURABHASTHANA (17y 0m)Jai SoniNo ratings yet

- Naukri SmritaRai (3y 0m)Document1 pageNaukri SmritaRai (3y 0m)Jai SoniNo ratings yet

- Naukri ArchanaKumari (10y 0m)Document3 pagesNaukri ArchanaKumari (10y 0m)Jai SoniNo ratings yet

- Naukri SakshiKaistha (10y 0m)Document5 pagesNaukri SakshiKaistha (10y 0m)Jai SoniNo ratings yet

- Naukri SAKETMISHRA (6y 6m)Document4 pagesNaukri SAKETMISHRA (6y 6m)Jai SoniNo ratings yet

- RESUME-Jyoti SakujaDocument3 pagesRESUME-Jyoti SakujaJai SoniNo ratings yet

- Resume Amit Bhawnani Export Sales MarketingDocument3 pagesResume Amit Bhawnani Export Sales MarketingJai SoniNo ratings yet

- Resume Kaushik Pal 29th April'23Document4 pagesResume Kaushik Pal 29th April'23Jai SoniNo ratings yet

- Resume 3 1 - 1670837161991 - Ankit RajDocument3 pagesResume 3 1 - 1670837161991 - Ankit RajJai SoniNo ratings yet

- Resume (Nikhil Sharma)Document3 pagesResume (Nikhil Sharma)Jai SoniNo ratings yet

- Resume 3 1 - 1670837161991 - Ankit RajDocument3 pagesResume 3 1 - 1670837161991 - Ankit RajJai SoniNo ratings yet

- Resume HimanshuDocument1 pageResume HimanshuJai SoniNo ratings yet

- Receipt HRDocument1 pageReceipt HRJai SoniNo ratings yet

- Richa ResumeDocument3 pagesRicha ResumeJai SoniNo ratings yet

- CV Varleen RawalDocument3 pagesCV Varleen RawalJai SoniNo ratings yet

- Curriculum Vitae - RahulDocument3 pagesCurriculum Vitae - RahulJai SoniNo ratings yet

- 2024 Calendar With Holidays Portrait Sunday Start en TZDocument1 page2024 Calendar With Holidays Portrait Sunday Start en TZJai SoniNo ratings yet

- 2024 Calendar With Holidays Portrait Sunday Start en deDocument1 page2024 Calendar With Holidays Portrait Sunday Start en deJai SoniNo ratings yet

- 2024 Calendar With Holidays Portrait Sunday Start en ZaDocument1 page2024 Calendar With Holidays Portrait Sunday Start en ZaJai SoniNo ratings yet

- Jurs Country: Specifications For The Rishabh Tower (Ultra Luxury Apartments)Document1 pageJurs Country: Specifications For The Rishabh Tower (Ultra Luxury Apartments)Jai SoniNo ratings yet