Professional Documents

Culture Documents

Form-12BB Format - FY 2023-24

Uploaded by

Sreedhar BodalapalleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form-12BB Format - FY 2023-24

Uploaded by

Sreedhar BodalapalleCopyright:

Available Formats

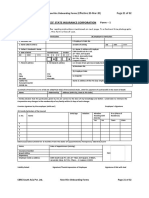

FORM NO.

12BB

(See rule 26C of Income Tax Rules 1962)

Statement showing particulars of claims by an employee for deduction of tax under section 192

Employee ID Gender

Employee Name Father's Name

Designation Date of Birth

Department Date of Joining

PAN Email ID

Financial Year 2023-24 Mobile

Details of claims and evidence thereof

New Tax Regime Old Tax Regime

Please select the tax regime for the F.Y. 2023-24

Note : In New Tax Regime, Any exemption or deduction is not allowed for tax saving investments i.e. those who are choosing new tax regime need not to fillup

/submit any tax saving proof.

Sl Nature of claim Amount (Rs.) Remarks

No.

(1) (2) (3) (4)

1 House Rent Allowance:

(a) Rent paid to the landlord

(b) PAN of Landlord Name and Address of landlord Rent Per Month Receipts to be enclosed

Note: Permanent Account Number shall be furnished if the aggregate rent paid during the previous year exceeds one lakh rupees

2 Leave travel concessions or assistance NA

3 Deduction of interest on borrowing: ( Housing Loan)

(a) Interest payable/paid to the lender

(b) PAN of Lender Name and Address of Lender

(a) Financial Institutions

(b) Employer

(c) Others

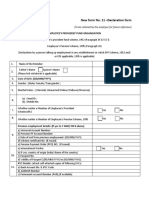

4 Deduction under Chapter VI-A

(A) Section 80C,80CCC and 80CCD

(a) Public Provident Fund (PPF)

(b) Life Insurance Premium

(c) Contribution to Pension Fund (80 CCC)

(d) National Saving Certificates (NSC)

(e) Accrued Interest (NSC)

(f) Children Education Tution Fees

(g) Investment in ULIP/Mutual Fund/ELSS

(h) Repayment of Housing Loan (Principal amount only)

(i) Fixed Deposit (Lock in period 5Years)

(j) Sukanya Samriddhi Yojana

(B) Other sections (e.g. 80D, 80E, 80TTA, etc.) under Chapter VI-A.

(a) Mediclaim Insurance Premium (U/S 80D)

(b) Mediclaim Insurance Premium (U/S 80D) for Senior Citizens

(c) Interest on Education Loan (U/S 80E)

(d) National Pension Scheme (NPS)

(e)

Verification

I,…………………….……………….., son / daughter of…………………….…………………….. do hereby certify that the information given above is complete and correct.

Place : Full Name

Date : (Signature of the employee)

Additional Details

Sl Nature of claim Amount (Rs.) Evidence / particulars

No.

A. Previous Employees Details ( Form 16 or Signed Tax Computation)

(a) Salary paid by the previous Employer after section 10 exemptions

(b) Professional Tax deducted by the previous employer

(c) Provident Fund deducted by the previous Employer

(d) Income Tax (TDS) deducted by the previous employer)

Verification

I,…………………….……………….., son / daughter of…………………….…………………….. do hereby certify that the information given above is complete and correct.

Place : Full Name

Date : (Signature of the employee)

You might also like

- Offer Letter Sasken PankajDocument12 pagesOffer Letter Sasken PankajLingaiah Chowdary Abburi67% (3)

- Gratuity Affidavit FormatDocument3 pagesGratuity Affidavit FormatSAI ASSOCIATE100% (1)

- EDITO GULFO and EMMANUELA GULFO, Petitioners, vs. JOSE P. ANCHETA, RespondentDocument3 pagesEDITO GULFO and EMMANUELA GULFO, Petitioners, vs. JOSE P. ANCHETA, RespondentJaylordPataotaoNo ratings yet

- SSS - Employee - Investment - Declaration - Form12BB - FY 2022-23Document10 pagesSSS - Employee - Investment - Declaration - Form12BB - FY 2022-23gowtham DevNo ratings yet

- Form 12BBDocument1 pageForm 12BBGopala KrishnanNo ratings yet

- LTA Reimbursement Claim Form For 2020-2021: Company NameDocument3 pagesLTA Reimbursement Claim Form For 2020-2021: Company NameAnish JainNo ratings yet

- Income Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document5 pagesIncome Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Santosh Aditya Sharma ManthaNo ratings yet

- BP040 Current Process ModelDocument1 pageBP040 Current Process Modelsastrylanka1980No ratings yet

- India Statutory Form TemplateDocument11 pagesIndia Statutory Form TemplateMadhusudan MadhuNo ratings yet

- Form12BB R539 Proof Submission Form PDFDocument4 pagesForm12BB R539 Proof Submission Form PDFHema GarikapatiNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAnonymous Gg6z0u9IBzNo ratings yet

- IT DeclarationDocument1 pageIT Declarationsiva kumaarNo ratings yet

- SL No. Amount (RS.) Evidence / Particulars Nature of ClaimDocument1 pageSL No. Amount (RS.) Evidence / Particulars Nature of ClaimJayanth vNo ratings yet

- Form 16 TDS CertificateDocument3 pagesForm 16 TDS CertificateBijay TiwariNo ratings yet

- Allegis - Investment Proof Submission Form - 2018-19Document6 pagesAllegis - Investment Proof Submission Form - 2018-19Sachin Kumar J KNo ratings yet

- Form 12BBDocument2 pagesForm 12BBBasavaraj NNo ratings yet

- Form11 - 111018740Document2 pagesForm11 - 111018740muskan davidNo ratings yet

- New IT Declaration FormDocument2 pagesNew IT Declaration FormMahakaal Digital PointNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationprasathNo ratings yet

- PF Form11 & Declaration FormDocument2 pagesPF Form11 & Declaration Formalapati NagalaxmiNo ratings yet

- Accenture India Employee Tax TrackingDocument4 pagesAccenture India Employee Tax TrackingSiva ThotaNo ratings yet

- Investment Proof Submission Form23 24Document6 pagesInvestment Proof Submission Form23 24Bindu madhaviNo ratings yet

- Form 12Document2 pagesForm 12sarathNo ratings yet

- PF Membership Details in Form 11Document2 pagesPF Membership Details in Form 11AbhilashNo ratings yet

- Sample Filled EPF Composite Declaration Form 11Document2 pagesSample Filled EPF Composite Declaration Form 11Varalakshmi SharanNo ratings yet

- 01 PF Declaration Form 11Document1 page01 PF Declaration Form 11Vijayavelu AdiyapathamNo ratings yet

- Form No. 16A (See Rule31 (L) (B) )Document4 pagesForm No. 16A (See Rule31 (L) (B) )Nirmal MalooNo ratings yet

- Tax DeclarationDocument2 pagesTax DeclarationVISHAKHA SHARMANo ratings yet

- Employee Proof Submission Form - 2011-12Document5 pagesEmployee Proof Submission Form - 2011-12aby_000No ratings yet

- Statutory Documents - CBREDocument9 pagesStatutory Documents - CBRERohit PatnalaNo ratings yet

- Employees' Provident Fund Organisation: Composite Declaration Form - 11Document5 pagesEmployees' Provident Fund Organisation: Composite Declaration Form - 11Yashveer Pratap SinghNo ratings yet

- Housing loan interest and principal declarationDocument1 pageHousing loan interest and principal declarationappsectesting3100% (1)

- New Form 12BBDocument2 pagesNew Form 12BBramanNo ratings yet

- EPF Declaration FormDocument2 pagesEPF Declaration Formvishalkavi18No ratings yet

- Composite Declaration Form for EPF MembershipDocument2 pagesComposite Declaration Form for EPF MembershipKeshav SarafNo ratings yet

- Employees Provident Fund Organization: Emp Code: CompanyDocument2 pagesEmployees Provident Fund Organization: Emp Code: CompanyAmit RuikarNo ratings yet

- P.F. Form 11Document1 pageP.F. Form 11DattaNo ratings yet

- 2307 Jan 2018 ENCS v3 - L.U. MORNING STAR Oct2023 FGGFDocument11 pages2307 Jan 2018 ENCS v3 - L.U. MORNING STAR Oct2023 FGGFpearlanncasem12No ratings yet

- Print Form 11Document2 pagesPrint Form 11Andrew WinnerNo ratings yet

- Welcome!: Updated To Work With NSDL FVU 3.1 (From FY 2010 Onwards)Document9 pagesWelcome!: Updated To Work With NSDL FVU 3.1 (From FY 2010 Onwards)SagarDaveNo ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- IT DeclarationDocument1 pageIT Declarationswapna vijayNo ratings yet

- Form No. - 11 - Declaration FormDocument2 pagesForm No. - 11 - Declaration FormDharshan ChandrasekaranNo ratings yet

- Form8 2007 08Document5 pagesForm8 2007 08api-3850174No ratings yet

- Form 12BBDocument3 pagesForm 12BBAmitNo ratings yet

- Form No 16Document4 pagesForm No 16Md ZhidNo ratings yet

- Declare EPF detailsDocument2 pagesDeclare EPF detailsADITYA R P 1937302No ratings yet

- Employees Provident Fund Organization: - Declaration FormDocument1 pageEmployees Provident Fund Organization: - Declaration FormRajeshNo ratings yet

- Form for Saving & Investment DeclarationDocument1 pageForm for Saving & Investment Declarationsabir aliNo ratings yet

- Form 11 (Download Here) - 54061825463895 - 54388549640084Document3 pagesForm 11 (Download Here) - 54061825463895 - 54388549640084Kishore NithyaNo ratings yet

- Form 2 and EPFODocument4 pagesForm 2 and EPFOSabarish T ENo ratings yet

- New Form 11 DeclarationDocument1 pageNew Form 11 Declarationsanjith_shelly290No ratings yet

- (To Be Retained by The Employer For Future Reference) : Employees'Provident Fund OrganisationDocument3 pages(To Be Retained by The Employer For Future Reference) : Employees'Provident Fund Organisationshashi kiranNo ratings yet

- PF ClaimDocument4 pagesPF ClaimAmarjeet TakNo ratings yet

- New Health Insurance Scheme 2021 Employee DataDocument2 pagesNew Health Insurance Scheme 2021 Employee DataIIC SArada collegeNo ratings yet

- Composite Declaration Form - 11: (To Be Retained by Employer For Future Reference) Employees' Provident Fund OrganizationDocument2 pagesComposite Declaration Form - 11: (To Be Retained by Employer For Future Reference) Employees' Provident Fund OrganizationManasNo ratings yet

- Employees Provident Fund Organization: - Declaration FormDocument1 pageEmployees Provident Fund Organization: - Declaration FormPAINNo ratings yet

- PF Declaration Form 11 New-Ayesha KhanDocument3 pagesPF Declaration Form 11 New-Ayesha KhanMalik PrintNo ratings yet

- J.K. Lasser's Your Income Tax 2024, Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNo ratings yet

- J.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnNo ratings yet

- Gs 51 General 6 PageDocument6 pagesGs 51 General 6 PageOneNationNo ratings yet

- MBA1038 Banking & Insurance: Key ConceptsDocument3 pagesMBA1038 Banking & Insurance: Key ConceptsnanakethanNo ratings yet

- Gang rate activity rates moduleDocument3 pagesGang rate activity rates moduleRambhakt HanumanNo ratings yet

- Accounting For Income Taxes ExercisessDocument5 pagesAccounting For Income Taxes ExercisessdorothyannvillamoraaNo ratings yet

- Right of Subrogation in Marine Insurance-A Comparative Study of English and Chinese LawDocument86 pagesRight of Subrogation in Marine Insurance-A Comparative Study of English and Chinese LawAnirban ChakrabortyNo ratings yet

- Monthly Overhead Expenses 1 Month Worksheet ExcelDocument1 pageMonthly Overhead Expenses 1 Month Worksheet ExcelSony HarsonoNo ratings yet

- Smart Platina Plus - Hand Bill 1Document1 pageSmart Platina Plus - Hand Bill 1Ashish RanjanNo ratings yet

- Annuity PresentationDocument16 pagesAnnuity PresentationPraveen100% (1)

- Bajaj Allianz General Insurance Company LTDDocument7 pagesBajaj Allianz General Insurance Company LTDZakir ShariffNo ratings yet

- RWTH Housing GuideDocument40 pagesRWTH Housing GuideUsama Zaid MalikNo ratings yet

- Exide Life Insurance - PO 1200011572Document16 pagesExide Life Insurance - PO 1200011572Joan AliNo ratings yet

- Nahidah Rana 2022Document3 pagesNahidah Rana 2022nahidahcomNo ratings yet

- Financial Accounting Assignment - 1Document17 pagesFinancial Accounting Assignment - 1Yosef MitikuNo ratings yet

- VD Nữa NèDocument14 pagesVD Nữa NèviethoangrepNo ratings yet

- ULK ManulifeDocument31 pagesULK ManulifeLong NguyenNo ratings yet

- Objective 5.02: Understand Risk Management and Insurance. Youtube - Risk Is Our BusinessDocument40 pagesObjective 5.02: Understand Risk Management and Insurance. Youtube - Risk Is Our BusinessShweta ShrivastavaNo ratings yet

- Insurance Products ENGDocument22 pagesInsurance Products ENGAndrej AndrejNo ratings yet

- Please Quote This Reference Number in All Future CorrespondenceDocument2 pagesPlease Quote This Reference Number in All Future CorrespondenceAlexander SolomonNo ratings yet

- Digital Covid Questionnaire For Revival Approval FormatDocument2 pagesDigital Covid Questionnaire For Revival Approval Formatsouravdey3No ratings yet

- The Development of Insurance Law: The English & Indian ExperiencesDocument17 pagesThe Development of Insurance Law: The English & Indian ExperiencesTanya RajNo ratings yet

- DL Doc ProofDocument3 pagesDL Doc ProofArjun Singh RawatNo ratings yet

- Carrier Liability in Maritime and Land Transport CasesDocument15 pagesCarrier Liability in Maritime and Land Transport CasesDaniela Erika Beredo InandanNo ratings yet

- Bhel Eoi Traction PDFDocument105 pagesBhel Eoi Traction PDFDeepak GehlotNo ratings yet

- How Insurance Drives Economic Growth: June 2018Document18 pagesHow Insurance Drives Economic Growth: June 2018Hamza AbidNo ratings yet

- Certificado de Elegibilidade 36902609810Document9 pagesCertificado de Elegibilidade 36902609810Samhec PrinceNo ratings yet

- Guaranty and Suretyship: Kuenzle & Streiff vs. Jose Tan Sunco, Et AlDocument3 pagesGuaranty and Suretyship: Kuenzle & Streiff vs. Jose Tan Sunco, Et AlLara DelleNo ratings yet

- Zfak HR Income Tax CalcDocument35 pagesZfak HR Income Tax CalcfahadnavaidkNo ratings yet

- Rizal Commercial Banking Corporation, Uy Chun BING AND ELI D. LAO, Petitioners, Court of Appeals and Goyu & SONS, INC., RespondentsDocument4 pagesRizal Commercial Banking Corporation, Uy Chun BING AND ELI D. LAO, Petitioners, Court of Appeals and Goyu & SONS, INC., RespondentsJared LibiranNo ratings yet