Professional Documents

Culture Documents

IndiaSales Feb CC Slabs

Uploaded by

socialmedia.manager.incOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IndiaSales Feb CC Slabs

Uploaded by

socialmedia.manager.incCopyright:

Available Formats

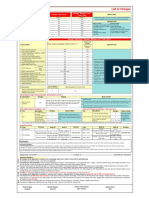

IndiaSales | February 2024 Slabs

5th Feb 2024

#Cards Slab Payout #Cards Slab Payout

AU Bank IndusInd Bank

FLAT 2100 (Jocata Assisted Journey) FLAT > 50 FLAT

> 50 FLAT 2150 Aura Edge/Platinum/Rupay 2000 2100

Kotak Signature Legend 2200 2300

Only NTB Cases FLAT 1800 Govt Fee Based 2600 2700

> 50 FLAT 1900 EazyDiner/Nexxt 3000 3100

IndusInd DIY

FLAT 2300 AXIS LIC LIC - Platinum LIC - Signature

>50 FLAT 2400 FLAT 900 1500

HDFC Bank > 50 FLAT 950 1700

Redirection Journey FLAT 2000 / 2450 (GST)

> 50 FLAT 2100 / 2600 (GST) Bajaj Finserv RBL

FLAT 1800

Prime & Growth

50 - 100 1900

UW Cases - 1500 FLAT >100 FLAT 2000

AXIS Bank

ETCC is ETB except Neo Cards Type >> Retail Emerging Affluent True Affluent Neo (No ETCC)

FLAT 1900 2100 2500 1000

> 50 FLAT 2000 2300 3000 1100

SBI Card

Cards Type >> 499 Fee Card 1499 Fee Card 2999 Fee Card 4999 Fee Card

FLAT 2200 2500 2800 3000

HDFC Deductions Other HDFC Deductions

Dump Decline / Reject Code Deduction in Rs. Fee Reversal cases 2 x of fees reversed - CBCI Dump

Decline 881, 882, 883, 884 300 CBCI/ MisInfo Complaints 1000 Per case

Decline 47 300 Early Closure 1000 Per case

Dip ok & Dip Reject Cases - Rs. 500 per case for

TAT Disincentive (Appn date to

Decline 42,92 500 TAT Bust >1% to 5% and Rs. 1000 per case for

submt date exceeding 3 days)

TAT Bust >5%

Risk/Audit/Sales Compliance

Decline 46 10000 penalty including TRAI As per penalty levied by Team concerned

Compliance

INR 320 deduction per Application (As per Bank

Dip Reject 863, 865 300 Biometric KYC

Norms)

Dip Reject 870 500

Dip Reject 87A 3000 AXIS Bank Cards

Kit Recovery/Account closed due to inactivity on the

Slab Payout Category Cards

38th day. (Inactive Card)

Biometric Success Cases

320 True Affluent Vistara Infinite, Magnus, Atlas

through Bank's channel

Priviledge, Vistara Platinum & Signature, Select,

Inhouse sourcing penalty* Greater than 15% 1200 per case Emerging Affluent

Voyage, Rewards

* Accounts prequalifying for card basis various internal policies only considered Retail Rest (Not NEO)

IndusInd Deductions

Definition Penalty Amount/Complaint (INR)

Terms & Conditions DND/DNC Complaint 1,000

The above payouts are exclusive of GST. Miss-selling/Miss-commitments 5,000

Payouts applicable only for Credit Cards activated and not applications sourced. Fudged/Manipulated Documents 5,000

The Advance Payout will be only given if the monthly business is over 1 lakh INR. NPS Detractors / On-Boarding Experience 5,000

The Payout will be made as per the

For any Slab, overall cards issued in a month will be considered for the particular Bank.

below schedule

*The above payouts are indicateive for February, will be confirmed in the first week. Instalment Date

The above slabs are applicable for Cards booked every month- 1st to 30th / 31st of every month. Advance Tranche 5-7th Next Month

The secured cards won't be counted in the total tally of the Credit Cards Issued Final Tranche 15-17th Next Month

Any penalty or fine imposed by brand in case of breach of conduct or fraudulent activity, the penalties will be passed on to the associates.

The journey must be enabled through the customers via explicit consent by the customers; cold calling, misinformation, misclaims will lead to penalties and

freezing of accounts and assets.

The cards should be activated as per RBI guidelines - otherwise we will clawback the base payout for every such cancellations

KOTAK Credit Cards are specifically for the NTB Cases

HDFC Bank: All non-floater cards issued, where the customer has a pre-approved offer from the Bank, will be paid at flat rate of Rs 2000 per card

(inclusive of GST; irrespective of card variant)

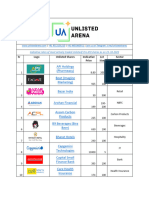

IndiaSales | February 2024 Slabs

5th Feb 2024

Slab for Additional Type of Laptop Allowed -

Journey Type Loan Payout

Incentive Incentive Loan IndiaSales

App KreditBee 3.25% 10 L 0.50% PL No

Web UTM Prefr 2.50% 10 L 0.35% PL Yes

Web UTM InCred Personal Loan 3.25% 10 L 0.50% PL Yes

Non-UTM Web Tata Capital Personal Loan 1.50% PL/BL Yes

Web UTM Paysense Personal Loan 4.00% 10L 0.50% PL Yes

Moneyview Personal Loan (Loan

Web UTM < 1 Lakh) 2.25% 10L 0.10% PL Yes

Moneyview Personal Loan (Loan

Web UTM >= 1 Lakh) 2.25% 10L 0.10% PL Yes

Web UTM IIFL Personal Loan 2.75% 10L 0.25% PL Yes

Web API Personal Loan (Via Indialends) 2.50% PL no

App Stashfin Rs. 1300 20+ Card Rs. 300 OD no

App Uni Paychek Rs 700 10+ Loan Rs. 100 Credit Line no

T&C for Stashfin

Applicable for NTB Customers. Payout will be given on credit approval (i.e. eNACH Completion). Minimum Credit Line Limit of 10000 INR

The Payout will be on the basis of Loan Amount Disbursed in the Customer's Account

You might also like

- A - Updated Price List & Payment BW Food Court 10012020Document8 pagesA - Updated Price List & Payment BW Food Court 10012020sishir mandalNo ratings yet

- SOC Jul Sep 2022 Branchless Banking - CompressedDocument2 pagesSOC Jul Sep 2022 Branchless Banking - CompressedBilal AsgharNo ratings yet

- ANNEXURE TITLEDocument1 pageANNEXURE TITLEakshatjain3001No ratings yet

- Demat and transaction charges comparison across multiple depository participantsDocument146 pagesDemat and transaction charges comparison across multiple depository participantssekradNo ratings yet

- Service Charges Popcorn Service ProviderDocument3 pagesService Charges Popcorn Service ProviderRajesh SharmaNo ratings yet

- (Prop. Advent Age Agency Pvt. LTD.) : K.K. PolymersDocument1 page(Prop. Advent Age Agency Pvt. LTD.) : K.K. Polymersakshatjain3001No ratings yet

- SOC Branchless Banking April June 2023 PDFDocument2 pagesSOC Branchless Banking April June 2023 PDFVijay VijdanNo ratings yet

- DPC9 1208160094828106 05032024235148Document2 pagesDPC9 1208160094828106 05032024235148dk031353No ratings yet

- Tariff Plan CDSLDocument1 pageTariff Plan CDSLJatinNo ratings yet

- Issue of Shares Questions With SolutionsDocument4 pagesIssue of Shares Questions With SolutionsSumiran BansalNo ratings yet

- Regional Schemes - Feb 24 KeralaDocument8 pagesRegional Schemes - Feb 24 KeralaanascrrNo ratings yet

- Financial Year: 2020-21 Assessment Year: 2021-22: TDS RATE CHART FY: 2020-21 (AY: 2021-22)Document2 pagesFinancial Year: 2020-21 Assessment Year: 2021-22: TDS RATE CHART FY: 2020-21 (AY: 2021-22)Mahesh Shinde100% (1)

- Salary - Smart NotingsDocument37 pagesSalary - Smart Notingssyedameerhamza762No ratings yet

- SCHEDULE OF CHARGES JUL-SEP 2021Document2 pagesSCHEDULE OF CHARGES JUL-SEP 2021Textro VertNo ratings yet

- Accounting: AssignmentDocument4 pagesAccounting: Assignmentiza khanNo ratings yet

- Skema Fee Keagenan: 1 Pembukaan Rekening 2 Setor Tunai 3 Tarik Tunai Rp. 1,-s/d Rp. 200.000, - Rp. 200.000Document4 pagesSkema Fee Keagenan: 1 Pembukaan Rekening 2 Setor Tunai 3 Tarik Tunai Rp. 1,-s/d Rp. 200.000, - Rp. 200.000Bang AY BharadutaNo ratings yet

- SOC Oct Dec 20hh21 Branchless BankingDocument2 pagesSOC Oct Dec 20hh21 Branchless BankingMishaal HassanNo ratings yet

- DPC9 1203320148457561 05032024234910Document2 pagesDPC9 1203320148457561 05032024234910dk031353No ratings yet

- Statement 122925Document3 pagesStatement 122925Itsmevenki SmileNo ratings yet

- Ans 2015 Dec Eh2207a1Document12 pagesAns 2015 Dec Eh2207a1muhd fahmiNo ratings yet

- Thyrocare Technologies Salary Slip April 2018Document1 pageThyrocare Technologies Salary Slip April 2018BIPINNo ratings yet

- Payslip Nov - Sailu1Document2 pagesPayslip Nov - Sailu1Christine Hall0% (1)

- PLC ATS Card Rates for Various Noida ProjectsDocument1 pagePLC ATS Card Rates for Various Noida ProjectsRohit ChhabraNo ratings yet

- CRQSDocument79 pagesCRQSAtka FahimNo ratings yet

- Salary Slip MayDocument1 pageSalary Slip MayselvaNo ratings yet

- List of Charges: For STB and VCDocument1 pageList of Charges: For STB and VCVijay SharmaNo ratings yet

- NVT Mystic Garden PricingDocument1 pageNVT Mystic Garden PricingHitesh NaikNo ratings yet

- Lightning Deals Cost SheetsDocument4 pagesLightning Deals Cost SheetsRavinder YadavNo ratings yet

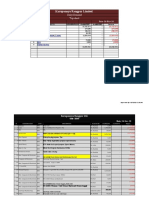

- Unlisted Arena Price List 23-10-2023Document5 pagesUnlisted Arena Price List 23-10-2023shammore97No ratings yet

- Elper Consulting Services-Demonstration Problem - Chapter 3Document5 pagesElper Consulting Services-Demonstration Problem - Chapter 3Tooba HashmiNo ratings yet

- SME Promo (Product Incentives)Document1 pageSME Promo (Product Incentives)Ahmed KhanNo ratings yet

- Sr. No. Description Allied Rate of Charges PL Category (T24)Document2 pagesSr. No. Description Allied Rate of Charges PL Category (T24)Daid AliNo ratings yet

- Nri SocDocument1 pageNri SocSaadia KhanNo ratings yet

- Wheat Seed Order and Dispatch Sheet 2019Document2 pagesWheat Seed Order and Dispatch Sheet 2019ImrNo ratings yet

- CorrectionDocument2 pagesCorrectionLEE SIN YINo ratings yet

- Aluminium Primary Metal Price List September 2021Document1 pageAluminium Primary Metal Price List September 2021SamuelNo ratings yet

- Correction of ErrorsDocument16 pagesCorrection of ErrorszahidkhanNo ratings yet

- My Pay PDFDocument1 pageMy Pay PDFbuckwheat122507No ratings yet

- Daily Demand KRL 24th Nov' 2020Document23 pagesDaily Demand KRL 24th Nov' 2020Riel RahmanNo ratings yet

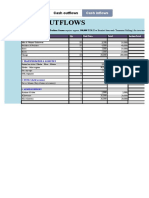

- Cash Flow2DDocument1 pageCash Flow2DFurquan KhanNo ratings yet

- Schedule-Of-Charge-2023 Trust Bank PLCDocument12 pagesSchedule-Of-Charge-2023 Trust Bank PLCfinancialsafetynetforbankersNo ratings yet

- Accounts Golden HandsDocument26 pagesAccounts Golden HandsAhmed SalemNo ratings yet

- Statement of Profit or Loss AnalysisDocument15 pagesStatement of Profit or Loss AnalysisNurain FatiniNo ratings yet

- Ashiyan Price List 19-Jul-22Document1 pageAshiyan Price List 19-Jul-22love sharmaNo ratings yet

- Naval Pay Office - Mumbai Statement of Entitlement For Mar-2010Document1 pageNaval Pay Office - Mumbai Statement of Entitlement For Mar-2010dbhanot193693No ratings yet

- Real Estate and Theater Trial BalancesDocument10 pagesReal Estate and Theater Trial BalancesThùy NguyễnNo ratings yet

- Key Fact Sheet for HBL ID Youth AccountDocument1 pageKey Fact Sheet for HBL ID Youth AccountUmair AbbasNo ratings yet

- Receivables Workbook (Lesson 9) 24.2.2022Document36 pagesReceivables Workbook (Lesson 9) 24.2.2022Phương Linh TrươngNo ratings yet

- 12 Acc Admission Partner Im3Document13 pages12 Acc Admission Partner Im3Piyush SrivastavaNo ratings yet

- Mumbai Goa ExpenseDocument3 pagesMumbai Goa ExpenseLalit BhambwaniNo ratings yet

- MAH Bad & Doubtful Debts Past Papers SolutionsDocument4 pagesMAH Bad & Doubtful Debts Past Papers Solutionsduniya t vNo ratings yet

- Chart of AccountDocument7 pagesChart of Accountacahalim1103No ratings yet

- Cash Outflows: Home Operations Cash InflowsDocument2 pagesCash Outflows: Home Operations Cash InflowsCapt John Daniel KamuliNo ratings yet

- Weather-based crop insurance scheme for Kharif 2011 paddy in Palakkad, KeralaDocument1 pageWeather-based crop insurance scheme for Kharif 2011 paddy in Palakkad, KeralaSyam KumarNo ratings yet

- TDS - and - TCS Rate Chart 2024Document5 pagesTDS - and - TCS Rate Chart 2024Taxation KTPL (Kalyani Techpark Taxation)No ratings yet

- Subic Bay Freeport Zone: Terms and ConditionsDocument1 pageSubic Bay Freeport Zone: Terms and ConditionsDylan GreyNo ratings yet

- 2023 Valuations Chapter 05 ProblemsDocument6 pages2023 Valuations Chapter 05 ProblemsShania LiwanagNo ratings yet

- TDS and TCS Rate Chart 2023Document5 pagesTDS and TCS Rate Chart 2023DEEPAK SHARMANo ratings yet

- terms-and-conditions-v1Document1 pageterms-and-conditions-v1socialmedia.manager.incNo ratings yet

- Rewards Credit Card Terms and ConditionsDocument9 pagesRewards Credit Card Terms and Conditionssocialmedia.manager.incNo ratings yet

- Workable Pin Codes - BFL 1Document441 pagesWorkable Pin Codes - BFL 1ayanbhargav3No ratings yet

- Ogl Pin CodeDocument108 pagesOgl Pin Codesocialmedia.manager.incNo ratings yet

- Wa0002.Document7 pagesWa0002.socialmedia.manager.incNo ratings yet

- CHM131 Presentation - Oxidation of MetalsDocument11 pagesCHM131 Presentation - Oxidation of MetalsNazrul ShahNo ratings yet

- Application of Gis in Electrical Distribution Network SystemDocument16 pagesApplication of Gis in Electrical Distribution Network SystemMelese Sefiw100% (1)

- Health Fitness Guide UK 2018 MayDocument100 pagesHealth Fitness Guide UK 2018 MayMitch Yeoh100% (2)

- Armv8-A Instruction Set ArchitectureDocument39 pagesArmv8-A Instruction Set ArchitectureraygarnerNo ratings yet

- Assessmentof Safety Cultureand Maturityin Mining Environments Caseof Njuli QuarryDocument12 pagesAssessmentof Safety Cultureand Maturityin Mining Environments Caseof Njuli QuarryAbdurrohman AabNo ratings yet

- Bareos Manual Main ReferenceDocument491 pagesBareos Manual Main ReferenceAlejandro GonzalezNo ratings yet

- Lodha GroupDocument2 pagesLodha Groupmanish_ggiNo ratings yet

- Danbury BrochureDocument24 pagesDanbury BrochureQuique MartinNo ratings yet

- BSNL TrainingDocument25 pagesBSNL TrainingAditya Dandotia68% (19)

- Inspection and Test Plan Steel Sheet Pile DriDocument6 pagesInspection and Test Plan Steel Sheet Pile DriSofda Imela100% (1)

- Ncm110nif Midterm Laboratory NotesDocument12 pagesNcm110nif Midterm Laboratory NotesMicah jay MalvasNo ratings yet

- Engagement LetterDocument1 pageEngagement LetterCrystal Jenn Balaba100% (1)

- Thesis Hakonen Petri - Detecting Insider ThreatsDocument72 pagesThesis Hakonen Petri - Detecting Insider ThreatsalexandreppinheiroNo ratings yet

- Api RP 2a WSD 1pdf - CompressDocument1 pageApi RP 2a WSD 1pdf - CompressRamesh SelvarajNo ratings yet

- FacebookH Cking 1 3 (SFILEDocument10 pagesFacebookH Cking 1 3 (SFILEFitra AkbarNo ratings yet

- SocorexDocument6 pagesSocorexTedosNo ratings yet

- What Is Your Road, Man?Document232 pagesWhat Is Your Road, Man?Oana AndreeaNo ratings yet

- Summarised Maths Notes (Neilab Osman)Document37 pagesSummarised Maths Notes (Neilab Osman)dubravko_akmacicNo ratings yet

- Mark Wildon - Representation Theory of The Symmetric Group (Lecture Notes) (2015)Document34 pagesMark Wildon - Representation Theory of The Symmetric Group (Lecture Notes) (2015)Satyam Agrahari0% (1)

- CS310 Sample PaperDocument10 pagesCS310 Sample PaperMohsanNo ratings yet

- Curriculam VitaeDocument3 pagesCurriculam Vitaeharsha ShendeNo ratings yet

- GSAA HET 2005-15, Tranche B2 / BSABS 2005-TC2, Tranche M6 Shown As An Asset of Maiden LaneDocument122 pagesGSAA HET 2005-15, Tranche B2 / BSABS 2005-TC2, Tranche M6 Shown As An Asset of Maiden LaneTim BryantNo ratings yet

- Map Project Rubric 2018Document2 pagesMap Project Rubric 2018api-292774341No ratings yet

- LTG 04 DD Unit 4 WorksheetsDocument2 pagesLTG 04 DD Unit 4 WorksheetsNguyễn Kim Ngọc Lớp 4DNo ratings yet

- WISECO 2011 Complete CatalogDocument131 pagesWISECO 2011 Complete CatalogfishuenntNo ratings yet

- Cubic Spline Tutorial v3Document6 pagesCubic Spline Tutorial v3Praveen SrivastavaNo ratings yet

- All Creatures Great and SmallDocument4 pagesAll Creatures Great and SmallsaanviranjanNo ratings yet

- The Joint Force Commander's Guide To Cyberspace Operations: by Brett T. WilliamsDocument8 pagesThe Joint Force Commander's Guide To Cyberspace Operations: by Brett T. Williamsأريزا لويسNo ratings yet

- Classification of AnimalsDocument6 pagesClassification of Animalsapi-282695651No ratings yet

- If Sentences Type 1 First Type Conditionals Grammar Drills - 119169Document2 pagesIf Sentences Type 1 First Type Conditionals Grammar Drills - 119169Ivanciu DanNo ratings yet