Professional Documents

Culture Documents

Replek

Uploaded by

sonpatz678Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Replek

Uploaded by

sonpatz678Copyright:

Available Formats

The Wolf of Wall Street: Reflection Paper

Bejino, Bulawin, Canlas, Gagalac

Critically acclaimed memoir-turned-film, The Wolf of Wall Street, follows the rise

and fall of Jordan Belfort through his illegal practices in the powerful world of Wall

Street. He started as a young and ambitious stock broker; his shift to a destructive and

egotistical state driven by drugs and money ultimately led to his inevitable downfall.

Through his firm called Stratton Oakmont, he sparked the beginning of the

“pump-dump” scheme, defrauding countless Americans of 200 million dollars, which all

went to his opulent and wild parties and belongings. Nevertheless, his chaotic lifestyle

has brought lessons to the world of finance and business operations.

Starting a business is no joke. To start a business, you must have confidence in

yourself. Jordan Belfort exemplified this confidence. Following his dismissal from a

brokerage firm on Wall Street, Belfort then established his own firm, Stratton Oakmont.

Initially composed of five individuals, including him, Belfort taught them how to converse

with customers, but then word got out that his firm was generating a huge fortune. That

is where Stratton Oakmont’s workforce went from a handful to dozens, then to

hundreds. The firm continued to grow as Belfort believed in his employees. However,

the firm’s illegal activities led to the downfall of Stratton Oakmont.

The movie highlights the importance of having confidence in starting a business

and the importance of promoting motivation in the workplace. However, it also

highlighted greed and corruption. Belfort was willing to engage in any means to

generate income, whether it involved cheating, dishonesty, or, most importantly,

defrauding his clients. He lost sight of what he should be putting first—his family. The

movie serves as a reminder that, while the pursuit of money might be appealing, it must

be done ethically and legally. The movie depicts how greed and corruption can have

negative consequences for both the individuals involved and society as a whole.

The film portrays a culture of fraud and unethical practices. It emphasizes the

risks of engaging in dishonest practices to achieve financial success and the potential

legal consequences that can follow. Jordan Belfort’s company, Stratton Oakmont,

participates in the “pump and dump” scheme where they encourage clients to buy

shares/stocks, inflating its value using false information and then selling them for a profit

which then will generate real income. This approach takes advantage of inexperienced

investors and emphasizes the importance of strong regulatory control in the finance

industry. Due to gaps in regulation and lax enforcement, Belfort and his colleagues were

able to carry out their fraudulent schemes for a considerable amount of time. The film

demonstrates a short-sighted focus on quick gains and wealth acquisition, contrasting to

a more sustainable and ethical approach to business that addresses the market’s and

financial system’s long-term viability. It illustrates the harsh legal implications that

individuals and businesses might face for committing financial crimes like the “pump

and dump” scheme. While the movie is a dramatized depiction of true events in real life,

it serves as a reminder of the importance of transparency, honesty, and regulatory

adherence to preserve a healthy and sustainable financial system.

On the other hand, beyond heavy portrayals of crime and broken relationships,

the film imparts a positive lesson—the power of resilience and determination in pursuing

one's goals. Despite facing numerous challenges in the storyline, such as L.F.

Rothschild's shutdown and his schemes' almost exposure, Jordan Belfort refused to

give in easily. He plotted out his goals and displayed unwavering resolve, adapting to

the challenging situations he encountered. This tenacity of his eventually drove him to

his dream destinations. It was only unfortunate he was overtaken by greed and his

persevering spirit was poured into the wrong pursuit which soon led to his downfall.

In conclusion, The Wolf of Wall Street, masterfully told through Scorsese’s film

style and acted by its outstanding star-studded cast, had left a profound impact on us,

marketing and advertising students, with a newly discovered knowledge of the history of

the American stock market crash and the importance of ethical decision-making in

business. This film has imparted a crucial lesson of being transparent, confident,

resilient, and determined in making business decisions. It accentuated the need to avoid

being influenced by illegitimate external factors that may dismantle business integrity.

You might also like

- The Wolf of Wall Street EthicsDocument22 pagesThe Wolf of Wall Street EthicsAhmad Shahrul100% (1)

- Enron - Reaction Paper # 2Document3 pagesEnron - Reaction Paper # 2delo8563% (8)

- Frauds - Rip.offs - And.con - Games LoompanicsDocument86 pagesFrauds - Rip.offs - And.con - Games Loompanicsuiopty100% (4)

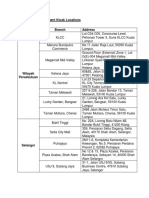

- Debit Card Replacement Kiosk Locations v2Document3 pagesDebit Card Replacement Kiosk Locations v2aiaiyaya33% (3)

- Meet The Real 'Wolf of Wall Street' in Forbes' Original Takedown of Jordan BelfortDocument4 pagesMeet The Real 'Wolf of Wall Street' in Forbes' Original Takedown of Jordan BelfortJay SayNo ratings yet

- The Wolf of Wall Street - A SummaryDocument3 pagesThe Wolf of Wall Street - A SummaryAkshatNo ratings yet

- Workbook From Desktop Lawyer Generic Lawyer (2012!06!06 09-22-58 UTC)Document691 pagesWorkbook From Desktop Lawyer Generic Lawyer (2012!06!06 09-22-58 UTC)Armond Trakarian100% (2)

- Inside JobDocument5 pagesInside Jobpkb0% (1)

- Tow Truck Law SuitDocument4 pagesTow Truck Law SuitAnthony TalcottNo ratings yet

- Sabic DirectoryDocument9 pagesSabic DirectoryPranabesh MallickNo ratings yet

- 3LP - Bsba3 - Erika Mae SoropiaDocument3 pages3LP - Bsba3 - Erika Mae SoropiaErika Mae SoropiaNo ratings yet

- The Wolf of Wall StreetDocument2 pagesThe Wolf of Wall StreetAbigail Cruz ParaanNo ratings yet

- No. FMDocument1 pageNo. FM202220012No ratings yet

- Wolf of Wall Street - SANCHEZ - FDNBUSF Reflection PaperDocument3 pagesWolf of Wall Street - SANCHEZ - FDNBUSF Reflection PaperJohn Arlo SanchezNo ratings yet

- SANCHEZ - FDNBUSF Reflection PaperDocument3 pagesSANCHEZ - FDNBUSF Reflection PaperJohn Arlo SanchezNo ratings yet

- Short Report On The Wolf of Wall Street Business ScandalDocument5 pagesShort Report On The Wolf of Wall Street Business Scandalapi-337517026No ratings yet

- The Ethics Behind Wolf of Wall StreetDocument5 pagesThe Ethics Behind Wolf of Wall StreetAhmad Shahrul100% (1)

- MADFUND Incentive PaperDocument2 pagesMADFUND Incentive PaperNicole FloresNo ratings yet

- OB Group WorkDocument3 pagesOB Group WorkAarya RaichuraNo ratings yet

- Jordan Belfort EssayFINALDocument7 pagesJordan Belfort EssayFINALKennyNo ratings yet

- Film AnalysisDocument3 pagesFilm AnalysisJmae GaufoNo ratings yet

- Reflection Paper - The Wolf of Wall StreetDocument5 pagesReflection Paper - The Wolf of Wall StreetNica Denise SiaNo ratings yet

- Financial Serial Killers: Inside the World of Wall Street Money Hustlers, Swindlers, and Con MenFrom EverandFinancial Serial Killers: Inside the World of Wall Street Money Hustlers, Swindlers, and Con MenNo ratings yet

- Analysis of The Movie "Wolf of Wall Street"Document2 pagesAnalysis of The Movie "Wolf of Wall Street"Kate Nicole BabidaNo ratings yet

- Reflection PaperDocument4 pagesReflection Paperdhanacruz2009No ratings yet

- Biography of Jordan BelfortDocument4 pagesBiography of Jordan Belfortjuan rodriguezNo ratings yet

- Case Analysis EditDocument4 pagesCase Analysis EditDaniel CruzNo ratings yet

- Quevedo, Jan Micka J. - Reaction Paper - Margin CallDocument2 pagesQuevedo, Jan Micka J. - Reaction Paper - Margin CalljmjquevedoNo ratings yet

- Write-Up For Movie Review ProjectDocument17 pagesWrite-Up For Movie Review ProjectVadiraj AshwinNo ratings yet

- Inside Job Movie ReviewDocument2 pagesInside Job Movie ReviewVivek ParmarNo ratings yet

- Selling America Short: The SEC and Market Contrarians in the Age of AbsurdityFrom EverandSelling America Short: The SEC and Market Contrarians in the Age of AbsurdityRating: 5 out of 5 stars5/5 (1)

- Essays On The Crucible by Arthur MillerDocument5 pagesEssays On The Crucible by Arthur Millerzobvbccaf100% (2)

- Film AnaylsisDocument7 pagesFilm AnaylsisBassem BeshayNo ratings yet

- Mike Whitney - If The Coming Wave Of: See RICO CaseDocument9 pagesMike Whitney - If The Coming Wave Of: See RICO CaseAlbert L. PeiaNo ratings yet

- Unveiling the Shadows: A Journey into Financial Crimes and ScandalsFrom EverandUnveiling the Shadows: A Journey into Financial Crimes and ScandalsNo ratings yet

- UntitledDocument3 pagesUntitledGian Carlo EspirituNo ratings yet

- Wolf of Wall Street ReflectionDocument1 pageWolf of Wall Street ReflectionShr BnNo ratings yet

- 15 Must Watch Stock Market Movies For Investor/TraderDocument7 pages15 Must Watch Stock Market Movies For Investor/TraderPradeep RaiNo ratings yet

- Midterm Project Film ReviewDocument3 pagesMidterm Project Film ReviewDanica CabaticNo ratings yet

- Behind The Curtain - The Full Monty (Part One)Document24 pagesBehind The Curtain - The Full Monty (Part One)Kris83% (6)

- Wolf of Wall Street Research PaperDocument8 pagesWolf of Wall Street Research Papertrvlegvkg100% (1)

- Continue: Enron Scandal Reaction Paper PDFDocument2 pagesContinue: Enron Scandal Reaction Paper PDFIccy GalarpeNo ratings yet

- The Wolf of The Wall StreetDocument10 pagesThe Wolf of The Wall StreetAnshul SinghNo ratings yet

- Reaction PaperDocument1 pageReaction PaperMarcos DmitriNo ratings yet

- 10 - Movies - To - Deepen - Thread - by - Fluentinfinance - Mar 4, 24 - From - RattibhaDocument21 pages10 - Movies - To - Deepen - Thread - by - Fluentinfinance - Mar 4, 24 - From - Rattibhadeepakmiri2003No ratings yet

- Can Capitalism Lead To Human HappinessDocument2 pagesCan Capitalism Lead To Human HappinessSushmita ThiyamNo ratings yet

- Nightcrawler and NeoliberalismDocument8 pagesNightcrawler and NeoliberalismAnonymous oxud9NNo ratings yet

- Celente: The Stimulus Game Is Up US FDIC Shuts Down 7 Banks, 2010 Total Now 37Document6 pagesCelente: The Stimulus Game Is Up US FDIC Shuts Down 7 Banks, 2010 Total Now 37Albert L. PeiaNo ratings yet

- The Corporation Is A Documentary by University of British Colombia Law Professor JoelDocument3 pagesThe Corporation Is A Documentary by University of British Colombia Law Professor Joelapi-194269006No ratings yet

- Wolf of Wall Street WhiteDocument13 pagesWolf of Wall Street WhiteLincolnNo ratings yet

- A Requirement For Every Foreclosure JudgeDocument3 pagesA Requirement For Every Foreclosure Judgedbush2778No ratings yet

- Capitalism in AmericaDocument6 pagesCapitalism in AmericaK.D.McCoyNo ratings yet

- Enron Reaction PaperDocument3 pagesEnron Reaction PaperJohn JasperNo ratings yet

- The CorporationDocument3 pagesThe CorporationLuna EstrellaNo ratings yet

- Philippine Yuh Chiau School: of The Wall Street Is Based On The Memoir of The Same Name Jordan Belfort Who Is PlayedDocument2 pagesPhilippine Yuh Chiau School: of The Wall Street Is Based On The Memoir of The Same Name Jordan Belfort Who Is PlayedaapNo ratings yet

- You Got Screwed!: Why Wall Street Tanked and How You Can ProsperFrom EverandYou Got Screwed!: Why Wall Street Tanked and How You Can ProsperRating: 3.5 out of 5 stars3.5/5 (14)

- Rhetorical Analysis Essay Final EditDocument7 pagesRhetorical Analysis Essay Final Editapi-439298928No ratings yet

- Agrawal Rohit Martha Stewart CaseDocument6 pagesAgrawal Rohit Martha Stewart CaserohitagNo ratings yet

- The Big Short - SANCHEZ - FDNBUSF Reflection PaperDocument4 pagesThe Big Short - SANCHEZ - FDNBUSF Reflection PaperJohn Arlo SanchezNo ratings yet

- Main Seems:: Capitalism: A Love StoryDocument6 pagesMain Seems:: Capitalism: A Love StoryMashood RajputNo ratings yet

- May Issue Larr-Murphy Report (LMR)Document34 pagesMay Issue Larr-Murphy Report (LMR)John Papola100% (2)

- Written Report ON Ethical Issues IN Media CoverageDocument3 pagesWritten Report ON Ethical Issues IN Media CoverageEMMANo ratings yet

- Property Tables AnnexDocument3 pagesProperty Tables AnnexkdescallarNo ratings yet

- Career Oriented ProfileDocument3 pagesCareer Oriented ProfileSami Ullah NisarNo ratings yet

- HirarchaddonDocument5 pagesHirarchaddonawe_emNo ratings yet

- University of The Philippines Open University Faculty of Management and Development Studies Master of Management ProgramDocument10 pagesUniversity of The Philippines Open University Faculty of Management and Development Studies Master of Management ProgramRoldan TalaugonNo ratings yet

- Boone Pickens' Leadership PlanDocument2 pagesBoone Pickens' Leadership PlanElvie PradoNo ratings yet

- Exercises 1-3 Corporate PlanningDocument17 pagesExercises 1-3 Corporate Planningmarichu apiladoNo ratings yet

- Gundarks Fantastic Technology Personal Gear WEG40158 PDFDocument114 pagesGundarks Fantastic Technology Personal Gear WEG40158 PDFPed_exing100% (3)

- Qualified Written RequestDocument9 pagesQualified Written Requestteachezi100% (3)

- MidtermDocument30 pagesMidtermRona CabuguasonNo ratings yet

- Trade Infrastructure (Maharashtra)Document5 pagesTrade Infrastructure (Maharashtra)RayNo ratings yet

- Preposition Exercises: SIUC Writing Center Write - Siuc.eduDocument4 pagesPreposition Exercises: SIUC Writing Center Write - Siuc.eduveni100% (1)

- Conditions of The Ahmediya Mohammediya Tijaniya PathDocument12 pagesConditions of The Ahmediya Mohammediya Tijaniya PathsamghanusNo ratings yet

- Kansai Survival Manual CH 15Document2 pagesKansai Survival Manual CH 15Marcela SuárezNo ratings yet

- Army Aviation Digest - Jan 1994Document56 pagesArmy Aviation Digest - Jan 1994Aviation/Space History Library100% (1)

- The MinoansDocument4 pagesThe MinoansAfif HidayatullohNo ratings yet

- Oracle IRecruitment Setup V 1.1Document14 pagesOracle IRecruitment Setup V 1.1Irfan AhmadNo ratings yet

- KGBV Bassi Profile NewDocument5 pagesKGBV Bassi Profile NewAbhilash MohapatraNo ratings yet

- KALIC J - Palata Srpskih Despota U Budimu (Zograf 6, 1975)Document9 pagesKALIC J - Palata Srpskih Despota U Budimu (Zograf 6, 1975)neven81No ratings yet

- Basic Features of Jaimini AstrologyDocument3 pagesBasic Features of Jaimini AstrologyVd Vivek SharmaNo ratings yet

- Section 6 in The Hindu Succession Act, 1956Document2 pagesSection 6 in The Hindu Succession Act, 1956Sathish KumarNo ratings yet

- Universalism and Cultural Relativism in Social Work EthicsDocument16 pagesUniversalism and Cultural Relativism in Social Work EthicsEdu ArdoNo ratings yet

- Randy C de Lara 2.1Document2 pagesRandy C de Lara 2.1Jane ParaisoNo ratings yet

- 520082272054091201Document1 page520082272054091201Shaikh AdilNo ratings yet

- Cat 178 BooksDocument35 pagesCat 178 BooksXARIDHMOSNo ratings yet

- Impact of Brexit On TataDocument2 pagesImpact of Brexit On TataSaransh SethiNo ratings yet

- Bakst - Music and Soviet RealismDocument9 pagesBakst - Music and Soviet RealismMaurício FunciaNo ratings yet