Professional Documents

Culture Documents

GSTR3B 33CVMPS7640R1ZK 012023

GSTR3B 33CVMPS7640R1ZK 012023

Uploaded by

hakkim satharOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GSTR3B 33CVMPS7640R1ZK 012023

GSTR3B 33CVMPS7640R1ZK 012023

Uploaded by

hakkim satharCopyright:

Available Formats

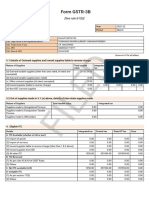

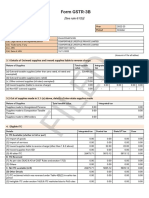

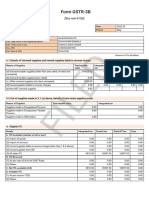

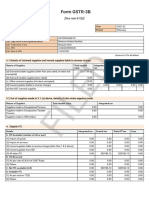

Form GSTR-3B

[See rule 61(5)]

Year 2022-23

Period January

1. GSTIN 33CVMPS7640R1ZK

2(a). Legal name of the registered person ANBALAGAN SEMBIAN

2(b). Trade name, if any AMS RENEWABLE ENERGY SERVICES

2(c). ARN AB330123805990H

2(d). Date of ARN 23/02/2023

(Amount in ₹ for all tables)

3.1 Details of Outward supplies and inward supplies liable to reverse charge

Nature of Supplies Total taxable Integrated Central State/UT Cess

exempted)

(b) Outward taxable supplies (zero rated)

(c ) Other outward supplies (nil rated, exempted)

(d) Inward supplies (liable to reverse charge)

(e) Non-GST outward supplies

ED

(a) Outward taxable supplies (other than zero rated, nil rated and

value

3.2 Out of supplies made in 3.1 (a) above, details of inter-state supplies made

204292.52

0.00

0.00

0.00

0.00

tax

-

0.00

0.00

0.00

tax

18386.33

-

-

-

0.00

tax

18386.33

-

-

-

0.00

0.00

0.00

-

0.00

-

FIL

Nature of Supplies Total taxable value Integrated tax

Supplies made to Unregistered Persons 0.00 0.00

Supplies made to Composition Taxable 0.00 0.00

Persons

Supplies made to UIN holders 0.00 0.00

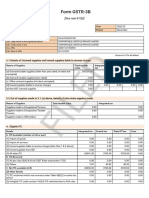

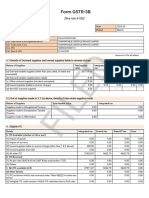

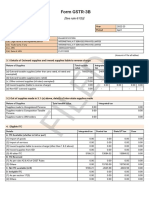

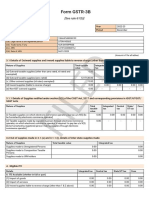

4. Eligible ITC

Details Integrated tax Central tax State/UT tax Cess

A. ITC Available (whether in full or part)

(1) Import of goods 0.00 0.00 0.00 0.00

(2) Import of services 0.00 0.00 0.00 0.00

(3) Inward supplies liable to reverse charge (other than 1 & 2 above) 0.00 0.00 0.00 0.00

(4) Inward supplies from ISD 0.00 0.00 0.00 0.00

(5) All other ITC 0.00 5029.93 5029.93 0.00

B. ITC Reversed

(1) As per rules 38,42 & 43 of CGST Rules and section 17(5) 0.00 0.00 0.00 0.00

(2) Others 0.00 0.00 0.00 0.00

C. Net ITC available (A-B) 0.00 5029.93 5029.93 0.00

(D) Other Details 0.00 0.00 0.00 0.00

(1) ITC reclaimed which was reversed under Table 4(B)(2) in earlier tax 0.00 0.00 0.00 0.00

period

(2) Ineligible ITC under section 16(4) & ITC restricted due to PoS rules 0.00 0.00 0.00 0.00

5 Values of exempt, nil-rated and non-GST inward supplies

Nature of Supplies Inter- State supplies Intra- State supplies

From a supplier under composition scheme, Exempt, Nil rated supply 0.00 0.00

Non GST supply 0.00 0.00

5.1 Interest and Late fee for previous tax period

Details Integrated tax Central tax State/UT tax Cess

System computed 12.38 - - -

Interest

Interest Paid 12.38 0.00 0.00 0.00

Late fee - 75.00 75.00 -

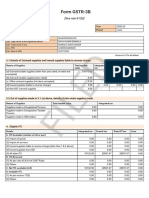

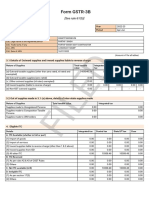

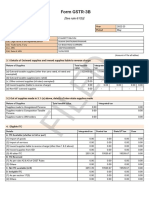

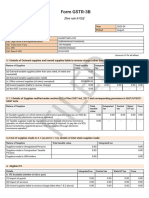

6.1 Payment of tax

Description Total tax Tax paid through ITC Tax paid in Interest paid in Late fee paid in

tax

Central tax

State/UT tax

Cess

payable

(A) Other than reverse charge

Integrated

(B) Reverse charge

Integrated

0.00

18386.00

18386.00

0.00

0.00

Integrated

tax

-

0.00

0.00

0.00

ED

Central

tax

5030.00

-

-

-

0.00

State/UT

tax

-

5030.00

-

-

0.00

Cess

-

-

0.00

-

cash

0.00

13356.00

13356.00

0.00

0.00

cash

-

12.00

0.00

0.00

0.00

cash

-

75.00

75.00

FIL

tax

Central tax 0.00 - - - - 0.00 - -

State/UT tax 0.00 - - - - 0.00 - -

Cess 0.00 - - - - 0.00 - -

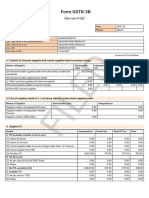

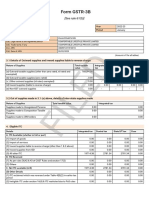

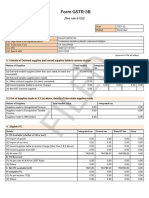

Breakup of tax liability declared (for interest computation)

Period Integrated tax Central tax State/UT tax Cess

January 2023 0.00 18386.00 18386.00 0.00

Verification:

I hereby solemnly affirm and declare that the information given herein above is true and correct to the best of my knowledge and belief and

nothing has been concealed there from.

Date: 23/02/2023 Name of Authorized Signatory

ANBALAGAN SEMBIAN

Designation /Status

proprietor

You might also like

- Billing Error Notice TemplateDocument4 pagesBilling Error Notice TemplateRoberto Monterrosa93% (27)

- 2 Broke Girls PDFDocument35 pages2 Broke Girls PDFnjNo ratings yet

- Sarosh Soli - UK VISA APPOINTMENTDocument1 pageSarosh Soli - UK VISA APPOINTMENTVM GlobalNo ratings yet

- GSTR3B 01bropg6451k1zp 032023Document2 pagesGSTR3B 01bropg6451k1zp 032023Ishtiyaq RatherNo ratings yet

- GSTR3B 52022Document2 pagesGSTR3B 52022Logesh Waran KmlNo ratings yet

- GSTR3B 29aavpv0973c1z3 032022Document2 pagesGSTR3B 29aavpv0973c1z3 032022Hemanth KumarNo ratings yet

- GSTR3B 03alnpk4728k1zv 072021Document2 pagesGSTR3B 03alnpk4728k1zv 072021Harish VermaNo ratings yet

- GSTR3B 32almph4268c1zc 122021Document2 pagesGSTR3B 32almph4268c1zc 122021efile.hco3No ratings yet

- Filed: Form GSTR-3BDocument2 pagesFiled: Form GSTR-3Bkrishswat7912No ratings yet

- GSTR3B 36aoupg4539a1zx 062022Document2 pagesGSTR3B 36aoupg4539a1zx 062022abhi ramNo ratings yet

- GSTR3B 27bjlpa8487j1zm 092022Document2 pagesGSTR3B 27bjlpa8487j1zm 092022SHAIKH MOINNo ratings yet

- GSTR3B 37adcfs8516j1zp 022019Document2 pagesGSTR3B 37adcfs8516j1zp 022019ravi kiranNo ratings yet

- GSTR3B 08absfa0925d1zk 032022Document2 pagesGSTR3B 08absfa0925d1zk 032022YOGESH JOSHINo ratings yet

- GSTR3B 33alapv4527e1za 012020Document2 pagesGSTR3B 33alapv4527e1za 012020hakkim satharNo ratings yet

- Filed: Form GSTR-3BDocument2 pagesFiled: Form GSTR-3Bkrishswat7912No ratings yet

- Filed: Form GSTR-3BDocument2 pagesFiled: Form GSTR-3Bkrishswat7912No ratings yet

- GSTR3B 33aespt6851j1zr 102023Document3 pagesGSTR3B 33aespt6851j1zr 102023Vignesh KrishnamoorthyNo ratings yet

- Apr June 3Document2 pagesApr June 3ROHAN AGGARWALNo ratings yet

- GSTR3B 33aespt6851j1zr 092023Document3 pagesGSTR3B 33aespt6851j1zr 092023Vignesh KrishnamoorthyNo ratings yet

- GSTR3B 29aaicc9487a1zb 012023Document2 pagesGSTR3B 29aaicc9487a1zb 012023krishswat7912No ratings yet

- GSTR3B 08absfa0925d1zk 122021Document2 pagesGSTR3B 08absfa0925d1zk 122021YOGESH JOSHINo ratings yet

- GSTR3B 36aoupg4539a1zx 052022Document2 pagesGSTR3B 36aoupg4539a1zx 052022abhi ramNo ratings yet

- GSTR3B 36aoupg4539a1zx 042022Document2 pagesGSTR3B 36aoupg4539a1zx 042022abhi ramNo ratings yet

- RecordstatementDocument18 pagesRecordstatementSanthoshNo ratings yet

- GSTR3B 09aaeci2181f2zn 042022Document2 pagesGSTR3B 09aaeci2181f2zn 042022Pushan SrivastavaNo ratings yet

- GSTR3B 36bmypp9150m1zx 062022Document2 pagesGSTR3B 36bmypp9150m1zx 062022RAJESH DNo ratings yet

- GSTR3B 09abwpb8808n1zt 052022 PDFDocument2 pagesGSTR3B 09abwpb8808n1zt 052022 PDFManeesh VermaNo ratings yet

- GSTR3B 33aespt6851j1zr 072023Document3 pagesGSTR3B 33aespt6851j1zr 072023Vignesh KrishnamoorthyNo ratings yet

- Recordstatement 2Document18 pagesRecordstatement 2SanthoshNo ratings yet

- GSTR3B 36fjypk4832a1zy 072022Document2 pagesGSTR3B 36fjypk4832a1zy 072022saiakhiltataNo ratings yet

- GSTR3B 27CSQPM9328F1Z5 122023Document2 pagesGSTR3B 27CSQPM9328F1Z5 122023Tanveer MansooriNo ratings yet

- GSTR3B 06aehpa7043l1zk 012022Document2 pagesGSTR3B 06aehpa7043l1zk 012022NITISH JAINNo ratings yet

- GSTR3B 24bedpj9895q1zi 032023Document2 pagesGSTR3B 24bedpj9895q1zi 032023hetalahir149No ratings yet

- GSTR3B 27auspp7198j1zh 052022Document2 pagesGSTR3B 27auspp7198j1zh 052022Aman PanwarNo ratings yet

- May GSTR3B - 27AAJCB3358E1ZP - 052023Document2 pagesMay GSTR3B - 27AAJCB3358E1ZP - 052023calmincometax36No ratings yet

- GSTR3B 19azwpd2404n1zx 062023Document3 pagesGSTR3B 19azwpd2404n1zx 062023ho.ubiquityNo ratings yet

- Jan 23-24Document3 pagesJan 23-24crmfinance.tnNo ratings yet

- GSTR3B 37adcfs8516j1zp 012018Document2 pagesGSTR3B 37adcfs8516j1zp 012018ravi kiranNo ratings yet

- GSTR3B 37adcfs8516j1zp 032020Document2 pagesGSTR3B 37adcfs8516j1zp 032020ravi kiranNo ratings yet

- GSTR3B 29aavpv0973c1z3 122021Document2 pagesGSTR3B 29aavpv0973c1z3 122021Hemanth KumarNo ratings yet

- GSTR3B 33aeqpy3870g1zy 062023Document3 pagesGSTR3B 33aeqpy3870g1zy 062023Durai kannuNo ratings yet

- GSTR3B 18agppi9704c1za 022023Document3 pagesGSTR3B 18agppi9704c1za 022023ABDUL KHALIKNo ratings yet

- GSTR3B 01aagff0848r1z8 092023Document2 pagesGSTR3B 01aagff0848r1z8 092023Ishtiyaq RatherNo ratings yet

- GSTR3B 19ahqpb1859d1za 092021Document2 pagesGSTR3B 19ahqpb1859d1za 092021Aditya MitraNo ratings yet

- GSTR3B 33anppm7249d1zt 052023Document3 pagesGSTR3B 33anppm7249d1zt 052023Logesh Waran KmlNo ratings yet

- GSTR3B 09aaeci2181f2zn 062022Document2 pagesGSTR3B 09aaeci2181f2zn 062022Pushan SrivastavaNo ratings yet

- GSTR3B 36bmypp9150m1zx 072022Document2 pagesGSTR3B 36bmypp9150m1zx 072022RAJESH DNo ratings yet

- GSTR3B 19bahph8899e1z2 022023Document3 pagesGSTR3B 19bahph8899e1z2 022023Pawan KanuNo ratings yet

- GSTR3B 33aeqpy3870g1zy 082023Document3 pagesGSTR3B 33aeqpy3870g1zy 082023Durai kannuNo ratings yet

- Aprli 22 GSTR3BDocument2 pagesAprli 22 GSTR3Bkishan bhalodiyaNo ratings yet

- GSTR3B 23aywpp5389h1zl 122023Document2 pagesGSTR3B 23aywpp5389h1zl 122023riturajasati4205No ratings yet

- GSTR3B 23apjps3159l1zg 032022Document2 pagesGSTR3B 23apjps3159l1zg 032022sales candoNo ratings yet

- GSTR3B 07ahepk2148n1z5 052023Document3 pagesGSTR3B 07ahepk2148n1z5 052023PKCL027 Rishabh JainNo ratings yet

- GSTR3B 03lmypk3229a1zy 032023Document2 pagesGSTR3B 03lmypk3229a1zy 032023nstradingcompany2023No ratings yet

- GSTR3B 29aajcb9687j2zp 122022Document3 pagesGSTR3B 29aajcb9687j2zp 122022nithinganesh174No ratings yet

- GSTR3B Matha MobilesDocument2 pagesGSTR3B Matha MobilesBRIGHT TAX CENTERNo ratings yet

- $RYYV1H3Document2 pages$RYYV1H3akxerox47No ratings yet

- GSTR3B 10BCSPC5671G1ZQ 062022Document2 pagesGSTR3B 10BCSPC5671G1ZQ 062022Kishan JaiswalNo ratings yet

- GSTR3B 19bahph8899e1z2 122022Document3 pagesGSTR3B 19bahph8899e1z2 122022Pawan KanuNo ratings yet

- GSTR3B 33aespt6851j1zr 082023Document3 pagesGSTR3B 33aespt6851j1zr 082023Vignesh KrishnamoorthyNo ratings yet

- GSTR3B 03cuzpr6190r2z9 012024Document3 pagesGSTR3B 03cuzpr6190r2z9 012024kunal3152No ratings yet

- GSTR3B 33aeqpy3870g1zy 112023Document3 pagesGSTR3B 33aeqpy3870g1zy 112023Durai kannuNo ratings yet

- GSTR1 33aqgpm9985j1z4 042022Document4 pagesGSTR1 33aqgpm9985j1z4 042022hakkim satharNo ratings yet

- GSTR3B 33blpps8304e1zy 012024Document3 pagesGSTR3B 33blpps8304e1zy 012024hakkim satharNo ratings yet

- GSTR1 33aqgpm9985j1z4 012023Document4 pagesGSTR1 33aqgpm9985j1z4 012023hakkim satharNo ratings yet

- Nirmala Axic BankDocument3 pagesNirmala Axic Bankhakkim satharNo ratings yet

- GSTR3B 33CVMPS7640R1ZK 032023Document2 pagesGSTR3B 33CVMPS7640R1ZK 032023hakkim satharNo ratings yet

- GSTR3B 33CVMPS7640R1ZK 022023Document2 pagesGSTR3B 33CVMPS7640R1ZK 022023hakkim satharNo ratings yet

- Asmt 10 Asian Steels 19-20Document3 pagesAsmt 10 Asian Steels 19-20hakkim satharNo ratings yet

- He - Global - Vi-18hec 606Document16 pagesHe - Global - Vi-18hec 606hakkim satharNo ratings yet

- Marketing Strategies of Samsung in PollachiDocument1 pageMarketing Strategies of Samsung in Pollachihakkim satharNo ratings yet

- Research On GDPR and CCPADocument5 pagesResearch On GDPR and CCPAdumps sumpsNo ratings yet

- Pta Reports: "A Quarter Jo Urney"Document14 pagesPta Reports: "A Quarter Jo Urney"JanNet D MindmasterNo ratings yet

- Overview of Residential Earthquake Insurance in Missouri (2020)Document21 pagesOverview of Residential Earthquake Insurance in Missouri (2020)KevinSeanHeld100% (1)

- DB Aabgfbbgcjjh0x0E64Document1 pageDB Aabgfbbgcjjh0x0E64Andrea Estefanía Muñoz gálvezNo ratings yet

- BSP Cir. 1075 - Amendments To Regulations On Financial Audit of Non-Bank Financial LnstitutionsDocument39 pagesBSP Cir. 1075 - Amendments To Regulations On Financial Audit of Non-Bank Financial LnstitutionsdignaNo ratings yet

- Labor Relations Module 1Document28 pagesLabor Relations Module 1Harold Garcia100% (2)

- Local Law BookDocument59 pagesLocal Law BookTouseef HamidNo ratings yet

- Off-Spec Fuel Oil Epidemic Preparing For Beyond 2020Document29 pagesOff-Spec Fuel Oil Epidemic Preparing For Beyond 2020Btwins123No ratings yet

- Wholesale BB Rates - Shawal Dhul Qe'daDocument2 pagesWholesale BB Rates - Shawal Dhul Qe'daRyan DarmawanNo ratings yet

- Campaign Period: Terms & Conditions - 2021 Online & Ewallet CampaignDocument9 pagesCampaign Period: Terms & Conditions - 2021 Online & Ewallet CampaignJenny LeeNo ratings yet

- Om-02-631 (Med 400P Opm)Document6 pagesOm-02-631 (Med 400P Opm)Phu Duc LeNo ratings yet

- CONSTITUTIONAL PROVISIONS For EducationDocument18 pagesCONSTITUTIONAL PROVISIONS For EducationCheril DRNo ratings yet

- The Register of Deeds Rizal vs. Ung Siu Si TempleDocument3 pagesThe Register of Deeds Rizal vs. Ung Siu Si TempleDorky DorkyNo ratings yet

- Eviction NoticeDocument2 pagesEviction Noticeparveensaini2146No ratings yet

- 1 Industrial Personnel & Management Services, Inc. (Ipams) v. de VeraDocument1 page1 Industrial Personnel & Management Services, Inc. (Ipams) v. de VeraEloise Coleen Sulla PerezNo ratings yet

- Affidavit of Self AdjudicationDocument2 pagesAffidavit of Self AdjudicationJames Decolongon100% (1)

- Media, The Fourth Pillar of Democracy: A Critical Analysis: Pratiyush Kumar & Kuljit SinghDocument9 pagesMedia, The Fourth Pillar of Democracy: A Critical Analysis: Pratiyush Kumar & Kuljit SinghifraNo ratings yet

- Toolkit On Insolvency and ArbitrationDocument26 pagesToolkit On Insolvency and ArbitrationSamriddh SharmaNo ratings yet

- Family Law TopicDocument6 pagesFamily Law TopicAman SharmaNo ratings yet

- 2016 Unreported High Court Civil Judgment IndexDocument168 pages2016 Unreported High Court Civil Judgment IndexSiteketa Bonifasia SihakoNo ratings yet

- SACI® 6400 - Daubert Chemical Company, Inc.Document2 pagesSACI® 6400 - Daubert Chemical Company, Inc.Long An ĐỗNo ratings yet

- Tulsa Massacre ArticleDocument17 pagesTulsa Massacre ArticleKirk HartleyNo ratings yet

- PNCC Vs NLRC, GR 248401, June 23, 2021Document7 pagesPNCC Vs NLRC, GR 248401, June 23, 2021Key ClamsNo ratings yet

- Assignment of DesignsDocument3 pagesAssignment of DesignsSimran BhattacharyaNo ratings yet

- Spouses Jesus L. Cabahug and Coronacion M. Cabahug, Petitioners, National Power CORPORATION, RespondentDocument14 pagesSpouses Jesus L. Cabahug and Coronacion M. Cabahug, Petitioners, National Power CORPORATION, RespondentLarssen IbarraNo ratings yet

- All Civil Drafting Documents-1Document97 pagesAll Civil Drafting Documents-1Karen MainaNo ratings yet

- Authorisation Letter For GERMANDocument7 pagesAuthorisation Letter For GERMANGuru MoorthiNo ratings yet