Professional Documents

Culture Documents

CHP 3 MCQ

Uploaded by

skynemesis3Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CHP 3 MCQ

Uploaded by

skynemesis3Copyright:

Available Formats

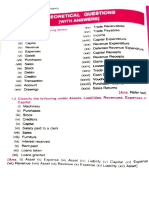

Accounting Equation

988919t(D)

Capita QUESTIONS

(Higher Order Thinking Skills (HOTS) Questions)

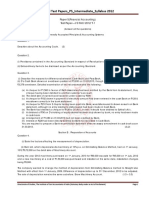

Q. 1. Do you think that a

9gT8d) jo (o)

nitaso908 doidW (ui)

transaet ion can break the Acounting Fuation2idsil (o)

0 and Ans. No, a transaction can only chnnge the

Accounting quation hut cannot break

eapi0,000ta Q. 2. Goods costing ? 10,000 have been

be shown in the

Accounting Equation?

sold for cash at 25% profit. How wili the

Ans. lncrease cash by ? 12,500; Decrease stock

Q. 3. The capital of a business is

tránsactio

by 10,000: and Increase capital by

2.500.

2,00,000 and outside liabilities are 1,50,000. Caleulate

the total assets of the business.

Ans. 3,50,000 (Capital + Outside Liabilities = Assets).

Q. 4. If total assets of abusiness are

ofts Ans.

liabilities.

1.30,000 and capital js 80.000. calculate the outaide

50,000 (Outside Liabilities = Total Assets - Capital).

Q. 5. If total assets of the business are 4,50,000 and outside liabilities are 2,00,000,

Of calculate owner's equity. (MSE Chandigarh)

Ans. Assets = Owner's Equity + Liabilities

4,50,000 = Owner's Equity + 2,00,000

000 Owner's Equity =2,50,000.

Q. 6. Jaspal has purchased a car for 5,00,000 which he got financed from a Bank to the

an extent of 4,00,000. How will it be shown in the accounting equation?

Ans. 1,00,000 will be deducted from Asset (Cash/Bank): Asset (Car) will be shown at

I 5,00,000 and Bank Loan (on the Liabilities side) will be shown at 4,00,000.

a Q7. Amit has incurred an expense of 5,000 towards repairs. However, the amount is yet

to be paid. How will it be shown in the accounting equation?

n

Ans. It is an outstanding expense. It will be shown in the accounting equation as deduction

from capital and as an Outstanding Expense on the Liabilities side.

Q. 8. Show the accounting equation if there are no liabilities.

Ans. Assets = Capital.

Multiple Choice Questions (MCQs)

Select thecorrect alternative:

) Which of the following equation is correct?

(a) Assets + Capital = Liabilities (b) Assets - Liabilities = Capital

(c) Assets + Liabilities = Capital (d) None of these.

(ii) Which of the following is correct?

Assets Liabilities Capital

() 7,85,000 ?1,25,000 { 6,60,000

(6)R 8,20,000 2,80,000 R11,00,000

(e) 9,55,000 ? 1,15,000 7 8,20,000

T6,54,000 ? 1,12,000.

(d) 5,42,000

5.16 Double Entry Booki

(i) Amount withdrawn by proprictor lor personnl use will ... (Cash and Capital. CBSEX

(a) Increase (b) Decrease

(c) Not Change (d) Nonc of these.

(i) Which accounting equation is incorrect out of the

following?

(o) Liabilitics = Assets Capital (b) Assets = Liabilities -

(c) Captal = Assets - Capital

Liabilities (d) Assets = Liabilities + Capital

() The liabilities of a firm are

3,000; the capital of the proprietor is ?

assets are 7,000. The toa.

(a)7.000. (6) 10,000.

(c) 4,000.

(d) None of these.

() X commenced business on 1st

2014, his April, 2013 with a capital of ?

assets were worth 8,00,000 and 6,00,000. On 31st Mark

(a) 7,50,000 liabilities? 50,000. Find out his closing capital

(c) 5,50,000 (6) 2,00,000

(vù) An increase in one asset is (d) None of these.

(a) accompanied by (KVS,

Decrease in another asset.

(c)

Increase in capital. (6) increase in a

() All of these.

liability.

(viii) Decrease in one

(a)

liability may lead to

Decrease in an asset.

(c) Either (o) or (6). (6) Increase in another

(ix) (d) None of these. liability.

Purchase of machine by cash means

(a) Decrease in asset

and decrease in

(6) Increase in

asset and decrease in lhability.

(c) Increase in asset asset.

and decrease in iability.

(d) Decrease in

asset and increase in

(c) Payment to a creditOr means capital.

(a) Increase in

asset and decrease in

(b) Decrease in

asset and liability,

(c) decrease in liability.

Decrease in asset and increase

(d) Increase in asset and increase inin liability.

liability,

[Ans.: () (6); (i0) (a); (iü) (b): (iv) (b): (o) (b): (v) (o:

ojective Type Questions (vii) (d); (vii) (c): (ix) (6); (*) (6).

State

income. (Delhi

Asa ve sales corret)

tadded

isWh ot

credited correct? proprietor's

payment. cheque.In Entity

Keeping-CBSEY

lehitcd

gone

why? chairs. the it is an owner. lhability. increase

in

liability.

has credited. madeIs business or

capital. it Account

asset.

Business

Ig Why?which

cash andofissue and yet Is its

as8t cash Account. capital?from in in in

Book cash, credit tables not proprietor's

proprietor'sLiabilities increase decrease

credited. cash, by is has of entity decrease

Entry debited? asset

n

increase

for

youmade recorded. because

Double benefit in in payment

of Ajay Liabilities and

incurred will an sales

credited.been becáuse in liability

distinct an a (6)

an a

is

Account. be

the accountbeingagainstwhy? the the balance

is

same (6) (d) (d)

an must has

QUESTIQuestions)

ONS and received against is

expense is

Account

payment and

in by

increase

liability earned

the Account

or

are and

Asset.assetAccount,

it Account

Which advance

treated in asignify samecapital

separate equity.

asset balance Capital

Bank a

whyinincreasehas credited.an chegue.

because as an profit may creditand

Liability

firm or an Cash receivedbe.treated

reduced. be means a proprietor's

(HOTS)nsset, cashof adyance net

a

signifies

balance

in is

liability )

(MCQs)

the purchase

Thus, credited increase and business liability.

an means means is in purchased aissuing furniture, business

Skillsof ain liability decreased. is thisshould because credit

the

debit asset, asset.

for the

purchaseincrease bank always which Questions

concept,

credit

Thinking asset liability On by be received

should the A of alternative:

correct in in in in

thus, asset. met will in correct. rules increase

increase decrease

increase

an is in

balance by correct balance on and the (ii)

Credit

means

an made,asset has is Account dealer earned

howadvance side (i)

Debit

means

Orderarecord

ofPurchasein

record

Increase an 1s liability capital.

the side.

Credit

Ans. the debitto Choice

an

3.

Q. cash not

a opinion

result, is Acredit the are According

of

an an an a

be :WhenCash it is

(Higher

To i.e., Bank Ajay, The ProfitYes, it Name WhyRules

To to

A No, (Multiple (a) (c) (a) (c)

1. Ans, qZ.Ans. Ans. Q.4.Ans. 5. the

Select

6.14 Q. Ans. Q.6. Ans. 7. Ans.8. Q.9.Ans.

Q. Q. Q.

(c).]

6.15 ()

(a);

(in)

(b);

Received

Discount

DiscountAccount.

Allowed Liability Account.

Ale Capital

(6) (viil)

to these.

ofNone these.

ofNone

theae

ofNonecredited Realthese. Real

Loaa Account.

(b) Account. (6) these.

these. Account.

Real

Alc

Capital

(h) (b);

Alc

Cash & of of of (vii)

Profit None None Nonebalance?

ia (a);

proprietor

(hy (d) (d) (d) (b) (d) (d) (6) (d) (b) (d) (d) (vi)

credit (a);

to ()

debited the as (c);

hy a shown

has

business (iv)

ond

Credit is accounts

is a (6);

cnsh Account isAccount (iüi)

from

ofDebit for (a) Account.

Nominal

(c) a Acount.

Account.

Personal (a) Account.

Nominal

(c)

Personal Account.

Personal

(a) Account.

Nominal Outward

(c) followingCarriage

(c) Account.

Revenue

(c) (c)(6):

(a) Account.

Liability

Account.

Revenue

Rnm is a Inward

Carriage Account.

Capital

(a)

cashA/e.

Drawings

(a) Account is Capital Creditors (i)

a account

Rules to

Accounting is (a);

goods Ale.(c) of

Sales (c) account

Ae.

Cash the

Withdrawal of ()

Procedures

g Ranm.

(a) Drawings Goodwill of

of Which Balance Sundry [Ans.:

ale Bank

(a)

(iii) i) () (v) (vi) (viüi) (ix) (x)

Ouestions (MCQs))

Multiple Choice

allernative:

Select the correct when goods are sold

prepared (6) onCash.

memo is

() Cash

(a) oncredit. (d) None of these.

Both(a) and (6). goods

(c)

source voucher 1or purchaser of

is a

(i) Cash memopurchases. (6) for credit purchases.

(a) for cash (d) for cash sales.

sales.

(c) for credit goods

sourceevoucher for

seller of'goods

(üi) Invoice is a (b) for credit purchases.

sales.

(a) for cash (d) for cash purchases.

(c) for credit sales.

for purchaser of goods

(iv) Invoice is a source voucher

(6) for cash sales.

(a) for cash purchases.

(c) for credit sales.

(d) for credit purchases.

from

(v) Accounting voucher is prepared

(a) source voucher. (6)) Jounal entry.

(c) Both (o) and (b). d) None of these.

(vi) If purchaser of goods returns them, he will prepare

(a) Credit Note. (6) Debit Note.

(c) Both (a) and (b). (d) None of these.

(vii) If seller receives back the goods sold, he will prepare

(a) Credit Note. (6) Debit Note.

(c) Both (a) and (6). (d) None of these.

(vii) Voucher is prepared for

(a) Cash and Credit purchases. (6) Cash and Credit sales.

(c) Cash received and paid. (d) All of these.

origin of Transactions--Source Documents ond Preparation of Vouchers 7.15

(ix) Cash Memo is

(a) a source voucher. (b) anaccounting voucher.

(c) Neither (a) nor (6). (d) Both (a) and (b).

(r) Invoice is a source voucher for

(a) Cash purchases. (6) Credit purchases.

(c) Both (a) and (b). (d) Neither (a) nor (b).

(x) Books of Account are written on thebasis of

(a) Source Document. (6) Accounting Vouchers.

(c) Both (a) and (b). (d) None of these.

(ri) Credit Note is prepared

(a) when credit is given to the account.

(6) when debit is given to the account.

(c) Both (a) and (b).

(a) None of the above.

(i) When goods are sold on credit, the seller prepares

(a) Cash Memo. (6) Invoice.

(c) Accounting Voucher. (d) None of these.

(riu) When goods are purchased against cash, the purchaser will get

(a) Cash Memo. (6) Invoice.

(c) Accounting Voucher. () None of these.

(zu) Transfer vouchers are prepared to record

(a) cash transactions. (6) non-cash transactions.

(c) Both (a) and (b). (d) None of these.

(cui) Credit purchase of furniture is recorded through

(a) Transfer voucher, (b) Cash voucher.

(c) Debit voucher. (d) Credit voucher.

[Ans.: () (b); (i1) (a); (iüi)(c); (iv) (d); (v) (a); (vi) (6); (vi) (a): (viim) (d);

(ix) (a); («) (b); (*i) (b); (xii) (a); (xiii) (b); (xiv) (a); (u) (6): (rvi) (a).]

Objective Type Questions)

I. State whether the following statements are True or False:

) Credit Vouchers are the documentary evidence of the cash payments.

() Transfer Vouchers are prepared to record the non-cash transactions.

sold for cash.

( ) Cash Memo is prepared by the seller when the goods are

having taken place.

(0) AVoucher is a documentaryevidence of the businesstransactions

ade in the bank

donation?

and oftime

entry.secondary

entry

secondary cash Alc. to

the credited

Received

at giving

filled Journalising. Donation

Ac.

6)

of Balancing.

b) is Capital

(6)

Ale.

book ld

Costing. on Alc. Stock

Discount (b)

Cash (d)

Alc. proprietor(d)

Bank

Alc.

is (d)

Rulig.

(d)

both Journal credited

a called

(6) (6) () to

the Journalis be debited the

in will by

Column accounts is business

entry. a cash

in

entry. transaction for

primary Folio) from

following

alternative: final Ram

called Ledger (a)

Journalising. (c)

Purchases

Alc. cash

to (a)

Dravwings

Alc.

of of of

is bookbook (c) of

Posting. (a) Transfer.

(c)

Posting. the (a)

Cash

Alc. goods Sales

(c)

Alc. WithdrawalAlc.

(c)

Cash

Jourmal (i.e., Recording

correct of Ram.

(a)

a a L.F. Which of

(a) (c) Sale

the

(i) (i) (ui)

Select (iv) (u) (vi)

20%. 10,000

Discount

will Amar? normal fiom (c); (c).]

8.45

(vi) (xii)

Acrount received

of with from (6): (b);

Discount The

Trade

paid respectively3.000

use.

(v) (ri)

Purchases Alc. was (a);

20%Anil this? (a);

Trade own Recovered rupee (iv)

of to (r)

leasdavs. his

record credited

less credited (d) purchase

300.900.

40,000, (b); (d);

cach period.

30 from 1,000. 1,500. a

Alc.

Debtors

(d) (iüi)

cach correctly Debts in (ix)

?(/) 50 within

60,000.

40),000 40,000, 1,500. are (6) 14,000.

paise 10,000.

50

a davshe cash 3,000.3,000.

stock 1,000.

by

(c): (a);

will 3,000.3,000. by by received

Bad 70 debited (ii) (vii)

0 made30 record from would Alc

Pens ? Alc ? insolvent. (a);

Pens (h) afterAccount.

(b) by by by by (b) (d)

to by by Alc Alc 1,000 Ale Purchases

Purchases Alc (i) (b);

by is

Roller entries now be

Gel

Roller amount,

pavment entryAmarAlc Cash 1,500. Sales Drawings [Ans.:

(vii)

debited Received Purchase

and will

Gell Purchases ?costing Journal

became

correct

Cr. Cr. Cr. Cr. Cr. Account

balance off Alc.

Addbe Addif is

will Discount

and Cr. and goods goods andand and Cr written Income 20,000

1Discount is following

1,0(00 1,000 Alc Cr. and Alc

(c) following

1,200.

40,000, Alc Ale Alc and Debts

Account and Obj

Qu

Typ

tookthe A/c.

Alc Purchases

Nil.

40,000, and

Purchases Drawings

DrawingsAle earlier Miscellaneous

Drawings

purchased

Anil purchased,

daysand of owed Bad

estate.

his

45,000. Cash

50,000. the AmarCash trader

pricethe Sales Debts 20,000.

?(a) 6,000.

Purchases 30 debited Debts ?(c)

of of who

3% Bad

Anil with1n WhichDr. Dr. Dr. Dr. soleselling WhichDr. Dr. Dr. Dr. Lalit,

and Bad

(a) (c) () be (a) (a) (6) (c) (d) A (a) (6) (c) () (a) (c)

Journal(vi) (ix) (x) (ci) (3ii)

transartions, ledger

is

called

issecond

stae

transar

recorded

the

of accounts the

(Posting) to

Financial

Statements. Journal

ledger maintained.

Transfer

Trial

Balance.

the the

maintained.

Statements.

from Costing.

maintained.

maintained. (b)

Posting.

is are

books

Balance. transactions

Accounts

these are

Financial

(6) (d) (a)

Journal.

in Ledger. areare Accounts

transactions Trial from Nominal

Accounts

Accounts

(MCQs) the

means

in in in in prepared transferring

transactions

transactions

transactions

transactions which Nominal

of stage. and

Recording Questions

transaction Nominal

Personal

first

the alternative: in

is Personal

and (a)

Journalising.

Account book (c)

Balancing.

Vouchers. of

entering

entering

entering (c) a andand Personal

enteringJournal. process

Choiceof

is Real Real,

Stage

Recording

of correct

Posting Ledger LedgerReal

The

Multiple (a) (6) (C) (a) (a) (a) (b) (c) (d)

the

() (ii) (iüi) (iv)

Seleci

9.17

Ledger

(v) What typeof Ledger Aceontsare not carried torwnrd to nexi year?

(a) PersOnal Acvonts tb) Real Accounta

(c) Nominal Acounts (d) Al of these

(v) What type of followng accounts will have debit balanee only?

(a) Personal Aceonts (b) Renl Accounts

(c) Nominall Acunts () Alof these.

(rin HoW many nccounts are affected in a transaction?

(a) Omly one (b) Only two

(c) A least two (d) 'T'wo or three

( ) When goods are lost by fire then LOSs of (Goods hy Fire Account is debited with

(a) Cost of goods sold.

(b) Cost of goods sold plus Gross Profit.

(c) Cost of goods sold less Gross Profit.

(d) Cost of goods purchased.

(ix) Which of the following expense is not a revenue expense?

(a) Salary (b) Electricity

(c) Water (d) Repair of second-hand machinery purchased

[Ans.: () (6); (ii) (c); (iü) (c); (iv) (b); (u) (c); (vi) (b);

(vii) (c); (viii) (d); (ix) ().]

You might also like

- Let's Practise: Maths Workbook Coursebook 6From EverandLet's Practise: Maths Workbook Coursebook 6No ratings yet

- (Ri) Trade Payables: 1.1 Explain The Tollowing TermsDocument7 pages(Ri) Trade Payables: 1.1 Explain The Tollowing TermsMurali KrishnaNo ratings yet

- Isc Mock 2Document14 pagesIsc Mock 2anshikajain3474No ratings yet

- Master Questions, Advance Level Questions and Additional Questions-Chapter 4Document18 pagesMaster Questions, Advance Level Questions and Additional Questions-Chapter 4manmeet0001No ratings yet

- Basics Practice QuestionDocument30 pagesBasics Practice Questiontalha ShakeelNo ratings yet

- Basics-Practice QuestionDocument10 pagesBasics-Practice Questiontalha ShakeelNo ratings yet

- Adobe Scan Jan 30, 2023Document6 pagesAdobe Scan Jan 30, 2023Karan RajakNo ratings yet

- Accounting - Text & Cases - 13 Edition Basic Accounting Concepts: The Balance SheetDocument7 pagesAccounting - Text & Cases - 13 Edition Basic Accounting Concepts: The Balance SheetV Hemanth KumarNo ratings yet

- Instruction: 1. Closed Book Exam 2. Use Calculator For All Calculations Use of Laptop/Mobile Is Not AllowedDocument2 pagesInstruction: 1. Closed Book Exam 2. Use Calculator For All Calculations Use of Laptop/Mobile Is Not AllowedPalak MendirattaNo ratings yet

- FR - QuestionsDocument8 pagesFR - Questionsrocks007123No ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument31 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementRonak ChhabriaNo ratings yet

- Financial Accounting-Iii - HonoursDocument7 pagesFinancial Accounting-Iii - HonoursAlankrita TripathiNo ratings yet

- HintDocument6 pagesHintAppleNo ratings yet

- P8 MTP 1 For Nov 23 Answers @CAInterLegendsDocument18 pagesP8 MTP 1 For Nov 23 Answers @CAInterLegendsraghavagarwal2252No ratings yet

- Internal Reconstruction - HomeworkDocument25 pagesInternal Reconstruction - HomeworkYash ShewaleNo ratings yet

- Accountancy Worksheet 2020-21: Bright Riders School Abu DhabiDocument4 pagesAccountancy Worksheet 2020-21: Bright Riders School Abu DhabiwafaNo ratings yet

- Liquidity Ratios - Practice QuestionsDocument14 pagesLiquidity Ratios - Practice QuestionsOsama SaleemNo ratings yet

- Financial Reporting & Financial Statement Analysis Paper - Dse 6.1A FM - 80 Group - A (5x3 15)Document5 pagesFinancial Reporting & Financial Statement Analysis Paper - Dse 6.1A FM - 80 Group - A (5x3 15)tanmoy sardarNo ratings yet

- Paper2 Set2 SolutionDocument7 pagesPaper2 Set2 Solutionadityatiwari122006No ratings yet

- SEM 6 - 10 - BCom - HONS - COMMERCE - DSE 61A - FINANCIAL REPORTING AND FINANCIAL STATEMENT ANALYSIS - 10297Document5 pagesSEM 6 - 10 - BCom - HONS - COMMERCE - DSE 61A - FINANCIAL REPORTING AND FINANCIAL STATEMENT ANALYSIS - 10297Aaysha AgrawalNo ratings yet

- June 2018Document2 pagesJune 2018peronNo ratings yet

- 1001 Practice QuestionsDocument95 pages1001 Practice QuestionsMohamad El-JadayelNo ratings yet

- Proposed DividebdDocument34 pagesProposed DividebdPiyush SrivastavaNo ratings yet

- Acctg 111 Assign3 ReviewerDocument5 pagesAcctg 111 Assign3 ReviewerChris Jay LatibanNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument23 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementZrake 24No ratings yet

- Financial Analysis TestsDocument25 pagesFinancial Analysis Teststheodor_munteanuNo ratings yet

- Ii Puc AccountsDocument3 pagesIi Puc AccountsShekarKrishnappaNo ratings yet

- Commercial Studies (Sem-2) 2022 Set - 2Document7 pagesCommercial Studies (Sem-2) 2022 Set - 2shrikantNo ratings yet

- PART-B Analysis Test YtDocument8 pagesPART-B Analysis Test YtRiddhi GuptaNo ratings yet

- Accounting IAS Model Answers Series 2 2010Document17 pagesAccounting IAS Model Answers Series 2 2010Aung Zaw HtweNo ratings yet

- Solution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDocument9 pagesSolution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDiane Jones100% (26)

- DocumentDocument4 pagesDocumentTûshar ThakúrNo ratings yet

- CSEC Principles of Accounts June 2015 Paper 1Document14 pagesCSEC Principles of Accounts June 2015 Paper 1Aria PersaudNo ratings yet

- Commerce - Practice Test 17 - Kautilya 2.0 21st JanDocument10 pagesCommerce - Practice Test 17 - Kautilya 2.0 21st Janitika.chaudharyNo ratings yet

- NyayDocument3 pagesNyayJunneth Pearl HomocNo ratings yet

- Bba FM 21Document3 pagesBba FM 21Kundan JhaNo ratings yet

- M.B.A (2021 Pattern)Document63 pagesM.B.A (2021 Pattern)Sahil DhumalNo ratings yet

- Postal Test Papers - P5 - Intermediate - Syllabus 2012Document27 pagesPostal Test Papers - P5 - Intermediate - Syllabus 2012Viswanathan SrkNo ratings yet

- Lesson PlanDocument2 pagesLesson PlanNick PerilNo ratings yet

- Csec Poa June 2007 p1Document10 pagesCsec Poa June 2007 p1Tavia LordNo ratings yet

- Chapter End Test 3accountancyDocument3 pagesChapter End Test 3accountancySwastik Mohanty-XII -H-42No ratings yet

- 12th Cbse Accounts Paper 10 06 2017Document2 pages12th Cbse Accounts Paper 10 06 2017Harpreet Singh SainiNo ratings yet

- Financial AnalysisDocument15 pagesFinancial AnalysisRONALD SSEKYANZINo ratings yet

- Foundation Course Examination: Suggested Answers To QuestionsDocument20 pagesFoundation Course Examination: Suggested Answers To Questionstapwater722No ratings yet

- Answer Key - Rules of Debit and CreditDocument6 pagesAnswer Key - Rules of Debit and CreditVishesh PandeyNo ratings yet

- Chap 6Document27 pagesChap 6Basant OjhaNo ratings yet

- MA Assignment IVDocument16 pagesMA Assignment IVJaya BharneNo ratings yet

- Abm Mock 2Document36 pagesAbm Mock 2ASHUTOSHNo ratings yet

- Time: 3 Hours Total Marks: 100: Printed Pages: 03 Sub Code: KMB103 Paper Id: 270103 Roll NoDocument4 pagesTime: 3 Hours Total Marks: 100: Printed Pages: 03 Sub Code: KMB103 Paper Id: 270103 Roll NoAbhishek ChaubeyNo ratings yet

- Suggested Solutions June 2008Document11 pagesSuggested Solutions June 2008kalowekamoNo ratings yet

- Cash Flow Statement Test Paper IIDocument2 pagesCash Flow Statement Test Paper IIRaman SachdevaNo ratings yet

- Accounting Finance Specialisation 7 6 22Document9 pagesAccounting Finance Specialisation 7 6 22Gourav kunduNo ratings yet

- Accountancy Class 11th (Term I) : Time:90 MinutesDocument5 pagesAccountancy Class 11th (Term I) : Time:90 MinutesImran farhathNo ratings yet

- Worksheet-4 On CFSDocument6 pagesWorksheet-4 On CFSNavya KhemkaNo ratings yet

- MGMT 600 SAMPLE Midterm Exam 1Document9 pagesMGMT 600 SAMPLE Midterm Exam 1Enkhbadral UlaanhuuNo ratings yet

- Lecture 03Document24 pagesLecture 03Bryan Andia LlerenaNo ratings yet

- Age No 5Document126 pagesAge No 5Deeran DhayanithiRPNo ratings yet

- Sample Paper: AccountancyDocument8 pagesSample Paper: AccountancyKhushi GoyalNo ratings yet

- F&AQPmidsem Summer22Document2 pagesF&AQPmidsem Summer22kanika thakurNo ratings yet

- 06 Oct 2020 DIVISLAB NSE Macquarie - ResearchDocument79 pages06 Oct 2020 DIVISLAB NSE Macquarie - ResearchAnupam JainNo ratings yet

- Account Statement: Date Inst No. Debit Credit Particulars BalanceDocument17 pagesAccount Statement: Date Inst No. Debit Credit Particulars BalanceMuhammad Sufyan Imtiaz50% (4)

- B00901573 International EntreprenuershipDocument14 pagesB00901573 International EntreprenuershipVipul NimbolkarNo ratings yet

- Challenges - SKDocument2 pagesChallenges - SKAmirahNo ratings yet

- Endreport Final India2008Document100 pagesEndreport Final India2008Raju GummaNo ratings yet

- BAI Registered Poultry Farms As of February 28 2021Document35 pagesBAI Registered Poultry Farms As of February 28 2021Dave De Los MartirezNo ratings yet

- Fin Tab 42201336a 105458345Document1 pageFin Tab 42201336a 105458345RAJPALNo ratings yet

- New NHB GuidelinesDocument101 pagesNew NHB Guidelinesblue13No ratings yet

- Dissertation Report ON Indian Banking Industry: Prachi Janapitha, Adaspur, Cuttack - 754011, OdishaDocument6 pagesDissertation Report ON Indian Banking Industry: Prachi Janapitha, Adaspur, Cuttack - 754011, OdishaAbhijit MohantyNo ratings yet

- Jindal+Star+Price+List+08 01 24Document1 pageJindal+Star+Price+List+08 01 24marketingabsairtechpvtltd1No ratings yet

- T5 Exercises QuestDocument6 pagesT5 Exercises QuestXin XiuNo ratings yet

- Farm Size Factor Productivity and Returns To ScaleDocument8 pagesFarm Size Factor Productivity and Returns To ScaleAkshay YadavNo ratings yet

- 008987690Document2 pages008987690bbNo ratings yet

- Chap 3Document6 pagesChap 3Triệu Nguyễn Minh100% (1)

- Accelerating Agricultural Productivity Growth PDFDocument266 pagesAccelerating Agricultural Productivity Growth PDFAlways 2810No ratings yet

- Compliance in Garment IndustryDocument11 pagesCompliance in Garment IndustryNICOLE ARIANA RAMOS DIAZNo ratings yet

- ANS KEY of CUSTOM WAREHOUSEDocument3 pagesANS KEY of CUSTOM WAREHOUSEjohn christopher rectoNo ratings yet

- Paper III - Objective III - ALexis Kabayiza - PHD AGBMDocument9 pagesPaper III - Objective III - ALexis Kabayiza - PHD AGBMAlexis kabayizaNo ratings yet

- E18-16 (LO3) Sales With Returns: InstructionsDocument15 pagesE18-16 (LO3) Sales With Returns: InstructionsHappy MichaelNo ratings yet

- Carbon Steel Tee Rails: Standard Specification ForDocument7 pagesCarbon Steel Tee Rails: Standard Specification ForCarlos CmbbNo ratings yet

- Mehsana ZoneDocument4 pagesMehsana ZoneCHETANNo ratings yet

- Poster SertuDocument1 pagePoster Sertuppccs uniklNo ratings yet

- KIPIC. إعلان الشركة الكويتية للصناعات البترولية المتكاملةDocument6 pagesKIPIC. إعلان الشركة الكويتية للصناعات البترولية المتكاملةجهاد موصليNo ratings yet

- A Case Study of Supplier Selection For Lean Supply by Using A Mathematical ModelDocument9 pagesA Case Study of Supplier Selection For Lean Supply by Using A Mathematical ModelstraheelNo ratings yet

- 1 PBDocument16 pages1 PBdavidNo ratings yet

- Contract Farming in India Present Status, Scope, Opportunity, Constraints, Importance and Strategies For It Contract FarmingDocument23 pagesContract Farming in India Present Status, Scope, Opportunity, Constraints, Importance and Strategies For It Contract FarmingMansi Parmar100% (1)

- W CM AssignmentDocument3 pagesW CM AssignmentSandeep DeodharNo ratings yet

- The Chemical Company: PresentsDocument16 pagesThe Chemical Company: PresentsDinesh Adwani100% (1)

- Power Plant Engineering 5Document20 pagesPower Plant Engineering 5Anushree Ghosh100% (1)

- L& T - Students List - 2019 BatchDocument3 pagesL& T - Students List - 2019 BatchAdhithya KiranNo ratings yet