Professional Documents

Culture Documents

Proposal Form

Proposal Form

Uploaded by

cursed.apurvaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Proposal Form

Proposal Form

Uploaded by

cursed.apurvaCopyright:

Available Formats

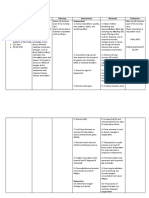

Max Life Insurance Company Limited

Regd. Office : 419, Bhai Mohan Singh Nagar, Railmajra,Tehsil

Balachaur,District Nawanshahr,Punjab-144533 Head Office: 11th

& 12th Floor, DLF Square, Jacaranda Marg,DLF City Phase-II, Proposer / Joint Life Payor

Gurugram-Haryana,122002 Attach RecentPhotograph Attach RecentPhotograph

Non Linked Proposal Form

Proposal Number: 372765735 GO/CA/Broker Code: 869196

Do you have a Max Life Insurance Policy or have currently applied simultaneous policies? Yes No If yes give Policy/Proposal number

Purpose of Insurance Savings Child Future Pension ✔ Protection Tax Benefit

Objective of Insurance E/E MWPA HUF CEIP Keyman Partnership ✔ Individual

Product Solution Affinity Customer Existing Customer

A. PERSONAL DETAILS

✔ Mr LIFE TO BE INSURED (if other than

1. Title Ms Mrs Dr Proposer / Joint Life

proposer)

First Apurva

2. Name Middle

Last Patel

3. Father's / First THAKORBHAI

Husband Name Last PATEL

4. Date of Birth 01-11-1982 (38 years)

5. Gender ✔ Male Female Transgender

6. Nationality ✔ Indian Indian NRI PIO Foreign

NRI PIO ForeignNational

National

6a. Residence for tax purposes in jurisdiction(s) outside India : No

(If Yes then FATCA & CRS-Self Certification Form to be mandatorily completed)

7. Marital Status Single ✔ Married Divorced Widow(er)

High School 12th Pass Graduate ✔

8. Education

Post Graduate Professional

9. Relationship with Proposer / Joint Life Self

CRPF Defence Oil and Natural Gas

10. Industry Type Merchant Marine Mining ✔ Others -

Pharma

11. Organisation Type NA

✔ Salaried Professional Self Employed

12. Occupation / Job Title from Home Self-employed Housewife

Retired Student Others

13.Name of entity / employer Supply Chain

14. Annual Income (Rs.) 25,00,000

15. Is the Life to be Insured / Proposer / Joint Life / Nominee / Payor a Politically Exposed Person? Yes ✔ No

16. NOMINEE DETAILS Nominee 1 (Mandatory) Nominee 2 (Optional) Nominee 3 (Optional)

a. Title Mr ✔ Ms Mrs Dr Master

First Dhvani

b. Name Middle Apurva

Last Patel

c. Date of Birth 24-02-1987

d. Gender Male ✔ Female

e. Percentage 100% % %

f. Relationship with Proposer /Joint Life ✔ Spouse Parents Others

g. Appointee Full Name

(if nominee is under age 18)

h. Appointee relationship to Nominee Spouse Parents Others

i. Appointee Gender Male Female Transgender

A Max Financial Services and MS Joint Venture 1 TRAD_STD_0221_5.5

17. CURRENT RESIDENTIAL ADDRESS

House No./Apt. Name B 103 DHARAM PALACE

Society Road/Area/Sector SHANTIVAN NR NATIONAL

Landmark PARK BORIVALI EAST

Village/Town City/ District Mumbai

Pin Code 400066 State/U.T. Maharashtra Country India

Mobile 1 9833555732 Mobile 2 STD Code Telephone #

E-mail ID apurva.patel@outook.com

18. PERMANENT RESIDENTIAL ADDRESS (optional)

House No./Apt. Name B 103 DHARAM PALACE

Society Road/Area/Sector SHANTIVAN NR NATIONAL

Landmark PARK BORIVALI EAST

Village/Town City/ District Mumbai

Pin Code 400066 State/U.T. Maharashtra Country India

19. Preferred Mailing Address ✔ Current Residential Permanent Residential

✔ English Hindi Punjabi Gujarati Marathi Tamil Malayalam

20. Preferred language of communication

Kannada Oriya Telegu Bengali

21.Do you wish to hold this Policy electronically under e-Insurance? ✔ Yes No

a. e-Insurance Account No. (if available): and Insurance Repository name:

b. Preferred Insurance Repository you would like to have your e-Insurance Account with ✔ CAMSRep Karvy CIRL NSDL

B. COVERAGE INFORMATION -Type of Coverage

Premium Back Sum Assured / Coverage Premium Modal

1. a Base Plan Variant premium Holiday Option GST

Option Income Payout Term Payment Term Premium

Max Life Smart Secure

Life Cover Yes ✔ No Yes No Rs. 1,00,00,000 27 15 1,611.47 290.53

Plus

Coverage Premium Modal

1. b Riders / Optional Benefits Sum Assured GST

Term Payment Term Premium

Modal Premium without GST* and Cess

GST* and applicable Cess 290.53 Total Premium Paid 1,902

1,611.47

*GST shall comprise of CGST, SGST/UTGST or IGST (whichever is applicable) including cesses and levies, if any. All applicable taxes, cesses and levies, as per prevailing

laws, shall be borne by you.

c Death Benefit Option Smart Secure Life Cover d. Life Stage Benefit Yes ✔ No NA

Bonus Option

(Not Applicable for plans that offer Paid to Policy holder Premium Offset Paid-up Addition

reversionary bonus)

2 NEFT BANK A/C DETAILS OF PROPOSER / JOINT LIFE

All Payouts will be credited to this account through Electronic mode of payment. (This will be applicable at select cities as per facilities/arrangements of Max Life Insurance).

Bank Account Number Account Holder's Name

MICR Code IFSC Code

Bank Name & Branch Type of Bank Account Saving Current Others

PERMANENT ACCOUNT

3 APVPP9834M Form 60 (for proposer / joint life) Form 60 (for insured)

NUMBER (PAN)

Proof of possession of

4. AADHAR (for proposer / joint life) (for insured)

(not mandatory)

TDS may be applicable, in accordance with Income Tax Act 1961, as amended from time to time.

5 MODE OF PAYMENT Monthly

6. RENEWAL PREMIUM BY Credit Card

7. SOURCE OF FUNDS Salary

8. IS PAYOR DIFFERENT FROM THE PROPOSER Yes No

Name Gender

DOB PAN

Address

Relationship to Proposer

Income

A Max Financial Services and MS Joint Venture 2 TRAD_STD_0221_5.5

/ Joint Life

BANK ACCOUNT

Banking Since DETAILS OF THE

PAYOR

Bank Account Number Bank Name & Branch

Are you a Max Life Agent Advisor or an employee of a Max Group Company/Corporate

9. Yes ✔ No

Agent?

10. DESIRED EFFECTIVE DATE OF POLICY 02/10/2021

PREMIUM PAYMENT

11. DETAILS One Thousand Nine Hundred Two Only.

(Amount in Words)

Paid Rs:1902 Payment By: Cash Cheque Demand Draft ✔ Credit Card Net Banking Debit Card

Cheque / Draft No / Insutrument No Date

Bank Name & Branch

Life to be

Proposer / Joint Life

C. INFORMATION OF LIFE TO BE INSURED Insured

Yes No Yes No

Do you have any life or Critical Illness insurance policy issued, pending, approval, from any other insurance companies or has

1. your application for Life/ Health/ Critical Illness insuarnce or its reinstatement ever been offered at modified terms, rejected ✔

orpostponed ?

Issued or Pending LIFE: TOTAL Sum Assured : CI / DD : Total Sum Assured :

Offered at modified terms, rejected or postponed

2. In next 12 months you intend to travel or reside abroad other than on holiday of more than 4 weeks ? Yes ✔ No

Do you participate or do you intend to participate in any hazardous activities as part of your Occupation/ Sports/ Hobby?

3. Yes ✔ No

Detail:-

Have you ever been convicted or are you under investigation for any criminal charges ?

4. Yes ✔ No

Detail:-

5. FOR FEMALE LIFE TO BE INSURED

Spouse Detail: Occupation: Annual Income: Insurance Amount: Are you pregnant ? Yes No

If "Yes" how many months ?

Do you have any complications related to pregnancy

Yes If "Yes", give detals.

Proposer/ Life to be

D. MEDICAL INFORMATION

Joint Life Insured

Yes No Yes No

FAMILY HISTORY- Has any two (2) or more of your family members (Parents & Siblings) ever been diagnosed with Diabetes or ✔

1

Hypertension or Kidney Failure or Cancer or Heart Attack or any Hereditary Disorder before the age of 60 ? Yes No

Proposer / Joint Life Life Insured

2 Height cms 5feet 10inch cms feet inch

Weight 79 Kg Kg

Proposer /

HAVE YOU EVER BEEN INVESTIGATED, TREATED OR DIAGNOSED WITH ANY OF THE FOLLOWING CONDITIONS. Life to be Insured

3 Joint Life

If "Yes", PLEASE PROVIDE DETAILS

Yes No Yes No

✔

i. Diabetes /High blood sugar levels

Yes No

✔

ii. Hypertension/ High Blood Pressure, High Cholesterol or Thyroid disorder

Yes No

✔

iii. Heart or vascular disorder including chest pain, stroke, heart attack or Angioplasty, CABG or any other heart surgery.

Yes No

✔

iv. Breathing or lung disorders including asthma, emphysema, tuberculosis.

Yes No

✔

v. Liver or digestive system related disorder including jaundice ,gall bladder, pancreas or Hepatitis B/C

Yes No

Any abnormal growth like tumour, lump, cancer or blood disorder, including anemia or thalassaemia or Sexually transmitted ✔

vi.

disease(STD) including HIV or AIDS Yes No

✔

vii. Any kind of Kidney or bladder disorder, including kidney failure, renal stone, nephritis or prostrate disorder.

A Max Financial Services and MS Joint Venture 3 TRAD_STD_0221_5.5

Yes No

✔

viii. Any neurological or mental health problem like paralysis, multiple sclerosis, Parkinson’s, epilepsy, depression or anxiety.

Yes No

✔

ix. Muscular-skeletal or joint disorders, including any kind of arthritis, gout, osteoporosis.

Yes No

Are you having history of any hospitalization, treatment or investigation? Or Have you advised now or in last 5 yrs tests like X-Ray/CT ✔

x.

scan/MRI/ Ultrasonography/ ECG/Blood test or any other investigatory or diagnostic tests, or any type of surgery? Yes No

Have you ever been diagnosed with any form of internal or external congenital anomaly or defect i.e. any condition(s) which is present ✔

xi.

since birth, and which is abnormal with reference to form, structure or position? Yes No

✔

xii. Have you had any genetic testing before?

Yes No

✔

4. TOBACCO / ALCOHOL/ DRUGS CONSUMPTION: Do you consume any of the following ?

Yes No

✔

i Tobacco ( Smoking /Chewing) currently or even occasionally in last 1 year ?

Yes No

✔

ii Are you smoking more than 20 cigrattes/ day or chew more than 10 sachet/day of tobacco ?

Yes No

✔

iii Are you drinking any kind of liquor more than 3 days a week ?

Yes No

✔

iv Have you ever been advised to quit alcohol ?

Yes No

✔

v) Are you taking drugs like cannabis/Marijuana/Ecstacy/Heroin/LSD/Amphetamines or any other illegal drugs?

Yes No

E. DECLARATION AND AUTHORISATION

DECLARATION BY PROPOSER / JOINT LIFE AND LIFE TO BE INSURED

I/We hereby declare that I/We fully understand the meaning and scope of the Proposal form and the questions contained above and I am submitting the completed proposal

form of my/our own volition, and confirm that I/We have not been induced by anyone to make the Proposal. I/We have been explained the nature of questions and the

importance of disclosing all material information.

I/We further declare that all the statements and declarations herein shall be the basis of a contract between me/us and the Company and that I/We have made complete, true

and accurate disclosure of all the facts and circumstances and have not withheld any information that may be relevant to enable the Company to make an informed decision

about the acceptability of the Proposal. I agree that in case of any fraud or misrepresentation, action will be initiated as per Section 45 of Insurance Act, 1938, as amended from

time to time. I/We undertake to notify the Company, forthwith in writing, of any change in any of the statements made in the Proposal subsequent to the signing of this proposal

and before acceptance of risk and issuance of the Policy by the Company. The first and subsequent year premium will paid out of legally acquired source of income. I will

provide information as and when required by the Company, acting on its own or under any order or instruction received from Statutory Authorities, as regards to the sources of

funds or utilizations or withdrawals. I agree that the Company may provide any information related to me as available to the Company at any time, to any Statutory Authority in

relation to the any laws including the laws governing prevention of money laundering, applicable in the country. To enable the Company to assess the risk under my/our

proposal or for any other purpose in relation to the policy, l/we, my/our heirs, administrators or executors or assignees hereby authorize my past or present

employer(s)/business association/medical practitioners /other agencies or governmental and/or any regulatory bodies, insurance repositories, CERSAI/ UIDAI, reinsurers /

hospitals or diagnostic centres/ other insurance companies/ service providers to disclose and make available to the Company such details/records, as may be requested by the

Company. I understand that I have disclosed my personal information with Max life and I hereby provide consent to Max Life to share, store my information with its authorized

service providers for servicing this policy/proposal such as issuance, underwriting renewal and claims process with respect to this policy as per the regulation applicable from

time to time. I/We submit the mandate to credit My / Our account towards all payments against the above policy and agree and understand that payouts would be processed

through electronic mode of payment and will be affected at select cities as per facilities/ arrangements of Max Life Insurance. I/We authorize Max Life to send all

communications by E-mail, SMS or any other communication mode. I/We agree to receive regular reminders, updates / alerts from Max life from time to time.

I do hereby certify that above stated information regarding the nationality and tax residential status is correct in all respects and may be used for all purposes, including

reporting to statutory authorities & compliances, and understand that it is my responsibility to report the changes, if any, to Max Life within 2 weeks of occurrence of such

change

Signature / Thumb Impression / Signature / Thumb Impression /

Signature / Thumb Impression / Electronic

Electronic Electronic

Signature of Proposer/ Joint Life

Signature of Life to be Insured Signature of Witness

Name of witness Place: Mumbai Date : 02-10-2021

VERNACULAR /ILLITERATE DECLARATION

(Declaration to be made by a person unconnected with Max life Insurance Company Limited but whose identify can be easily established.) I hereby declare that I have fully

explained the contents of this proposal to the proposer/Life to be Insured in ______________ language, as understood by him/her and that the left thumb impression/signature

of the proposer/Life to be Insured has been appended/affixed after fully understanding the contents thereof. I have truthfully recorded the answers given by the Proposer/Life to

be Insured. I have understood the content of the proposal form as explained to me in______________ language by the declarant, Mr./Ms. _______________________________ ,

filling in the proposal form and after the same, I am affixing my signature/thumb-impression.

Name of the Declarant Address of the Declarant:

I have understood the content of the proposal form as explained to me in______________ language by the declarant, Mr./Ms. _______________________________ , filling in

the proposal form and after the same, I am affixing my signature/thumb-impression.

A Max Financial Services and MS Joint Venture 4 TRAD_STD_0221_5.5

Signature / Thumb Impression / Electronic Signature / Thumb Impression / Electronic

Signature of Declarant Signature of Proposer/ Joint Life

DECLARATION BY PRINCIPAL OFFICER/AGENT ADVISOR/SPECIFIED PERSON

I _________________________having known the Proposer / Life Insured for a period of________________ do declare that I have explained the nature of the questions

contained in this Proposal form to him / her. I have also explained that the answers to the questions form the basis of the contract of the Insurance between the Company and

the Proposer / Life Insured and if any untrue statement is contained therein and / or any information that may be relevant to enable the Company make an informed decision,

the Company shall have the right to vary the benefits which may be payable and / or treat the policy voidable at the option of the company subject to section 45 of the Insurance

Act, 1938 as amended from time to time. I confirm that to the best of my knowledge the Life Insured does not suffer from any physical or mental abnormality or handicap or has

/ had been hospitalised, undergone any surgery or treatment, or he /she is involved in activities including any hazardous avocation or occupation or any other information

material for underwriting this proposal form, unless expressly stated in this Proposal. I also declare and represent to the Company that I am in full compliance with the regulatory

requirements applicable to agent / corporate agent / specified person / broker prescribed by the Insurance Act 1938, as amended from time to time and any other regulation,

circular, instruction issued by IRDAI from time to time. I confirm that I have verified the identity, current / permanent residential address of the proposer/Insured, the nature of

his/her business and his / her financial status basis the AML Max Life moral hazard checklist.

Is this a Replacement Sale? If yes, I have adequately explained the consequences of re placement sale to the customer. Yes No

Relationship of Principal Officer/Agent Advisor/Specified Person with the Proposer/Joint Life/Life Insured

Name of Principal Officer/Agent Advisor/Specified Person

Principal Officer/Agent Advisor/Specified Person Code 869196

Phone No. with STD Code

Date Place

Signature / Thumb Impression / Electronic Signature of Principal Officer/Agent Signature / Thumb Impression / Electronic Signature of

Advisor/Specified Person Sales Manager

We Confirm that we have made joint efforts in soliciting the prospect and will be jointly responsible for performing the service related to the policy. We further confirm that the

objective of sharing the commission is not for qualifying for any contest and/or reward & recognition programs of the company.

(Applicable only if more than one Agent Advisors share the commission.)

Name(S) of the Principal Officer / AA / Spec Principal Officer / AA / Spec Person

Principal Officer/AA/Spec Person's Signature / OTP Confirmation Date % Share

Person Code

Important Notes

(1) Any payment/s including initial payment accompanying this proposal, cash or by bearer instrument must be made at any of the Company's General Office only. (2) Crossed

cheque or bank drafts must be made in favour of MAX LIFE INSURANCE COMPANY LIMITED ACCOUNT (Proposal No. as above) may be handed over to the Agent Advisor.

(3) Receipt of the Completed Proposal and initial payment does not create any obligations upon the Company to underwrite the risk. The Company shall not be liable until it has

underwritten the risk and issued the Policy. If the Policy is sent by post it shall be deemed to have been delivered to and received by you in the ordinary course within 3 (three)

days of posting. We draw your attention to Section-39, 45 and 41 of the Insurance Act, 1938, which reads as follows-

Section 39: In case nomination facility is availed, section 39 of the Insurance Act, 1938 as amended from time to time shall apply.

Section 45: No policy of life insurance shall be called in question on any ground whatsoever after the expiry of three years from the date of issuance of policy, from the date of

the Commencement of Risk or Revival of the policy or the date of the rider to the policy, whichever is later. However, Insurer may question the Policy at any time within three

years from the date of issuance of policy, from the date of Commencement of Risk or Revival of the policy or the date of the rider to the policy, whichever is later, on the ground

of fraud, in which case insurer shall inform Proposer/Life Insured/legal representatives in writing specifying the grounds and materials on which such decision is based. For

other details please refer to Section 45 of the Insurance Act, 1938 as amended from time to time.

Section 41:(1) No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take or renew or continue an insurance in respect of any

kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any

person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the

insurer.(2) Any person making default in complying with the provisions of this section shall be punishable with fine which may extend to ten lakhs rupees.

A Max Financial Services and MS Joint Venture 5 TRAD_STD_0221_5.5

CKYC Annexure

1. CENTRAL KYC REGISTRY | Know Your Customer(KYC) Application Form | Individual

Application Type:

KYC Number: 40073622005219

2. PERSONAL DETAILS (Please refer instruction A at the end)

Prefix First Name Middle Name Last Name

Name(Same as ID proof) Mr Apurva Patel

Maidan Name(If any)

Father/ Spouse Name Mr THAKORBHAI PATEL

Mrs MANJULABEN

Mother Name

THAKORBHAI PATEL

Date of Birth* 01-11-1982 (38 years)

Gender ✔ Male Female

Single ✔ Married

Marital Status

Divorced Widow(er)

Nationality ✔ Indian NRI

Resident Status ✔ Indian NRI

Occupation Type Salaried

3.RESIDENCE FOR TAX PURPOSESIN JURISDICTION(S) OUTSIDE INDIA

Tax Identification number or Equivalent

Country Code of Jurisdiction of Residence

Place/City of Birth*

Country Code of Birth

4. PROOF OF IDENTITY(Please refer instruction C at the end)

ID/Address proof name Aadhaar

ID/Address proof Number xxxxxxxx9495

ID/Address proof Expiry date

5. PROOF OF ADDRESS(PoA)*

Address proof name Aadhaar

Address Line1 B 103 DHARAM PALACE

Address Line2 SHANTIVAN NR NATIONAL

Address Line3 PARK BORIVALI EAST

City Mumbai

State Maharashtra

PIN 400066

Country INDIA

6. Address in the Jurisdiction details where Applicant is Resident Outside India for Tax Purposes

Overseas Address

7. Contact Details

Mobile Number 9833555732

Email -ID apurva.patel@outook.com

8. APPLICATION DECLARATION

I hereby declare that the details furnished above are true and correct to the best of my knowledge and belief and I undertake to inform you of any change

therein immediately. In case of the aboveinformation is found to be false or untrue or misleading or misrepresenting. I am aware that I am be held liable for it.

I hereby consent to receiving information from Canral KYC Registrythrough SMS/Email on the above registered number/email address

Name/Date/Place

Name of the applicant Mr Apurva Patel

Place Mumbai

Date 02-10-2021

Proposal Form Annexure- Additional Questions Annexure

Industry Type

A Max Financial Services and MS Joint Venture 6 TRAD_STD_0221_5.5

Defence/CRPF

a. Place of Posting

b. Rank

c. Which branch of Armed Forces

are you in?

d. Are you involved in hazardous

activities?

e.g. Aviation, diving, parachuting, Yes No

bomb disposal,special services

group etc?

Nature of Duties/Business Supply Chain

Are you/your Nominee a Politically Exposed Person (PEP)?

If above Question "Yes" then answer below:

a. Which of the following persons is PEP (Tick as applicable) Life Insured Family member of Life Insured

Specify:

b. Please specify the extent of Political involvement:

i. Political Experience (Years)

ii. Affiliation to Political Party

iii. Role in Political Party Social Worker MLA MP Others

iv. Portfolio Handled

v. Whether Party in Power Yes No

c. Whether the concerned PEP has ever been posted in foreign office/portfolio? Yes No

Specify:

d. Please specify all sources of income of concerned PEP?

e. Has the concerned PEP ever been convicted or is under any investigation for any crime punishable by 3 or more years of imprisonment? Yes No

Specify:

Insurance History Annexure

Do you have any Life, Disability, Critical Illness or Health Insurance policy issued/pending/lapsed with or any other insurance company? Yes ✔ No

Name of Insurance

Policy Number Type of Policy (Life,Health,CI,Disability) Total Sum Assured Status: Pending/Issued/Lapsed

Company

Has any proposal/reinstatement for life or health Insurance ever been refused, modified, postponed or offered with extra premium

Yes ✔ No

(Reason, Month, Year and Name of the Insurance Company)? Give details below

Policy Number Name of Insurance Company Type of Policy Total Sum Assured Status

A Max Financial Services and MS Joint Venture 7 TRAD_STD_0221_5.5

Medical and Travel Questions Annexure

In next 12 months you intend to travel or reside abroad other than on holiday of more than 4 weeks ? Yes ✔ No

Country Cities Purpose Duration of Stay in Weeks

Has any two (2) or more of your family members (Parents & Siblings) ever been diagnosed with Diabetes or Hypertension or Kidney Failure or

✔ Yes No

Cancer or Heart Attack or any Hereditary Disorder before the age of 60 ?

Family Details Proposer Life Insured

Family Member Age at Diagnosis Disease/Medical Problem Age at Diagnosis Disease/Medical Problem

Mother 58 Diabetes

Age at Diagnosis Disease/Medical Problem

Tobacco/Alcohol/Drugs Consumption: (In case you consume or have ever consumed)

Proposer Life Insured

No. of No. of

Substance Type Qty Frequency Type Qty Frequency

Yrs. Yrs.

Tobacco/Nicotine products (in the last 1 year

(sticks/gms))Cigarettes/Beedis/Cigars/Gutkha/Flavored PanMasala

etc.

Alcohol (ML) - Beer/Wine/Hard Liquor

Drugs other thanprescribed by Doctors -Cannabis,

Marijuana,Ecstacy, Heroin, LSD,Amphetamines or otherillegal drugs

MAX LIFE INSURANCE COMPANY LIMITED

Medical Questionnaire

Proposal No.: Name of the Insured:

High blood pressure reflexive questions

Information required Insured's Information

1) When was High Blood Pressure Diagnosed?

2) Please provide the details of the medication?

3) How often do you attend for follow ups and when was your last consultation?

4) What was your last Blood Pressure Reading?

High Blood Sugar or Diabetes reflexive questions

Information required Insured's Information

1) When was Diabetes/ High Blood Sugar Diagnosed?

2) Are you on Insulin/Tablets or both? Please give details of medication and dosage.

3) Do you follow a strict diet?

4) How often do you attend for follow ups and when was your last consultation?

5) What was your last Blood Sugar Values(Fasting Blood Sugar, HbA1c etc)?

6) Have you ever had numbness or tingling in your feet/ legs? If yes, provide details.

Respiratory disorder reflexive questions

Information required Insured's Information

1) When was this condition diagnosed?

A Max Financial Services and MS Joint Venture 8 TRAD_STD_0221_5.5

2) Please describe your symptoms and do your symptoms make you wake up at night?.

3) How frequently do the symptoms occur and when was the last occurrence of the symptom?

4) Please provide medication details (currently and in past)

5) Have you ever taken steroids? If Yes, then please provide details

Asthma reflexive questions

Information required Insured's Information

1) When was this condition diagnosed?

2) Please describe your symptoms and do your symptoms make you wake up at night?.

3) How frequently do the symptoms occur and when was the last occurrence of the symptom?

4) Please provide medication details (currently and in past)

5) Have you ever taken steroids? If Yes, then please provide details

I/We hereby declare that the above statements and answers are true in every respect and I/We agree for treating this to be part of the Proposal Form.

Name of Insured:

A Max Financial Services and MS Joint Venture 9 TRAD_STD_0221_5.5

You might also like

- Proposal FormDocument9 pagesProposal FormAmbuj ChaturvediNo ratings yet

- Proposal FormDocument9 pagesProposal FormrohitNo ratings yet

- Proposal FormDocument9 pagesProposal FormNinad KamatNo ratings yet

- A. Personal DetailsDocument9 pagesA. Personal DetailsRavi KiranNo ratings yet

- Proposal Form - 190411025505Document6 pagesProposal Form - 190411025505p.sridhar.priNo ratings yet

- Userdocument 4Document7 pagesUserdocument 4Gopal SutharNo ratings yet

- Max Life Assured PlanDocument8 pagesMax Life Assured Plankalai selvanNo ratings yet

- User DocumentDocument7 pagesUser DocumentGopal SutharNo ratings yet

- Application For Employment: Post Applied For: Assistant EngineerDocument4 pagesApplication For Employment: Post Applied For: Assistant Engineersri marwaNo ratings yet

- Candidate Information FormDocument5 pagesCandidate Information FormAhmad Ammad chNo ratings yet

- Application Form NadhirahDocument8 pagesApplication Form NadhirahEryna RahimNo ratings yet

- Application Form For EmploymentDocument1 pageApplication Form For EmploymentZiña SuilujNo ratings yet

- 0307 - RMG Employment Application Form PDFDocument3 pages0307 - RMG Employment Application Form PDFVivien Christe ValderamaNo ratings yet

- Interaction With EntrepreneursDocument74 pagesInteraction With EntrepreneursNligah SimonNo ratings yet

- Application FormDocument6 pagesApplication Formfloyren valdezNo ratings yet

- APPLICATION BLANK New Format XLS - 2 Pages Ver 1 2Document3 pagesAPPLICATION BLANK New Format XLS - 2 Pages Ver 1 2eldridatech pvt ltdNo ratings yet

- Kotak Proposal Form (KPF) : For Office Use OnlyDocument8 pagesKotak Proposal Form (KPF) : For Office Use OnlyMoushumiNo ratings yet

- Parle Agro PVT LTD.: Acknowledge FormDocument4 pagesParle Agro PVT LTD.: Acknowledge FormPankaj TripathiNo ratings yet

- Kotak Proposal Form (KPF) : For Office Use OnlyDocument8 pagesKotak Proposal Form (KPF) : For Office Use OnlyMoolam RaoNo ratings yet

- Annexure - Additional - Withdrawal - Details 3.0Document2 pagesAnnexure - Additional - Withdrawal - Details 3.0Vinod NairNo ratings yet

- DS-0174 Print FullDocument12 pagesDS-0174 Print FullCamila Alicia López AndradeNo ratings yet

- Youth ItumelengDocument18 pagesYouth ItumelengKeneilwe CalistusNo ratings yet

- Og 23 1155 6021 00005597 1Document6 pagesOg 23 1155 6021 00005597 1Honey SharmaNo ratings yet

- Kotak T.U.L.I.P: ChopraDocument8 pagesKotak T.U.L.I.P: ChopraKamal PrajapatNo ratings yet

- Application Form: (Please Fill in Details Below For Our Reference) Job Application FormDocument6 pagesApplication Form: (Please Fill in Details Below For Our Reference) Job Application Formmutia makhfirahNo ratings yet

- Individual S Application For Group InsuranceDocument2 pagesIndividual S Application For Group InsuranceBitumen Allianz OperationsNo ratings yet

- Stanford Knight-Hennessy Scholars ApplicationDocument12 pagesStanford Knight-Hennessy Scholars ApplicationAmir NazirNo ratings yet

- Personal Information SheetDocument2 pagesPersonal Information SheetChristopher Jorca CabucosNo ratings yet

- Employee Enrollment Form: GSSR, Inc. 0562040Document4 pagesEmployee Enrollment Form: GSSR, Inc. 0562040yowza123No ratings yet

- Employee Enrollment Form - Texas: Allagadda Nageswara RaoDocument5 pagesEmployee Enrollment Form - Texas: Allagadda Nageswara RaoNageswara Rao AllagaddaNo ratings yet

- Reliance General Insurance Company Limited: Reliance Healthgain Policy ScheduleDocument6 pagesReliance General Insurance Company Limited: Reliance Healthgain Policy Schedulekundanjha82No ratings yet

- Bjaz GC Policy ScheduleDocument3 pagesBjaz GC Policy SchedulePrashant MadkarNo ratings yet

- With Write Nurturing: MRS, May Thi Home Myo - Oo Street Pattheingyi Township Mandalay 09-797541952 September 2016Document7 pagesWith Write Nurturing: MRS, May Thi Home Myo - Oo Street Pattheingyi Township Mandalay 09-797541952 September 2016Mie NgeNo ratings yet

- With Write Nurturing: MRS, May Thi Home Myo - Oo Street Pattheingyi Township Mandalay 09-797541952 September 2016Document32 pagesWith Write Nurturing: MRS, May Thi Home Myo - Oo Street Pattheingyi Township Mandalay 09-797541952 September 2016Mie NgeNo ratings yet

- Assistant Facility Manager & Lead Engineer FSN-11 FP-4 15/02Document12 pagesAssistant Facility Manager & Lead Engineer FSN-11 FP-4 15/02Francisco TavarezNo ratings yet

- ResearchDocument8 pagesResearchgsandhu437777No ratings yet

- Employment Application Form: 1.position Applying For 2.employee InformationDocument3 pagesEmployment Application Form: 1.position Applying For 2.employee Informationunknown youthNo ratings yet

- Franchise Application FormDocument3 pagesFranchise Application FormkartikNo ratings yet

- Devina D. Enggas: ExperienceDocument1 pageDevina D. Enggas: ExperienceDemetrio CarbonNo ratings yet

- NSD La of 24 Nov 23111812Document8 pagesNSD La of 24 Nov 23111812toficka61No ratings yet

- Jambajuicelv-Application-0618 1Document2 pagesJambajuicelv-Application-0618 1api-526082107No ratings yet

- fs3 p6P9kbDocument2 pagesfs3 p6P9kbdanielNo ratings yet

- I. Personal Information: II. EDUCATION DETAILS (Academic/Technical/Professional)Document4 pagesI. Personal Information: II. EDUCATION DETAILS (Academic/Technical/Professional)sadasNo ratings yet

- CABEZASDocument2 pagesCABEZASKenneth CabezasNo ratings yet

- Application For Employment: North West Regional Health AuthorityDocument3 pagesApplication For Employment: North West Regional Health AuthorityMelissaChouglaJosephNo ratings yet

- Applicant Information FormDocument17 pagesApplicant Information Formanditta zahraniNo ratings yet

- Tesdaform-1 WordDocument2 pagesTesdaform-1 WordcamillegNo ratings yet

- Application For GraduationDocument1 pageApplication For GraduationMaria Lutz DualloNo ratings yet

- Employment FormDocument4 pagesEmployment FormAbhishek ChandraNo ratings yet

- Grant Application: Do Not Exceed Character Length Restrictions IndicatedDocument1 pageGrant Application: Do Not Exceed Character Length Restrictions Indicatedmyco samNo ratings yet

- Kotak E-Term PlanDocument9 pagesKotak E-Term Planriya sethNo ratings yet

- 2022 Reinstatement Form For Individual PO FILLABLE v2Document3 pages2022 Reinstatement Form For Individual PO FILLABLE v2amamora89No ratings yet

- Rishu Allied Application Form 2017Document1 pageRishu Allied Application Form 2017RISHAV SHARMANo ratings yet

- Quote Sheet For Group Health Insurance PolicyDocument2 pagesQuote Sheet For Group Health Insurance PolicyABED ALI KHANNo ratings yet

- Partner Risk Assessment Questionnaire - Pss - 22022021Document9 pagesPartner Risk Assessment Questionnaire - Pss - 22022021sosina mengistuNo ratings yet

- Grant Application: Do Not Exceed 56-Character Length Restrictions, Including SpacesDocument1 pageGrant Application: Do Not Exceed 56-Character Length Restrictions, Including SpacesNEKRONo ratings yet

- Application of Employment (Gabriel Mahligai Pampang)Document4 pagesApplication of Employment (Gabriel Mahligai Pampang)ArdiansyahNo ratings yet

- Unit Linked Proposal Form: Max Life Insurance Company LimitedDocument5 pagesUnit Linked Proposal Form: Max Life Insurance Company LimitedShabbu ayeshaNo ratings yet

- GPR Aplication FormDocument6 pagesGPR Aplication FormJhon ArdiNo ratings yet

- Unemployment to Self-Employment and Beyond: The Journey of a Reluctant EntrepreneurFrom EverandUnemployment to Self-Employment and Beyond: The Journey of a Reluctant EntrepreneurNo ratings yet

- Jun 23Document1 pageJun 23cursed.apurvaNo ratings yet

- 490270915-Petrol-1-Trial-Bill-Sample-empty v1Document2 pages490270915-Petrol-1-Trial-Bill-Sample-empty v1cursed.apurvaNo ratings yet

- Petrol 1 Trial Bill Sample EmptyDocument2 pagesPetrol 1 Trial Bill Sample Emptycursed.apurvaNo ratings yet

- Poonam 2022-23Document1 pagePoonam 2022-23cursed.apurvaNo ratings yet

- Vital Sign: Blood Pressure and Its AlterationsDocument55 pagesVital Sign: Blood Pressure and Its Alterationsbemina jaNo ratings yet

- Source Information: Disclosure FormsDocument1 pageSource Information: Disclosure FormsSav GaNo ratings yet

- Human HeartDocument6 pagesHuman HeartVui SengNo ratings yet

- Circulatory System QuizDocument5 pagesCirculatory System QuizJohn LesterNo ratings yet

- Icu DrugsDocument205 pagesIcu DrugsAli50% (2)

- Choice of Therapy in PrimaryDocument19 pagesChoice of Therapy in PrimaryThiago SartiNo ratings yet

- CVS - History CollectionDocument9 pagesCVS - History CollectionEllen AngelNo ratings yet

- Alejandro Oet Listening PracticeDocument12 pagesAlejandro Oet Listening PracticeChapa BandaraNo ratings yet

- NCM116 Prelim Week 1Document15 pagesNCM116 Prelim Week 1Loungayvan BatuyogNo ratings yet

- Blood Transfusion & ComponentsDocument56 pagesBlood Transfusion & Componentsadithya polavarapuNo ratings yet

- Neonatal SepsisDocument6 pagesNeonatal SepsisSunaina AdhikariNo ratings yet

- Pulmonary EmbolismDocument28 pagesPulmonary EmbolismMohamedEzzNo ratings yet

- Cwu Cardio AziziDocument16 pagesCwu Cardio AziziAshbirZammeriNo ratings yet

- Transport SystemDocument2 pagesTransport Systemgnana87No ratings yet

- Hyper - and HypoglycemiaDocument3 pagesHyper - and HypoglycemiaaerugiNo ratings yet

- Pediatrics ArimgsasDocument403 pagesPediatrics ArimgsasGabriela ChristianNo ratings yet

- Case Study For Acute Coronary SyndromeDocument7 pagesCase Study For Acute Coronary SyndromeGabbii CincoNo ratings yet

- The Normal CSFDocument2 pagesThe Normal CSFUm MahmoudNo ratings yet

- Hypercholesterolemia PDFDocument7 pagesHypercholesterolemia PDFkookiescreamNo ratings yet

- Gerd - Peptic Ulcer - GastritisDocument87 pagesGerd - Peptic Ulcer - GastritisErickson V. LibutNo ratings yet

- Aortic StenosisDocument3 pagesAortic StenosisZweNo ratings yet

- BLISTRADocument27 pagesBLISTRAAurelia SoetomoNo ratings yet

- EsophagusDocument41 pagesEsophagusrayNo ratings yet

- Assessment Nursing Diagnosis Planning Intervention Rationale Evaluation IndependentDocument3 pagesAssessment Nursing Diagnosis Planning Intervention Rationale Evaluation IndependentSHEILA MAE SACLOTNo ratings yet

- Pregnancy Induced Hypertension: Definition of TermsDocument6 pagesPregnancy Induced Hypertension: Definition of TermsPAULINE BERNICE BAGUIONo ratings yet

- Recognizing Interstitial Versus Airspace Disease Recognizing Interstitial Versus Airspace DiseaseDocument29 pagesRecognizing Interstitial Versus Airspace Disease Recognizing Interstitial Versus Airspace DiseasemariputNo ratings yet

- Mitral Valve Prolapse of The Heart: Mod D BY Robyn LayneDocument20 pagesMitral Valve Prolapse of The Heart: Mod D BY Robyn LaynelaynerobynNo ratings yet

- The Esc Textbook of Cardiovascular Imaging 3Rd Edition Jose Luis Zamorano Full Download ChapterDocument58 pagesThe Esc Textbook of Cardiovascular Imaging 3Rd Edition Jose Luis Zamorano Full Download Chapterregina.sandoval785100% (5)

- PolytraumaDocument117 pagesPolytraumaTufan BhutadaNo ratings yet

- SyncopeDocument12 pagesSyncopeSuha AbdullahNo ratings yet