Professional Documents

Culture Documents

Accounting Journal

Uploaded by

edwinjethromoliveros0 ratings0% found this document useful (0 votes)

10 views6 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views6 pagesAccounting Journal

Uploaded by

edwinjethromoliverosCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 6

Accounting Journal

Business Name: Accounting Period:

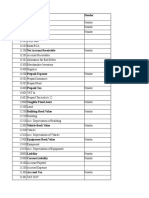

Account Code Account Trial Balance Adjusting Entries Adjusted Trial Balance

Debit Credit Debit Credit Debit

10 Freehold property

11 Leasehold property

20 Plant & Machinery

21 Plant & m/cy depreciation

30 Office equipment

31 Office equipt depreciation

40 Furniture & fixtures

41 Furniture & fxts depreciation

50 Motor Vehicles

51 Motor vehicles depreciation

1001 Inventory

1002 Work in progress

1003 Finished goods

1100 Accounts Receivable Control

1101 Sundry debtors

1102 Other debtors

1103 Prepayments

1200 Bank current account

1210 Bank deposit account

1220 Building society account

1230 Petty cash

1235 Cash receipts

1240 Company credit card

1250 Credit card receipts

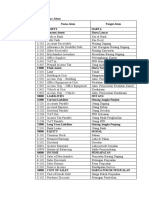

2100 Accounts Payable Control

2101 Sundry creditors

2102 Other creditors

2109 Accruals

2200 Sales Tax Control

2201 Purchase Tax Control

2202 VAT liability

2210 PAYE

2211 National Insurance

2220 Net wages control

2230 Pension fund

2300 Loans

2310 Hire purchase

2320 Corporation tax

2330 Mortgages

3010 Preference shares

3100 Reserves

3101 Undistributed reserves

3200 Profit & Loss Account

4000 Sales type A

4001 Sales type B

4002 Sales type C

4009 Discounts allowed

4100 Sales type D

4101 Sales type E

4200 Sale of Assets

4400 Credit charges

4900 Miscellaneous income

4901 Royalties received

4902 Commissions received

4903 Insurance claims

4904 Rent income

4905 Distribution & carriage

5000 Materials purchased

5001 Materials imported

5002 Miscellaneous purchases

5003 Packaging

5009 Discounts taken

5100 Carriage

5101 Import duty

5102 Transport insurance

5200 Opening stock

5201 Closing stock

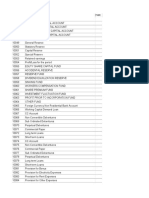

6000 Productive Labour

6001 Cost of sales labour

6002 Sub-contractors

6100 Sales commissions

6200 Sales promotion

6201 Advertising

6202 Gifts & samples

6203 PR

6900 Miscellaneous expenses

7000 Gross wages

7001 Directors salaries

7002 Directors remuneration

7003 Staff salaries

7004 Wages regular

7005 Wages casual

7006 Employers NI

7007 Employers pensions

7008 Recruitment expenses

7009 Adjustments

7010 SSP reclaimed

7011 SMP reclaimed

7100 Rent

7102 Water rates

7103 General rates

7104 Premises insurance

7200 Electricity

7201 Gas

7202 Oil

7203 Other heating costs

7300 Motor fuel

7301 Motor repairs

7302 Licenses

7303 Vehicle insurance

7304 Miscellaneous motor

7350 Scale charges

7400 Travelling

7401 Car hire

7402 Hotels

7403 UK Entertainment

7404 Overseas Entertainment

7405 Overseas travelling

7406 Subsistence

7500 Printing

7501 Postage & carriage

7502 Telephone

7503 Telex/telegram/fax

7504 Office stationery

7505 Books etc

7600 Legal fees

7601 Audit & accountancy fees

7602 Consultancy fees

7603 Professional fees

7700 Equipment hire

7701 Office m/c maintenance

7800 Repairs & renewals

7801 Cleaning

7802 Laundry

7803 Premises expenses

7900 Bank interest paid

7901 Bank charges

7902 Currency charges

7903 Loan interest paid

7904 HP interest

7905 Credit charges

7906 Exchange rate variance

8000 Depreciation

8001 Plant & m/cy depreciation

8002 Furniture/fit. depreciation

8003 Vehicle depreciation

8004 Office equip. depreciation

8100 Bad debt write off

8102 Bad debt provision

8200 Donations

8201 Subscriptions

8202 Clothing costs

8203 Training costs

8204 Insurance

8205 Refreshments

9998 Suspense account

9999 Mispostings account

Total 0 0 0 0 0

Adjusted Trial Balance Income Statement Balance Sheet

Credit Debit Credit Debit Credit

0 0 0 0 0

You might also like

- Model Policies and Procedures for Not-for-Profit OrganizationsFrom EverandModel Policies and Procedures for Not-for-Profit OrganizationsNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- IC Accounting Journal Template Updated 8552Document6 pagesIC Accounting Journal Template Updated 8552MochdeedatShonhajiNo ratings yet

- Sage Nominal CodesDocument2 pagesSage Nominal Codesmalinkalon12No ratings yet

- List AccountDocument6 pagesList AccountBerkah CahayaNo ratings yet

- Daftar Akun, Jasa, Dagang, ManufakturDocument14 pagesDaftar Akun, Jasa, Dagang, ManufakturSiti YulandariNo ratings yet

- Chart of Accounts: Account NumberingDocument15 pagesChart of Accounts: Account NumberingrjrjrjNo ratings yet

- Charts of Accounts of Eagle Wheels Auto Solutions For QBDocument16 pagesCharts of Accounts of Eagle Wheels Auto Solutions For QBMuhammad UsmanNo ratings yet

- Sample Chart of AccountsDocument5 pagesSample Chart of AccountssnsdyurijjangNo ratings yet

- Construction Company Account PlanDocument8 pagesConstruction Company Account PlanScribdTranslationsNo ratings yet

- Financial Statements NBBDocument29 pagesFinancial Statements NBBLawrence MosizaNo ratings yet

- Airfreight 2100 Cost CodesDocument12 pagesAirfreight 2100 Cost Codes175pauNo ratings yet

- Book 1Document10 pagesBook 1Majed AliNo ratings yet

- Akun LKSDocument6 pagesAkun LKSNiken PurnamasariNo ratings yet

- Chart of Accounts (Sole Proprietorship) Account No. Account Title AssetsDocument16 pagesChart of Accounts (Sole Proprietorship) Account No. Account Title Assetselaine galvezNo ratings yet

- Exel Jaya TamaDocument2 pagesExel Jaya TamaTiara XI AKL CNo ratings yet

- Accont MapDocument29 pagesAccont MapSujeet KumarNo ratings yet

- Default Chart of AccountsDocument4 pagesDefault Chart of Accountsjmanzungu2820No ratings yet

- Daftar Akun Renata Kls XI-PS Luthfi, Alma, IndriDocument3 pagesDaftar Akun Renata Kls XI-PS Luthfi, Alma, IndriPindra ekoNo ratings yet

- Chart of Accounts For Small Business Template V 1.0Document3 pagesChart of Accounts For Small Business Template V 1.0molateam2No ratings yet

- Daftar AkunDocument2 pagesDaftar AkunGoms GultomNo ratings yet

- Daftar Nama Akun PT JayatamaDocument2 pagesDaftar Nama Akun PT Jayatamastriii906No ratings yet

- Daftar AkunDocument2 pagesDaftar AkunRisma WahyuniNo ratings yet

- Nama Akun PT. SHAKTI BANDUNGDocument2 pagesNama Akun PT. SHAKTI BANDUNGRossa Rizqia AprianiNo ratings yet

- Provided by Tutoring Services 1 Chart of AccountsDocument6 pagesProvided by Tutoring Services 1 Chart of AccountsAn Cj De'LexusNo ratings yet

- Daftar Akun Pt. JayatamaDocument2 pagesDaftar Akun Pt. Jayatamalaisya fitrianykurniaNo ratings yet

- Sample Chart of AccountsDocument5 pagesSample Chart of AccountslkuchinNo ratings yet

- Account Name Header Account NumberDocument6 pagesAccount Name Header Account NumberMutiara Ayu NingtyasNo ratings yet

- Chart of Accounts: Current AssetsDocument8 pagesChart of Accounts: Current Assetsgalatid4u100% (1)

- Balance Sheet Chart of Accounts For Small Businesses Numb Er Account Title Balance Sheet SectionDocument5 pagesBalance Sheet Chart of Accounts For Small Businesses Numb Er Account Title Balance Sheet SectionmakahiyaNo ratings yet

- Chart of Accounts BR: 0050Document117 pagesChart of Accounts BR: 0050Thiago Holanda CavalcanteNo ratings yet

- Trial Balance: Pt. Jayatama 31 Desember 2021Document2 pagesTrial Balance: Pt. Jayatama 31 Desember 2021Desti AriantiNo ratings yet

- Opening Balance Sheet TotalsDocument22 pagesOpening Balance Sheet TotalsMuhammad MohsinNo ratings yet

- Revisi COA (Chart of Account)Document3 pagesRevisi COA (Chart of Account)Simarfian jaya abadiNo ratings yet

- Daftar Nama Akun Perusahaan DagangDocument2 pagesDaftar Nama Akun Perusahaan Dagangkalin callysta ayu 18No ratings yet

- Bank Accounts, Assets, Liabilities, and Income Statement AccountsDocument5 pagesBank Accounts, Assets, Liabilities, and Income Statement AccountsGraceeyNo ratings yet

- Chart of AccountsDocument4 pagesChart of Accountsjyllstuart100% (3)

- DAFTAR AKUN PT SEJAHTERA - ExcelDocument9 pagesDAFTAR AKUN PT SEJAHTERA - ExcelDesi ErmitaNo ratings yet

- Chart of Accounts SamplesDocument9 pagesChart of Accounts Samplesredro50% (2)

- Kertas Kerja AkuntansiDocument12 pagesKertas Kerja AkuntansiRaffelNo ratings yet

- Name Type: NumberDocument8 pagesName Type: NumberRAVITEJANo ratings yet

- Coa Mapping Int enDocument26 pagesCoa Mapping Int enMuhammad Javed IqbalNo ratings yet

- SAP ObjectCodeDocument15 pagesSAP ObjectCodeArwin SomoNo ratings yet

- Daftar AkunDocument2 pagesDaftar Akunike sinagaNo ratings yet

- Chart of AccountsDocument12 pagesChart of AccountsameirelameirNo ratings yet

- LK Sesi Pertama - CV Maju HWDocument25 pagesLK Sesi Pertama - CV Maju HWAura Nur ApriliaNo ratings yet

- Modern Languages University Course DetailsDocument3 pagesModern Languages University Course DetailsJawad AzizNo ratings yet

- Audit Module 1 - Variance Analysis TemplateDocument8 pagesAudit Module 1 - Variance Analysis TemplateKawtar BensalahNo ratings yet

- FBN HFM Reporting Template MAY 2022 - First Pension Custodian Nig. Ltd. ADocument48 pagesFBN HFM Reporting Template MAY 2022 - First Pension Custodian Nig. Ltd. AIkechukwu ObiajuruNo ratings yet

- Chart of AccountDocument5 pagesChart of Accountsana82966534100% (1)

- Descriptions For NAHB COA AccountsDocument67 pagesDescriptions For NAHB COA AccountsdumpNo ratings yet

- Siklus Akuntansi Laporan KeuanganDocument67 pagesSiklus Akuntansi Laporan KeuanganAlya AdeliaNo ratings yet

- Account Number Account Name Header BalanceDocument4 pagesAccount Number Account Name Header BalanceErma WulandariNo ratings yet

- USAR Chart of Accounts ReviewDocument8 pagesUSAR Chart of Accounts ReviewManel AmaratungaNo ratings yet

- Sample chart accountsDocument3 pagesSample chart accountsJulie R. UgsodNo ratings yet

- 0Document2 pages0Hyuna KimNo ratings yet

- Project For The Course Accounting Software Applications ACFN 272Document4 pagesProject For The Course Accounting Software Applications ACFN 272Daandii HarmeeNo ratings yet

- List of Accounts SAP Hel-ExportDocument216 pagesList of Accounts SAP Hel-ExportEnrique MarquezNo ratings yet

- Akun ManunggalDocument1 pageAkun Manunggalyukidestara pardedeNo ratings yet

- A Contractor's Guide to the FIDIC Conditions of ContractFrom EverandA Contractor's Guide to the FIDIC Conditions of ContractNo ratings yet

- IC Balance Sheet Template 8897Document2 pagesIC Balance Sheet Template 8897bagirNo ratings yet

- Bill To InvoiceDocument2 pagesBill To InvoiceedwinjethromoliverosNo ratings yet

- IC Accounts Receivable 8852Document3 pagesIC Accounts Receivable 8852moggy giNo ratings yet

- Accounts Payable LedgerDocument4 pagesAccounts Payable LedgeredwinjethromoliverosNo ratings yet

- 7 - NIBL - G.R. No. L-15380 Wan V Kim - DigestDocument1 page7 - NIBL - G.R. No. L-15380 Wan V Kim - DigestOjie SantillanNo ratings yet

- Mondstadt City of Freedom Travel GuideDocument10 pagesMondstadt City of Freedom Travel GuideShypackofcheetos100% (3)

- MIZAT PWHT Procedure Ensures Welded Joints Meet StandardsDocument9 pagesMIZAT PWHT Procedure Ensures Welded Joints Meet StandardsM. R. Shahnawaz KhanNo ratings yet

- St. Francis de Sales Sr. Sec. School, Gangapur CityDocument12 pagesSt. Francis de Sales Sr. Sec. School, Gangapur CityArtificial GammerNo ratings yet

- Crashing Pert Networks: A Simulation ApproachDocument15 pagesCrashing Pert Networks: A Simulation ApproachRavindra BharathiNo ratings yet

- DOJ OIG Issues 'Fast and Furious' ReportDocument512 pagesDOJ OIG Issues 'Fast and Furious' ReportFoxNewsInsiderNo ratings yet

- Patient Admission Note TemplateDocument4 pagesPatient Admission Note Templatejonnyahn100% (1)

- MNCs-consider-career-development-policyDocument2 pagesMNCs-consider-career-development-policySubhro MukherjeeNo ratings yet

- Radio Drama (Rubric)Document1 pageRadio Drama (Rubric)Queenie BalitaanNo ratings yet

- ZiffyHealth Pitch DeckDocument32 pagesZiffyHealth Pitch DeckSanjay Kumar100% (1)

- M.Com Second Semester – Advanced Cost Accounting MCQDocument11 pagesM.Com Second Semester – Advanced Cost Accounting MCQSagar BangreNo ratings yet

- Samsung RAM Product Guide Feb 11Document24 pagesSamsung RAM Product Guide Feb 11Javed KhanNo ratings yet

- BSNL TrainingDocument25 pagesBSNL TrainingAditya Dandotia68% (19)

- 2008-14-03Document6 pages2008-14-03RAMON CALDERONNo ratings yet

- MaheshDocument20 pagesMaheshParthNo ratings yet

- SecASC - M02 - Azure Security Center Setup and ConfigurationDocument53 pagesSecASC - M02 - Azure Security Center Setup and ConfigurationGustavo WehdekingNo ratings yet

- INA128 INA129: Features DescriptionDocument20 pagesINA128 INA129: Features DescriptionCDDSANo ratings yet

- RIBA Outline Plan of Work ExplainedDocument20 pagesRIBA Outline Plan of Work ExplainedkenNo ratings yet

- Sato Printer Api Reference DocumentDocument34 pagesSato Printer Api Reference Documentsupersteel.krwNo ratings yet

- Annual Report 18Document363 pagesAnnual Report 18Safeer UllahNo ratings yet

- IEC61508 GuideDocument11 pagesIEC61508 Guidesrbehera1987No ratings yet

- Nettoplcsim S7online Documentation en v0.9.1Document5 pagesNettoplcsim S7online Documentation en v0.9.1SyariefNo ratings yet

- IGNOU MBA MS-11 Solved AssignmentDocument5 pagesIGNOU MBA MS-11 Solved AssignmenttobinsNo ratings yet

- 2020.07.31 Marchese Declaration With ExhibitsDocument103 pages2020.07.31 Marchese Declaration With Exhibitsheather valenzuelaNo ratings yet

- BED 101 Voc & Tech. Course ContentDocument3 pagesBED 101 Voc & Tech. Course ContentSunday PaulNo ratings yet

- RTR Piping Inspection GuideDocument17 pagesRTR Piping Inspection GuideFlorante NoblezaNo ratings yet

- Setup LogDocument77 pagesSetup Loganon-261766No ratings yet

- Format of Synopsis - Project - 1Document5 pagesFormat of Synopsis - Project - 1euforia hubNo ratings yet

- Atomic Structure QuestionsDocument1 pageAtomic Structure QuestionsJames MungallNo ratings yet

- Cengage Eco Dev Chapter 13 - The Environment and Sustainable Development in AsiaDocument32 pagesCengage Eco Dev Chapter 13 - The Environment and Sustainable Development in AsiaArcy LeeNo ratings yet