Professional Documents

Culture Documents

2024 Acc GR 12 Test 1 QP

2024 Acc GR 12 Test 1 QP

Uploaded by

LloydOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2024 Acc GR 12 Test 1 QP

2024 Acc GR 12 Test 1 QP

Uploaded by

LloydCopyright:

Available Formats

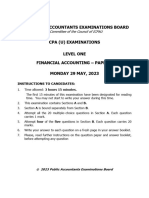

Accounting Activities Term 1 2024

TEST 1 (Buy Back of shares: Calculations, Ledger & Notes to Fin Statements)

(30 marks; 20 min)

The information below relates to BAC Ltd. Their financial year ends annually on 28 February.

Show the following calculations and entries in your ANSWER BOOK.

1.1 Show the calculations for the average share price BEFORE the buy back of the shares

on 1 March 2023. (4)

1.2. Show the required calculations FOR the buy-back of the shares on 1 June 2023. (4)

1.3 Calculate the Average share price and Net Asset Value (NAV) per share AFTER the

repurchase of the shares on 28 February 2024. (4)

1.4 Show the necessary entries in the General Ledger for the year ending 28 February 2024. (14)

1.5 Complete the Retained Income Note on 28 February 2024. (4)

Information:

Balances on 1 March 2023:

Ordinary Share Capital R4 500 000 (750 000 shares in issue)

Retained income R1 200 000

Bank R1 100 000 (Dr)

1 June 2023

The directors decided to pay R800 000 for the buy-back of 100 000 shares.

28 February 2024

Net profit before tax R1 300 000

Income tax for the year R 390 000

Dividends declared and paid R 260 000

TOTAL: 30

You might also like

- Accounting and Management Exam - MancosaDocument11 pagesAccounting and Management Exam - MancosaFrancis Mtambo100% (1)

- 2023 03 Acc QPDocument8 pages2023 03 Acc QPmongezisokhela9No ratings yet

- 2023 Grade 12 Controlled Test 1 QPDocument5 pages2023 Grade 12 Controlled Test 1 QPannabellabloom282007No ratings yet

- ACCOUNTING P1 GR11 QP NOV 2023 - EnglishDocument12 pagesACCOUNTING P1 GR11 QP NOV 2023 - EnglishChantelle IsaksNo ratings yet

- 1 NW NSC Accounting P1 Eng QP Sept 2023Document10 pages1 NW NSC Accounting P1 Eng QP Sept 2023bmwanacondaNo ratings yet

- ACCOUNTING P1 GR12 QP JUNE 2023 - EnglishDocument11 pagesACCOUNTING P1 GR12 QP JUNE 2023 - Englishfanelenzima03No ratings yet

- 2024.written presentation grade 12Document5 pages2024.written presentation grade 12ngomanewandile24No ratings yet

- ACCF3114-1Document12 pagesACCF3114-1Krishna 11No ratings yet

- 15 March Worksheet - Cash FlowDocument11 pages15 March Worksheet - Cash FlowkeithsimphiweNo ratings yet

- Sample Paper-5Document8 pagesSample Paper-5Keshav GoyalNo ratings yet

- HFAC130 1 JanJun2024 FA1 GC V.2 07022024Document9 pagesHFAC130 1 JanJun2024 FA1 GC V.2 07022024ICT ASSIGNMENTS MZANSINo ratings yet

- Israel Corp Q2 2023 Financial Report EnglishDocument71 pagesIsrael Corp Q2 2023 Financial Report Englisha.belgherrasNo ratings yet

- SIB Result Q1 2024 FinalDocument24 pagesSIB Result Q1 2024 Finalseeme55runNo ratings yet

- KZN 2020 June P1 Answer Book 2Document7 pagesKZN 2020 June P1 Answer Book 2shandren19No ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument7 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerHarsh KumarNo ratings yet

- Q4-2022-2023 Japana Kubota ReportDocument30 pagesQ4-2022-2023 Japana Kubota ReportnainqaecNo ratings yet

- Accounting QP 1Document29 pagesAccounting QP 1mulisanembaheNo ratings yet

- 15 March Worksheet - Cash FlowDocument7 pages15 March Worksheet - Cash FlowkeithsimphiweNo ratings yet

- A221 MC 9 - StudentDocument4 pagesA221 MC 9 - StudentNajihah RazakNo ratings yet

- 1 March Live Lesson WorksheetDocument6 pages1 March Live Lesson Worksheetnikiwe mathebulaNo ratings yet

- 12_20_CA_APPL_Q__ADocument119 pages12_20_CA_APPL_Q__AHassaniNo ratings yet

- Pep Technologies - Annual Report - FY21Document38 pagesPep Technologies - Annual Report - FY21Sagar SangoiNo ratings yet

- ACCOUNTING P2 QP GR12 P2 JUNE 2023 - EnglishDocument13 pagesACCOUNTING P2 QP GR12 P2 JUNE 2023 - EnglishmulisanembaheNo ratings yet

- CPA 1 - Financial Accounting-1Document9 pagesCPA 1 - Financial Accounting-1LYNETTE NYAKAISIKI50% (2)

- Accountancy Set 1 QPDocument6 pagesAccountancy Set 1 QPShaurya JainNo ratings yet

- Financial Accounting and Reporting 1: (Good Luck)Document1 pageFinancial Accounting and Reporting 1: (Good Luck)Touseef JavedNo ratings yet

- Jenn Accounting_2024_Autumn_MaterialDocument46 pagesJenn Accounting_2024_Autumn_Material9vrzdg24pzNo ratings yet

- TEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Document3 pagesTEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Fatin AqilahNo ratings yet

- CAF-1-FAR1-Spring-2024Document7 pagesCAF-1-FAR1-Spring-2024khalidumarkhan1973No ratings yet

- MSA 1 Winter2021Document16 pagesMSA 1 Winter2021RSM PakistanNo ratings yet

- 2024 Acc Gr12 T2 Project QPDocument6 pages2024 Acc Gr12 T2 Project QPntandowsegowNo ratings yet

- AFAR-FC-2Document5 pagesAFAR-FC-2Ann MagsipocNo ratings yet

- Accounting p1 Gr12 Ab September 2023_englishDocument11 pagesAccounting p1 Gr12 Ab September 2023_englishTiffany PatersonNo ratings yet

- 2020 Gr 12 Controlled Test 1 QP EnglishDocument7 pages2020 Gr 12 Controlled Test 1 QP Englishmbalentledaniso035No ratings yet

- Accounting - IIDocument12 pagesAccounting - IISethmika DiasNo ratings yet

- Spring 2022-FAR-1 - Comprehensive Question On IAS33 IAS8 IAS1 IAS7Document7 pagesSpring 2022-FAR-1 - Comprehensive Question On IAS33 IAS8 IAS1 IAS7Dua FarmoodNo ratings yet

- CH18601 FM - II Model PaperDocument5 pagesCH18601 FM - II Model PaperKarthikNo ratings yet

- Management Accounting and Finance: Level Iii Examination - January 2021Document9 pagesManagement Accounting and Finance: Level Iii Examination - January 2021Rajendran KajananthanNo ratings yet

- 2022 Financial StatementsDocument138 pages2022 Financial Statements贺He沁QinNo ratings yet

- CIE A Level Accounting Work Sheet Topic: Budgeting: Loss 5 945Document15 pagesCIE A Level Accounting Work Sheet Topic: Budgeting: Loss 5 945rizwan ul hassanNo ratings yet

- 2022 AC202 SummerDocument4 pages2022 AC202 Summermollymgonigle1No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument13 pages© The Institute of Chartered Accountants of IndiaRohit SadhukhanNo ratings yet

- Control Test 1 - March 2022Document4 pagesControl Test 1 - March 2022yandisaNo ratings yet

- 28th Annual Report-2022Document165 pages28th Annual Report-2022titu_1552No ratings yet

- Accounting P1 May-June 2024 Eng_240523_163001Document13 pagesAccounting P1 May-June 2024 Eng_240523_163001snothandoxesibe2006No ratings yet

- UBL Annual Report 2018-147Document1 pageUBL Annual Report 2018-147IFRS LabNo ratings yet

- CPA Paper 1 Financial Accounting 2Document9 pagesCPA Paper 1 Financial Accounting 2philipisingomaNo ratings yet

- Accounting P1 NSC Nov 2020 EngDocument11 pagesAccounting P1 NSC Nov 2020 EngSweetness MakaLuthando LeocardiaNo ratings yet

- Dac1102 Past Examination Paper 11.04.2023 1Document10 pagesDac1102 Past Examination Paper 11.04.2023 1marumoduberemofilwerethabilevaNo ratings yet

- FA Dec 2022Document8 pagesFA Dec 2022Shawn LiewNo ratings yet

- LXL Gr12Acc 08 Exam-Questions-Live 04jun2015Document6 pagesLXL Gr12Acc 08 Exam-Questions-Live 04jun2015Nezer Byl P. VergaraNo ratings yet

- Acc G11 Ec Nov 2022 P1 QPDocument10 pagesAcc G11 Ec Nov 2022 P1 QPTshenoloNo ratings yet

- 1 GR 12 MARCH 2023 QP P1Document10 pages1 GR 12 MARCH 2023 QP P1juniorfrankk73No ratings yet

- F2 November 2014 Question PaperDocument20 pagesF2 November 2014 Question PaperRobert MunyaradziNo ratings yet

- Final FAR-2 Mock Q. PaperDocument6 pagesFinal FAR-2 Mock Q. PaperAli OptimisticNo ratings yet

- XBRL Financial Statements Duly Authenticated As Per Section 134 (Including BoardDocument123 pagesXBRL Financial Statements Duly Authenticated As Per Section 134 (Including BoardvineminaiNo ratings yet

- Financial Results For The Three Months Ended July 31, 2022Document9 pagesFinancial Results For The Three Months Ended July 31, 2022Ally LuNo ratings yet

- 41110_FIDELITY_BANK_PLC-_QUARTER_1_-_FINANCIAL_STATEMENT_FOR_2024_FINANCIAL_STATEMENTS_APRIL_2024Document86 pages41110_FIDELITY_BANK_PLC-_QUARTER_1_-_FINANCIAL_STATEMENT_FOR_2024_FINANCIAL_STATEMENTS_APRIL_2024frederick aivborayeNo ratings yet

- Accn. Lockdown Worksheet 1Document3 pagesAccn. Lockdown Worksheet 1Wonder Bee NzamaNo ratings yet

- ACA Audit and Assurance Professional: Exam Preparation KitFrom EverandACA Audit and Assurance Professional: Exam Preparation KitNo ratings yet