Professional Documents

Culture Documents

1 March Live Lesson Worksheet

Uploaded by

nikiwe mathebulaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 March Live Lesson Worksheet

Uploaded by

nikiwe mathebulaCopyright:

Available Formats

Accounting 11 DBE/November 2019

NSC

CORRECTION OF NET PROFIT AFTER TAX AND BALANCE SHEET- 01 MARCH 2024

QUESTION 4: BALANCE SHEET AND AUDIT REPORT (70 marks; 45 minutes)

4.1 Choose an explanation in COLUMN B that matches the term in COLUMN A.

Write only the letters (A–E) next to the question numbers (4.1.1 to 4.1.5) in the

ANSWER BOOK.

COLUMN A COLUMN B

4.1.1 Internal auditor A appointed by shareholders to manage

a company

4.1.2 Memorandum of

incorporation (MOI) B the body responsible for registration

of all companies

4.1.3 Limited liability

C employed by a company to ensure

4.1.4 Director good internal control procedures

4.1.5 Companies and D indicates that a company has a legal

Intellectual Property personality of its own

Commission (CIPC)

E the document that establishes the

rules and procedures of a company

(5 x 1) (5)

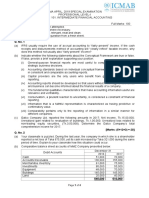

4.2 VISIV LTD

The financial year ended on 28 February 2019.

REQUIRED:

4.2.1 Calculate:

Amounts for (i) and (ii) in the Fixed Assets Register (5)

Profit/Loss on sale of asset (2)

Fixed assets carrying value on 28 February 2019 (4)

4.2.2 Calculate the correct net profit after tax for the year ended

28 February 2019. Indicate (+) for increase and (–) for decrease. (9)

4.2.3 Refer to Information A–H. Prepare the following on 28 February 2019:

Retained Income Note (9)

Statement of Financial Position (Balance Sheet). (27)

NOTE: Show workings. Certain figures are provided in the

ANSWER BOOK.

Copyright reserved Please turn over

Accounting 12 DBE/November 2019

NSC

INFORMATION:

A. Fixed assets:

A delivery vehicle was sold on 31 October 2018 but no entries were made

to record this transaction.

Details of vehicle sold:

Delivery Vehicle X43

Date purchased: 1 March 2016

Date sold: 31 October 2018 Sold for: R195 000 (cash)

Depreciation rate: 25% p.a. (diminishing-balance method)

CARRYING

COST DEPRECIATION

VALUE

28 February 2017 R400 000 R100 000 R300 000

28 February 2018 75 000 225 000

31 October 2018 (i) (ii)

B. List of balances/totals on 28 February 2019 (before taking into

account all adjustments below):

Ordinary share capital R8 152 000

Retained income (1 March 2018) 865 300

Mortgage loan: Prati Bank 1 758 000

Fixed assets (carrying value) 10 190 000

Fixed deposit: Prati Bank (balancing figure) ?

Trading stock 1 102 000

Net trade debtors 1 090 000

Bank (favourable) ?

SARS: Income tax (provisional tax payments) 155 000

Creditors' control 1 906 800

C. Net profit before tax, R822 700, was calculated before correcting the

following:

Provision for bad debts must be increased by R65 000.

R9 800 of an advertising contract applies to the next financial year.

A tenant paid rent of R334 000 for the period 1 March 2018 to

31 March 2019. Rent was increased by R3 000 per month from

1 January 2019.

Depreciation and profit/loss on the vehicle sold must be recorded.

A further R43 000 is owed for income tax.

Copyright reserved Please turn over

Accounting 13 DBE/November 2019

NSC

D. Ordinary shares:

DATE DETAILS

1 March 2018 2 000 000 shares in issue; total book value R7 600 000

31 May 2018 360 000 shares repurchased at R4,10 each

1 October 2018 800 000 new shares issued

28 February 2019 2 440 000 shares in issue

E. Dividends:

Interim dividends were paid in September 2018, R295 200.

Final dividends of 20c per share were declared on 28 February 2019.

F. A creditor with a debit balance of R7 600 must be transferred to the

Debtors' Ledger.

G. A cheque for R75 000, dated 30 April 2019, was issued to a supplier in

February.

H. After processing all adjustments:

The current ratio is 0,8 : 1.

The current liabilities totalled R2 900 000.

The current portion of the loan is the balancing figure.

Copyright reserved Please turn over

Accounting 9 DBE/November 2019

NSC – Answer Book

QUESTION 4

4.1 4.1.1

4.1.2

4.1.3

4.1.4

4.1.5 5

4.2 VISIV LTD

4.2.1 (i) Calculate: Depreciation for the current year

Workings Answer

(ii) Calculate: Carrying value of vehicle sold

Workings Answer

5

Calculate: Profit/Loss on sale of asset

Workings Answer

2

Calculate: Fixed assets carrying value on 28 February 2019

Workings Answer

Copyright reserved Please turn over

Accounting 10 DBE/November 2019

NSC – Answer Book

4.2.2 Calculate the correct net profit after tax for the year ended

28 February 2019. Indicate (+) for increase and (–) for decrease.

Workings Answer

Incorrect net profit before tax 822 700

Correct net profit after tax 9

4.2.3 RETAINED INCOME NOTE:

Balance at beginning 865 300

Ordinary share dividends

Balance at end 9

Copyright reserved Please turn over

Accounting 11 DBE/November 2019

NSC – Answer Book

VISIV LTD

STATEMENT OF FINANCIAL POSITION (BALANCE SHEET)

ON 28 FEBRUARY 2019

ASSETS

Non-current assets

Fixed assets

Fixed deposit

Current assets

Inventories 1 102 000

Cash and cash equivalents

TOTAL ASSETS

EQUITY AND LIABILITIES

Ordinary shareholders' equity

Ordinary share capital 8 152 000

Non-current liabilities

Current liabilities 2 900 000

Current portion of loan

TOTAL EQUITY AND LIABILITIES 27

Copyright reserved Please turn over

You might also like

- Accounting Grade 12 Test 1Document4 pagesAccounting Grade 12 Test 1Ryno de BeerNo ratings yet

- Accn. Lockdown Worksheet 1Document3 pagesAccn. Lockdown Worksheet 1Wonder Bee NzamaNo ratings yet

- Accounting P1 NSC Nov 2020 EngDocument12 pagesAccounting P1 NSC Nov 2020 EngTlhago PitseNo ratings yet

- Accounting P1 NSC Nov 2020 EngDocument11 pagesAccounting P1 NSC Nov 2020 EngSweetness MakaLuthando LeocardiaNo ratings yet

- 2018 GR 10 Case Study 2Document2 pages2018 GR 10 Case Study 2Ghostgirl 437No ratings yet

- B7AF102 Financial Accounting May 2020Document9 pagesB7AF102 Financial Accounting May 2020dayahNo ratings yet

- ACCOUNTING P1 GR12 QP JUNE 2023 - EnglishDocument11 pagesACCOUNTING P1 GR12 QP JUNE 2023 - Englishfanelenzima03No ratings yet

- Accounting P1 GR 11 Exemplar Nov 2019 EngDocument12 pagesAccounting P1 GR 11 Exemplar Nov 2019 EngMalwandla MashabaNo ratings yet

- Acc G11 Ec Nov 2022 P1 QPDocument10 pagesAcc G11 Ec Nov 2022 P1 QPTshenoloNo ratings yet

- 02 Acc GR 12 Companies Work SheetDocument8 pages02 Acc GR 12 Companies Work Sheet218041659mqikelayNo ratings yet

- Accounting p1 Prep Sept 2022 QP EngDocument13 pagesAccounting p1 Prep Sept 2022 QP Engrifumo579No ratings yet

- Bangladesh Open University: BBA Program Semester: 192 (8 Level-AIS & Finance)Document11 pagesBangladesh Open University: BBA Program Semester: 192 (8 Level-AIS & Finance)monir mahmudNo ratings yet

- Accounting P1 Nov 2021 EngDocument12 pagesAccounting P1 Nov 2021 EngnicholasvhahangweleNo ratings yet

- 1 NW NSC Accounting P1 Eng QP Sept 2023Document10 pages1 NW NSC Accounting P1 Eng QP Sept 2023bmwanacondaNo ratings yet

- Project Question: Financial Management 1ADocument4 pagesProject Question: Financial Management 1AHashimRazaNo ratings yet

- 301 AFA II PL III Question CMA June 2021 Exam.Document4 pages301 AFA II PL III Question CMA June 2021 Exam.rumelrashid_seuNo ratings yet

- Acc 113day 23sasdocx PDF FreeDocument6 pagesAcc 113day 23sasdocx PDF FreeMariefel OrdanezNo ratings yet

- 2023 Grade 12 Controlled Test 1 QPDocument5 pages2023 Grade 12 Controlled Test 1 QPannabellabloom282007No ratings yet

- Icag Nov 2020-Group Discuss...Document6 pagesIcag Nov 2020-Group Discuss...Papa Ekow ArmahNo ratings yet

- B7AF102 2021 OMD1 First Sitting Exam PaperDocument10 pagesB7AF102 2021 OMD1 First Sitting Exam PaperAZLEA BINTI SYED HUSSIN (BG)No ratings yet

- Sem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201Document5 pagesSem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201ruPAM DeyNo ratings yet

- FAR B92 1st PB PDFDocument14 pagesFAR B92 1st PB PDFomer 2 gerdNo ratings yet

- ACCN. LOCKDOWN WORKSHEET 2aDocument2 pagesACCN. LOCKDOWN WORKSHEET 2aRyno de BeerNo ratings yet

- Specific Financial Reporting Questions & Answers: Suggested Solution 1Document37 pagesSpecific Financial Reporting Questions & Answers: Suggested Solution 1Tawanda Tatenda Herbert100% (2)

- Grade 12 Class Test Company 70 Minutes 120 MarksDocument11 pagesGrade 12 Class Test Company 70 Minutes 120 MarksStars2323100% (1)

- Chapter 1 11 IA3Document10 pagesChapter 1 11 IA3ZicoNo ratings yet

- Chapter-2 Homework MisstatementsDocument4 pagesChapter-2 Homework MisstatementsKenneth Christian WilburNo ratings yet

- Statement of Financial Position (Balance Sheet) : Lopez, Erica BS Accountancy 2Document8 pagesStatement of Financial Position (Balance Sheet) : Lopez, Erica BS Accountancy 2Erica LopezNo ratings yet

- Classroom Exerisises On Presentation of Financial Statements PDFDocument2 pagesClassroom Exerisises On Presentation of Financial Statements PDFalyssaNo ratings yet

- Viray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsDocument6 pagesViray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsZeeNo ratings yet

- CPA 1 - Financial AccountingDocument8 pagesCPA 1 - Financial AccountingPurity muchobella100% (1)

- ExercisesDocument20 pagesExercisesRolivhuwaNo ratings yet

- Chapter 1 Practice Test - Problems (Answers)Document12 pagesChapter 1 Practice Test - Problems (Answers)anonymousNo ratings yet

- Accounting P1 Nov 2021 EngDocument11 pagesAccounting P1 Nov 2021 EngLloydNo ratings yet

- (EN) Problem Mojakoe AK1Document11 pages(EN) Problem Mojakoe AK1gebbyNo ratings yet

- Control Test 1 - March 2022Document4 pagesControl Test 1 - March 2022yandisaNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Group Assignment On Fundamentals of Accounting IDocument6 pagesGroup Assignment On Fundamentals of Accounting IKaleab ShimelsNo ratings yet

- FA Dec 2020Document9 pagesFA Dec 2020Shawn LiewNo ratings yet

- June 2019 QDocument8 pagesJune 2019 Q2024786333No ratings yet

- Cib GH 04-23 Financial Reporting, Planning & Analysis Level Iii Page 1Document8 pagesCib GH 04-23 Financial Reporting, Planning & Analysis Level Iii Page 1lilliananne5051No ratings yet

- ACCOUNTING P1 GR11 QP NOVEMBER 2020 EnglishDocument12 pagesACCOUNTING P1 GR11 QP NOVEMBER 2020 EnglishbmtnrcmzqyNo ratings yet

- 6727 Statement of Financial PositionDocument3 pages6727 Statement of Financial PositionJane ValenciaNo ratings yet

- Accounting Grade 12 Support 2021 JIT Paper 1Document134 pagesAccounting Grade 12 Support 2021 JIT Paper 1Hunadi BabiliNo ratings yet

- ACCT2014 Final Exam 2021-2022 - K.Ashman v2Document9 pagesACCT2014 Final Exam 2021-2022 - K.Ashman v2Christina StephensonNo ratings yet

- 2020 FA L4 To L10 StudentsDocument40 pages2020 FA L4 To L10 Students徐恺民No ratings yet

- Financial Accounting and Reporting: Page 1 of 4Document4 pagesFinancial Accounting and Reporting: Page 1 of 4ebshuvoNo ratings yet

- Accounting's AssignmentDocument4 pagesAccounting's AssignmentLinhzin LinhzinNo ratings yet

- AUDITING-Adjusting Entries-Correction of ErrorsDocument10 pagesAUDITING-Adjusting Entries-Correction of ErrorsJamhel MarquezNo ratings yet

- 3rd Year Diagnostic TestDocument11 pages3rd Year Diagnostic TestRaizell Jane Masiglat CarlosNo ratings yet

- Far-I Autumn 2021 TsaDocument3 pagesFar-I Autumn 2021 TsaUsman AhmedNo ratings yet

- ACC401-2023 Business Valuation TutorialsDocument3 pagesACC401-2023 Business Valuation TutorialsOhene Asare PogastyNo ratings yet

- PDF Topic No 2 Statement of Cash Flows PDF - CompressDocument3 pagesPDF Topic No 2 Statement of Cash Flows PDF - CompressMillicent AlmueteNo ratings yet

- Question CMA April 2019 SP Exam.Document4 pagesQuestion CMA April 2019 SP Exam.F A Saffat RahmanNo ratings yet

- March 2020 Diploma in Accountancy Programme Question and AnswerDocument102 pagesMarch 2020 Diploma in Accountancy Programme Question and Answerethel100% (1)

- QUESTION 4 - Financial-Reporting - QUESTION 4 - NEETADocument7 pagesQUESTION 4 - Financial-Reporting - QUESTION 4 - NEETALaud ListowellNo ratings yet

- AccountingDocument6 pagesAccountingBlue HourNo ratings yet

- BAC 322 Advanced AccountingDocument9 pagesBAC 322 Advanced AccountingLawrence jnr MwapeNo ratings yet

- BADVAC1X - MOD 2 Conso FS Date of AcqDocument6 pagesBADVAC1X - MOD 2 Conso FS Date of AcqJopnerth Carl CortezNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Raj SakariaNo ratings yet

- Percentage and Profit and LossDocument7 pagesPercentage and Profit and LossMuhammad SamhanNo ratings yet

- Workplace Wellness Survey Report - FinalDocument43 pagesWorkplace Wellness Survey Report - FinalMeeraNo ratings yet

- Alcpt 27R (Script)Document21 pagesAlcpt 27R (Script)Matt Dahiam RinconNo ratings yet

- Lambda Exercises - Copy (11Document6 pagesLambda Exercises - Copy (11SamNo ratings yet

- 137684-1980-Serrano v. Central Bank of The PhilippinesDocument5 pages137684-1980-Serrano v. Central Bank of The Philippinespkdg1995No ratings yet

- Test Beca Week 6de8Document3 pagesTest Beca Week 6de8Ninoshka EstradaNo ratings yet

- World Oil April 2010Document200 pagesWorld Oil April 2010Tahar Hajji0% (1)

- Concept Note Digital Platform Workshop - en PDFDocument3 pagesConcept Note Digital Platform Workshop - en PDFgamal90No ratings yet

- Mini Flour Mill KarnalDocument9 pagesMini Flour Mill KarnalAnand Kishore100% (2)

- Kukurija: Shuyu KanaokaDocument10 pagesKukurija: Shuyu KanaokaMarshal MHVHZRHLNo ratings yet

- Budget Finance For Law Enforcement Module 7 Ggonzales 2Document9 pagesBudget Finance For Law Enforcement Module 7 Ggonzales 2api-526672985No ratings yet

- Reading 53 Pricing and Valuation of Futures ContractsDocument3 pagesReading 53 Pricing and Valuation of Futures ContractsNeerajNo ratings yet

- Exercises 1-3 Corporate PlanningDocument17 pagesExercises 1-3 Corporate Planningmarichu apiladoNo ratings yet

- 01 - Quality Improvement in The Modern Business Environment - Montgomery Ch01Document75 pages01 - Quality Improvement in The Modern Business Environment - Montgomery Ch01Ollyvia Faliani MuchlisNo ratings yet

- DomOrlando Corporate Resume000Document3 pagesDomOrlando Corporate Resume000domorlando1No ratings yet

- Marxism and Brontë - Revenge As IdeologyDocument8 pagesMarxism and Brontë - Revenge As IdeologyJonas SaldanhaNo ratings yet

- (Digest) Marcos II V CADocument7 pages(Digest) Marcos II V CAGuiller C. MagsumbolNo ratings yet

- 50CDocument65 pages50Cvvikram7566No ratings yet

- Walt DisneyDocument56 pagesWalt DisneyDaniela Denisse Anthawer Luna100% (6)

- 2.Hp2.Eou Test U7 PreinterDocument6 pages2.Hp2.Eou Test U7 PreinterMinh Trí NgôNo ratings yet

- COM379 Essay 7Document5 pagesCOM379 Essay 7Ali RungeNo ratings yet

- 520082272054091201Document1 page520082272054091201Shaikh AdilNo ratings yet

- A Tuna ChristmasDocument46 pagesA Tuna ChristmasMark100% (3)

- Urban Planning PHD Thesis PDFDocument6 pagesUrban Planning PHD Thesis PDFsandracampbellreno100% (2)

- Review Test 4 - Units 7-8, Real English B1, ECCEDocument2 pagesReview Test 4 - Units 7-8, Real English B1, ECCEΜαρία ΒενέτουNo ratings yet

- The Customary of The House of Initia Nova - OsbDocument62 pagesThe Customary of The House of Initia Nova - OsbScott KnitterNo ratings yet

- KGBV Bassi Profile NewDocument5 pagesKGBV Bassi Profile NewAbhilash MohapatraNo ratings yet

- Nag ArjunaDocument6 pagesNag ArjunanieotyagiNo ratings yet

- Strategic Action Plans and Alignment GuideDocument13 pagesStrategic Action Plans and Alignment GuideAbeer AzzyadiNo ratings yet