Professional Documents

Culture Documents

Project Info

Uploaded by

Hassan0 ratings0% found this document useful (0 votes)

3 views2 pagesOriginal Title

375889996 - Project Info

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesProject Info

Uploaded by

HassanCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

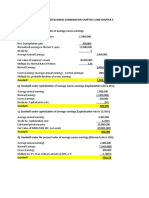

BA216 LLC

Scenario 1 and 2 Summary

Income Statement Items Calculations

Item % of Scenario 1

Sales $ 600,000

Sales $ 600,000

Gross Profit sales 50.00%

Gross Profit $300,000

Sales commission expense net sales 2.00%

Sales commission expense $12,000

Payroll tax expense payroll 8.65%

Payroll tax expense $8,650

Employee benefit expense monthly per employee $ 400

Number of employees 3

Website/social media expense $ 24,000

Website/social media expense $24,000

Scenario 1 expense items are given in the table on the right.

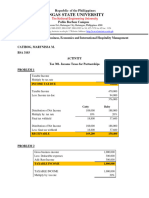

BA216 LLC

mary First Year Operating Budget

Scenario 1

Given Amounts

Scenario 1

Scenario 2 Sales Revenue $ 600,000

Increases by 100% Cost of Goods Sold $ 300,000

1,200,000

50.00% Operating expenses:

$600,000

10% of amount over Scenario 1 sales Salaries expense 100,000

$60,000

8.65% Sales commission expense 12,000$

$8,650

$ 500 Payroll tax expense $8,650

3 Employee benefits expense $1,200

Increases by 50% Advertising expense 9,000

$36,000 Event Expense 12,000

Website/Social Media expense 24,000

Professional services 12,000

Building Lease Expense 43,200

Depreciation expense, equipmen 6,000

Insurance expense 12,000

Supplies expense 18,000

Utilities Expense 12,000

You might also like

- FU Money - Dan Lok (Updated)Document284 pagesFU Money - Dan Lok (Updated)Siddharth Kalyani98% (45)

- Answers and Solutions For Business Combination Chapter 3 and Chapter 4Document4 pagesAnswers and Solutions For Business Combination Chapter 3 and Chapter 4Kyree Vlade0% (1)

- FNC535 Midterms DraftDocument8 pagesFNC535 Midterms DraftRufino Gerard MorenoNo ratings yet

- Model Questions - 2018 - Macroeconomics FinalDocument9 pagesModel Questions - 2018 - Macroeconomics FinalSomidu ChandimalNo ratings yet

- 1 Introduction To Trade FinanceDocument10 pages1 Introduction To Trade Financemathewx01No ratings yet

- Itbark Exp19 Excel AppCapstone Intro CollectionDocument6 pagesItbark Exp19 Excel AppCapstone Intro CollectionMohit LukhiNo ratings yet

- Budget OperationDocument2 pagesBudget OperationHassanNo ratings yet

- Fabm2 Learning-Activity-2Document5 pagesFabm2 Learning-Activity-2Cha Eun WooNo ratings yet

- Activity 01 PDFDocument5 pagesActivity 01 PDFJennifer AdvientoNo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- Model - Student Version: MODULE 13 CORAL BAY HOSPITAL: Traditional Project AnalysisDocument23 pagesModel - Student Version: MODULE 13 CORAL BAY HOSPITAL: Traditional Project AnalysisHassanNo ratings yet

- Quiz 1.01 Financial Statements To Interim ReportingDocument22 pagesQuiz 1.01 Financial Statements To Interim ReportingJohn Lexter MacalberNo ratings yet

- Ratio Analysis ActivityDocument3 pagesRatio Analysis ActivityKarlla ManalastasNo ratings yet

- Quiz 2 - Income Tax Concepts and ComplianceDocument3 pagesQuiz 2 - Income Tax Concepts and CompliancelcNo ratings yet

- Pa Revision For FinalsDocument9 pagesPa Revision For FinalsKhải Hưng NguyễnNo ratings yet

- 6.01 Develop An Income StatementDocument2 pages6.01 Develop An Income StatementAditya NigamNo ratings yet

- Review Session 2024 SolutionsDocument3 pagesReview Session 2024 SolutionsHitesh MehtaNo ratings yet

- Chapter 11 Mini Case: Cash Flow EstimationDocument60 pagesChapter 11 Mini Case: Cash Flow EstimationafiNo ratings yet

- 2020 Expenses: What SUP, Inc. Income Statement For The Year EndedDocument5 pages2020 Expenses: What SUP, Inc. Income Statement For The Year EndedRi BNo ratings yet

- Patrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTDocument12 pagesPatrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTJohnrick RabaraNo ratings yet

- Statement of Income SAT Notes - RemovedDocument7 pagesStatement of Income SAT Notes - Removedmariaeahjiselle.quebengco.commNo ratings yet

- Assignment 2 Solution Fall 2023 MBA 5241EDocument11 pagesAssignment 2 Solution Fall 2023 MBA 5241EDhyan HariaNo ratings yet

- Ammar Abbasi Assignment 5Document8 pagesAmmar Abbasi Assignment 5Usman SiddiquiNo ratings yet

- Bachelor of Management With Honours (Bim)Document11 pagesBachelor of Management With Honours (Bim)Aizat Ahmad100% (3)

- Material - Gestión Financiera - Excel Master Class Investment Decision MakingDocument8 pagesMaterial - Gestión Financiera - Excel Master Class Investment Decision MakingjessicaNo ratings yet

- Solutions For Notes and Loans ReceivableDocument4 pagesSolutions For Notes and Loans ReceivableKenaniah SanchezNo ratings yet

- Chapter 12. Tool Kit For Cash Flow Estimation and Risk AnalysisDocument4 pagesChapter 12. Tool Kit For Cash Flow Estimation and Risk AnalysisHerlambang PrayogaNo ratings yet

- LEARNING KIT Accounting2 Week 3Document4 pagesLEARNING KIT Accounting2 Week 3Asahi HamadaNo ratings yet

- Franchise and LTCCDocument4 pagesFranchise and LTCCAngela Marie PenarandaNo ratings yet

- Worksheet - ABC Marketing AgencyDocument6 pagesWorksheet - ABC Marketing AgencyZymcel Ann VidallonNo ratings yet

- Gross Profit/net Sales Gross Profit/revenue Net Income/Total AssetsDocument85 pagesGross Profit/net Sales Gross Profit/revenue Net Income/Total AssetsMaria Dana BrillantesNo ratings yet

- 07 Activity AtanezDocument2 pages07 Activity AtanezSteff Atañez100% (1)

- Accounting Assignment CHP 1-1Document11 pagesAccounting Assignment CHP 1-1MUHAMMAD AMMAD ARSHADNo ratings yet

- Construction Company Profit and Loss Statement TemplateDocument1 pageConstruction Company Profit and Loss Statement Template123prasad1234No ratings yet

- Template 37 Construction Company Profit and Loss StatementDocument1 pageTemplate 37 Construction Company Profit and Loss StatementIhin SolihinNo ratings yet

- Output Tax 396,000Document2 pagesOutput Tax 396,000almira garciaNo ratings yet

- Dream World CompanyDocument9 pagesDream World CompanyJC NicaveraNo ratings yet

- Quiz 2 Financial ManagementDocument6 pagesQuiz 2 Financial ManagementMARVIE JUNE CARBONNo ratings yet

- Responsiblity Accounting IllustrationDocument14 pagesResponsiblity Accounting IllustrationRianne NavidadNo ratings yet

- Chapter 4 Review Principles of Accounting AnswersDocument3 pagesChapter 4 Review Principles of Accounting AnswersChien Phuong ThanhNo ratings yet

- Accounting 2Document2 pagesAccounting 2reeisha7No ratings yet

- Practice Problem Set 9 - Long ProblemDocument7 pagesPractice Problem Set 9 - Long ProblemMarian Augelio PolancoNo ratings yet

- Itemized Deduction Vs Optional Standard Deductions 40OSDDocument4 pagesItemized Deduction Vs Optional Standard Deductions 40OSDjason genitaNo ratings yet

- Income Statement: Format: Single Step: List All Revenues and SubtotalDocument2 pagesIncome Statement: Format: Single Step: List All Revenues and SubtotalRabia RabiaNo ratings yet

- I. Multiple Choice 1. D 2. A 3. A 4. D 5. BDocument3 pagesI. Multiple Choice 1. D 2. A 3. A 4. D 5. BBianca Nicole LiwanagNo ratings yet

- Quali Review Statement of Cash Flows Complete SolutionDocument5 pagesQuali Review Statement of Cash Flows Complete SolutionPaul Ivan CabanatanNo ratings yet

- Activity 4.1 JKL Company Horizontal AnalysisDocument4 pagesActivity 4.1 JKL Company Horizontal AnalysisChancellor RimuruNo ratings yet

- Use The Following Information For The Next Two (2) QuestionsDocument21 pagesUse The Following Information For The Next Two (2) QuestionsJennifer AdvientoNo ratings yet

- Activity 3Document1 pageActivity 3John Michael Gaoiran GajotanNo ratings yet

- Midterm 1217Document7 pagesMidterm 1217Iphegenia DipoNo ratings yet

- FIRST PB FAR Solutions PDFDocument6 pagesFIRST PB FAR Solutions PDFStephanie Joy NogollosNo ratings yet

- Module 2 - Quiz To Give 03.06.23-1Document1 pageModule 2 - Quiz To Give 03.06.23-1ZAIL JEFF ALDEA DALENo ratings yet

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeHaidee Flavier SabidoNo ratings yet

- BBUS1DAS Final Alternative Assessment (Exam) T1 2020 - FinalDocument18 pagesBBUS1DAS Final Alternative Assessment (Exam) T1 2020 - FinalBilal ZafarNo ratings yet

- Catibog, Marynissa M. - Activity On Income Taxes For PartnershipsDocument2 pagesCatibog, Marynissa M. - Activity On Income Taxes For PartnershipsMarynissa CatibogNo ratings yet

- 05 Task Performance 1-BADocument3 pages05 Task Performance 1-BATyron Franz AnoricoNo ratings yet

- Citra Dewi - 4112001008 - AM 4A Pagi - Study Case Chapter 4Document16 pagesCitra Dewi - 4112001008 - AM 4A Pagi - Study Case Chapter 4Citra DewiNo ratings yet

- Description: Tags: 668appgDocument2 pagesDescription: Tags: 668appganon-829526No ratings yet

- Fa2 Module234Document20 pagesFa2 Module234Yanna100% (1)

- (C) San Antonio Home Furnishings Company-1Document3 pages(C) San Antonio Home Furnishings Company-1Mark OteroNo ratings yet

- FS Consolidation at The Date of Acquisition v2Document16 pagesFS Consolidation at The Date of Acquisition v2Pagatpat, Apple Grace C.No ratings yet

- Jawaban Mid Test Praktik Dagang 2022Document14 pagesJawaban Mid Test Praktik Dagang 2022Rahmal SimarangkirNo ratings yet

- Consolidation/Group Accounts: Example 18: Disposal of SubsidiaryDocument4 pagesConsolidation/Group Accounts: Example 18: Disposal of SubsidiaryMuhammad Sarfraz AsmatNo ratings yet

- Santosh 2Document1 pageSantosh 2Mohd Anees QayamiNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- ProposalDocument10 pagesProposalHassanNo ratings yet

- ExcelDocument10 pagesExcelHassanNo ratings yet

- ResearchDocument7 pagesResearchHassanNo ratings yet

- JanetDocument11 pagesJanetHassanNo ratings yet

- MarketingDocument3 pagesMarketingHassanNo ratings yet

- Decision ModellingDocument9 pagesDecision ModellingHassanNo ratings yet

- EconomicsDocument2 pagesEconomicsHassanNo ratings yet

- MemoDocument3 pagesMemoHassanNo ratings yet

- ReportDocument4 pagesReportHassanNo ratings yet

- Homework ch3-3Document3 pagesHomework ch3-3Qasim MansiNo ratings yet

- Punjab National Bank - Banking ReportDocument36 pagesPunjab National Bank - Banking ReportGoutham SunilNo ratings yet

- Solved 1 Herm S International Was A Family Owned Business For Many YearsDocument1 pageSolved 1 Herm S International Was A Family Owned Business For Many YearsJusta MukiriNo ratings yet

- All Countries Flags of CountriesDocument6 pagesAll Countries Flags of CountriesWelkin Sky100% (1)

- Usefull File For Accounting.Document150 pagesUsefull File For Accounting.Danes WaranNo ratings yet

- Financial Instruments - IPSAS Slides PresentationDocument40 pagesFinancial Instruments - IPSAS Slides PresentationJOHN TUMWEBAZENo ratings yet

- Lecture Notes Credit RisksDocument28 pagesLecture Notes Credit RisksMoussa EL GassmiNo ratings yet

- 2020 Cma P1 B SCFDocument37 pages2020 Cma P1 B SCFThasveer AvNo ratings yet

- MFT Samp Questions Business PDFDocument9 pagesMFT Samp Questions Business PDFpravin thoratNo ratings yet

- Evaristo NotesDocument52 pagesEvaristo NotesCyr Evaristo Franco100% (1)

- Billing InvoicesDocument1 pageBilling InvoicesPewnoy GamingNo ratings yet

- Bahan Kbat Bahasa Inggeris 2017Document21 pagesBahan Kbat Bahasa Inggeris 2017wiesukhihotuNo ratings yet

- Group Assignment (Student's Copy) EditedDocument7 pagesGroup Assignment (Student's Copy) EditedNUR HAIFFAHH BINTI JOHNNY MoeNo ratings yet

- SOC FlyerDocument2 pagesSOC Flyersammer1985No ratings yet

- Answer:: Stock ValuationDocument3 pagesAnswer:: Stock Valuationmuhammad hasanNo ratings yet

- Chapter - 6: International Monetary SystemDocument24 pagesChapter - 6: International Monetary Systemtemesgen yohannesNo ratings yet

- Product Creditvision Risk Scores AsDocument2 pagesProduct Creditvision Risk Scores AsRaj singhNo ratings yet

- FinanceDocument48 pagesFinancetinie@surieqNo ratings yet

- 9-Public DebtDocument19 pages9-Public DebtUsama AdenwalaNo ratings yet

- Principles of Microeconomics-57375Document15 pagesPrinciples of Microeconomics-57375msfaziah.hartanahNo ratings yet

- The Nature Conservancy - 2023 Endowment Impact Report (40p)Document40 pagesThe Nature Conservancy - 2023 Endowment Impact Report (40p)Aza O'Leary - SEE The Change ProductionsNo ratings yet

- Fundamanetal Analysis of Automobile Industry (Tata Motors)Document63 pagesFundamanetal Analysis of Automobile Industry (Tata Motors)Amit Sharma100% (1)

- Impact of Currency Fluctuations On Indian Stock MarketDocument5 pagesImpact of Currency Fluctuations On Indian Stock MarketShreyas LavekarNo ratings yet

- Akd 73680719195Document1 pageAkd 73680719195Hayat Ali Shaw100% (1)

- 2019 Dfcu Limited Annual ReportDocument168 pages2019 Dfcu Limited Annual ReportHillaryNo ratings yet