Professional Documents

Culture Documents

Class Question2

Uploaded by

SARAH PASHA0 ratings0% found this document useful (0 votes)

2 views1 pageOriginal Title

Class Question2 (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageClass Question2

Uploaded by

SARAH PASHACopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

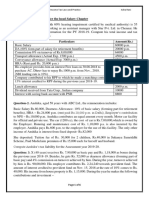

Question 1:

Sara resigned from Kakashi Ltd as finance manager on 1st August 2022 and joined Mikasa Ltd as the

financial controller on the same date. Details of her remunerations are as follows:

Kakashi Ltd:

a) She received a basic salary of Rs. 200,000 pm. In addition, she was also paid conveyance and

medical allowance of Rs. 20,000 pm and 30,000 pm respectively. Kakashi Ltd credits the

salary on 5th of the following month.

b) On resignation, Sara was paid Rs. 500,000 and Rs. 650,000 on account of gratuity from an

unapproved fund and an approved provident fund respectively.

Mikasa Ltd:

a) She received a basic salary of Rs. 300,000 per month.

b) She also received Rs. 500,000 to terminate her employment with Kakashi Ltd.

c) Under her employment terms, Sara is also entitled to conveyance allowance, house guard

salary and medical allowance of Rs. 25,000 pm, Rs. 30,000 pm and Rs. 40,000 pm

respectively. Sara also gets a full medical reimbursement for her hospital bills and OPD.

d) Sara has been provided with an accommodation facility with an annual rental of Rs. 700,000

which she has opted for instead of a house rent allowance of Rs. 60,000 pm.

e) Mikasa Ltd contributes an amount equal to 10% of the basic salary per month in an approved

provident fund. Sara contributes the same monthly. During the year, Rs. 85,000 interest was

credited to her fund at the rate of 18%.

f) Mikasa Ltd gave an option to its employees to acquire used cars at substantial discounts.

During the year, Sara bought a Toyota Yasir for Rs. 2.5 million. The cost of the car, net book

value and fair market value on the date of purchase were Rs. 3 million, Rs. 1.5 million and Rs.

3.5 million respectively.

g) Sara is also provided with a company maintained Honda Civic for both personal and official

use. The cost of the car to the employer was Rs. 6 million.

h) During the year, Mikasa Ltd sent Sara on a scholarship abroad to attend a two-month course

on sustainability reporting. The cost to the employer was Rs. 500,000 in respect of course fee

and travel and accommodation.

i) Sara was provided tickets for her family vacations amounting to Rs. 250,000.

j) On Jan 15, 2021, Sara participated in employee share scheme offered by Mikasa Ltd. Cost of

the option was Rs. 5,000 for 10,000 shares. The shares were transferable on completion of 2

years of service from the date of issue. Sara exercised to buy 5,000 shares at a price of Rs. 12

per share. The fair market value of the shares on the exercise date was Rs. 20 per share. The

fair market value on Jan 15, 2023 was Rs. 25 per share. She sold the option for the remaining

shares at a price of Rs. 20,000. After 2 months, she sold 2,000 shares in the open market for

Rs. 32 per share.

k) During the year, Zakat of Rs. 15,000 was deducted from her savings account.

Calculate Sara’s total income, taxable income, and tax liability for tax year 23.

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Citizens Bank Statements Format PDFDocument3 pagesCitizens Bank Statements Format PDFErvin Scsad60% (5)

- Harry Thomas JR IRS Form 3949aDocument2 pagesHarry Thomas JR IRS Form 3949aWashington City Paper100% (1)

- Xii Comm Holiday Homework 2020 23Document44 pagesXii Comm Holiday Homework 2020 23Mohit SuryavanshiNo ratings yet

- Statement 05-APR-23 AC 20312789 07043628 PDFDocument4 pagesStatement 05-APR-23 AC 20312789 07043628 PDFBakhter Jabarkhil0% (1)

- Your Accounts at A Glance: Premier BankingDocument6 pagesYour Accounts at A Glance: Premier BankingSuzanne MurphyNo ratings yet

- Property Tax Payment ReceiptDocument3 pagesProperty Tax Payment ReceiptRagini KumariNo ratings yet

- A Study On Electronic Payment System in IndiaDocument67 pagesA Study On Electronic Payment System in IndiaAvula Shravan Yadav50% (2)

- Quiz 4Document1 pageQuiz 4Khalid IMRANNo ratings yet

- Assignment Questions: Q1. Raza Is A General Manager in A Pharmaceutical Company in Karachi. His Basic Salary Is RsDocument2 pagesAssignment Questions: Q1. Raza Is A General Manager in A Pharmaceutical Company in Karachi. His Basic Salary Is RsWaasfaNo ratings yet

- Income From Salary Chapter QuestionsDocument5 pagesIncome From Salary Chapter Questionsanon_595315274100% (1)

- NullDocument5 pagesNullAshar HammadNo ratings yet

- Practice QuestionDocument1 pagePractice QuestionKhalid IMRANNo ratings yet

- Tax Mid Term Draft: 15 MarksDocument4 pagesTax Mid Term Draft: 15 MarksWaasfa100% (1)

- CAF 2 - Energizer - Day 1 - March 2023Document14 pagesCAF 2 - Energizer - Day 1 - March 2023Muhammad Ahsan RiazNo ratings yet

- Caf PracticeDocument2 pagesCaf Practicedavid.ellis1245No ratings yet

- CFAP 5 AT SupplementDocument28 pagesCFAP 5 AT SupplementHassan NaeemNo ratings yet

- BS 6th Taxation Final Term PaperDocument3 pagesBS 6th Taxation Final Term PaperFarjad AliNo ratings yet

- Assignment No.01 - Salary IncomeDocument1 pageAssignment No.01 - Salary Incomeabdul.fattaahbakhsh29No ratings yet

- Problems On Income From Other SourcesDocument3 pagesProblems On Income From Other Sourcesgoli pandeyNo ratings yet

- Tax Assignment - 1 2Document1 pageTax Assignment - 1 2mujtabamarchNo ratings yet

- Salary Mock March-24Document3 pagesSalary Mock March-24syedameerhamza762No ratings yet

- Inter Test Paper 4 - SalaryDocument3 pagesInter Test Paper 4 - SalarySrushti Agarwal100% (1)

- Illustration On Special AllowanceDocument3 pagesIllustration On Special AllowanceNitin RajNo ratings yet

- 4.1 Questions On Income From SalaryDocument4 pages4.1 Questions On Income From SalaryAashi GuptaNo ratings yet

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- IT AssignmentDocument5 pagesIT AssignmentAlena AlenaNo ratings yet

- PFTP - Unit II - Income From Salary - Short SumsDocument3 pagesPFTP - Unit II - Income From Salary - Short Sumsgeetagupta2974No ratings yet

- Assignment 1 ABDocument4 pagesAssignment 1 ABWaasfaNo ratings yet

- AssignmentDocument5 pagesAssignmentMd. Alif HossainNo ratings yet

- Ch1 AssignmentDocument3 pagesCh1 AssignmentRachit JainNo ratings yet

- Income Tax Practice QuestionsDocument18 pagesIncome Tax Practice QuestionsNuman Rox0% (2)

- Sem - IV Master Problem On SalaryDocument1 pageSem - IV Master Problem On SalaryHemant shawNo ratings yet

- Questions On Income From SalaryDocument3 pagesQuestions On Income From SalaryAniket AgrawalNo ratings yet

- Income From SalaryDocument10 pagesIncome From SalaryShubham BajajNo ratings yet

- Additional Case - Urban Chic DesignersDocument2 pagesAdditional Case - Urban Chic DesignersNaman MantriNo ratings yet

- Employt Revision Qns. 2023Document8 pagesEmployt Revision Qns. 2023Mbeiza MariamNo ratings yet

- Computation of Total Income & TaxDocument3 pagesComputation of Total Income & TaxkhushhalibajajNo ratings yet

- Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsDocument8 pagesSample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General Instructions9chand3No ratings yet

- Income Tax II Illustration Computation of Total Income PDFDocument7 pagesIncome Tax II Illustration Computation of Total Income PDFSubramanian SenthilNo ratings yet

- Holidays Home Work Xii 2023-24Document5 pagesHolidays Home Work Xii 2023-24Akshat TiwariNo ratings yet

- IFS QuestionDocument6 pagesIFS QuestionHdkakaksjsbNo ratings yet

- Correct AnswerDocument20 pagesCorrect AnswerToji ThomasNo ratings yet

- CA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Document36 pagesCA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Velayudham ThiyagarajanNo ratings yet

- WBHSCMock 2Document4 pagesWBHSCMock 2Smita AdhikaryNo ratings yet

- Term Test 2Document5 pagesTerm Test 2lalshahbaz57No ratings yet

- 7401D001 Direct TaxesDocument22 pages7401D001 Direct TaxesMadhuram SharmaNo ratings yet

- Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsDocument11 pagesSample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsSikha KaushikNo ratings yet

- Dac 212 Ass.1Document3 pagesDac 212 Ass.1Nickson AkolaNo ratings yet

- Employment IncomeDocument2 pagesEmployment IncomeFarhanah AfendiNo ratings yet

- AFP Case Study AnamikaDocument7 pagesAFP Case Study Anamikavenkat sbiNo ratings yet

- Tax Mid Term (Q) S24Document5 pagesTax Mid Term (Q) S24abdulazeem_cfeNo ratings yet

- Taxation of Individuals QuestionsDocument2 pagesTaxation of Individuals QuestionsPerpetua KamauNo ratings yet

- Ca Inter TaxationDocument29 pagesCa Inter TaxationKathan TrivediNo ratings yet

- 1 Residential Status: 8 Marks Incidence of Tax: 7 Marks: ST NDDocument3 pages1 Residential Status: 8 Marks Incidence of Tax: 7 Marks: ST NDadhishree bhattacharyaNo ratings yet

- Numericals of SalaryDocument7 pagesNumericals of SalaryAnas ShaikhNo ratings yet

- 2016 12 SP Accountancy Solved 01Document8 pages2016 12 SP Accountancy Solved 01Sto BreakerNo ratings yet

- CA Inter Taxation Mock Test - 02.08.2018 - Only QuestionDocument7 pagesCA Inter Taxation Mock Test - 02.08.2018 - Only QuestionKaustubhNo ratings yet

- Term Test 1Document5 pagesTerm Test 1lalshahbaz57No ratings yet

- GST MCQ For Nov 2023 TdsDocument15 pagesGST MCQ For Nov 2023 TdsNikiNo ratings yet

- TAXATION (Preps)Document5 pagesTAXATION (Preps)Navya GulatiNo ratings yet

- 4.2 Home Assignment Questions - Income From SalaryDocument3 pages4.2 Home Assignment Questions - Income From SalaryAashi Gupta100% (1)

- Worksheet 1-Fundamentals of PartnershipDocument6 pagesWorksheet 1-Fundamentals of Partnershipshakir surtiNo ratings yet

- Accountancy For Class XII Full Question PaperDocument35 pagesAccountancy For Class XII Full Question PaperSubhasis Kumar DasNo ratings yet

- CAF 2 TAX Autumn 2020Document6 pagesCAF 2 TAX Autumn 2020duocarecoNo ratings yet

- Income From SalaryDocument9 pagesIncome From Salaryvinod nainiwalNo ratings yet

- Ordinance Resolution 2024Document2 pagesOrdinance Resolution 2024Weng KayNo ratings yet

- V3 Bachelor of Law and Sharia KUCCPS4Document1 pageV3 Bachelor of Law and Sharia KUCCPS4AllanNo ratings yet

- Bangladesh Railway: Shohoz - Synesis - Vincen JVDocument1 pageBangladesh Railway: Shohoz - Synesis - Vincen JVসাইদুর রহমানNo ratings yet

- Effective JANUARY 1, 2009 Revised Withholding Tax Tables Annex "C"Document1 pageEffective JANUARY 1, 2009 Revised Withholding Tax Tables Annex "C"Vita DepanteNo ratings yet

- IHCDocument52 pagesIHCMin Li67% (3)

- Taxation MBADocument903 pagesTaxation MBAkeyurNo ratings yet

- Chapter 2 - Donor's Tax (Notes)Document8 pagesChapter 2 - Donor's Tax (Notes)Angela Denisse FranciscoNo ratings yet

- #REF! #REF! #REF! #REF!: Pay Slip Pay SlipDocument13 pages#REF! #REF! #REF! #REF!: Pay Slip Pay SlipLex AmarieNo ratings yet

- Mhban01285390000015876 2023Document2 pagesMhban01285390000015876 2023AIX CONNECT PVT LTDNo ratings yet

- Income Tax MCQ Tyfm Sem VDocument26 pagesIncome Tax MCQ Tyfm Sem Vrkhadke1No ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)mhb hussainNo ratings yet

- Dilip SirDocument1 pageDilip SirGarima MalikNo ratings yet

- BUFIN ITDeclarationFormDocument2 pagesBUFIN ITDeclarationFormdpfsopfopsfhopNo ratings yet

- Anil Neerukonda Institute of Technology & Sciences: Fee Structure For B.Tech., 1 Year 2018 - 2019Document5 pagesAnil Neerukonda Institute of Technology & Sciences: Fee Structure For B.Tech., 1 Year 2018 - 2019p.narendraNo ratings yet

- About BlankDocument1 pageAbout BlankiamtheavijeetNo ratings yet

- Voylite Labs Private LimitedDocument1 pageVoylite Labs Private LimitedSunil PatelNo ratings yet

- Orient Cables (India) Pvt. LTD: Party DetailsDocument1 pageOrient Cables (India) Pvt. LTD: Party DetailsShashank SaxenaNo ratings yet

- Gasbill 6191371000 202310 20231102185048Document1 pageGasbill 6191371000 202310 20231102185048kamran.mhrbprNo ratings yet

- NAB Statement X0256 10-Sep-2021Document6 pagesNAB Statement X0256 10-Sep-2021mkilfoyle11No ratings yet

- CDocument1 pageCAakash GuptaNo ratings yet

- BUSANA1Document32 pagesBUSANA1Raphael RazonNo ratings yet

- WBGST Rules 2017 - Amended Upto 18.10.2017 PDFDocument411 pagesWBGST Rules 2017 - Amended Upto 18.10.2017 PDFAdesh KumarNo ratings yet

- Rra Kumenyekanisha No KwishyuraDocument2 pagesRra Kumenyekanisha No KwishyuraAimable ISHIMWENo ratings yet

- gst523 1 Fill 15eDocument3 pagesgst523 1 Fill 15eJeff MNo ratings yet