Professional Documents

Culture Documents

PDF 145351270310723

Uploaded by

khatrirajiv213Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PDF 145351270310723

Uploaded by

khatrirajiv213Copyright:

Available Formats

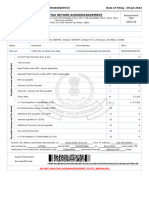

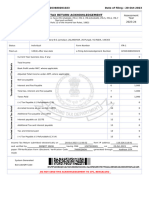

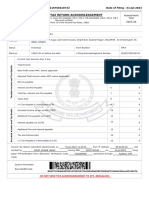

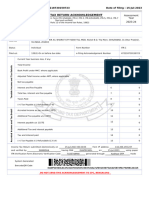

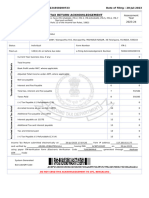

Acknowledgement Number:145351270310723 Date of filing : 31-Jul-2023*

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT Assessment

[Where the data of the Return of Income in Form ITR-1(SAHAJ), ITR-2, ITR-3, ITR-4(SUGAM), ITR-5, ITR-6, ITR-7 Year

filed and verified]

(Please see Rule 12 of the Income-tax Rules, 1962) 2023-24

PAN FJXPK8615N

Name RAJIV KHATRI

Address bagdogra, 39 GTC , C COMPANY, 39 Gtd S.O, Varanasi, VARANASI, 31-Uttar Pradesh, 91-INDIA, 221002

Status Individual Form Number ITR-1

Filed u/s 139(1)-On or before due date e-Filing Acknowledgement Number 145351270310723

Current Year business loss, if any 1 0

Total Income 2 4,95,000

Taxable Income and Tax Details

Book Profit under MAT, where applicable 3 0

Adjusted Total Income under AMT, where applicable 4 0

Net tax payable 5 0

Interest and Fee Payable 6 0

Total tax, interest and Fee payable 7 0

Taxes Paid 8 0

(+) Tax Payable /(-) Refundable (7-8) 9 0

Accreted Income and Tax Detail

Accreted Income as per section 115TD 10 0

Additional Tax payable u/s 115TD 11 0

Interest payable u/s 115TE 12 0

Additional Tax and interest payable 13 0

Tax and interest paid 14 0

(+) Tax Payable /(-) Refundable (13-14) 15 0

Income Tax Return submitted electronically on 31-Jul-2023 21:36:57 from IP address 60.254.68.62 and

verified by RAJIV KHATRI having PAN FJXPK8615N on 31-Jul-2023 using paper

ITR-Verification Form /Electronic Verification Code 7GF8262FAI generated through Aadhaar OTP mode

System Generated

Barcode/QR Code

FJXPK8615N011453512703107231e67098f6f4b05557130ceb4902944b00270b69a

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

*If the return is verified after 30 days of transmission of return data electronically, then date of verification will be considered as date of

filing the return (Notification No.05 of 2022 dated 29-07-2022 issued by the DGIT (Systems), CBDT).”

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- PDF 233526110140623Document1 pagePDF 233526110140623p. r ravichandraNo ratings yet

- Zakiriya ItDocument1 pageZakiriya Itp. r ravichandraNo ratings yet

- Ack 155284530310723Document1 pageAck 155284530310723sankarpradhan354No ratings yet

- ACK490991281311023Document1 pageACK490991281311023x.tv211No ratings yet

- Itrv 1Document1 pageItrv 1mickieNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:275118460220623 Date of Filing: 22-Jun-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:275118460220623 Date of Filing: 22-Jun-2023consultant.v.1001No ratings yet

- Itr Pankaj 2022-23Document1 pageItr Pankaj 2022-23gafoh81124No ratings yet

- Ayush K 23-24Document1 pageAyush K 23-24uk07artsNo ratings yet

- ACK565404030200723Document1 pageACK565404030200723Sumit SainiNo ratings yet

- Ack 312603180280623Document1 pageAck 312603180280623info.ashokchoudhary.icaNo ratings yet

- PDF 138101320310723Document1 pagePDF 138101320310723INSTA SERVICENo ratings yet

- Ack23 24eDocument1 pageAck23 24emanishgoyani225No ratings yet

- Wa0292.Document1 pageWa0292.snzrealtorsNo ratings yet

- PDF 119002240310723Document1 pagePDF 119002240310723srinivasarao achallaNo ratings yet

- Ack 220825270110623Document1 pageAck 220825270110623s114111010No ratings yet

- Manjot Singh ITR 2023Document1 pageManjot Singh ITR 2023parwindersingh9066No ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearAfsar AliNo ratings yet

- PDF 337886890310722Document1 pagePDF 337886890310722pankajNo ratings yet

- PDF 604326750311223Document1 pagePDF 604326750311223bghosh00112233No ratings yet

- Zil Patel 22-23Document1 pageZil Patel 22-23232014djNo ratings yet

- PDF 472850270150723Document1 pagePDF 472850270150723Pijush SinhaNo ratings yet

- PDF 144690140310723Document1 pagePDF 144690140310723AE Junnar UrbanNo ratings yet

- PDF 221418360290722Document1 pagePDF 221418360290722Chandan MauryaNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearrandhawagurbirkaurNo ratings yet

- PDF 117257030310723Document1 pagePDF 117257030310723laduugamerNo ratings yet

- PDF 333192290010723Document1 pagePDF 333192290010723Dharmendra ShashtryNo ratings yet

- PDF 109868640310723Document1 pagePDF 109868640310723Steve BurnsNo ratings yet

- ACK576076730200723Document1 pageACK576076730200723Sourav MohapatraNo ratings yet

- ACK513888080170723Document1 pageACK513888080170723SHIVAM THAKURNo ratings yet

- PDF 994183480250722Document1 pagePDF 994183480250722ca.bhagirathbariNo ratings yet

- Itr 23-24 AnubhavDocument1 pageItr 23-24 AnubhavAnubhav MishraNo ratings yet

- ACK562750660200723Document1 pageACK562750660200723krishna salesNo ratings yet

- Nitin ItrDocument1 pageNitin ItrNitin TayadeNo ratings yet

- PDF 293196870250623Document1 pagePDF 293196870250623nagesh valunjNo ratings yet

- PDF 878508300190722Document1 pagePDF 878508300190722chanchal deviNo ratings yet

- Manoj Thakur ITR AY2023-24Document1 pageManoj Thakur ITR AY2023-24balwanthakur2412No ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearParth GamiNo ratings yet

- Ack 348372290030723Document1 pageAck 348372290030723Vishal BawaneNo ratings yet

- Itr Ay 2022-23Document1 pageItr Ay 2022-23Soumya SwainNo ratings yet

- PDF 400872730090723Document1 pagePDF 400872730090723Rstuv WNo ratings yet

- ACK953216760310723Document1 pageACK953216760310723krishna salesNo ratings yet

- Itr Ay 2022-23Document1 pageItr Ay 2022-23Soumya SwainNo ratings yet

- Hardeep Singh ITR 2023Document1 pageHardeep Singh ITR 2023parwindersingh9066No ratings yet

- PDF 230861000130623Document1 pagePDF 230861000130623Sunil AccountsNo ratings yet

- ACK663138420240723Document1 pageACK663138420240723Dr Sachin Chitnis M O UPHC AiroliNo ratings yet

- PDF 994401670250722Document1 pagePDF 994401670250722ca.bhagirathbariNo ratings yet

- PDF 333524110310722Document1 pagePDF 333524110310722vijayNo ratings yet

- Baupa1247e AckDocument1 pageBaupa1247e Ackasmodalimondal2000No ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearRavi KumarNo ratings yet

- PDF 154521810310723Document1 pagePDF 154521810310723MUNPL HRNo ratings yet

- PDF 569515710231223Document1 pagePDF 569515710231223sushmithasaptharshiofficialNo ratings yet

- PDF 404118660090723Document1 pagePDF 404118660090723arjunbasfore84No ratings yet

- AcknowledgmentDocument1 pageAcknowledgmentSatyam MaramNo ratings yet

- Ack 657892140240723Document1 pageAck 657892140240723ravindraNo ratings yet

- PDF 472218730150723Document1 pagePDF 472218730150723pankajNo ratings yet

- PDF 596320240210723Document1 pagePDF 596320240210723Deepika SNo ratings yet

- PDF 668536300140622Document1 pagePDF 668536300140622Ajay KumarNo ratings yet

- Itr 22-23 MamtaDocument1 pageItr 22-23 MamtaRuloans VaishaliNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:569224350200723 Date of Filing: 20-Jul-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:569224350200723 Date of Filing: 20-Jul-2023tdsbolluNo ratings yet

- Effective JANUARY 1, 2009 Revised Withholding Tax Tables Annex "C"Document1 pageEffective JANUARY 1, 2009 Revised Withholding Tax Tables Annex "C"Vita DepanteNo ratings yet

- AboutSSNsAndTINs PDFDocument57 pagesAboutSSNsAndTINs PDFDonnell DeLoatcheNo ratings yet

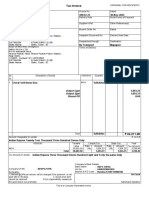

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountAmanNo ratings yet

- COMPARISON of SEC 222 and 203 - CABUSOGDocument2 pagesCOMPARISON of SEC 222 and 203 - CABUSOGKristine Jay Perez-CabusogNo ratings yet

- Request For Transcript of Tax Return: Sign HereDocument2 pagesRequest For Transcript of Tax Return: Sign HereRobert StraubNo ratings yet

- CustomInvoice 4642100886Document1 pageCustomInvoice 4642100886cgdgg4xbgs100% (1)

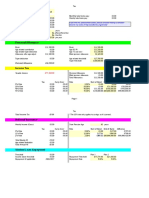

- Assignment ON Tax Calculation: Calculated byDocument4 pagesAssignment ON Tax Calculation: Calculated byAkanksha Sinha MBA20100% (2)

- Allowable Deductions Part 1Document3 pagesAllowable Deductions Part 1John Rich GamasNo ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document1 pageIncome Tax Department: Computerized Payment Receipt (CPR - It)muhammad kamranNo ratings yet

- Taft Corporation Operates Primarily in The United States However ADocument1 pageTaft Corporation Operates Primarily in The United States However AAmit PandeyNo ratings yet

- DIGIROVERSDocument1 pageDIGIROVERSAbhijit SarkarNo ratings yet

- Indo PacksDocument1 pageIndo PacksChandan SharmaNo ratings yet

- Monthly: Old Taxation TablesDocument2 pagesMonthly: Old Taxation TablesBai NiloNo ratings yet

- GST FormDocument16 pagesGST FormPruthiv RajNo ratings yet

- Introduction To Income TaxDocument8 pagesIntroduction To Income TaxKartikNo ratings yet

- Employee Final SettlementDocument1 pageEmployee Final SettlementZeeshan Mirza0% (1)

- Business Tax Environment: by Aliza Abid BhuttaDocument15 pagesBusiness Tax Environment: by Aliza Abid BhuttaAhmed zeeshanNo ratings yet

- New Form 2550 M - Monthly VAT Return P 1-2Document3 pagesNew Form 2550 M - Monthly VAT Return P 1-2Pearl Reyes64% (14)

- Tax Saving InstrumentsDocument19 pagesTax Saving Instrumentsharry.anjh3613No ratings yet

- Prasanna G Dev InvoiceDocument1 pagePrasanna G Dev Invoicehimanshi khivsaraNo ratings yet

- Rev Law PDFDocument19 pagesRev Law PDFZahi HoqueNo ratings yet

- Cir Cta Notes 3-119Document1 pageCir Cta Notes 3-119BGodNo ratings yet

- CIR vs. Baier-NickelDocument1 pageCIR vs. Baier-NickelJakeDanduanNo ratings yet

- Basilan V CIRDocument2 pagesBasilan V CIRReinier Jeffrey AbdonNo ratings yet

- Ukpaye-2017-2018 - 18500Document2 pagesUkpaye-2017-2018 - 18500Anonymous jEmTt5o6No ratings yet

- Tax Invoice Aditya Birla Fashion and Retail Limited Fred PerryDocument2 pagesTax Invoice Aditya Birla Fashion and Retail Limited Fred PerrybidikajyotiNo ratings yet

- Tata Business Support Services LTD: 00150785 Amir KhanDocument2 pagesTata Business Support Services LTD: 00150785 Amir KhanAamir KhanNo ratings yet

- Omnia 301-044959 Payslip 20191031 26 PDFDocument1 pageOmnia 301-044959 Payslip 20191031 26 PDFMilkovic DinoNo ratings yet

- Submissions - B-BTAX211 BSA22 1st Sem (2021-2022) - Enabling Assessment - Dealings in Properties and The Withholding Tax System - DLSU-D College - GSDocument3 pagesSubmissions - B-BTAX211 BSA22 1st Sem (2021-2022) - Enabling Assessment - Dealings in Properties and The Withholding Tax System - DLSU-D College - GSPran piyaNo ratings yet

- 1801 Estate Tax Return FormDocument2 pages1801 Estate Tax Return FormMay DinagaNo ratings yet