Professional Documents

Culture Documents

2023 Accounting Learners Notes Session 1-8

Uploaded by

Nomfundo ShabalalaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2023 Accounting Learners Notes Session 1-8

Uploaded by

Nomfundo ShabalalaCopyright:

Available Formats

SECONDARY SCHOOL IMPROVEMENT PROGRAMME

(SSIP) 2023

GRADE 12

SUBJECT: ACCOUNTING

LEARNER NOTES

SESSION 1- 8

(Page 1 of 215 pages)

2

TABLE OF CONTENTS

SESSION TOPIC PAGE

3 - 35

1 Companies Ledger Accounts

Companies Financial Statements

2

• Statement of Comprehensive Income 36 - 76

(Income Statement)

Companies Financial Statements

3 • Statement of Comprehensive Income 77 - 101

(Income Statement)

Companies Financial Statements

4 • Statement of Comprehensive Income 102 -114

(Correction of net profit after tax)

Companies Financial Statements

5 Statement of Financial Position 115 - 143

(Balance Sheet)

Companies Financial Statements

6 • Statement of Financial Position 144 - 163

(Balance Sheet)

Companies Financial Statements

7 164 - 192

Cash Flow Statement

Companies Financial Statements

8 193 - 215

Cash Flow Statement

© Gauteng Department of Education

3

GRADE 12 CONCEPTS AND DEFINITION ON COMPANIES LEDGER ACCOUNTS

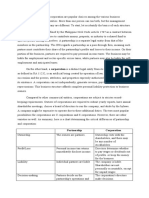

Grade Grade 10 Grade 11 Grade 12

1 Forms of SOLE TRADER PARTNERSHIP COMPANY

ownership SINGLE Owner of a Business TWO or more owners ONE or MULTIPLE ‘owners’

taught in All profits/losses belong to owner. Profit/Losses belong to the ‘Owners’ buy shares from the

Accounting The business does not pay income partners. business and are called –

tax. The business does not pay income SHAREHOLDERS.

Owner must complete a tax return tax. Profit/Losses belong to the

and pay tax on personal income. They must complete their tax company; and shareholders will

return and pay tax on their only lose the money invested.

individual income. Company seen as a “legal person”;

and it will PAY income

tax on its profits.

SOLE TRADER PARTNERSHIP SHAREHOLDERS – PUBLIC LIMITED

COMPANY

2 Capital CAPITAL CAPITAL SHAREHOLDERS EQUITY

contributions Owner’s Personal Account Same as ‘Sole Trader’; but Partners To become a shareholder in a

Money or Fixed assets can be have their own Capital accounts. company; a person needs to ‘buy’

contributed capital. Money, Fixed Assets or Legal Fees shares (A Piece-of-the-Pie).

DRAWINGS (if one is a lawyer) are regarded as The issued shares are known as

Owner can withdraw money from capital contribution. ORDINARY SHARE CAPITAL.

the business DRAWINGS This account will record the

Same as ‘Sole Trader’; but each shareholders’ contribution and can

partner has their own drawings ONLY be reduced when the company

account. buy back shares.

CURRENT ACCOUNTS

Profit sharing and drawings are

closed off to their personal current

accounts.

© Gauteng Department of Education

4

Grade Grade 10 Grade 11 Grade 12

SOLE TRADER PARTNERSHIP SHAREHOLDERS – PUBLIC LIMITED

Illustration COMPANY

of capital Dr Capital account [OE] Cr Dr Capital: KIT [OE] Cr

contribution Bank 60 Bank 60 Dr Ordinary share Capital Cr

into the Vehicle 50 Equipment 50 Bank (100 shares in issue) 200

different 110 110

forms of

businesses

Dr Capital: KAT [OE] Cr

Sole Trader contributed 100 Shares have been

Bank 60

R60 and a delivery Legal fees 50 issued/sold at R2 per share.

vehicle of R50; as his 110 The company has received

capital Contribution. R200.

Partner KAT; has contributed

Legal Service of R50 to the

partnership

To calculate the profit of the company,

income - expenses = profit that belongs

to the company and must be allocated to

SARS and shareholders as dividends. Any

To calculate the profit of the sole trader’s To calculate the profit of the partnership, profit not shared belongs to the company.

3 Profits business, income - expenses = profit income - expenses = profit that will be

that belongs to the owner. shared between the partners.

© Gauteng Department of Education

5

Grade Grade 10 Grade 11 Grade 12

SOLE TRADER PARTNERSHIP SHAREHOLDERS – PUBLIC LIMITED

COMPANY

Dr Trading account [F1] Cr Dr Trading account [F1] Cr

-Cost of sales 40 Sales ) 100 -Cost of sales 40 Sales ) 100 Dr Trading account [F1] Cr

=Profit and loss 60 =Profit and loss 60 -Cost of sales 40 Sales ) 100

(gross profit (gross profit) =Profit and loss 60

100 100 100 100 (gross profit)

100 100

Dr Profit and loss [F2] Cr Dr Profit and loss[2] Cr

-e.g., Wages 70 Trading account 60 -e.g., Wages 70 Trading acc 60 Dr Profit and loss[2] Cr

(Gross profit) (Gross profit)

-e.g., Wages 70 Trading acc 60

=Capital(net profit) 20 e.g., Rent income 30 =Appropriation 20 e.g. Rent income 30 (Gross profit)

(net profit)

Calculation 90 90 =Appropriation 20 e.g., Rent income 30

90 90

of profit, (net profit)

income 90 90

Dr Appropriation [F3] Cr

minus

-Salaries: KIT 5 Profit and loss 20 Dr Appropriation [F3] Cr

expenses -Salaries :KAT 5 (net profit) -Income tax 6 Profit and loss 20

-Interest on capital 3 (net profit)

-Bonus 1 -Dividends of 5

=Current acc: KIT 3 ordinary shares

Current acc:KAT 3 = Retained income 9

20 20 20 20

Net Profit allocation:

Income Tax

Dividends to Shareholders

And, remaining profit as

‘Retained Income’

PROFIT = HEALTHY BUSINESS

© Gauteng Department of Education

6

Grade Grade 10 Grade 11 Grade 12

SOLE TRADER PARTNERSHIP SHAREHOLDERS – PUBLIC LIMITED COMPANY

Illustration BALANCE SHEET BALANCE SHEET BALANCE SHEET

of Note 7 in Note 7: Capital Note 7: Partnership’s Capital Note 7: Ordinary Share Capital

the Balance Opening balance 60 Kit Kat Authorised:

Sheet Additional capital contribution 50 Opening balance 60 60 1 000 ordinary shares

Plus net profit 20 Additional capital contribution 50 50 Issued

Minus Drawings (0) Closing balance at yearend 110 110 100 Shares in issue at beginning of year 200

Closing balance at year-end 130 50 Shares issued during the year @ R4 200

(10) Buyback of share at average price @R2 (20)

140 Shares in issue at year-end 380

PARTNERSHIP

BALANCE SHEET

SHAREHOLDERS – PUBLIC LIMITED

SOLE TRADER

COMPANY

BALANCE SHEET Note 8:Partners’ Currents accounts

BALANCE SHEET

ALL CALCULATIONS ARE DONE IN Kit Kat Total

NOTE 7 Profit per income statement = 10 10 20

Illustration Note 8: Retained income

Salaries 5 5 10

of Note 8 in

3 the Balance Bonus 0,5 0,5 1

Retained income at the beginning of year 18

Sheet Interest on capital 1,5 1,5 3 Net profit after tax [20 – 6] *see above 14

=Primary distribution = 7 7 14 10 Buyback shares @R1 above average price (10)

Final distribution of profits 3 3 6 Dividends paid and declared (5)

(0) (0) (0) Retained income at the end of year 17

Drawings for the year

Balance at the begin of year

Balance at yearend

© Gauteng Department of Education

7

Grade 12: Public Limited Companies = Ordinary share capital

4 Make sure you understand the GENERAL LEDGER BALANCE SHEET

meaning of the following words used ILLUSTRATION ILLUSTRATION

in Companies: Shares bought back in the ledger

How the Ordinary share capital look like

Public Shares in issue: Shares that have been sold Then Ordinary Share Capital will in the Balance sheet in Note 7:

Company’s Average price: R200 ÷ 100 shares in issue = be reduced by 10 x R2 = R20

unique R2 Dr Ordinary share Capital [OE] Cr Note 7: Ordinary Share Capital

accounts and Buy back shares: Shares can be bought back Bank (10 xR2) 20 Bank (100 shares in issue) 200 Issued

Terminology that were sold previously.

Balance c/d 380 Bank (50 shares) 200

Market price: The price that potential 100 Shares in issue at beginning of year 200

400 400 50 Shares issued during the year @ R4 200

shareholders are prepared to pay for shares

Balance b/d 380 (10) Buyback of share at average price @R2 (20)

Net asset value: The real value of the shares

Ordinary Share capital can only be reduced 140 Shares in issue at year-end 380

by average price: Need to calculate the Additional 50 shares issued at R4 after

average price to determine the amount that the buyback of shares]

will be subtracted from Ordinary Share The average price of shares will change

Capital The other R1 per share will come from when additional shares have been issued

If shares are bought back for more than the Retained Income account [10 x R1 =R10] R380 ÷ 140 shares = R2, 72 per share

average price:

For example:

average price = R2 Dr Retained Income [OE] Cr Note 8: Retained income

and Bank (10 xR1) 10 Balance b/d 18

10 shares are bought back at R3. Balance c/d 17 Appropriation 9 Retained income at the beginning of year 18

27 27 Net profit after tax [20 – 6] *see above 14

Balance b/d 17 10 Buyback shares @R1 above average price (10)

Dividends paid and declared (5)

*** Retained income at the end of year 17

Compare the above ledger accounts

with Note 7 and 8 to the Balance sheet Above average price

Means that shares were bought back at

R1 plus R2 (average price) = R3

© Gauteng Department of Education

8

Grade 12: Public Limited Companies –SARS- income tax [5A] –credit balances

EXAMPLE ONE: Opening and closing balances are credit balances

5A Timeline 1Mar 2020 30 March 30 August 27 Feb 2021 28 Feb 2021

dealing with

INCOME TAX. 2nd a. Calculate the net profit

Opening 1st provisional Net profit: E.g:R220 000

Payment of amount owing provisional b. Calculate the income tax for the

balance tax payment

tax payment year (28% of net profit)

e.g. (R10 000) (R30 000) (R30 000) R220 000 X 28%=R61 600

c. Calculate the amount owing to or

R10 000 (cr) by SARS!

The provisional income tax is normally an estimate from last year’s R61 600 – [30 000 + 30000]

income tax, therefore the income tax, of previous year was R60 000 = Owe SARS R1 600

What you need to know about SARS income tax GENERAL LEDGER BALANCE SHEET

Public Two provisional payments are done during ILLUSTRATION ILLUSTRATION

Company’s the year, (being paying income tax in

unique advance). 61 600 – 60 000 = 1 600 still owing to How the SARS (income tax) looks like in

The provisional payments are calculated on SARS the Balance sheet in Note 9:

accounts

estimates (last year’s income tax figure) Dr SARS [INCOME TAX] B Cr

and

These payments in advance will show as a Bank 10 000 Balance b/d 10 000 Note 9: Trade and other payables

Terminology debit balance in the Trial Balance during the Bank 30 000 Income tax 61 600 SARS income tax 1 600

year. Therefore, an asset during the year. Bank 30 000

INCOME TAX.

SARS income tax account can have a debit or Balance c/d 1 600

credit balance. Depends on if the provisional INCOME STATEMENT

71 600 71 600

tax payments were more than the income tax

Balance b/d 1 600 ILLUSTRATION

for the year.

Debit Extract from the Income statement

A tax return is completed at end of financial

balance = year.

Dr Income tax (expense) N Cr

asset The income tax is calculated at 28% of the net

SARS (income tax) 61 600 Appropriation 61 600 Net profit before tax 220 000

Credit profit. Minus Income tax (61 600)

balance = Compare the above ledger accounts with Net profit after tax 158 400

Note 9 and INCOME STATEMENT

liability

© Gauteng Department of Education

9

Grade 12: Public Limited Companies-SARS - income tax [5B] – debit and credit balance

EXAMPLE TWO: Opening balance (credit) and closing balance (debit)

5B Timeline 1 Mar 2021 30 March 30 August 27 Feb 2022 28 Feb 2022

dealing with st

Opening Payment of amount 1 provisional 2nd a. Calculate the net profit

INCOME E.g.: R180 000

balance owing tax payment provisional

TAX. b. Calculate the income tax for the year

tax payment (28% of net profit)

e.g. R180 000 X 28%=R50 400

R1 600 (cr) (R1 600) (R30 800) (R30 800) c. Calculate the amount owing to or by

SARS

R50 400 – [30 800 + 30800]

= Paid SARS R11 200 (dr) too much

GENERAL LEDGER BALANCE SHEET

Public ILLUSTRATION ILLUSTRATION

Company’s

Dr SARS [INCOME TAX] B Cr

unique Balance sheet in Note 5:

Bank 1 600 Balance b/d 1 600

accounts and Note 9: Trade and other receivables

Bank 1st 30 800 Income tax 50 400

Terminology nd SARS income tax 11 200

Bank 2 30 800 Balance c/d 11 200

INCOME

63 200 63 200

TAX.

Balance b/d 11 200

Dr Income tax (expense) N Cr INCOME STATEMENT

SARS (income tax) 50 400 Appropriation 50 400 ILLUSTRATION

Extract from the Income statement

Compare the above ledger accounts Net profit before tax 180 000

with Note 5 and INCOME STATEMENT Minus Income tax (50 400)

Net profit after tax 129 600

© Gauteng Department of Education

10

Grade 12: Public Limited Companies- SARS - income tax [5C] – debit balances

EXAMPLE THREE: Opening balance (debit) and closing balance (debit)

5C Timeline 1 Mar 2022 30 March 30 August 27 Feb 2023 28 Feb 2023

dealing with

Opening Payment of amount 1st provisional 2nd d. Calculate the net profit

balance owing tax payment provisional E.g.: R170 000

INCOME TAX.

e. Calculate the income tax for the year

tax payment (28% of net profit)

e.g. R170 000 X 28%=R47 600

R11 200 (R 0 ) (R19 600) (R19 600) f. Calculate the amount owing to or by

(dr.) SARS

Only for enrichment R47 600 – 11 200+19 600 + 19 600

Estimate provisional tax: 50 400 – 11 200 = 39 200 ÷ 2 =19 600. Remember: you paid = Paid SARS R2 800 (dr.) too much

R11 200 in advance. These figures will be given to you and don’t need to be calculated!

GENERAL LEDGER BALANCE SHEET

ILLUSTRATION ILLUSTRATION

Public Dr SARS [INCOME TAX] B Cr

Company’s Balance b/d 11 200 Income tax 47 600 Balance sheet in Note 5:

unique Bank 1st 19 600 Balance c/d 2 800

accounts and Bank 2nd 19 600 Note 9: Trade and other receivables

SARS income tax 2 800

Terminology 50 400 50 400

Balance b/d 2 800

INCOME TAX

Dr Income tax (expense) N Cr INCOME STATEMENT

SARS (income tax) 50 400 Appropriation 50 400 ILLUSTRATION

27 27 Extract from the Income statement

Net profit before tax 170 000

Compare the above ledger accounts with Note 5 and Minus Income tax (47 600)

INCOME STATEMENT

Net profit after tax 122 400

© Gauteng Department of Education

11

Grade 12: Public Limited Companies –Dividends paid and final dividends declared

EXAMPLE: ‘Shareholders for dividends’ always have credit opening and closing balances:

6 Time line 1 Mar 2022 30 March 30 August 28 Feb 2023 28 Feb 2023

dealing

Payment of amount Interim After the net profit has been

with Opening Final dividend calculated and the income tax

owing to dividends

INTERIM balance declared has been calculated, the final

shareholders paid

DIVIDENDS dividend will be determined.

e.g. E.g.,100 000 shares in issue: 100 000 x 22c

AND FINAL R10 000 (cr.) (R10 000) 10 000 x 8c =100 000 x ,08 = (R8000) 100 000 x ,22 = 22 000

DIVIDENDS

DECLARED To calculate a dividend, you need to know how many shares were issued.

GENERAL LEDGER BALANCE SHEET

What you need to know about Dividends paid or

Public declared

ILLUSTRATION ILLUSTRATION

Company’s

Dividends are the return on the shareholders’ How the dividends will appear in the

unique

investment.

accounts and Dr Shareholders for dividends B Cr Balance sheet in Note 8 and 9:

Dividends are only declared when there is

Terminology Bank 10 000 Balance b/d 10 000 Note 8: Retained income

income available to pay shareholders

INTERIM Directors have the right to declare an interim

Dividends on 22 000 Balance at the beginning of the year

DIVIDENDS ordinary shares Plus Net profit after tax

dividend during the year if there are available

AND FINAL Balance c/d 22 000 Minus buy back of shares

funds.

DIVIDENDS 32 000 32 000 Minus ordinary shares issued (30 000)

A Final dividend is declared at year-end and

DECLARED will only be paid the following financial year. Balance b/d 22 000 Interim Paid [100 000 x .8c] 8 000

The number of shares in issue must be known Final dividend declared 22 000

Dr Dividends on ordinary shares (exp) N Cr

to calculate the total dividends paid or Balance at the end of financial year

declared. Bank 8 000 Appropriation 30 000

Shareholders for 22 000

The opening balance is always the dividends Note 9: Trade and other payables

dividends

declared at the end of the previous financial Shareholders for dividends 22 000

year and will be paid ASAP. 30 000 30 000

Compare the above ledger accounts with

Note 8 and 9

© Gauteng Department of Education

12

SESSION 1: COMPANIES LEDGER ACCOUNTS AND NOTES TO FINANCIAL

STATEMENTS

BUY BACK OF SHARES

WORKED EXAMPLE 1

COMPANY ACCOUNTS AND BUY BACK OF SHARES

Kalel Company Limited has been authorised to issue an unlimited number of ordinary shares

to prospective shareholders. On 1 March 2021 the company issued 2 000 000 ordinary shares

at an issue price of 300 cents per share (R3). During the same financial year March 2021 to

February 2022, another 2 000 000 ordinary shares were issued at an issue price of 600 cents

per share.

The current financial year is from 1 March 2022 to 28 February 2023

REQUIRED

A. Complete Note 7 of the Financial Statements: Ordinary Share Capital on 28 Feb 2023

B. Complete Note 8 of the Financial Statements: Retained Income

C. Complete SARS-Income Tax Account and balance the account at the end of the

financial year.

D. Complete Dividends on Ordinary Shares Account and close off the account at the end

of the financial year.

E. Show the calculation of the average price of the total issued shares on 1 October

2022.

F. What was the total amount paid to the estate of the deceased shareholder? Show

calculations.

G. Show the calculation of the final dividend per share on 28 February 2023.

H. Give TWO possible reasons for the company’s decision to buy back the shares from

the deceased estate on 1 October 2022.

© Gauteng Department of Education

13

INFORMATION

At the beginning of the new financial year, 1 March 2022, the following balances appeared in the

General Ledger of Kalel Company Limited:

Ordinary share Capital R18 000 000

Retained Income R1 800 000

SARS(income tax) (credit) R 500 000

Shareholders for dividends R640 000

TRANSACTIONS DURING THE FINANCIAL YEAR:

1 March 2022 Kalel Company Limited offered more shares to prospective shareholders at

an issue price of 700 cents per share. All the shares were sold and

R7 000 000 was recorded in the Cash Receipts Journal.

31 March 2022 The amount owing on 1 March 2022 to SARS and to the Shareholders were

settled and recorded.

31 August 2022 The directors paid provisional tax of R420 000 and interim dividends of

8 cents per share. This was NOT APPLICABLE to the shares issued

on 1 March 2022 to shareholders.

1 October 2022 The directors decided to buy back 200 000 ordinary shares from an estate

of a deceased shareholder at a price of R2 more than the average price

and an electronic transfer was made to the estate of the deceased.

25 February 2023 Close to the end of the financial year the company paid the second

provisional tax payment of R460 000.

28 February 2023 Additional information

The net profit for the year was R 2 800 000

Income tax was calculated at 30 % of net profit

A final dividend was declared at 22 cents per share. This is applicable

to all existing shareholders

© Gauteng Department of Education

14

SUGGESTED SOLUTION

200 000 x R3

COMPANY ACCOUNTS AND BUY BACK OF SHARES 200 000 x R6

A NOTES TO THE BALANCE SHEET

Note 7: Ordinary Share Capital

Issued:

4 000 000 ordinary shares on 1 March 2022 18 000 000

1 000 000 ordinary shares issued @ R7 each 7 000 000

(200 000) ordinary shares bought back @R5 each (1 000 000)

4 800 000 -ordinary shares on 28 Feb 2023 24 000 000

18 000 000+7 000 000

4 000 000+1 000 000

=R5.00

B NOTES TO THE BALANCE SHEET

Note 8: Retained income

Retained income on 1 March 2022 1 800 000

Net profit after tax ( 2 800 000 – 840 000) 1 960 000

200 000 Buy back shares@ R2 above the average price (400 000)

Dividends on ordinary shares (1 376 000)

Paid (interim) (4 000 000 x 8 cents) 320 000

Declared (final) 5 000 000 – 200 000 = 4 800 000 x 22c 1 056 000

Retained income on 28 February 2023 1 984 000

C GENERAL LEDGER OF KALEL COMPANY LIMITED

Dr. SARS(INCOME TAX) Cr.

2022 Bank CPJ 500 000 2022 1 Balance 500 000

Mar 1 Mar

2022 31 Bank CPJ 420 000 2023 28 Income tax 840 000

Aug Feb

2022 25 Bank CPJ 460 000 Balance c/d 40 000

Feb

1 380 000 1 380 000

2023 Balance b/d 40 000

Mar

© Gauteng Department of Education

15

D GENERAL LEDGER OF KALEL COMPANY LIMITED

Dr. DIVIDENDS ON ORDINARY SHARES Cr.

2022 CPJ 2023 28 GJ

Aug 31

Bank/Shareholders 320 000 Feb

Appropriation 1 376 000

for dividends

2023 28 GJ

Feb

Shareholders for 1 056 000

dividends

1 376 000 1 376 000

E Show the calculation of the average price of the total issued shares on 1

October 2022

18 000 000 + 7 000 000 = 25 000 000 ÷ 5 000 000 = R5 per share

(500 cents per share)

F What was the total amount paid to the estate of the deceased shareholder?

Show calculations

[R5 x 200 000] + [R2 x 200 000 ] = R1 400 000

OR

1 000 000 + 400 000 =R 1 400 000

G Show the calculation of the final dividend per share on 28 February 2023.

[4 000 000 + 1 000 000]

5 000 000 – 200 000 = 4 800 000 shares x .22c = R1 056 000

H Give TWO possible reasons for the company’s decision to buy back the

shares from the deceased estate on 1 October 2022.

Company can decide to buy back shares using surplus funds provided that

the company stays solvent and liquid.

The deceased’s family does not want the shares

The deceased’s family need the capital to cover the costs of the estate

Company can decide to buy back shares to ensure that the market is not

flooded with the same type of shares.

Directors can decide to buy back because they are concerned that the shares

could be undervalued in the market place.

© Gauteng Department of Education

16

ACTIVITY 1:COMPANY LEDGER ACCOUNTS AND BUY BACK OF SHARES

KIMA LIMITED

Kima Limited has been registered to issue 10 000 000 ordinary shares. During the past

years 4 000 000 shares have been issued to shareholders at different issue prices.

The financial year ends every year on 28 February.

REQUIRED

1.1 Complete Note 7 of the Financial Statements. (11)

1.2 Complete Note 8 of the Financial Statements. (15)

1.3 Complete SARS (INCOME TAX) LEDGER ACCOUNT and balance the account at (10)

the end of the financial year.

1.4 Show the calculations of interim dividends and the dividends declared at the end of (8)

the financial year.

INFORMATION

At the beginning of the new financial year, 1 March 2022, the following balances appeared in the

General Ledger of KIMA Company Limited:

Ordinary share Capital R15 000 000

Retained Income R1 200 000

SARS(income tax) (credit) R 400 000

Shareholders for dividends R340 000

Extracts of transactions during the financial year:

1 March 2022

KIMA Limited offered an additional 1 000 000 ordinary at an issue price of 600 cents per share. All

the shares were sold and recorded in the Cash Receipts Journal.

31 March 2022

The amount owing on 1 March 2020 to SARS and to the Shareholders were settled and recorded.

31 August 2022

The directors paid provisional tax of R400 000 and interim dividends of 7 cents per share.

© Gauteng Department of Education

17

1 October 2022

The market price dropped at JSE and the directors made the decision to buy back 150 000

shares at R5, 00 per share. The monies were paid.

25 February 2023

Kima Limited paid the second provisional tax payment of R400 000.

28 February 2023

Additional Information

The net profit for the year was R 2 950 000

Income tax for the year R585 000

A final dividend was declared at 18 cents per share. This is applicable to all existing

shareholders.

© Gauteng Department of Education

18

ACTIVITY 1 ANSWER SHEET

COMPANY’S LEDGER ACCOUNTS AND BUY BACK OF SHARES

1.1 NOTES TO THE BALANCE SHEET

Note 7: Ordinary Share Capital

Authorised:

Issued:

11

1.2 NOTES TO THE BALANCE SHEET

NOTE 8: RETAINED INCOME

15

© Gauteng Department of Education

19

1.3 GENERAL LEDGER OF KIMA COMPANY LIMITED

Dr. SARS(INCOME TAX) Cr.

10

1.4 Calculate the interim and declared dividends and show all calculations

1.4.1 Interim dividends on 31 August 2022

1.4.2 Declared Dividends at the end of the financial year on 28 February 2023

44

© Gauteng Department of Education

20

ACTIVITY 2 : COMPANY’S LEDGER ACCOUNTS AND BUY BACK OF SHARES (46 marks)

ASHY COMPANY LIMITED

Ashy Company Limited trades in Proudly South African bottled water. The Company is

authorized to issue an unlimited number of no-par value ordinary shares.

The directors are concerned that the market price per share at Johannesburg Securities

Exchange (JSE) on 1 March 2022 has declined from R8, 00 to R5, 00 per share. The directors

informed the internal auditor to investigate what contributed to the declined market price per

share.

You have been requested by shareholders to present information relating to the following

company accounts for the period 1 March 2022 to 28 February 2023.

REQUIRED

2.1 Calculate the average price of shares before the shares were bought back.

2.2 Calculate the price that the company bought back the shares for on 15 September 2022.

2.3 Complete the following accounts and balance/close off the accounts on 28 February 2023.

Ordinary share capital

Retained income.

Shareholders for dividends

SARS: income tax

Ordinary share dividends

Income tax

2.4 The directors requested from you, being the internal auditor, to report on the repurchase of

shares on 15 September 2022. The value of the market price per share on the 28 February

2023 was R7,00 per share. Was the buying back of shares a good decision for the

company? Give a short report in point form and make use of financial indicators as part of

your answer. Provide TWO points.

(Financial indicator means show relevant figures.)

© Gauteng Department of Education

21

INFORMATION:

The following balances appeared in the books on 1 March 2022

Ordinary Share Capital ( 70 000 shares issued) 475 250

Retained Income/ Accumulated Profits 136 000

SARS (Income Tax) (Cr) 130 000 (cr)

Shareholders for dividends 120 000

ADDITIONAL INFORMATION

A 2022 The amounts due to SARS for income tax and to shareholders for dividends

Mar 31 were paid.

B Income tax details are as follows:

2022

Aug 31 The company paid their first provisional tax of R170 000.

2023

Feb 28 A second provisional tax payment of R195 000 was made.

The Income tax for the year amounted to R450 000, being 30% of net profit.

C Shares and Dividends

2022

Mar 31 Issued 15 000 ordinary shares for R92 250.

Mar 31 Issued another 90 000 ordinary shares for a total of R360 000.

Aug 30 The directors decided to pay an interim dividend R75 000.

Sep 15 After investigation the directors realised that the shares were undervalued in

the marketplace and therefore decided to buy 65 000 ordinary shares for

R390 000.

2023

28 Feb The directors recommended and declared a dividend of R3 per share to the

shareholders at the AGM meeting.

© Gauteng Department of Education

22

ACTIVITY 2 ANSWER SHEET

COMPANY’S LEDGER ACCOUNTS AND BUY BACK OF SHARES

2.1 Calculate the average price of shares before the buy-back of shares. (3)

2.2 Calculate the price that the company bought back the shares for on (2)

15 September 2022.

2.3 GENERAL LEDGER OF ASHY C

Dr. Ordinary Share Capital B1 Cr.

10

© Gauteng Department of Education

23

Dr. Retained income B2 Cr.

Dr. Shareholders for dividends B3 Cr.

Dr. SARS: Income tax B4 Cr.

© Gauteng Department of Education

24

Dr. Ordinary share dividends N11 Cr.

Dr. Income tax N12 Cr.

© Gauteng Department of Education

25

ACTIVITY 3: REPORT ON BUY BACK OF SHARES (50 marks )

REPORT: KALEL COMPANY LIMITED

According to the books of Kalel Company Limited, the company bought back ordinary shares

during the previous financial year

During a meeting with shareholders, questions were raised which the directors could not

answer with clarity. A written report was then requested by the shareholders. As the

accountant of Kalel Company Limited you had to respond to the directors’ requests to compile

a report.

The directors requested a report on the points mentioned below:

Use the numbering system (A to I) to complete a report to directors.

A What was the reason for the buyback of shares? (Possible 2 reasons) (4)

IDENTIFY the possible reasons[ applying]

B How did the accountant arrive at the Average price of R5 when 200 000 ordinary (3)

shares were bought back? Show all the calculations necessary in the report

ANALYSE how the accountant arrived at the average price of R5[analysing]

C Could the company afford to buy back the shares and what was the total AMOUNT (5)

PAID PER SHARE for the buyback of shares? Explain and show the calculations.

Explain and support your answer with relevant calculations[ evaluating]

D From which funds were the money retrieved to pay for the buyback shares? Explain (4)

and show figures.

Explain and show calculations [ understanding]

E How much was paid for the buyback of shares? Show calculations (4)

Support your answer by showing relevant calculations [ evaluating]

F According to the financial statements what possible advantage could the buyback of (2)

shares hold for the existing shareholders? Comment on the dividends.

Discuss what possible advantages could the buyback of shares held for the existing

shareholders according to the financial statements? [ creating]

G The shareholders did not understand how the accountant arrived at the amount of (3)

R1 056 000 for the final dividend at the end of the financial year. Show the relevant

calculations so that the directors will be able to demonstrate to the shareholders in

question.

Show the relevant calculations so that the directors will be able to demonstrate to the

shareholders in question. [understanding]

H The directors also requested a copy of the Ordinary Share Capital account, (17)

(7 marks) and the Retained Income account (8 marks) in the general ledger.

Reconstruct the two accounts and record the accounts as part of the report.

© Gauteng Department of Education

26

I The shareholders want to know why are there three Bank entries in the SARS (income (8)

tax) account and why can’t the company just make one electronic transfer of

R840 000 during the year to save bank charges. Explain all three electronic transfers

and the amount of R840 000 in your report.

Explain all three EFT‘s the amounting to R840 000 in your report. [understanding]

INFORMATION RELATING TO H

As the accountant make use of the following information to complete the report:

(I) NOTES TO THE BALANCE SHEET

Note 7: Ordinary Share Capital

Issued:

4 000 000 ordinary shares on 1 March 2022 18 000 000

1 000 000 ordinary shares issued @R7 each (1 April 2022) 7 000 000

(200 000) ordinary shares bought back @R5 each ( 1 October 2022) (1 000 000)

4 800 000-ordinary shares on 28 Feb 2023 24 000 000

(II) NOTES TO THE BALANCE SHEET

Note 8: Retained income

Retained income on 1 March 2022 1 800 000

Net profit after tax ( 2 800 000 – 840 000) 1 960 000

200 000 Buy back shares@ R2 above the average price (400 000)

Dividends on ordinary shares (1 376 000)

Paid ( interim) (4 000 000 x .08 c each) (1 April 2022) 320 000

Declared ( final) (22c per share) 1 056 000

Retained income on 28 February 2023 1 984 000

(III) GENERAL LEDGER OF KALEL COMPANY LIMITED

Dr. SARS(INCOME TAX) Cr.

2022 Bank CPJ 500 000 2022 1 Balance b/d 500 000

Mar 1 Mar

2022 31 Bank CPJ 420 000 2023 28 Income tax GJ 840 000

Aug Feb

2023 25 Bank CPJ 460 000 Balance c/d 40 000

Feb

1 380 000 1 380 000

2023 Balance b/d 40 000

Mar

© Gauteng Department of Education

27

ACTIVITY 3: ANSWER SHEET (50 marks)

COMPANY’S LEDGER ACCOUNTS AND BUY BACK OF SHARES

The directors requested a report on the points mentioned below:

Use the numbering system (A to I) to complete a report to directors.

A What was the reason for the buyback of shares? (Possible 2 reasons) (4)

B How did the accountant arrive at the Average price of R5 when 200 000 (3)

ordinary shares were bought back? Show all the calculations necessary

in the report

C Could the company afford to buy back the shares and what was the total (5)

AMOUNT PAID PER SHARE for the buyback of shares? Explain and show

the calculations.

Explanation:

Calculations:

From which funds were the money retrieved to pay for the buyback

D (4)

shares?

Explain and show figures.

© Gauteng Department of Education

28

E How much was transferred by the company towards the buyback of (4)

shares? Show calculations.

F According to the financial statements what possible advantage could the

buyback of shares hold for the existing shareholders? Comment on the

(2)

dividends.

G The shareholders did not understand how the accountant arrived at the amount

of R1 056 000 for the final dividend at the end of the financial year. Show the

(3)

calculations so that directors can show the figures to the shareholders in

question.

H The directors also requested a copy of the Ordinary Share Capital

account; (17)

(7 marks) and the Retained Income account (8 marks) in the general

ledger. Reconstruct the two accounts and placed it in the report.

© Gauteng Department of Education

29

I The shareholders want to know why there are three Bank entries in the SARS (8)

(income tax) account and why can’t the company just write out one EFT of

R840 000 during the year to save bank charges. Explain all three EFT’s and

the amount of R840 000 in your report.

TOTAL: 50

© Gauteng Department of Education

30

GENERAL LEDGER OF KALEL COMPANY LIMITED

Dr. ORDINARY SHARE CAPITAL Cr.

GENERAL LEDGER OF KALEL COMPANY LIMITED

Dr. RETAINED INCOME Cr.

© Gauteng Department of Education

31

WORKED EXAMPLE ONE - ADAPTED (NSC NOV 2017)

SO-FINE LTD

The given information relates to So-Fine Ltd for the financial year ended 31 August 2023.

REQUIRED:

Prepare the following notes to the Balance Sheet on 31 August 2023:

Ordinary share capital

Retained income

INFORMATION:

A. Information from the Income Statement for the financial year ended

31 August 2023:

Operating profit 697 000

Income tax 187 770

Net profit after income tax 438 130

B. Information from the Balance Sheet on 31 August:

2023 2022

(R) (R)

Shareholders' equity ? ?

Ordinary share capital 5 292 000 ?

Retained income ? 147 370

Shareholders for dividends 168 000 120 000

SARS: Income tax 11 800 (Cr) 2 400 (Dr)

C. Share capital and dividends

The authorised share capital comprises 1 200 000 ordinary shares.

900 000 ordinary shares were in issue on 1 September 2022.

The company issued 150 000 ordinary shares at R6,30 per share on 1 May 2023.

70 000 ordinary shares were repurchased from shareholders on 30 August 2023.

An amount of R437 500 was transferred electronically to shareholders. These

shareholders qualify for final dividends.

An interim dividend of 12 cents per share was paid on 1 February 2023.

A final dividend was declared on 30 August 2023.

© Gauteng Department of Education

32

SUGGESTED SOLUTION

SO-FINE LTD

ORDINARY SHARE CAPITAL

AUTHORISED SHARE CAPITAL

1 200 000 ordinary shares

ISSUED SHARE CAPITAL

Given

figure Ordinary shares on 1 September 2022 4 725 000 Balancing figure

900 000

150 000 Issued on 1 May 2023 at R6,30 each 945 000

(70 000) Re-purchased 30 August 2023 for R5,40 (378 000) ASP :

5 292 000/980 000

= R5.40

980 000 Ordinary shares on 31 August 2023 5 292 000 Given figure

Note: the value of shares at the beginning of the year was not

provided, we relied on the closing balances to determine our ASP.

Bottom –up Approach is recommended for determining the balancing figures:

4 725 000 Answer

945 000 Subtract

(378 000) Add

5 292 000 Start here

Always change signs

when you use Bottom-up

Approach

Note: The positive sign for 5 292 000 does not change.

Calculation : 5 292 000 +378 000 -945 000 = 4 725 000

© Gauteng Department of Education

33

RETAINED INCOME

Balance on 1 September 2022 147 370 Given figure

Net profit after income tax 438 130 Given figure

Shares repurchased (437 500 – 378 000 ) *** (59 500) 378 000 (check OSC)

Ordinary share dividends (276 000)

Dividends were paid

Interim dividends (900 000 x 0,12) 108 000 before issuing

additional shares

Extracted from Balance

Final dividends 168 000 Sheet – declared ,not

paid

Balance on 31 August 2023 250 000

Alternative method for calculating repurchased shares :

Transaction Total amount (A) Number of Unit

shares (B) price

(i) Shares repurchased R437 500 70 000 R6,25 (A/B)

(ii) Average share price R378 000 check OSC 70 000 R5,40 (A/B)

(iii) Above average R59 500 ( i – ii) 70 000 R0,85 (A/B)

amount

Shares repurchased ***

70 000 x R0,85 = R59 500

70 000 – (R6,25 –R5,40) = R59 500

© Gauteng Department of Education

34

ORDINARY SHARE CAPITAL (NOTE 7) AND RETAINED INCOME (NOTE 8)

EXTRACTED FROM NSC NOV 2022 – QUESTION 2

A. Extract: Statement of Comprehensive Income on 28 February 2022:

Net profit before tax 1 297 700

Income tax 389 300

Net profit after tax 908 400

B. Extract: Statement of Financial Position on 28 February 2022:

2022 2021

Shareholders’ equity 12 350 000 10 750 000

Ordinary share capital 11 968 000 ?

Retained income 382 800 ?

C. Ordinary shares:

NO. OF SHARES

Number of shares on 1 March 2021 1 180 000

Number of shares issued on 1 July 2021 at R9.30 each 300 000

Number of shares repurchased on 1 January 2022 at 120 000

R1,40 above the average price

Number of shares on 28 February 2022 1 360 000

D. Dividends:

Interim dividends of R710 400 were paid on 31 August 2021.

A final dividend of 12 cents per share was declared to all shareholders on the

share register on 28 February 2022.

© Gauteng Department of Education

35

ORDINARY SHARE CAPITAL (NOTE 7)

1 180 000 Ordinary shares 10 234 000 Do the bottom up calculation to get this

figure

300 000 Ordinary shares issued @R9.30 2 790 000 300 000 shares x R9.30

(price at which the shares were issued at)

When preparing the Cash flow statement,

this full amount will appear under Cash

flow from Financing Activities 2 790 000

cash inflow

(120 000) Shares repurchased @R8.80 (1 056 000) You can only get the 1 056 000 after

getting the average price of R8.80 as

shown below.

1 360 000 11 968 000 We are given the OSC amount at the end

and the number of shares at the end,

therefore

𝑹𝟏𝟏 𝟗𝟔𝟖 𝟎𝟎𝟎

Bottom up calculations = R8.80

𝟏 𝟑𝟔𝟎 𝟎𝟎𝟎

11 968 000 + 1 056 000 – 2 790 This approach can only be used when

000 there is no further issue of shares after

the repurchase of shares

RETAINED INCOME (NOTE 8)

Balance on 1 March 2021 516 000 This was the missing amount in this question, therefore

the bottom-up approach was necessary to complete

this question.

382 000 + 873 600 + 168 000 – 908 400 =516 000

Net profit after tax 908 400 This amount is given in the question

Repurchase of shares (168 000) The repurchase of shares is recorded at the amount

(120 000 x 1.40) above the average price, in this it is R1.40

Ordinary share dividends (873 600) A total of interim and final (163 200 + 710 400)

Remember to put brackets on this figure.

Interim 710 400 This amount was given in the question paper

Final (1 360 000 x 12c) 163 200 Refer to Note 7 above, the number of shares in the

share register is very important. On this date there is

1 360 000 shares.

Balance at the end 382 000 This amount was given in the answer book

© Gauteng Department of Education

36

SESSION 2: STATEMENT OF COMPREHENSIVE INCOME

STATEMENT OF COMPREHENSIVE INCOME (INCOME STATEMENT)

Income Statement reflects the trading results in the form of profit or loss for a specific

accounting period, usually a year.

At year end, all the income and expense accounts will be checked to ensure that all the

figures represent the amounts for the current year.

Adjustments will then be done to rectify any accrued or prepaid. The net income or net loss is

obtained by subtracting expenses from the income.

In Grade 10 the financial statements of the sole trader were introduced, in Grade 11 the

partnership and Grade 12 the companies are introduced.

NOTE: The structure of the trading section and operating activities (income and expenses)

are similar for all the three forms of ownership.

FORMAT OF STATEMENT OF COMPREHENSIVE INCOME

Statement of Comprehensive Income/Income Statement for the year ended

Notes

The FORMAT Sales (Sales – debtors allowances) 100 000

of a

Trading

Section

Cost of Sales (40 000)

Company’s

INCOME Gross profit 60 000

STATEMENT

Plus Other Operating Income 8 000

is similar to

the Sole Discount received 1 000

trader and Rent income 6 000

Partnership Profit on sale of asset 600

Operating

Section

Bad debts recovered 300

Provision for bad debts adjustment 100

Etc.

Operating Profit 68 000

© Gauteng Department of Education

37

These are

the new Minus Operating Expenses (10 000)

expense Advertising 100

accounts

Operating Section

Salaries and wages 3 000

unique to Insurance 200

companies Provision for bad debts adjustment (if increased) 50

Bad debts 50

Sundry expenses 2 000

Audit fees 400

Directors fees 4 000

Trading stock deficit 20

Depreciation 160

Loss on sale of assets 20

Etc.

Operating Profit (Loss) 58 000

Company Ltd

Sole Partnership

trader

Shareholders

Sole Trader /Partnership Company

Operating Profit (Loss) 58 000 Operating Profit (Loss) 58 000

Plus Interest Income 1 1 200 Plus Interest Income 1 1 200

Profit (loss) before interest Profit (loss) before interest

expense 59 200 expense 59 200

Minus Interest expense / Minus Interest expense /

Finance cost 2 (200) Finance cost 2 (200)

Net Profit (Loss) for the Profit (Loss) before tax 59 000

year 59 000 Taxation (28%) (16 520)

Net Profit (Loss) after

Income tax not applicable for a sole tax 8 42 480

trader or in a partnership. Partners

and owners pay income tax in their Income tax for the year is subtracted

own personal capacity in the Income Statement

REMEMBER: Only nominal accounts are recorded in the Income Statement.

© Gauteng Department of Education

38

TRIAL BALANCE AND YEAR –END ADJUSTMENTS

The nominal accounts section of the Pre-adjustment Trial Balance will indicate the total

amounts received or paid during the financial year. Therefore it’s very important to take into

account the accruals in order to determine the correct profit.

Accrual - it means a company to record revenue before receiving payment for goods or

services sold or expenses are recorded as incurred before the company has paid for them.

A Pre-adjustment Trial Balance or list of balances extracted from the trial balance are used to

adjust the year-end adjustments or transactions.

The diagram provided below indicates a chain of financial records involved in the calculation

of retained income.

Nominal Accounts

Trading Account Profit nd Loss Appropriation

Determine Net Determine

Determine Gross Retained

Profit Profit

Earnings

ILLUSTRATIVE EXAMPLES FOR YEAR-END ADJUSTMENTS

Rent expense - a % increase/decrease during the year.

Provision for bad debts

Interest on loan extract from the loan statement

Calculate the ‘short term loan’

© Gauteng Department of Education

39

Rent income/expense

Adjustment Income statement

Example: 1

Pre-adjustment Trial Balance Feb 2023 Income statement for the year ended

Nominal sections Dr Cr Less operating expenses

Rent expense 11 000 Rent expense 12 000

(11 000 + 1 000)

Adjustment: Balance Sheet for Feb 2023

Brought into account that one month’s rent is Note 9: trade and other payables

still outstanding at R1 000 per month. Accrued expense 1 000

Calculations

(1 000 x12 ) – 11 000 = 1000 accrued

12 000

OR

Adjustment Financial statements

Example: 2

Income statement for the year ended

Pre-adjustment Trial Balance Feb 2023

Less operating expenses

Nominal section Dr Cr

Rent Income 27 200 Rent Income 25 000

(27 200 - 2 200)

Adjustment:

The tenant paid his rent one month in advance.

Take into account that the rent of R2 000 Balance Sheet for Feb 2023

increased by 10 % from 1 October 2022.

Note 9: trade and other payables

Income received in advance 2 200

Calculations

1 Mar 2022 till 30 Sep 2022 = 7 months x 2 000

1 Oct 2022 till 28 Feb 2023 = 5 months x 2 200

March 2023= 1 month x 2 200

Deferred income/ Income received in advance must be subtracted.

© Gauteng Department of Education

40

OR

Adjustment Financial statements

Example: 3

Income statement for the year ended

Plus other operating income

Pre-adjustment Trial Balance 28 Feb 2023

Nominal section Dr Cr Rent Income 25 000

Rent Income 27 200 (27 200-2200)

Adjustment:

Take into account that rent increased by R200 Balance Sheet as at 28 February 2023

on 1 October 2022 and the tenant paid the rent Note 9: trade and other payables

for March during February 2023.

Income received in 2 200

advance

CALCULATIONS

1 March to 30 Sep = 7 months x 100%

1 Oct - 28 Feb = 5 months x 100% +(200 x 5)

March = 1 month x 100%+(200 x 1)

Total amount received = 27 200

Tot increase received: R200 x 6 m = (1 200)

R26 000 ÷ 13m = R2 000 p.m.

Prepaid amount is R2 000 + R200 = R2 200

Deferred income/ Income received in advance must be subtracted

TIME LINE will reflects calculations for rent for the year and the rent that was received in advance

Financial year prepaid

1 Mar Apr May June July Aug Sept 1 Oct Nov Dec Jan Feb Mar

100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100%

+200 +200 +200 +200 +200 +200

© Gauteng Department of Education

41

OR

Adjustment Financial statements

Example: 4

Income statement for the year ended

Pre-adjustment Trial Balance -28 Feb 2023

Plus other operating income

Nominal section Dr Cr

Rent Income 22 800 Rent Income 25 000

(22 800+2200)

Adjustment:

Take into account that the rent increased by 10%

on 1 October 2020 and the tenant hasn’t yet paid Balance Sheet as at 28 Feb 2023

the rent for February 2023 Note 5: Trade and other receivables

Accrued Income 2 200

Mar 30 Sep = 7 months x 100%

1 Oct -Jan = 4 months x 100% +10%

Mar = 1 month x 100%+10% accrued

(100% x 7) + (110% x 4) = 22 800

700% + 440% = 22 800

1140% = 22 800 (known)

𝑢𝑛𝑘𝑛𝑜𝑤𝑛 𝑼

Make use of cremora / or =

𝑘𝑛𝑜𝑤𝑛 𝑲

𝑢𝑛𝑘𝑛𝑜𝑤𝑛 110

x 22 800 = R 2 200

𝑘𝑛𝑜𝑤𝑛 1140

Accrued income must be added

Draw a TIME LINE to determine the rent for the year and the rent that was ACCRUED

Financial year

1 Mar Apr May June July Aug Sept 1 Oct Nov Dec Jan Feb

100% 100% 100% 100% 100% 100% 100% 110% 110% 110% 110% 110%

7 x 100% =700% + 110% x 4 =440% + Feb/accrued = 22 800

© Gauteng Department of Education

42

Adjustment Financial statements

Example: 5

Income statement for the year ended

Plus other operating income

Pre-adjustment Trial Balance - 28 Feb 2023 Rent Income

Nominal section Dr Cr 23 000

(24 800- 1 800)

Rent Income 24 800

Adjustment: Balance Sheet as at 28 Feb 2023

Take into account that the rent decreased by 10% Note 9: Trade and other payables

on 1 October 2022 due to the lockdown and the

tenant paid the rent for March during February Income received in advance 1 800

2023

Calculations

Mar 30 Sep = 7 months x 100%

1 Oct -Feb = 5 months x 100% -10%

Mar = 1 month x 100%-10% Deferred income

(100% x 7) + (90% x 5) + 90% = 24 800

700% + 450% + 90% = 24 800

1240% = 24 800 (known)

𝑢𝑛𝑘𝑛𝑜𝑤𝑛

Make use of cremora / or

𝑘𝑛𝑜𝑤𝑛

𝑢𝑛𝑘𝑛𝑜𝑤𝑛 90

x 24 800 = R 1 800

𝑘𝑛𝑜𝑤𝑛 1240

Time line illustrates rent received for the year and the Rent received in advance

Financial year Prepaid

1 Mar Apr May June July Aug Sept 1 Oct Nov Dec Jan Feb Mar

100% 100% 100% 100% 100% 100% 100% 90% 90% 90% 90% 90% 90%

March 90% x1

7 x 100% =700% + [100%-10%] 90% x 5 = 450% + = 24 800

© Gauteng Department of Education

43

Provision for bad debts: [create/increase/ or decrease]

The provision for bad debts account must be adjusted according to the balance of the Debtors

Control account.

The new adjusted balance of the Debtors control account will be used to calculate the provision

for bad debts after all additional adjustments took place in the Debtors control account

When the company creates provision for bad debts for the first time, the Provision for bad

debts adjustment will be regarded as an expense.

Three examples are used to illustrate when provision for bad debts adjustment.

[Create or increase or decrease]

Adjustment Financial statements

Example: 1:

Income statement for the year

financial year-end: 31 August Minus operating expense

Pre-adjustment Trial Balance Provision for bad debts 850

Balance sheet section Dr Cr adjustment

Debtors control 17 000

Provision for bad debts 0 Balance Sheet as at August 2022

Note 5 Trade and other receivables

Trade debtors 17 000

Adjustment: 2022

Create a provision for bad debts at 5% of debtors. Less provision for bad (850)

debts

Net Debtors 16 150

Calculations

17 000 x 5% = R 850 NOTE: when creating provision for

bad debts the amount recorded in

Create: expense the Income Statement will be

Create:

recorded in our note for trade and

expense other receivables.

© Gauteng Department of Education

44

Adjustment Financial statements

Example: 2

Pre-adjustment Trial Balance Income statement –August 2022

Balance sheet section Dr Cr Minus operating expense

Debtors control 22 000 Provision for bad debts 150

Provision for bad debts adjustment (1 000 - 850)

850 Bad debts 2 000

Adjustment: 2022 Balance Sheet as at August 2022

Adjust the provision for bad debts at 5% of

debtors. Take into account that additional bad Note 5 Trade and other receivables

debts of R2 000 must still be written off. Trade debtors 20 000

(22 000-2 000)

Less provision for bad (1 000)

debts (850 +150 =1000)

Net Debtors 16 150

Calculations

Debtors control: NOTE

22 000 – 2 000 = 20 000 When the provision for bad

debts increase the difference is

20 000 x 5% = R1 000 regarded as an expense.

R1 000 will be recorded in note for

Adjust from R850 to R1 000 (increase)

Increase: expense trade and other receivables and

(1000 – 850 = R150 ) R150 will be recorded in the

Income Statement.

increase: expense (difference between R1 000 and R850)

© Gauteng Department of Education

45

When the provision for bad debts decrease the difference is regarded as an income.

ADJUSTMENT Financial Statements

Example: 2.3

Income statement - February 2023

Pre-adjustment Trial Balance Plus other operating income :

Balance sheet section Dr Cr Provision for bad debts 270

Debtors control 19 000 adjustment (1 000 -730)

Provision for bad debts 1 000

Adjustments: 2020

Balance Sheet as at February 2023

Take into account that additional bad debts of R1

600 must be written off. Note 5 : Trade and other receivables

Transfer R2 800 a debit balance of a debtor to Trade debtors 14 600

the creditors’ ledger. (19000-1600-2800)

Adjust the provision for bad debts at 5% of Less provision for bad (730)

debtors debts (1000-270 =730)

Net Trade Debtors 13 870

Calculations

Debtors control:

19 000 – 3 200 + [1400 + 200] - 2 800 = 14 600

Remember:

Only the difference, R270 between

+ Debtors control -

the opening balance and current

b/d 19 000 Bad debts 1 600

provision will be recorded in the

J credits 2 800

Income statement

c/d 14 600

19 000 19 000

b/d 14 600

14 600 x 5% = R730

NOTE:

Adjust from R1 000 to R730 (decrease) When the provision for bad debts

(1000 – 730 = R270 ) decrease the difference is

regarded as an income.

Income

© Gauteng Department of Education

46

Interest on loan extract from the loan statement (capitalised)

The amounts used to calculate the interest on loan are obtainable from the loan

statement issued by the bank.

Adjustment Financial statements

Example: 3.1

Income statement– February 2023

Pre-adjustment Trial Balance

Profit before interest expense

Balance sheet section Dr Cr

Minus interest expense (75 000)

Loan 525 000

Net profit before tax

Balance Sheet – February 2023

Calculations before consideration of

statement Non-current liabilities

948 000 – 423 000

Interest not added Loan 600 000 - 348 000 252 000

Adjustment: 2023 Current liabilities

Short term loan 348 000

948000 -600 000

Loan statement from Rand Bank

OR 423 000 -75 000

Balance 1 Mar 2022 948 000

Repayments 423 000

interest capitalised ?

Balance at 28 Feb 2023 600 000

Calculations

Interest on loan : The repayment of the loan will be :

948 000 – 423 000 – 600 000 = 75 000 the interest on loan 75 000

Adjust the loan account as well: + the loan instalment *348 000 (short term)

- Loan + = repayment of loan 423 000

Bank 423 000 Bal b/d 948 000 OR

Bal c/d 600 000 ** 75 000

1 023 000 1 023 000 Opening balance 948 000

Closing balance - 600 000

= Short term loan 348 000

348 000 will be classified as short-term loan if the

capital repayment is not changed in the following

year.

© Gauteng Department of Education

47

Adjustment Financial statements

Example: 3.2

Income statement –February 2023

Pre-adjustment Trial Balance

Balance sheet section Dr Cr Profit before interest expense

Loan ?

Minus interest expense 223 500

= Net profit before tax

Adjustment: 2023 Balance Sheet –February 2023

Loan statement from Rand Bank Non-current liabilities

Balance 1 Mar 2022 R 2 813 500 Loan 2777 500 -555 500 2 222 000

Repayments 259 500 Current liabilities

interest capitalised 223 500 Short term loan 555 500

Balance at 28 Feb 2023 2 777 500

20% of the loan balance will be paid in the next

financial year

Calculations

Interest on loan : 223 500

Adjust the loan account as well:

- Loan +

Bank 259 500 Bal b/d 2 813 500

Bal c/d 777 500 interest 223 500

3 037 000 3 037 000

Short term loan:

2 777 500 x 20% = R555 500

© Gauteng Department of Education

48

iv. Calculation of the short term loan – Balance Sheet

When completing the Balance Sheet, it is imperative to indicate the loan that will be paid within

the next financial year (short term loan) as well as the loan that is payable in the long term.

Refer to the examples provided below:

Adjustment Financial statements

Example: 1

Balance Sheet as at FEBRUARY 2023

Pre-adjustment Trial Balance

Balance sheet section Dr Cr Non-current liabilities

Loan ?

Loan 900 000 – 300 000 600 000

Current liabilities

Short term loan 300 000

Adjustment: 28 February 2023

A Loan of R1 500 000 from Ekasi Bank was

originally received on 1 March 2021. It will be

repaid in equal monthly instalment over 5

years.

Calculations

Adjust the loan account as well:

- Loan + Original loan: R1 500 000

2019 Bank 300 000 2018 b/d 1 500 000

2020 Bank 300 000 Check the timeline provided for annual

c/d 900 000 repayments

Loan

1 500 000 – 300 000 – 300 000

= 900 000

TIME LINE - Term Loan (Current Liability )

Financial year one Financial year two Next financial year

1 Mar 28 1 Mar 28 Feb 1 Mar

2021 Feb 2022 2023 2023

2022

Payment per year Payment per year

R 1 500 000 - 300 000 = R 1 200 000 – 300 000 = Short term loan to current liabilities

=1 200 000 900 000 =300 0000

𝑹𝟏 𝟓𝟎𝟎 𝟎𝟎𝟎𝟎

= R300 000 repayment per year

𝟓 𝒚𝒆𝒂𝒓𝒔

© Gauteng Department of Education

49

Second example: Short term loan

Adjustment Financial statements

Example:.2

Balance Sheet as at FEBRUARY 2023

Pre-adjustment Trial Balance

Balance sheet Dr Cr Non-current liabilities

sections

Loan 235 200 – 67 200 168 000

Loan 235 200

Current liabilities

Short term loan 67 200

Adjustment: 2023 (R5 600 x 12 = 67 200)

The loan from Oka Lenders was originally

received on 1 September 2021. The loan is to

be repaid in equal monthly instalments over 5

years. The 1st instalment was paid on 30

September 2021.

Calculations

Original loan: R? and must pay it back over 5 years

( 5 x 12 months = 60 payments per month)

Loan on yearend Feb 2020: R235 200

60 – 18 months paid = 42 months still to pay.

𝟐𝟑𝟓𝟐𝟎𝟎

Therefore the short term loan is 𝟒𝟐 𝒎𝒐𝒏𝒕𝒉 =R5 600

per month

TIME LINE - Term Loan (Current Liability )

Financial year one Financial year two Next financial year

1 Mar 1 Sept 28 1 Mar 28 Feb 1 Mar

2021 Feb 2022 2023 2023

2022

6 months + 12 months = 18 months 60 – 18 = 42 months outstanding

paid

Loan: _____? __ 12 months –payable in the short-term

18 m’s later: Loan= R235

30 months is payable in the long- term

200

Instalments of 5 years: 5 x 12 = 60 months to pay-back loan

© Gauteng Department of Education

50

ILLUSTRATIVE ACTIVITY 1 25 Minutes

FINANCIAL STATEMENT AND NOTES

You are provided with the Pre-adjustment Trial Balance of BEN Limited for the year

ended 28 February 2019. Business had 281 000 shares in issue at the end of the

financial year.

REQUIRED:

1. Prepare the Income Statement for the year ended 28 February 2019.

INFORMATION:

BEN LTD

PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2019

DEBIT CREDIT

Balance Sheet Accounts Section

Trading stock 477 500

Debtors control 198 000

Creditors control 267 640

Provision for bad debts 10 050

Nominal Account Section

Sales 5 250 000

Debtors allowances 72 600

Cost of sales 3 743 500

Packing material 11 550

Bad debts recovered 1 150

Directors fees 420 000

Salaries and wages 330 000

Bad debts 6 000

Adjustments

1. The company has two directors. They all received the same monthly remuneration.

One director took his March 2019 fee on 15 February 2019. This has been recorded

2. The account of debtor, G. Zondi, R1 000 must be written off as irrecoverable.

3. N. Ngcobo’s credit balance of R2 000 in the debtors ledger must be transferred to

his account in the creditors ledger.

4. The provision for bad debts must be adjusted to 5% of the good book debtors.

5. A physical stock-taking on 28 February 2019 revealed the following inventories on

hand:

• Trading stock, R470 000

• Packing material, R450

© Gauteng Department of Education

51

ANSWER SHEET

REQUIRED:

Complete the answer sheet individually after the discussion of the adjustments.

BEN LIMITED

INCOME STATEMENT FOR THE YEAR ENDED 28 FEBRUARY 2019

Note R

Sales 5 250 000 – 72 600 5 177 400

Cost of sales 3 743 500 (3 743 500)

Gross profit 1 433 900

Other operating income

Bad debts recovered 1 150 1 150

Provision for bad debts adjustment 10 050 100

Gross operating income

Operating expenses

Directors fees 420 000

Packing material 11 550

Bad debts 6 000

Trading stock deficit 47 750

Net profit (loss) after tax

Suggested solutions

no. Adjustment Calculations Income statement

1 The company has two NOTE- add all the months that have Operating Expenses

directors. They all received been paid

the same monthly R420 000 ÷ 25 (12 + 13) Directors fees

remuneration. One director = R16 800 420 000 – 16 800 = 403 200

took his March 2019 fee on 15 OR

February 2019. This has been Dr Prepaid expenses 16 800 42 000 X 24/25=403 200

recorded Cr Directors fees 16 800

Operating Expenses

2 The account of debtor, G. NOTE- if an account is irrecoverable it

Bad debts

Zondi, R1 000 must be written becomes a bad debt

6 000 + 1 000 = 7 000

off as irrecoverable. R1 000

Debtors control [198 000 – 1 000]

Dr Bad debts 1 000

Cr Debtors Control 1 000

© Gauteng Department of Education

52

3 N. Ngcobo’s credit balance of Credit balance R2 000

R2 000 in the debtors ledger

Debtors control [198 000 –1 000 +2 000]

must be transferred to his

account in the creditors Creditor control [267 640 + 2 000]

ledger.

Dr N Ngcobo – Debtors Control 2 000

Debtor :N Ngcobo Cr N Ngcobo – Creditors Control 2 000

NO ENTRIES in Income

2 000 b/d 2 000 statement

Creditor: N Ngcobo

2 000

Adjustment Calculations Income statement

4 The provision for bad Trade Debtors Other operating income

debts must be adjusted to (198 000 – 1 000 + 2 000 )X 5% Provision for bad debts

5% of the good book = 199 000 X 5% = 9 950 adjustment

debtors. Provision for bad debts R10 050

Decreased 10 050 – 9 950 =100

Hint: If the provision for bad

debts: 10 050 – 9 950 = 100

Increase -classify as an Dr Provision for bad debts 100 Recorded under operating

expense Cr Provision for bad debts adjustment Income

Decrease -classify as income

100

5 A physical stock-taking on HINT – use note 4 to calculate trading Operating expenses

28 February 2019 revealed stock surplus or deficit Trading stock deficit

the following inventories 477 500 – 470 000 = 7 500

on hand: 477 500 – 470 000 = 7 500

Trading stock, Dr Trading stock deficit 7 500 Packing material

R470 000 Cr Trading stock 7 500 11 550 – 450 = 11 100

Packing material, R450 Packing material on hand, 450

Dr Consumable stores on hand 450

Cr Packing material 450

v. Credit notes omitted at yearend –Income Statement

When a credit note was not recorded, an adjustment must be made to adjust 4 ledger

accounts. The following example will illustrate how the 4 accounts will be adjusted

© Gauteng Department of Education

53

ILLUSTRATIVE ACTIVITY 2– CREDIT NOTES

25 Minutes

Take note: Credit

INFORMATION note:

Extract from the Pre-adjustment Trial Balance on 30 Debtors at

R

June 2020:

Balance Sheet Accounts control Selling

Debtors' control 116 500 Debtors price

Trading stock 209 500 Allowances

Nominal Accounts

Cost of at

Sales (less allowances) 4 777 300

sales Cost

Cost of sales ?

Trading price

stock

Adjustments and additional information:

Adjustments Explanation

1 A credit note for R35 700 issued to a 1. Debtors control = decrease by R35 700

debtor, dated 27 June 2020, was not 2. Debtors Allowances = increase by R35 700

recorded. The cost price of these 3. Trading Stock = increase the stock by R21 000

goods was R21 000. The goods 4. Cost of Sales= decrease the sales by R21 000

were placed back into stock.

To find the original selling price, the trade discount

2 The business prices its goods at a

must be added back in order to calculate Cost of sales

mark-up of 70% on cost. Trade 100

discount of R297 200 was allowed Sales + trade discount =total sales x 170= C of Sales

100

on invoices to certain customers. 4 777 300 + 297 200=5 074 500 x 170 = COST OF SALES

Remember: trade discount and cash discount are not recorded in journals,

only the reduced amount APPEARS ON THE SOURCE DOCUMENT and

recorded. Before you calculate the cost of sales, you need to find the sales

amount before the cash/trade discount was given.

100

[4 777 300 + 297 200] x 170 = 2985 000 (Cost of Sales)

© Gauteng Department of Education

54

REQUIRED:

Complete the income statement in order to calculate the gross profit

Income Statement For The Year Ended 30 June 2020

Sales (4 777 300 – 35 700) 4 741 600

Cost of sales ( 4 741 600 +297 200) x 100/170 (2 964 000)

Gross profit 1 777 600

HINT for Adjustment B – to calculate the cost of sales ADD the trade discount of R297 200

𝑵𝒆𝒆𝒅 𝑼𝒏𝒌𝒏𝒐𝒘𝒏

to sales then apply the CREMORA method / or 𝑯𝒂𝒗𝒆 / or 𝑲𝒏𝒐𝒘𝒏

How to earn easy marks when completing the Income Statement

You must know the FORMAT of the Income Statement.

Always start with the PRE-ADJUSTMENT FIGURES FROM THE TRIAL BALANCE or

information extracted when preparing the income statement.

Start with NOMINAL ACCOUNTS ITEMS

RECORD THE FIGURES IN INCOME STATEMENT to earn part/method marks

START WITH ADJUSTMENTS –you will also have to consider the amounts in the

Balance Sheet Section [More marks are allocated to adjustments]

Income received in advance and prepaid expenses are DEDUCTED

Accrued income and accrued expenses are ADDED

More marks are

Remember to DEDUCT debtors’ allowances from sales earned through

adjusted figures

If goods are returned, cost of sales must also be REDUCED

ALWAYS SHOW your WORKINGS IN BRACKETS to earn part marks

© Gauteng Department of Education

55

COMPANIES FINANCIAL STATEMENTS

ACTIVITY 1

FIXED ASSETS AND INCOME STATEMENT (60 marks)

ADAPTED [NSC/ NOVEMBER 2020]

The information relates to Robbie Ltd for the financial year ended 28 February 2021

1.1 Refer ton INFORMATION B(a) for fixed assets

Calculate the following

1.1.1 The missing amounts denoted by (i) to (ii) on the Fixed asset Note (11)

1.1.2 Profit/Loss on the sale of equipment on 1 October 2020 (2)

1.2 Refer to INFORMATION B (e) for trading stock

Calculate the trading stock deficit

1.3 Prepare the Statement of Comprehensive Income for the financial year ended

28 February 2021

INFORMATION:

A Extract from the Pre-adjustment Trial Balance on 28 February 2021:

R

Mortgage loan: Sufi Bank 1 005 500

Debtors' control 123 000

Trading stock ?

Provision for bad debts 7 030

Sales ?

Cost of sales 6 966 000

Salaries and wages 1 468 120

Directors' fees 3 330 000

Audit fees 91 000

Repairs 476 000

Rent Income 173 000

Interest Income 25 000

Interest on loan ?

Bad debts 19 200

Advertising 25 680

Sundry expenses 452 310

Ordinary share dividends 86 400

© Gauteng Department of Education

56

B Adjustments and additional information:

Fixed Assets:

Vehicles:

The business owns two vehicles on 28 February 2021. The second vehicle

was purchased on 1 November 2020

Vehicles are depreciated at 15% p.a. on cost

Equipment

Depreciation is 20% p.a. on the diminishing balance method

Unused equipment was sold for R40 000 on 1 October 2020. Accumulated

depreciation on the equipment sold was R36 600 on 1 March 2020.

Extract of the Fixed Asset Note:

Vehicles Equipment

Cost (1 March 2020) 460 000 360 000

Accumulated depreciation (1 March 2020) (396 750) (187 595)

CARRYING VALUE ( 1 March 2020) (i) 172 405

Additions (at cost) 510 000 0

Disposals (at carrying value) 0 (iii)

Depreciation (ii) (31 281)

CARRYING VALUE (28 February 2021)

Cost (28 February 2021) 970 000 285 000

Accumulated depreciation (28 February 2021)

(b) The business maintains a mark-up of 120% on cost. Note that trade discounts of

R648 000 were granted to special customers.

(c) The account of debtor B Melta, R800, must be written off.

(d) Provision for bad debts must be adjusted to 5% of outstanding debtors

(e) Trading stock is valued on the weighted-average method. The Ledger Account and

records reflect that 280 units should be on hand. However, the physical stock count

reflects only 262 units on hand. The stock records are as follows:

© Gauteng Department of Education

57

UNITS UNIT PRICE TOTAL

Stock at beginning of year 200 R 3 600 R720 000

Purchased during the year 1 840 R4 100 R7 544 000

Returns: damaged units 40 R4 100 R164 000

Available for sale 2 000 R8 100 000

Stock units per records 280 ? ?

(f) 30% of the audit fees is still outstanding.

(g) The monthly rent income did not change during the year, During February 2021 the

tenant paid R9 000 for repairs to the premises, and deduced this from his rent for

February 2021. The rent for March 2021 was received in advance.

(h) The company has four directors earning the same fee. One director resigned on

31 may 2020 and received his fees up to this date. Another director is still owed

fees for January and February 2021.

(i) Advertising consists of a contract with a newspaper for the entire financial year.

Payments are monthly, however instalments were paid for 11 months only. NOTE:

The monthly rate decrease by R240 from 1 November 2020

(j) The net profit after tax was accurately calculated at R1 054 000. The income tax

rate is 32%.

60

© Gauteng Department of Education

58

ACTIVITY 1 ANSWER SHEET

NSC NOV 2020

1.1.1 (i) Calculate: Carrying value of the vehicle on hand on 1 March 2020

Workings Answer

(ii) Calculate: Depreciation on vehicles for the year

Workings Answer

5

(iii) Calculate: Carrying value of equipment sold

Workings Answer

1.1.2 Calculate: Profit/Loss on sale of equipment

Workings Answer

1.2 (iii) Calculate: Trading stock deficit

Workings Answer

4

NOTE: The relevant figures calculated above must be transferred to the

Statement of Comprehensive Income

© Gauteng Department of Education

59

1.3 STATEMENT OF COMPREHENSIVE INCOME (INCOME STATEMENT) FOR

THE YEAR ENDED 28 FEBRUARY 2021

Sales

Cost of sales (6 966 000)

Operating Income

Gross Operating Income

Operating Expenses

Salaries and wages 1 468 120

Depreciation

Sundry expenses 452 310

Operating Profit

Profit before interest expenses

Interest expenses

Net profit before taxation

43

Net profit after taxation 1 054 000

TOTAL MARKS

60

© Gauteng Department of Education

60

INCOME STATEMENT AND NOTES TO BALANCE SHEET

ACTIVITY 2

MVVS LTD [ADAPTED NSC MAY/JUNE 2019]

The information relates to the financial year ended 31 March 2019.

REQUIRED:

2.1 Complete the Statement of Comprehensive Income (Income Statement) for the year ended

31 March 2021. (53)

2.2 Complete the following notes to the Balance Sheet:

Fixed/Tangible Asset Note (8)

Ordinary share capital (6)

INFORMATION:

Figures extracted from the Pre-adjustment Trial Balances on 31 March:

2021 2020

R R

Ordinary share capital 9 300 000 4 800 000

Mortgage loan: Sapphire Bank 1 430 200 1 658 000

Land and buildings 12 500 000 12 500 000

Vehicles 1 377 000 750 000

Equipment ? 398 000

Accumulated depreciation on vehicles ? 475 000

Accumulated depreciation on equipment ? 117 500

Provision for bad debts ? 30 100

Trading stock 364 200

Debtors' control 578 000

Sales 10 563 280

Cost of sales 6 236 000

Rent income 99 500

Directors' fees 1 262 100

Water and electricity 218 000

Telephone 75 600

Audit fees 104 000

Sundry expenses 61 001

Salaries and wages 1 280 000

Employer's contributions (medical, pension and UIF) 316 000

Bad debts 22 300

Consumable stores 53 200

Interest income ?

Insurance 79 500

Depreciation (on equipment sold) 1 750

Interest on loan ?

Bad debts recovered 6 000

Ordinary share dividends (interim) 375 000

© Gauteng Department of Education

61

ADJUSTMENTS AND ADDITIONAL INFORMATION:

A. A credit invoice for R36 720 (after deducting a 10% trade discount) issued on 31

March 2021, was not recorded. Goods are marked up at 70% on cost.

B. The physical stock count on 31 March 2021 revealed the following on hand:

Trading stock, R334 500

Consumable stores, R3 400

C. Debtor S Magnum was declared insolvent. His estate paid R2 000, which was 20% of

his debt. The difference must be written off as a bad debt.

D. R1 800 was received from a debtor, J Misting, whose debt had previously been written

off. The bookkeeper incorrectly credited the amount to the Debtors' Control Account.

Correct the error.

E. Adjust the provision for bad debts to R28 500.

F. Insurance includes an annual premium of R51 000 paid for the period 1 January 2019

to 31 December 2021.