Professional Documents

Culture Documents

Taxation Reviewer

Taxation Reviewer

Uploaded by

cyndi.biceraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation Reviewer

Taxation Reviewer

Uploaded by

cyndi.biceraCopyright:

Available Formats

TAXATION REVIEWER | CYNDI SATORRE-BICERA | 2nd Sem SY 2022-2023 | 1

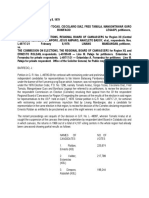

CONCEPT AND PURPOSES OF TAXATION GR, Not subject to set-off Subject to set-off

Governed by special Governed by the ordinary

TAXATION – the inherent power of the sovereign exercised prescriptive periods in NIRC. periods of prescription.

through legislature to impose burdens upon subjects and

objects within its jurisdiction for the purpose of raising

revenues to carry out the legitimate objectives of the TAX LICENSE FEE

government.

Imposed to raise revenue Imposed for regulation and

PURPOSES OF TAXATION control

Collected under the power Collected under the police

PRIMARY: To raise funds or property to enable the State to of taxation power

promote general welfare and protection of the people.

Amount is unlimited Amount is limited to the

SECONDARY [PRREP]: necessary expenses of

1. Promotion of General Welfare e.g. salary of law enforcers regulation and control.

for the protection of the people; if taxes is used to implement

the police power; Non-payment does not Non-payment makes the

make business illegal business illegal

2. Regulation of Activities/Industries e.g. regulation of the

price of onion; Normally paid after the Normally paid before the

3. Reduction of Social Inequality start of the business. commencement of the biz.

4. Encourage Economic Growth e.g. tax holidays (exemption

to pay taxes) to encourage investors or in economic zones

DISTINCTIONS OF THE THREE INHERENT POWERS

(lower to zero taxes to encourage investors to contribute for

the economic growth);

As to who exercises the power, taxation and police power is

5. Protectionism e.g. protection of the production or market of

exercised by the government or its political subdivisions; while

the local products against foreign products (imported) they

in eminent domain, it is the government or public service

would tax those imported products in order to protect the local

companies and public utilities.

products so that people would buy them because it is way

cheaper.

As to purpose, taxation is to raise revenue in support of the

government, police power is for the promotion of general

TAX TARIFF/CUSTOM DUTIES welfare through regulations, while eminent domain is to

facilitate taking of private property for public purpose.

All embracing term One kind of tax

As to the objects, taxation and police power are imposed

Persons, property, Goods that are imported or

upon community or class or individuals while eminent domain

privilege transactions exported

is imposed on an individual as the owner of a particular

property.

TAX TOLL

As to the impairment of contracts, tax laws generally do not

Enforced proportional A consideration paid for the impair contracts unless the government is a party to the

contribution from persons use of a road, bridge or the contract granting exemption while in police and inherent

and property for public like, of a public nature. powers, contracts may be impaired.

purpose/s

THEORIES AND BASES OF TAXATION**

Demand of Sovereignty Demand of Proprietorship

Amount is unlimited Amount is limited to the cost 1. Lifeblood Theory – taxes are the lifeblood of the nation

and maintenance of public through which the government agencies continue to operate

improvement and with which the State effects its functions for the welfare of

its constituents. [CIR vs. CTA, GR 106611, 7/21/1994]

May be imposed by the May be imposed by private

State only individuals or entities. 2. Necessity Theory – the theory behind exercise of the

power to tax emanates from necessity. Without taxes, the

government cannot fulfill its mandate of promoting general

TAX DEBT welfare and well-being of people. [Gerochi vs. DOE, GR

159796, 7/17/2007]

Obligation created by law Obligation based on contract

latest is CREATE law express or implied.

3. Benefits-Protection/Received Theory – taxes are what we

Not Assignable Assignable pay for a civilized society. Without taxes the government would

be paralyzed for lack of motive power to activate and operate

Generally payable in money Payable in kind or in money it. Hence, despite the natural reluctance to surrender part of

one’s earned income to the taxing authorities, every person

From the Discussions of Atty. Denise Christine Lim, CPA

University of Mindanao College of Law

TAXATION REVIEWER | CYNDI SATORRE-BICERA | 2nd Sem SY 2022-2023 | 2

who is able must contribute his share in the running of the 4. International Comity

government. The government, for its part, is expected to 5. Exemption of government entities, agencies and

respond in the form of tangible and intangible benefits intended instrumentalities

to improve the lives of the people and enhance their material

and moral values [CIR vs. Algue L028896, 2/17/1988] – 1. PUBLIC PURPOSE

Symbiotic relationship. • The proceeds of tax must be used:

a. for the support of the State

JURISDICTION OVER SUBJECT AND OBJECTS b. for some recognized objective of the government or to

directly promote the welfare of the community.

GR: Taxation is TERRITORIAL because it is only within the

confines of its territory that a country, state or sovereign may • Public purpose does not only pertain to those purposes which

give protection. are traditionally viewed as essentially government-functions

but also includes those designed to promote social justice (ex.

PRINCIPLES OF A SOUND TAX SYSTEM [FAT] social housing).

1. Fiscal Adequacy – revenue must be sufficient to meet

government/public expenditures and other public needs. Test in determining public purpose:

1. Duty test – whether the thing to be furthered by the

2. Administrative Feasibility – the tax system should be appropriation of public revenue is something which is the duty

capable of being effectively administered and enforced with the of the State as a government to provide.

least inconvenience to the taxpayer. [Diaz vs. SOF, G.R. No.

193007, 7/19/2011] 2. Promotion of General Welfare Test – whether the

proceeds of the tax will directly promote the welfare of the

3. Theoretical Justice – must take into consideration the community in equal measure.

taxpayer’s ability to pay.

• Determination when an enacted law is for public purpose lies

Ability to Pay Theory (Art. 6, Sec. 28, 1987 Constitution): in the Congress.

(1) The rule of taxation shall be uniform and equitable. The • However, this will not prevent the court from questioning the

Congress shall evolve a progressive system of taxation. propriety of such a statute on the ground that the law enacted

is not for public purpose.

(2) The Congress may, by law, authorize the President to fix

within specified limits, and subject to such limitations and • If the tax measure is not for public purpose, the act amounts

restrictions as it may impose, tariff rates, import and export quotas, to confiscation (will go to the other two inherent powers of the

tonnage and wharfage dues, and other duties or imposts within the

State).

framework of the national development program of the

Government.

2. INHERENTLY LEGISLATIVE

GR: Only the legislature has the full discretion (non-delegable)

(3) Charitable institutions, churches and parsonages or convents

appurtenant thereto, mosques, non-profit cemeteries, and all as to (who, what, how, where): [KAMPS]

lands, buildings, and improvements, actually, directly, and

exclusively used for religious, charitable, or educational purposes a. Persons, property, occupation or business to be taxed

shall be exempt from taxation. provided these are all within the State’s jurisdiction.

b. Amount or rate of tax

(4) No law granting any tax exemption shall be passed without the c. Kind of tax to be imposed (income tax, vat, tariff)

concurrence of a majority of all the Members of the Congress. d. Method of collection (withhold, voluntary filing)

e. Situs of tax (where to pay the taxes, which regional

A tax law will retain its validity even if it is not in consonance district offices are covered)

with the principles of fiscal adequacy and administrative

feasibility. XPNs: Delegations to LAP:

1. Delegation to LGU (Art. X, Sec. 5 Constitution)

However, if a tax runs contrary to the principle of theoretical

justice, such violation will render the law unconstitutional. • Power of LGUs to create its own sources of revenue and to

levy taxes, fees and charges.

LIMITATIONS IN TAXATION (TWO KINDS)

Section 5. Each local government unit shall have the power to

(1) Inherent; and (2) Constitutional create its own sources of revenues and to levy taxes, fees and

charges subject to such guidelines and limitations as the

(1) INHERENT LIMITATIONS [PITIE] Congress may provide, consistent with the basic policy of local

autonomy. Such taxes, fees, and charges shall accrue

1. Public Purpose exclusively to the local governments.

2. Inherently Legislative

• Art. X, Sec. 5 does not change the doctrine that municipal

3. Territorial

corporations do not possess inherent powers of taxation. What

From the Discussions of Atty. Denise Christine Lim, CPA

University of Mindanao College of Law

TAXATION REVIEWER | CYNDI SATORRE-BICERA | 2nd Sem SY 2022-2023 | 3

it does is to confer municipal corporations a general power to International Comity – the respect accorded by nations to

levy taxes and otherwise create sources of revenue and they each other because they are sovereign equals (par in parem

no longer have to wait for the statutory grant of these powers. non habet imperium). Thus, the property or income of a foreign

state may not be subject to taxation by another state.

2. Delegation to the President – the authority of the President

to tariff taxes, import, or export quotas, tonnage and wharfage 5. EXEMPTION OF GOVERNMENT ENTITIES, AGENCIES

dues or other duties and imposts (Art. VI, Sec. 28 [2] supra) AND INSTRUMENTALITIES

3. Delegation to the Administrative Agencies – when the GR: The government is exempt from tax.

delegation relates merely to administrative implementation that XPN: When it chooses to tax itself.

may call for some degree of discretionary powers under xxx

• National government (agency and instrumentality) is exempt

Section 6. Local government units shall have a just share, as from local taxation, RPT.

determined by law, in the national taxes which shall be

automatically released to them. MIAA’s Airport lands and buildings are exempt from real estate

tax imposed by local governments. [MIAA vs. CA, GR 155650,

NOTE: This is debatable because some authors said that the 2006]

Administrative Agency is only for implementation of tax laws;

ministerial. But some authors claimed that delegation to Admin • GOCCs perform proprietary functions. Hence, they are

Agencies is not really delegation. subject to taxation except: [GSP-Water]

(1) GSIS; (2) SSS; (3) PHIC; and (4) Local Water Districts.

• The purpose of such law can be determined in its whereas

clause. (2) CONSTITUTIONAL LIMITATIONS

Provisions directly affecting taxation [PUPCreNeMULVeN]

Congressman Mandanas et al v. Exec. Sec. Ochoa,

1. Prohibitions against imprisonment for non-payment of Poll

G.R. No. 199802/208488, 4/10/2019

tax (Sec. 20, Article III);

2. Uniformity and equality of taxation (Sec. 28 [1], Art. VI];

HELD: Sec. 6 Art. X of the 1987 Constitution textually

3. Grant by Congress of authority to the President to impose

commands the allocation to the LGUs of the just share in

tariff rates (Sec. 28 [2], Article VI];

the national taxes. Sec. 6 embodies three (3) mandates:

4. Prohibition against taxation of Charitable, religious, and

educational entities (Sec. 28 [3], Article VI];

1. The LGUs shall have a just share in the national taxes.

5. Prohibition against taxation of non-stock, Non-profit

2. The just share shall be determined by law.

educational institutions (Sec. 4 [3][4], Art. XIV)

3. The just share shall be automatically released by the

6. Majority vote of Congress for grant of tax exemption.

LGUs.

7. Prohibition on Use of tax levied for special purpose.

8. President’s Veto power on appropriation, revenue, tariff bills.

Congress has exceeded its constitutional boundary by

9. Non-impairment of jurisdiction of the Supreme Court.

limiting to the NIRTs the base from which to compute the just

10. Grant of power to LGUs to create its own sources of

share of LGUs. Although the power of Congress to make

revenue. [NOTE: 7,8,9,10 no discussions/slides?]

laws is plenary in nature, congressional lawmaking remains

subject to limitations stated in the 1987 Constitution. Thus,

Provisions indirectly affecting taxation: [FREND]

the phrase “national internal revenue taxes” engrafted in

1. Due Process

Sec. 284 is undoubtedly more restrictive than the term

2. Equal Protection

“national taxes” written in in Sec. 6.

3. Religious Freedom

4. Non-impairment of obligations of contract

NOTE: Regardless of who collects, the LGU has a share.

5. Freedom of the press (no slides/discussion)

3. TERRITORIAL A. PROVISIONS DIRECTLY AFFECTING TAXATION

GR: Taxation may be exercised only within the territorial

jurisdiction of the taxing authority. 1. PROHIBITION AGAINST IMPRISONMENT FOR

NON-PAYMENT OF A POLL TAX

XPNs:

1. Where the tax laws operate outside the territorial No person shall be imprisoned for debt or non-payment of a poll

jurisdiction. Ex. Income earned abroad by RA. tax. (Art. III, Sec. 20)

2. Where tax laws do not operate within the territorial

jurisdiction of the State. NOTE: within PH but not Poll tax – levied on persons who are residents within the

taxable (Ex. economic zones are not taxable in some territory of the taxing authority without regard to their property,

charges because they are not within the territory of business or occupation.

the PH; Embassies have no RPT).

4. TREATY AND INTERNATIONAL COMITY 2. UNIFORMITY AND EQUALITY

From the Discussions of Atty. Denise Christine Lim, CPA

University of Mindanao College of Law

TAXATION REVIEWER | CYNDI SATORRE-BICERA | 2nd Sem SY 2022-2023 | 4

EXEMPT = If Operating exclusively for

The rule of taxation shall be uniform and equitable. The congress

charitable and religious purposes and where

shall evolve a progressive system of taxation (Art. VI, Sec. 28 [1])

not part inures to the benefit of any member

organizer, officer or any specific person.

Uniformity – all taxable articles or kinds of property of the

same class shall be taxed at the SAME RATE; tax operates TAXABLE = If Income of whatever kind and

with the same force and effect in every place where the subject INCOME TAX

nature from any of their properties (real or

is found. personal) or from any other activities for

profit regardless of the disposition made of

Equitability – when the burden of taxation falls on those better such income (Sec. 30 [e]).

able to pay.

Donations received = considered as

Equality – when the burden of tax falls equally and impartially income but NOT TAXABLE (excluded).

upon all the persons and property subject to it.

Generally not subject to tax provided that

Progressive Taxation – when the tax rate increases as the not more than 30% of the said bequests,

income of the taxpayer increases; those who are able to pay ESTATE TAX devises, legacies, or transfers shall be used

such institutions for administrative purposes

more should shoulder the bigger portion of the tax burden.

i.e. salary, maintenance of the building.

The Constitution does not prohibit regressive taxes.

Donations are not subject to tax provided

(increase in income = decrease in tax). Progressive is DONOR’S TAX that no more than 30% of the said bequests,

encouraged but regressive is not prohibited. devises, legacies, or transfers shall be used

such institutions for administrative purposes.

3. GRANT BY CONGRESS OF AUTHORITY TO THE

PRESIDENT TO IMPOSE TARIFF RATES

5. PROHIBITION AGAINST TAXATION OF NON-STOCK,

The Congress may, by law, authorize the President to fix within NON-PROFIT EDUCATIONAL INSTITUTIONS

specified limits, and subject to such limitations and restrictions as it

may impose, tariff rates, import and export quotas, tonnage and (3) All revenues and assets of non-stock, non-profit

wharfage dues, and other duties or imposts within the framework educational institutions used actually, directly, and

of the national development program of the Government. (Art. VI, exclusively (ADE) for educational purposes shall be exempt

Sec. 28 [2]) from taxes and duties. Upon the dissolution or cessation of the

corporate existence of such institutions, their assets shall be

Flexible Tariff Clause – authority given to the President to disposed of in the manner provided by law.

adjust tariff rates under Sec. 1608 of RA No. 10863 (Customs

Modernization and Tariff Act of 2016) Proprietary educational institutions, including those

cooperatively owned, may likewise be entitled to such

4. PROHIBITION AGAINST TAXATION OF RELIGIOUS, exemptions, subject to the limitations provided by law,

CHARITABLE AND EDUCATIONAL ENTITIES including restrictions on dividends and provisions for

reinvestment.

Charitable institutions, churches and parsonages or convents

appurtenant thereto, mosques, non-profit cemeteries, and all (4) Subject to conditions prescribed by law, all grants,

lands, buildings, and improvements, actually, directly, and endowments, donations, or contributions used actually,

exclusively used for religious, charitable, or educational purposes directly, and exclusively for educational purposes shall be

shall be exempt from taxation. (Art. VI, Sec. 28 [3])

exempt from tax.

It is NOT the use of income from the real property that is Art. XIV, Sec. 4(3) Art. VI, Sec. 28(3)

determinative of whether the property is used for tax exempt

purposes. NOTE: What is contemplated here is the RPT. Grantee NS/NP educational Religious,

institution educational,

charitable

Rules on Taxation of NS Corporations for Charitable &

Religious Purposes: Tax Exemptions All taxes and duties Real Property Tax

Granted

Art. XIV, Sec. 4(3) does not require that the revenues and

income must also be sourced from educational activities

related to the purposes of an educational institution.

6. MAJORITY VOTE OF CONGRESS FOR GRANT OF TAX

EXEMPTION

Exemptions may be created:

1. By the constitution

From the Discussions of Atty. Denise Christine Lim, CPA

University of Mindanao College of Law

TAXATION REVIEWER | CYNDI SATORRE-BICERA | 2nd Sem SY 2022-2023 | 5

2. By the statue, subject to limitations as the Constitution STAGES OR ASPECTS OF TAXATION [LARP]

may provide. 1. Levy or imposition (tax legislation)

2. Assessment and Collection (tax administration)

B. PROVISIONS INDIRECTLY AFFECTING TAXATION 3. Payment

4. Refund

1. DUE PROCESS

a. Substantive Due Process 1. LEVY OR IMPOSITION (TAX LEGISLATION)

1. Tax must be for public purpose. Enactment of law by Congress authorizing the imposition of

2. Imposed within the territorial jurisdiction. tax. This cannot be delegated.

b. Procedural Due Process – no arbitrariness or oppression 2. TAX ADMINISTRATION (ASSESSMENT AND

either in the assessment or collection of the taxes. COLLECTION) – The act of assessing and collecting taxes is

administrative in character and therefore can be delegated.

Violations of Due Process:

1. Tax amount to confiscation of property. 3. PAYMENT

2. Subject of confiscation is outside the jurisdiction of GR: Tax shall be paid by the person subject thereto at the time

the taxing authority. the return is filed. (Sec. 56 (A) (1) NIRC)

3. Law is imposed for a purpose other than for a public

purpose. XPN: When the tax is due is in excess of P2,000 the

4. Law which is applied retroactively imposes unjust taxpayer other than a corporation may elect to pay the tax in

and oppressive taxes. 2 equal installments in which case, the first installment shall be

5. The law is in violation of the inherent limitations. paid at the time the return is filed and the second

installment, on or before October 15 following the close of

2. EQUAL PROTECTION the C.Y., if any installment is not paid on or before the date

Applies only to persons or things identically situated and does fixed for its payment, the whole amount of the tax unpaid

not bar a reasonable classification of the subject legislation. becomes due and payable together with the delinquency

penalties. (Sec. 56 (A)(2), NIRC)

Requisites for valid classification: To be reasonable, the

classification (a) must be based on substantial distinctions 4. REFUND

which make for real differences; (b) must be germane to the The recovery of any alleged to have been erroneously or

purpose of the law; (c) must not be limited to existing illegally assessed or collected, or of any penalty claimed to be

conditions only; and (d) must apply equally to each member of without authority, or of any sum alleged to have been

the class – There must be compliance with all these conditions. excessively, or in any manner wrongfully collected.

3. RELIGIOUS FREEDOM Proof of remittance is not necessary for claim of refund. What

The RPT of religious organizations is violative of the is needed is the proof that taxes were withheld from its interest

non-established clause. Neither the purpose nor the effect of income. [PAL vs. CIR, G.R. No. 206079-80, 1/17/2018]

the exemption is the advancement or the inhibition of religion;

and it constitutes neither personal sponsorship of, nor hostility REQUISITES OF A VALID TAX

to religion. [Walz vs. Tax Commission, 397 US 664] 1. It should be for a Public purpose.

2. It should be Uniform.

4. NON-IMPAIRMENT OF OBLIGATION OF CONTRACT 3. It should be within the Jurisdiction of the taxing authority.

4. Tax must not violate the inherent and constitutional

On contractual exemption – when the State grants an limitations on the power of taxation.

exemption on the basis of contract, consideration is presumed

to be paid to the State and the public is supposed to receive NOTE: These four requisites must be present.

the whole equivalent thereof.

KINDS OF TAX [BiGPRO]

Rules regarding non-impairment of obligation and 1. As to Burden or Incidence

contract with respect to the grant of Tax Exemptions: 2. As to Graduation

3. As to Purposes

• If grant is merely a spontaneous concession by the legislature 4. As to Tax Rates

= EXEMPTION may be revoked. 5. As to Object

• If without payment of any consideration or assumption of new 1. AS TO BURDEN OR INCIDENCE

burden (mere gratuity and exemption/franchise) = may be (1) Direct and (2) Indirect

REVOKED

2. AS TO GRADUATION

• If constitutes a binding contract and for valuable 1. Progressive – a tax rate which increases as the tax base or

consideration (bilateral exemption) = Government CANNOT bracket increases.

unilaterally revoke the exemption

From the Discussions of Atty. Denise Christine Lim, CPA

University of Mindanao College of Law

TAXATION REVIEWER | CYNDI SATORRE-BICERA | 2nd Sem SY 2022-2023 | 6

2. Regressive – the tax rate decreases as the tax base or

bracket increases. Poll/Capitation/Community Tax = residence of taxpayer

3. Proportionate – a tax of a fixed percentage of the amounts Property Tax (real property) = location of the property

of the base. Ex. VAT and other percentage taxes.

Property Tax (personal property)

3. AS TO PURPOSES tangible = location of the property

1. Government/Fiscal or Revenue – tax imposed solely for intangible = domicile of the owner (mobilia sequntur personam)

the general purpose of the government. XPNs:

1. When the property has acquired a business situs in another

2. Special/Regulatory or Sumptuary – tax levied for specific jurisdiction.

purpose i.e. to achieve some social economic ends. Ex. tariff 2. When an express provision of the statute for another rule

and certain dues on imports (Sec. 104 of the NIRC)

3. AS TO TAX RATES

EXCISE TAX

1. Specific – tax of a fixed amount imposed by the head or

number or by some standard of weight measurement. Ex. Criteria Income Tax Donor’s Tax

excise tax on cigar, cigarettes, and liquors.

2. Ad Valorem (according to value) – tax based on the value Place (applied to NRA, (applied to NRA)

of property with respect to which the tax assessed. Ex. real NRFC, NRC) from Taxed on properties

estate tax, income tax, donor’s and estate tax. sources of income situated within PH.

derived within PH.

3. Mixed – choice between ad valorem and specific tax

Nationality (applied to RC, DC) (RC, NRC)

depending on the condition attached.

From sources of Taxed upon their

income derived within properties wherever

5. AS TO OBJECT and without PH. situated.

1. Personal/Poll/Capitation Tax – a fixed amount imposed

upon all persons, or upon all persons of a certain class or Residence (applied to RA, RFC) (Applied to RA)

residents within a specified territory, without regard to their sources of income Taxed upon their

property or occupation. Ex. Cedula or CTC derived within PH. properties wherever

situated.

2. Property Tax – imposed on property in proportion to its

value or in accordance with some other reasonable VAT = place where the transaction is made.

classification. Ex. RPT, local transfer tax DST = Excise tax (where the transaction is made)

3. Privilege/Excise Tax – a charge upon the performance of DOUBLE TAXATION — Refers to income tax being paid twice

an act, the enjoyment of a privilege, or engaging in a on the same source of income. Double taxation occurs when

profession. Ex. Income Tax income is taxed at both the corporate level and personal level,

as in the case of stock dividends. Double taxation also refers to

GENERAL CONCEPTS OF TAXATION the same income being taxed by two different countries.

PROSPECTIVITY OF TAX LAWS 1. Indirect/Broad Sense – when some of the elements of

GR: Tax laws must only be imposed prospectively. direct double taxation are absent.

XPN: If the law expressly provides for retroactive application. 2. Direct/Strict Sense – the same property is taxed twice

Retroactive application is allowed if it will not amount to denial when it should be taxed only once.

of due process (always the case even if it is not a tax law).

NOTE: If all of the elements are present, then it is a direct

NOTE: Sec. 246, NIRC Non-retroactivity of Rulings with the double taxation in a strict sense but if some elements are not

BIR and CIR (with XPNs). The BIR and CIR rulings in query, present, then it is called an INDIRECT double taxation in its

cases, etc. are different from tax laws and there is also no broad sense (Ex. income tax for OFW)

retroactive application.

There is no Constitutional prohibition against double taxation in

IMPRESCRIPTIBILITY the Philippines. It is something NOT favored but it is

GR: Taxes are imprescriptible by reason that it is the lifeblood permissible provided that other constitutional requirements are

of the government. not violated.

XPN: Tax law may provide for statute of limitations. (ex.

Assessment – 5, 10 years) Tax treaties may be used as relief for double taxation either:

1. Exemption method

SITUS OF TAXATION 2. Credit method

The place or authority that has the right to impose and collect

taxes. Ex. National Internal Revenue Taxes (NRIT) = BIR; ESCAPE FROM TAXATION

Tariffs and customs = BOC; Local taxes = LGU

From the Discussions of Atty. Denise Christine Lim, CPA

University of Mindanao College of Law

TAXATION REVIEWER | CYNDI SATORRE-BICERA | 2nd Sem SY 2022-2023 | 7

Shifting of Tax Burden – Ex. VAT, percentage tax COMPROMISE

Persons allowed to compromise tax obligations:

Impact of Taxation Incidence of Taxation

1. BIR Commissioner

The statutory liability to pay Burden of taxation; who has a. When a reasonable doubt as to the validity of the

the tax. the economic cost of tax. claim against the taxpayer exist (40%); OR

b. The financial position of the taxpayer demonstrates a

On the seller to whom the On the final consumer. clear inability to pay the assessed tax (10%). [Sec.

tax is imposed. 204 (A)]

TAX AVOIDANCE 2. Collector of Customs – custom duties

A scheme where the taxpayer uses a legally permissible 3. Customs Commissioner – fines, surcharges, forfeitures.

alternative method of assessing taxable property or income, in

order to avoid or reduce tax liability. It is a tax saving device TAX AMNESTY – general pardon or intentional overlooking by

sanctioned by law. the State of its authority to impose penalties on persons

otherwise guilty of evasion or violation of a revenue or tax law.

Ex. Choosing what percentage of tax 8%, 40%, etc. [Asia International Auctioneers, Inc. v. CIR]

EXEMPTION FROM TAXATION • It is never favored or presumed in law; construed against the

The grant of immunity, express or implied, to particular persons taxpayer.

or corporations, from a tax upon property or an excise tax

which persons or corporations generally within the same taxing • Disallowed when the taxpayer is assessed on his capacity as

districts are obliged to pay. withholding agent.

AMNESTY EXEMPTION

It is the legislature, unless limited by a provision by the

Constitution, which has the full power to exempt any person, Immunity from all criminal, civil, Immunity from civil

corporation, or class of property from taxation. and administrative obligations liability only

arising from non-payment of taxes

Taxation is the general rule, exemption is the exception.

Applied retroactively (complete Applied prospectively

eradication)

❖ Personal in nature and covers only taxes for which

the grantee is directly liable.

❖ Strictly construed against the taxpayer. CONSTRUCTION AND INTERPRETATION OF TAX LAWS,

❖ Not presumed; burden on the claimant. RULES AND REGULATIONS

❖ Generally revocable unless founded on contracts

which are protected by the non-impairment clause.

TAX LAWS

GR: Tax statutes must be construed strictly against the

TAX EXEMPTION TAX ASSUMPTION government and liberally in favor of the taxpayer.

XPN: Unless a statute imposes a tax clearly.

Grant of immunity from Merely allows shifting the burden

paying tax. of taxation to another duty.

TAX EXEMPTION AND EXCLUSION

GR: Statutes granting tax exemptions are construed

EQUITABLE RECOUPMENT (not applicable in PH) strictissimi juris against the taxpayers and liberally in favor

A principle which allows a taxpayer, whose claim for refund has of the taxing authority.

been barred due to prescription, to recover said tax by setting XPNs:

off the prescribed refund against a tax that may be due and 1. If the grantee is a political subdivision or instrumentality;

collectible from him. Only allowed in common law countries. 2. Exemption granted to NAPOCOR;

3. Erroneous payment of tax because of law for government

PROHIBITION ON COMPENSATION AND SET-OFF exaction.

Compensation/Set-off – takes place when two persons, in TAX RULES AND REGULATIONS

their own right, are credits and debtors of each other. • The construction placed by the office charged with the

implementing and enforcing the provisions of a Code should be

GR: No set-off is admissible against the demand for taxes given controlling weight unless such interpretation is clearly

levied for general or local government purposes. erroneous.

• Because the Government and taxpayer are not creditors and • A rule or regulation (IRR or RMC) must be consistent with the

debtors of each other (Philex Mining v. CIR, 1998) provisions of the enabling statute.

XPNs: Where both the claims of the government and the • Revenue Memorandum Circulars (RMC) must not override,

taxpayer against each other have already become due, supplant, or modify the law.

demandable, and fully liquidated.

From the Discussions of Atty. Denise Christine Lim, CPA

University of Mindanao College of Law

TAXATION REVIEWER | CYNDI SATORRE-BICERA | 2nd Sem SY 2022-2023 | 8

8. Examine returns and determine tax due.

• The government is not estopped from collecting taxes legally 9. Prescribe any additional requirements for the submission or

due because of mistakes or errors of its agents. But like other preparation of financial statements accompanying tax returns.

principles of law, this admits of exceptions in the interest of 10. Inquire into bank deposits of:

justice and fair play, as where injustice will result to the a. Decedent to determine his gross income;

taxpayer. [CIR v. CA, G.R. No. 117982 (1997)] b. A TP who filed an application to compromise payment

of tax liability by reason of financial incapacity.

PENAL PROVISIONS OF TAX LAWS c. Request for the supply of tax information from a

Statutes of limitations receive strict construction in favor of foreign tax authority pursuant to an international

the government and limitations in such cases will not be convention.

presumed in the absence of clear legislation. 11. Delegate powers vested upon him to subordinate officials

with rank equivalent to Division Chief or higher.

NON-RETROACTIVE APPLICATION TO TAXPAYERS 12. Prescribe property values.

Tax laws, rules, and regulations operate prospectively unless 13. Take inventory of goods of any taxpayer and place any

otherwise legislatively intended. business under observation or surveillance.

14. Register tax agents.

GR: BIR rules that revoke, modify, or reverse the ruling or 15. Suspend the business operations of a taxpayer for

circular shall NOT be given retroactive application if such violations of VAT rules.

would be prejudicial to the taxpayer.

In the case of VAT-registered person:

XPNs: a. Failure to issue receipts or invoices;

1. Where the taxpayer deliberately misstates or omits material b. Failure to file a VAT Return as required under Sec. 114;

facts from his return or any document required of him by the c. Understatement of taxable sales or receipts by 30% or more

BIR; of his correct taxable sales or receipts for the taxable quarter.

2. Where the facts subsequently gathered by the BIR are • Failure of any person to register as required under Sec. 236

materially different from the facts on which the ruling is based;

• The temporary closure of not less than 5 days and shall be

3. Where the taxpayer acted in bad faith; lifted only upon compliance with whatever requirements

prescribed by the CIR in the closure order.

4. If the revocation is due to the fact that the regulation is

erroneous or contrary to law, such revocation shall have POWERS OF THE BIR WHICH CANNOT BE DELEGATED

retroactive operation as to affect past transactions because a 1. To recommend promulgation of rules and regulations by the

wrong construction of the law cannot give rise to a vested right Secretary Of Finance (SOF);

that can be invoked by a taxpayer. 2. To issue ruling of first impression or to reverse, revoke, or

modify an existing rule of the BIR;

3. To assign or reassign internal revenue officers to

II. NATIONAL TAXATION

establishments where articles subject to excise tax are kept.

RULE-MAKING POWER OF THE SECRETARY OF FINANCE

A. TAXING AUTHORITY

• To promulgate all needful rules and regulations for effective

enforcement of the NIRC.

POWERS AND DUTIES OF THE BIR

1. Assessment and collection of all NIRT, fees, and charges; LARGE TAXPAYER

2. Enforcement of all forfeitures, penalties and fines; 1. VAT: VAT paid/payable of at least P100,000 for any quarter.

3. Execution of judgments in all cases decided in its favor; 2. Excise Tax: at least P1M for the preceding taxable year.

4. Give effect and administer the supervisory and police 3. Corporation Income Tax: at least P1M for the preceding TY

powers conferred to it by the NIRC and other laws; 4. Withholding Tax: at least P1M for the preceding TY.

5. Recommend for the effective enforcement of the provision of

NIRC. NOTE: SOF may modify or add to the above criteria.

POWERS OF THE COMMISSIONER

1. Interpret tax laws and to decide cases (Sec. 4) B. INCOME TAX

2. Obtain information and to summon or examine and take

testimony of persons (Sec. 5) INCOME TAXATION

3. Make assessments and prescribed additional requirements In the nature of excise taxation system; taxation on the

for tax administration and enforcement. exercise of privilege to earn yearly points from various sources.

4. Assign internal revenue officers and other Employees.

5. Suspend the business operations of a taxpayer for violations Income Tax – a tax on yearly profits arising from property,

of tax rules. profession, trade or business.

6. Terminate the taxable period for reasons provided in the

NIRC.

7. Make or amend a return in case the taxpayer fails to file a

return or files a false or fraudulent return.

From the Discussions of Atty. Denise Christine Lim, CPA

University of Mindanao College of Law

TAXATION REVIEWER | CYNDI SATORRE-BICERA | 2nd Sem SY 2022-2023 | 9

Global Tax System – where the tax system views indifferently iii. PH citizen who works and derives income from

the tax based and generally treats in common all categories of abroad and whose employment thereat requires him

taxable income of the individual. to be physically present abroad most of the time

during the taxable year.

Schedular Tax System – systems employed where the iv. A citizen who has been previously considered as

income tax treatment varies and is made to depend on the kind NRC and who arrives in PH at any time during the TY

or category of taxable income of the taxpayer. to reside permanently in PH shall be treated as NRC

for the TY in which he arrives in PH with respect to his

FEATURES OF PHILIPPINE TAX INCOME income derived from sources abroad until the date of

his arrival in PH.

1. Direct Tax

2. Progressive Tax • The taxpayer shall submit proof to the Commissioner of his

3. Comprehensive (Adopts citizenship, residence, and intention of leaving PH to reside permanently abroad or to

source principles) reside or return in PH as the case may be.

4. Semi-schedular or semi-global system

2. ALIENS

CRITERIA IN IMPOSING PHILIPPINE INCOME TAX LAW a. Resident Alien (RA) – an individual whose residence

1. Citizenship is within PH who is not a citizen thereof.

2. Residence

3. Source b. Non-Resident Alien (NRA) – an individual whose

residence is not within PH and who is not a citizen

GENERAL PRINCIPLES OF INCOME TAXATION thereof.

i. Engaged in Trade/Business (ETB)

TAXPAYER WITHIN PH WITHOUT PH

ii. Not Engaged in Trade/Business (NETB)

RC (Resident Citizen) / /

3. SPECIAL CLASS OF INDIVIDUAL EMPLOYEES

NRC (Non-Resident Citizen) / x a. Minimum Wage Earner

RA (Resident Alien) / x 4. CORPORATIONS

a. Domestic

NRA (Non-Resident Alien) / x b. Foreign

i. Resident Foreign Corporation (RFC) – a foreign

DC (Domestic Corp) / /

corporation ETB and has a presence in PH.

ii. Non-Resident Foreign Corporation – a FC, ETB

FC (Foreign Corp) / /

which has no presence in PH but derives income

therein.

TYPES OF PHILIPPINE INCOME TAX c. Joint Venture

d. Partnership

1. Minimum Corporate Income Tax (MCIT)

2. Capital Gains Tax (CGT) 5. ESTATES

3. Final Withholding Tax (FWT) 6. TRUSTS

4. Fringe Benefit Tax (FBT)

5. Branch Profit Remittance Tax (BPRT) IMPORTANCE OF KNOWING CLASSIFICATION

6. Improperly Accumulated Taxable Income (IAET) To determine the applicable [GrIDEE]:

7. Normal Corporate Income Tax (NCIT) 1. Gross income

8. Graduated Income Tax on Individuals 2. Income Tax Rates,

9. Optional Income Tax of 8% for Individuals 3. Deduction.

10. Special Income Tax on certain Corporations 4. Exclusions from Income

5. Exemptions

KINDS OF TAXPAYERS

TAXABLE PERIOD [FisCalShort]

1. CITIZEN 1. Calendar Period

a. Resident Citizen (RC) 2. Fiscal Period

i. Engaged in business/practice of profession. 3. Short Period

ii. Not engaged in business/practice of profession.

iii. Mixed Income Earner = both i and ii CALENDAR PERIOD – the 12 consecutive months starting

from January 1 and ending December 31.

b. Non-Resident Citizen (NRC)

i. Citizen who has physical presence abroad with a Instances when calendar year shall be the basis of

definite intention to reside therein. computing income:

ii. PH citizen who leaves PH during the TY to reside 1. When the TP is individual.

abroad, either as an immigrant or for employment on 2. When the TP does not keep books of account.

a permanent basis.

From the Discussions of Atty. Denise Christine Lim, CPA

University of Mindanao College of Law

TAXATION REVIEWER | CYNDI SATORRE-BICERA | 2nd Sem SY 2022-2023 | 10

3. When the TP has no annual accounting period. CLAIM OF RIGHT DOCTRINE/DOCTRINE OF OWNERSHIP,

4. When the TP is an estate or a trust. COMMAND AND CONTROL

A taxable gain is conditioned upon the presence of a claim of

FISCAL PERIOD – a period of 12 months ending on the last right to the alleged gain and the absence of a definite

day of any month other than December. unconditional obligation to return or pay.

SHORT PERIOD – a period less than 12 months. DOCTRINE OF PROPRIETARY INTEREST (ECONOMIC

1. When the corporation is newly organized and commences BENEFITS TEST)

operations on any day within the year. Income is taxable to the extent that the taxpayer is

2. When the corporation changes its accounting period. economically benefited.

3. When the corporation is dissolved.

4. When the CIR, by authority, terminates the TY of a TP. SEVERANCE TEST – income is recognized when there is

5. In case of final return of the decedent and such period ends separation of something which is exchangeable value.

at the time of his death.

RULES ON DETERMINATION OF SITUS

WHEN INCOME IS TAXABLE [ERR]

1. Existence of Income

KINDS OF INCOME TAX SITUS

2. Realization of Income

3. Recognition of Income Service or compensation Place or performance of

income service.

EXISTENCE OF INCOME – there must be income before

there is taxation. Rent Location of property (real or

personal)

Receipts not considered as income:

1. Advance payments or deposits for payments. Royalties Place of use of intangibles

2. Increments resulting from revaluation of property.

Merchandising Place of Sale

3. Money or property borrowed.

4. Security advances and security deposits. Gain on sale of personal Place of Sale

property purchased and not

RECOGNITION OF INCOME produced

1. Actually receipt.

Gain on sale of REAL Location of property

2. Constructive receipt – when money consideration or its property

equivalent is placed at the control of the person who rendered

Mining income Location of mines

the service without restriction by the payor.

Farming income Place of farming activities

Ex. deposits in banks, issuance by the debtor of a notice to

offset any debt and acceptance by the seller, transfer of the Gain on sale of domestic Income within the

amounts retained by the payor to the account of the contractor, stock Philippines.

undistributed share of a partner in the profits.

Interest Residence of the debtor

TESTS IN DETERMINING WHETHER INCOME IS EARNED

1. Realization Test Gain on sale of transport Place of activity that

document produces the income

2. Claim of Right Doctrine or Doctrine of Ownership, Command

or Control. Manufacturing:

3. Economic Benefit Test or Doctrine of Proprietary Interest. a. Produced in whole within a. Income purely within

4. Severance Test. and sold within

REALIZATION TEST – there is no taxable income unless b. Produced in whole without b. Income purely without

income is deemed realized. Revenue is generally recognized and sold without

when both conditions are met:

c. Produced within and sold c. Income partly within and

1. The earnings process is complete; AND without partly without

2. An exchange has taken place.

d. Produced without and d. Income partly within and

ALL EVENTS TEST – Requires that the right to income or sold within partly without

liability be fixed and determined with reasonable accuracy.

However, this test does not demand that the amount of income Dividend Income from:

a. Domestic Corporation a. Income within

or liability be known absolutely, only that a taxpayer has at his

b. Foreign Corporation (if for

disposal the information necessary to compute the amount with the 3-year period preceding

reasonable accuracy. [CIR vs. Isabela Cultural Corp. G.R. the declaration of dividend,

172231, 2/12/2007] the ratio of such

corporation’s PH income to

From the Discussions of Atty. Denise Christine Lim, CPA

University of Mindanao College of Law

TAXATION REVIEWER | CYNDI SATORRE-BICERA | 2nd Sem SY 2022-2023 | 11

e. Interest on loans at less than the market rate

the world (total) was:

f. Membership fees

i. Less than 50% i. Entirely without g. Expenses for foreign travel

ii. 50% to 85% ii. Proportionate** h. Holiday and vacation expenses

iii. More than 85% iii. Entirely within i. Educational assistance to the EE or his dependant

j. Life or health insurance

GROSS INCOME NOTE: Fringe Benefits are for Managerial ONLY. 'Fringe

benefits' are defined as any goods, services, or other benefits

GROSS INCOME (NIRC, Sec. 32[A]). furnished or granted in cash or in kind by an employer to an

Except when otherwise provided, gross income means all individual employee, except rank and file employees, such as,

income derived from whatever source, including but not but not limited to: housing expense account, vehicles etc.

limited to the following items: (CG2I-R2DAP3)

3. PROFESSIONAL INCOME

1. Compensation for services in whatever form paid, Fees received by a profession from practice of profession,

including, but not limited to fees, salaries, wages, commissions provided that there is no ER-EE relationship between him and

and similar items. his clients.

2. Gross income derived from the conduct of trade or

business or the exercise of a profession. 4. INCOME FROM BUSINESS (no slide)

3. Gains derived from dealing in property.

4. Interests 5. INCOME FROM DEALINGS IN PROPERTY

5. Rents

6. Royalties Ordinary Assets:

7. Dividends 1. Stock in trade of the TP or other property of a kind

8. Annuities which would properly be included in the inventory of

9. Prizes and Winnings the TP if on hand at the close of the taxable year.

10. Pensions and 2. Property held by a TP primarily for sale to costumers

11. Partner’s distributive share from the net income of the in the ordinary course of business.

general professional partnership 3. Property used in the trade or business of a character

NOTE: The above enumeration of gross income under NIRC, which is subject to the allowance for depreciation.

is not exclusive. 4. Real property used in trade and business.

Capital Assets:

GROSS INCOME NET INCOME TAXABLE INCOME Property held by a TP other than ordinary assets.

All income Gross income Items of gross income

Ordinary Income: includes the gain derived from the sale or

derived from less allowable specific in the Code

whatever source. deductions. less deductions exchange of ordinary assets.

authorized for such

types of income. Ordinary Loss: Loss that may be sustained from the sale or

exchange of ordinary assets.

SOURCES OF INCOME

Capital Gain: Gain derived from the sale or exchange of an

1. Compensation Income

asset not connected in trade or business.

2. Fringe Benefits

3. Professional Income

Capital Loss: Loss that may be sustained from the sale or

4. Income from Business

exchange of an asset not connected in trade or business.

5. Income from Dealings in Property

6. Passive Investment Income

Presumed Gain: The law presumes that the seller of real

7. Annuities, proceeds of life insurance, or other types of

property classified as capital asset realized gains, which is

insurance.

taxed at 6% of the selling price or the FMV (assessed value

8. Prizes and awards

from the Assessor’s office or the zonal value from the BIR)

9. Pensions, retirement benefit, or separation pay

whichever is higher.

10. Income from whatever source.

RULES ON CAPITAL ASSET

1. COMPENSATION INCOME

All enumeration for services rendered by an employee for INDIVIDUAL CORPORATION

his employer unless specifically excluded under the NIRC.

Holding Period • Available • Not available

2. FRINGE BENEFIT Rule – Assets

a. Housing must be held for • Gain to be taken into • 100%

one year and account

b. Expense account

one day to be

c. Vehicle of any account entitled to • 100% – CA must have

d. Household personnel

From the Discussions of Atty. Denise Christine Lim, CPA

University of Mindanao College of Law

TAXATION REVIEWER | CYNDI SATORRE-BICERA | 2nd Sem SY 2022-2023 | 12

7. If there is no full utilization, the portion of the gains

long-term capital been held for 12 months

gain treatment. or less. presumed to have been realized shall be subject to

GGT.

• 50% – CA has been 8. The 6% CGT shall be deposited with an AAB subject

held for more than 12 to release upon certification by the RDO that the

months. proceeds of the sale have been utilized.

Capital Loss • Capital losses are • Same; XPN: TAX-FREE EXCHANGES:

Limitation allowed only up to the Rule 39 (c)

extent of capital gains

1. Transfer to a controlled corporation – no gain or loss

Net Capital • Allowed for a period of • Not allowed shall be recognized if property is transferred to a corporation

Loss Carry Over 1 year by a person in exchange for stock or unit of participation in

such corporation of which as a result of such exchange, said

person, alone or together with others, not exceeding 4 persons

Net Operating Loss Carryover (NOLCO)

gains control of said corporation.

• Arises from ordinary transactions meaning involving ordinary

assets.

2. Merger of Consolidation – no gain or loss if in pursuance

of a plan of merger or consolidation:

• Allows carryover of operating loss in 3 succeeding taxable

a. A corporation which is a party to the merger or

years of 5 years in case of mining companies.

consolidation, exchanges property solely for stock in a

corporation which is a party to the M/C.

Tax Treatment of Capital Gains and Losses

b. A shareholder exchanges stock in a corporation which

Sales of Shares of Stock Sale of Real Properties/Land is a party to the M/C, solely for the stock of another

and/or Buildings in PH corporation also a party to the M/C.

c. A security holder of a corporation which is a party to

• Traded on Stock Exchange • CGT the M/C exchanges his securities xxx

6/10 of 1% of the Gross

Selling Price • No loss is recognized because

gain is presumed 6. PASSIVE INVESTMENT INCOME

• Not Traded on SE • An income derived from any activity in which the TP has no

CGT, 15% of Final Tax • 6% of the higher amount active participation or involvement.

between: Income subject to final tax: income where the tax due is fully

1. GSP (Gross Selling Price) or collected through the withholding tax system (the payor of the

2. FMV (Fair Market Value)

income withholds the tax and remits it to the government as a

a. Zonal Value

b. Assessed Value final settlement of the income tax due on said income and the

recipient is no longer required to include income subject to final

tax as part of his gross income in his income tax returns).

5. Sale of Principal Residence

Intercorporate Dividend – when a dividend is declared by

Principal Residence – dwelling house, including the land on one corporation and received by another corporation

which it is situated, where the individual and members of his which is a stockholder to the former.

family reside, and whenever absent, the said individual intends

to return.

NATURE OF INCOME DC RFC NRFC

• Actual occupancy is NOT considered interrupted or

Interest from any Short-term Shall be

abandoned by reason of temporary absence due to travel or

currency bank interest: considered

studies or work abroad or such similar circumstances. deposits, yield, or any 20% 20% as part of

other monetary gross

Sale of Principal Residence is TAX EXEMPT (6% CGT) if: benefits from deposit Long term income

1. Sale of disposition of the old actual principal substitutes and from interest: subject to

residence. trust fund and similar 30% 30% NCIT.

2. By a citizen or resident alien. arrangements and

Royalties derived

3. Proceeds from which are fully utilized in acquiring or

from sources within

constructing a new principal residence within 18 PH.

calendar months from the sale or disposition.

4. Notify the CIR within 30 calendar days from the date NOTE: Interest income or yield earned by DC from sources

of sale or disposition through a prescribed return of outside PH shall not be subject to final tax of 20% but

his intention to avail the tax exemption. included in the gross income and subject to NCIT.

5. Can be availed of once every 10 years.

6. The historical cost or adjusted basis of his old Interest Income 15% 7.5% Exempt

derived under the

principal residence shall be carried over to the cost

expanded foreign

basis of his new principal residence. currency deposit

system.

From the Discussions of Atty. Denise Christine Lim, CPA

University of Mindanao College of Law

TAXATION REVIEWER | CYNDI SATORRE-BICERA | 2nd Sem SY 2022-2023 | 13

Interest derived by 10% 10% Exempt Received by a DC and RFC Not subject to tax

depository bank

under the expanded Received by a NRFC Subject to 15% FWT (30%

foreign currency NCIT before but reduced

deposit system from due to stock sparing rule)

foreign currency loans

granted to residents

other than offshore Tax Sparing Rule

banking units (OBUs). Dividends received shall be subject to 15% FWT, provided, that

the country in which the corporation is domiciled either:

NOTE: If granted to non-residents, OBUs, local commercial (1) allows a tax credit of 15% against the taxes dues from the

banks or branches foreign banks authorized by BSP to foreign corporation for taxes deemed paid; OR

transact = EXEMPT (2) does not impose income tax on such dividends; otherwise

the dividend shall be subject to 30%. **[CIR vs. Wander

Interest received by Philippines, Inc. G.R. No. L-8375, 4/15/1988]

NRFC on foreign loans – – 20%

(NIRC, Sec. 28 [5a]) TAX TREATMENT OF DIVIDEND INCOME

Dividends received Exempt Exempt 15% Subject to basic tax 1. Dividends from FC

from DC (subject to 2. Share in the income of a GPP

(inter-corporate tax sparing 3. Share in income of an exempt JV

dividend) rule)

Subject to final tax 1. Cash and/or property dividends

Tax-Exempt Interest Income: actually or constructively received by

individuals from DC or from a joint

1. From bank deposits if the recipient are the ff: stock company, insurance or mutual

a. Foreign government fund company and regional operating

b. Financing corporations controlled, owned, or financed HQ of multinationals.

by the government.

2. Inter-corporate dividends from DC

2. Regional or international financing institutions established by by NRFC.

foreign governments;

3. Share of an individual in the net

3. On loans extended to any of the above-mentioned entities; income (after tax) of an association,

joint account, or a JV or consortium

4. On bonds, debentures and other certificate of indebtedness taxable as corporation for which he is

received by any of the above-mentioned entities; a member or co-venturer.

5. On bank deposit maintained under the expanded foreign Exempt from tax Inter-corporate dividends received

currency deposit; from DC by another DC and RFC.

6. From a long-term investment or deposit with a maturity B. ROYALTY INCOME – share of the earnings from the

period of 5 years or more. invention, book or play, paid to inventor, writer, etc for the right

to make, use, or publish the same.

A. DIVIDENDS [CLiPS]

1. Cash Dividend SUBJECT TO 10% FINAL TAX

2. Property Dividend

Royalties on books, other literary works and musical

composition from sources within the Philippines.

3. Stock Dividend

GR: Stock dividends represent capital and do not constitute SUBJECT TO 20% FINAL TAX

income to its recipient. So that the mere issuance thereof is not

subject to income tax as they are nothing but enrichment Royalties derived from sources within the Philippines

through increase of capital investment. other than royalties subject to 10% final tax.

XPNs:

a. change in shareholder’s equity, right or interest in the net SUBJECT TO BASIC TAX

assets of the corporation.

b. recipient is other than the shareholder (ex. creditor). Royalties derived by RC and DC from sources without PH.

c. cancellation or redemption of shares of stock

d. Distribution of treasury shares C. RENTAL INCOME

e.. Dividends declared in the guise of treasury stock dividend

to avoid the effects of income taxation. Prepaid Rent: taxable income by the lessor in the year

received, if received under a claim of right and without

f. Different classes of stocks issued.

restriction as to its use, regardless of the method of accounting

employed.

4. Liquidating Dividend – return of capital, hence, not income.

Security Deposit: recognized as income at the time it is

1. Dividends received from DC applied; not income to the lessor until the lessee violates any

From the Discussions of Atty. Denise Christine Lim, CPA

University of Mindanao College of Law

TAXATION REVIEWER | CYNDI SATORRE-BICERA | 2nd Sem SY 2022-2023 | 14

provision of the contract.

Rates subject to Special Rate: 3. PCSO/Lotto winnings.

1. Those paid to non-resident cinematographic film owners or NOTE: Only exempt if the amount is P10,000 or less for RC,

lessor or distributors = 25% of its gross income from all NRC, and RA (Sec. 25[B][1], NIRC). Always exempt for

sources within PH. (Sec. 28[B][2], NIRC) NRA-ETB (Sec. 25[A][2], NIRC). Always subject to tax for

NRA-NETB (Sec. 25[b], NIRC).

2. Those paid to non-resident owner or lessor of vessels NRA = Non-Resident Alien

chartered by PH national = 4.5% of gross rentals (Sec. ETB = Engaged in Trade or Business

28[B][3], NIRC) NETB = Not Engaged in Trade or Business

3. Those paid to non-resident owner or lessor of aircraft,

machineries, and other equipment = 7.5% of gross rental or SUBJECT TO BASIC TAX

fees (Sec. 28[B][4], NIRC)

1. Prizes and Other winnings derived by resident citizens

D. PROCEEDS OF LIFE INSURANCE and domestic corporations from sources without the PH.

GR: Amounts received under a life insurance, endowment or

annuity contract paid to the beneficiaries upon the death of the 2. Prizes and Winnings received by corporations from

insured are EXCLUDED from the gross income. sources within the Philippines.

XPNs: 3. Prizes received by individuals from sources within the PH

1. If such amounts, when added to amounts already received amounting to P10,000 or less.

before the taxable year under such contract, exceed the

aggregate premiums or considerations paid, the EXCESS

should be included as gross income. SUBJECT TO 20% FINAL TAX

2. Interest payment thereon if such amounts are held by the 1. Prizes received by individuals (except NRA-NETB) from

insurer under an agreement to pay interest shall be taxable. sources within PH exceeding P10,000.

XPN:XPN: Proceeds taken by a corporation on the life 2. Other winnings from sources within PH regardless of

insurance policies on the life of an executive to indemnify it amount (other than PCSO and Lotto winnings for NRA-ETB)

against loss in case of his death do not constitute taxable

income. 3. PCSO and Lotto winnings exceeding P10,000 for RC,

NRA and RA.

Income Taxation Estate Taxation

No need for the Concept of revocability or INCOME FROM ANY SOURCE

determination of revocability irrevocability in the designation • All income not expressly exempted from the class of taxable

of the beneficiary for of beneficiary is necessary to income under our laws from part of taxable income; source

purposes of exclusion of determine whether the life may be legal or illegal; Examples:

such proceeds from the insurance proceeds are included

gross income. in the gross estate or not. 1. Gains arising from expropriation of property.

2. Gains from gambling.

E. PRIZES AND AWARDS 3. Gains from embezzlement or stealing money.

Amount of money in cash or in kind received by chance or 4. Money received under solutio indebiti (mistake of payment).

through luck and is generally taxable (because this is 5. Exercise of stock options.

considered as passive income) except if specifically mentioned 6. Condonation of indebtedness for a consideration.

under exclusions from computation of gross income under Income If an individual performs services for a creditor,

NIRC or special laws. who in consideration thereof, cancels the debt;

income to the extent of compensation of his

EXEMPT FROM TAX services.

1. Prizes and award made primarily in recognition of: Gift If the creditor merely desires to benefit a debtor

a. Religious charitable; without any consideration therefore.

b. Scientific;

c. Educational artistic, literary; or If a corporation to which a stockholder is indebted

d. Civic achievement. forgives the debt.

Provided the recipient was: • An insolvent debtor does not realize income resulting from

a. Selected without any action on his part to enter the the cancellation or forgiveness of indebtedness when he

contest or proceeding (not constituting gains from becomes insolvent. However, he realizes income when he

labor); AND becomes solvent.

b. Not required to render substantial future services

as a condition to receive the prize/award. Recovery of Accounts (Receivable) Previously Written Off

Ex. A supplier corporation has accounts receivable from a

2. All prizes and awards granted to athletes in local and certain debtor who was unable to pay the debts. The

international sports competitions and tournaments, whether corporation has the option to write off the AR but in the event

held in the PH or abroad and sanctioned by their respective the debtor becomes solvent again and is able to pay the debt,

national sports association. that is called recovery of accounts previously written off. The

payment will be recognized as income.

From the Discussions of Atty. Denise Christine Lim, CPA

University of Mindanao College of Law

TAXATION REVIEWER | CYNDI SATORRE-BICERA | 2nd Sem SY 2022-2023 | 15

Tax Benefit Rule or Equitable Doctrine of Tax Benefit money’s worth.

If a taxpayer recovers a loss or expense that was deducted in Bequests: gift of personal property

the previous year, the recovery must be included in the current Devise: gift or real property

year’s gross income up to the extent that it was previously

deducted. • Regardless of whether donation inter vivos or mortis causa,

EXCLUDED from income.

Coverage:

1. Recovery of bad debts (those that can’t be collected). Gift Tax (Donor’s Tax) Test – when a person gives a thing or

2. Receipt of tax refund or credit. right to another and it is not a “legally demandable obligation”

XPN: Income Tax (except FBT), Estate Tax, Donor’s Tax, then it is treated as a gift and excluded from gross income.

Special Assessments, VAT and Stock Transactions Tax.

2. Life Insurance Proceeds

Debts – borrowed money is not part of taxable income Insurance on human life and insurance appertaining thereto or

because it has to be repaid by the debtor. connected therewith.

James Doctrine – even though the law imposes a legal Conditions for Exclusion:

obligation upon an embezzler or thief to repay the funds, the 1. Proceeds of life insurance policy

embezzled or stolen money still forms part of the gross 2. Paid to the heirs or beneficiaries

income since the embezzler or thief has no intention of 3. Upon the death of the insured

repaying money. 4. Whether in a single sum or otherwise

Rationale: partakes the nature of an indemnity or

EXCLUSIONS compensation rather than gain to the recipient.

EXCLUSIONS (NON-TAXABLE INCOME) Exceptions to Exclusions:

• Flow of income not considered as part of gross income due to 1. Agreement between the insurer and the insured to the effect

the ff: that the amount shall be withheld by the insurer under an

1. It does not come within the definition of gross income. agreement to pay interest thereon; only the interest is taxable.

2. It is exempted by the constitution or by statute.

2. Life insurance policy is used to secure money obligations.

Construction: In the nature of tax exemptions; strictly

construed against the taxpayer and liberally in favor of the 3. LIP was transferred for valuable consideration.

government.

4. Recipient of the proceeds is the business partner of the

EXCLUSIONS UNDER THE CONSTITUTION deceased and insurance was taken to compensate the

1. Income derived by the government or its political subdivision partner-beneficiary for any loss of income that may result from

if the source of income is from any public utility or from the the death of the insured partner.

exercise of essential governmental functions.

2. All revenue and assets of NS/NP educational institutions 5. The recipient of the insurance proceeds is a partnership in

used Actually, Directly, and Exclusively for educational which the insured is a partner of the deceased and the

purposes. insurance was taken to compensate the partnership for any

loss of income that may result from the death of the insured

EXCLUSIONS UNDER THE NIRC partner.

1. Gifts, Bequests and Devises 6. The recipient is a corporation in which the insured was an

2. Life Insurance Proceeds employee or officer.

3. Amount Received by Insured as Return of Premium

4. Retirement Benefit, pensions, gratuities, etc. 3. Amount Received by Insured as Return of Premium

5. Income exempt under treaty (Insurance is outlived by the Insured)

6. Compensation for injuries or sickness

7. Miscellaneous Items: • In order that the life insurance proceeds may be totally

a. 13th month pay and other benefits exempt from income taxation, the insured must die (Life

b. Prizes and awards Insurance Proceeds)

c. Prizes and awards in sports competitions

d. Income derived by foreign government • If he survives, there is only exemption on the portion of the

e. Income derived by the government or its political proceeds representing the return of premiums previously paid

subdivisions is excluded. (Return of Premium)

f. GSIS, SSS, Philhealth, and other contributions

g. Gains from sale of bonds, debentures or other 4. Retirement Benefit, pensions, gratuities, etc.

certificate of indebtedness. 1. Retirement benefits under RA No. 7641

h. Gains from redemption of shares in mutual funds. 2. Social Security benefits, retirement, gratuities,

pensions and other similar benefits.

1. Gifts, Bequests and Devises 3. Retirement received by officials and Employees (EE)

of private firms, in accordance with a reasonable

• Value of property subject of gifts, bequests and devises are private plan maintained by the Employer (ER).

EXCLUDED. 4. Benefits from the US Veterans Administration

5. GSIS Benefits

• Income from such property = INCLUDED 6. SSS

7. Separation Pay

Gift: transfer not in the ordinary course of business which is

not made for full and adequate consideration in money or

From the Discussions of Atty. Denise Christine Lim, CPA

University of Mindanao College of Law

TAXATION REVIEWER | CYNDI SATORRE-BICERA | 2nd Sem SY 2022-2023 | 16

b. Prizes and awards

Where the retirement plan is established in the CBA or other 1. Primarily in recognition of scientific, civic, artistic, religious,

applicable employment contract (RA 7641) educational, literary, or charitable achievement.

2. The recipient was selected without any action on his part to

Receive benefits as earned under existing laws and the CBA. enter the contest or proceeding.

3. He is not required to render substantial future services as a

Conditions to avail the exemption under a Reasonable Private

condition to receiving the prize or award.

Benefit Plan (RPBP):

1. The RPBP must be approved by the BIR;

2. The retiree must have been in the service of the same ER for c. Prizes and awards in sports competitions

at least 10 years at the time of retirement; 1. All prizes and awards

3. The private EE or official must be at least 50 years old at the 2. Granted to athletes

time of retirement; 3. In local and international sports tournaments or competitions

4. The benefits must have been availed once. (may be held locally or internationally).

4 Sanctioned by their national sports associations.

In the absence of a RPBP or Agreement providing for NSA – duly accredited by the PH Olympic Committee

retirement benefits of EE in the establishment

d. Income derived by foreign government

a. Optional: 1. It must be an income derived from investments in PH.

1. An EE upon reaching the age of 60 or more but not more 2. It must be derived from loans, bonds, or other domestic

than 65; securities, stocks, or interests on deposits in banks.

2. Served at least 5 years in the said establishment; 3. The recipient of such income must be a:

3. Entitled to retirement pay equivalent to 1/2 month salary a. Foreign government

for every year of service. b. Financing institutions owned, controlled, or financed

by foreign government OR

b. Mandatory: c. Regional or international financing institutions

1. An EE upon reaching the age of 65 years; established by foreign governments.

2. Served at least 5 years in the said establishment;

3. Entitled to retirement pay equivalent to 1/2 month salary e. Income derived by the Gov’t or its political subdivisions

for every year of service. The source of income must be from any public utility or from

the exercise if any essential government functions.

NOTE: This provision is also found in the Labor Code.

• GOCCs performing governmental functions = EXEMPT

Separation Pay

1. Amount received by an official, EE or by his heirs. • GOCCs performing proprietary functions = TAXABLE

2. From the Employer (ER). XPNs: GSIS, SSS, PHIC, Local Water Districts (RA No. 8424)

3. As a consequence of separation of official/EE from service:

a. Because of death, sickness or disability, OR g. Gains from sale of bonds, debentures or other

b. For any cause beyond the control of the official/EE. certificate of indebtedness.

• Must be with maturity of more than 5 years.

Terminal Leave Pay – amount received arising from the

accumulation of sick leave or vacation leave credits.

DEDUCTIONS

5. Income Exempt Under Treaty

• Amounts authorized by law to be subtracted from pertinent

Most Favored Nation Clause items of gross income to arrive at the taxable income. (Sec.

• This grants to the contracting party treatment not less 34)

favorable than which has been or may be granted to the most

favored among other countries. Nature: strictly construed against the taxpayer (same as

• It allows the taxpayer in one state to avail more liberal exemptions and exclusions; there must be proof).

provisions granted in another treaty to which the country of

residence of such taxpayer is also a party; provided that the RULES:

subject matter of taxation is the same as that in the tax treaty 1. Deductions must be paid or incurred in connection with the

under which the taxpayer is liable. taxpayer’s trade, business or profession.

6. Compensation for injuries or sickness Matching Concept of Deductibility – deductions must

“match” the income.

1. Amounts received through accident or health insurance or

Workmen Compensation’s Act as compensation for personal • Ordinary and necessary expenses must have been paid or

injuries or sickness. incurred during the taxable year for it to be deductible from

gross income. [CIR v. Isabela Cultural Corp. GR 172231,

2. Amounts of any damages received whether by suit or 2/12/2007

agreement on account of such injuries or illness.

2. Must be supported by adequate receipts or invoices; XPN:

Rationale: Mere compensation for injuries or sickness suffered Standard Deductions

and not income.

3. The withholding and payment of tax required must be

7. Miscellaneous Items: shown.

a. 13th month pay and other benefits NOT ALLOWED TO CLAIM DEDUCTIONS

Provided that the total exclusions shall not exceed P90,000.

From the Discussions of Atty. Denise Christine Lim, CPA

University of Mindanao College of Law

TAXATION REVIEWER | CYNDI SATORRE-BICERA | 2nd Sem SY 2022-2023 | 17

Subject to final tax on their gross income:

(1) NRA Not Engaged in Trade or Business; (2) NRFC Substantial Rule – The TP shall substantiate the expense

being deducted with sufficient evidence such as official receipts

When income is purely compensation: or other adequate records showing:

(1) RC; (2) NRC; (3) RA 1. The amount of expense being deducted; and

2. The direct connection or relation of the expense being

Return of Capital – while in general, the nomenclature of “cost deducted to the development, management, operation, and/or

of sales or cost of goods sold” is applied, the return of capital conduct of the trade, business, or exercise of a profession.

has different components depending upon the nature of the

business being taxed. Cohan Principle – TPs may use estimates when they can

show that there is some factual foundation on which to base a

EXCLUSIONS UNDER THE CONSTITUTION reasonable approximation of the expense, they can prove that

1. Itemized Deductions (ID) they had made a deductible expenditure but just cannot prove

2. Optional Standard Deduction (OSD) how much the expenditure was. [Cohan vs. CIR, F (2d) 540]

RMC No. 23-2000 – If there is showing that expenses have

ITEMIZED OSD been incurred but the exact amount thereof cannot be

ascertained due to absence of receipts and vouchers of the

Definition List every item In lieu of IDs: expenditures involved, the BIR will make an estimate of

of business Presumed as a fixed deduction that may be allowed in computing the TP’s taxable