Professional Documents

Culture Documents

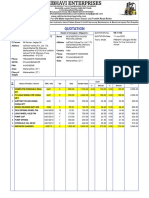

Akhila SALE INVOICE

Uploaded by

ameenskollam716Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Akhila SALE INVOICE

Uploaded by

ameenskollam716Copyright:

Available Formats

Original Copy

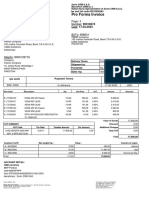

TAX INVOICE

EMIRATES INFOSYS

PATTATHUVILA PLAZA, VADAYATTUKOTTA ROAD, CHINNAKADA KOLLAM

Mob: 7293111222, 9995771020

GSTIN :

email : emiratesinfosys@gmail.com

Invoice No. : 122/2022-23 Place of Supply : Kerala (32)

Dated : 20-08-2022 Reverse Charge : N

Billed to : Shipped to :

Cash Cash

GSTIN / UIN : GSTIN / UIN :

S.N. Description of Goods HSN Qty. Unit Price CGST Rate SGST Rate Amount ( ` )

1. BARCODE SCANNER FINGERS QUICKSCAN WL5 84716050 1.00 Nos 4,661.02 9.00 % 9.00 % 5,500.00

2. BATTERY AMARON 8506 1.00 Nos 11,016.94 9.00 % 9.00 % 13,000.00

3. CCTV CABLE HIKVISION 90MTR 85258090 1.00 Nos 1,694.92 9.00 % 9.00 % 2,000.00

4. CCTV CONNECTOR POWER(DC WIRE TYPE) 85366990 3.00 Nos 16.95 9.00 % 9.00 % 60.00

5. CCTV CONNECTOR BNC 85367000 6.00 Nos 19.49 9.00 % 9.00 % 138.00

6. CCTV POWER SUPPLY ERD 4CH AD-11 85044090 1.00 Nos 593.22 9.00 % 9.00 % 700.00

7. CCTV PVC JUNCTION BOX 85369030 3.00 Nos 42.37 9.00 % 9.00 % 150.00

8. DVR HIKVISION 4CH DS 7104HGHI K1 852190 1.00 Nos 2,288.14 9.00 % 9.00 % 2,700.00

9. ESYPOS THERMAL LABEL PRINTER 844339 1.00 Nos 11,440.68 9.00 % 9.00 % 13,500.00

10. FIBER RACK 8538 1.00 Nos 1,694.92 9.00 % 9.00 % 2,000.00

11. HARD DISK TOSHIBA 1TB 84717020 1.00 Nos 2,796.62 9.00 % 9.00 % 3,300.00

12. HIKVISION BLT 2MP DS2CE16DOTITPF 85258020 3.00 Nos 1,440.68 9.00 % 9.00 % 5,100.00

13. INSTALLATION CHARGE 8523 1.00 Nos 1,525.42 9.00 % 9.00 % 1,800.00

14. KEYBOARD AND MOUSE FINGERS VELVET C4 84716040 1.00 Nos 593.22 9.00 % 9.00 % 700.00

15. LAPTOP LENOVO IDEAPAD 110 8471 1.00 Nos 11,016.94 9.00 % 9.00 % 13,000.00

16. Luminous Zelio+ 1100 Home Pure Sinewave 85044010 1.00 Nos 6,778.82 9.00 % 9.00 % 7,999.00

17. RACKSPACE RACK 2U 350D LARGE 85258020 1.00 Nos 1,483.06 9.00 % 9.00 % 1,750.00

18. SOFTWARE ACCOUNTING 85238020 1.00 Nos 6,779.66 9.00 % 9.00 % 8,000.00

19. THERMAL PRINTER 84433290 1.00 Nos 9,745.76 9.00 % 9.00 % 11,500.00

Grand Total 30.00 Nos ` 92,897.00

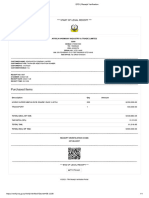

HSN/SAC Tax Rate Taxable Amt. CGST Amt. SGST Amt. Total Tax

84433290 18% 9,745.76 877.12 877.12 1,754.24

844339 18% 11,440.68 1,029.66 1,029.66 2,059.32

8471 18% 11,016.94 991.53 991.53 1,983.06

84716040 18% 593.22 53.39 53.39 106.78

Declaration

Certified that all the particulars shown in the above Invoice are true and correct in all respects and the goods on which the tax

charged and collected are in accordance with the provisions of the KVAT ACT 2003 and the rules made thereunder. It is also certified

that my/our Registration under KVAT Act 2003 is not subject to any suspension/cancellation and is valid as on the date of this Bill.

Terms & Conditions Receiver's Signature :

E.& O.E.

1. Goods once sold will not be taken back.

2. Interest @ 18% p.a. will be charged if the payment For EMIRATES INFOSYS

is not made with in the stipulated time.

3. Subject to 'Kerala' Jurisdiction only.

Authorised Signatory

Original Copy

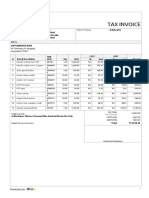

TAX INVOICE

EMIRATES INFOSYS

PATTATHUVILA PLAZA, VADAYATTUKOTTA ROAD, CHINNAKADA KOLLAM

Mob: 7293111222, 9995771020

GSTIN :

email : emiratesinfosys@gmail.com

Invoice No. : 122/2022-23 Place of Supply : Kerala (32)

Dated : 20-08-2022 Reverse Charge : N

Billed to : Shipped to :

Cash Cash

GSTIN / UIN : GSTIN / UIN :

S.N. Description of Goods HSN Qty. Unit Price CGST Rate SGST Rate Amount ( ` )

84716050 18% 4,661.02 419.49 419.49 838.98

84717020 18% 2,796.62 251.69 251.69 503.38

85044010 18% 6,778.82 610.09 610.09 1,220.18

85044090 18% 593.22 53.39 53.39 106.78

8506 18% 11,016.94 991.53 991.53 1,983.06

852190 18% 2,288.14 205.93 205.93 411.86

8523 18% 1,525.42 137.29 137.29 274.58

85238020 18% 6,779.66 610.17 610.17 1,220.34

85258020 18% 5,805.10 522.45 522.45 1,044.90

85258090 18% 1,694.92 152.54 152.54 305.08

85366990 18% 50.84 4.58 4.58 9.16

85367000 18% 116.94 10.53 10.53 21.06

85369030 18% 127.12 11.44 11.44 22.88

8538 18% 1,694.92 152.54 152.54 305.08

Totals 78,726.28 7,085.36 7,085.36 14,170.72

Rupees Ninety Two Thousand Eight Hundred Ninety Seven Only

- 92,897.00

Declaration

Certified that all the particulars shown in the above Invoice are true and correct in all respects and the goods on which the tax

charged and collected are in accordance with the provisions of the KVAT ACT 2003 and the rules made thereunder. It is also certified

that my/our Registration under KVAT Act 2003 is not subject to any suspension/cancellation and is valid as on the date of this Bill.

Terms & Conditions Receiver's Signature :

E.& O.E.

1. Goods once sold will not be taken back.

2. Interest @ 18% p.a. will be charged if the payment For EMIRATES INFOSYS

is not made with in the stipulated time.

3. Subject to 'Kerala' Jurisdiction only.

Authorised Signatory

You might also like

- Dilshad 2Document1 pageDilshad 2ameenskollam716No ratings yet

- Dell Inspiron 15 Service Invoice 17-11-2022Document1 pageDell Inspiron 15 Service Invoice 17-11-2022ameenskollam716No ratings yet

- Arman Auto Spares PC Build - 2 Qta 29-10-2022Document1 pageArman Auto Spares PC Build - 2 Qta 29-10-2022ameenskollam716No ratings yet

- CUSTMORDocument2 pagesCUSTMORRadhe shamNo ratings yet

- Adv. Anil SALES QTA (HIKVISION)Document1 pageAdv. Anil SALES QTA (HIKVISION)ameenskollam716No ratings yet

- Tax Invoice AnalysisDocument2 pagesTax Invoice Analysisnoor alamNo ratings yet

- Ve-1155!22!23-Inditech Valves Private Limited Hand Pallet Truck Repair QuotationDocument2 pagesVe-1155!22!23-Inditech Valves Private Limited Hand Pallet Truck Repair QuotationIndiTech ServiceNo ratings yet

- Asif - HIK-DVR+1TBDocument1 pageAsif - HIK-DVR+1TBameenskollam716No ratings yet

- Vinodbhia Kenya - Freight - PNGDocument1 pageVinodbhia Kenya - Freight - PNGVikki PatelNo ratings yet

- Mech It Possible: Tax InvoiceDocument1 pageMech It Possible: Tax InvoiceDeepak GovardhaneNo ratings yet

- Tax InvoiceDocument2 pagesTax InvoiceVenky SamNo ratings yet

- Aneesh EZVIZ+MMC+ROUTER SALES QTADocument1 pageAneesh EZVIZ+MMC+ROUTER SALES QTAameenskollam716No ratings yet

- Anti Virus+Extn Cord 5mtrDocument1 pageAnti Virus+Extn Cord 5mtrameenskollam716No ratings yet

- Project PLB-G00100-0029-0 Opening: Client Statement (Mentioned in Above Statement)Document6 pagesProject PLB-G00100-0029-0 Opening: Client Statement (Mentioned in Above Statement)waqas akramNo ratings yet

- Sales-2Document1 pageSales-2skgts787737No ratings yet

- TrialBalDocument1 pageTrialBalkonceptz20No ratings yet

- BSE-AMS - 22 - 1101 - AL TurkiDocument1 pageBSE-AMS - 22 - 1101 - AL Turkiranvijay dubeyNo ratings yet

- Bill FormetDocument1 pageBill Formetshuklavishal135No ratings yet

- Get in VoiceDocument2 pagesGet in VoiceAMOL YADAVNo ratings yet

- Party and Invoice Details for Automotive Parts PurchaseDocument4 pagesParty and Invoice Details for Automotive Parts PurchaseElakya muniNo ratings yet

- Invoice 106168Document1 pageInvoice 106168Pranav ParikhNo ratings yet

- Le 023934Document2 pagesLe 023934PRECITECH CNCNo ratings yet

- Est 002273Document1 pageEst 002273PRINT HUBNo ratings yet

- Original invoice for telecom servicesDocument2 pagesOriginal invoice for telecom servicesITNo ratings yet

- Tax Invoice: Invoice No. Invoice Date 1/1 Customer No. Purchase Order NoDocument1 pageTax Invoice: Invoice No. Invoice Date 1/1 Customer No. Purchase Order NoTinos Joshua MatanhireNo ratings yet

- Rama Raju Final Workings 30.08.2020Document2 pagesRama Raju Final Workings 30.08.2020Varma RebalNo ratings yet

- Samcr23112021 ASADocument1 pageSamcr23112021 ASAAbhishek MongaNo ratings yet

- 1st Moving ItemsDocument12 pages1st Moving Itemsshahbaz hussainNo ratings yet

- QuotationDocument1 pageQuotationParameswaran SreenivasanNo ratings yet

- Government of Telangana: PAYSLIP:-MAY-2021Document1 pageGovernment of Telangana: PAYSLIP:-MAY-2021AL-FAIZAAN GIFT-PHOTO COPYNo ratings yet

- Government of Telangana: PAYSLIP:-JUL-2021Document1 pageGovernment of Telangana: PAYSLIP:-JUL-2021AL-FAIZAAN GIFT-PHOTO COPYNo ratings yet

- 24X7 KOEL CARE Helpdesk Parts QuotationDocument1 page24X7 KOEL CARE Helpdesk Parts QuotationKalpavriksha SocietyNo ratings yet

- Purchase Order-PO - 01333 - 22-23Document2 pagesPurchase Order-PO - 01333 - 22-23Jayapal100% (1)

- EFD - Receipt Verification2Document1 pageEFD - Receipt Verification2Ramadhani YahayaNo ratings yet

- Brick LayerDocument8 pagesBrick Layerram skytradeNo ratings yet

- Invoice 39618325Document1 pageInvoice 39618325sam huangNo ratings yet

- Inv Ka B1 108455092 102664801731 November 2023Document4 pagesInv Ka B1 108455092 102664801731 November 2023TejusNo ratings yet

- MicriDocument1 pageMicriHashim MalikNo ratings yet

- Inv E230016Document1 pageInv E230016Fitri SukendarNo ratings yet

- E-Way Bill: Government of IndiaDocument1 pageE-Way Bill: Government of IndiaArun AggarwalNo ratings yet

- Sudesh Automobiles Private Limited: Billed To: Shipped ToDocument4 pagesSudesh Automobiles Private Limited: Billed To: Shipped ToSRNSNo ratings yet

- Phoenix Consulting Receives Supplies OrderDocument2 pagesPhoenix Consulting Receives Supplies OrderAlexandru GheorgheNo ratings yet

- Tax invoice for IT productsDocument1 pageTax invoice for IT productsAbhinav NigamNo ratings yet

- Tax Invoice: Tax Amount Amount Rate Amount Rate ValueDocument1 pageTax Invoice: Tax Amount Amount Rate Amount Rate ValueTula rashi videosNo ratings yet

- FZ-Si BikeMaintenanceDocument1 pageFZ-Si BikeMaintenanceatul rasekarNo ratings yet

- Quotation for elevator parts and installationDocument1 pageQuotation for elevator parts and installationOnamika AktherNo ratings yet

- HH304Document1 pageHH304Sumanta PatelNo ratings yet

- 039DX04625Document2 pages039DX04625Usha Hasini VelagapudiNo ratings yet

- MKC Infrastructure Limited 13286Document1 pageMKC Infrastructure Limited 13286mkcil purchaseNo ratings yet

- Sales Quotation - 546Document2 pagesSales Quotation - 546NIPUN SURESHNo ratings yet

- ST SupO 2944 2022 23 183233 PDFDocument1 pageST SupO 2944 2022 23 183233 PDFRajat SharmaNo ratings yet

- Ap Ele 230255Document1 pageAp Ele 230255Mohammad Azhar AliNo ratings yet

- Sudesh Automobiles Private Limited: Billed To: Shipped ToDocument4 pagesSudesh Automobiles Private Limited: Billed To: Shipped ToSRNSNo ratings yet

- Neto $18,479 I.V.A. (19%) $3,511 Exento $0 Monto Total $21,990 Cuota $0 Total A Pagar $21,990Document5 pagesNeto $18,479 I.V.A. (19%) $3,511 Exento $0 Monto Total $21,990 Cuota $0 Total A Pagar $21,990Graciela ParedesNo ratings yet

- Fxrate 23 05 2023Document2 pagesFxrate 23 05 2023ShohanNo ratings yet

- Driver FinalDocument1 pageDriver Finalamit acharyaNo ratings yet

- LAN Networking-01700Document1 pageLAN Networking-01700Ramakanth ReddyNo ratings yet

- AC23I12179Document1 pageAC23I12179vijayakaviya21No ratings yet

- Faith Leaders Letter Ohio SB3Document4 pagesFaith Leaders Letter Ohio SB3WKYC.comNo ratings yet

- Aznar vs. YapdiangcoDocument1 pageAznar vs. YapdiangcoCarissa CruzNo ratings yet

- Abdul Ghaffar Khan - WikipediaDocument64 pagesAbdul Ghaffar Khan - WikipediaAli HamzaNo ratings yet

- GE-8 Ethics - Module 15 - Deontology - The Life of Emmanuel Kant, - Introduction, - Autonomous Reasons, - Good Will, - Duty, - Categorical ImperativeDocument4 pagesGE-8 Ethics - Module 15 - Deontology - The Life of Emmanuel Kant, - Introduction, - Autonomous Reasons, - Good Will, - Duty, - Categorical ImperativeRica Mae BotorNo ratings yet

- China's Regulatory ProcessDocument2 pagesChina's Regulatory ProcessPhilip TaiNo ratings yet

- Draft Agreement For Long Grain Indian Creamy Pusa Sella 1121 RiceDocument7 pagesDraft Agreement For Long Grain Indian Creamy Pusa Sella 1121 RiceHarish PurohitNo ratings yet

- Lenin's Imperialism in The 21st CenturyDocument172 pagesLenin's Imperialism in The 21st CenturyAnonymous xcXBfKz5No ratings yet

- Prime White Cement Vs IacDocument2 pagesPrime White Cement Vs IacNegou Xian TeNo ratings yet

- Siteminder Wa Install Apache EnuDocument91 pagesSiteminder Wa Install Apache EnuIoan MaximNo ratings yet

- Attachment of PropertyDocument3 pagesAttachment of Propertyishmeet kaurNo ratings yet

- NCRP Report No. 177 PDFDocument245 pagesNCRP Report No. 177 PDFVivien FerradaNo ratings yet

- 3rd Quarter 2017 Lesson 12 Powerpoint Presentation by Claro VicenteDocument22 pages3rd Quarter 2017 Lesson 12 Powerpoint Presentation by Claro VicenteRitchie FamarinNo ratings yet

- Info Pack - InvictusDocument4 pagesInfo Pack - InvictusSomething FunnyNo ratings yet

- Namaz Jumatul VidahDocument5 pagesNamaz Jumatul VidahkhanzaheedNo ratings yet

- Numere RomaneDocument1 pageNumere RomaneAndrei NechitaNo ratings yet

- Law Reading For Executive Magistrate Volume IDocument235 pagesLaw Reading For Executive Magistrate Volume IManishNo ratings yet

- Labor Law Region Cum IndustryDocument13 pagesLabor Law Region Cum IndustrySteven Mathew0% (1)

- RENTALJKHKDocument2 pagesRENTALJKHKSRINIVASREDDY PIRAMALNo ratings yet

- 1 Control Valve (Main)Document5 pages1 Control Valve (Main)Putra JawaNo ratings yet

- Format. Hum - Delineation of Indian Reality in Raag Darbari - 1 - 1Document8 pagesFormat. Hum - Delineation of Indian Reality in Raag Darbari - 1 - 1Impact JournalsNo ratings yet

- Unit 8 and Unit 4 History TestDocument21 pagesUnit 8 and Unit 4 History TestRamyaNo ratings yet

- Quiz 4.2Document2 pagesQuiz 4.2Joziel CondimanNo ratings yet

- Rosete v. LimDocument3 pagesRosete v. LimEnzo RegondolaNo ratings yet

- RC Design EC2 v1.9Document64 pagesRC Design EC2 v1.9mohammed alebiedNo ratings yet

- Common Carrier Liable for Passenger InjuriesDocument2 pagesCommon Carrier Liable for Passenger InjuriesJerome MoradaNo ratings yet

- Romania's Banking System OverviewDocument34 pagesRomania's Banking System OverviewRoxanaT22No ratings yet

- Pleading PublicianaDocument2 pagesPleading Publicianaalfx21683% (6)

- ObliCon ReviewerDocument8 pagesObliCon ReviewerRaymark MejiaNo ratings yet

- Patrones GuantesDocument7 pagesPatrones GuantesYadira Isabel Pacheco HernándezNo ratings yet

- City Government of Makati vs. OdeñaDocument3 pagesCity Government of Makati vs. OdeñaGraceNo ratings yet