Professional Documents

Culture Documents

Performa Income Statement

Uploaded by

Ahsan JamalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Performa Income Statement

Uploaded by

Ahsan JamalCopyright:

Available Formats

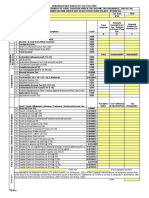

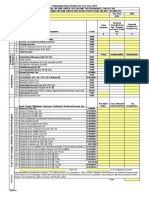

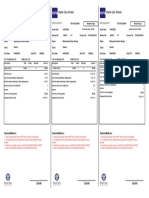

COMPUTATION OF TAXABLE INCOME & LIABILITY

MR. ABC

CNIC: 123456789 Tax Year 202X

Normal Tax Regime (NTR)

Amount Exempt Taxable

Income From Behbood Certificate

Income from Salary Certificate - -

A - - -

Profit on debt

To be

Gross Tax Deducted Difference

Deducted

Frist Woman Bank TDR Profit As per - -

Certificate

Frist Woman Bank A/c - -

BAHL A/c - -

BAHL A/c - -

B - - - -

Taxable Income A+B -

Noraml tax Liability -

Liability under FTR

Total Tax liability -

Tax Credit for Share from Taxed AOP

Tax Liability

-

Less : Tax Deducted

Tax deduction on Salary Certificate

Tax On Telephone

Cash Withdrawal

Tax on mobile

Educational fee

Tax deduction on Services As per client

On profit -

-

Payable/Refund -

Computation of Tax

Tax on

Up to 6,000,000 -

Exceeding to (6,000,000) 35.00%

- -

You might also like

- M/S ABC Limited NTN: Cnic: Income Tax Computation Tax Year 20X6Document1 pageM/S ABC Limited NTN: Cnic: Income Tax Computation Tax Year 20X6fergusonaf555No ratings yet

- Case Studies in MAT 2021Document5 pagesCase Studies in MAT 2021kanchan palNo ratings yet

- It 23-24Document5 pagesIt 23-24Alok G ShindeNo ratings yet

- AST2267 Generic Tax Filing and Payment Table ENDocument1 pageAST2267 Generic Tax Filing and Payment Table ENGhepo GhoruiNo ratings yet

- Tax Summary 2019 Ver.1Document163 pagesTax Summary 2019 Ver.1Aiko Cherrie NakamuraNo ratings yet

- Mat CalculaterDocument1 pageMat CalculatershriniskNo ratings yet

- Income Tax Calculator FY 2014 15Document2 pagesIncome Tax Calculator FY 2014 15atul bansalNo ratings yet

- Business Tax Chapter 9 ReviewerDocument3 pagesBusiness Tax Chapter 9 ReviewerMurien LimNo ratings yet

- Net Business IncomeDocument21 pagesNet Business IncomedonawajNo ratings yet

- Untitled SpreadsheetDocument8 pagesUntitled SpreadsheetAretha DawesNo ratings yet

- Income Tax Notes-IAS 12Document11 pagesIncome Tax Notes-IAS 12mehdi.jjh313No ratings yet

- Republic Act No. 11976 (EOPT) - Infographics - SGVDocument3 pagesRepublic Act No. 11976 (EOPT) - Infographics - SGVAlbert SantiagoNo ratings yet

- TDS Rate Chart For FY 2023-24 (AY 2024-25)Document70 pagesTDS Rate Chart For FY 2023-24 (AY 2024-25)DRK FrOsTeRNo ratings yet

- Mr. Zulfiqar Computation of Taxable Income For Tax Year 2009 RupeesDocument5 pagesMr. Zulfiqar Computation of Taxable Income For Tax Year 2009 Rupeesmeelas123No ratings yet

- IAS-12 Lecture NotesDocument11 pagesIAS-12 Lecture NotesAli OptimisticNo ratings yet

- Majeed SB - COMPUTATION and WEALTH STATEMENT 2022Document5 pagesMajeed SB - COMPUTATION and WEALTH STATEMENT 2022Muhammad SherazNo ratings yet

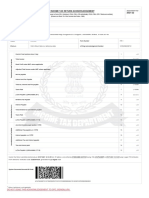

- Individual Paper Return For Tax Year 2020: SignatureDocument26 pagesIndividual Paper Return For Tax Year 2020: SignaturejamalNo ratings yet

- Taxability of PartnershipDocument6 pagesTaxability of PartnershipPrincess Janine SyNo ratings yet

- Tutorial 8 - CIT Problems - Sample AnswerDocument13 pagesTutorial 8 - CIT Problems - Sample Answerhien cungNo ratings yet

- Oho Shop CoiDocument5 pagesOho Shop CoiJAY K SHAH & ASSOCIATESNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruKokila Sham100% (1)

- "Individual Paper Return For Tax Year 2021: SignatureDocument25 pages"Individual Paper Return For Tax Year 2021: SignatureWaqas MehmoodNo ratings yet

- Manual ReturnDocument26 pagesManual ReturnMuhammad Arsalan TariqNo ratings yet

- Ivt BS 2021Document53 pagesIvt BS 2021Sujan TripathiNo ratings yet

- Goods and Services Tax - Negative Liablity StatementDocument2 pagesGoods and Services Tax - Negative Liablity StatementANAND AND COMPANYNo ratings yet

- Salient Features of Income Tax Act 2023Document79 pagesSalient Features of Income Tax Act 2023Md. Abdullah Al ImranNo ratings yet

- Chapter 10: Income TaxDocument32 pagesChapter 10: Income TaxNgô Thành DanhNo ratings yet

- PC - 01-Subcon & Supplier FormatDocument3 pagesPC - 01-Subcon & Supplier FormatnileshNo ratings yet

- Manish Srivastava-TDS ConfigrationDocument14 pagesManish Srivastava-TDS ConfigrationTaneesha YadavNo ratings yet

- Ack CLSPJ9707L 2022-23 839939030091222Document1 pageAck CLSPJ9707L 2022-23 839939030091222Fascino WhiteNo ratings yet

- ACFrOgCJ87XweE1ORK13I2yjbAMpCA3F8IcGcpwOM7Zst d62VpOa - XyXN MuGeegYkBFHwEvDzNOO7UyAo3ZaahtGIUUtsLu9puasYbmvQsTO8CMisioK4V7tRmWf MWfXFiQHjT0hWqlhMM4XDocument8 pagesACFrOgCJ87XweE1ORK13I2yjbAMpCA3F8IcGcpwOM7Zst d62VpOa - XyXN MuGeegYkBFHwEvDzNOO7UyAo3ZaahtGIUUtsLu9puasYbmvQsTO8CMisioK4V7tRmWf MWfXFiQHjT0hWqlhMM4XAngelica PagaduanNo ratings yet

- TAXATION II KMA PREFINALS VAT EditedDocument14 pagesTAXATION II KMA PREFINALS VAT Editedethel hyuga0% (1)

- POWIBA NOTICE CORPORATE TAX AssessmentDocument2 pagesPOWIBA NOTICE CORPORATE TAX AssessmentHassan OmaryNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruHussain YadavNo ratings yet

- IT Return Guidelines v2.0Document15 pagesIT Return Guidelines v2.0Hasan MurtazaNo ratings yet

- In Come Tax Return Form 2019Document48 pagesIn Come Tax Return Form 2019Mirza Naseer AbbasNo ratings yet

- Ias 12 Income TaxesDocument52 pagesIas 12 Income TaxesJames MutarauswaNo ratings yet

- Ind As - 12 Income TaxesDocument26 pagesInd As - 12 Income TaxesAlok ThakurNo ratings yet

- SCorp 26062022Document27 pagesSCorp 26062022Jagmohan TeamentigrityNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDIVYANSHU SHEKHARNo ratings yet

- Acknowledgement HamidDocument1 pageAcknowledgement HamidDIVYANSHU SHEKHARNo ratings yet

- New Income Tax Calculator For Old & New Tax Regime For Salaried EmployeeDocument4 pagesNew Income Tax Calculator For Old & New Tax Regime For Salaried EmployeeKiran KumarNo ratings yet

- Draft Manual Income Tax Return FormDocument26 pagesDraft Manual Income Tax Return FormSaleem MominNo ratings yet

- Evaluation of Borrowing To BuyDocument7 pagesEvaluation of Borrowing To BuySreyas S KumarNo ratings yet

- BAC103A-02c Income Tax For Individuals Week 8Document4 pagesBAC103A-02c Income Tax For Individuals Week 8Novelyn Degones DuyoganNo ratings yet

- Ordinary Allowable Deductions 1Document19 pagesOrdinary Allowable Deductions 1Jester LimNo ratings yet

- Manage Taxes - 8Document1 pageManage Taxes - 8I'm RangaNo ratings yet

- Financial StatementsDocument5 pagesFinancial Statementskl2304013112No ratings yet

- GAMDOORDocument2 pagesGAMDOORRashpreet PandiNo ratings yet

- 16 Summer 2018 BT SADocument8 pages16 Summer 2018 BT SApabloescobar11yNo ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- P6MYS 2012 Dec ADocument15 pagesP6MYS 2012 Dec AFakhrul Azman NawiNo ratings yet

- PGBPDocument45 pagesPGBPNidhi Lath100% (1)

- Index: Direct TaxationDocument265 pagesIndex: Direct TaxationnaskNo ratings yet

- Reit Feb 2021Document6 pagesReit Feb 2021MUHAMMAD AFIQ SAFWAN ROSLINo ratings yet

- Individual Paper Returnfor Tax Year 2022Document25 pagesIndividual Paper Returnfor Tax Year 2022abdul karimNo ratings yet

- SampleDocument2 pagesSampleHarue LeeNo ratings yet

- BIR GlobeDocument4 pagesBIR GlobeRenge TañaNo ratings yet

- Tsu Note G.R. No. 173425 en Banc Tax CaseDocument4 pagesTsu Note G.R. No. 173425 en Banc Tax CaseAnonymous BYeqWt8FHyNo ratings yet

- PO FormatDocument3 pagesPO FormatSanjeev KhannaNo ratings yet

- Rmo 27-89 PDFDocument1 pageRmo 27-89 PDFPeter Joshua OrtegaNo ratings yet

- TAXATION 2 Chapter 5 Estate Tax Payable PDFDocument5 pagesTAXATION 2 Chapter 5 Estate Tax Payable PDFKim Cristian MaañoNo ratings yet

- Prudential Bank v. CIRDocument2 pagesPrudential Bank v. CIRKaren Ryl Lozada BritoNo ratings yet

- EIN IRS MicroInformationTechnologiesDocument2 pagesEIN IRS MicroInformationTechnologiesmariefe.wvillacoraNo ratings yet

- Multiple Choice Questions in Tax Review Jan 5Document1 pageMultiple Choice Questions in Tax Review Jan 5Gileah ZuasolaNo ratings yet

- Public Debt FlowchartDocument1 pagePublic Debt FlowchartRbNo ratings yet

- Fesco Online Bill May 2018Document2 pagesFesco Online Bill May 2018Ataa Ul MustafaNo ratings yet

- Chapter 12: Tax Deduction at Source and Introduction To Tax Collection Practice QuestionsDocument11 pagesChapter 12: Tax Deduction at Source and Introduction To Tax Collection Practice QuestionsNaimish AbhangiNo ratings yet

- Collection. Recovery and RefundDocument25 pagesCollection. Recovery and RefundDharshini AravamudhanNo ratings yet

- GST Numericals2Document11 pagesGST Numericals2Kautilya VithobaNo ratings yet

- PDF&Rendition 1Document2 pagesPDF&Rendition 1vijaybhaskar damireddyNo ratings yet

- Tax For Corp - AnswersDocument8 pagesTax For Corp - AnswersChelsea SabadoNo ratings yet

- Reimbursement Expense ReceiptDocument1 pageReimbursement Expense ReceiptAlexie CarvajalNo ratings yet

- Excercise 19Document7 pagesExcercise 19raihan aqilNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsMae MarinoNo ratings yet

- Business Plan Excel TemplateDocument3 pagesBusiness Plan Excel TemplateFirman HanantoNo ratings yet

- Provisional: Provisional Income Tax CalculationDocument1 pageProvisional: Provisional Income Tax CalculationM. A Hossain & Associates Tax ConsultantsNo ratings yet

- Compliance ManualDocument52 pagesCompliance ManualNupur GajjarNo ratings yet

- Post Quiz 1Document3 pagesPost Quiz 1Randelle James FiestaNo ratings yet

- Republic of The Philippines v. Honorable E.L. Peralta, Et AlDocument5 pagesRepublic of The Philippines v. Honorable E.L. Peralta, Et AlKriselNo ratings yet

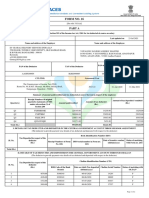

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinuthna ChinnapaNo ratings yet

- Income Tax Card Tax Year 2015Document3 pagesIncome Tax Card Tax Year 2015Sardar Shahid KhanNo ratings yet

- Alpha Core School Alpha Core School Alpha Core School: NTN # 7432741-1 NTN # 7432741-1 NTN # 7432741-1Document1 pageAlpha Core School Alpha Core School Alpha Core School: NTN # 7432741-1 NTN # 7432741-1 NTN # 7432741-1Arms Branch SindhNo ratings yet

- Form DGT - Certificate of Domicile of Nonresident (Indonesia WHT) - ExecutedDocument2 pagesForm DGT - Certificate of Domicile of Nonresident (Indonesia WHT) - ExecutedAjuna KaliantigaNo ratings yet

- AccountingDocument16 pagesAccountingMARY GRACE VARGASNo ratings yet

- Milkiy FF 2011Document263 pagesMilkiy FF 2011Asfawosen Dingama100% (1)

- Excel Basics FinishedDocument55 pagesExcel Basics Finishedwklbs4691No ratings yet

- Tax 2 Outline (Consolidated)Document24 pagesTax 2 Outline (Consolidated)MRNo ratings yet