Professional Documents

Culture Documents

Sheet Solution

Uploaded by

mmh771984Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sheet Solution

Uploaded by

mmh771984Copyright:

Available Formats

Question B:-

Unrealized profit in beginning inventory = 50000 – (50000 /1.25) = 10000

Unrealized profit in shipment from HO = 142500 – (142500/1.25) or 142500 – 114000 = 28500

Unrealized profit in ending inventory = 32000 – (32000 / 1.25) = 6400

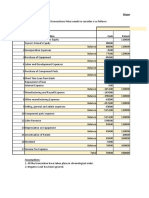

Combined statements Workpaper

Item Trial balances Eliminations Combined

H.O Branch DR CR balances

Income statement:

Sales 962000 272000 1234000

Beginning inventory 120000 50000 10000 160000

Purchases 500000 28000 528000

Shipments from H.O 0 - 142500 142500 0 -

620000 220500 688000

Shipments to branch 1140000 0 114000 0

Ending inventory 98000 48000 6400 139600

Cost of goods sold 408000 172500 548400

Other expenses 272000 36000 . . . 308000

Net income to retained earnings 282000 63500 120400 152500 377600

Question C: - exercise 24-7

Question D:-

Subscriptions for 2016 = 34000 – 1400 + 1200 + 200 – 300 = 33700

Depreciation expenses for premises = 40000 – 36000 = 4000

Depreciation expenses for fixtures = 6000 – 4000 = 2000

Total depreciation expenses = 4000 + 2000 = 6000

Income & Expenditure account for the year ended 31 December 2016

Income :

Subscriptions 33700

Donations 15000

Total 48700

Expenditures :

Rates 1200

General expenses 28000

Repairs 8000

Depreciation expenses 6000 43200

Surplus of income over expenditures 5500

Accumulated fund at 31/12/2015 = 1400+40000+6000+2000 – 200 = 49200

Accumulated fund at 31/12/2015 = 1200+36000+4000+13800 – 300 = 54700 or = 49200 + 5500

You might also like

- HO and Branches Combined StatmentDocument5 pagesHO and Branches Combined Statmentmmh771984No ratings yet

- Cash Flow QN 3Document4 pagesCash Flow QN 3Takudzwa LanceNo ratings yet

- Financial Accounting AssignmentsDocument3 pagesFinancial Accounting AssignmentsMemes CreatorNo ratings yet

- Cash Flow StatementDocument4 pagesCash Flow StatementNarayan DhunganaNo ratings yet

- Work Sheet 1 PDFDocument9 pagesWork Sheet 1 PDFProtik SarkarNo ratings yet

- Sales Cost of Sales Opening Stock Purchases Carriage Inwards Import Duty Closing Stock Gross ProfitDocument6 pagesSales Cost of Sales Opening Stock Purchases Carriage Inwards Import Duty Closing Stock Gross ProfitSweets CheapNo ratings yet

- FinancialDocument15 pagesFinancialAdrià BurgellNo ratings yet

- Weller Company Cash FlowDocument3 pagesWeller Company Cash Flowsuske.uchiha2000No ratings yet

- FS With AdjustmentsDocument25 pagesFS With AdjustmentsBlack NightNo ratings yet

- ACCT6005 COMPANY ACCOUNTING ASSESSMENT 2 CASE STUDYDocument8 pagesACCT6005 COMPANY ACCOUNTING ASSESSMENT 2 CASE STUDYRuhan SinghNo ratings yet

- Weller Company Cash FlowDocument3 pagesWeller Company Cash FlowMd. Omar Sakib HossainNo ratings yet

- Financial Statement of DeliDocument5 pagesFinancial Statement of DeliBishowraj PariyarNo ratings yet

- Exercise Financial Statements Without AdjustmentsDocument3 pagesExercise Financial Statements Without AdjustmentsShahrillNo ratings yet

- Financial File: 1. Estimated BudgetDocument7 pagesFinancial File: 1. Estimated BudgetGhita TalhaNo ratings yet

- Income Statement and Balance SheetDocument8 pagesIncome Statement and Balance SheetAhmer NaeemNo ratings yet

- FA With AdjustmentsDocument14 pagesFA With AdjustmentsHarshini AkilandanNo ratings yet

- Prob 5 UnsolvedDocument3 pagesProb 5 UnsolvedBhushan ShirsathNo ratings yet

- Direct MethodDocument3 pagesDirect Methodانا و البحرNo ratings yet

- Fac2601-2013-6 - Answers PDFDocument9 pagesFac2601-2013-6 - Answers PDFcandiceNo ratings yet

- Chữa đề NLKT thầy Cường và đề EBBADocument12 pagesChữa đề NLKT thầy Cường và đề EBBATiêu Vân GiangNo ratings yet

- Trister Company FileDocument11 pagesTrister Company FilehljuristsinternationalNo ratings yet

- Answer No. 1: A. MaterialDocument4 pagesAnswer No. 1: A. MaterialFaroo wazirNo ratings yet

- Final AccountDocument4 pagesFinal AccountSunita BasakNo ratings yet

- Transactions Balance Sheet Assets Liabilities + Equity Cash Non - Cash Contra Asset Liabilities Earned CapitalDocument4 pagesTransactions Balance Sheet Assets Liabilities + Equity Cash Non - Cash Contra Asset Liabilities Earned CapitalSatish ReddyNo ratings yet

- Midterms MADocument10 pagesMidterms MAJustz LimNo ratings yet

- Audit CompletionDocument5 pagesAudit CompletionEunice CoronadoNo ratings yet

- Statement of Comprehensive Income Part 2Document8 pagesStatement of Comprehensive Income Part 2AG VenturesNo ratings yet

- Solution To Compiled QuestionsDocument7 pagesSolution To Compiled Questionslovia mensahNo ratings yet

- PROBLEM 2-45:: Particulars Case A Case B Case CDocument6 pagesPROBLEM 2-45:: Particulars Case A Case B Case CSrihari KumarNo ratings yet

- 2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)Document20 pages2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)ahmedNo ratings yet

- Project ACRDocument30 pagesProject ACRMuneeb KhalidNo ratings yet

- Jurnal Penutupan PENJUALAN dan Pengakuan RealisasiDocument2 pagesJurnal Penutupan PENJUALAN dan Pengakuan RealisasifaldyNo ratings yet

- Akl - Agung Prabowo - 02 - 5-3Document3 pagesAkl - Agung Prabowo - 02 - 5-3Agung PrabowoNo ratings yet

- Accounting RatiosDocument7 pagesAccounting Ratios27h4fbvsy8No ratings yet

- Solution Past Year Exam Financial Statements GCDocument12 pagesSolution Past Year Exam Financial Statements GCFara husnaNo ratings yet

- CostingDocument46 pagesCostingRaghav KhakholiaNo ratings yet

- Working Lecture 7Document17 pagesWorking Lecture 7Sara KarenNo ratings yet

- NirmalaDocument3 pagesNirmalaswamilpatniNo ratings yet

- Mock Exam 2 Suggested SolutionsDocument10 pagesMock Exam 2 Suggested SolutionsAna-Maria GhNo ratings yet

- California Dispensers Financial StatementsDocument9 pagesCalifornia Dispensers Financial StatementsHarsh MaheshwariNo ratings yet

- Accounting 2 CatDocument6 pagesAccounting 2 Catbobitnrb278223No ratings yet

- Solution: Computation of The FollowingDocument1 pageSolution: Computation of The FollowingherrajohnNo ratings yet

- DFNDFNDFNDFNDFDocument6 pagesDFNDFNDFNDFNDFMohammad Ibnu LapaolaNo ratings yet

- XYZ Company flexible budget and variance analysisDocument15 pagesXYZ Company flexible budget and variance analysisTanvir OnifNo ratings yet

- Intermediate Accounting 3 Part 1 Statement of Comprehensive Income ProblemsDocument7 pagesIntermediate Accounting 3 Part 1 Statement of Comprehensive Income ProblemsAG VenturesNo ratings yet

- Tutorial 1: Journal Entries and Basic Financial StatementsDocument5 pagesTutorial 1: Journal Entries and Basic Financial StatementsD SPNo ratings yet

- Cost Sheet Analysis TitleDocument7 pagesCost Sheet Analysis TitleShambhawi SinhaNo ratings yet

- Investment 80000 Cost Reduction 22000 Life 5 Salvage 20000 Tax 21% Discounting Rate 10%Document7 pagesInvestment 80000 Cost Reduction 22000 Life 5 Salvage 20000 Tax 21% Discounting Rate 10%Sneha DasNo ratings yet

- Prince Corporation Acquired 100 Percent of Sword CompanyDocument2 pagesPrince Corporation Acquired 100 Percent of Sword CompanyKailash Kumar50% (2)

- Jawaban P5-1Document3 pagesJawaban P5-1Nadillah LeicaNo ratings yet

- In The Books of Nil Kamal Ltd. Particulars 2012 2013 Change % ChangeDocument21 pagesIn The Books of Nil Kamal Ltd. Particulars 2012 2013 Change % ChangeRaj KamaniNo ratings yet

- Cost Sheet AnalysisDocument7 pagesCost Sheet AnalysisShambhawi SinhaNo ratings yet

- Ae 112 Prelim Assessment 1Document7 pagesAe 112 Prelim Assessment 1Chelssy ParadoNo ratings yet

- FAC1602 Exam PackDocument25 pagesFAC1602 Exam PackNthabeza De Ntha MogaleNo ratings yet

- Question 3 & 4Document6 pagesQuestion 3 & 4Usama KhalidNo ratings yet

- AC3097 Management Accounting - Preliminary Paper 2015 - AnswersDocument10 pagesAC3097 Management Accounting - Preliminary Paper 2015 - AnswersPei TingNo ratings yet

- Prelim Bring Home Exam ResultsDocument12 pagesPrelim Bring Home Exam ResultsMary Joy CabilNo ratings yet

- Financial Decision Making: Module Code: UMADFJ-15-MDocument9 pagesFinancial Decision Making: Module Code: UMADFJ-15-MFaraz BakhshNo ratings yet

- Common Size Statement Analysis PDF Notes 1Document10 pagesCommon Size Statement Analysis PDF Notes 124.7upskill Lakshmi V0% (1)

- 2 Balance Sheet Liquidity ProfitabilityDocument37 pages2 Balance Sheet Liquidity ProfitabilityBeatriz RodriguesNo ratings yet

- Should ASB accept KRSB's offer to supply wheelsDocument2 pagesShould ASB accept KRSB's offer to supply wheelsTeo ShengNo ratings yet

- Ratio Tell A StoryDocument5 pagesRatio Tell A Storyamatuer3293No ratings yet

- Entity Accounting Analysis: Thermo's Spinout StrategyDocument30 pagesEntity Accounting Analysis: Thermo's Spinout StrategyNguyễn LinhNo ratings yet

- FM Chapter 2 - Study TextDocument14 pagesFM Chapter 2 - Study Textirmaya.safitraNo ratings yet

- Samudera Indonesia TBK - 31 Mar 2023Document116 pagesSamudera Indonesia TBK - 31 Mar 2023damycenelNo ratings yet

- Elemente Ale Manage Mentul Lui Lanțului de Aprovizionare Livrare. Aspecte În Domeniul Militar. - 17 Oct 2019 - 17-19Document92 pagesElemente Ale Manage Mentul Lui Lanțului de Aprovizionare Livrare. Aspecte În Domeniul Militar. - 17 Oct 2019 - 17-19Marius SorinNo ratings yet

- Case Competition GuideDocument49 pagesCase Competition GuidexxNo ratings yet

- 2022 Ebmv301 TM2 MemoDocument7 pages2022 Ebmv301 TM2 MemoSouthNo ratings yet

- Ias 02 InventoryDocument11 pagesIas 02 InventoryÁnh Nguyễn Thị NgọcNo ratings yet

- FARAP 4406A Investment in Equity SecuritiesDocument8 pagesFARAP 4406A Investment in Equity SecuritiesLei PangilinanNo ratings yet

- NCAHS & Discontinued OperationsDocument2 pagesNCAHS & Discontinued Operations夜晨曦No ratings yet

- Build and Manage Your Investment PortfolioDocument39 pagesBuild and Manage Your Investment PortfolioLea AndreleiNo ratings yet

- UntitledDocument3 pagesUntitledKim VelascoNo ratings yet

- Accountancy 12th Sample Paper 2023-24Document11 pagesAccountancy 12th Sample Paper 2023-24thegeekchampNo ratings yet

- Task 2 (DD 24 Nov 23)Document2 pagesTask 2 (DD 24 Nov 23)LEW GEN HONG STUDENTNo ratings yet

- Sea Ltd. (SE) - Earnings Review - Upbeat Guidance, Strong Growth Buy (On CL)Document12 pagesSea Ltd. (SE) - Earnings Review - Upbeat Guidance, Strong Growth Buy (On CL)Poen, Chris ChouNo ratings yet

- Instant Download Ebook PDF Essentials of Investments 10th Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Essentials of Investments 10th Edition PDF Scribdcandace.greco74998% (45)

- Chapter 10 IFDocument25 pagesChapter 10 IFcuteserese roseNo ratings yet

- Jurnal Skripsi - Edwin GunawanDocument11 pagesJurnal Skripsi - Edwin GunawanEdwin GunawanNo ratings yet

- ABC Company Balance Sheet and Income Statement 2011-2010Document18 pagesABC Company Balance Sheet and Income Statement 2011-2010Annalyn SamaniegoNo ratings yet

- MP2 CalculatorDocument4 pagesMP2 CalculatorJeany NoquilloNo ratings yet

- Capital Budgeting-2Document6 pagesCapital Budgeting-2Kishan TCNo ratings yet

- CAPITAL BUDGETING HandoutDocument2 pagesCAPITAL BUDGETING HandoutAndrea TorcendeNo ratings yet

- Audit of Financial StatementsDocument3 pagesAudit of Financial StatementsGwyneth TorrefloresNo ratings yet

- Cvp-Analysis AbsvarcostingDocument13 pagesCvp-Analysis AbsvarcostingGwy PagdilaoNo ratings yet

- Speciality ChemicalsDocument32 pagesSpeciality ChemicalsKeshav KhetanNo ratings yet

- Cost of CapitalDocument26 pagesCost of CapitalShaza NaNo ratings yet

- FINC521-Most Important QuestionsDocument24 pagesFINC521-Most Important QuestionsAll rounder NitinNo ratings yet

- Evaluating forklift systems and capital projects using NPV, IRR, payback and other metricsDocument18 pagesEvaluating forklift systems and capital projects using NPV, IRR, payback and other metricsAn Hoài ThuNo ratings yet