Professional Documents

Culture Documents

Tax e Filing

Uploaded by

AishaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax e Filing

Uploaded by

AishaCopyright:

Available Formats

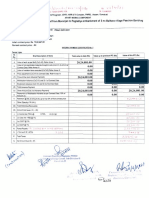

IRD(IT)-03-01(b)

Consolidated Capital Gains Tax Return according to

Tax Administration Law section 22 and Income Tax

Law section 17, subsection (a)

(for consolidated capital gains tax return for all capital gains transactions occurred in the income year 1 April 2022 to

31 March 2023)

A. Type of taxpayer: Tick applicable box ► □ Individual □ Company □ State-owned Economic Enterprise

□ Primary Cooperative □ Non-primary Cooperative

□ Another Association

B. Residency: Tick applicable box ► □ Myanmar Citizen □ Non-resident citizen

□ Non-resident foreigner

□ Resident foreigner - if an individual, enter number of days you

TAXPAYER DETAILS

were a resident during the year ► ______

C. Name of tax treaty country (if any) ► ______________________

D. Tick applicable box(es): □ Amended return for 2022-2023 income year

□ Change of address

□ Company is a participant in the oil and gas exploration and production

sector

Name TIN

Full name of spouse (if

TIN

married)

Postal address (including

postal code)

Physical address

Contact telephone number E-mail address

Customs IE Code Industry code

PART A

TOTAL CONSIDERATION RECEIVED

(a) Description of Assets Sold, Exchanged, or Transferred (b) Consideration received

1a. Shares and securities (enter description)

0.00

b. Land (enter description)

0.00

IRD(IT)-03-01(b) (31 Mar 2023) EN Page 1

c. Property, plant, and equipment (enter description)

0.00

d. Other assets (enter description)

0.00

2. Total consideration received (Add lines 1a+1b+1c+1d in column (b)) 0.00

PART B

TOTAL ADJUSTED COST

(a) (b) (c) (d) (e)

Assets Sold, Exchanged, or Transferred Original cost (or Allowed additions to Accumulated Totals

market value if original cost (or depreciation for the

applicable) market value if current and prior

applicable) years

1a. Shares and securities from Part A 0.00 0.00

b. Land from Part A 0.00 0.00

c. Property, plant, and equipment from Part A 0.00 0.00 0.00

d. Other assets from Part A 0.00 0.00 0.00

2. Add the amounts in each of columns (b),

0.00 0.00 0.00

(c), and (d)

3. Add columns (b) and (c) on line 2 0.00

4. Enter the amount from line 2, column (d) 0.00

5. Total adjusted cost. Line 3 minus line 4 0.00

PART C

NET CAPITAL GAINS & TAX DUE

1. Total consideration received. Enter the amount from Part A, line 2 0.00

2. Total adjusted cost. Enter the amount from Part B, line 5 0.00

3. Capital gains. Line 1 minus line 2. (If zero or less, enter -0-; do not complete the rest of this form. You do

0.00

not owe tax on net capital gains).

4. Net tax due. Multiply line 3 by 10%. Oil and natural gas sector companies, see instructions for the tax

0.00

rates that apply (attach bank receipt)

5. Total advance tax payments 0.00

6. Amount of tax overpaid last year carried forward to this year. 0.00

7. Balance due. Line 4 minus the sum of line 5 + line 6. If zero or less, enter -0-. 0.00

8. Amount overpaid. The sum of line 5 + line 6 minus line 4. If zero or less, enter -0-. The amount overpaid

will be refunded in accordance with the Section 43 of the Tax Administration Law. If there is a remaining

0.00

amount of overpayment after complying with the Section 43 of the Tax Administration Law and you want to

carry forward it to the next year, tick the box. ►□

IRD(IT)-03-01(b) (31 Mar 2023) EN Page 2

PART D

ADDITIONAL INFORMATION (tick the applicable box for each question)

1. Was any disposal of an asset between related parties or otherwise not at arm’s length? If “Yes,” attach a statement with

the name, address, and relationship to you of the related party or an explanation of the reason the disposal was not at □ Yes □ No

arm’s length.

2. Were any of the original acquisitions of assets between related parties or otherwise not at arm’s length? If “Yes,” attach

a statement with the name, address, and relationship to you of the related party or an explanation giving the reason the □ Yes □ No

acquisitions were not at arm’s length.

3. Was the market value substituted for the cost of acquisition of any assets disposed of? If “Yes,” attach a statement

□ Yes □ No

explaining why market value was substituted (for example, the transfer was a gift or inheritance).

Declaration of Paid Preparer (Skip this section if there is no paid preparer.)

Based on all information of which I have any knowledge, I declare that to the best of my knowledge and belief, the information given on this

return is correct and complete.

(Note: Submission of false documents is a violation of Section 177, Myanmar Penal Code.)

Signature of paid

Date (DD/MM/YYYY)

preparer

Name of paid preparer TIN

Firm’s name

Firm’s address

Firm’s TIN

Contact telephone

E-mail address

number

Declaration of Taxpayer or Representative

Based on all information of which I have any knowledge, I declare that to the best of my knowledge and belief, the information given on this

return is correct and complete.,

(Note: Submission of false documents is a violation of Section 177, Myanmar Penal Code.)

Signature Date (DD/MM/YYYY)

If you are signing this form on behalf of an

association of persons, a Government organization,

Your title

or a legally incapacitated person, print your full

name

IRD(IT)-03-01(b) (31 Mar 2023) EN Page 3

You might also like

- 2020-2021 Transaction CapitalGains 6nov2020Document3 pages2020-2021 Transaction CapitalGains 6nov2020Wint PaingNo ratings yet

- 22-23 Annual IT 02052023 0210pmDocument8 pages22-23 Annual IT 02052023 0210pmWint PaingNo ratings yet

- 21 22-Annual IT 22mar2022 1155pmDocument8 pages21 22-Annual IT 22mar2022 1155pmWint PaingNo ratings yet

- 2019-2020 Associations Income Tax Return - 2dec - 3PMDocument10 pages2019-2020 Associations Income Tax Return - 2dec - 3PMMYO KO KONo ratings yet

- GSTR9 33dgwpp5135e1z4 032021Document8 pagesGSTR9 33dgwpp5135e1z4 032021newquper2022No ratings yet

- 20-21 CT Annual 24nov2021Document3 pages20-21 CT Annual 24nov2021Wint PaingNo ratings yet

- GSTR9 09abepk8302l1zh 032018Document8 pagesGSTR9 09abepk8302l1zh 032018Capraful PrabhakaranNo ratings yet

- 2017-2018 Associations Income Tax Return With Instructions - EnglishDocument18 pages2017-2018 Associations Income Tax Return With Instructions - EnglishAung Aung OoNo ratings yet

- GSTR9 09aaact9363l1zq 032023Document8 pagesGSTR9 09aaact9363l1zq 032023sachinkumar.rkcjNo ratings yet

- 2022-2023 - Associations - IT Return (Eng)Document20 pages2022-2023 - Associations - IT Return (Eng)fimolec598No ratings yet

- GSTR9 19GCBPS5582Q1ZH 032023Document8 pagesGSTR9 19GCBPS5582Q1ZH 032023nirmalku2061No ratings yet

- GSTR9 27aahcb1010d1zg 032023Document8 pagesGSTR9 27aahcb1010d1zg 032023arpindlavNo ratings yet

- FIN AL: Form GSTR-9Document8 pagesFIN AL: Form GSTR-9RM PlusNo ratings yet

- GSTR9 29aaqfm8617b1zz 032022Document8 pagesGSTR9 29aaqfm8617b1zz 032022helloNo ratings yet

- GSTR9 07balps3408q1z0 032023Document4 pagesGSTR9 07balps3408q1z0 032023RINKOO SHARMANo ratings yet

- GSTR9 33aahcb1010d1zn 032023Document8 pagesGSTR9 33aahcb1010d1zn 032023arpindlavNo ratings yet

- GSTR9 29aahcv2115k1z5 032020Document8 pagesGSTR9 29aahcv2115k1z5 032020MICO EMPLOYEES CO OPERATIVE SOCIETY LTDNo ratings yet

- GSTR9 23apjps3159l1zg 032022Document8 pagesGSTR9 23apjps3159l1zg 032022sales candoNo ratings yet

- 19 CT Annual 18dec19 11.09AMDocument2 pages19 CT Annual 18dec19 11.09AMWUTYI THINNNo ratings yet

- Form IR2 4Document3 pagesForm IR2 4khaingshwe wutyiNo ratings yet

- GSTR9 33AAACA7962L1ZH 032022-FinalDocument8 pagesGSTR9 33AAACA7962L1ZH 032022-FinalVASUMATHY SURESHNo ratings yet

- GSTR9 19anypg3791m1zy 032022 PDFDocument8 pagesGSTR9 19anypg3791m1zy 032022 PDFManprit MahalNo ratings yet

- GSTR9 10JHBPS7007C1ZR 032019Document8 pagesGSTR9 10JHBPS7007C1ZR 032019karanNo ratings yet

- Form 8582Document3 pagesForm 8582Mira HuNo ratings yet

- GSTR9 08aaafu3205h1zh 032022Document8 pagesGSTR9 08aaafu3205h1zh 032022Deepanshu AgarwalNo ratings yet

- FIN AL: Form GSTR-9Document8 pagesFIN AL: Form GSTR-9mani samiNo ratings yet

- GSTR9 09bwbpk7755a1zk 032021Document8 pagesGSTR9 09bwbpk7755a1zk 032021Ankit JainNo ratings yet

- GSTR9Document8 pagesGSTR9legendry007No ratings yet

- Econ 2017 Spec Paper 1Document12 pagesEcon 2017 Spec Paper 1Ronaldo Taylor67% (3)

- 18-19 - CT - Annual - 19dec19 - 05.35PM - SEE & Financial InstitutionDocument2 pages18-19 - CT - Annual - 19dec19 - 05.35PM - SEE & Financial InstitutionWUTYI THINNNo ratings yet

- GSTR9 29aahcv2115k1z5 032021Document8 pagesGSTR9 29aahcv2115k1z5 032021MICO EMPLOYEES CO OPERATIVE SOCIETY LTDNo ratings yet

- Form PDF 274600500220623Document9 pagesForm PDF 274600500220623vikash pandeyNo ratings yet

- 19BLWPH6736C1ZO_122022_GSTR-3B MDocument4 pages19BLWPH6736C1ZO_122022_GSTR-3B MSheksNo ratings yet

- MCQ MathDocument173 pagesMCQ Mathlavyamehta007No ratings yet

- JTTTTTTDocument2 pagesJTTTTTTpkrawat208No ratings yet

- Form 16 Salary DetailsDocument2 pagesForm 16 Salary DetailsSanjay DuaNo ratings yet

- 2019-01-24-Amit Swaroop - Atgps5835e - 2018Document8 pages2019-01-24-Amit Swaroop - Atgps5835e - 2018ApoorvNo ratings yet

- 19BLWPH6736C1ZO_112022_GSTR-3B MDocument4 pages19BLWPH6736C1ZO_112022_GSTR-3B MSheksNo ratings yet

- Annexure III&IIIA-Form12C&ComputationSheetDocument2 pagesAnnexure III&IIIA-Form12C&ComputationSheetBhooma Shayan100% (1)

- 2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFDocument5 pages2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFMohammed MaazNo ratings yet

- Annexure III&IIIA Form12C&ComputationSheetDocument2 pagesAnnexure III&IIIA Form12C&ComputationSheetkalpNo ratings yet

- ITR-1 Acknowledgement for Salaried IndividualDocument8 pagesITR-1 Acknowledgement for Salaried Individualsuhail amirNo ratings yet

- US Internal Revenue Service: f6781 - 2002Document3 pagesUS Internal Revenue Service: f6781 - 2002IRSNo ratings yet

- GSTR9 22aabcn2864p1z7 032018Document8 pagesGSTR9 22aabcn2864p1z7 032018Sumit K JhaNo ratings yet

- Form_pdf_159884980300324Document12 pagesForm_pdf_159884980300324uday.jee1No ratings yet

- (Attach Additional Sheet, If Necessary) : Useful Life or 60 Mos. (Whichever Is Shorter)Document3 pages(Attach Additional Sheet, If Necessary) : Useful Life or 60 Mos. (Whichever Is Shorter)commoNo ratings yet

- Construction progress and payment certificate for road projectDocument8 pagesConstruction progress and payment certificate for road projectMriganka BorahNo ratings yet

- Construction progress and payment certificate for road projectDocument21 pagesConstruction progress and payment certificate for road projectMriganka BorahNo ratings yet

- US Internal Revenue Service: f6781 - 2001Document3 pagesUS Internal Revenue Service: f6781 - 2001IRSNo ratings yet

- 19BLWPH6736C1ZO_022023_GSTR-3B MDocument4 pages19BLWPH6736C1ZO_022023_GSTR-3B MSheksNo ratings yet

- 2018 07 14 18 04 09 892 - 1041233281Document6 pages2018 07 14 18 04 09 892 - 1041233281nibeditapompy7314No ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Pradip kr BhattacharyaNo ratings yet

- US Internal Revenue Service: F1120icd - 2000Document6 pagesUS Internal Revenue Service: F1120icd - 2000IRSNo ratings yet

- 21-22 Annual CT 19042022 0402pmDocument3 pages21-22 Annual CT 19042022 0402pmWint PaingNo ratings yet

- Form PDF 401621100220322Document6 pagesForm PDF 401621100220322Aravai BDONo ratings yet

- Form 16 Salary CertificateDocument3 pagesForm 16 Salary CertificateDeeptimayee SahooNo ratings yet

- c91cdcb0-2b62-4b4a-9f3a-c2f82124965bDocument11 pagesc91cdcb0-2b62-4b4a-9f3a-c2f82124965bAvnish KhuranaNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Part A General InformationDocument6 pagesItr-1 Sahaj Indian Income Tax Return: Part A General InformationRajatGuptaNo ratings yet

- POMI SampleDocument223 pagesPOMI SampleJayathu SandaruwanNo ratings yet

- Theories on Government Spending and Fiscal PolicyDocument2 pagesTheories on Government Spending and Fiscal PolicyFaidah Palawan AlawiNo ratings yet

- Guild or Shrenis in IndiaDocument10 pagesGuild or Shrenis in Indiaramashankar10No ratings yet

- Depreciation, Depletion and ITC: 1 - Principles of AccountingDocument11 pagesDepreciation, Depletion and ITC: 1 - Principles of AccountingAthena Satria TumambingNo ratings yet

- Chapter 16Document17 pagesChapter 16Punit SharmaNo ratings yet

- Oct 2022 Profit and Loss Report for NiagawanDocument1 pageOct 2022 Profit and Loss Report for NiagawanNM SOLUTIONNo ratings yet

- BIR Form Certificate of Final Tax WithheldDocument2 pagesBIR Form Certificate of Final Tax WithheldBarangay SamputNo ratings yet

- Using ReceivingDocument94 pagesUsing ReceivingPavlina StoqnovaNo ratings yet

- Tax Invoice: Transportation Charges On Sale Output CGST Output SGST Round OffDocument1 pageTax Invoice: Transportation Charges On Sale Output CGST Output SGST Round OffAlfiyaNo ratings yet

- YogSandesh October Eng2011Document66 pagesYogSandesh October Eng2011Manmohan Gupta100% (1)

- Achievable NationhoodDocument298 pagesAchievable NationhoodNadeem100% (1)

- Sa6 Pu 14 PDFDocument118 pagesSa6 Pu 14 PDFPolelarNo ratings yet

- Case C-145 18 Regards Photographiques SARLDocument2 pagesCase C-145 18 Regards Photographiques SARLDanielaAdrianaNeagoeNo ratings yet

- Poland JPK - Surprise Slides-V4Document21 pagesPoland JPK - Surprise Slides-V4Hans KolbeNo ratings yet

- EUROPEAN HISTORY COPY 2019 - by mr-1 PDFDocument467 pagesEUROPEAN HISTORY COPY 2019 - by mr-1 PDFRichard Simon KisituNo ratings yet

- Basco Vs Pagcor (G.r. No. 91649, May 14, 1991)Document10 pagesBasco Vs Pagcor (G.r. No. 91649, May 14, 1991)Carlota Nicolas VillaromanNo ratings yet

- Declaration of Covenants & Restrictions 1977Document14 pagesDeclaration of Covenants & Restrictions 1977PAAWS2No ratings yet

- Pno: Name: Raghuver Singh Rank: HC CP Unit: Hardoi P Slip Nov-2021 GPF No: Pli No: Nps A/C: Bank: A/C No: Recovery DetailsDocument1 pagePno: Name: Raghuver Singh Rank: HC CP Unit: Hardoi P Slip Nov-2021 GPF No: Pli No: Nps A/C: Bank: A/C No: Recovery Detailsjitendra kumarNo ratings yet

- Application For Exemption of Customs DutyDocument10 pagesApplication For Exemption of Customs DutyFahad BataviaNo ratings yet

- Excise Tax: Major Classification of Excisable Articles and Related Codal SectionDocument1 pageExcise Tax: Major Classification of Excisable Articles and Related Codal SectionolafedNo ratings yet

- Research 1 QuestionDocument7 pagesResearch 1 Questiondoom zy100% (1)

- Simcity 3000 TipsDocument26 pagesSimcity 3000 TipsArslan YousafNo ratings yet

- Steps in Transferring TitleDocument4 pagesSteps in Transferring TitleMJ PerryNo ratings yet

- FY 2018 Proposed BudgetDocument312 pagesFY 2018 Proposed BudgetinForney.comNo ratings yet

- Laws on Military Base ConversionDocument263 pagesLaws on Military Base ConversionJojo Aboyme Corcilles100% (2)

- Massachusetts Last Will and Testament TemplateDocument5 pagesMassachusetts Last Will and Testament TemplateRamana DaliparthyNo ratings yet

- Cir vs. William SuterDocument1 pageCir vs. William SuterIrish LlarenasNo ratings yet

- QMar2013 Financials of Relieance WeavingDocument20 pagesQMar2013 Financials of Relieance WeavingTauraabNo ratings yet

- EAC Customs Valuation ManualDocument111 pagesEAC Customs Valuation Manualrodgerlutalo100% (1)

- Taxation Law Review Final ExaminationsDocument4 pagesTaxation Law Review Final ExaminationsRufino Gerard MorenoNo ratings yet