Professional Documents

Culture Documents

Notes - Chapter 7 - Unit

Notes - Chapter 7 - Unit

Uploaded by

priya.shambhavi20030 ratings0% found this document useful (0 votes)

6 views4 pagesThis document summarizes a virtual coaching class on preparing final accounts for sole proprietors. It discusses the preparation of a manufacturing account, which is required for manufacturing entities before preparing the trading account. The manufacturing account records all manufacturing costs such as raw materials, wages, direct and indirect expenses. It also takes into account opening and closing stocks of raw materials and work-in-progress. The net result of the manufacturing account is the cost of goods sold, which is then used in the trading account. An illustration is provided to demonstrate how to prepare the manufacturing account.

Original Description:

Good resource

Original Title

PPT_notes_chapter 7_Unit

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes a virtual coaching class on preparing final accounts for sole proprietors. It discusses the preparation of a manufacturing account, which is required for manufacturing entities before preparing the trading account. The manufacturing account records all manufacturing costs such as raw materials, wages, direct and indirect expenses. It also takes into account opening and closing stocks of raw materials and work-in-progress. The net result of the manufacturing account is the cost of goods sold, which is then used in the trading account. An illustration is provided to demonstrate how to prepare the manufacturing account.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views4 pagesNotes - Chapter 7 - Unit

Notes - Chapter 7 - Unit

Uploaded by

priya.shambhavi2003This document summarizes a virtual coaching class on preparing final accounts for sole proprietors. It discusses the preparation of a manufacturing account, which is required for manufacturing entities before preparing the trading account. The manufacturing account records all manufacturing costs such as raw materials, wages, direct and indirect expenses. It also takes into account opening and closing stocks of raw materials and work-in-progress. The net result of the manufacturing account is the cost of goods sold, which is then used in the trading account. An illustration is provided to demonstrate how to prepare the manufacturing account.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

Date: 01 July 2020

VIRTUAL COACHING CLASSES

ORGANISED BY BOS, ICAI

FOUNDATION LEVEL

PAPER 1: PRINCIPLES AND PRATICE OF

ACCOUNTING

Faculty: CA VS Hiranmai

© The Institute of Chartered Accountants of India

CHAPTER 7- Preparation of final accounts

of sole proprietors- Unit 2

• This chapter has 2 units wherein the Unit 1 deals with final accounts of non-manufacturing

entities where we need to prepare the Trading, Profit and loss account and the Balance sheet.

• This unit entirely deals with manufacturing entities, where in before preparing the trading

account, we need to prepare another account called as the manufacturing account.

•Manufacturing account shows the Cost of goods sold as the final result. This includes the raw

material stock, work in progress stock and the finished goods stock also.

•Manufacturing costs = Raw materials consumed+ direct wages+ direct expenses+ direct costs+

Indirect expenses.

•Raw materials consumed= Opening stock of raw materials+ purchases during the period-

closing stock of raw material.

© THE INSTITUTE OF CHARTERED ACCOUNTANTS OF

12 March 2021 INDIA

2

CHAPTER 7- Preparation of final accounts

of sole proprietors- Unit 2

• Under this chapter- we are required to prepare the manufacturing account- where in all the

expenses are debited and the closing stocks are credited.

•We can have stock with regard to raw materials and WIP mainly, which are to be debited.

Wages, other direct expenses like power , rent of factory to be debited. The Other indirect

expenses like hire charges of the machinery or factory and royalty to be paid in case of use of

technology of others- they will be charged on unit basis.

•The closing stock of WIP to be credited and if there is any by-product- the sale value also should

be credited to the manufacturing account.

•The units and the amount to be written in the manufacturing account. There is only one

illustration 2 which has been asked in the exam too.

© THE INSTITUTE OF CHARTERED ACCOUNTANTS OF

12 March 2021 INDIA

3

THANK YOU

12 March 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 4

You might also like

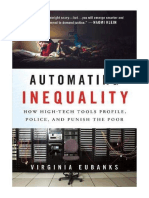

- Automating Inequality: How High-Tech Tools Profile, Police, and Punish The Poor - Virginia EubanksDocument6 pagesAutomating Inequality: How High-Tech Tools Profile, Police, and Punish The Poor - Virginia Eubankshixadaco0% (1)

- Malice and Want of Probable Cause As Element or Factor of Action For False ImpriDocument136 pagesMalice and Want of Probable Cause As Element or Factor of Action For False ImpriJamie FlicksNo ratings yet

- MPBF PresentationDocument28 pagesMPBF PresentationAbinash BiswalNo ratings yet

- ACC 101 - Module 7Document14 pagesACC 101 - Module 7Rhian BarzanaNo ratings yet

- Merchandising and ManufacturingDocument23 pagesMerchandising and ManufacturingARABELLA CLARICE JIMENEZNo ratings yet

- 2-Understanding Financial StatementsDocument5 pages2-Understanding Financial StatementsanuNo ratings yet

- Ch.19 Managerial Accounting: Chapter Learning ObjectiveDocument11 pagesCh.19 Managerial Accounting: Chapter Learning ObjectiveIntan ParamithaNo ratings yet

- Instruction Sheet Applicant (EN)Document9 pagesInstruction Sheet Applicant (EN)vaibhav kudaleNo ratings yet

- Moderator: Mr. L.J. Muthivhi (CA), SADocument11 pagesModerator: Mr. L.J. Muthivhi (CA), SANhlanhla MsizaNo ratings yet

- Basic Financial Model - User ManualDocument5 pagesBasic Financial Model - User ManualnexoseNo ratings yet

- Job, Batch and Service CostingDocument22 pagesJob, Batch and Service CostingSanjeev JayaratnaNo ratings yet

- Learning Guide: Accounts and Budget ServiceDocument20 pagesLearning Guide: Accounts and Budget ServiceMitiku Berhanu100% (3)

- Special and Combination JournalsDocument8 pagesSpecial and Combination Journalsreagan blaireNo ratings yet

- Cost Accounting SystemDocument64 pagesCost Accounting Systemaparna bingi0% (1)

- Lecture Inventory ValuationDocument20 pagesLecture Inventory ValuationNeha singhNo ratings yet

- Cost Accounting Systems: Learning OutcomesDocument61 pagesCost Accounting Systems: Learning OutcomesHari AdabalaNo ratings yet

- OST Ccounting Ystems: After Studying This Chapter, You Would Be Able ToDocument63 pagesOST Ccounting Ystems: After Studying This Chapter, You Would Be Able TotempNo ratings yet

- ACCT 4200 Project Transactions Final 2022Document4 pagesACCT 4200 Project Transactions Final 2022Jaspal SinghNo ratings yet

- Cost Accounting SystemDocument61 pagesCost Accounting SystemjayakumarNo ratings yet

- Chapter 5 Non Integrated AccountsDocument52 pagesChapter 5 Non Integrated AccountsmahendrabpatelNo ratings yet

- Est & Main Accrual Acc Sys L4Document20 pagesEst & Main Accrual Acc Sys L4nahu a dinNo ratings yet

- Chapter - 6: © The Institute of Chartered Accountants of IndiaDocument56 pagesChapter - 6: © The Institute of Chartered Accountants of IndiaArvind RamanujanNo ratings yet

- 2 Final Acc. Manu.Document24 pages2 Final Acc. Manu.caprerna2022No ratings yet

- Act 202 SS5Document24 pagesAct 202 SS5estherNo ratings yet

- Integrated Accounting SystemsDocument15 pagesIntegrated Accounting SystemsSanjeev JayaratnaNo ratings yet

- nguyên lí kế toán assignmentDocument10 pagesnguyên lí kế toán assignmentAnh Hoàng TrọngNo ratings yet

- Accounting A Level Notes 9706Document45 pagesAccounting A Level Notes 9706shabanaNo ratings yet

- Accountancy and Auditing 2-2011Document7 pagesAccountancy and Auditing 2-2011Muhammad BilalNo ratings yet

- Luminus Education: - Assignment Brief (RQF)Document15 pagesLuminus Education: - Assignment Brief (RQF)Tawfiq Nassoura0% (1)

- Acct 202 Ch1Document24 pagesAcct 202 Ch1Hieu DamNo ratings yet

- Chapter 2 - Financial, Managerial Accounting and ReportingDocument27 pagesChapter 2 - Financial, Managerial Accounting and ReportingBinish JavedNo ratings yet

- Faculty Name - Sandeep Bhatiya: Financial Accounting FundamentalDocument34 pagesFaculty Name - Sandeep Bhatiya: Financial Accounting FundamentalNamrata PrasadNo ratings yet

- Review Chapter 4 and Chapter 5Document17 pagesReview Chapter 4 and Chapter 5Khánh PhươngNo ratings yet

- Chapter 6 Preparation of Final Accounts of Sole Proprietors PDFDocument56 pagesChapter 6 Preparation of Final Accounts of Sole Proprietors PDFBabalss MishraNo ratings yet

- Financial Accounting WorkBook ICMRDocument368 pagesFinancial Accounting WorkBook ICMRSarthak Gupta75% (4)

- LP4 - Accounting For Job Order Costing-2Document4 pagesLP4 - Accounting For Job Order Costing-2Ciana SacdalanNo ratings yet

- Accounts & Adv Account BookDocument308 pagesAccounts & Adv Account Bookvishnuverma100% (1)

- 2230 RTP CA PCC - Paper 4 Cost Accounting and Financial ManagementDocument41 pages2230 RTP CA PCC - Paper 4 Cost Accounting and Financial ManagementNaveen R HegadeNo ratings yet

- MODULE 5 Learning Activity 1-3Document1 pageMODULE 5 Learning Activity 1-3Regina PhalangeNo ratings yet

- Unit 19 Accounting and Financial Statement Pre-Reading Tasks DiscussionDocument3 pagesUnit 19 Accounting and Financial Statement Pre-Reading Tasks DiscussionTrúc Đan HồNo ratings yet

- Accounting For Manufacturing ActivitiesDocument6 pagesAccounting For Manufacturing ActivitiesshawtyNo ratings yet

- Ch03 - The adjusting process đã chuyển đổiDocument26 pagesCh03 - The adjusting process đã chuyển đổiNguyễn Quốc KiệtNo ratings yet

- NON INTEGRATED TheoryDocument26 pagesNON INTEGRATED TheorySushant MaskeyNo ratings yet

- Accounting AssignmentDocument6 pagesAccounting Assignmentsaminder reddyNo ratings yet

- Cost System: Process CostingDocument19 pagesCost System: Process CostingMohamed Ahmed RammadanNo ratings yet

- Note Buổi 7Document3 pagesNote Buổi 7Long Chế Vũ BảoNo ratings yet

- FA Materials - Chapter 8Document18 pagesFA Materials - Chapter 8Nazrin HasanzadehNo ratings yet

- CHAPTER 04-Job CostingDocument30 pagesCHAPTER 04-Job CostingRaina RajNo ratings yet

- Financial Accounting (1st Semester)Document143 pagesFinancial Accounting (1st Semester)ngodisha07No ratings yet

- AMITY Business School: Cost Accounting Nupur AgarwalDocument41 pagesAMITY Business School: Cost Accounting Nupur AgarwalNupur AgarwalNo ratings yet

- 03 Cost BehaviorDocument71 pages03 Cost BehaviorKrizah Marie CaballeroNo ratings yet

- ABM 1 Q1-Week 8 For Teacher1Document14 pagesABM 1 Q1-Week 8 For Teacher1Kassandra Kay De Roxas100% (1)

- PFS: Financial Aspect - Investment CostsDocument11 pagesPFS: Financial Aspect - Investment CostsSheena Cadiz FortinNo ratings yet

- CS ACCT 11 - Journalizing, Posting and Preparation of Trial BalanceDocument19 pagesCS ACCT 11 - Journalizing, Posting and Preparation of Trial BalanceDanica del RosarioNo ratings yet

- ACCOUNTANCY (Code No. 055)Document2 pagesACCOUNTANCY (Code No. 055)Ashish GangwalNo ratings yet

- 37 Paper1AccountingModule2Document289 pages37 Paper1AccountingModule2neha mundra100% (1)

- Accounting Standards Board (ASB) in 1977Document15 pagesAccounting Standards Board (ASB) in 1977amit kathaitNo ratings yet

- CenvatDocument10 pagesCenvatincometaxreckonerNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Alternative Liquidity Index Announces Offer To Purchase Shares in TreeCon Resources, Inc.Document2 pagesAlternative Liquidity Index Announces Offer To Purchase Shares in TreeCon Resources, Inc.PR.comNo ratings yet

- Introduction To The Philosophy of The Human Person Quarter 2 Module 3Document3 pagesIntroduction To The Philosophy of The Human Person Quarter 2 Module 3Ericka Rivera SantosNo ratings yet

- Research Proposal On The Impact of Covid-19 On Gender Relations Among Households in DelhiDocument13 pagesResearch Proposal On The Impact of Covid-19 On Gender Relations Among Households in DelhiKunjanNo ratings yet

- Assignment 2 and 3 COLREGDocument19 pagesAssignment 2 and 3 COLREGaprilNo ratings yet

- The Rebellious Game The Power of Football in The Middle East and North Africa Between The Global and The LocalDocument18 pagesThe Rebellious Game The Power of Football in The Middle East and North Africa Between The Global and The LocalOlaf DucalNo ratings yet

- PPT2-Corporate Governance and Strategic Management IssuesDocument26 pagesPPT2-Corporate Governance and Strategic Management IssuesRizaldi MaulanaNo ratings yet

- Incident Report TemplateDocument2 pagesIncident Report TemplateMostafa AbdullahNo ratings yet

- Adani Vs HindenburgDocument6 pagesAdani Vs HindenburgAnmol SinhaNo ratings yet

- DSWD EndorsedDocument19 pagesDSWD EndorsedmennaldzNo ratings yet

- Commonwealth Literature EngDocument13 pagesCommonwealth Literature EngFurti FizaNo ratings yet

- Introduction To Politics and GovernanceDocument19 pagesIntroduction To Politics and GovernanceIsh Guidote100% (11)

- Judicial Precedent As A Source of LawDocument43 pagesJudicial Precedent As A Source of LawshayneyyNo ratings yet

- China Banking Corporation VDocument2 pagesChina Banking Corporation VJustin Luis JalandoniNo ratings yet

- 1L Contracts OutlineDocument36 pages1L Contracts Outlinekkiss18No ratings yet

- Kachru Model "The Three Circles of English" - by Ana Valpa - MediumDocument5 pagesKachru Model "The Three Circles of English" - by Ana Valpa - MediumAminul Islam JoyNo ratings yet

- Strange BedfellowsDocument36 pagesStrange BedfellowsIssa JaffNo ratings yet

- Dissertation - Legality of Shell Companies As Per Company's Law Lib ReviewDocument46 pagesDissertation - Legality of Shell Companies As Per Company's Law Lib Reviewabhay kaulNo ratings yet

- Bard Subclass - College of MetalDocument5 pagesBard Subclass - College of Metalgabrielcostayah10No ratings yet

- Affidavit For Preliminary AttachmentDocument1 pageAffidavit For Preliminary AttachmentRached Piamonte Rondina100% (1)

- LBJDocument2 pagesLBJbog macNo ratings yet

- 13 Baleros v. People G.R. No. 138033 February 22, 2006Document1 page13 Baleros v. People G.R. No. 138033 February 22, 2006RexNo ratings yet

- ΙΔ ΑΥΤΟΝΟΜΙΑ ΕΡΓΑΣΙΑDocument6 pagesΙΔ ΑΥΤΟΝΟΜΙΑ ΕΡΓΑΣΙΑkaldisalexNo ratings yet

- Revised Format of SH-4Document2 pagesRevised Format of SH-4legal shuruNo ratings yet

- 16 PGLEL Mentoring Personal Guide FELLOW CRAFT v1 01F PDFDocument22 pages16 PGLEL Mentoring Personal Guide FELLOW CRAFT v1 01F PDFLeonardo RedaelliNo ratings yet

- Letter No 008 Reply by Authority EngineerDocument8 pagesLetter No 008 Reply by Authority EngineerAbhishek BhandariNo ratings yet

- Linsangan Vs TolentinoDocument2 pagesLinsangan Vs TolentinoDaphne RodriguezNo ratings yet

- Dera Baba Bhumman Shah Sangar Sarista Vs Dr. Subhash NarulaDocument2 pagesDera Baba Bhumman Shah Sangar Sarista Vs Dr. Subhash NarulaDolphinNo ratings yet

- Authority Matrix 17.07.2023Document12 pagesAuthority Matrix 17.07.2023tejasj171484No ratings yet