Professional Documents

Culture Documents

MS - Accountancy - 12-Practice Paper-1

Uploaded by

Arun kumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MS - Accountancy - 12-Practice Paper-1

Uploaded by

Arun kumarCopyright:

Available Formats

Practice Paper 1 Marking Scheme – Accountancy XII MARKS

1. (a) 41 : 7 : 12 1

2. (d) A is incorrect but R is correct. 1

3. (b) Issuing fully paid bonus shares 1

OR

(d) Credited by ₹2,000

4. (a) ₹ 18,000, ₹ 18,000 and ₹ 9,000 1

OR

(d) Sam needs to return Rs.5,50,000 to the firm

5. (a) ₹26,267 for Partner B and C and ₹27,466 for Partner A. 1

6. 1

7. (a) ₹ 21,000 1

8. (b) ₹20,000 & ₹30,000 1

OR

(a)₹1,00,000

9. (c) ₹ 15,000 1

10. (d) Anu ₹ 45,000; Charu ₹ 30,000; Divya ₹ 75,000 1

11. (c) do not contribute any capital and without having any interest in the business, 1

lend their name to the business

12. (a) Both Assertion (A) and Reason (R) are Correct and Reason (R) is the correct 1

explanation of Assertion (A)

13. (c) 2,000 shares 1

14. (b) ₹45,000 1

15. (c) ₹1,500 1

OR

(a) Ayan- Rs. 1,800, Azan- Rs.3,300, Aqib- Rs. 6,000

16. (c) Cash Account by ₹9,900 1

17. In the books of Abhay, Bheem and Chunnu

Journal

DATE PARTICULARS L.F. DEBIT ₹ CREDIT ₹

2019 Bheem’s Current A/c Dr. 1000 1

MARCH Chunnu’s Current A/c Dr. 4000

31 To Abhay’s Current A/c 5,000

(Being omission of interest on

capital for three years rectified) 1

Statement showing Adjustment to be made

Particulars Abhay ₹ Bheem ₹ Chunnu ₹ Total ₹

Interest on capital to be 30,000 24,000 21,000 75,000 1

credited

Amount of profit already 25,000 25,000 25,000 75000 1+1+1=3

credited, to be debited

now

Net Effect (Cr.)5,000 (Dr.)1,000 (Dr.)4,000 ---------

OR

Profit & Loss Appropriation A/c for the year ended on March 31, 2022

PARTICULARS ₹ PARTICULARS ₹

To Interest on Capital A/c By P & L A/c 23,800 3

Arun -3,000 (₹26,800-₹3,000)

Barun-1,800 4,800

To Salary A/c

Barun 4,000

To Profit transferred to

Partners’ Capital A/c: Arun

-9,000

Barun-6,000 15,000

23,800 23,800

18. Total Assets of the firm (Sundry Assets + Stock) = 1,00,000+ 20,000= ₹1,20,000

Current Liabilities of the firm = ₹10,000

Capital Employed = Total Assets - Current Liabilities

=1,20,000- 10,000= ₹1,10,000

Normal Profits = Capital Employed x Normal Rate of Return

1000

=1,10,000 × 8 = ₹ 8,800

100 3marks

Goodwill= Super Profits x No. of years of purchase

60,000= Super Profits × 4

Super Profits = 60,000 = ₹15,000

4

Super Profits= Average Actual Profits- Normal Profits

15,000 =Average Actual Profits - 8,800

Average Actual Profits = 15,000 +8,800 = ₹23,800

19.

DATE PARTICULARS L.F. DEBIT ₹ CREDIT ₹

Assets A/c Dr. 10,00,000

Goodwill A/c Dr. 60,000

To Liabilities A/c 1,70,000 3marks

To Healthy World ltd. (Being 8,90,000

assets and liability taken over)

Healthy World Ltd. Dr. 8,90,000

Loss on issue of Debentures A/c 80,000

Dr.

To 8% Debentures A/c 8,00,000

To Securities Premium A/c 40,000

To Premium on redemption A/c 80,000

To Bank A/c 50,000

(Being Purchase consideration

discharged by issue of Debentures

and in Cash)

3

OR

BOOKS OF RANDOM LTD.

JOURNAL

DATE PARTICULARS L.F. DEBIT ₹ CREDIT ₹

Assets A/c Dr. 45,00,000 3marks

To Liabilities A/c 6,40,000

To Mature Ltd. A/c 36,00,000

To Capital Reserve A/c 2,60,000

(Business purchased)

Mature ltd A/c Dr. 36,00,000

To bank A/c 1,50,000

To 12% preference share 30,00,000

capital A/c

To securities premium A/c 4,50,000

20. JOURNAL 4marks

DATE PARTICULARS L.F. DEBIT CREDIT

₹ ₹

2018 Z’s Capital A/c 5400

APRI Dr. 5400

L1 To X’s Capital A/c

(Adjustment entry passed)

Net Amount to be adjusted= 6000+24000-12000= ₹18,000

Calculation of Sacrificing (or Gaining ratio)

X’s share= 5/10-2/10=3/10

Y’s share= 3/10-3/10=0 nil

Z’s share= 2/10- 5/10= -3/10

Amount to be debited to Z’s Capital A/c= 18,000*3/10= ₹5400

Amount to be credited to X’s Capital A/c= 18,000*3/10= ₹5400

21. Share Capital- Rs-20,000 4

Share Forfeiture-Rs-14,000

Bank account-Rs-12,000

Share Forfeitures-Rs-3,000

Share Capital – Rs -15,000

In the ledger Account – Share Capital –Rs 3,000

22. JOURNAL ENTRIES 4

DATE PARTICULARS L.F. DEBIT ₹ CREDIT ₹

i) a) Y‘s Capital A/c ……Dr 72,000

To Realiasation A/c 72,000

(Being sundry assets of

value

Rs.80,000(72,000x100/90)

taken over by Y at 29,600

Rs.72,000. 29,600

b) Z‘s capital A/c…..Dr.

To Realisation A/c

(Being the remaining sundry

assets taken over by Z)

(1,17,000-80,000)x 80/100 60,000

60,000

a)W.C.R A/c ……. Dr.

ii) To Realisation A/c

(Being WCR transferred to

Realisation account) 75,000

75,000

b)Realisation A/c …….Dr.

To Bank A/c

(Being liability on account of

workmen compensation

paid) 35,000

35,000

a)W.C.R A/c ………….Dr.

iii) To Realisation A/c 25,000

(Being WCR to the extent of 25,000

worker‘s claim transferred)

b) W.C.R A/c ……. Dr.

To partner’s capital A/c

(Being surplus of WCR

transferred to partner’s 7,84,000

capital account) 7,84,000

Bank A/c…………. Dr.

iv) To Realisation A/c

(Being Building value

realised after charging 8,00,000

commission) (800000 – 2%) 8,00,000

Or,

a)Bank A/c ………. Dr.

To Realisation A/c 16,000

(Being Building value 16,000

realised)

b) Realisation A/c ……Dr.

To Bank A/c

(Being commission @2%

paid)

23. JOURNAL ENTRIES IN THE BOOKS OF X LTD

DATE PARTICULARS L.F. DEBIT CREDIT

i) Bank A/c Dr. 8,00,000

To Equity Share Application A/c 8,00,000

ii) Equity share application A/c Dr. 8,00,000

To Equity share capital A/c 5,00,000

To Equity Share Allotment A/c 2,00,000

To Bank A/c 1,00,000

iii) Equity share Allotment A/c Dr. 10,00,000

To Equity share capital A/c 10,00,000

iv) Bank A/c Dr. 7,92,000

Calls in Arrear A/c Dr. 8,000

To Equity share allotment A/c 8,00,000

v) Equity share first call A/c Dr. 15,00,000

To Equity share capital A/c 15,00,000

6marks

vi) Bank A/c Dr. 14,70,000

Calls in Arrear A/c Dr. 30,000

To Equity share First Call A/c 15,00,000

vii) Equity Share Second and Final Call

A/c Dr. 20,00,000

To Equity Share Capital A/c 20,00,000

viii) Bank A/c Dr. 19,60,000

Calls in Arrear A/c Dr. 40,000

To Equity share Second and 20,00,000

final Call A/c

ix) Equity Share Capital A/c Dr. 1,00,000

To Share Forfeiture A/c 22,000

To Calls in Arrear A/c 78,000

x) Bank A/c Dr. 96,000

To Equity Share Capital A/c 80,000

To Security Premium Reserve A/c 16,000

xi) Share forfeited A/c Dr. 16,000

To Capital Reserve A/c 16,000

OR

JOURNAL ENTRIES IN THE BOOKS OF SHAKTIMAN LTD

DATE PARTICULARS L.F. DEBIT CREDIT

i) Share Application A/c Dr. 6,00,000

To Share Capital A/c 2,00,000

To Securities Premium A/c 2,00,000

To Share Allotment A/c 2,00,000

(Being Application money utilised)

ii) Share Allotment A/c Dr. 5,00,000

To Share Capital A/c 5,00,000

(Being allotment due with premium)

iii) Share First and Final Call A/c Dr. 3,00,000

To Share Capital A/c 3,00,000

(Being call money due)

iv) Calls in Arrears A/c Dr. 15,000

To Share First and Final Call A/c 15,000

(Being call money received except of

Simba)

v) Share Capital A/c Dr. 50,000

To Share Forfeited A/c 35,000

To Calls in Arrears A/c 15,000

(Being Simba’s shares forfeited)

vi) Share Forfeited A/c Dr. 14,000

To Capital Reserve A/c 14,000

(Being gain on re-issue transferred to 6x1=6

Capital Reserve)

Cash book balance- Rs.12,11,000

24. REVALUATION A/C

PARTICULARS AMOUNT PARTICULARS AMOUNT

(₹) (₹)

To Workmen 2,000 By Patents A/c 5,000

Compensation Claim

A/c

To Provision for 100 By Investments A/c 5,000

Doubtful Debts A/c

To Machinery A/c 1,500

To Partners’ Capital A/c

(Profit)

Bablu 3,840 2marks

Dablu 2,560 6,400

10,000 10,000

PARTNERS CAPITAL A/C’s

DR.

DATE PARTICULARS BABLU ₹ DABLU ₹ MANGLU ₹

To Bal C/d 85,840 56,560 35,600

85,840 56,560 35,600

CR.

DATE PARTICULARS BABLU ₹ DABLU ₹ MANGLU ₹

By Bal B/d 60,000 40,000

By Cash A/c 35,600

By Premium for 4000 2000

2marks

Goodwill A/c

By General 12,000 8,000

Reserve A/c

By Revaluation 3,840 2,560

A/c

By Investment 6,000 4,000

Fluctuation

Reserve A/c

85,840 56,560 35,600

Balance Sheet as at 31st March, 2022

LIABILITIES ₹ ASSETS ₹

Capital A/cs: Cash 66,600 2marks

Bablu 85,840 Bills Receivable 30,000

Dablu 56,560 Stock 45,000

Manglu 35,600 1,78,000 Debtors 42,000

Creditors 50,000 Less: Prov. 2,100 39,900

Bills Payable 30,000 Investments 40,000

Workmen 2,000 Machinery 13,500

Compensation Claim Patents 25,000

2,60,000 2,60,000

OR 2+2+2

Revaluation Profit: ₹ 15,000; =6marks

Partners’ Capital Accounts

Bhavin’s Capital Account = ₹ 72,000

Ankit’s Loan Account= ₹ 67,000

Kartik’s Capital Account= ₹ 42,000

25. Maheep dues to be transferred to executors = 1,15,000 + 5,000 + 20,000 + 60,000

– 20,000 = ₹1,80,000

Maheep’s Executors Account

DATE PARTICULARS ₹ DATE PARTICULARS ₹

31/03/21 To Balance c/d 1,93,500 30/06/20 By Maheep’s 1,80,000

31/03/21 Cap. A/c

Interest (9 13,500 6marks

months)

1,93,500 1,93,500

30/06/21 To Bank 78,000 01/04/21 By Balance b/d 1,93,500

31/03/22 (I Instalment) 30/06/21 By Interest 4,500

To Balance c/d 1,29,000 31/03/22 (3 months)

By Interest 9,000

(9 months)

2,07,000 2,07,000

30/06/22 To Bank 72,000 01/04/22 By Balance b/d 1,29,000

31/03/23 (II Instalment) 30/06/22 By Interest 3,000

To Balance c/d 64,500 31/03/23 (3 months)

By Interest 4,500

(9 months)

1,36,500 1,36,500

30/06/23 To Bank 66,000 01/04/23 By Balance b/d 64,500

(III Instalment) 30/06/23 By Interest 1,500

(3 months)

66,000 66,000

26. Journal Entries in the Books of Panther Ltd.

DATE PARTICULARS L.F DEBIT CREDIT

July 1 Bank A/c 21,60,000

2022 Dr. 21,60,000

To Debenture Application and

Allotment A/c

(Being Application money

received)

July 1 Debenture Application and 21,60,000

2022 Allotment

Dr. 3,00,000

Loss on Issue of Debentures A/c 6marks

Dr.

To 9% Debentures A/c 20,00,000

To Securities Premium A/c 1,60,000

To Premium on Redemption 3,00,000

of Debentures A/c

(Being Debentures issued)

Mar. 31 DebentureInterestA/c 1,35,000

2022 Dr. 1,35,000

To Debenture holders A/c

(Being Interest due on debentures)

Mar. 31 Debenture holders A/c Dr. 1,35,000

2022 To Bank A/c 1,35,000

(Being interest paid to debenture

holders)

Mar. 31 Statement of Profit and Loss 1,35,000

2022 Dr. 1,35,000

To Debenture Interest A/c

(Interest on Debentures charged

from Statement of P&l)

Mar. 31 Securities Premium A/c 2,40,000

2022 Dr. 60,000

Statement of Profit and Loss

Dr. 3,00,000

To Loss on Issue of

Debentures A/c (Loss on Issue of

Debentures written off)

Loss on Issue of Debentures A/c

DATE PARTICULARS ₹ DATE PARTICULARS ₹

01 To Premium on 3,00,000 31 By Securities 2,40,0000

July Redemption of Mar. Premium A/c

2022 Debentures A/c 2023 By Statement of 60,000

Profit and Loss

3,00,000 3,00,000

Part – B (Analysis of Financial Statements)

27. (d) Inter firm comparisons 1

28. (c) Loose tools and Stores and spares. 1

29. (b) Both, Assertion (A) and Reason (R) are correct and Reason (R) is the correct 1

explanation of Assertion (A)

OR

(c) Cash flow from investing activities Rs.34,000

30. (c) Cash used (Payment) from financial activities Rs.2,10,000 1

31. (i) Accrued Incomes-Current Assets- Other Current Assets 6x.5=3

(ii) Current Maturities of Long term Debts.-Current Liabilities- Short

term Borrowings

(iii) Provision for Employees Benefits-Non Current Liabilities-Long

term Provisions

(iv) Unpaid Dividend-Current Liabilities- Other Current Liabilities

(v) Short-term Loans- Current Liabilities- Short term Borrowings

(vi) Long-term Loans- Non Current Liabilities-Long term Borrowings

32. (a)Current Ratio = Current Assets / Current Liabilities

2 = 8,00,000 / Current Liabilities

So, Current Liabilities = ₹ 4,00,000

Liquid Ratio = Liquid Assets / Current Liabilities

1.5 = Liquid Assets / 4,00,000

So, Liquid Assets = ₹ 6,00,000

Inventory = Current Assets - Liquid Assets

Inventory = 8,00,000 – 6,00,000 = ₹ 2,00,000

Inventory Turnover Ratio = Cost of Revenue From Operations / Average

Inventory 1.5x2=3

6 = Cost of Revenue from Operations / 2,00,000

Cost of Revenue from Operations = ₹ 12,00,000

Gross Profit = 25% of Cost i.e ₹ 3,00,000

Revenue From Operations = Cost of Revenue from Operations + Gross Profit =

12,00,000 + 3,00,000

Revenue From Operations = ₹ 15,00,000

(b)Debt to Capital employed ratio = Debt / Capital Employed

Debt to Capital employed ratio = 7,50,000 / (7,50,000 + 15,00,000) = 7,50,000 /

22,50,000 Debt to Capital employed ratio = 1/3 = 0.33 : 1

33. Common Size Statement of Profit & Loss

Particulars 2022-23 2021-22 % on % on

(₹) (₹) revenue revenue 4maks

from from

operations operations

(2021-22) (2022-23)

Revenue from operations 8,00,000 10,00,000 100 100

Less :- Expenses

Cost of revenue 3,20,000 3,00,000 40 30

Other Expenses 2,20,000 2,60,000 27.5 26

Total Expenses 5,40,000 5,60,000 67.5 56

Profit Before Tax 2,60,000 4,40,000 32.5 44

Less:- Tax 1,30,000 2,20,000 16.25 22

Profits after Tax 1,30,000 2,20,000 16.25 22

OR

Comparative Balance Sheet of Sunrise

PARTICULARS NOTE 31st 31st Absolute Percentage

NO. March, March, Change Change

2022 (Rs) 2023(Rs) (Rs) (%)

IEquity and

Liabilities 15,00,000 22,50,000 7,50,000 50.00

1.shareholders funds 7,50,000 7,50,000 - -

2.Non Current Assets 2,50,000 7,50,000 5,00,000 200.00

3.Current Liabilities 25,00,000 37,50,000 12,50,000 50

Total 4marks

II Assets 17,50,000 26,50,000 8,75,000 50.00

1.Non Current Assets 7,50,000 11,25,000 3,75,000 50.00

2.Current Assets 25,00,000 37,50,000 12,50,000 50

Total

34. Net Cash Flows from Operating Activities- Rs 1,52,000 2+2+2=6

Net Cash Used in Investing Activities- Rs (3,62,000)

Net Cash Flows from Financing Activities- Rs 1,50,000

Net Decrease in cash and cash equivalents- Rs (60,000)

You might also like

- 13 Impairment of AssetsDocument44 pages13 Impairment of Assetsfordan Zodorovic56% (9)

- SolutionsDocument6 pagesSolutionsElenaNo ratings yet

- Sample Paper 2023-24Document172 pagesSample Paper 2023-24shouryayadav87267% (3)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Guide To Global Stock ExchangesDocument199 pagesGuide To Global Stock ExchangesvipulscribdNo ratings yet

- Set - 1 Acc MS PB12023-24Document10 pagesSet - 1 Acc MS PB12023-24aamiralishiasbackup1No ratings yet

- Accountancy Answer Key Class XII PreboardDocument8 pagesAccountancy Answer Key Class XII PreboardGHOST FFNo ratings yet

- Accountancy 2023-24 MSDocument11 pagesAccountancy 2023-24 MSirfanoushad15No ratings yet

- Accountancy MSDocument11 pagesAccountancy MSmansoorbariNo ratings yet

- Accountancy-MS 23-24Document10 pagesAccountancy-MS 23-24Ashutosh SinghNo ratings yet

- 1MS-CLASS XII ACC - Common Board-2022-23 (2) - 230329 - 142033Document21 pages1MS-CLASS XII ACC - Common Board-2022-23 (2) - 230329 - 142033jiya.mehra.2306No ratings yet

- Marking Scheme: PRE - BOARD-2 (2023 - 2024)Document11 pagesMarking Scheme: PRE - BOARD-2 (2023 - 2024)Kaustav DasNo ratings yet

- MS Accountancy XIIDocument8 pagesMS Accountancy XIISahil RaikwarNo ratings yet

- Practice Paper Pre-Board Xii Acc 2023-24Document13 pagesPractice Paper Pre-Board Xii Acc 2023-24Pratiksha Suryavanshi100% (1)

- XII ACCOUNTANCY SET-2 Marking Scheme Ist Pre Board 2023-24-1Document9 pagesXII ACCOUNTANCY SET-2 Marking Scheme Ist Pre Board 2023-24-1Riddhima Murarka50% (2)

- Cbse SQP 22-23 MSDocument12 pagesCbse SQP 22-23 MSPankaj KumarNo ratings yet

- Marking Scheme, Set-3: CLASS-12, Accountancy MM:80 Time: 3 Hrs Part A - Accounting For Partnership Firms and CompaniesDocument9 pagesMarking Scheme, Set-3: CLASS-12, Accountancy MM:80 Time: 3 Hrs Part A - Accounting For Partnership Firms and CompaniesKunwar PalNo ratings yet

- MS Xii Accountancy Set 1Document10 pagesMS Xii Accountancy Set 1arikoff07No ratings yet

- Marking Scheme Mock Test I 2023 24Document9 pagesMarking Scheme Mock Test I 2023 24HARSH CHAURASIYANo ratings yet

- Accountancy MSDocument13 pagesAccountancy MSJas Singh DevganNo ratings yet

- Set 2 MS, 2ND PBDocument10 pagesSet 2 MS, 2ND PBHarini NarayananNo ratings yet

- MS Accountancy XIIDocument8 pagesMS Accountancy XIITûshar ThakúrNo ratings yet

- MS Accountancy PB Xii Set 2Document9 pagesMS Accountancy PB Xii Set 2DakshitaNo ratings yet

- 2020-BPS - Pre - Board II-Accountancy Answer KeyDocument16 pages2020-BPS - Pre - Board II-Accountancy Answer KeyJoshi DrcpNo ratings yet

- Hsslive Xii Acc 3 Admission of A Partner KeyDocument8 pagesHsslive Xii Acc 3 Admission of A Partner KeyShinu ShinadNo ratings yet

- 2accountancy-Ms (4) - 230329 - 173510Document11 pages2accountancy-Ms (4) - 230329 - 173510jiya.mehra.2306No ratings yet

- Accountancy MARKING SCHEME Class-XII Set-IDocument9 pagesAccountancy MARKING SCHEME Class-XII Set-Iaamiralishiasbackup1No ratings yet

- CBSE Class XII 2024 Commerce Accountancy Sample Paper SolDocument11 pagesCBSE Class XII 2024 Commerce Accountancy Sample Paper Solrajputudbhav2429No ratings yet

- SMS 11 AccountancyDocument11 pagesSMS 11 AccountancyacguptaclassesNo ratings yet

- FT GR12 Acak Set1 - 17832Document5 pagesFT GR12 Acak Set1 - 17832Amaan AbbasNo ratings yet

- Answer Key 3Document8 pagesAnswer Key 3Hari prakarsh NimiNo ratings yet

- Partnership - Admission of Partner - DPP 10 (Of Lecture 12) - (Kautilya)Document8 pagesPartnership - Admission of Partner - DPP 10 (Of Lecture 12) - (Kautilya)Shreyash JhaNo ratings yet

- Solution Ultimate Sample Paper 4Document5 pagesSolution Ultimate Sample Paper 4Karthick KarthickNo ratings yet

- Marking Scheme 2020Document5 pagesMarking Scheme 2020Joanna GarciaNo ratings yet

- Set - 3 Acc MSDocument6 pagesSet - 3 Acc MSaamiralishiasbackup1No ratings yet

- Paper2 Set2 SolutionDocument7 pagesPaper2 Set2 Solutionadityatiwari122006No ratings yet

- Sujeet Sjuje BktesDocument13 pagesSujeet Sjuje BktesPawan TalrejaNo ratings yet

- Accountancy SolutionsDocument5 pagesAccountancy Solutionsrajpranav239No ratings yet

- Answer Key - 1 TermDocument9 pagesAnswer Key - 1 TermsamayaksahuNo ratings yet

- 12 Accounts CBSE Sample Papers 2019 Marking SchemeDocument16 pages12 Accounts CBSE Sample Papers 2019 Marking SchemeSalokya KhandelwalNo ratings yet

- Accountancy Sample PaperDocument13 pagesAccountancy Sample PaperFatima IslamNo ratings yet

- 2023 24 Xii Pre Board 1 MsDocument13 pages2023 24 Xii Pre Board 1 MsacguptaclassesNo ratings yet

- PB SQP 12th ACC (SS) 2023-24Document14 pagesPB SQP 12th ACC (SS) 2023-24aanchal prasad100% (4)

- Accountancy - Additional Questions MARKING SCHEMEDocument15 pagesAccountancy - Additional Questions MARKING SCHEMEseema chadhaNo ratings yet

- MS Accountancy Set 10Document18 pagesMS Accountancy Set 10Tanisha TibrewalNo ratings yet

- Problem No.: 1 (March 2018) Assets : Solution.: - Capital Reduction A/CDocument3 pagesProblem No.: 1 (March 2018) Assets : Solution.: - Capital Reduction A/CAnshrNo ratings yet

- Keys and Marking Scheme Acc XIIDocument3 pagesKeys and Marking Scheme Acc XIIPankaj PatidarNo ratings yet

- Sample Paperpre Board II Acct 2324-2Document10 pagesSample Paperpre Board II Acct 2324-2kanakchauhan206No ratings yet

- ISM Accountancy (055) XII (FBE) QP & MS (23-24) SET A B CDocument63 pagesISM Accountancy (055) XII (FBE) QP & MS (23-24) SET A B Chiruh5396No ratings yet

- Sahodaya Accountancy AKDocument23 pagesSahodaya Accountancy AKrthi kusumNo ratings yet

- CBSE Class 12 Accountancy Question Paper Delhi 2017Document28 pagesCBSE Class 12 Accountancy Question Paper Delhi 2017harshit agrawalNo ratings yet

- XII CBSE - Accounts HY Exam - 01-Oct-2022 (Sug)Document7 pagesXII CBSE - Accounts HY Exam - 01-Oct-2022 (Sug)naviagrawal2006No ratings yet

- CBSE-Sample-Paper-2024-Class-12-Accountancy-MSDocument11 pagesCBSE-Sample-Paper-2024-Class-12-Accountancy-MSskhushbusahniNo ratings yet

- MS G12 Acc PT1 2023Document8 pagesMS G12 Acc PT1 2023Ethan LourdesNo ratings yet

- Business Combination Answers (Manav)Document58 pagesBusiness Combination Answers (Manav)Harshit ChauhanNo ratings yet

- Hsslive Xii Acc 4 Retiremnet and Death of A Partner KeyDocument6 pagesHsslive Xii Acc 4 Retiremnet and Death of A Partner Keypirated wallahNo ratings yet

- Accountancy Term-2 MVP 2023-24Document7 pagesAccountancy Term-2 MVP 2023-24Cp GpNo ratings yet

- Suggested Answer CAP II December 2016Document88 pagesSuggested Answer CAP II December 2016Nirmal ShresthaNo ratings yet

- Ultimate Accountancy Class 12 Sample Paper SolutionsDocument8 pagesUltimate Accountancy Class 12 Sample Paper SolutionsBeena ShibuNo ratings yet

- 1712478858310_Ch_1_Accounting_for_Partnership_Firms_Basic_Concepts_worksheet__iDocument3 pages1712478858310_Ch_1_Accounting_for_Partnership_Firms_Basic_Concepts_worksheet__iaryannchauhaan30No ratings yet

- Cbse cl12 Ead Accountancy Answers To Sample Paper 6Document15 pagesCbse cl12 Ead Accountancy Answers To Sample Paper 6amaankhan828768No ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Acc Comprehensive Project XiDocument11 pagesAcc Comprehensive Project Ximrnaman.0328No ratings yet

- Lecture 2 Statement of Changes in Equity Multiple ChoiceDocument5 pagesLecture 2 Statement of Changes in Equity Multiple ChoiceJeane Mae Boo100% (1)

- Adani Group - How The World's 3rd Richest Man Is Pulling The Largest Con in Corporate History - Hindenburg ResearchDocument90 pagesAdani Group - How The World's 3rd Richest Man Is Pulling The Largest Con in Corporate History - Hindenburg ResearchmallikarjunbpatilNo ratings yet

- Independent Directors in India and USADocument7 pagesIndependent Directors in India and USApragya jaiswalNo ratings yet

- Hong Kong Tax Alert: 21 September 2020 2020 Issue No. 13Document6 pagesHong Kong Tax Alert: 21 September 2020 2020 Issue No. 13gir botNo ratings yet

- Investment Perception and Selection Behaviour Towards Mutual FundDocument11 pagesInvestment Perception and Selection Behaviour Towards Mutual FundmmmmmNo ratings yet

- Regulatory Framework for Business TransactionsDocument23 pagesRegulatory Framework for Business TransactionsJasmine Marie Ng Cheong0% (1)

- Pre Board Class XII AccountancyDocument12 pagesPre Board Class XII AccountancyShubham100% (1)

- CARO 2020 Book NotesDocument11 pagesCARO 2020 Book NotesCreanativeNo ratings yet

- (ANSWER) - 04 - Completing The Accounting CycleDocument9 pages(ANSWER) - 04 - Completing The Accounting CycledeltakoNo ratings yet

- Kalbe Farma TBK - Billingual - 30 - Sept - 2023 - ReleasedDocument145 pagesKalbe Farma TBK - Billingual - 30 - Sept - 2023 - ReleasedTimothy GracianovNo ratings yet

- Chapter 1 Not-For-Profit OrganizationDocument54 pagesChapter 1 Not-For-Profit OrganizationDivyansh ThakurNo ratings yet

- ICQDocument12 pagesICQAndrew LamNo ratings yet

- CSEC POA June 2008 P3Document4 pagesCSEC POA June 2008 P3Jon DoeNo ratings yet

- Farap 4502Document9 pagesFarap 4502Marya NvlzNo ratings yet

- Effective Management of Small BusinessDocument21 pagesEffective Management of Small Businessmurugesh_mbahit100% (2)

- Test On Trial BalanceDocument1 pageTest On Trial Balanceamitabhkumar1979No ratings yet

- FAC3702 Question Bank 2015Document105 pagesFAC3702 Question Bank 2015Itumeleng KekanaNo ratings yet

- Browning Ch03 P15 Build A ModelDocument3 pagesBrowning Ch03 P15 Build A ModelAdam0% (1)

- 3-3 Waiver of Notice - Annual MeetingDocument1 page3-3 Waiver of Notice - Annual MeetingDaniel100% (3)

- Opening Accounts of Various Types of CustomersDocument26 pagesOpening Accounts of Various Types of CustomersnayanPatel4677No ratings yet

- Accounting Text Book - 2019Document37 pagesAccounting Text Book - 2019Shenali NupehewaNo ratings yet

- Chapter 13 - Statement of Cash FlowsDocument165 pagesChapter 13 - Statement of Cash FlowsElio BazNo ratings yet

- Indiawin Sports Private LimitedDocument37 pagesIndiawin Sports Private LimitedAnna AugustineNo ratings yet

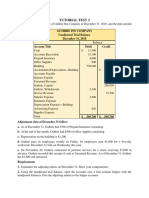

- Tutorial Test 3Document2 pagesTutorial Test 3b1112014041No ratings yet

- Working Capital Management of Odisha State Co-operative BankDocument26 pagesWorking Capital Management of Odisha State Co-operative BankSUBHASMITA SAHUNo ratings yet

- 14-6: A (At Fair Value at Date of Acquisition) 14-7: D: Total Net Income P1,800,000Document26 pages14-6: A (At Fair Value at Date of Acquisition) 14-7: D: Total Net Income P1,800,000Love FreddyNo ratings yet