Professional Documents

Culture Documents

Cash & Cash E

Cash & Cash E

Uploaded by

JoyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash & Cash E

Cash & Cash E

Uploaded by

JoyCopyright:

Available Formats

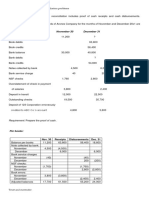

On June 30, 2021, the bank statement of ABC Co. had an ending balance of P3,735,000.

The following data were assembled in the course of reconciling the bank balance:

The bank erroneously credited ABC Co. for P21,000 in June 22

During the month, the bank returned NSF checks amounting to P23,000, of which

P8,000 had been redeposited and cleared in June 25

Collection for June 30 amounting P103,000 was deposited the following month

Checks outstanding on June 30 amounted to P302,000

Note collected by the bank for ABC Co. was P80,000, and the corresponding bank

charges was P5,000

4. What is the unadjusted cash in bank per ledger on June 30, 2021?

a. 3,515,000

b. 3,557,000

c. 3,455,000

d. 3,497,000

Unadjusted BANK balance 3,735,000

Add: Deposit in Transit 103,000

Add: NSF Checks (23,000 – 8,000) 15,000

Add: Bank charges on note collected by the bank 5,000

Less: Outstanding Checks (302,000)

Less: Bank erroneous credit to ABC CO.’s account (21,000)

Less: Note collected by the bank (80,000)

----------------

Unadjusted BOOK balance (4) 3,455,000

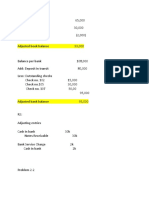

5. What is the adjusted balance per book on December 31?

a. 3,515,000

b. 3,557,000

c. 3,455,000

d. 3,497,000

BANK BOOK

UNADJUSTED balances 3,735,000 3,455,000

Add (Deduct) Reconciling Items

Deposit in Transit 103,000

Outstanding Checks (302,000)

Bank erroneous credit to ABC CO.’s account (21,000)

NSF Checks (23,000 – 8,000) (15,000)

Note collected by the bank 80,000

Bank charges on note collected by the bank (5,000)

------------------ ------------------

ADJUSTED balances 3,515,000 (5) 3,515,000

You might also like

- Statement Bank March Delavid Distributor LLC A2cb2f38f9Document10 pagesStatement Bank March Delavid Distributor LLC A2cb2f38f9Madelyn Vasquez100% (1)

- BSF Matthew-ParablesStudyDocument31 pagesBSF Matthew-ParablesStudypianonerd7No ratings yet

- Bank ReconciliationDocument3 pagesBank Reconciliationalford sery Cammayo86% (7)

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia PartDocument15 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia PartMike Joseph E. Moran100% (3)

- Proof of Cash and Bank Recon StatementDocument7 pagesProof of Cash and Bank Recon StatementJean BritoNo ratings yet

- Problem 15-1 (AICPA Adapted) : Solution 15 - 1 Answer ADocument37 pagesProblem 15-1 (AICPA Adapted) : Solution 15 - 1 Answer AAldrin Lozano87% (15)

- Bam 006: Bank Reconciliation Quiz 2: Use The Problem Below To Answer Numbers 5 - 7Document2 pagesBam 006: Bank Reconciliation Quiz 2: Use The Problem Below To Answer Numbers 5 - 7honeyjoy salapantanNo ratings yet

- Ch. 02 Bank Reconciliation Intermediate Accounting Volume 1 2021 Edition ValixDocument7 pagesCh. 02 Bank Reconciliation Intermediate Accounting Volume 1 2021 Edition ValixNathalie GetinoNo ratings yet

- Samplepractice Exam 15 October 2020 Questions and AnswersDocument6 pagesSamplepractice Exam 15 October 2020 Questions and AnswersMartha Nicole MaristelaNo ratings yet

- Bank Reconciliation: Problem 1: True or FalseDocument5 pagesBank Reconciliation: Problem 1: True or FalseJannelle SalacNo ratings yet

- Proof of Cash ProblemsDocument2 pagesProof of Cash ProblemsSamantha Marie Arevalo100% (1)

- Solution - Problems 1-8 Cash and Cash EquivalentsDocument3 pagesSolution - Problems 1-8 Cash and Cash Equivalentsanon_965241988No ratings yet

- Bank Reconciliation PDFDocument2 pagesBank Reconciliation PDFFazal Rehman MandokhailNo ratings yet

- Quiz - Chapter 3 - Bank ReconciliationDocument6 pagesQuiz - Chapter 3 - Bank ReconciliationSHE82% (11)

- Quiz 3-Audit CashDocument8 pagesQuiz 3-Audit CashCindy CrausNo ratings yet

- RESA - AP-702S (MCQs Solutions To Problems)Document12 pagesRESA - AP-702S (MCQs Solutions To Problems)Mellani100% (1)

- Bank Reconciliations PROBLEMS With Solutions PDFDocument5 pagesBank Reconciliations PROBLEMS With Solutions PDFlei vera100% (4)

- WGP Chemical Company Case StudyDocument4 pagesWGP Chemical Company Case StudyFolakemi Lawal56% (16)

- Duct Sizing-Static BalanceDocument24 pagesDuct Sizing-Static BalancemohdnazirNo ratings yet

- Bank Reconciliation: Basic ProblemsDocument25 pagesBank Reconciliation: Basic ProblemsAndrea FontiverosNo ratings yet

- (03A) Cash Quiz ANSWER KEYDocument11 pages(03A) Cash Quiz ANSWER KEYGabriel Adrian ObungenNo ratings yet

- Cfas Bsa1b Bank Recon ActivityDocument4 pagesCfas Bsa1b Bank Recon ActivityKristan EstebanNo ratings yet

- Activity Chapter 6Document2 pagesActivity Chapter 6Randelle James FiestaNo ratings yet

- Bank Recon Sample ProblemsDocument4 pagesBank Recon Sample ProblemsKathleen100% (1)

- ADMU Vs Capulong Due ProcessDocument2 pagesADMU Vs Capulong Due ProcessDave Jonathan Morente100% (3)

- Bank ReconciliationDocument6 pagesBank ReconciliationXienaNo ratings yet

- (03B) Cash SPECIAL Quiz ANSWER KEYDocument6 pages(03B) Cash SPECIAL Quiz ANSWER KEYGabriel Adrian ObungenNo ratings yet

- Bank ReconciliationDocument12 pagesBank ReconciliationJieniel ShanielNo ratings yet

- PDF Prac Acc Chapter 15 16docxdocx DDDocument37 pagesPDF Prac Acc Chapter 15 16docxdocx DDBetty SantiagoNo ratings yet

- UntitledDocument5 pagesUntitledShevina Maghari shsnohsNo ratings yet

- Cashew ProblemDocument2 pagesCashew ProblemJoyNo ratings yet

- Exercises No1 CCash Equiv and Bank ReconDocument3 pagesExercises No1 CCash Equiv and Bank Recondelrosario.kenneth996No ratings yet

- Ga Problem SolvingDocument9 pagesGa Problem SolvinggarciarhodjeannemarthaNo ratings yet

- Quiz 1Document3 pagesQuiz 1Van MateoNo ratings yet

- Fabm2 - 8.2Document15 pagesFabm2 - 8.2Kervin GuevaraNo ratings yet

- Solution To Quiz 1Document2 pagesSolution To Quiz 1Carmi FeceroNo ratings yet

- Long QuizDocument6 pagesLong QuizRinconada Benori ReynalynNo ratings yet

- Sample Prob Bank ReconDocument4 pagesSample Prob Bank Reconlil mixNo ratings yet

- Assignment 1Document12 pagesAssignment 1Ira YbanezNo ratings yet

- ReconciliationDocument6 pagesReconciliationElizabethNo ratings yet

- Proof+of+Cash ProblemsDocument2 pagesProof+of+Cash ProblemshelaihjsNo ratings yet

- Valix Bank ReconDocument5 pagesValix Bank ReconEloiNo ratings yet

- Proof of CashDocument1 pageProof of Cashco230154No ratings yet

- Bank ReconciliationDocument3 pagesBank ReconciliationjinyangsuelNo ratings yet

- Quiz Part 2 (Bank Reconciliation)Document2 pagesQuiz Part 2 (Bank Reconciliation)YameteKudasaiNo ratings yet

- Prelim Quiz 2 CMPC 313Document10 pagesPrelim Quiz 2 CMPC 313Nicole ViernesNo ratings yet

- Financial Accounting Review, Problem Preliminary Examination Problem 1Document16 pagesFinancial Accounting Review, Problem Preliminary Examination Problem 1John Emerson PatricioNo ratings yet

- Bank ReconciliationDocument3 pagesBank Reconciliationlucas lilaNo ratings yet

- 001 Cash Cash Equi Bank Recon and PocDocument5 pages001 Cash Cash Equi Bank Recon and PocArsenio N. RojoNo ratings yet

- Bank ReconciliationDocument6 pagesBank Reconciliationclarisse jaramillaNo ratings yet

- Pak Enings HTDocument15 pagesPak Enings HTVincent SampianoNo ratings yet

- HO 1 - Cash and Cash EquivalentsDocument8 pagesHO 1 - Cash and Cash EquivalentsCharmain ReganitNo ratings yet

- Chapter 2 Bank ReconciliationDocument10 pagesChapter 2 Bank ReconciliationZeo AlcantaraNo ratings yet

- Solution Manual Ch. 1 19Document55 pagesSolution Manual Ch. 1 19Aira Mae TaborNo ratings yet

- 2 BOOKKEEPING MODEL ANSER Bank Reconciliation - Answer To Assignment 3Document3 pages2 BOOKKEEPING MODEL ANSER Bank Reconciliation - Answer To Assignment 3hftysndt2jNo ratings yet

- Assessment Task 1-1Document10 pagesAssessment Task 1-1hahahahaNo ratings yet

- Chapter 7 Practice SolutionsDocument5 pagesChapter 7 Practice Solutionslemanhan240103No ratings yet

- Cash AssignmentDocument2 pagesCash Assignmentyjkq4byrj6No ratings yet

- 3Document4 pages3Francis Lloyd TongsonNo ratings yet

- Requirement No. 1: PROBLEM NO. 1 - Peso CorporationDocument13 pagesRequirement No. 1: PROBLEM NO. 1 - Peso CorporationDreiu EsmeleNo ratings yet

- ACTIVITYDocument3 pagesACTIVITYAerwyna AfarinNo ratings yet

- AuditingDocument5 pagesAuditingRochelle ManayaoNo ratings yet

- Container Port Performance Index 2022: A Comparable Assessment of Performance Based on Vessel Time in PortFrom EverandContainer Port Performance Index 2022: A Comparable Assessment of Performance Based on Vessel Time in PortNo ratings yet

- Concentrating Solar Power in Developing Countries: Regulatory and Financial Incentives for Scaling UpFrom EverandConcentrating Solar Power in Developing Countries: Regulatory and Financial Incentives for Scaling UpNo ratings yet

- The Fallout of War: The Regional Consequences of the Conflict in SyriaFrom EverandThe Fallout of War: The Regional Consequences of the Conflict in SyriaNo ratings yet

- Spice Grindibmbmbng and PackagingDocument6 pagesSpice Grindibmbmbng and Packagingarabindaxyz5967No ratings yet

- Silent Letters Info PageDocument1 pageSilent Letters Info PagehimanshuNo ratings yet

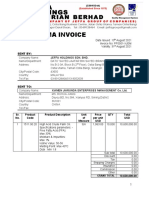

- Pro Forma Invoice - 0001Document4 pagesPro Forma Invoice - 0001noreenNo ratings yet

- IncidentRequest Closed Monthly JulDocument275 pagesIncidentRequest Closed Monthly Julأحمد أبوعرفهNo ratings yet

- GMR HYDERABAD AIRPORT RELTED CONTACTS Schedule - Charges - 090409 PDFDocument2 pagesGMR HYDERABAD AIRPORT RELTED CONTACTS Schedule - Charges - 090409 PDFCharan RajNo ratings yet

- Bulilis Vs Nuez SalvanaDocument4 pagesBulilis Vs Nuez SalvanaPauline DgmNo ratings yet

- 2 Functions of Public HealthDocument26 pages2 Functions of Public HealthMoreiyamNo ratings yet

- SLM3Document6 pagesSLM35sz5v4wq96No ratings yet

- The Expansion and Reorganization of The Agricultural BureaucracyDocument31 pagesThe Expansion and Reorganization of The Agricultural BureaucracyJC CulisNo ratings yet

- Tvet ScriptDocument4 pagesTvet ScriptEBUENGA, Raymarc Brian R.No ratings yet

- Sahyadri - Farms Sumit MogalDocument12 pagesSahyadri - Farms Sumit MogalVishal gavaliNo ratings yet

- Research MethodologyDocument2 pagesResearch MethodologyLouie OmpadNo ratings yet

- Duties and ResponsibilitiesDocument7 pagesDuties and Responsibilitiesvivian apolinarioNo ratings yet

- Acct Statement XX5581 01062023Document2 pagesAcct Statement XX5581 01062023Desai AbhishekNo ratings yet

- Metrobank Annual Report 2020Document250 pagesMetrobank Annual Report 2020Hera IgnatiusNo ratings yet

- CAF5 FAR1 QB 2017-Castar - PK PDFDocument210 pagesCAF5 FAR1 QB 2017-Castar - PK PDFYousaf JamalNo ratings yet

- 1.2passive Voice ExerciseDocument6 pages1.2passive Voice ExerciseYe MinNo ratings yet

- Lord of The Flies Quiz CH. 1-3Document4 pagesLord of The Flies Quiz CH. 1-3Mel TelfordNo ratings yet

- Types of CriticismDocument3 pagesTypes of CriticismSonia LawsonNo ratings yet

- Advocates For Truth in Lending, Inc. & Olaguer v. Banko Sentral Monetary BoardDocument6 pagesAdvocates For Truth in Lending, Inc. & Olaguer v. Banko Sentral Monetary BoardNoemi MejiaNo ratings yet

- Module 4 Present Worth Analysis - RevDocument21 pagesModule 4 Present Worth Analysis - RevPutri Aaliyah SNo ratings yet

- LM - GRADE 6 - DLP 5 - Words With Affixes - Prefixes - OptDocument11 pagesLM - GRADE 6 - DLP 5 - Words With Affixes - Prefixes - OptAllan RonuloNo ratings yet

- General Concepts and Historical Events in ScienceDocument14 pagesGeneral Concepts and Historical Events in ScienceEdgar MenorNo ratings yet

- Catalog Placement Tester User's GuideDocument16 pagesCatalog Placement Tester User's GuideruehlruehlNo ratings yet