Professional Documents

Culture Documents

English Test

English Test

Uploaded by

rahimdaudaniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

English Test

English Test

Uploaded by

rahimdaudaniCopyright:

Available Formats

English test

2 hours test

Today, with a Nobel Prize to its credit, Grameen is one of the largest micro-finance organizations in the

world. It started out lending small sums to poor entrepreneurs in Bangladesh to help them grow from a

subsistence living to a livelihood The great its founders made was that even with few assets, these

entrepreneurs repaid on time.

Grameen and micro-finance have since become financial staples of the developing world.

Grameen's approach, unlike other micro financiers, uses the group-lending model. Costs are kept down

by having borrowers vet one another, tying together their financial fates and eliminating expensive loan

officers entirely. The ultimate promise of Grameen is to use business lending as a way for people to lift

themselves out of poverty. 3. Recently, Grameen has taken on a different challenge by setting up

operations in the US. money may be tight in the waning recession, but it is still a nation bank branches.

Globally, the working microfinance equation consists of borrowing funds cheaply and keeping loan

defaults and overhead expenses sufficiently low. Micro lenders, including Grameen, do this by charging

colossal interest rates-as high as 60% or 70%-which is necessary to compensate for the risk and attract

bank funding. but loans rates much above the standard 15% would most likely be attacked as usurious in

America.

So, the question is whether there is a role for a Third World lender in the world's largest economy.

Grameen America believes that in a few years it will be successful and turn a profit, thanks to 9 million US

households untouched by mainstream banks and 21 million using the likes of pay-day loans and pawn

shops for financing. But enticing the unbanked won't be easy. After all, profit has long eluded US micro

financiers and if it is not lucrative, it is not micro-lending, but charity. When Grameen first went to the US,

in the late 1980s, it tripped up. Under Grameen's tutelage, banks started micro loans to entrepreneurs

with a shocking 30% loss. But Grameen America says that this time results will be making loans, not

training an American bank to do it. More often than not, the borrowers, Grameen finds, in the US already

have jobs (as factory workers for example) or side

business-selling toys, cleaning houses etc.

The loans from Grameen, by and large, provide a steadier source of funding, but they don't create

businesses out of nothing financial staples. More importantly for many entrepreneurs, group members are

tremendous sources of support to one another. But money isn't everything. So even if studies are yet to

determine if Grameen is a clear-cut pathway out of poverty it still achieves something useful.

Questions

Q1. What was the starting of the Grameen banks? 3 marks

Q2. Did you think the decision to give a noble prize to Grameen banks is right? Give reasons to support

your answer.

Q3. How Grameen banks is helping to entrepreneurs?

Q4. Explain your opinion about phrase 3marks

“But money isn’t everything.”

Q5. write the meaning of following words or phrases and sentences. 8 marks

1. financial staples

2. steadier

3. recession

4. pawn

Summary writing

Write summary of above passage.

Narrative Writing

The Most Memorable Summer Vacation.

The Impact of a Life-Altering Decision.

Report writing

Write a report about one of the topics

School club

Israel and Palestine war

You might also like

- Credit Card DetailsDocument2 pagesCredit Card DetailsLazare Lazare100% (1)

- Summary of I Will Teach You To Be Rich: by Ramit Sethi | Includes AnalysisFrom EverandSummary of I Will Teach You To Be Rich: by Ramit Sethi | Includes AnalysisNo ratings yet

- What Is Microfinance and What Does It PromiseDocument16 pagesWhat Is Microfinance and What Does It PromiseZahid BhatNo ratings yet

- SIN Collusion Bonus Chapter Rv0 1Document6 pagesSIN Collusion Bonus Chapter Rv0 1monday125No ratings yet

- Estate TaxDocument9 pagesEstate TaxHafi DisoNo ratings yet

- Money is Not Rocket Science - 2013 Edition - Common Sense Rules for Financial SuccessFrom EverandMoney is Not Rocket Science - 2013 Edition - Common Sense Rules for Financial SuccessNo ratings yet

- 4 Problem of Credit Card Debt and How To Solve Them TodayDocument8 pages4 Problem of Credit Card Debt and How To Solve Them Todayfaithworks financialNo ratings yet

- Credit TipsDocument13 pagesCredit TipsMatthew Cody SnyderNo ratings yet

- Salary Slip Feb 2019 of SandeepDocument1 pageSalary Slip Feb 2019 of SandeepSawan YadavNo ratings yet

- Kieso 6Document54 pagesKieso 6noortiaNo ratings yet

- Fintech, Small Business & the American Dream: How Technology Is Transforming Lending and Shaping a New Era of Small Business OpportunityFrom EverandFintech, Small Business & the American Dream: How Technology Is Transforming Lending and Shaping a New Era of Small Business OpportunityNo ratings yet

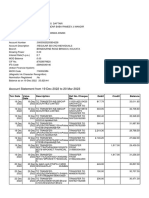

- Acct Statement XX4735 13112021Document15 pagesAcct Statement XX4735 13112021Srilekha ProdduturiNo ratings yet

- Income Statement: Reference: 408 083 646BDocument2 pagesIncome Statement: Reference: 408 083 646BStephen FairbairnNo ratings yet

- Statement 2022 12Document3 pagesStatement 2022 12GustavoNo ratings yet

- Balance StatementDocument3 pagesBalance StatementGustavoNo ratings yet

- Small Business Lending in The Digital AgeDocument27 pagesSmall Business Lending in The Digital AgeCrowdfundInsiderNo ratings yet

- The Total Money Makeover: by Dave Ramsey | Key Takeaways, Analysis & Review: A Proven Plan for Financial FitnessFrom EverandThe Total Money Makeover: by Dave Ramsey | Key Takeaways, Analysis & Review: A Proven Plan for Financial FitnessNo ratings yet

- Case Study On Grameen BankDocument7 pagesCase Study On Grameen BankShruti Patel75% (4)

- Minimalist Budget: Simple And Practical Strategies to Get You on the Road to Financial Freedom: Minimalist Living, #2From EverandMinimalist Budget: Simple And Practical Strategies to Get You on the Road to Financial Freedom: Minimalist Living, #2No ratings yet

- English TestDocument1 pageEnglish TestrahimdaudaniNo ratings yet

- Assignment 2.microfinanceDocument6 pagesAssignment 2.microfinanceAUE19No ratings yet

- What Is Microcredit and The Idea Behind ItDocument4 pagesWhat Is Microcredit and The Idea Behind Itcông lêNo ratings yet

- Concept of Micro CreditDocument16 pagesConcept of Micro CreditSyed Wahidur RahmanNo ratings yet

- When US Markets Go BustDocument16 pagesWhen US Markets Go BustchnlmttlNo ratings yet

- grameen bank案例研究Document6 pagesgrameen bank案例研究cjbyd3tkNo ratings yet

- A Cost-Effectiveness Analysis of The Grameen Bank of BangladeshDocument50 pagesA Cost-Effectiveness Analysis of The Grameen Bank of BangladeshFahmida AnjumanNo ratings yet

- Issues That Affect The Global Banking IndustryDocument3 pagesIssues That Affect The Global Banking IndustryNimisha ShahNo ratings yet

- Compartamos Banco and Grameen BankDocument7 pagesCompartamos Banco and Grameen BankEduardo CortesNo ratings yet

- Persuasive SpeechDocument3 pagesPersuasive SpeechMark RossolNo ratings yet

- MM10Document3 pagesMM10Huỳnh Ngan AnhNo ratings yet

- Bank To The PoorDocument5 pagesBank To The PoorDominic NguyenNo ratings yet

- CA Newsletter July 28 To 03 AugDocument15 pagesCA Newsletter July 28 To 03 AugAshish DeshpandeNo ratings yet

- Research Essay - Final DraftDocument11 pagesResearch Essay - Final Draftapi-509696889No ratings yet

- Exercise 2 Development Economics Prof. Iwan Jaya Azis Fall 2022Document2 pagesExercise 2 Development Economics Prof. Iwan Jaya Azis Fall 2022Gede Tristan Desirata RamaNo ratings yet

- Read The Following Text Written by An MP (A Member of Parliament)Document4 pagesRead The Following Text Written by An MP (A Member of Parliament)luana marli gomes cruzNo ratings yet

- The Tremendous Opportunity in Small Banks: Why Not Give The Ball To The Big Man?Document7 pagesThe Tremendous Opportunity in Small Banks: Why Not Give The Ball To The Big Man?nancypatwaryNo ratings yet

- Advantages and Disadvantages of MicrofinanceDocument10 pagesAdvantages and Disadvantages of MicrofinanceMohammadur Rahman50% (2)

- P P: T A I P L: Ayday Eonage Hirteenth Mendment Mplications in Ayday EndingDocument38 pagesP P: T A I P L: Ayday Eonage Hirteenth Mendment Mplications in Ayday EndingajarmanNo ratings yet

- Shuld Bank Size Be CappedDocument10 pagesShuld Bank Size Be CappedScribd FdssdNo ratings yet

- Case Analysis of Countrywide Financial - The Subprime MeltdownDocument5 pagesCase Analysis of Countrywide Financial - The Subprime Meltdownharsha_silan1487100% (1)

- Delinquency in Microfinance in India (30.10.22)Document24 pagesDelinquency in Microfinance in India (30.10.22)Kunal PurohitNo ratings yet

- What Is 'Microfinance': Next UpDocument19 pagesWhat Is 'Microfinance': Next UpVijay ChanderNo ratings yet

- The Role of Microcredit in Poverty Reduction and Promoting Gender Equity A Discussion PaperDocument37 pagesThe Role of Microcredit in Poverty Reduction and Promoting Gender Equity A Discussion PaperCharu ModiNo ratings yet

- About Microfinance: I. OverviewDocument13 pagesAbout Microfinance: I. OverviewAnkur SrivastavaNo ratings yet

- A Scoring Model of The Risk of Costly Arrears at A Microfinance Lender in BoliviaDocument31 pagesA Scoring Model of The Risk of Costly Arrears at A Microfinance Lender in BoliviapendejitusNo ratings yet

- Islamic Financial InstitutionsDocument12 pagesIslamic Financial InstitutionshaithamzeinNo ratings yet

- SHS General Mathematics Q2 M6Document16 pagesSHS General Mathematics Q2 M6Christian Leimer GahisanNo ratings yet

- Issues That Affect The Global Banking IndustryDocument3 pagesIssues That Affect The Global Banking Industryem-tech100% (1)

- Zippa Journal Jan - March 2009Document9 pagesZippa Journal Jan - March 2009Chola Mukanga100% (2)

- White Paper - Regulation Crowdfunding 1 Year in ForceDocument17 pagesWhite Paper - Regulation Crowdfunding 1 Year in ForceCrowdfundInsiderNo ratings yet

- As The FDIC Mops Up The Mess That Was Once IndyMac BankDocument6 pagesAs The FDIC Mops Up The Mess That Was Once IndyMac BankTawanda MagomboNo ratings yet

- A Grameen Bank Concept: Micro-Credit and Poverty Alleviation Program in BangladeshDocument5 pagesA Grameen Bank Concept: Micro-Credit and Poverty Alleviation Program in BangladeshMuhammad Al HafizhNo ratings yet

- Movie Analysis: The Big ShortDocument4 pagesMovie Analysis: The Big ShortHads LunaNo ratings yet

- Class Exercise PacketDocument27 pagesClass Exercise PacketPaige DarbonneNo ratings yet

- Advantages and Disadvantages of MicrofinanceDocument11 pagesAdvantages and Disadvantages of MicrofinanceprashantNo ratings yet

- History: Microcredit Is The Extension of Very SmallDocument5 pagesHistory: Microcredit Is The Extension of Very SmallDhira DaDaNo ratings yet

- Subprime Is The Cause of USA Economy Melt Down. It Is The Very Popular News AmongDocument18 pagesSubprime Is The Cause of USA Economy Melt Down. It Is The Very Popular News AmongPradeep SahooNo ratings yet

- Fault Lines Review #2Document2 pagesFault Lines Review #2Pramod Govind SalunkheNo ratings yet

- 2008 Recession Explained in Hindi ? 2008 Financial Crisis के मुख्य कारण - Live Hindi FactsDocument4 pages2008 Recession Explained in Hindi ? 2008 Financial Crisis के मुख्य कारण - Live Hindi FactsPrayas GambhirNo ratings yet

- The Business of Banking ReadingDocument10 pagesThe Business of Banking ReadingRodrigo MontesolerNo ratings yet

- Muhammad YunusDocument7 pagesMuhammad Yunussudip_13100% (1)

- CaseStudy HMWBRD RCDMDocument2 pagesCaseStudy HMWBRD RCDMReign Carylle MontemayorNo ratings yet

- 53 Microfinance Revolution and The Grameen Bank Experience in Bangladesh20190805-48922-1a68le6-With-Cover-Page-V2Document62 pages53 Microfinance Revolution and The Grameen Bank Experience in Bangladesh20190805-48922-1a68le6-With-Cover-Page-V2Hidayatullah GanieNo ratings yet

- HHS Tech FestDocument3 pagesHHS Tech FestrahimdaudaniNo ratings yet

- Ix - All Subjects Preparation-Papers 2024 - Homelander GroupDocument28 pagesIx - All Subjects Preparation-Papers 2024 - Homelander GrouprahimdaudaniNo ratings yet

- AKU-EB September Exams 2019 For Teaching & Learning OnlyDocument12 pagesAKU-EB September Exams 2019 For Teaching & Learning OnlyrahimdaudaniNo ratings yet

- Chemistry Revision Work Sheet Grade 9Document7 pagesChemistry Revision Work Sheet Grade 9rahimdaudaniNo ratings yet

- CH 08 Clearing House SystemDocument13 pagesCH 08 Clearing House SystemMoshhiur RahmanNo ratings yet

- Wyx 0 KD STza JQI3Document14 pagesWyx 0 KD STza JQI3Whales CallNo ratings yet

- 1.1 Background of The StudyDocument15 pages1.1 Background of The StudyBhimad Municipality ChamberNo ratings yet

- FRM Final ProjectDocument5 pagesFRM Final ProjectOkasha AliNo ratings yet

- Chapter-16 - Simple Interest PDFDocument6 pagesChapter-16 - Simple Interest PDFdeepaksaini140% (1)

- Grace Sdolares ArgumentDocument6 pagesGrace Sdolares Argumental_crespoNo ratings yet

- Wa0006.Document29 pagesWa0006.Mithun ChowdhuryNo ratings yet

- Instrukcija Za Prilive Iz Inostranstva - 30092020Document1 pageInstrukcija Za Prilive Iz Inostranstva - 30092020Miloš LazarevićNo ratings yet

- Exide Life Smart Income Plan - Brochure - 19012022.cdrDocument7 pagesExide Life Smart Income Plan - Brochure - 19012022.cdrarulkumarNo ratings yet

- Stat 3Document9 pagesStat 3Madan RajNo ratings yet

- Worksheet 1 - IXDocument2 pagesWorksheet 1 - IXJa HahaNo ratings yet

- NTS - Candidate (Portal)Document3 pagesNTS - Candidate (Portal)Adnan QadirNo ratings yet

- Valvetables PDFDocument10 pagesValvetables PDFrraditaNo ratings yet

- JENNY AGUILAR - Cash Surrender - Termination RequestDocument4 pagesJENNY AGUILAR - Cash Surrender - Termination Requestjenny aguilarNo ratings yet

- Freddie Mac Designated Counsel-Trott and OrlansDocument47 pagesFreddie Mac Designated Counsel-Trott and Orlansgb@chile.com100% (1)

- Carvana Auto Receivables Trust 2021-P2 New Issue ReportDocument29 pagesCarvana Auto Receivables Trust 2021-P2 New Issue ReportGarvitNo ratings yet

- 1 Subprime Mortgages Targeted Lower Income Americans New Immigrants and PeopleDocument1 page1 Subprime Mortgages Targeted Lower Income Americans New Immigrants and PeopleAmit PandeyNo ratings yet

- Grade 11 MATHAGISAN NG TALINO 2024Document4 pagesGrade 11 MATHAGISAN NG TALINO 2024Prilyn Sultan AlbNo ratings yet

- Awais ShootDocument2 pagesAwais ShootMuhammadNo ratings yet

- My CCH HKV7 Bgo 77 ZDocument12 pagesMy CCH HKV7 Bgo 77 ZShriyans DaftariNo ratings yet

- Wa0001.Document1 pageWa0001.Georgina W. RuschNo ratings yet