Professional Documents

Culture Documents

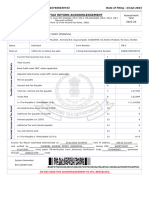

Income Tax Return

Uploaded by

Antonio InzulzaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Return

Uploaded by

Antonio InzulzaCopyright:

Available Formats

6/2/24, 0:36 Income Tax Return

LOG OUT (/FORM12-2023-WEB/LOGOUT)

Income Tax Return 2023

(Read only - Submitted : 06/02/2024)

Declaration

After reviewing your return details below, please read and confirm your declaration before continuing to submit your Income Tax Return.

Review ANTONIO's details

* Denotes a required field

Income(1) €24,645.73

Description Amount on revenue record Amount declared Status

VGL SUPPORT SERVICES IRELAND LI €24,645.73 €24,645.73 Confirmed

MITED

Tax credits & reliefs(5)

Description Amount on revenue record Amount claimed Status

Personal Tax Credit €1,775.00 €1,775.00 Confirmed

Flat Rate Expenses €121.00 €121.00 Confirmed

Employee Tax Credit €1,775.00 €1,775.00 Confirmed

Remote Working Relief — €317.97 Added

Rent Tax Credit — €2,500.00 Added

Declaration

I declare that, to the best of my knowledge and belief, this form contains a correct return in accordance with the provisions of the Taxes Consolidation Act

1997 of all sources of my income and the amount of income derived from each source in the year 2023.

I declare that to the best of my knowledge and belief, all particulars given as regards tax credits, allowances and reliefs claimed and as regards outgoings

and charges are stated correctly.

Civil Penalties/Criminal Prosecution - Tax law provides for both civil penalties and criminal sanctions for the failure to make a return, the making of a false

return, facilitating the making of a false return, or claiming tax credits, allowances or reliefs which are not due. In the event of a criminal prosecution, a

person convicted on indictment of an offence may be liable to a fine not exceeding €126,970 and/or to a fine of up to double the difference between the

declared tax due and the tax ultimately found to be due and/or to imprisonment.

Check this box to confirm this declaration. *

Back (/form12-

2023-

web/form12.html?

execution=e4s3&_eventId_back)

Done

Print

https://www.ros.ie/form12-2023-web/form12.html?execution=e4s3 1/1

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDocument2 pagesAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloNo ratings yet

- f1062 Guide To HMRC Tax CalcDocument7 pagesf1062 Guide To HMRC Tax CalcFake Documents of Simply Jodan's LLCNo ratings yet

- Noa-Iit Ob212020062419132485y PDFDocument1 pageNoa-Iit Ob212020062419132485y PDFilamahizhNo ratings yet

- Tax Credit Certificate 2023 9552941697409 PDFDocument2 pagesTax Credit Certificate 2023 9552941697409 PDFCarlos ResendeNo ratings yet

- Declaration 3310085249835Document4 pagesDeclaration 3310085249835Farhan AliNo ratings yet

- 3Rd Floor PNSC Building M. T Khan Road Inayat Ali: Thu, 16 Sep 2021 20:53:04 +0500Document4 pages3Rd Floor PNSC Building M. T Khan Road Inayat Ali: Thu, 16 Sep 2021 20:53:04 +0500ZeeshanNo ratings yet

- Noa-Iit Ob2220231215050837ibnDocument1 pageNoa-Iit Ob2220231215050837ibnFrankie TanNo ratings yet

- Amended Tax Credit Certificate 2020 7243210862511Document2 pagesAmended Tax Credit Certificate 2020 7243210862511Aurimas AurisNo ratings yet

- Amended Tax Credit Certificate: 2217905KA Pps NoDocument2 pagesAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- Tax Credit Certificate 2023 9552312947779Document2 pagesTax Credit Certificate 2023 9552312947779Toni rogers CardosoNo ratings yet

- GEN ELEC 04 G01 Guide For Completing The Value Added Tax VAT201 Declaration External GuideDocument50 pagesGEN ELEC 04 G01 Guide For Completing The Value Added Tax VAT201 Declaration External Guidesibiyazukiswa27No ratings yet

- Lecture 4 - Income Statement - Adjusting EntriesDocument2 pagesLecture 4 - Income Statement - Adjusting EntriesMaham FarooquiNo ratings yet

- PDF 949279100021221Document1 pagePDF 949279100021221MUTHUMUNEESH WARANNo ratings yet

- A Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsDocument7 pagesA Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsbswaminaNo ratings yet

- Mashood K ITR COMPUTATION AY 2022-23Document3 pagesMashood K ITR COMPUTATION AY 2022-23sidvikventuresNo ratings yet

- Ilovepdf MergedDocument7 pagesIlovepdf MergedRavi ChristoNo ratings yet

- Cir v. Cebu HoldingsDocument16 pagesCir v. Cebu HoldingsBeltran KathNo ratings yet

- Declaration 3120292219185Document4 pagesDeclaration 3120292219185umerkhanNo ratings yet

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business (Part Ii-A)Document9 pagesBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business (Part Ii-A)Tumamudtamud, JenaNo ratings yet

- Tax ReturnDocument26 pagesTax ReturnjoshuaharaldNo ratings yet

- Vamsi Krishna Velaga - ITDocument1 pageVamsi Krishna Velaga - ITvamsiNo ratings yet

- ITR Main Page (AY 22-23)Document1 pageITR Main Page (AY 22-23)ParthNo ratings yet

- Noa-Iit Ob25202003170642261sf PDFDocument1 pageNoa-Iit Ob25202003170642261sf PDFSoon SoonNo ratings yet

- Business Examples 2021Document12 pagesBusiness Examples 2021Faizan HyderNo ratings yet

- Ack Cespc6304p 2022-23 811632260201122Document1 pageAck Cespc6304p 2022-23 811632260201122knowthebest787No ratings yet

- Formal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument3 pagesFormal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDominic Dela VegaNo ratings yet

- 02 Proforma InvoiceDocument13 pages02 Proforma InvoiceVinodNo ratings yet

- PDF 265963700280222Document1 pagePDF 265963700280222Nemaram PatelNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearYash ChauhanNo ratings yet

- PDF 841012480101222Document2 pagesPDF 841012480101222Sanjay KumarNo ratings yet

- Net Income 17,000: Account Receivable - 45,000Document3 pagesNet Income 17,000: Account Receivable - 45,000Rock RoseNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Document7 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Bm ShopNo ratings yet

- Personal Income Tax: Lecture 1: Importance of Taxation in Financial PlanningDocument24 pagesPersonal Income Tax: Lecture 1: Importance of Taxation in Financial PlanningjulieNo ratings yet

- PDF 426362070130822Document1 pagePDF 426362070130822Laba MeherNo ratings yet

- Noa-Iit Ob2420230619070707preDocument1 pageNoa-Iit Ob2420230619070707prehvikashNo ratings yet

- Notice of Assessment OriginalDocument1 pageNotice of Assessment OriginalWawan SaidNo ratings yet

- Income Tax - Notice of Assessment (Original) : What Do You Need To Do? $467.44Document1 pageIncome Tax - Notice of Assessment (Original) : What Do You Need To Do? $467.44wahleng ChewNo ratings yet

- Accounting For Income TaxDocument6 pagesAccounting For Income TaxRyll BedasNo ratings yet

- 1201 Rental Tax Books of AcctDocument3 pages1201 Rental Tax Books of AcctMaddahayota College100% (1)

- Tax Return: Wealth and Income Tax 2021Document6 pagesTax Return: Wealth and Income Tax 2021evelinaburagaite2001No ratings yet

- Ack Aecpd7811g 2021-22 567944130291221Document1 pageAck Aecpd7811g 2021-22 567944130291221montu singhNo ratings yet

- FINMANDocument11 pagesFINMANJenny Shane UmaliNo ratings yet

- 21 - B Faisal Street Ghazi Colony Sanda Road Abdul Basit QureshiDocument2 pages21 - B Faisal Street Ghazi Colony Sanda Road Abdul Basit QureshisahrisNo ratings yet

- PDF 383442410310722Document1 pagePDF 383442410310722Ritik JangidNo ratings yet

- Notice of Assessment 2023 04 11 12 04 11 210682Document6 pagesNotice of Assessment 2023 04 11 12 04 11 210682namenoname363No ratings yet

- Ack 638167400230723Document1 pageAck 638167400230723gamers SatisfactionNo ratings yet

- Declaration 3430274906183Document4 pagesDeclaration 3430274906183Khokhar MirzaNo ratings yet

- PDF 534109970291221Document1 pagePDF 534109970291221tax advisorNo ratings yet

- Asad Naseer Malik ITR 2022Document6 pagesAsad Naseer Malik ITR 2022Deen with AyaanNo ratings yet

- PDF 924220340170123Document1 pagePDF 924220340170123Panwar JiNo ratings yet

- Template For PresentationDocument9 pagesTemplate For PresentationTheodorus RiadyNo ratings yet

- P21 Balancing Statement 2021 1919455700005Document3 pagesP21 Balancing Statement 2021 1919455700005Mo IbrahimNo ratings yet

- Itr21 22Document1 pageItr21 22RahulMahajanNo ratings yet

- TAXN 1016 FE - Long ProblemsDocument11 pagesTAXN 1016 FE - Long ProblemsCrystel Kate MananganNo ratings yet

- 2021 IK Return WDocument6 pages2021 IK Return Wali razaNo ratings yet

- Ay2022 23 Ujjawal Dhawan Apypd6567j ComputationDocument2 pagesAy2022 23 Ujjawal Dhawan Apypd6567j ComputationAkshat MittalNo ratings yet

- PDF 837919210071222Document1 pagePDF 837919210071222Harpreet SinghNo ratings yet

- 2023 Itr PravinvallikaduDocument18 pages2023 Itr PravinvallikadudennisNo ratings yet

- Himanshu Aggarwal Itr 21 22Document1 pageHimanshu Aggarwal Itr 21 22prateek gangwaniNo ratings yet

- Roy Padilla, Et Al V. Court of AppealsDocument1 pageRoy Padilla, Et Al V. Court of AppealsJill BagaoisanNo ratings yet

- State of Madhya Pradesh Vs Pradeep Sharma 06122013s131171COM630379Document6 pagesState of Madhya Pradesh Vs Pradeep Sharma 06122013s131171COM630379sagarNo ratings yet

- 3republic: Tbe Flbilippine%Document12 pages3republic: Tbe Flbilippine%Engelov AngtonivichNo ratings yet

- Scope and Power of Court To Seek Bond Under Section 88 CRPC by Rakesh Kumar SinghDocument4 pagesScope and Power of Court To Seek Bond Under Section 88 CRPC by Rakesh Kumar SinghLatest Laws TeamNo ratings yet

- The Rights of Accused Person in MalaysiaDocument24 pagesThe Rights of Accused Person in Malaysiaspecies09No ratings yet

- Indian Law On Cyber StalkingDocument5 pagesIndian Law On Cyber StalkingDavid RobertsonNo ratings yet

- Evaulation Boyd ShootingDocument13 pagesEvaulation Boyd ShootingNew Mexico Political ReportNo ratings yet

- Anger Management Letter To Judges PDFDocument1 pageAnger Management Letter To Judges PDFapi-256033751No ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument2 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledRudejane TanNo ratings yet

- Defences (Criminal Law - Cape Law)Document26 pagesDefences (Criminal Law - Cape Law)Nikki LorraineNo ratings yet

- West Virginia Inmate Search Department of Corrections LookupDocument4 pagesWest Virginia Inmate Search Department of Corrections LookupinmatesearchinfoNo ratings yet

- Sanchez v. Demetriou G.R. Nos. 111771-77Document2 pagesSanchez v. Demetriou G.R. Nos. 111771-77Joycee ArmilloNo ratings yet

- SLIDES - The Accused and His Prescence As A PartyDocument29 pagesSLIDES - The Accused and His Prescence As A PartySinelizwi NyangindlelaNo ratings yet

- San Beda Crim 2Document86 pagesSan Beda Crim 2Lenard Trinidad100% (1)

- Paul Joseph Wright Vs Court of AppealsDocument2 pagesPaul Joseph Wright Vs Court of AppealsBryan NavarroNo ratings yet

- Edward Kline IndictmentDocument9 pagesEdward Kline IndictmentWKYC.comNo ratings yet

- Objection FiledDocument8 pagesObjection FiledWNDUNo ratings yet

- Tan V PCIBDocument3 pagesTan V PCIBCourt NanquilNo ratings yet

- Case ResearchDocument5 pagesCase ResearchKharen StephensonNo ratings yet

- People v. NierraDocument5 pagesPeople v. NierraAngelica Alvero100% (1)

- Civil List IPS OfficersDocument7 pagesCivil List IPS Officersdeba01234No ratings yet

- Prosecution of Offenses (Rule 110)Document21 pagesProsecution of Offenses (Rule 110)anon_614984256No ratings yet

- All The Elements of The War Crime Are PresentDocument8 pagesAll The Elements of The War Crime Are PresentAlyssa Clarizze MalaluanNo ratings yet

- People v. CADocument2 pagesPeople v. CAAnonymous AzoGEVcNo ratings yet

- Reformation of PrisonersDocument2 pagesReformation of Prisonerskvreddy100% (1)

- Albany Police Dept Arrest Summary ReportDocument4 pagesAlbany Police Dept Arrest Summary ReportBryan FitzgeraldNo ratings yet

- Crim Digests IIDocument37 pagesCrim Digests IIJanica Lobas50% (2)

- Purdy Exhibit ADocument9 pagesPurdy Exhibit AIndiana Public Media News100% (1)

- People Vs XXXDocument17 pagesPeople Vs XXXJess RañaNo ratings yet

- The Level of Effectiveness of Curfew Implementation InairaloveutalDocument3 pagesThe Level of Effectiveness of Curfew Implementation Inairaloveutalmark jayson vasquezNo ratings yet