Professional Documents

Culture Documents

Suggested Solutions: Standard Costing and Variance Analysis

Uploaded by

api-3824657Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Suggested Solutions: Standard Costing and Variance Analysis

Uploaded by

api-3824657Copyright:

Available Formats

CHAPTER 10 STANDARD COSTING AND VARIANCE ANALYSIS

SUGGESTED SOLUTIONS

SOLUTION TO MULTIPLE CHOICE QUESTIONS

10.1 (e) 10.6 (b)

10.2 (c) 10.7 (d)

10.3 (d) 10.8 (e)

10.4 (c) 10.9 (a)

10.5 (b) 10.10 (a)

END OF CHAPTER QUESTIONS

10.1

Standard costing enables a benchmark to be set against which actual costs, revenues and

volumes can be measured. This assists in management by exception, that is, it easily

identifies situations where actual results differ from what was expected. By identifying a

standard, budgets can be prepared and control is made easier because the variance from the

plan is easily determined.

10.2

A variance is a deviation in actual performance when measured against the standard

expected. While it is always anticipated that there will be some deviation from standard,

variance analysis permits a tolerance level to be established. This means, for example, that if

a 5% deviation (above or below standard) is considered to be acceptable, variances in excess

of the tolerance levels can be identified. There may be legitimate reasons for such deviations,

but it nevertheless brings it to the attention of the responsible manager, who will request an

explanation. If the variance is as a result of a situation which requires correction, then action

can be taken timeously.

10.3

The two most significant variables when setting standards for materials are the standard price

and the standard quantity of the materials used per item of production. In addition, attention

must be paid to the quality of the materials, as lower quality material may be less costly, but

larger quantities may be required. The three critical variables are therefore the price, the

quantity and the quality of the materials. Other factors which must be considered are the

availability and the supplier from which it will be sourced. There must be confidence that a

specific material will always be able to be sourced, so alternative and contingency plans must

be on hand. In the event of materials being sourced from outside the country, consideration

must be given to exchange rates and lead times for delivery.

10.4

Direct material standards are set based on price, quantity and quality of materials required.

Consideration must be given to wastage which is inevitable in the use of all materials. This

must be included the standard material requirements in order to ensure that the standard is

realistic under normal working conditions

Direct labour standards are set based on the wage which must be paid and the average time

required for production of each unit. The wage should be market related and must comply with

any minimum wage legislation. Consideration needs to be given to possible down time as a

result of machine malfunctions and other possible stoppages in the normal course of

production.

10.5

An ideal standard is based on perfect conditions and no consideration of any defects or

malfunctions. This is not practical in real life situations, so due consideration is given to these

issues when setting practical standards.

© FLYNN D K: UNDERSTANDING FINANCE AND ACOUNTING: 2ND EDITION: SUGGESTED SOLUTIONS 1

10.6

When actual sales units are identical to standard sales units, the only variance is the price

variance. This variance has an impact on the gross profit.

When actual sales units exceed the standard sales units, a volume variance is present. This

variance is the number of units in excess of the standard, multiplied by the gross profit of each

unit. It is a positive sales volume variance.

10.7

Direct costing treats overhead costs as an expense for the period under review. Stated

differently, all overhead costs are written off as an expense for the period, regardless of how

many units were produced or sold. No allocation of overheads is included in the cost of the

units, which is determined only on the basis of the direct (variable) costs.

As a result, when direct costing is used, the only overhead variance is the overhead spending

variance, that is the difference between budgeted overheads and actual overheads incurred

during the period.

When absorption (full) costing is used, a portion of the overheads is budgeted into the cost of

each unit of production, based on the budgeted production volume. When there is a difference

between budgeted and actual volume, it follows that overheads will either have been under

absorbed or over absorbed by the production output. The overhead volume variance (volume

of over/under production x standard overhead allocation) must be determined in order to

reconcile the Rand difference between budgeted and actual production cost.

10.8

All resources used can conveniently and intuitively be divided into the quantity of the resource

used and the price paid. In most cases there are different people responsible for each and

dividing the variance in this way enables the person responsible to offer the reasons for such

variances.

10.9

Whenever the actual volume of units produced or sold is above or below the budgeted volume

of units, it follows that many other cost and revenue items will also be affected. In fact, the

only item which should not be affected is fixed costs. In order to make the variances more

useful, it also follows that the budget against which actual performance is measured should be

"flexed" in order to see what the budget would have been, had it budgeted for the actual

production. Variances are then comparable and provide useful information.

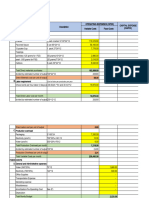

10.10 STRUMMERS LTD

10.11

Labour cost 28 DESIGNER

1 CONTAINERS LTD

Material cost [100kg] 600 100

Labour per 10 units STANDARD COST OF GUITARS MANUFACTURED

Material Kg per 100 units

Ultra Extra Jars

Bottles PER 10

Pots UNITS

Jars

5 8

Ultra Extra

Material cost 36 24 15

R 220.00 Wood Direct labour rates per hour

Ultra Skilled

Extra labour Labour 140.00 224.00

15

Material 745.00 997.00

Wood 0.25 0.35 0

Unskilled labour 8

Varnish 0 0 0

Wood

Varnish Unskilled 55.00 77.00

Geeks 0 0 R 8.00

0 STANDARD COST OF460.00 CONTAINERS690.00MANUFACTURED

0 0 Geeks

0 Bottles Pots Jars 230.00

PER 230.00

1OO UNITS

R 230.00 Packing 0.00 0.00

Varnish and Geeks

Mixing 30 40 25 Bottles Jars Pots

Ultra Extra

Pressing 0

Standard Variable 0

Cost 0 885.00 2161,221.00 144

Wood 0 0 0 Material 90

Varnish 2 Finishing

3 0 0 0 0

Labour 1,370 1,166 955

Geeks 1 Packing1 0 10 12 10

0 0 0 Mixing 240 320 200

R 15.00 Skilled

Pressing 300 300 225

Bottles Pots Jars

Finishing 750 450 450

Mixing 0 0 0

© Packing SUGGESTED SOLUTIONS

FLYNN D K: UNDERSTANDING FINANCE AND ACOUNTING: 2ND EDITION: 80 2 96 80

Pressing 20 20 15

Finishing 50 Standard

30 Variable

30 Cost 1,586 1,310 1,045

Packing 0 0 0

© FLYNN D K: UNDERSTANDING FINANCE AND ACOUNTING: 2ND EDITION: SUGGESTED SOLUTIONS 3

10.12 MARATIME SURFING

Material cost 50 litre] R 1,540 50

Material Kg per 100 units

Body Long Surf

Material usage 12 16 10

Bought in Material 295 425 250

per hour

R 18.00 Unskilled

Body Long Surf

Shaping

Sanding 0.5 1 0.5

Colouring 0 0 0

Finishing 0.75 1 0.5

per hour

R 35.00 Skilled

Body Long Surf

Shaping 1 1.5 0.5

Sanding

Colouring 1.5 2 1

Finishing 0 0 0

STANDARD COST OF MARATIME SURFING

PER 1OO UNITS

Body Long Surf

Material 664.60 917.80 558.00

Wooden Base 295.00 425.00 250.00

Sheen 369.60 492.80 308.00

Labour 110.00 158.50 70.50

Shaping 35.00 52.50 17.50

Sanding 9.00 18.00 9.00

Colouring 52.50 70.00 35.00

Finishing 13.50 18.00 9.00

Standard Variable Cost 774.60 1,076.30 628.50

© FLYNN D K: UNDERSTANDING FINANCE AND ACOUNTING: 2ND EDITION: SUGGESTED SOLUTIONS 4

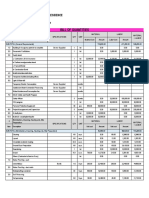

10.13 AIM HIGH LTD

(a) (b) & (c)

AIM HIGH LTD

unit sp/cost MASTER BUDGET

Manuf/Sell 100,000 12 100,000

material A 5,000 40 Sales 1,200,000

Material B Cost of Sales 800,000

Material C Materials 200,000

Labour A 8,000 50 Labour 400,000

Labour B Prime Cost 600,000

Labour C Overheads 200,000

Overhead 100,000 2

Net Profit 400,000

Profit/Sales 33.3%

Markup 50.0%

10.14 LUCID LTD

unit sp/cost LUCID LTD

Manuf/Sell 500,000 35 MASTER BUDGET

material A 600,000 18 500,000

Material B Sales 17,500,000

Material C Cost of Sales 15,960,000

Labour A 80,000 42 Materials 10,800,000

Labour B Labour 3,360,000

Labour C Prime Cost 14,160,000

Overhead 600,000 3 Overheads 1,800,000

Net Profit 1,540,000

Profit/Sales R 31.92

Markup 9.6%

10.15 AIM HIGH LTD [Flexible Budget]

AIM HIGH LTD

MASTER BUDGET

100,000 80,000 50,000

Sales 1,200,000 960,000 600,000

Cost of Sales 800,000 680,000 500,000

Materials 200,000 160,000 100,000

Labour 400,000 320,000 200,000

Prime Cost 600,000 480,000 300,000

Overheads 200,000 200,000 200,000

Net Profit 400,000 280,000 100,000

Cost per unit R 8.00 R 8.50 R 10.00

Profit/Sales 33.3% 29.2% 16.7%

Markup 50.0% 41.2% 20.0%

© FLYNN D K: UNDERSTANDING FINANCE AND ACOUNTING: 2ND EDITION: SUGGESTED SOLUTIONS 5

10.16 LUCID LTD [Flexible Budget]

(a) (b)

LUCID LTD

MASTER BUDGET

500,000 600,000 750,000

Sales 17,500,000 21,000,000 26,250,000

Cost of Sales 15,960,000 18,792,000 23,040,000

Materials 10,800,000 12,960,000 16,200,000

Labour 3,360,000 4,032,000 5,040,000

Prime Cost 14,160,000 16,992,000 21,240,000

Overheads 1,800,000 1,800,000 1,800,000

Net Profit 1,540,000 2,208,000 3,210,000

Cost per unit R 31.92 R 31.32 R 30.72

Profit/Sales 8.8% 10.5% 12.2%

Markup 9.6% 11.7% 13.9%

(c) The cost per unit declines as production increases, because the fixed costs are spread across

a grater number of units.

10.17 AIM HIGH LTD [Actual Production]

AIM HIGH LTD

VARANCE

VARANCE

MASTER FLEXIBLE ACTUAL FLEXIBLE

MASTER

BUDGET BUDGET RESULTS TO

TO ACTUAL

ACTUAL

100,000 75,000 75,000 0 -25,000

Sales 1,200,000 900,000 825,000 -75,000 -375,000

Cost of Sales 800,000 650,000 911,600 -261,600 -111,600

Materials 200,000 150,000 228,800 -78,800 -28,800

Labour 400,000 300,000 442,800 -142,800 -42,800

Prime Cost 600,000 450,000 671,600 -221,600 -71,600

Overheads 200,000 200,000 240,000 -40,000 -40,000

Net Profit 400,000 250,000 -86,600 -336,600 -486,600

Cost per unit R 8.00 R 8.67 R 12.15

Profit/Sales 33.3% 27.8% -10.5%

Markup 50.0% 38.5% -9.5%

CHECK: Variance Net profit -336,600 -486,600

STANDARD unit sp/cost

Manuf/Sell 100,000 12

material A 5,000 40

Labour A 8,000 50

Overhead 100,000 2

ACTUAL unit sp/cost COMMENTS ON VARIANCES

Manuf/Sell 75,000 11 Lower units, lower prices

material A 5,200 44 Higher units, higher costs

Labour A 8,200 54 More hours, higher cost per hour

Overhead 240,000 Fixed costs more than budgeted

© FLYNN D K: UNDERSTANDING FINANCE AND ACOUNTING: 2ND EDITION: SUGGESTED SOLUTIONS 6

10.18 LUCID LTD [Actual Production]

LUCID LIMITED

VARANCE VARANCE

MASTER FLEXIBLE ACTUAL

FLEXIBLE TO MASTER TO

BUDGET BUDGET RESULTS

ACTUAL ACTUAL

500,000 670,000 670,000 0 170,000

Sales 17,500,000 23,450,000 22,110,000 -1,340,000 4,610,000

Cost of Sales 15,960,000 20,774,400 17,655,000 3,119,400 -1,695,000

Materials 10,800,000 14,472,000 11,400,000 3,072,000 -600,000

Labour 3,360,000 4,502,400 4,320,000 182,400 -960,000

Prime Cost 14,160,000 18,974,400 15,720,000 3,254,400 -1,560,000

Overheads 1,800,000 1,800,000 1,935,000 -135,000 -135,000

Net Profit 1,540,000 2,675,600 4,455,000 1,779,400 2,915,000

Cost per unit R 31.92 R 31.01 R 26.35

Profit/Sales 8.8% 11.4% 20.1%

Markup 9.6% 12.9% 25.2%

CHECK: Variance Net profit 1,779,400 2,915,000

STANDARD unit sp/cost

Manuf/Sell 500,000 35

material A 600,000 18

Labour A 80,000 42

Overhead 600,000 3

ACTUAL unit flex sp/cost COMMENTS ON VARIANCES

Manuf/Sell 670,000 33 Considerably higher units, slightly lower price

material A 570,000 804,000 20 lower units than flexible, higher cost

Labour A 96,000 107,200 45 More hours, higher cost per hour

Overhead 1,935,000 Fixed costs more than budgeted

LUCID LIMITED

BUDGET VARIANCE REPORT

Budgeted Net profit 1,540,000

Sales Variance -204,400

Volume Variance 1,135,600

Price Variance -1,340,000

Material Variance 3,072,000

Volume Variance 4,212,000

Price Variance -1,140,000

Labour Variance 182,400

Volume Variance 470,400

Price Variance -288,000

Overhead Spending Variance -135,000

Actual Net Profit 4,455,000

© FLYNN D K: UNDERSTANDING FINANCE AND ACOUNTING: 2ND EDITION: SUGGESTED SOLUTIONS 7

10.19 THE TACK SHACK CC

(a) (b) &(c)

THE TACK SHOP CC

VARANCE

VARANCE

MASTER FLEXIBLE ACTUAL MASTER

FLEXIBLE

BUDGET BUDGET RESULTS TO

TO ACTUAL

ACTUAL

100 80 80 0 -20

Sales 5,000 4,000 4,240 240 -760

Cost of Sales 3,000 2,400 2,705 -305 295

Materials 2,000 1,600 1,960 -360 40

Labour 900 720 640 80 260

Prime Cost 2,900 2,320 2,600 -280 300

Overheads 100 80 105 -25 -5

Net Profit 2,000 1,600 1,535 -65 -465

Cost per unit R 30.00 R 30.00 R 33.81 -R 65

Profit per unit R 20.00 R 20.00 R 19.19 CHECK

Profit/Sales 40.0% 40.0% 36.2%

Markup 66.7% 66.7% 56.7%

CHECK: Variance Net profit -65 -465

(d)

BASIC VARIANCES

Master Budget Profit 2,000

Sales Volume -400

Sales Price 240

Cost -305

Actual Profit 1,535

(e)

THE TACK SHOP

BUDGET VARIANCE REPORT

Budgeted Net profit 2,000

Sales Variance -160

Volume Variance -400

Rate Variance 240

Material Variance -360

Usage Variance -640

Rate Variance 280

Labour Variance 80

Usage Variance 240

Rate Variance -160

Overhead Variance -25

Spending Variance -5

Qantity Variance -18

Actual Net Profit 1,535

© FLYNN D K: UNDERSTANDING FINANCE AND ACOUNTING: 2ND EDITION: SUGGESTED SOLUTIONS 8

10.20 RHINO DOORS (PTY) LTD

(a) (b) &(c)

RHINO DOORS CC

VARANCE

VARANCE

MASTER FLEXIBLE ACTUAL MASTER

FLEXIBLE

BUDGET BUDGET RESULTS TO

TO ACTUAL

ACTUAL

500 550 550 0 50

Sales 425,000 467,500 473,000 5,500 48,000

Cost of Sales 379,800 417,780 396,000 21,780 -16,200

Materials 54,000 59,400 55,000 4,400 -1,000

Labour 315,000 346,500 330,000 16,500 -15,000

Prime Cost 369,000 405,900 385,000 20,900 -16,000

Overheads 10,800 11,880 11,000 880 -200

Net Profit 45,200 49,720 77,000 27,280 31,800

Cost per unit R 759.60 R 759.60 R 720.00 R 27,280

Profit per unit R 90.40 R 90.40 R 140.00 CHECK

Profit/Sales 10.6% 10.6% 16.3%

Markup 11.9% 11.9% 19.4%

CHECK: Variance Net profit 27,280 31,800

(d)

BASIC VARIANCES

Master Budget Profit 45,200

Sales Volume 4,520

Sales Price 5500

Cost 21,780

Actual Profit 77,000

THE TACK SHOP

BUDGET VARIANCE REPORT

Budgeted Net profit 45,200

Sales Variance 10,020

Volume Variance 4,520

Rate Variance 5,500

Material Variance 4,400

Usage Variance -6600

Rate Variance 11000

Labour Variance 16,500

Usage Variance 0

Rate Variance 16,500

Overhead Variance 880

Spending Variance 200

Qantity Variance 880

Actual Net Profit 77,000

© FLYNN D K: UNDERSTANDING FINANCE AND ACOUNTING: 2ND EDITION: SUGGESTED SOLUTIONS 9

10.21 THE NATIONAL SAFE LTD

(a) (b) &(c)

NATIONAL SAFE LTD

VARANCE VARANCE

MASTER FLEXIBLE ACTUAL

FLEXIBLE MASTER

BUDGET BUDGET RESULTS

TO ACTUAL TO ACTUAL

1,200 1,400 1,400 0 200

Sales 14,400,000 16,800,000 17,360,000 560,000 2,960,000

Cost of Sales 11,760,000 13,720,000 13,605,600 114,400 -1,845,600

Materials 5,400,000 6,300,000 6,160,000 140,000 -760,000

Labour 4,800,000 5,600,000 5,745,600 -145,600 -945,600

Prime Cost 10,200,000 11,900,000 11,905,600 -5,600 -1,705,600

Overheads 1,560,000 1,820,000 1,700,000 120,000 -140,000

Net Profit 2,640,000 3,080,000 3,754,400 674,400 1,114,400

Cost per unit R 9,800.00 R 9,800.00 R 9,718.29 R 674,400

Profit per unit R 2,200.00 R 2,200.00 R 2,681.71 CHECK

Profit/Sales 18.3% 18.3% 21.6%

Markup 22.4% 22.4% 27.6%

CHECK: Variance Net profit 674,400 1,114,400

(d)

BASIC VARIANCES

Master Budget Profit 2,640,000

Sales Volume 440,000

Sales Price 560000

Cost 114,400

Actual Profit 3,754,400

(e)

NATIONAL SAFE LTD

BUDGET VARIANCE REPORT

Budgeted Net profit 2,640,000

Sales Variance 1,000,000

Volume Variance 440,000

Rate Variance 560,000

Material Variance 140,000

Usage Variance 525000

Rate Variance -385000

Labour Variance -145,600

Usage Variance 280,000

Rate Variance -425,600

Overhead Variance 120,000

Spending Variance -140,000

Qantity Variance 260000

Actual Net Profit 3,754,400

© FLYNN D K: UNDERSTANDING FINANCE AND ACOUNTING: 2ND EDITION: SUGGESTED SOLUTIONS 10

You might also like

- Mercedes - Benz Vito & V-Class Petrol & Diesel Models: Workshop Manual - 2000 - 2003From EverandMercedes - Benz Vito & V-Class Petrol & Diesel Models: Workshop Manual - 2000 - 2003Rating: 5 out of 5 stars5/5 (1)

- Papaya Partners Case Study Unit 5Document3 pagesPapaya Partners Case Study Unit 5Ola AlyousefNo ratings yet

- Iiid Iiig Iiih CorpusDocument7 pagesIiid Iiig Iiih CorpusKristine Anne InalNo ratings yet

- Break Even PointsDocument21 pagesBreak Even PointsPrashant VermaNo ratings yet

- MFA - Assignment 2: Management and Financial Accounting - Individual Assignment 2Document9 pagesMFA - Assignment 2: Management and Financial Accounting - Individual Assignment 2Mohan sunderNo ratings yet

- Nam SinDocument22 pagesNam SinKhayla RaymundoNo ratings yet

- Bcom 03 Block 04Document97 pagesBcom 03 Block 04sonukumargope562No ratings yet

- Accounting Assignment CardiffDocument12 pagesAccounting Assignment CardiffpavanihirushaNo ratings yet

- Standard Cost and Variances Final ReportDocument45 pagesStandard Cost and Variances Final ReportChristian AribasNo ratings yet

- Jusko Po Final Na Talaga PromiseDocument67 pagesJusko Po Final Na Talaga PromiseNicole FerrerNo ratings yet

- Chapter 10 - Advanced VariancesDocument19 pagesChapter 10 - Advanced VariancesVenugopal SreenivasanNo ratings yet

- IsapaDocument2 pagesIsapatupe lasikoNo ratings yet

- Cost ManagementDocument9 pagesCost ManagementVikkuNo ratings yet

- Crunchy ChipsDocument4 pagesCrunchy ChipsMae BalandanNo ratings yet

- Costing Maggi PDFDocument3 pagesCosting Maggi PDFPoorvi Singhal33% (3)

- Operational Budgeting and Variance Analysis: Topic 5Document17 pagesOperational Budgeting and Variance Analysis: Topic 5sv03No ratings yet

- Standard CostingDocument11 pagesStandard CostingyatharthlmdNo ratings yet

- Assignment - Cost and Management AccountingDocument7 pagesAssignment - Cost and Management AccountingShivam GoelNo ratings yet

- Akuntansi ManajemenDocument8 pagesAkuntansi ManajemenAslinda MutmainahNo ratings yet

- Accy 211 - Week 7 Tut HWDocument1 pageAccy 211 - Week 7 Tut HWIsaac ElhageNo ratings yet

- Chapter-V - Financial-Aspect - RevisedDocument31 pagesChapter-V - Financial-Aspect - RevisedRenabelle CagaNo ratings yet

- 2020 - Onion BudgetDocument13 pages2020 - Onion BudgetGeros dienosNo ratings yet

- Standard Costing Standard Costing Standard Costing Standard CostingDocument22 pagesStandard Costing Standard Costing Standard Costing Standard CostingKUNAL GOSAVINo ratings yet

- Mix and Yield Variances: Unit 3 SectionDocument5 pagesMix and Yield Variances: Unit 3 SectionBabamu Kalmoni JaatoNo ratings yet

- Unit 10 Approaches To Budgeting: StructureDocument17 pagesUnit 10 Approaches To Budgeting: StructurerehanNo ratings yet

- 1st Term Acc9 HandoutDocument55 pages1st Term Acc9 HandoutMallet S. GacadNo ratings yet

- MARGINAL COSTING Short Run Decision AnalysisDocument61 pagesMARGINAL COSTING Short Run Decision AnalysisAshutosh DayalNo ratings yet

- Chapter 3Document17 pagesChapter 3Geoana Jane BadenasNo ratings yet

- CHPTR 3 Flexible Budget and Budget VarianceDocument39 pagesCHPTR 3 Flexible Budget and Budget VarianceShandy NewgenerationNo ratings yet

- Mustard Oil: 1.0 Product and Its ApplicationsDocument6 pagesMustard Oil: 1.0 Product and Its Applicationsagarwal.rmNo ratings yet

- Application of Marginal Costing: Prof. Madhumathi Kristu Jayanti College BangaloreDocument10 pagesApplication of Marginal Costing: Prof. Madhumathi Kristu Jayanti College BangaloreMs. Madhumathi T KNo ratings yet

- Flexible Budgeting 7-8-2018Document7 pagesFlexible Budgeting 7-8-2018Mini BapnaNo ratings yet

- Technicalstudy RDocument17 pagesTechnicalstudy REar TanNo ratings yet

- Estimate Template 2014Document4 pagesEstimate Template 2014hasanNo ratings yet

- Papad MakingDocument9 pagesPapad Makingsaicon022No ratings yet

- Intensive VariancesDocument11 pagesIntensive VariancesZainab SyedaNo ratings yet

- Comprehensive Case 2 Chapters 5-10Document10 pagesComprehensive Case 2 Chapters 5-10Ato SumartoNo ratings yet

- Standard Cost and Operating Performance Measures FinalDocument20 pagesStandard Cost and Operating Performance Measures FinalNieje Opema GutangNo ratings yet

- Chapter 10Document90 pagesChapter 10Aftarur Rahaman AnikNo ratings yet

- Chapter-: Standard CostingDocument28 pagesChapter-: Standard CostingDurdana NasserNo ratings yet

- Session 3 - Standard CostingDocument18 pagesSession 3 - Standard Costingshinee2267No ratings yet

- Chapter 8 Solution Manual of Managerial Accounting Ronald HiltonDocument46 pagesChapter 8 Solution Manual of Managerial Accounting Ronald HiltonMuhammad Sadiq50% (8)

- Estimate Template 2014Document4 pagesEstimate Template 2014Level InteriorsNo ratings yet

- Sun Boat: Case StudyDocument9 pagesSun Boat: Case StudyvinagoyaNo ratings yet

- Chapter VDocument23 pagesChapter VJewel KimNo ratings yet

- Marta's Financial AspectDocument22 pagesMarta's Financial AspectMarvin GamboaNo ratings yet

- Model Solution - Assessment 2Document12 pagesModel Solution - Assessment 2rajeshkinger_1994100% (2)

- Financial AssumptionsDocument15 pagesFinancial AssumptionsAngelica VinasNo ratings yet

- The Woods - Furniture Production Final VersionDocument30 pagesThe Woods - Furniture Production Final VersionAssylay UzakbayevaNo ratings yet

- GreenhouseTomatoBudget2018 InteractiveFinalDocument37 pagesGreenhouseTomatoBudget2018 InteractiveFinalEduardo GalindoNo ratings yet

- Sales Variance & Operating StatementDocument12 pagesSales Variance & Operating StatementEjaz AhmadNo ratings yet

- Sunair Boat BuildersDocument9 pagesSunair Boat BuildersWei DaiNo ratings yet

- Case Study Unit 5Document4 pagesCase Study Unit 5Hilkiah MusNo ratings yet

- Material Variance ProblemsDocument4 pagesMaterial Variance ProblemsmohitNo ratings yet

- Best Financial Forecast FinalDocument13 pagesBest Financial Forecast Finalitsmethird.26No ratings yet

- Executive Summary: 1.1 ObjectivesDocument16 pagesExecutive Summary: 1.1 ObjectivesBonDocEldRicNo ratings yet

- Assignment PDFDocument15 pagesAssignment PDFpavanihirushaNo ratings yet

- BOQ1Document7 pagesBOQ1Milo NuggetsNo ratings yet

- Chapter 2 Solutions: Solution 2.1Document12 pagesChapter 2 Solutions: Solution 2.1Mobin RahmanNo ratings yet

- Chapter 006 - Standard Costs VariancesDocument43 pagesChapter 006 - Standard Costs VariancesChi Nguyễn Thị KimNo ratings yet

- Chapter 16: Principles of Valuation: Suggested SolutionsDocument9 pagesChapter 16: Principles of Valuation: Suggested Solutionsapi-3824657No ratings yet

- Ufa#Ed 2#Sol#Chap 14Document13 pagesUfa#Ed 2#Sol#Chap 14api-3824657No ratings yet

- Chapter 12: The Cost of Capital: Suggested SolutionsDocument7 pagesChapter 12: The Cost of Capital: Suggested Solutionsapi-3824657No ratings yet

- Chapter 15: Methods of Financing A Business: Suggested SolutionsDocument10 pagesChapter 15: Methods of Financing A Business: Suggested Solutionsapi-3824657No ratings yet

- Ufa#Ed 2#Sol#Chap 11Document8 pagesUfa#Ed 2#Sol#Chap 11api-3824657No ratings yet

- Chapter 13: Working Capital Management: Suggested SolutionsDocument10 pagesChapter 13: Working Capital Management: Suggested Solutionsapi-3824657No ratings yet

- Ufa#Ed 2#Sol#Chap 09Document19 pagesUfa#Ed 2#Sol#Chap 09api-3824657No ratings yet

- Ufa#Ed 2#Sol#Chap 07Document14 pagesUfa#Ed 2#Sol#Chap 07api-3824657No ratings yet

- Ufa#Ed 2#Sol#Chap 06Document18 pagesUfa#Ed 2#Sol#Chap 06api-3824657No ratings yet

- Ufa#Ed 2#Sol#Chap 05Document40 pagesUfa#Ed 2#Sol#Chap 05api-3824657No ratings yet

- Ufa#Ed 2#Sol#Chap 08Document21 pagesUfa#Ed 2#Sol#Chap 08api-3824657No ratings yet

- Ufa#Ed 2#Sol#Chap 04Document29 pagesUfa#Ed 2#Sol#Chap 04api-3824657No ratings yet

- Chapter 3 Suggested Solutions: Input Output + - + - + ProcessDocument11 pagesChapter 3 Suggested Solutions: Input Output + - + - + Processapi-3824657No ratings yet

- Ufa#Ed 2#Sol#Chap 02Document14 pagesUfa#Ed 2#Sol#Chap 02api-3824657No ratings yet

- Ufa#Ed 2#Sol#Chap 01Document5 pagesUfa#Ed 2#Sol#Chap 01api-3824657No ratings yet

- Busy Association BeckyDocument11 pagesBusy Association BeckySamuel L ENo ratings yet

- Table No 4.1: Showing The Classification of The Respondents According To The Demographic FeaturesDocument19 pagesTable No 4.1: Showing The Classification of The Respondents According To The Demographic Featuresskumargb22No ratings yet

- Chap 16Document29 pagesChap 16Dyan IRNo ratings yet

- Module 3 Unit 19Document75 pagesModule 3 Unit 19raden gurnandaNo ratings yet

- Sudana, 2019Document26 pagesSudana, 2019inaaakk wkwkNo ratings yet

- HR OngcDocument77 pagesHR Ongcvipul tandonNo ratings yet

- Best Practices of Catchment Scoping, Territory Potential & Target AnalysisDocument17 pagesBest Practices of Catchment Scoping, Territory Potential & Target AnalysisVipul GuptaNo ratings yet

- WLB ReportDocument18 pagesWLB ReportDr-Shefali GargNo ratings yet

- Lecture 18 Ee Esdm 2109 Tnb.Document19 pagesLecture 18 Ee Esdm 2109 Tnb.ayonpakistanNo ratings yet

- Value of A Bond: Arbitrage-Free Valuation Approach For BondsDocument5 pagesValue of A Bond: Arbitrage-Free Valuation Approach For BondsXyza Faye RegaladoNo ratings yet

- Ebook Corporate Financial Management 5Th Edition Glen Arnold Test Bank Full Chapter PDFDocument28 pagesEbook Corporate Financial Management 5Th Edition Glen Arnold Test Bank Full Chapter PDFdextrermachete4amgqg100% (10)

- Handling Customer ComplaintDocument15 pagesHandling Customer ComplaintVikram KatariaNo ratings yet

- Actual Costing OverviewDocument14 pagesActual Costing OverviewBrian3911100% (1)

- Literature Review On The Topic of Strategic Human Resource ManagementDocument6 pagesLiterature Review On The Topic of Strategic Human Resource Managementea3j015dNo ratings yet

- Group Assignment TaxationDocument20 pagesGroup Assignment TaxationEnat Endawoke100% (1)

- Business Strategy: RequirementsDocument3 pagesBusiness Strategy: Requirementsasdfghjkl007No ratings yet

- FABM2 Module 04 (Q1-W5)Document5 pagesFABM2 Module 04 (Q1-W5)Christian Zebua100% (1)

- Activity Based CostingDocument50 pagesActivity Based CostingParamjit Sharma97% (65)

- Global Body of Investment KnowledgeDocument86 pagesGlobal Body of Investment KnowledgeMiMNo ratings yet

- Merger of Citi N TravelersDocument17 pagesMerger of Citi N TravelersSonica ShetNo ratings yet

- Taxation AmendmentsDocument33 pagesTaxation AmendmentscawinnersofficialNo ratings yet

- CA Final RM IndexDocument60 pagesCA Final RM IndexAnchal KhemkaNo ratings yet

- Important Steps To Implement Risk Management in QMS ProcessesDocument2 pagesImportant Steps To Implement Risk Management in QMS ProcessesCentauri Business Group Inc.No ratings yet

- Airbed&Breakfast: Book Rooms With Locals, Rather Than HotelsDocument17 pagesAirbed&Breakfast: Book Rooms With Locals, Rather Than HotelsMd Mostakin RabbiNo ratings yet

- India NBFC Summit & Awards 2019Document7 pagesIndia NBFC Summit & Awards 2019Rahul SeleriNo ratings yet

- Report Prepaid UtilityDocument36 pagesReport Prepaid Utilitymethos40100% (1)

- 01.13 ClearingDocument38 pages01.13 Clearingmevrick_guy0% (1)

- Chapter 7Document22 pagesChapter 7anis abdNo ratings yet

- SodapdfDocument1 pageSodapdfMarcos WilkerNo ratings yet

- EL Estee Lauder 2018Document15 pagesEL Estee Lauder 2018Ala Baster100% (1)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (8)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetFrom EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetRating: 5 out of 5 stars5/5 (2)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamFrom EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo ratings yet

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistFrom EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistRating: 4 out of 5 stars4/5 (32)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsFrom EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsRating: 5 out of 5 stars5/5 (1)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionFrom EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionRating: 5 out of 5 stars5/5 (1)

- Creating Shareholder Value: A Guide For Managers And InvestorsFrom EverandCreating Shareholder Value: A Guide For Managers And InvestorsRating: 4.5 out of 5 stars4.5/5 (8)

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Other People's Money: The Real Business of FinanceFrom EverandOther People's Money: The Real Business of FinanceRating: 4 out of 5 stars4/5 (34)