Professional Documents

Culture Documents

IJCRT2305935

Uploaded by

Vedartha PathakOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IJCRT2305935

Uploaded by

Vedartha PathakCopyright:

Available Formats

www.ijcrt.

org © 2023 IJCRT | Volume 11, Issue 5 May 2023 | ISSN: 2320-2882

THE HISTORY OF UPI

Prasanna T R

Student

MBA

Issm B. School, Chennai, India.

Abstract: The Unified Payment Interface (UPI) has revolutionized the way people make digital payments in

India. UPI was launched by the National Payments Corporation of India (NPCI) in 2016 and has since become

the most widely used digital payment system in India. This article provides an overview of the history of UPI,

including its origins, development, and growth. The article also discusses the key features and benefits of UPI,

as well as some of the challenges and concerns associated with the system. Finally, the article concludes with

a discussion of the future prospects of UPI.

Keywords: UPI, digital payments, NPCI, India, mobile payments, banking

Introduction:

The advent of digital technology has brought about a revolution in the way people make payments. Digital

payment systems have made it easier, faster, and more convenient for people to transfer money, pay bills, and

make purchases. In India, the Unified Payment Interface (UPI) has emerged as the most popular digital

payment system. UPI was launched by the National Payments Corporation of India (NPCI) in 2016 and has

since gained widespread acceptance across the country. UPI has not only simplified the process of making

payments but has also brought millions of unbanked Indians into the formal banking system.

Beginning of UPI:

In April 2009, National Payment Corporation of India (NPCI) was formed to integrate all the payment

mechanisms in India and make them uniform for all retail payments. By March 2011, RBI found out that in

India, only six non-cash transactions happen every year by an individual citizen while 10 million retailers

accepted card-based payment. Around 145 million families have no access to any form of banking. There is

also the problem of tackling black money and corruption that happens mostly in cash.

RBI in 2012 released a vision statement for a period of four years that indicated commitment towards building

a safe, efficient, accessible, inclusive, interoperable and authorized payment and settlement system in India.

IJCRT2305935 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org h634

www.ijcrt.org © 2023 IJCRT | Volume 11, Issue 5 May 2023 | ISSN: 2320-2882

It is part of the Green Initiative to decrease the usage of paper in domestic payments market. UPI was officially

launched in 2016 for public use.

Under RBI guidance, NPCI became the primary body tasked with developing a new payment system that is

simple, secure, and interoperable. UPI works on four pillar push-pull interoperable model where there will be

remitter/beneficiary front end PSP (payment service provider) and remitter/beneficiary back-end bank that

settles the monetary transaction for the users. According to CEO of Net magic Solutions, UPI became one of

the most successful deep-tech innovation coming out of India.

In December 2019, noting the success of UPI, Google suggested Federal Reserve Board to follow UPI as

example in developing Fed Now, a real-time payment system for United States.

With exponential growth of UPI, India became the world's largest real-time payment market with 25.50 billion

annual transactions in 2020 per data from ACI Worldwide and Global Data, ahead of China and United States.

As per the Economist Intelligence Unit Report 2021, UPI made India a leader in global real-time payment

market followed by China and South Korea. After the decision of Ministry of Finance to nullify merchant

discount rate (MDR) in 2019 from UPI, the number of low value transactions skyrocketed making huge gains

on real-time transaction volume data. Nations such as Brazil, Bahrain, Saudi Arabia, Singapore, United

States and European Union are now trying to emulate the success of UPI in their own market.

From January 1, 2019, UPI became a popular payment option for initial public offerings (IPOs). The

transaction limit was enhanced from ₹100,000 to ₹200,000 in March 2020. From December 2021, RBI again

increased the limit to ₹500,000 for Retail Direct Scheme and IPO applications.

To make UPI economically feasible for payment companies, RBI is considering merchant discount

rate (MDR) on future UPI transactions. In its first monetary policy for financial year 2022–23, RBI proposed

cardless cash withdrawal facility from ATM using UPI based QR code. In partnership with NSDL Payments

Bank and NPCI, Tone Tag launched Voice SE which will enable 400 million feature phone users to make

UPI payment using voice in Hindi, Tamil, Telugu, Malayalam, Kannada, and Bengali languages.

Development of UPI:

UPI is based on the Immediate Payment Service (IMPS) platform, which was also developed by the NPCI.

UPI allows customers to transfer money instantly between bank accounts using their mobile phones. UPI uses

a unique virtual payment address (VPA) that is linked to a customer's bank account. Customers can create

their VPAs and share them with others to receive payments. UPI also allows customers to make payments by

scanning QR codes or using a mobile number.

Since its launch, UPI has grown rapidly and has become the most widely used digital payment system in

India. According to the NPCI, UPI processed over 22 billion transactions worth over INR 41 trillion

(approximately USD 556 billion) in 2021. The number of UPI transactions has been increasing steadily, with

over 3.6 billion transactions processed in March 2021 alone. UPI has also enabled millions of unbanked

Indians to access digital payments, as customers can link their mobile wallets to UPI and use it to make

payments.

IJCRT2305935 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org h635

www.ijcrt.org © 2023 IJCRT | Volume 11, Issue 5 May 2023 | ISSN: 2320-2882

Globalization:

Around 777 million Indian consumers shop across the border in 2021. To make ease of payment, NPCI

International Payments Limited (NIPL) signed Memorandum of Understanding (MoU) with UK based PPRO

Financial on 17 November 2021 to expand the acceptance of UPI into foreign markets especially in China

and United States which accounts for half of all international transaction coming from India. On 26 January

2022, UK based fintech startup Transact365 enabled UPI for global merchants with real time currency

conversion facility that will help them do business in India independent of local presence.

As per NPCI and RBI mandate, banks, payment service providers (PSPs) and third-party application

providers (TPAPs) in India must enable international acceptance through UPI from 30 September 2022.

With the release of Payments Vision 2025 document on 17 June 2022, RBI will push for internationalization

of UPI with nations using United States dollar, Pound sterling and Euro under bilateral treaties.

Ministry of External Affairs (MEA) also actively pushing for internationalization of UPI due to geopolitical

concerns. But several countries including Canada are reluctant to accept UPI due to push back from American

firms. MEA is looking for Central Bank to Central Bank transfer using UPI as the pipeline and a collaborative

effort if the countries have a similar system like UPI. On 12 October 2022, India offered UPI and related

technologies to Commonwealth of Nations.

On 7 February 2023, PhonePe announced extending support of UPI for international payments in UAE,

Singapore, Mauritius, Nepal and Bhutan. Users will be able to pay in international currency directly from

Indian bank accounts. NIPL signed a definitive agreement with PPRO Financial on 27 April 2023 that will

enable acceptance of UPI among international payment service providers (PSPs) and global merchant

acquirers.

The Countries that Started Adapting towards UPI for doing Transactions:

1. Singapore

2. UAE

3. Oman

4. Saudi Arabia

5. Malaysia

6. France

7. Netherlands

8. Nepal

And many more countries are Adapting towards UPI for their day today transactions

IJCRT2305935 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org h636

www.ijcrt.org © 2023 IJCRT | Volume 11, Issue 5 May 2023 | ISSN: 2320-2882

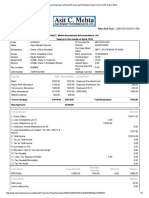

No of Banks Live on UPI from 2016 – 2021:

No. of

Transaction volume INR Value (in USD Value (in

Year Banks live

(in Mn) Cr.) Billions)

on UPI

2021 282 38,744.55 7,159,285.80 966.17

2020 207 18,880.89 3,387,744.72 457.19

2019 144 10,787.54 1,836,638.18 247.86

2018 129 3,746.32 585,710.45 79.04

2017 67 418.8 57,020.87 7.7

2016 35 2.65 893.07 0.12

App Wise Market Share:

Transaction

Transaction Value

App % Rank Number (In % Rank

(Rs)

Million)

PhonePe 5,247,424,900,000 49.25% 1 2,993.83 47.33% 1

Google

3,666,690,900,000 34.42% 2 2,130.63 33.68% 2

Pay

Paytm 1,111,496,600,000 10.43% 3 933.88 14.76% 3

Amazon

67,518,000,000 0.63% 8 68.77 1.09% 4

Pay

IJCRT2305935 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org h637

www.ijcrt.org © 2023 IJCRT | Volume 11, Issue 5 May 2023 | ISSN: 2320-2882

Market Capitalization:

On 26 March 2021, NPCI defined standard operating procedure for third-party payment providers on 30%

market cap. The limit will be calculated on the basis of total volume of transactions processed over UPI during

the preceding three months on a rolling basis starting from 1 January 2021. Compliance deadline is until

December 2023. NPCI will push first alert through an email or a letter to third-party payment providers and

their partner banks when UPI transactions hits 25-27% threshold which payment providers must acknowledge.

In return, payment providers will send second alert to NPCI with evidence on the steps taken for compliance.

In case 30% mark is breached, payment providers and banks must stop new user on-boarding. In special cases,

payment providers and banks may get an exemption of 6 months for compliance.

The report of breaching 30% market cap must reach NPCI within first five working days with plan for

corrective measures. During the same period, payment providers and banks must inform new customers about

the issue. Non-compliance of market cap bring penalties under UPI procedural guidelines. NPCI will check

operating procedures of UPI every 6 months to meet objectives without creating inconvenience for end users.

PhonePe made a formal request to NPCI to defer 30% market cap deadline from January 2023 to January

2026. NPCI is discussing this issue with RBI and Government. Industry stakeholders want to do away with

30% market cap proposed by NPCI, instead want organic growth based on customer demand.

Implementation is another contentious issue since it results in blocking existing users from performing

payment to maintain 30% market cap which is not feasible from business point of view. RBI also started

looking for solutions to fix the duopoly situation created by Google Pay and PhonePe. Both the players will

get two additional years till 31 December 2024 to fix their market cap.

Features and benefits of UPI:

UPI offers several key features and benefits that have contributed to its popularity. Firstly, UPI allows

customers to make instant and secure payments using their mobile phones. Customers do not need to share

their bank account details with others, as they can use their VPAs to receive payments. Secondly, UPI is

interoperable, which means that customers can use any bank's UPI app to make payments. Thirdly, UPI

supports a wide range of transactions, including peer-to-peer (P2P) transfers, bill payments, and merchant

payments. Fourthly, UPI is cost-effective, as it charges lower transaction fees compared to other payment

systems.

IJCRT2305935 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org h638

www.ijcrt.org © 2023 IJCRT | Volume 11, Issue 5 May 2023 | ISSN: 2320-2882

On-Device wallet:

NPCI called this feature UPI Lite. It can scan QR code without the need of an internet connection. In phase

1, UPI Lite will process the debit transaction offline while the credit will happen when the device goes online.

But the final goal is to achieve both credit and debit transaction through offline mode.

The upper limit of UPI Lite On-Device wallet is ₹2,000. Additional factor authentication or UPI AutoPay

feature will be used to securely load the desirable amount. Since 50% of UPI transactions are below ₹200

with a higher frequency rate, the per transaction limit will be maximum ₹200, as it creates a large backlog of

volume which increases the failure rate and affects the stability of the entire payment network.

To save electricity consumption and computing power of banks, UPI mobile apps will have to support on-

device wallet features as per the RBI directive from December 2021. The in-built wallet will help in low-

value instant payment by using the infrastructure of the mobile app developer, thus decreasing the load on

banks through decentralization of back-end infrastructure and resources.

On September 20, RBI governor Shakti kanta Das officially launched UPI Lite at Global Fintech Fest

2022. Canara Bank, HDFC Bank, Indian Bank, Kotak Mahindra Bank, Punjab National Bank, State Bank of

India, Union Bank of India and Utkarsh Small Finance Bank enabled UPI Lite feature on BHIM. Paytm

Payments Bank on 15 February 2023 went live with UPI Lite feature.

Challenges and concerns with UPI:

While UPI has been widely praised for its ease of use and convenience, there are also some concerns

associated with the system. One of the main concerns is the security of UPI transactions. While UPI uses

encryption and multi-factor authentication to secure transactions, there have been instances of fraud and

hacking.

Conclusion:

The Unified Payments Interface has transformed the Indian payments landscape, by providing a seamless,

easy-to-use, and secure platform for inter-bank transactions. Since its launch in 2016, UPI has become the

fastest-growing payment system in India, with over 3 billion transactions per month. UPI has revolutionized

the way people in India transfer money, pay bills, and make purchases. UPI also faces several challenges,

including data privacy concerns and competition from other payment systems. As UPI continues to grow and

evolve, it will be important to address these challenges and ensure that the system remains secure and user-

friendly. UPI has made it easier and more.

IJCRT2305935 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org h639

www.ijcrt.org © 2023 IJCRT | Volume 11, Issue 5 May 2023 | ISSN: 2320-2882

Reference:

1. National Payments Corporation of India (2021). UPI About UPI.

2. Reserve Bank of India (2018) Report of the Committee on Digital Payments.

3. National Payments Corporation of India (2021) UPI FAQs.

4. PwC India (2018) UPI Driving the growth of digital payments.

5. The Economic Times (2021) UPI transactions cross 3 billion in March, clock Rs 5.04 lakh crore worth

of payments.

6. Ahirrao, S., & Jagtap, V. (2019). Unified payments interface (UPI): Opportunities and challenges in

Indian banking sector. Management & Change, 23(1), 11-23.

7. Bhattacharya, A. (2020). Payment systems and digital economy in India: A review of recent

developments. Journal of Financial Economic Policy.

8. Ehrlich, L. C. (2019). Radio UPI and the Rise of the National Radio News Networks in the 1930s.

American Journalism, 36(4), 544-571.

9. Andrews, M. (2015). Newswriting on deadline. CRC Press.

10. Heritage, S. (2007). United Press International: A case study in changing professional norms and news

values. American Journalism.

IJCRT2305935 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org h640

You might also like

- Saif ProjectDocument41 pagesSaif ProjectMD TAHSEEN ZAFARNo ratings yet

- An Analysis of How COVID-19 Revolutionized India's Payment InfrastructureDocument11 pagesAn Analysis of How COVID-19 Revolutionized India's Payment InfrastructureIJRASETPublicationsNo ratings yet

- Credit-Linked UPI - An Evolving SagaDocument8 pagesCredit-Linked UPI - An Evolving Sagaashutosh chaudharyNo ratings yet

- Origin of UPI & Internet Payment SystemDocument11 pagesOrigin of UPI & Internet Payment SystemSiddhant BoradeNo ratings yet

- UPI AmoghDas 2022Document19 pagesUPI AmoghDas 2022Saloni MaharanaNo ratings yet

- Micro Lit Review AssignmentDocument19 pagesMicro Lit Review AssignmentVidhi GhadiNo ratings yet

- Dr. K V R Satya Kumar Assoc Professor Dept of Management Studies, VJIT & Dr. Seema Nazneen Assoc Professor Som, AuDocument26 pagesDr. K V R Satya Kumar Assoc Professor Dept of Management Studies, VJIT & Dr. Seema Nazneen Assoc Professor Som, AuSatya KumarNo ratings yet

- Consumer Perception Towards Digital Payment ModeDocument8 pagesConsumer Perception Towards Digital Payment ModeSibiCk100% (1)

- Phase 3Document9 pagesPhase 3Akshit AggarwalNo ratings yet

- 11 V May 2023Document6 pages11 V May 2023kapil_jNo ratings yet

- Trends in Digital Payments System in India-A Study On Google Pay, Phonepe and PaytmDocument5 pagesTrends in Digital Payments System in India-A Study On Google Pay, Phonepe and PaytmTokyo BtyNo ratings yet

- BAHAN RESEARCH GAP - TRUST - Analysis of Factors Affecting Use Behavior of QRIS PaymentDocument20 pagesBAHAN RESEARCH GAP - TRUST - Analysis of Factors Affecting Use Behavior of QRIS PaymentNathaniel Felix Syailendra PrasetyoNo ratings yet

- Group8-Fintech-Digital PaymentsDocument19 pagesGroup8-Fintech-Digital PaymentsNikita ShahNo ratings yet

- Group 7 - C4 IndiaDocument13 pagesGroup 7 - C4 IndiaSRISHTI NARANGNo ratings yet

- Case Study - TrueCaller UPIDocument5 pagesCase Study - TrueCaller UPImon2584No ratings yet

- 3 RDDocument4 pages3 RDBeneath B MathewNo ratings yet

- IEEESentiment Analysisof Digital Walletsand UPISystemsin India Post Demonetization Using IBMWatsonDocument7 pagesIEEESentiment Analysisof Digital Walletsand UPISystemsin India Post Demonetization Using IBMWatsonAarindam RainaNo ratings yet

- Monthly Beepedia September 2022Document129 pagesMonthly Beepedia September 2022Ashutosh KumarNo ratings yet

- A Study On Customer Insight Towards UPI (Unified Payment Interface) - An Advancement of Mobile Payment SystemDocument8 pagesA Study On Customer Insight Towards UPI (Unified Payment Interface) - An Advancement of Mobile Payment SystemAnkita RanaNo ratings yet

- A Study of Perception Towards Digital Payment Adoption in Sagar City of Madhya PradeshDocument8 pagesA Study of Perception Towards Digital Payment Adoption in Sagar City of Madhya Pradeshpankaj_jhariyaNo ratings yet

- MIDE Final ProjectDocument25 pagesMIDE Final ProjectMrinal DuttNo ratings yet

- GD Topics - Supply ChainDocument10 pagesGD Topics - Supply ChainVast H keenNo ratings yet

- Case 1Document11 pagesCase 1Ayushmaan mahendraNo ratings yet

- ICT India Working Paper 01Document17 pagesICT India Working Paper 01love bangtanNo ratings yet

- SL22ULBB039Document12 pagesSL22ULBB039shriya raoNo ratings yet

- Banking ProjectDocument25 pagesBanking ProjectHarshit MalviyaNo ratings yet

- Digital Cashless PaymentDocument13 pagesDigital Cashless Paymentmalhotrakunal551No ratings yet

- Mobile WalletDocument25 pagesMobile WalletbinalamitNo ratings yet

- IJCRT2302494Document5 pagesIJCRT2302494nirupamNo ratings yet

- Structure and Conduct Analysis of P2P Lending in IndonesiaDocument11 pagesStructure and Conduct Analysis of P2P Lending in IndonesiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- PWC Payments Handbook 2023Document34 pagesPWC Payments Handbook 2023Koshur KottNo ratings yet

- M6 - IIFT GK Compendium (2022-23)Document81 pagesM6 - IIFT GK Compendium (2022-23)Ayush BeryNo ratings yet

- Sakshi Short Synopsis 2023Document33 pagesSakshi Short Synopsis 2023vipin.kukreja955No ratings yet

- Ezetap Caselet Case Study PDFDocument12 pagesEzetap Caselet Case Study PDFSaurabh KumarNo ratings yet

- BECGDocument16 pagesBECGDev ShahNo ratings yet

- Daily Current Affairs: 9 November 2023Document18 pagesDaily Current Affairs: 9 November 2023vivek dwivediNo ratings yet

- SYMCA2006 Seminar ReportDocument20 pagesSYMCA2006 Seminar ReportMunna BhaiNo ratings yet

- ICT India Working Paper 1Document16 pagesICT India Working Paper 1Mohan SinghNo ratings yet

- September-Current Affairs-Part-4Document7 pagesSeptember-Current Affairs-Part-4sailuteluguNo ratings yet

- Digital PaymentDocument11 pagesDigital PaymentP S ShahilNo ratings yet

- Consumer's Perception Towards Online Banking ServicesDocument7 pagesConsumer's Perception Towards Online Banking ServicesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Cashless Economy (Oct 2022)Document30 pagesCashless Economy (Oct 2022)Priti DuttaNo ratings yet

- A Study On How The Usage of Upi Has Created An Impact On StudentsDocument43 pagesA Study On How The Usage of Upi Has Created An Impact On Studentspinky ns33% (3)

- Ajibm 2017102515484308Document18 pagesAjibm 2017102515484308Aarindam RainaNo ratings yet

- UPI Balances Consumer Experience With Growth For TPAPsDocument2 pagesUPI Balances Consumer Experience With Growth For TPAPsabhijitkortiNo ratings yet

- Monthly Current Affairs 2023 For September 29Document29 pagesMonthly Current Affairs 2023 For September 29malgeram13No ratings yet

- DSInnovate Fintech Report 2021Document76 pagesDSInnovate Fintech Report 2021Emil Fahmi YakhyaNo ratings yet

- JETIR2012274Document5 pagesJETIR2012274Muruga.v maddyNo ratings yet

- 4 THDocument6 pages4 THBeneath B MathewNo ratings yet

- A Study of Digital Payments:: Trends, Challenges and Implementation in Indian Banking SystemDocument19 pagesA Study of Digital Payments:: Trends, Challenges and Implementation in Indian Banking SystemHafsa HamidNo ratings yet

- NPCI Press Release RBI Governor Announces Launch of Three Key Initiatives at Global Fintech Fest 2022Document2 pagesNPCI Press Release RBI Governor Announces Launch of Three Key Initiatives at Global Fintech Fest 2022Prasan JayaramanNo ratings yet

- Finance IndustryDocument4 pagesFinance IndustrySmike ToretoNo ratings yet

- NPCI Magazine - TXN NXT Vol 2 - CollateralDocument76 pagesNPCI Magazine - TXN NXT Vol 2 - CollateraldupeshNo ratings yet

- Digital Payments Trends in India - A ForecastDocument9 pagesDigital Payments Trends in India - A ForecastIJRASETPublicationsNo ratings yet

- Fintech in India-Opportunities and ChallengesDocument14 pagesFintech in India-Opportunities and Challengescaalokpandey2007No ratings yet

- Digital Payment Systems - An Overview of Categories and Extant Opportunities and ChallengesDocument9 pagesDigital Payment Systems - An Overview of Categories and Extant Opportunities and ChallengesIJRASETPublicationsNo ratings yet

- Bhim Upi-Singapore Fintech FestivalDocument2 pagesBhim Upi-Singapore Fintech FestivalKunwarbir Singh lohatNo ratings yet

- Digital Journey IndiaDocument2 pagesDigital Journey IndiaAlaukik VarmaNo ratings yet

- UPI For Feature Phones - Blog - BhavyaDocument5 pagesUPI For Feature Phones - Blog - BhavyaBhavya SolankiNo ratings yet

- Managing the Development of Digital Marketplaces in AsiaFrom EverandManaging the Development of Digital Marketplaces in AsiaNo ratings yet

- Globebill 881537234 07-06-2019Document3 pagesGlobebill 881537234 07-06-2019Benjie PrilaNo ratings yet

- Oct StatementDocument8 pagesOct StatementqueenbeeastNo ratings yet

- Au 170Document1 pageAu 170Ida Bagus Gede PalgunaNo ratings yet

- DRC 03 PDFDocument2 pagesDRC 03 PDFP&AFIRMS TRICHYNo ratings yet

- Earning Rate Amount (RS.) Deductions Amount (RS.)Document2 pagesEarning Rate Amount (RS.) Deductions Amount (RS.)Ajay KharwarNo ratings yet

- Booking Details: Route Airline Flight # Departure ArrivalDocument4 pagesBooking Details: Route Airline Flight # Departure ArrivalCasareo LabNo ratings yet

- How Does A Letter of Credit WorkDocument9 pagesHow Does A Letter of Credit WorkAnju KumariNo ratings yet

- Disbursement Voucher: Contract Amount: - Less 5% Vat: - Less 1% W/ Holding TaxDocument3 pagesDisbursement Voucher: Contract Amount: - Less 5% Vat: - Less 1% W/ Holding TaxJessie MendozaNo ratings yet

- Road Safety: By-Shyamala ReubenDocument17 pagesRoad Safety: By-Shyamala ReubenAmunah ServNo ratings yet

- Tanggal Transaksi Debit KreditDocument16 pagesTanggal Transaksi Debit Kreditrahmie clinicNo ratings yet

- Axis Bank RtgsDocument1 pageAxis Bank Rtgsshankar shantkumarNo ratings yet

- What Is Containerization and Explain Its Various TypesDocument4 pagesWhat Is Containerization and Explain Its Various Typesshivamdubey12No ratings yet

- Why Do People Travel?: Leisure TourismDocument2 pagesWhy Do People Travel?: Leisure TourismSaniata GaligaNo ratings yet

- Voucher Redemption ProcessDocument5 pagesVoucher Redemption ProcessShubham Kumar RoyNo ratings yet

- Cah Receipts JournalDocument86 pagesCah Receipts JournalLouise BattungNo ratings yet

- SOA TemplateDocument20 pagesSOA TemplateNrkNo ratings yet

- Financial Accounting 2 Semester Level 1Document3 pagesFinancial Accounting 2 Semester Level 1Folegwe FolegweNo ratings yet

- N T N No. 2180652-7 03-05-5205-038-46 Sale Tax Reg. No.: 132-J Johar Town, Near Expo Center LahoreDocument1 pageN T N No. 2180652-7 03-05-5205-038-46 Sale Tax Reg. No.: 132-J Johar Town, Near Expo Center LahoreMuhammad Wasim ArifNo ratings yet

- Invoice: Gross Invoice Total Minus Outstanding AmountDocument3 pagesInvoice: Gross Invoice Total Minus Outstanding AmountAbdullah Al Mahmud SuzonNo ratings yet

- Fire Department Listing - USA Fire DepartmentsDocument27 pagesFire Department Listing - USA Fire Departmentsjohn reyesNo ratings yet

- 2019 Bar Qs TaxDocument9 pages2019 Bar Qs Taxzealous9carrotNo ratings yet

- 1580740668762Document26 pages1580740668762A.E.PNo ratings yet

- Ticket of Lakhjinder PalDocument5 pagesTicket of Lakhjinder PalAyaan Khan100% (1)

- IFFMDocument8 pagesIFFMNishant AnandNo ratings yet

- Status Update: Features of CREATEDocument18 pagesStatus Update: Features of CREATEMarkie GrabilloNo ratings yet

- Payment Instruction: TrxidDocument2 pagesPayment Instruction: TrxidGolam Rabbani SujonNo ratings yet

- Import Export ProjectDocument88 pagesImport Export ProjectÂjày Háñdè100% (2)

- 2012 20191025 StatementDocument2 pages2012 20191025 StatementDS QwerityNo ratings yet

- Tax Deposit-Challan 281-Excel FormatDocument8 pagesTax Deposit-Challan 281-Excel FormatMahaveer DhelariyaNo ratings yet

- Issues Challenges and Problems With Tax Evasion TH PDFDocument21 pagesIssues Challenges and Problems With Tax Evasion TH PDFkartikeya gulatiNo ratings yet