Professional Documents

Culture Documents

Financial Accounting 2 Semester Level 1

Uploaded by

Folegwe FolegweOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting 2 Semester Level 1

Uploaded by

Folegwe FolegweCopyright:

Available Formats

Answer 2 out of the 3 questions.

Question 1 is compulsory

1.Solve and record the following invoices

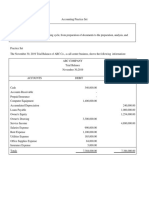

ABA SARL

AKO Debit ABESSOLO

Debit : ABA SARL Ebolowa

Batouri

Invoice No 65 Invoice No 86

The 03/06/2007 The : 10/06/2007

Description UNIT QTY UP AMOUN Description Unit Qty U.P Amount

T

TUBERS NET 5000 1500 Couscous Net ------- 20000 ---------

Trade disc 10% Rebate 5% 500000

Commercial Net Commercial net

Deposit on Cont 5000 600 Deposit on cont

Carriage invoiced 20000 Carriage invoiced

(tax exclusive) (tax exclusive)

Vat 19.25% 2 281 125

Net payable Net payable

Cash settlement ----------- Settlement by Bank cheque --------------

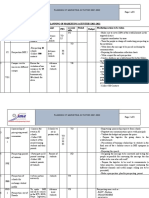

ABA SARL

ABA SARL Debit ABESSOLO

Batouri Ebolowa

Debit : ETIA

Berterati Credit note No 033

The : 12/06/2007

Invoice No 87

The 15/06/2007

Description UNIT QTY UP AMOUNT Description Unit Qty U.P Amount

Couscous NET 450 30000 Couscous Net 20 ---------

Rebate 100000 Rebate ---------

Commercial net Commercial net --------

Cash disc 2% Deposit on cont --------

Deposit on cont Carriage paid 35775

Vat 19.25% (tax inclusive)

Dispatching fees( Tax Vat 19.25% --------

inclusive) 59 625

Net payable Net to your credit

On credit ----------- --------------

Question 2

Ndotiti was recruited on the 23rd June 2018. As an accountant in ABC enterprise

cow street Po box 1816 Kumba. His basic salary is 468000 frs monthly and his

normal weekly hours are 40. During the month of August 2019 he effectively

worked as follows

1st week: 59hours with 2hours on Sunday

2nd week: 60hours with 3hours from 10:00pm to 6:00am

3rd week: 59hours with 1 hour waiting for a colleague to come replace him, 3hours

on public holiday

4th week: 47hours with 2 hours balancing the account which finally did not

balance.

He was married and had a son for which he was entitle to

-longevity allowance of 50000frs, milk allowance 15000frs, risk allowance

7000frs, out of station indemnity 50000frs, transportation indemnity 10000frs

Work required

1. Calculate the total amount of overtime and net taxable salary taken in to

consideration that he had all the various benefits in kind.

Question 3

Lafon and sons enterprise realized the following transaction from October to

December 2018. Purchase NB: VAT 19.25% note that vat is paid by cheque.

01/10/2018 purchase of goods 800 000frs and transport on purchase 20

000frs

18/10/2018 purchase of transport equipment 500 000frs

26/10/2018 sales of goods 1 500 000frs

01/11/2018 purchase of goods 400 000frs

13/11/2018 transport expenses on purchases 50 000frs

25/11/2018 sales of goods 1400 000frs (of which 300000frs is for export

sales)

01/12/2018 purchase of goods 600 000frs

02/12/2018 Electricity consumption 320KW at 50frs per KW

28/12/2018 sales of goods 900 000frs by cash

Work required

1. Do the accounting recording and calculate the monthly VAT payable.

You might also like

- Test WorksheetDocument1 pageTest WorksheetattackcairoNo ratings yet

- Pc3 5 JersonDocument13 pagesPc3 5 JersonAlex HCNo ratings yet

- Elaine WorkDocument8 pagesElaine WorkElaine CasamaNo ratings yet

- Balance Sheet Format For ItrDocument3 pagesBalance Sheet Format For ItrCommerce Adda ConsultancyNo ratings yet

- AHM13e Chapter - 03 - Solution To Problems and Key To CasesDocument24 pagesAHM13e Chapter - 03 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- AR Sample ProbDocument9 pagesAR Sample ProbCix SorcheNo ratings yet

- Group Assignment On Fundamentals of Accounting IDocument6 pagesGroup Assignment On Fundamentals of Accounting IKaleab ShimelsNo ratings yet

- Jawaban Siklus AkuntansiDocument9 pagesJawaban Siklus AkuntansiRendyyyNo ratings yet

- ABC CompanyDocument11 pagesABC CompanyA DiolataNo ratings yet

- BIR Form Quarterly Tax Returns: INSTRUCTION: Refer To Chapter 14 of Your Book in Answering The Requirements BelowDocument6 pagesBIR Form Quarterly Tax Returns: INSTRUCTION: Refer To Chapter 14 of Your Book in Answering The Requirements Belowdianne caballeroNo ratings yet

- Tutorial 6Document4 pagesTutorial 6MisteroNo ratings yet

- Ratios AS - Topical A Level Accounting Past PaperDocument27 pagesRatios AS - Topical A Level Accounting Past PaperVersha 2021No ratings yet

- Kier 2022Document7 pagesKier 2022Sander D. PeraNo ratings yet

- PC3 29Document12 pagesPC3 29ScribdTranslationsNo ratings yet

- Project Two. Process Financial Transactions and Prepare Financial The Accounts in The Ledger ofDocument11 pagesProject Two. Process Financial Transactions and Prepare Financial The Accounts in The Ledger ofGetahunNo ratings yet

- Cash Flow Excercise Questions-Set-2Document2 pagesCash Flow Excercise Questions-Set-2AgANo ratings yet

- Ffa/F3 Financial AccountingDocument16 pagesFfa/F3 Financial AccountingArt and Fashion galleryNo ratings yet

- GSTR1 03ajdpk8658g1z5 092022Document7 pagesGSTR1 03ajdpk8658g1z5 092022SANJEEV KUMARNo ratings yet

- Prac 1 Cash Basis PDFDocument12 pagesPrac 1 Cash Basis PDFMiraflor Sanchez BiñasNo ratings yet

- Prac 1 Cash Basis PDFDocument12 pagesPrac 1 Cash Basis PDFJay Lord FlorescaNo ratings yet

- Chapter 14Document6 pagesChapter 14Mychie Lynne MayugaNo ratings yet

- Chapter 5 Exercises-Exercise BankDocument9 pagesChapter 5 Exercises-Exercise BankPATRICIUS ALAN WIRAYUDHA KUSUMNo ratings yet

- Cash Flow Statement ProblemDocument2 pagesCash Flow Statement Problemapi-3842194100% (2)

- Final Assignment No 3 Acctg 121Document4 pagesFinal Assignment No 3 Acctg 121Pler WiezNo ratings yet

- 12-Mar Accounts Receivable 11,000 Service Revenue 11,000 20-Mar Cash 10,780 Sales Discount 220 Accounts Receivable 11,000Document6 pages12-Mar Accounts Receivable 11,000 Service Revenue 11,000 20-Mar Cash 10,780 Sales Discount 220 Accounts Receivable 11,000Tess CoaryNo ratings yet

- Notting Hill SolutionDocument10 pagesNotting Hill SolutionBurhan AzharNo ratings yet

- GSTR1 03ajdpk8658g1z5 062022Document7 pagesGSTR1 03ajdpk8658g1z5 062022SANJEEV KUMARNo ratings yet

- Bookkeeping Practice SetDocument31 pagesBookkeeping Practice SetSittie NorhanizahNo ratings yet

- Submission Tutorial 2 - SolutionDocument5 pagesSubmission Tutorial 2 - SolutionNdisa ChumaNo ratings yet

- Final Exam - ACCT 5001P - Fall 2022Document23 pagesFinal Exam - ACCT 5001P - Fall 2022shuvorajbhattaNo ratings yet

- BC 405 PII Past PapersDocument24 pagesBC 405 PII Past PapersArbaz KhanNo ratings yet

- BC 405 PII Past PapersDocument22 pagesBC 405 PII Past PapersRaza Ali SoomroNo ratings yet

- GSTR1 03ajdpk8658g1z5 122022Document7 pagesGSTR1 03ajdpk8658g1z5 122022SANJEEV KUMARNo ratings yet

- ST ND RDDocument6 pagesST ND RDCarlos Miguel MendozaNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- ACCT 100, Fall Semester 2020-21 Quiz 2Document48 pagesACCT 100, Fall Semester 2020-21 Quiz 2Ali Zain ParharNo ratings yet

- 2019 Unit 4 Budgeting SAC Solution BookDocument3 pages2019 Unit 4 Budgeting SAC Solution BookLachlan McFarlandNo ratings yet

- DSR Mock Test - 1 - Ca FoundationDocument5 pagesDSR Mock Test - 1 - Ca Foundationmaskguy001No ratings yet

- CIR Vs PAL - ConstructionDocument15 pagesCIR Vs PAL - ConstructionEvan NervezaNo ratings yet

- 15-Mca-Or-Accounting and Financial ManagementDocument4 pages15-Mca-Or-Accounting and Financial ManagementSRINIVASA RAO GANTANo ratings yet

- Answers OPERATIONDocument6 pagesAnswers OPERATIONAltea AroganteNo ratings yet

- A90 Report 1Document22 pagesA90 Report 1Jewel Mae MercadoNo ratings yet

- PC3 9Document11 pagesPC3 9ScribdTranslationsNo ratings yet

- Omar Muhktar Abusama Nov 19Document34 pagesOmar Muhktar Abusama Nov 19Garpt Kudasai100% (1)

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDocument10 pagesFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Cash and AccrualDocument3 pagesCash and Accrual夜晨曦No ratings yet

- CAPI Suggested June 2014Document25 pagesCAPI Suggested June 2014Meghraj AryalNo ratings yet

- Stuvia 2638335 Fac1502 Assignment 2 Semester 2 2023 (1) (2) (Original)Document597 pagesStuvia 2638335 Fac1502 Assignment 2 Semester 2 2023 (1) (2) (Original)Tlholego McepheNo ratings yet

- Elements ARR PaybackDocument3 pagesElements ARR PaybackAngela Miles DizonNo ratings yet

- Pay SlipDocument1 pagePay SlipShreya VermaNo ratings yet

- MP Meenakshi ITC ExcessDocument1 pageMP Meenakshi ITC ExcessSudhar SanNo ratings yet

- Finals Lecture Discussion On Special JournalsDocument36 pagesFinals Lecture Discussion On Special JournalsGarpt Kudasai100% (1)

- Is Fishing Non Motorized BangkaDocument4 pagesIs Fishing Non Motorized BangkaAnonymous EvbW4o1U7No ratings yet

- Tutorial QuestionsDocument2 pagesTutorial QuestionsNishika KaranNo ratings yet

- Amended Tax Credit Certificate: 2217905KA Pps NoDocument2 pagesAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- Bir Form 2307g JNJ Online ShopDocument5 pagesBir Form 2307g JNJ Online ShopReagan RodriguezNo ratings yet

- Business Taxation: (Malawi)Document11 pagesBusiness Taxation: (Malawi)angaNo ratings yet

- Exercise 2 (Cashflow Statements)Document2 pagesExercise 2 (Cashflow Statements)Prince TshepoNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Accounting and Finance Set One Marking GuideDocument5 pagesAccounting and Finance Set One Marking GuideFolegwe FolegweNo ratings yet

- Curriluim Vitae: Civil StatusDocument2 pagesCurriluim Vitae: Civil StatusFolegwe FolegweNo ratings yet

- Supply Budget ControlDocument16 pagesSupply Budget ControlFolegwe FolegweNo ratings yet

- 2021 STYS Fiverr EbookDocument31 pages2021 STYS Fiverr EbookPedroNo ratings yet

- Accounting and Finance Set 2Document6 pagesAccounting and Finance Set 2Folegwe FolegweNo ratings yet

- Curriluim Vitae: Civil StatusDocument2 pagesCurriluim Vitae: Civil StatusFolegwe FolegweNo ratings yet

- Canevas HND 2020Document594 pagesCanevas HND 2020Folegwe Folegwe100% (2)

- Accounting and Finance Set One Marking GuideDocument5 pagesAccounting and Finance Set One Marking GuideFolegwe FolegweNo ratings yet

- Acte Ohada en AnglaisDocument594 pagesActe Ohada en Anglaiscompte eleveNo ratings yet

- Communiqué BTS 2021Document3 pagesCommuniqué BTS 2021Folegwe FolegweNo ratings yet

- Progammes Bachelors NewDocument323 pagesProgammes Bachelors NewFolegwe FolegweNo ratings yet

- Accounting and Finance Set 2Document6 pagesAccounting and Finance Set 2Folegwe FolegweNo ratings yet

- Accounting For Banking Institutions: February 2020Document46 pagesAccounting For Banking Institutions: February 2020Folegwe FolegweNo ratings yet

- Accounting and Finance Set 1Document10 pagesAccounting and Finance Set 1Folegwe FolegweNo ratings yet

- Accounting and Finance Marking Guide For Set 2Document5 pagesAccounting and Finance Marking Guide For Set 2Folegwe FolegweNo ratings yet

- Makarios Library The Pastors Treasure LibraryDocument2 pagesMakarios Library The Pastors Treasure LibraryFolegwe FolegweNo ratings yet

- Accounting and Finance Set One Marking GuideDocument5 pagesAccounting and Finance Set One Marking GuideFolegwe FolegweNo ratings yet

- Marketing Plan For The AnglophonesDocument8 pagesMarketing Plan For The AnglophonesFolegwe FolegweNo ratings yet

- Accounting and Finance Marking Guide For Set 2Document5 pagesAccounting and Finance Marking Guide For Set 2Folegwe FolegweNo ratings yet

- Accounting and Finance Set 1Document10 pagesAccounting and Finance Set 1Folegwe FolegweNo ratings yet

- Accounting and Finance Set 2Document6 pagesAccounting and Finance Set 2Folegwe FolegweNo ratings yet

- .. at OnDocument8 pages.. at OnFolegwe FolegweNo ratings yet

- Advanced Financial Management PDFDocument205 pagesAdvanced Financial Management PDFaponojecy100% (5)

- Marketing Plan For The AnglophonesDocument8 pagesMarketing Plan For The AnglophonesFolegwe FolegweNo ratings yet

- Marketing Plan For The Anglophones-1Document8 pagesMarketing Plan For The Anglophones-1Folegwe FolegweNo ratings yet

- Training Lecturers Maintain A Continuous Improvement of Teaching Methods Teaching MethodDocument4 pagesTraining Lecturers Maintain A Continuous Improvement of Teaching Methods Teaching MethodFolegwe FolegweNo ratings yet

- Accounting For Banking Institutions: February 2020Document46 pagesAccounting For Banking Institutions: February 2020Folegwe FolegweNo ratings yet

- Acounting Atve Summarised NotesDocument118 pagesAcounting Atve Summarised NotesFolegwe FolegweNo ratings yet

- Acte Ohada en AnglaisDocument594 pagesActe Ohada en Anglaiscompte eleveNo ratings yet

- LOSTICS AND TRANSPORT SUPERVISION - CopieDocument1 pageLOSTICS AND TRANSPORT SUPERVISION - CopieFolegwe FolegweNo ratings yet

- Appellant DSNLU VishakapatnamDocument40 pagesAppellant DSNLU VishakapatnamKeerthana Gedela89% (9)

- ASEB III (Accounts) Form-1 Assam Power Distribution Company Ltd. Bill For Electricity Supply, APDCLDocument1 pageASEB III (Accounts) Form-1 Assam Power Distribution Company Ltd. Bill For Electricity Supply, APDCLPulak DuttaNo ratings yet

- Petty Cash LogDocument225 pagesPetty Cash Loghaswini baskaranNo ratings yet

- Computation of Income Tax Sagar Panjwani FY 2016-17Document3 pagesComputation of Income Tax Sagar Panjwani FY 2016-17Amol vasanta dhakateNo ratings yet

- How To Pay Zero Income Tax On 20 Lakhs SalaryDocument9 pagesHow To Pay Zero Income Tax On 20 Lakhs SalaryvijaytechskillupgradeNo ratings yet

- Reference No: 923839: American International University - BangladeshDocument1 pageReference No: 923839: American International University - BangladeshNayeem IslamNo ratings yet

- 4073xxxxxxxx4016 32545 Retail MMT NormDocument4 pages4073xxxxxxxx4016 32545 Retail MMT NormAishwarya MandhalkarNo ratings yet

- Mitteilungszentrale - Mitteilungen.steuerauszug 2023 CSS Borislav VulicDocument3 pagesMitteilungszentrale - Mitteilungen.steuerauszug 2023 CSS Borislav VulicBorislav VulicNo ratings yet

- Profile Jethani and AssociatesDocument8 pagesProfile Jethani and AssociatesCA UMESH KUMAR JETHANINo ratings yet

- Danish Taxes and The Taxation System in DenmarkDocument3 pagesDanish Taxes and The Taxation System in Denmarkbhushan kumarNo ratings yet

- ACS Registration Made EasyDocument10 pagesACS Registration Made EasycchukwunekeNo ratings yet

- Your Electricity Bill For: Details OverleafDocument2 pagesYour Electricity Bill For: Details Overleafamalendu sundar mandalNo ratings yet

- ANZ Personal Banking Account Fees and ChargesDocument20 pagesANZ Personal Banking Account Fees and ChargesmmirpuriNo ratings yet

- Tuition TableDocument2 pagesTuition TableJerlin Orexy Ubeda GutierrezNo ratings yet

- Tax Remedies SummaryDocument6 pagesTax Remedies Summarypja_14100% (2)

- ChallanDocument1 pageChallanramveer singhNo ratings yet

- Guide To Payment Services in SLDocument86 pagesGuide To Payment Services in SLTharuka WijesingheNo ratings yet

- 2.form of Appeal ACIR - MDocument4 pages2.form of Appeal ACIR - Mwasim nisarNo ratings yet

- Checklist of Documentary Requirements - Issuance by BIR of CARDocument1 pageChecklist of Documentary Requirements - Issuance by BIR of CARLRMNo ratings yet

- Onward Journey Ticket Details: Terms and ConditionsDocument3 pagesOnward Journey Ticket Details: Terms and ConditionsMahesh Chandra SinghNo ratings yet

- Fee Challan 19 Apr 2022Document18 pagesFee Challan 19 Apr 2022FaAriiNo ratings yet

- Chapter 5.0 Value Added Tax Percentage TaxesDocument14 pagesChapter 5.0 Value Added Tax Percentage TaxesDerick Ocampo Fulgencio0% (1)

- Info Edge (India) LTD: Tax InvoiceDocument1 pageInfo Edge (India) LTD: Tax Invoicephani raja kumarNo ratings yet

- Eliud Kitime, Laws of Taxation in TanzaniaDocument425 pagesEliud Kitime, Laws of Taxation in Tanzaniajonasharamba6No ratings yet

- Yellow - Not Sure, Green - CorrectDocument7 pagesYellow - Not Sure, Green - CorrectIsaiah John Domenic M. CantaneroNo ratings yet

- Exam SampleDocument15 pagesExam SampleKim LeNo ratings yet

- Credit Card Industry in India-Yash RochlaniDocument74 pagesCredit Card Industry in India-Yash RochlaniYash RochlaniNo ratings yet

- Statements 1232Document2 pagesStatements 1232josepaticaNo ratings yet

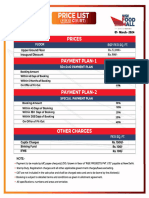

- Rise Food Mall (Food Court) Price List 1 March 2024Document1 pageRise Food Mall (Food Court) Price List 1 March 2024Navjot Singh NarangNo ratings yet

- TTT PDFDocument1 pageTTT PDFarunshanNo ratings yet