Professional Documents

Culture Documents

74534bos60448 Indas110

74534bos60448 Indas110

Uploaded by

pave.scgroupOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

74534bos60448 Indas110

74534bos60448 Indas110

Uploaded by

pave.scgroupCopyright:

Available Formats

SARANSH Indian Accounting Standards

INDIAN ACCOUNTING STANDARD (IND AS) 110:

CONSOLIDATED FINANCIAL STATEMENTS

MULTIPLE STANDARDS FOR GROUP ACCOUNTS

GROUP ACCOUNTS/CONSOLIDATION

Ind-AS-27 Ind-AS-28 Ind-AS-103 Ind-AS-110 Ind-AS 111

Separate financial Investment in Business Consolidated Joint Arrangement

statements associates combination financial

Statements

- Presenting -Accounting for - Define business -Control -Joint ventures

separate financial associates combination -Consolidated -Joint operations

statements -Equity method -Recognition financial

(investor) -Measurements Statements

-Procedures

-Investment entities

Ind-AS-112: Disclosures of interests in other entities

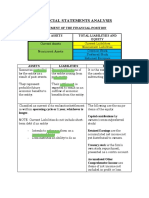

TYPES OF INVESTMENTS

Subsidiary Associate Joint Arrangement Other Investments

Criteria Control Significant influence Joint Control Not applicable

Share (Guidance only) >50% 20%+ Not Applicable <20%

Accounting Acquisition Method Equity Method Depends on Type Financial Instrument

(Full Consolidation) Accounting Ind-AS 109

IND AS 110: CONSOLIDATED FINANCIAL STATEMENTS

TYPES OF CONTROL –OUTRIGHT CONTROL AND JOINT CONTROL

Control can be

1 Outright Control 2 Joint Control

11

AS -1

ly Ind

App

Apply • Using Ind AS-110 Principles:

Ind-AS 110 • First, decide, if there is a control?

• Then decide, is the control jointly exercised?

• If Joint Control – then, it is a Joint Arrangement

• Classify between Joint Venture and Joint Operation

© ICAI BOS(A) 205

SARANSH Indian Accounting Standards

TYPES OF CONTROL – DE FACTO CONTROL

De Facto Control represents a situation, where Power (as defined in

Ind-AS 110) exists with less than 50% of the voting rights

De Facto Example:

Control • Parent owns 20% of voting rights and the balance 80% voting rights

are spread over 2000 shareholders across the country

• There exists a contractual arrangement to direct, despite having just

20% voting rights

Control is possible without majority of voting rights

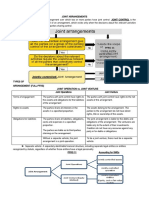

INTERACTION BETWEEN IND-AS 110,IND-AS 111, IND-AS 112 AND IND-AS 28

Outright

YES NO

Control

Joint

YES NO

Control?

Which type of Joint Significant influence

Agreement

YES NO

Joint Operation Joint Venture

Consolidate Accounts of assets Equity Accounting Ind Financial Assets

Ind AS 110 liabilities etc. Ind AS 111 AS 28 Accounting Ind AS 109

Apply Ind AS 107

Apply Ind AS 112 Disclosures

Disclosures

OBJECTIVE OF IND AS 110

Objective of To establish principles for preparation and presentation of:

Ind AS 110 - Consolidated Financial Statements (CFSs) when an entity controls another entity

Objective Ind AS 110

Consolidate Financial

Control Accounting requirement Investment entities

statements

© ICAI BOS(A) 206

SARANSH Indian Accounting Standards

SCOPE OF IND AS 110

More specifically Ind AS 110

requires an entity (a parent) that controls one or more other entities (subsidiaries) to present

consolidated financial statements (CFS)

defines the principle of control and establishes Control as the basis for consolidation

SCOPE OF provides guidance on how to interpret or apply control

IND AS

110

sets out how to identify whether the investor controls the investee

sets out the accounting requirements for the preparation of CFS

defines an investment entity and sets out an exception to consolidating particular

subsidiaries of an investment entity

Ind AS 110 does not cover the following

Covered by

1. Business Combination and initial recognition of goodwill Ind AS 103

2. Accounting for investments without having control Ind AS 111, Ind AS 28, Ind AS 109

3. Disclosures Ind AS 112

KEY DEFINITIONS

Parent Parent is an entity that controls one or more subsidiaries

Subsidiary Subsidiary is an entity that is controlled by another entity

Associate is an entity, over which an investor has significant influence and which is

Associate

neither a subsidiary nor an interest in joint venture

Joint

An arrangement of which two or more parties have joint control

Arrangement

Consolidated CFSs are the financial statements of a Group in which (1)assets (2)liability (3)equity

Financial (4)income (5)expenses and (6)cash flows of the parent and the subsidiary – are present-

Statements (CFS) ed as those of a single economic activity

© ICAI BOS(A) 207

SARANSH Indian Accounting Standards

(a)Existing rights that give the (b)current ability to direct the c) relevant activities

Assume that:

• CT Corp owns 40% shares of ABSPL

• ABSPL’s shares are structured in such a way that every share has one voting

right

• CT Corp also owns options (that are exercisable at any stage) under which CT

Corp can obtain another 20% share capital of ABSPL

• At the reporting date, CT Corp has the financial ability and the intention to

exercise these options and acquire 20% shares of ABSPL

Power

Does CT Corp controls ABSPL?

YES

In this case:

• Power over investee Voting Rights + Potential Voting Rights

• Exposure to Variability:

o CT Corp’s profit will depend on ABSPL’s financial performance (Equity Shares)

• Ability to Affect the Outcome:

o The voting rights give CT Corp the ability to control decisions made by the

BODs, viz. the relevant activities are affected by CT Corp’s

Power arises from right which can be (a) voting rights (b) potential voting rights (c) arising from

contractual arrangements or (d) a combinations of these rights

Activities of the investee that significantly affect investee’s returns

Relevant • Assume that a structured entity (SE) is formed to manage debts of a financial

Activities institution including activities such as (a) restructuring of debts (b) debt collection

(c) debt management (d) legal process relating to debt management etc.

• In this case, the party which controls the above activities actually control the SE

If more than one investors direct different relevant activities, identify which investors can

direct that activities that most significantly affect return

Exposure to Link between

Control = Power + variability in + power and

return return

Removal

Rights to deprive the decision-maker of its decision-making authority

Rights

Participative Participative rights generally do not provide the holder of such rights with power,

Rights but may preclude another party from having power

Rights designed to protect the interest of the party holding those rights, without giving

that party power over the entity to which the rights relate

Protective • When entering into a contract, there may be certain T&C that protect the interest

Rights of the party under certain circumstances

• These rights apply only under those circumstances

• Therefore, protecting rights are not considered as substantive in all circumstances,

and hence are not seen as Power

Protective Rights held by others can’t prevent control

© ICAI BOS(A) 208

SARANSH Indian Accounting Standards

• Substantive rights are that are exercisable when decisions about the

relevant activities of the investee need to be made

• The investor must have the current ability to direct relevant activities

• The holder of these rights has the practical ability to exercise them;

they are not merely in the nature of protective rights

Key factor to consider-to determine if the rights are substantive in nature

Do several parties need to agree

Are their barriers that prevents

Substantive for the right to become

holder from exercising the rights?

Rights exercisable or operational

Would party holding the rights Practical ability to

benefits from their exercise exercise the rights

• Only substantive rights are considered in assessing Power

• Determination of whether the rights are substantive calls for judgement and is

based on considering all facts and circumstances

Potential • Potential Voting Rights are considered in assessment of power only if they are

Voting substantive

Rights

Purpose and Design also considered

• Potential voting rights that are substantive-can give the holder power

• Determining whether potential voting rights are substantive require judgement !

DEFINITION OF “CONTROL” UNDER IND-AS 110

An investor controls an investee when the investor:

• is exposed to (or, has right to) variable returns from its involvement with the

Control investee

• has the ability to affect those returns

• through its power over the investee

idiar y

a subs

Here investee

is the

Three Elements of Control, which are the basis of consolidation under Ind-AS 110

Control = 1 Power + 2 Variability of returns + 3

Link between power

and variability

Power is signified by Returns that are not fixed and Ability to use power to

existing (substantive) rights have the potential to vary – affect returns

that give the current ability with the performance of the

to direct the relevant activities investee

of the investee

To have power, it is necessary for the investor to have (a) existing (substantive) rights that give it (b)

current ability to direct (c) the relevant activities (that significantly affect the investee’s returns)

© ICAI BOS(A) 209

SARANSH Indian Accounting Standards

The new control model under Ind-AS 110 is based on the existence of three elements of control:

Control = 1 Power + 2 Variability of returns + 3

Link between power

and variability

When all of these three elements of control are present, then an investor is considered to control an

investee and consolidation is required

An Investor Consider Potential Potential Voting When one or more of the

takes into Voting Rights only if Rights need to be elements is not present, an

account all facts they are substantive currently exercisable investor will not consolidate,

and (Consider factors and must take into but instead be required to

like exercise price, account the determine the nature of its

circumstances to

date, procedures etc) economic reality viz. relationship with the

assess whether

control exists Is it practically to investee (eg. Significant

Control is re

assessed, if there is a exercise - influence, joint control) and

Protective Rights change in the considering will follow appropriate

don’t provide underlying facts & financial and accounting under the

Control circumstances intention to exercise requisite Ind AS

SINGLE CONTROL MODEL… UNDER IND-AS 110

Control = 1 Power + 2 Variability of returns + 3

Link between power

and variability

Control assessed on continuous basis

Re-assessment of control is required if facts and circumstances

indicate that ANY of THREE key elements have CHANGED

Ind-AS 110 requires extensive use of judgment; and

Ind-AS 112 requires disclosure of such areas of judgment

• Same criteria for all entities – for determination of control

• For determining control, consider all facts and circumstances

• Temporary control does not prevent consolidation

WHAT IS POWER ?

Do

e

t

no d Power is the (a) existing right – that give an investor Pro s not

ed e tec aris

Ne ercis (b) current ability to direct (c) the relevant activities tive e fr

ex Rig om

be Power arises from substantive rights to direct the relevant activities hts

• Rights depend on the (a) nature of activities, (b) legal structure and (c) the

manner in which decisions are taken

Rights • Can arise from voting rights, potential voting rights, contractual rights, or a

combination

• Evaluate the impact of various rights and their interaction

• Practical ability to exercise the right

Substantive • Current ability to direct relevant activities

• Rights need not be actively exercised (a passive majority owner has the power)

• These are activities that significantly affect the returns

Relevant

• Examples include (a) purchases/sales, (b) financial assets management,

Activities

(c) acquisition/disposal of investments, (d) R&D, (e) financing etc.

Rights that are solely protective:

DO NOT provide Power and DO NOT prevent another investor from having control

© ICAI BOS(A) 210

SARANSH Indian Accounting Standards

EVALUATION OF POWER

A. Assess purpose B. Determine relevant activities

and design of entity

C. Determine how relevant activities are directed

D. Determine whether

investor’s rights provide ability

to direct relevant activities E. Does entity have

power over

structured entity?

YES Directed by

Does entity own> 50% of

contracts

substantive voting rights NO YES

Directed by

contracts

NO

YES

Is there de-facto control? No Power Power

NO

YES

Do substantive potential voting

rights give controlling power?

NO

Do other contractual

agreements, or some

YES UNCLEAR

combination of contracts, Consider factors in

voting rights and potential Ind AS110. B18-B20

voting rights provide

controlling power?

NO e.g.

• Appointment of KMPS

• Verb power held by investor

No Power • Investee’s KMP are related party of

investor

• Investee is dependent on investor’s

Power funds/technology

FACTORS TO CONSIDER IN EVALUATING POWER

A. Purpose and Design of the Investee- Key questions to be asked

Purpose Identify For instance

of the • Why the invested has been formed or incorporated? An investor may form a trust

investee • What is the purpose and objective of the investee? • To carry out CSR activities; or

• Whether the purpose is to enter into new line of business? • To implement ESOP plans; or

• Whether it has been incorporated to comply with a • To provide post-employment

regulatory requirements? • employee benefits to its EEs

Design of Look at the structure of the investee as to whether

the • It is a firm, trust, listed entity, public entity, private entity, SPV etc.?

investee • It is controlled through voting rights, shareholder’s agreement or contractual arrangement?

• It is controlled through convertible instruments?

• Who takes the decision for the design and what are the investee’s exposure to risk and rewards?

© ICAI BOS(A) 211

SARANSH Indian Accounting Standards

FACTORS TO CONSIDER IN EVALUATING POWER

B. and C. • How (a) operating and capital decisions (b) budget (c) appointment and

Relevant activities remuneration of KMPs etc. are made?

and how decisions • How decisions that arise only in response to specific circumstances are made?

are made w.r.t. these • If different investors have ability to direct different activities – which activities

relevant activities most significantly affect returns?

D. Current ability • Consider all substantive rights

to direct relevant • Protective vs participating rights

activities • Direct and indirect rights (financing, guarantees, operational ties)

Power can exist - even if others participates in directing the relevant activities.

For instance, other participating may have significant influence over the investee

Evidence that an investor directed activities in the past is an indicator of power, but is not conclusive

APPLYING SINGLE CONTROL MODEL UNDER IND AS 110

Identify the investee

Identify the relevant activities of the investee

Identify how decisions about the relevant activities are made

Assess whether the investor has power over the relevant activities

Assess whether the investor is exposed to variability in returns

Assess whether there is a link between power and returns

© ICAI BOS(A) 212

SARANSH Indian Accounting Standards

HOW CONTROL IS ASSESSED?

Application of Single Control Model under Ind AS 110 entails several steps

1. Identify the investee (legal entity or SILO)

2. Identify the relevant activities of the investee

3. Identify how decision about the relevant activities are made

4. Assess whether the investor has power over the relevant activities

4A. Consider only substantive rights

Voting rights are relevant 4D. Rights other than

voting rights are relevant

Majority of voting rights 4D. Rights other than Consider

voting rights are relevant

Consider Purpose and design

Consider

Rights may be held Evidence of practical

by others Agreement with

ability to direct

other vote holders

Special relationship

Other contractual

agreement

Large exposure to

variability in returns

4B. Potential voting

rights

4C. De facto power

5. Assess whether the investor is exposed to variability in returns

6. Assess whether there is link between power and returns

IDENTIFY THE INVESTEE (LEGAL ENTITY OR SILO)

Control by an Investor is generally assessed @ entity level

However, in some circumstances, the assessment is made for a portion of an entity

viz’- over only specified assets and liability (i.e. a Silo)

Silo = portion

of an entity • None of the silo’s assets can be used to pay other obligations of the entity

that is treated • The Silo’s assets are the only source of payment for the silo’s liabilities and

as a deemed • Other than the silo’s creditors, no party has any rights or obligations related

separate entity to the silo’s assets or to residual cashflows from those assets

This will be the case if all the assets, liabilities and equity of that part of the investee are

ring-fenced from the rest of the entity

Note: If an Investor has control over specified assets of an investee, it treats that portion(‘silo’) of the

investee as a separate entity

Existence of silos is not confined to structured entities but is more likely to arise there

© ICAI BOS(A) 213

SARANSH Indian Accounting Standards

IDENTIFY THE INVESTEE (LEGAL ENTITY OR SILO)

Legal entity • New Millennium Fund is open-ended investment

fund with two sub-funds, viz. Tech Fund and

Pharma Fund, that are cells within the legal entity

New Millennium Fund

• Assets of Tech Fund are not available to meet

liabilities of Pharma Fund, including in the event

of insolvency – and vice versa

Tech Fund Pharma Fund

• Contracts entered into each sub-fund implies that

the counterparty does not have access to the

Que: Whether Tech and assets of the other

Pharma Funds are silos?

• No liquidity assistance available from New

Yes Millennium Fund

IDENTIFY RELEVANT ACTIVITIES OF THE INVESTEE

Relevant activities are those activities that significantly affect the investor’s returns

Example of relevant activities include the following:

• Establishing operating, capital and financing policies

• Determining funding structure and obtaining funding

• Appointing, remunerating, and terminating employment of service providers or KMPs

• Researching and developing new products or processes

If two investors direct different relevant activities, identify which investor can direct the activities

that most significantly affect the investor’s returns

Also, consider and understand the purpose and design of the investee

Determination of relevant activities will often entail the following:

• Understand purpose and design of the investee

• Identify the activity that significantly affects returns

• Identify which investor can direct the activities that most significantly affect returns

• Investors’ exposure to variability of returns

IDENTIFY RELEVANT ACTIVITIES OF THE INVESTEE

Appointing Major Capital

Board Members Expenditure

Buying / Selling Relevant Acquiring / Disposing

goods and services Activities off Subsidiary

Dividend & Approving Budgets or

Remuneration Decisions Determining Funding

© ICAI BOS(A) 214

SARANSH Indian Accounting Standards

IDENTIFY RELEVANT ACTIVITIES OF THE INVESTEE

Relevant Activities Key Take Away

Examples of activities that can potentially be Assess which activity most significantly

relevant activities include: affects investee’s returns, considering the

• Selling and purchasing of goods or services following factors:

• Managing financial assets during their life • Purpose and design of the investee

(including on default) • Factors that determine profit margin,

• Selecting, acquiring or disposing of assets revenue, value of the investee

• Researching & developing new products / • Effect of each investor’s decision-making

processes authority on investee’s returns

• Determining a funding structure or obtaining • Investor’s exposure to variability of returns

funding etc.

Relevant activities can change over a period of time………..need for continuous assessment…..

IDENTIFY HOW DECISIONS ABOUT RELEVANT ACTIVITIES ARE MADE

Are voting rights relevant? ( In assessing whether investors has over investee)

Yes – Voting rights are No- Voting rights are not

relevant relevant

More Complex

Investee is controlled by Investee is controlled by Cases

means of voting rights means of contractual

rights

Focus on and consider: Focus on and consider: Number of factors

Which investor has voting Rights other than voting relevant in assessing

rights sufficient to direct rights what drives power

investee’s relevant activities

How decisions about relevant activities are taken?

Determine What is the process of making decisions with respect to relevant activities?

Who is the decision maker – Shareholders / BoDs / Contractually Appointed Person?

© ICAI BOS(A) 215

SARANSH Indian Accounting Standards

ASSESS WHETHER INVESTOR HAS POWER OVER RELEVANT ACTIVITIES

Are voting rights relevant? (In assessing whether investor has power over invested)

Voting Rights are relevant (4A) Rights other than voting rights are

relevant (like contractual rights)

Majority of voting rights Less than majority of

voting rights Consider

Consider

Consider • Purpose and design

Rights held by (like investor’s commitment to continued

others Agreement with operation of investee, contractual agreement

other vote holders etc.)

• Evidence of practical ability to direct

Other contractual (E.g. directing investee to enter into significant

agreements transactions for investor’s benefit)

• Special relationships

Potential voting (like De facto Agent, Investee’s operations

rights (4B) depend on investor funding or technology etc.)

• Large Exposure to variability of returns

De facto power 4(C)

Protective rights

NOT evaluated Consider only substantive rights

Note:

Only one investor can have power over the investee at a single point in time (Ind AS 11.16)

ASSESS WHETHER INVESTOR HAS POWER OVER RELEVANT ACTIVITIES

Whether the holder has the practical ability to exercise the rights?

Consider the following factors for determining the practical ability

Only

Are there barriers that prevent

Substantive

holder from exercising the rights? Do several parties need to agree

Rights

considered for the rights to become

Would party holding the rights exercisable or operational?

benefit from their exercise?

Yes

Is the right exercisable when decision about the relevant activities of an investee

need to be made?

Yes

Substantive Right

© ICAI BOS(A) 216

SARANSH Indian Accounting Standards

ASSESS WHETHER INVESTOR HAS POWER OVER RELEVANT ACTIVITIES

Substantive vs. Protective Rights

Substantive Rights Protective Rights

• Substantive Rights are rights that are Protective rights are right that:

exercisable when decision on relevant • Are intended solely to protect the interest of

activities are made their holders rather than to transfer power to

• Substantive rights are existing rights, that give that party

the investor the current ability to direct the • Relate to fundamental changes in entity’s

relevant activities of the investee activities or apply only in exceptional

• A right is substantive if the holder has the circumstances

practical ability to exercise that right, when

decisions about relevant activities are made

Factors to consider is assessing whether a right is substantive, inter alia, include the following:

Are there barriers (economic or otherwise) that would prevent the holder from exercising their

rights?

• Exercise or conversion price

• Penalties that may prevent/deter exercise

• Absence of explicit mechanism allowing exercise

• Inability to obtain information required for exercise

• Legal or regulatory constraints

• Other constraints, making it unlikely for exercise of rights

Do the holders have the practical ability to exercise their rights - in cases where exercise

requires agreement by more than one investor?

Would the investor that holds the rights benefit from their exercise of conversion?

Are the rights currently exercisable or convertible?

POTENTIAL Potential Voting Rights are considered in assessment of power, only if they are

VOTING substantive (considering factors like exercise price, date, procedures, etc.)

RIGHTS

Factors for evaluating whether options are Other aspects to be considered

substantive: • Purpose and design of the instrument

• Exercise price/conversion price, relative to • Investor’s apparent expectations, motives and

market terms reasons for agreeing the terms of the

• Ability to obtain financing instrument

• Timing and length of exercise period • Combination of potential voting rights and

• Benefits, which the investor could derive from other rights (voting or contractual)

exercising these instruments (like economies • Other involvements the investor has with the

of scale, synergies etc) investee

Example

Parameters Substantive Non-substantive Depends on facts and

circumstances

Exercise Price At market (fair value) OR Deeply out-of-the-money Out-of-the-money

in-the-money

Exercise Period Currently exercisable Not exercisable Exercisable, but decisions

need to be made

Financial Ability to Exercise Holder has cash/financing Holder has no financial Holder would have to raise

readily available ability financing

© ICAI BOS(A) 217

SARANSH Indian Accounting Standards

ASSESS WHETHER INVESTOR IS EXPOSED TO VARIABLE RETURNS

Variable Return Examples of Variable Returns

Exposure to variability in returns is a broader • Residual interests

concept than ownership benefits • Dividends / changes in value

• Fixed interest payments from bond (exposes

Variability in returns is not limited to:

investor to credit /default risk of the issue)

• Distributions and changes in value of

• Remuneration for servicing assets or liabilities

investment

• Synergistic returns (like economies of scale, cost

Also include: savings and other synergies)

• Fees • Tax benefits

• Tax benefits • Access to future liquidity

• Residual interest in net assets • Fees for exposures to loss from providing credit /

• Exposure to loss providing credit or liquidity liquidity support

support etc.

• Returns that are not available to other interest

holders e.g. the investor’s ability to use

investee’s assets… in combination with its own

to achieve economies of scale

• Exposure to variable returns is an indicator of control

• Greater the exposure – greater incentive to obtain power

• Other parties may also share in the returns (e.g.NCI)

ASSESS WHETHER THREE IS A LINK BETWEEN POWER AND RETURN

Delegated Rights – an overview

• An agent is a party engaged to act on behalf of other party (the Principal)

Delegated • A principal may delegate some or all decision-making authority to the agent

Rights • An agent does not control an investee

• All facts and circumstances must be considered

If the agent gains any benefit from the arrangement – the agent could be regarded as the “Principal” and could

then “Control” the investee

The conclusion as to whether the agent Controls and investee is to be drawn after considering all facts and

circumstances, including the following:

• Rights of the agent

• Discretion available to the agent

• Range of Decision-making authority of the agent

• Agent’s level of involvement with the investee

• Financial benefit enjoyed by the agent

LINK BETWEEN POWER AND RETURN

Ability to use Power to affect Return Ability Returns

On its own account as Principal On Behalf of Other Investors as Agent

An investor with decision-making power shall determine – whether it is a principal or an agent

An agent is primarily engaged to act on behalf of and for the benefit of others

Principal’s power may be held and exercisable by an agent, but on behalf of the principal

Only principal may have control, and not agent

© ICAI BOS(A) 218

SARANSH Indian Accounting Standards

Power Power

+ +

Exposure to Exposure to

Variability in returns Variability in returns

+ +

Use of Power – primarily to Use of Delegated Power –

generate returns for itself primarily for the benefit of others

= =

Investor is a Principal Investor is an Agent

CONSOLIDATION EXEMPTION FOR INVESTMENT ENTITIES

Investment entities:

• should not consolidate controlled investments

• measure investments at FVTPL

A parent of an investment entity should consolidate all subsidiaries it controls, unless the parent itself is an

investment entity

CONTINUOUS ASSESSMENT OF CONTROL

• Reassess to determine whether the investor continue to control the investee

When to

• Reassessment must be done if facts and circumstances suggest there is a change to one /

re-assess?

more of the criteria for control

If change in market conditions affect one of the Control criteria, re-evaluate control

Consolidation of an investee shall:

• begin from the date the investor obtains control of the investee; and

• cease when the investor loses control of the investee

CONSOLIDATION PROCEDURE UNDER IND AS 110

Combine like items of assets, liabilities, equity, income, expenses and cash flows of the parent

Step 1 with those of its subsidiaries

Offset (eliminate):

Step 2 • Carrying amount of parent’s investment in subsidiary

• Parent’s portion if equity of each subsidiary

Step 3 Offset (eliminate) items related to intragroup transactions

© ICAI BOS(A) 219

SARANSH Indian Accounting Standards

TRANSACTIONS WITHIN THE GROUP (CONSOLIDATION PROCEDURE)

Eliminate in full intra-group….

Balances Income and expense Dividends

Profits / losses from intra-group transactions recognized in assets are eliminated in full

Intra-group losses may indicate an impairment

OTHER KEY REQUIREMENTS RELATED TO CONSOLIDATION

Apply uniform accounting policies to all subsidiaries

(Adjustment is required, if different accounting policies followed and impact is significant)

Parent and Subsidiary to use the same reporting date unless impracticable

(Difference in period ends cannot exceed 3 months)

Significant events adjusted, even if difference in period ends is up to 3 months

• NCI is shown separately within Equity

• Losses are allocated to NCI even if NCI balance goes Negative

EXEMPTION FROM PREPARING CFS

A parent need not present Consolidated Financial Statement, If all the following conditions are met:

1 Entity is a subsidiary (wholly owned or, partially owned) and no owners object to non-consolidation

2 No debt or equity instrument traded in public market

3 Did not file and is not in the process of filing its financial statements with a regulatory organization – to issue

any class of instruments in a public market

4 The ultimate parent (or, any intermediate parent of the parent) produces a CFS that comply with Ind-AS & the

same is available for public use

Note: There is mandatory consolidation exception for an investment entity

© ICAI BOS(A) 220

SARANSH Indian Accounting Standards

De facto control is a situation, where an entity that owns less than 50% of the

DE FACTO

voting rights in another entity is deemed to have control, when it has the

CONTROL

practical ability to direct relevant activities of the entity

To ascertain if… De facto control exists, consider all facts and circumstances like

• Contractual arrangements between the investor and other vote holders

• Contractual rights arising from other arrangements (such as operational or financial agreements that

may provide significant substantive rights)

• Potential voting rights of the investor and/or other investors

• Relative size of the investor’s % of vote and dispersion of the voting rights

• Size of an investor’s voting rights

- Voting rights (absolute amount and relative to other vote holders)

- Number of other vote holders that will need to act together

- Voting patterns at previous shareholders’ meetings

Note:

If after considering the above factors, it is not clear that the investor has power- then the investor does not

control the investee

ACCOUNTING TREATMENT ON LOSS OF CONTROL OF A SUBSIDIARY

If a parent loses control of a subsidiary, it shall follow the accounting treatment mentioned below:

Derecognise: Recognise: Reclassify: Recognises gain / loss:

• the assets (including • the fair value of the • to profit or loss, or • recognise any resulting

any goodwill) and consideration received transfer directly to difference as a gain or

liabilities of the • if loss of control retained earnings if loss in profit or loss

subsidiary involves a distribution required by other Ind attributable to the

• the carrying amount of of shares of the ASs, the amounts parent

any non-controlling subsidiary to owners, recognised in other

interests in the former then that distribution; comprehensive income

subsidiary and in relation to the

• any investment subsidiary (refer note 2

retained in the former below)

subsidiary at its fair

value at the date when

control is lost (refer

note 1 below)

Note 1:

The fair value at which the retained interest is recognized shall be regarded as the fair value on initial

recognition of a financial asset in accordance with Ind AS 109 or, when appropriate, the cost on initial

recognition of an investment in an associate or joint venture.

Note 2:

If a parent loses control of a subsidiary, the parent shall account for all amounts previously recognized in

other comprehensive income in relation to that subsidiary on the same basis as would be required if the

parent had directly disposed of the related assets or liabilities.

© ICAI BOS(A) 221

SARANSH Indian Accounting Standards

LOSS OF CONTROL OF A SUBSIDIARY IN

TWO OR MORE ARRANGEMENTS TRANSACTIONS

In determining whether to account for the arrangements as a single transaction, a parent shall consider all the terms

and conditions of the arrangements and their economic effects. One or more of the following indicate that the parent

should account for the multiple arrangements as a single transaction:

They are entered into at the same time or in contemplation of each other.

They form a single transaction designed to achieve an overall commercial effect

The occurrence of one arrangement is dependent on the occurrence of at least one other arrangement.

One arrangement considered on its own is not economically justified, unless it is considered together with

other arrangements. (e.g. when a disposal of shares is priced below market and is compensated for by a

subsequent disposal priced above market)

DISCLOSURES RELATED TO INTERESTS IN SUBSIDIARIES

An entity shall disclose information that enables users of its consolidated financial statements

to understand

• the composition of the group; and

• the interest that non-controlling interests have in the group’s activities and cash flows; and

to evaluate

• the nature and extent of significant restrictions on its ability to access or use assets, and settle liabilities, of the group

• the nature of, and changes in, the risks associated with its interests in consolidated structured entities

• the consequences of changes in its ownership interest in a subsidiary that do not result in a loss of control; and

• the consequences of losing control of a subsidiary during the reporting period

When the financial statements of a subsidiary used in the preparation of consolidated financial statements are as of a date

or for a period that is different from that of the consolidated financial statements, an entity shall disclose:

• the date of the end of the reporting period of the financial statements of that subsidiary; and

• the reason for using a different date or period

© ICAI BOS(A) 222

SARANSH Indian Accounting Standards

THE INTEREST THAT NONCONTROLLING INTERESTS

HAVE IN THE GROUP’S ACTIVITIES AND CASH FLOWS

An entity shall disclose for each of its subsidiaries that have non-controlling interests that are material to the

reporting entity:

the name of the subsidiary.

the principal place of business (and country of incorporation if different from the principal place of business) of the

subsidiary.

the proportion of ownership interests held by non-controlling interests.

the proportion of voting rights held by non-controlling interests, if different from the proportion of ownership

interests held.

the profit or loss allocated to non-controlling interests of the subsidiary during the reporting period.

accumulated non-controlling interests of the subsidiary at the end of the reporting period.

summarised financial information about the subsidiary

THE NATURE AND EXTENT OF SIGNIFICANT RESTRICTIONS

An entity shall disclose following:

Significant restrictions (eg statutory, contractual and regulatory restrictions) on its ability to access or use the

assets and settle the liabilities of the group, such as:

• those that restrict the ability of a parent or its subsidiaries to transfer cash or other assets to (or from) other

entities within the group.

• guarantees or other requirements that may restrict dividends and other capital distributions being paid, or loans

and advances being made or repaid, to (or from) other entities within the group.

The nature and extent to which protective rights of non-controlling interests can significantly restrict the entity’s

ability to access or use the assets and settle the liabilities of the group (such as when a parent is obliged to settle

liabilities of a subsidiary before settling its own liabilities, or approval of non-controlling interests is required

either to access the assets or to settle the liabilities of a subsidiary).

The carrying amounts in the consolidated financial statements of the assets and liabilities to which those

restrictions apply.

© ICAI BOS(A) 223

You might also like

- FFA Day 1Document64 pagesFFA Day 1Himemiya ChikaneNo ratings yet

- Adverse Possession Question and AnswersDocument3 pagesAdverse Possession Question and AnswersMuhammad Shahmeer MemonNo ratings yet

- Proceeds of Crime Recovery and Management Act 2022Document47 pagesProceeds of Crime Recovery and Management Act 2022jideNo ratings yet

- Joint Arrangement UeueueuueDocument34 pagesJoint Arrangement UeueueuuechiNo ratings yet

- Afar01 Joint Arrangements ReviewersDocument13 pagesAfar01 Joint Arrangements ReviewersPam G.No ratings yet

- 74919bos60524 cp13 U1Document4 pages74919bos60524 cp13 U1Bhanu RawatNo ratings yet

- Intercorporate Investments - Study Session 5, Reading 14Document18 pagesIntercorporate Investments - Study Session 5, Reading 14Analyst832No ratings yet

- Afar01 Joint Arrangements ReviewersDocument14 pagesAfar01 Joint Arrangements ReviewerstheresaazuresNo ratings yet

- ACC2001 Lecture 7 Business Combinations IDocument53 pagesACC2001 Lecture 7 Business Combinations Imichael krueseiNo ratings yet

- Afar01 Joint Arrangements ReviewersDocument14 pagesAfar01 Joint Arrangements ReviewersmixxNo ratings yet

- Lecture 2Document39 pagesLecture 2MariaNo ratings yet

- Advanced FA I - Chapter 01, Accounting For Investment in JADocument58 pagesAdvanced FA I - Chapter 01, Accounting For Investment in JAKalkidan G/wahidNo ratings yet

- Chapter 4 Joint Arrengement and Public SectorDocument58 pagesChapter 4 Joint Arrengement and Public SectorLakachew Getasew100% (2)

- Lecture 3-PostDocument45 pagesLecture 3-PostcoolirlbbNo ratings yet

- 67214bos54111 Cp7u8Document37 pages67214bos54111 Cp7u8Dhruv JainNo ratings yet

- AFAR01 Joint Arrangements Reviewers AFAR01 Joint Arrangements ReviewersDocument14 pagesAFAR01 Joint Arrangements Reviewers AFAR01 Joint Arrangements ReviewersMarco Louis Duval UyNo ratings yet

- Ind AS 110Document37 pagesInd AS 110cgaurav50No ratings yet

- Ind AS 32 - Financial InstrumentsDocument2 pagesInd AS 32 - Financial InstrumentsJAINAM SHETHNo ratings yet

- Special Transaction Chap 6Document9 pagesSpecial Transaction Chap 6balidleahluna20No ratings yet

- Unit 8: Indian Accounting Standard 105: Non-Current Assets Held For Sale and Discontinued OperationsDocument25 pagesUnit 8: Indian Accounting Standard 105: Non-Current Assets Held For Sale and Discontinued OperationsJyotiNo ratings yet

- 财务、企业理财、权益、其他Document110 pages财务、企业理财、权益、其他Ariel MengNo ratings yet

- Lecture ONE Accounting For ManagerDocument30 pagesLecture ONE Accounting For Managermohamed elsabahiNo ratings yet

- E1-E2 - Text - Chapter 10. Accounting Standards and RatiosDocument10 pagesE1-E2 - Text - Chapter 10. Accounting Standards and Ratiospintu_dyNo ratings yet

- 105 Non CurrentDocument42 pages105 Non Currentchandrakantchainani606No ratings yet

- MCom - Accounts ch-6 Topic3Document21 pagesMCom - Accounts ch-6 Topic3Sameer GoyalNo ratings yet

- CHAP001 2eDocument47 pagesCHAP001 2eeren rasteNo ratings yet

- Basel III Pillar III Disclosures As On 30.09.2022 3Document67 pagesBasel III Pillar III Disclosures As On 30.09.2022 3avinash sNo ratings yet

- Joint ArrangementsDocument9 pagesJoint Arrangementscarlos antonio IbuanNo ratings yet

- Pictorial Representation of Indian AS: Financial Reporting & AnalysisDocument8 pagesPictorial Representation of Indian AS: Financial Reporting & AnalysisSHWETANo ratings yet

- PWC Indonesia Energy, Utilities & Mining Newsflash: A Practical Guide To Psak 66Document8 pagesPWC Indonesia Energy, Utilities & Mining Newsflash: A Practical Guide To Psak 66Lynx SuitonNo ratings yet

- l1 Ac Rsheets b2Document1 pagel1 Ac Rsheets b2eloise.vernierNo ratings yet

- Joint Arrangement UeueueuueDocument35 pagesJoint Arrangement Ueueueuueidk520055No ratings yet

- Accounting Treatment of Different Types of Investment Shares of Stocks (Equity Instrument)Document1 pageAccounting Treatment of Different Types of Investment Shares of Stocks (Equity Instrument)Kit BergzNo ratings yet

- 52465bos42065final p1 cp1 U5 PDFDocument14 pages52465bos42065final p1 cp1 U5 PDFRAHUL PRASADNo ratings yet

- Analysis of Financial Statements: International Financial Reporting StandardsDocument22 pagesAnalysis of Financial Statements: International Financial Reporting Standardsvvs176975No ratings yet

- Chapter ThreeDocument101 pagesChapter ThreeBogale GiragnNo ratings yet

- Ifrs 10 Consolidated Financial Statements SnapshotDocument2 pagesIfrs 10 Consolidated Financial Statements SnapshotangaNo ratings yet

- The Basis For Business DecisionsDocument13 pagesThe Basis For Business DecisionsmzqaceNo ratings yet

- Chapter 5 Review Questions and ProblemsDocument11 pagesChapter 5 Review Questions and ProblemsLars FriasNo ratings yet

- ACTG240 - Ch01Document44 pagesACTG240 - Ch01xxmbetaNo ratings yet

- Accounting Principles and Business Transactions Cheat Sheet: by ViaDocument1 pageAccounting Principles and Business Transactions Cheat Sheet: by Viaheehan6No ratings yet

- 157 17945 EY111 2013 1 2 1 Chap001Document39 pages157 17945 EY111 2013 1 2 1 Chap001ngaNo ratings yet

- Accountancy For Managers (DONE)Document10 pagesAccountancy For Managers (DONE)Gouri mattadNo ratings yet

- Joint ArrangementsDocument3 pagesJoint ArrangementsfrondagericaNo ratings yet

- FS AnalysisDocument4 pagesFS Analysisserixa ewanNo ratings yet

- Comprehensive Ratio AnalysisDocument8 pagesComprehensive Ratio Analysis9694878No ratings yet

- 74535bos60448 Indas111Document7 pages74535bos60448 Indas111pave.scgroupNo ratings yet

- Stockholders' Equity:: Paid-In CapitalDocument34 pagesStockholders' Equity:: Paid-In Capitaldecipher7No ratings yet

- Overiew of Accounting StandardsDocument1 pageOveriew of Accounting Standardsangus33261No ratings yet

- Afm 1Document20 pagesAfm 1antrikshaagrawalNo ratings yet

- Digest - PFRS 3 and PFRS 10Document4 pagesDigest - PFRS 3 and PFRS 10Elizabeth DumawalNo ratings yet

- Basic Accounting RatiosDocument47 pagesBasic Accounting RatiosSUNYYRNo ratings yet

- Analysis of Reformulated Financial StatementsDocument46 pagesAnalysis of Reformulated Financial StatementsAkib Mahbub KhanNo ratings yet

- Financial ReportingDocument44 pagesFinancial ReportingsumaihabdalkreemNo ratings yet

- FM. Financial Analysis BookDocument31 pagesFM. Financial Analysis Bookahmedsoobi73No ratings yet

- Contractually Agreed Sharing Relevant Activities Unanimous ConsentDocument3 pagesContractually Agreed Sharing Relevant Activities Unanimous ConsentKathleen MarcialNo ratings yet

- Intercorporate Investments PDFDocument1 pageIntercorporate Investments PDFMohaiminul Islam ShuvraNo ratings yet

- Unit 6: As 27: Financial Reporting of Interests in Joint VenturesDocument28 pagesUnit 6: As 27: Financial Reporting of Interests in Joint Venturesvikash1905No ratings yet

- Accounting ConceptsDocument20 pagesAccounting ConceptsZargham DurraniNo ratings yet

- OLC Chapter 01Document16 pagesOLC Chapter 01Satarupa MukherjeeNo ratings yet

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- Web Profile A A1Document6 pagesWeb Profile A A1pave.scgroupNo ratings yet

- Performance Evaluation Review and Planning: April 2001Document49 pagesPerformance Evaluation Review and Planning: April 2001pave.scgroupNo ratings yet

- E-Mail: Mob: 66121678, 66480241 Doha - Qatar: Curriculum Vitae Shefeer. N.ADocument3 pagesE-Mail: Mob: 66121678, 66480241 Doha - Qatar: Curriculum Vitae Shefeer. N.Apave.scgroupNo ratings yet

- Resume World Inc, CaDocument10 pagesResume World Inc, Capave.scgroupNo ratings yet

- Senior Accountant Resume Sample: Name & Personal Details of Clients Are Not Included For AnonymityDocument9 pagesSenior Accountant Resume Sample: Name & Personal Details of Clients Are Not Included For Anonymitypave.scgroupNo ratings yet

- AFS Profile 27 Dec 2015Document5 pagesAFS Profile 27 Dec 2015pave.scgroupNo ratings yet

- Quick Insights On Professional OpportunitiesDocument90 pagesQuick Insights On Professional Opportunitiespave.scgroupNo ratings yet

- Icai Member CardDocument2 pagesIcai Member Cardpave.scgroupNo ratings yet

- Sep 2017Document15 pagesSep 2017pave.scgroupNo ratings yet

- YR LLP FirmProfileDocument23 pagesYR LLP FirmProfilepave.scgroupNo ratings yet

- 74530bos60448 Indas103Document20 pages74530bos60448 Indas103pave.scgroupNo ratings yet

- RCCA Firm Profile June 2012Document2 pagesRCCA Firm Profile June 2012pave.scgroupNo ratings yet

- 05 - Misc - Audit - Checklist-forQtly - CCAR - RBIARDocument4 pages05 - Misc - Audit - Checklist-forQtly - CCAR - RBIARpave.scgroupNo ratings yet

- 1 List of BankDocument14 pages1 List of Bankpave.scgroupNo ratings yet

- CCA - Q - Oct - NTB - GhaziabadDocument36 pagesCCA - Q - Oct - NTB - Ghaziabadpave.scgroupNo ratings yet

- 04 List FinacleDocument3 pages04 List Finaclepave.scgroupNo ratings yet

- 3 FAQ On The SchemeDocument3 pages3 FAQ On The Schemepave.scgroupNo ratings yet

- 00 - Checklist - Past Audit Reports - TransmissionDocument4 pages00 - Checklist - Past Audit Reports - Transmissionpave.scgroupNo ratings yet

- 7 Grievance RedressalDocument10 pages7 Grievance Redressalpave.scgroupNo ratings yet

- User Manual General Public SearchDocument12 pagesUser Manual General Public Searchpave.scgroupNo ratings yet

- Virendra Sir Audit Report 0000Document10 pagesVirendra Sir Audit Report 0000pave.scgroupNo ratings yet

- New Microsoft Office Excel WorksheetDocument5 pagesNew Microsoft Office Excel Worksheetpave.scgroupNo ratings yet

- Atch 1Document6 pagesAtch 1pave.scgroupNo ratings yet

- 03 - GuidelinesDocument9 pages03 - Guidelinespave.scgroupNo ratings yet

- Atch 2djjDocument3 pagesAtch 2djjpave.scgroupNo ratings yet

- LLP - Forms and Related Sections, Rules: S. No. Form Purpose Section & RulesDocument2 pagesLLP - Forms and Related Sections, Rules: S. No. Form Purpose Section & RulesVipul DesaiNo ratings yet

- Microeconomics 11Th Edition by Slavin Full ChapterDocument13 pagesMicroeconomics 11Th Edition by Slavin Full Chapterdavid.wilson367100% (41)

- Asiya Was Driving Home On The Bawang Merah Bawang PutihDocument2 pagesAsiya Was Driving Home On The Bawang Merah Bawang PutihbellaNo ratings yet

- Philippine Refining Co., Inc. vs. NG SamDocument2 pagesPhilippine Refining Co., Inc. vs. NG SamboybilisNo ratings yet

- 4B Merc 2 Insurance Credit Trans PPSADocument203 pages4B Merc 2 Insurance Credit Trans PPSAMica Joy FajardoNo ratings yet

- Case Law Ruling - 2 PDFDocument1 pageCase Law Ruling - 2 PDFrengarajan nNo ratings yet

- Employee's Signature Guarantor's SignatureDocument14 pagesEmployee's Signature Guarantor's SignaturedsvmaniNo ratings yet

- Essentail of Valid Contract PresentationDocument19 pagesEssentail of Valid Contract PresentationkaleemshanNo ratings yet

- Torts Outline - Spring 2010Document51 pagesTorts Outline - Spring 2010angelicxthingsNo ratings yet

- Nervous ShockDocument6 pagesNervous ShockMD junaid imamNo ratings yet

- Variations in Construction ContractsDocument6 pagesVariations in Construction Contractsanon_391880811No ratings yet

- Nature of Tax ExemptionDocument2 pagesNature of Tax ExemptionLeah Mariz RocaNo ratings yet

- Qua Chee Gan v. Law Union and Rock Insurance Co Case DigestDocument4 pagesQua Chee Gan v. Law Union and Rock Insurance Co Case DigestYodh Jamin OngNo ratings yet

- OVERTIME FORM - TempDocument1 pageOVERTIME FORM - TemprizNo ratings yet

- Partnership 1828Document6 pagesPartnership 1828Roji Belizar HernandezNo ratings yet

- Duty of Care 2 (Autosaved)Document18 pagesDuty of Care 2 (Autosaved)Lili ChambersNo ratings yet

- 10 - Valuation For Residential Property OverviewDocument14 pages10 - Valuation For Residential Property OverviewiugjkacNo ratings yet

- RM Tanchan V Allied Banking Corp DigestDocument1 pageRM Tanchan V Allied Banking Corp DigestRed Hale0% (1)

- New Life Enterprise Vs CA G.R. No. 94071 March 31, 1992Document2 pagesNew Life Enterprise Vs CA G.R. No. 94071 March 31, 1992Emrico CabahugNo ratings yet

- ACEF LA TemplateDocument11 pagesACEF LA TemplateCEDDFREY JOHN ENERIO AKUTNo ratings yet

- Code of Practice For Mediators 2021Document4 pagesCode of Practice For Mediators 2021Dima BraimNo ratings yet

- Corpo Digest - Chapter VIII BY LAWSDocument3 pagesCorpo Digest - Chapter VIII BY LAWSarmeruNo ratings yet

- In McAllenDocument1 pageIn McAllenismeldareyna0622No ratings yet

- 495, 496 Case DigestsDocument12 pages495, 496 Case DigestsnaomiNo ratings yet

- COMPANY LAW II SyllabusDocument2 pagesCOMPANY LAW II SyllabusGurdev SinghNo ratings yet

- Dalisay v. SSSDocument23 pagesDalisay v. SSSCaryl EstradaNo ratings yet

- British South Africa Company V de Beers Consolidated Mines, LimitedDocument12 pagesBritish South Africa Company V de Beers Consolidated Mines, LimitedEsinam AdukpoNo ratings yet

- Defendant Answer To Complaint Affirmative Defenses and Counterc PDFDocument15 pagesDefendant Answer To Complaint Affirmative Defenses and Counterc PDFAmicus CuriaeNo ratings yet