Professional Documents

Culture Documents

Operations Audit - Finance and Accounting

Uploaded by

Carmela Peduche0 ratings0% found this document useful (0 votes)

3 views11 pagesThe document discusses the need for an operations audit of the accounting and finance function. Key areas to look for in auditing the accounting operations include verifying employee credentials and training, reviewing processes to ensure they are documented and followed properly, observing employee behavior, and conducting substantive testing of accounting records related to expenses, income, assets, and liabilities to evaluate correctness and completeness.

Original Description:

Guidelines on Auditing Finance and Accounting

Original Title

Operations Audit_Finance and Accounting

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the need for an operations audit of the accounting and finance function. Key areas to look for in auditing the accounting operations include verifying employee credentials and training, reviewing processes to ensure they are documented and followed properly, observing employee behavior, and conducting substantive testing of accounting records related to expenses, income, assets, and liabilities to evaluate correctness and completeness.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views11 pagesOperations Audit - Finance and Accounting

Uploaded by

Carmela PeducheThe document discusses the need for an operations audit of the accounting and finance function. Key areas to look for in auditing the accounting operations include verifying employee credentials and training, reviewing processes to ensure they are documented and followed properly, observing employee behavior, and conducting substantive testing of accounting records related to expenses, income, assets, and liabilities to evaluate correctness and completeness.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

Operations Audit:

Focus on Finance and Accounting

PreElec 1: Operation Auditing

La Verdad Christian Colleges

2nd Term SY 2021-2022

Instructor: Carmela Peduche

• Accounting has an operations side –

document processing.

The Need for • Human intervention is involved each

step of the way from origination to

Operations recording of expenses.

• Risks are present both in manual and

Audit on the electronic system

Accounting • There are always areas for

improvement

and Finance • Expenses can be properly recorded, but

not properly authorized

Function • Sales can be identified according to

accounting standards, but

documentation could be lacking

• Job Description

PURPOSE: Ensure each individual is fit and ready for

What to Look the job

Steps taken:

for in Auditing - Verify the credentials (education and experience)

the Accounting of the employee

- Review trainings attended if aligned with the job

Operations? - Investigate on the morals of the employee

especially if tasks involve handling cash

What to Look for in Auditing the Accounting

Operations?

• Interview on Process

PURPOSE: Ensure that the processes are undertaken as documented

Steps taken:

- Look for, read, and familiarize the company manual

- Interview and determine if steps taken are aligned with the manual

- Look for control lapses and red flags

- Evaluate if proper segregation of duties is applied each step of the

way

What to Look for in Auditing the Accounting

Operations?

• Observation

PURPOSE: Evaluate the interpersonal behavior and work ethic

Steps taken:

- Observe on the employee’s alignment with the company’s standard

on behavior

What to Look for in Auditing the Accounting

Operations?

• Substantive Testing

PURPOSE: Evaluate on the correctness and completeness of corporate

accounting records

Steps taken:

- System check

- Review the system design and flowchart

- Verify the flow chart against the inputs and outputs of the system

What to Look for in Auditing the Accounting

Operations?

• Substantive Testing

PURPOSE: Evaluate on the correctness and completeness of corporate

accounting records

Steps taken:

- Document check

- Verify the existence of approvals on documents

- Check if documents are prepared and issued chronologically

What to Look for in Auditing the Accounting

Operations?

• Substantive Testing

PURPOSE: Evaluate on the correctness and completeness of corporate

accounting records

Steps taken:

- Transaction Check for Expenses

- Are all expenses approved?

- Are all expenses within the limits established by corporate policies?

- Are all expenses within budget?

What to Look for in Auditing the Accounting

Operations?

• Substantive Testing

PURPOSE: Evaluate on the correctness and completeness of corporate

accounting records

Steps taken:

- Transaction Check for Income

- Did all sales transactions go through credit check?

- Are all discounts within standard and given to customers of good credit

standing?

What to Look for in Auditing the Accounting

Operations?

• Substantive Testing

PURPOSE: Evaluate on the correctness and completeness of corporate

accounting records

Steps taken:

- Transaction Check for Fixed Assets

- Did all purchase of assets went through proper approval and review?

- Are all fixed assets accounted for?

- Are all assets of resigned employees surrendered?

What to Look for in Auditing the Accounting

Operations?

• Substantive Testing

PURPOSE: Evaluate on the correctness and completeness of corporate

accounting records

Steps taken:

- Transaction Check for Liabilities

- Are all loans made with reputable financial institutions?

- Are all loans reasonably made based on annual budget?

- Are the purpose of loan broken down?

- Are payments made as based contractual agreements?

You might also like

- Macroeconomics 6th Edition Williamson Solutions ManualDocument14 pagesMacroeconomics 6th Edition Williamson Solutions Manualregattabump0dt100% (30)

- E-Clone Corporation Our Mission: Chuck S. ValdezDocument9 pagesE-Clone Corporation Our Mission: Chuck S. Valdezjessica laran100% (1)

- Budgeting Exercise 03Document7 pagesBudgeting Exercise 03ERIK ACEVEDO ESCOBEDONo ratings yet

- 3 Audit ProcessDocument66 pages3 Audit ProcessSabiriene HaroonNo ratings yet

- Chapter 7 EvidenceDocument6 pagesChapter 7 Evidencerishi kareliaNo ratings yet

- Interim Report Internal AuditDocument9 pagesInterim Report Internal Auditshreya sheteNo ratings yet

- Overall Audit PlanDocument37 pagesOverall Audit PlanshirleysimasikuNo ratings yet

- Auditing One 04 For ClassDocument22 pagesAuditing One 04 For ClassRObel demisNo ratings yet

- Fundamentals of Auditing: Ajmal Khan MomandDocument29 pagesFundamentals of Auditing: Ajmal Khan MomandMasood khanNo ratings yet

- Week 3 PlanningDocument38 pagesWeek 3 Planningptnyagortey91No ratings yet

- Performance Measurement Chp11Document30 pagesPerformance Measurement Chp11jitendra sahNo ratings yet

- CHAPTER 4 Audit IDocument24 pagesCHAPTER 4 Audit IDanisaraNo ratings yet

- Presentation On Performance Measurement of QualityDocument31 pagesPresentation On Performance Measurement of QualityDivakar RanjanNo ratings yet

- Management Control SystemDocument34 pagesManagement Control Systemravish419100% (6)

- 6.0EM (Lec 27 29) ControllingDocument22 pages6.0EM (Lec 27 29) ControllingWaleedNo ratings yet

- In The Name of Allah, The Most Beneficent, The Most MercifulDocument40 pagesIn The Name of Allah, The Most Beneficent, The Most MercifulMuhammad SaadNo ratings yet

- 5 Tips For Improved Internal AuditsDocument2 pages5 Tips For Improved Internal Auditsjohnybull100% (1)

- L.U 4Document16 pagesL.U 4migishadieumerci1No ratings yet

- Chapter Four Internal Control SystemDocument28 pagesChapter Four Internal Control SystemMeseret AsefaNo ratings yet

- Unit 2 Internal Check SystemDocument24 pagesUnit 2 Internal Check SystemShaifaliChauhanNo ratings yet

- Unit 3,4&5Document56 pagesUnit 3,4&5nidhicariktureNo ratings yet

- Audit ProceduresDocument33 pagesAudit ProceduresshirleysimasikuNo ratings yet

- PPT1-Auditing Integral To The EconomyDocument34 pagesPPT1-Auditing Integral To The EconomyEvelyn Purnama SariNo ratings yet

- 01 Rittenberg PPT Ch1Document48 pages01 Rittenberg PPT Ch1Isabel HigginsNo ratings yet

- Unit II Company Audit and VouchingDocument36 pagesUnit II Company Audit and VouchingMuskan TyagiNo ratings yet

- Auditing 1Document4 pagesAuditing 1tooru oikawaNo ratings yet

- Introduction To Internal AuditingDocument34 pagesIntroduction To Internal AuditingIrish Keith Sanchez100% (1)

- Auditing: Integral To The EconomyDocument47 pagesAuditing: Integral To The EconomyPei WangNo ratings yet

- Management AuditDocument15 pagesManagement AuditDhanashree ChaudhariNo ratings yet

- UNIT - I Basic Concepts of MCSDocument19 pagesUNIT - I Basic Concepts of MCSsagar029No ratings yet

- Risk Assesment 1 MOHDocument12 pagesRisk Assesment 1 MOHGukan DoniNo ratings yet

- Auditing: Integral To The Economy: Chapter 1Document48 pagesAuditing: Integral To The Economy: Chapter 1Alain Fung Land MakNo ratings yet

- Tut 103 Slides - 30 April 2020Document30 pagesTut 103 Slides - 30 April 2020phosagontseNo ratings yet

- Auditing and PrinciplesDocument16 pagesAuditing and PrinciplesMilena RancicNo ratings yet

- Chapter 6 PlanningDocument5 pagesChapter 6 Planningrishi kareliaNo ratings yet

- Case Delima Solution and AnswersDocument7 pagesCase Delima Solution and AnswersTeresa M. EimasNo ratings yet

- Module 2 - Internal Control-1Document20 pagesModule 2 - Internal Control-1Melvin JustinNo ratings yet

- 2010 05 20 PresentationDocument91 pages2010 05 20 PresentationChinh Lê ĐìnhNo ratings yet

- Management Control System: Presented byDocument34 pagesManagement Control System: Presented bysweetyNo ratings yet

- Lect 7Document41 pagesLect 7Sandy Sandy Samy Bebawey MesakNo ratings yet

- Modern Internal AuditsDocument44 pagesModern Internal AuditsJoshua HardinNo ratings yet

- Introduction To ISO: Buena, Matthew Paulo B. BBM - Mba Management ConsultancyDocument16 pagesIntroduction To ISO: Buena, Matthew Paulo B. BBM - Mba Management ConsultancymatthewbuenaNo ratings yet

- Session 2 - QAR Audit Methodology Manual - IsQMDocument49 pagesSession 2 - QAR Audit Methodology Manual - IsQMRheneir MoraNo ratings yet

- Usama Siddique CVDocument2 pagesUsama Siddique CVnasir elahiNo ratings yet

- ControllingDocument31 pagesControllingElleNo ratings yet

- ISO 9001 AuditDocument4 pagesISO 9001 Auditbalotellis721No ratings yet

- Measuring ResultsDocument29 pagesMeasuring Resultsjoseph cadenasNo ratings yet

- Topic 2Document58 pagesTopic 2fbicia218No ratings yet

- Auditors Code of ConductDocument33 pagesAuditors Code of ConductSherwin MosomosNo ratings yet

- Tips For Internal Auditing of ISO 9001 QMSDocument12 pagesTips For Internal Auditing of ISO 9001 QMSabdul qudoosNo ratings yet

- Job Family Matrix: Job Function: Finance Job Family: Accounting Job Family SummaryDocument10 pagesJob Family Matrix: Job Function: Finance Job Family: Accounting Job Family SummaryDilip DasNo ratings yet

- ControllingDocument31 pagesControllingMehbub Bihan SajinNo ratings yet

- Audit: Quality System Quality Management System ISO ISO 9001Document6 pagesAudit: Quality System Quality Management System ISO ISO 9001Sherwin MosomosNo ratings yet

- Purchasing Audit Work ProgramDocument10 pagesPurchasing Audit Work Programmr auditorNo ratings yet

- Auditing Lecture Slides Introduction.Document30 pagesAuditing Lecture Slides Introduction.MoniqueNo ratings yet

- Componenets of Audit ReportDocument66 pagesComponenets of Audit ReportAltum Pokoo-AikinsNo ratings yet

- For BSNL Qa Centres OF Mankapur AND RaebareliDocument42 pagesFor BSNL Qa Centres OF Mankapur AND Raebareliमिताली जोशीNo ratings yet

- BPM Maturity Review Proposition v8Document21 pagesBPM Maturity Review Proposition v8Luis Alberto Lamas LavinNo ratings yet

- W5 Slides - Int ControlsDocument33 pagesW5 Slides - Int ControlsHieu HoangNo ratings yet

- ISO 9001:2015 Internal Audits Made Easy: Tools, Techniques, and Step-by-Step Guidelines for Successful Internal AuditsFrom EverandISO 9001:2015 Internal Audits Made Easy: Tools, Techniques, and Step-by-Step Guidelines for Successful Internal AuditsNo ratings yet

- ECON3124 Behavioural Economics S12013 PartADocument7 pagesECON3124 Behavioural Economics S12013 PartAsyamilNo ratings yet

- Quality Control Management AssignmentDocument8 pagesQuality Control Management AssignmentKimmy LyonsNo ratings yet

- Nmat Quantitative Simulations (Mock 2) Section 1. Fundamental OperationsDocument2 pagesNmat Quantitative Simulations (Mock 2) Section 1. Fundamental OperationsRACKELLE ANDREA SERRANONo ratings yet

- Blankie Owl Crochet Pattern Sol MaldonadoDocument24 pagesBlankie Owl Crochet Pattern Sol Maldonadonatys100% (1)

- DPWH Structural 01Document9 pagesDPWH Structural 01AndengBaduriaNo ratings yet

- Estimate For Providing, Lowering, Laying and Jointing of 110mm, 200mm and 250 MM Dia - Di Pipeline of SawriR.R.wss-1 From WTP To ChimurDocument6 pagesEstimate For Providing, Lowering, Laying and Jointing of 110mm, 200mm and 250 MM Dia - Di Pipeline of SawriR.R.wss-1 From WTP To Chimurmilind lohitNo ratings yet

- Effect of Product Quality, Promotion, and Brand Image On Purchase Decision of Nike Sports Shoes (Case Study On S1 FISIP UNDIP Students)Document12 pagesEffect of Product Quality, Promotion, and Brand Image On Purchase Decision of Nike Sports Shoes (Case Study On S1 FISIP UNDIP Students)BhiintaNo ratings yet

- Revised Confirmation of Johor Student Leader Council (JSLC)Document6 pagesRevised Confirmation of Johor Student Leader Council (JSLC)Shahmel IrfanNo ratings yet

- The Difference Between Shuttle Loom and Shuttle-Less Loom - News - Hangzhou Shuyuan Imp.& Exp Co.,LtdDocument1 pageThe Difference Between Shuttle Loom and Shuttle-Less Loom - News - Hangzhou Shuyuan Imp.& Exp Co.,LtdBiswajit PalNo ratings yet

- WA Minerals Fees & Charges - 2023Document2 pagesWA Minerals Fees & Charges - 2023aracgx9900No ratings yet

- Night AuditDocument16 pagesNight AuditKumarasamy Vijayarajan100% (1)

- Business PlanDocument3 pagesBusiness PlanPenninah MainaNo ratings yet

- 02 TISAX Participant Price ListDocument2 pages02 TISAX Participant Price ListKolhapur ANANo ratings yet

- The Consolidated Statement of Profit or Loss and Other Comprehensive Income - STUDENTDocument32 pagesThe Consolidated Statement of Profit or Loss and Other Comprehensive Income - STUDENTlinh nguyễnNo ratings yet

- Industrial Pricing Decisions in B2B Marketing: Ravi R Ahuja Roll No:01Document9 pagesIndustrial Pricing Decisions in B2B Marketing: Ravi R Ahuja Roll No:01taru88No ratings yet

- Assignment With Solutions Day 4Document13 pagesAssignment With Solutions Day 4HIMANSHU Ak MISRANo ratings yet

- The Role of Transaction Advisers in A PPP Project PDFDocument15 pagesThe Role of Transaction Advisers in A PPP Project PDFOladunni AfolabiNo ratings yet

- Agribisnis Lorjuk (Solen Grensalis) Dalam Analisis Targeting Dan Positioning Di Kabupaten PamekasanDocument12 pagesAgribisnis Lorjuk (Solen Grensalis) Dalam Analisis Targeting Dan Positioning Di Kabupaten PamekasanZaki AbdilahNo ratings yet

- Matl Control ProcedureDocument3 pagesMatl Control Procedureimran_amamiNo ratings yet

- NeelofaDocument3 pagesNeelofaNur Syahirah binti Mohd IdrisNo ratings yet

- 2015 SALN Form - Doc UPDATEDDocument2 pages2015 SALN Form - Doc UPDATEDFem Fem100% (1)

- Profile PDFDocument13 pagesProfile PDFWakari Masta0% (1)

- Acct Statement - XX9642 - 10082022Document87 pagesAcct Statement - XX9642 - 10082022sunkenapelli adityaNo ratings yet

- Comparative Development Expericences of India Its NeigborsDocument30 pagesComparative Development Expericences of India Its NeigborsshivangiNo ratings yet

- FP922 - Human BehaviourDocument181 pagesFP922 - Human Behaviouraditijaswal25No ratings yet

- FLC Application FormDocument10 pagesFLC Application FormMuhammad Zaheer NaivasalNo ratings yet

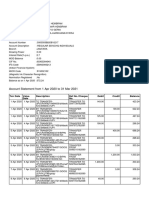

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument14 pagesAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceHyper GamingNo ratings yet