Professional Documents

Culture Documents

Corp Governance

Uploaded by

Niket SharmaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corp Governance

Uploaded by

Niket SharmaCopyright:

Available Formats

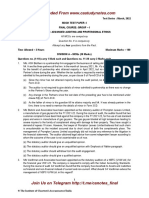

CA Final – Advanced Auditing & Professional Ethics Additional Questions for Practice (Chapter 11)

11

Chapter Audit Committee & Corporate Governance

Q.1 Audit Committee of XYZ Limited has conducted 4 meetings in 2020-21. i.e. June 15, 2020,

October 18, 2020, February 10, 2021 and March 10, 2021. Does it comply with provisions of

conducting meeting? [Study Material – ICAI]

Ans.: Meetings of the Audit Committee:

As per Regulation 18 of SEBI (LODR) Regulations 2015, the audit committee should meet at

least 4 times in a year and not more than 120 days shall elapse between two meetings.

In the given case, audit committee of XYZ Limited has conducted 4 meetings in 2020-21. i.e.

June 15, 2020, October 18, 2020, February 10, 2021 and March 10, 2021. It does not comply

with provisions because time gap between June 15 and October 18 is more than 120 days

i.e. 125 days.

Conclusion: XYZ Ltd. has not complied with provisions of Regulation 18 of SEBI (LODR)

Regulations 2018 as gap between two meetings of audit committee. Auditor is required to make

a suitable qualified statement in the Auditors’ Certificate, in respect of compliance of

requirements of corporate governance.

Q.2 Statutory auditor of ABC Limited has resigned on July 10, 2020. Whether he shall be liable for

issuing limited review report for quarter ended June 30, 2020. [Study Material – ICAI]

Ans.: Obligations of Statutory Auditor in case of resignation:

As per the directions given by SEBI through its circular, all listed entities/material

subsidiaries while appointing/re-appointing an auditor shall ensure compliance with

certain conditions.

One of such condition is that if the auditor resigns within 45 days from the end of a quarter

of a financial year, then the auditor shall, before such resignation, issue the limited review/

audit report for such quarter.

In the given situation, statutory auditor of ABC Limited has resigned on July 10, 2020.

Conclusion: Auditor would be liable for issuing limited review report for quarter ended June

30, 2020 because time gap between June 30, 2020 and July 13, 2020 is less than 45 days.

Q.3 PQR, auditor of XYZ Limited has signed limited review report of 2nd and 3rd quarter.

Whether auditor is liable to issue limited review report of 4th quarter before resignation?

[Study Material – ICAI]

Ans.: Obligations of Statutory Auditor in case of resignation:

As per the directions given by SEBI through its circular, all listed entities/material

subsidiaries while appointing/re-appointing an auditor shall ensure compliance with

certain conditions.

One of such condition is that if the auditor has signed the limited review/ audit report for

the first three quarters of a financial year, then the auditor shall, before such resignation,

issue the limited review/ audit report for the last quarter of such financial year as well as

the audit report for such financial year.

In the given situation, PQR, auditor of XYZ Limited has signed limited review report of 2nd

and 3rd quarter.

Conclusion: Auditor is not liable to issue limited review report of 4th quarter because he has

not signed limited review report of first 3 quarters.

©CA. Pankaj Garg www.altclasses.in Page 1

CA Final – Advanced Auditing & Professional Ethics Additional Questions for Practice (Chapter 11)

Q.4 The Board of Directors of PQR Ltd. have laid down the code of conduct for all Board members

and senior management. The auditor is provided with the annual compliance affirmations

received from the Board members and explained that since there has been no change in the

composition of the senior management, the previous year’s affirmations may be considered

valid. Is the contention of the Company valid? [Study Material – ICAI]

Ans.: Compliance of LODR Regulations as to provisions relating with Code of Conduct:

As per Regulation 26(3) of SEBI (LODR) Regulations, 2015, all Board members and senior

management personnel have to affirm compliance with the code on an annual basis.

In the given case, the auditor is provided with the annual compliance affirmations received

from the Board members and explained that since there has been no change in the

composition of the senior management, the previous year’s affirmations may be considered

valid.

Conclusion: Decision to consider the previous year’s affirmations from the senior management

personnel as valid is not in line with the SEBI (LODR) Regulations.

Q.5 RST Ltd. has established a vigil mechanism to enable its directors and employees to report

genuine concerns and seek protection against victimization. The details of the mechanism

are available on the company intranet which is accessible by the directors and employees.

Are the measures taken by the Company in line with the LODR Regulations?

[Study Material – ICAI]

Ans.: Compliance of LODR Regulations as to provisions relating with Vigil Mechanism:

As per Regulation 22 of the SEBI (LODR) Regulations, 2015, the vigil mechanism can be used

by directors, employees and any other person.

For this purpose, Regulation 46 of the SEBI (LODR) Regulations, 2015 requires the details of

establishment of such mechanism to be disclosed by the company on its website and in the

Board Report.

In the given case, details of the mechanism are available on the company intranet which is

accessible by the directors and employees.

Conclusion: By only providing the details in the intranet, the Company has failed to meet the

LODR Regulations.

Q.6 Genuine Ltd. has established the Internal Complaints Committee under the Sexual

Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013

(‘POSH Act’). The details (names, email addresses and contact numbers) of the Committee

members are available on the company intranet which is accessible by all employees.

However, no disclosure regarding number of complaints pertaining to sexual harassment of

women at workplace is being made. Are the measures taken by the Company adequate?

[Study Material – ICAI]

Ans.: Disclosures in relation to the Sexual Harassment of Women at Workplace:

As per Schedule V of SEBI (LODR) Regulations, 2015, in relation to the Sexual Harassment of

Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013, following should

be disclosed in the section on Corporate Governance of the Annual Report:

(a) number of complaints filed during the financial year

(b) number of complaints disposed of during the financial year

(c) number of complaints pending as on end of the financial year.

In the given case, details (names, email addresses and contact numbers) of the Committee

members are available on the company intranet which is accessible by all employees.

However, no disclosure regarding number of complaints pertaining to sexual harassment of

women at workplace is being made.

Conclusion: By only providing the details in the intranet, the Company has failed to meet the

disclosure requirements of Schedule V of SEBI (LODR) Regulation 2015.

©CA. Pankaj Garg www.altclasses.in Page 2

CA Final – Advanced Auditing & Professional Ethics Additional Questions for Practice (Chapter 11)

Q.7 BG Limited is a large-sized listed company. The Board of directors have constituted

Nomination and Remuneration committee comprising of non-executive and independent

directors. The management seeks your advice on the composition and role of the committee.

Elucidate the composition and role of Nomination and Remuneration committee as per SEBI

(Listing Obligations and Disclosure Requirements) Regulations, 2015.

[Nov. 20 – New Syllabus (5 Marks)]

Ans.: Composition and Role of Nomination and Remuneration Committee:

Regulation 19 of SEBI (LODR) Regulations, 2015 provides the requirements relating with the

Nomination and Remuneration Committee.

Composition of Nomination and Remuneration Committee:

(1) The board of directors shall constitute the nomination and remuneration committee as

follows:

(a) the committee shall comprise of atleast three directors;

(b) all directors of the committee shall be non-executive directors; and

(c) at least 50% of the directors shall be independent directors and in case of a listed

entity having outstanding SR equity shares, 2/3rd of the nomination and remuneration

committee shall comprise of independent directors.

(2) The Chairperson of the nomination and remuneration committee shall be an independent

director.

Provided that the chairperson of the listed entity, whether executive or non-executive, may

be appointed as a member of the Nomination and Remuneration Committee and shall not

chair such Committee.

Role of Nomination and Remuneration Committee:

The role of the nomination and remuneration committee is specified in Part D of the Schedule

II. Accordingly, role of Nomination and Remuneration Committee shall be:

(1) Formulation of the criteria for determining qualifications, positive attributes and

independence of a director and recommend to the board a policy relating to, the

remuneration of the directors, KMP and other employees;

(2) Formulation of criteria for evaluation of performance of independent directors and the

board;

(3) Devising a policy on diversity of board;

(4) Identifying persons who are qualified to become directors and who may be appointed in

senior management in accordance with the criteria laid down, and recommend to the

board of directors their appointment and removal;

(5) whether to extend or continue the term of appointment of the independent director, on the

basis of the report of performance evaluation of independent directors.

(6) recommend to the board, all remuneration, in whatever form, payable to senior

management.

Q.8 Mr. BK, Partner in M/s. BK and Associates, as part of their audit presentation to the Audit

Committee of M/s. XYZ Limited, a listed company, highlighted the following:

• Difficulties faced during the audit

• Disagreements with the management

• Management Letter Points

• Draft Management Representation letter to be provided by the Company in connection

with the audit.

©CA. Pankaj Garg www.altclasses.in Page 3

CA Final – Advanced Auditing & Professional Ethics Additional Questions for Practice (Chapter 11)

Some of the Audit Committee members were not happy with the above presentation and

asked Mr. BK to take it back and submit directly to the Board. They believe that Audit

Committee is not the forum for discussing such problems and this has to be sorted out

between auditors and the management. Please comment on the above.

[Nov. 20 – Old Syllabus (5 Marks)]

Ans.: Mandatory Review Areas of Audit Committee:

• As per SA 260 “Communication with Those Charged with Governance,” statutory auditor of

the Company is having an obligation to bring certain matters to the attention of TCWG, which

inter alia includes aspects such as -

(a) Difficulties faced by them during the audit

(b) Disagreements with the management

(c) Management Letter Points

(d) Draft Management Representation letter to be provided by the Company in connection

with the audit.

• Further, the Audit Committee is also having an obligation to mandatorily review certain

areas before providing their recommendations/inputs to the board. Given below are the

areas required to be mandatorily reviewed by the ACM in the case of listed companies.

(i) Management discussion and analysis of financial condition and results of operations;

(ii) Statement of significant related party transactions (as defined by the Audit Committee),

submitted by management;

(iii) Management letters / letters of internal control weaknesses issued by the statutory

auditors;

(iv) Internal audit reports relating to internal control weaknesses;

• The auditor should further ascertain whether the Management Discussion and Analysis

report includes discussion on the matters stipulated. Where certain deficiencies or adverse

findings are noted by the Audit Committee, the auditor will be required to see that these

have been suitably dealt with by the management in the report on corporate governance.

• In the instant case, Mr. BK, Partner in M/s BK and Associates highlighted the facts such as

difficulties faced during the audit, disagreements with the management, managements

letters points and draft management letters to be provided by the Company in connection

with the audit. However, some of the audit committee members were not happy and as

according to them audit committee is not the forum for discussing such problems.

Conclusion: Contention of those audit committee members regarding problems to be sorted

out between auditors and the management is not in order as Audit Committee is required to

mandatorily review the same in accordance with Schedule II of SEBI (LODR) Regulations, 2015.

Q.9 LDH Ltd., a company incorporated in India and listed on a recognized stock exchange in India

has entered into various related parties transactions during the financial year. You are

required to answer the following keeping in mind the Listing Obligations and Disclosure

Requirements (LODR) on corporate Governance.

(i) Who should sign the report of material transactions with related parties?

(ii) What type of transactions and policy are required to be disclosed in relation to related

party transactions?

(iii) Whether disclosures of related party transactions on consolidated financial statements

are required to be made? If yes, what are the guidelines?

[Jan. 21 – New Syllabus (5 Marks)]

Ans.: Related Party Disclosures:

Provisions related with Related Party Transactions are covered under 23, 27, 46 and Schedule

V of SEBI (LODR) Regulations, 2015. Accordingly,

©CA. Pankaj Garg www.altclasses.in Page 4

CA Final – Advanced Auditing & Professional Ethics Additional Questions for Practice (Chapter 11)

(i) As per Regulation 27 of SEBI (LODR) Regulations, 2015, report of material transactions

with related parties shall be signed either by the compliance officer or the chief executive

officer of the listed entity.

(ii) As per Schedule V of SEBI (LODR) Regulations, 2015, listed entity shall disclose

transactions of the listed entity with any person or entity belonging to the

promoter/promoter group which hold(s) 10% or more shareholding in the listed entity, in

the format prescribed in the relevant accounting standards for annual results.

(iii) As per Regulation 23 of SEBI (LODR) Regulations, 2015, disclosures of related party

transactions on consolidated financial statements are required to be made. The listed

entity shall submit within 30 days from the date of publication of its standalone and

consolidated financial results for the half year, disclosures of related party transactions on

a consolidated basis, in the format specified in the relevant ASs for annual results to the

stock exchanges and publish the same on its website.

Q.10 A certificate of compliance of conditions of corporate governance has been issued by CEO of

VAM Ltd. In the context of internal control, which points you as an auditor would like to

ensure and examine in the said compliance certificate? [Jan. 21 – Old Syllabus (5 Marks)]

Ans.: CEO Certification:

The CEO and the CFO shall certify to the Board that they accept responsibility for establishing

and maintaining internal controls for financial reporting and that they have evaluated the

effectiveness of the internal control systems and they have disclosed to the auditors,

deficiencies in the design or operation of internal controls, if any, of which they are aware and

the steps they have taken or propose to take to rectify these deficiencies.

In the context of internal controls, the auditor should ensure that -

• The management has instituted an internal control framework with respect to financial

reporting controls. The framework should be examined in the context of the documentation

created for each significant process in terms of the related risk and mitigating control;

• He has further examined whether the assessment process followed for evaluation of

controls is reasonable and there is a process by which significant deficiencies as well as steps

taken to correct them is communicated to the Audit Committee and to the auditors;

• He should also examine whether a process exists in the listed entity whereby all significant

changes in the accounting policies and in the system of internal controls are communicated

to the Audit Committee and the auditors.

• The auditor should examine the adequacy of the process followed for issuing the Compliance

Certificate and should review the same in regard to matters stated above and the

consideration of the same by the Audit Committee. For this purpose, he should refer to the

minutes of the Audit Committee meetings.

• In situations where negative or adverse comments or exclusions/disclaimers are contained

in the Compliance Certificate, the auditor should take cognizance of the same in the Audit

Report and/or the certificate of compliance of conditions of corporate governance.

Q.11 RAO & Co., a Chartered Accountant Firm, is appointed as the principal auditor of a listed

company, Triumph Ltd.

Figures of income and net worth of 5 out of 7 components of Triumph Ltd., which are its

unlisted subsidiaries, is tabulated below for the immediate preceding financial year along

with the consolidated amount:

(Rs. in crores)

Particulars Consolidated Component Component Component Component Component

‘A’ ‘B’ ‘C’ ‘D’ ‘E’

Income 300 35 10 70 65 20

Net Worth 800 40 20 140 180 50

©CA. Pankaj Garg www.altclasses.in Page 5

CA Final – Advanced Auditing & Professional Ethics Additional Questions for Practice (Chapter 11)

Which of the components of Triumph Ltd. can be termed as “material subsidiary” and in the

board of which of the unlisted subsidiaries at least one independent director of Triumph Ltd.

needs to be appointed or would be appointed? [MTP-March 21]

Ans.: Determination of Status of Material Subsidiary:

• As per Regulation 16(c) of the SEBI (LODR) Regulations, 2015, “material subsidiary” shall

mean a subsidiary, whose income or net worth exceeds 10% of the consolidated income or

net worth respectively, of the listed entity and its subsidiaries in the immediately preceding

accounting year.

• Regulation 24(1) of the SEBI (LODR) Regulations, 2015, provides that at least one

independent director on the board of directors of the listed entity shall be a director on the

board of directors of an unlisted material subsidiary, whether incorporated in India or not.

• For the purposes of Regulation 24(1), notwithstanding anything to the contrary contained

in regulation 16, the term “material subsidiary” shall mean a subsidiary, whose income or

net worth exceeds 20% of the consolidated income or net worth respectively, of the listed

entity and its subsidiaries in the immediately preceding accounting year.

• On the basis of above provisions, following information is tabulated as below:

Particulars Share in Consolidated Share in Consolidated Net

Income Worth

Component ‘A’ 11.67% 5%

Component ‘B’ 3.33% 2.5%

Component ‘C’ 23.33% 17.5%

Component ‘D’ 21.67% 22.5%

Component ‘E’ 6.67% 6.25%

Conclusion: From the above discussion, following conclusions may be drawn:

• Component ‘A’, Component ‘C’ and Component ‘D’, respectively, can be termed as “material

subsidiary” as their shares in either consolidated Income or net worth exceeds 10%.

• At least one independent director from the board of directors of Triumph Ltd. shall be

appointed or would have been appointed on the board of Component ‘C’ and Component ‘D’,

respectively, as their shares in either consolidated income or net worth exceeds 20%.

Q.12 Mr. Ibrahim was appointed as statutory auditor of New Limited and Old Limited. Both the

Companies were having their base in Chennai they had recently listed their shares on the

Stock Exchange. For the financial year 2020-21, Mr. Ibrahim had signed limited review

reports for each quarter, till the quarter ended 31st December 2020 for both the companies.

Owing to his personal commitments and increased workload, he tendered his resignation to

M/s New Limited on 30th January 2021 and asked the Company to appoint another auditor

to issue audit report for the remaining quarter and the FY 2020-21 as a whole. But the

management of the Company did not accept the same.

Mr. Ibrahim continued to as act as auditor for M/s Old limited. During the 1st week of March

2021, Mrs. W (wife of Mr. Ibrahim) had borrowed a sum of ₹ 6 lakh from the Company for her

personal use. Having come to know about this, Mr. Ibrahim immediately informed the

management that he had been disqualified to act as auditor and told them that he won ’t issue

audit report for last quarter. But management of the Company argued that it’s the legal

responsibility of Mr. Ibrahim to do the same.

Whether contention of management of New Limited and Old Limited is justified in asking Mr.

Ibrahim to issue audit report for the last quarter and the FY 2020-21 as a whole, despite his

resignation? Discuss. [RTP-May 21]

©CA. Pankaj Garg www.altclasses.in Page 6

CA Final – Advanced Auditing & Professional Ethics Additional Questions for Practice (Chapter 11)

Ans: Obligations of Statutory Auditor in case of resignation:

As per the directions given by SEBI through its circular, all listed entities/material

subsidiaries while appointing/re-appointing an auditor shall ensure compliance with

certain conditions.

One of such condition is that if the auditor has signed the limited review/ audit report for

the first three quarters of a financial year, then the auditor shall, before such resignation,

issue the limited review/ audit report for the last quarter of such financial year as well as

the audit report for such financial year. However, in case the auditor is rendered disqualified

due to operation of any condition mentioned in Section 141 of the Companies Act, 2013, then

the provisions of this Circular shall not apply.

In the given case, Mr. Ibrahim was appointed as statutory auditor of two listed entities i.e.,

New Limited and Old Limited. For the financial year 2020-21, Mr. Ibrahim had signed limited

review reports for first three quarter i.e., till the quarter ended 31st December 2020 for both

the companies. Owing to his personal commitments and increased workload, he resigned

from New Limited and asked the Company to appoint another auditor to issue audit report

for the remaining quarter and audit report for the FY 2020-21. Further, Mr. Ibrahim

immediately informed the management of Old Limited that he had been disqualified to act

as auditor and told them that he won’t issue audit report for last quarter as Mrs. W (wife of

Mr. Ibrahim) had borrowed a sum of ₹ 6 lakh from the Company for her personal use.

Conclusion: Based on the aforesaid discussion, following conclusions may be drawn:

(a) Mr. Ibrahim is required to issue the audit report for the last quarter and audit report for the

year 2020-21 for New Limited as he has issued audit report for the first three quarters.

(b) Mr. Ibrahim is not required to issue the audit report for remaining quarter and audit report

for the year 2020-21 as a whole for Old Limited as he is disqualified under section 141 of

Companies Act.

Accordingly, contention of Management of New Limited is correct and tenable for issuing the

audit report for remaining quarter and audit report for financial year 2020-21 however,

contention of management of Old Limited is not correct regarding the legal responsibility of Mr.

Ibrahim to issue audit report for remaining quarter and for the whole year.

© All rights reserved

Law stated in this publication is upto 31.10.2020 and is relevant for May 2021 Exams and onwards.

Disclaimer:

Every effort has been made to avoid errors or omissions in this publication. In spite of this, errors may creep in.

Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next

edition. No part of this publication may be reproduced or copied in any form or by any means.

For academic updates and related contents:

Join telegram channel: https://t.me/altclasses

Visit knowledge portal of www.altclasses.in

For books/class related queries:

E-mail: info@altclasses.in

Ph.: 9319805511

For academic doubts:

E-mail: cacs.gargpankaj@gmail.com

For Online purchase of books/classes:

Visit our web portal: www.altclasses.in

©CA. Pankaj Garg www.altclasses.in Page 7

You might also like

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- ResearchDocument77 pagesResearchSakshi GuptaNo ratings yet

- Ep Module 1 Dec18 OsDocument81 pagesEp Module 1 Dec18 OsHeena MistryNo ratings yet

- Audit Papers DecDocument164 pagesAudit Papers DecKeshav SethiNo ratings yet

- Paper - 3: Advanced Auditing and Professional Ethics: (5 Marks)Document18 pagesPaper - 3: Advanced Auditing and Professional Ethics: (5 Marks)Suryanarayan RajanalaNo ratings yet

- Suggested Answers Compiler May 2018 To July 2021Document113 pagesSuggested Answers Compiler May 2018 To July 2021rabin067khatriNo ratings yet

- Test 4 - SolutionDocument2 pagesTest 4 - SolutionMuhammad ImranNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument11 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The Restritz meshNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument11 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestAditya MaheshwariNo ratings yet

- CT AuditReg 2 QPDocument5 pagesCT AuditReg 2 QPKhushi KapurNo ratings yet

- Audit MTP Nov'22Document22 pagesAudit MTP Nov'22Kushagra SoniNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestShivanshu sethiaNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument13 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestGJ ELASHREEVALLINo ratings yet

- CT AuditReg 3 QPDocument7 pagesCT AuditReg 3 QPKhushi KapurNo ratings yet

- CT AuditReg 4 QPDocument4 pagesCT AuditReg 4 QPKhushi KapurNo ratings yet

- Paper 3 - Audit - TP-1Document7 pagesPaper 3 - Audit - TP-1Suprava MishraNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestShrwan SinghNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestMehul JainNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The Restritz meshNo ratings yet

- Law T4Document8 pagesLaw T4Badhrinath ShanmugamNo ratings yet

- Audit Icap Chapterwise Past Paper With Solution Prepared by Fahad Irfan PDFDocument113 pagesAudit Icap Chapterwise Past Paper With Solution Prepared by Fahad Irfan PDFShaheryar Shahid100% (1)

- CA Final Law Notes by Gurukripa - AUDITORSDocument56 pagesCA Final Law Notes by Gurukripa - AUDITORSYogesh KumarNo ratings yet

- Audit 2 QDocument21 pagesAudit 2 QG INo ratings yet

- Financial Results 201920Document26 pagesFinancial Results 201920Ankush AgrawalNo ratings yet

- May 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeDocument19 pagesMay 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeVonnieNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- F MauditDocument4 pagesF MauditPaulomee JhaveriNo ratings yet

- Law Chapter 9 QPDocument8 pagesLaw Chapter 9 QPlostworld2005777No ratings yet

- Draft Preliminary ReportsDocument4 pagesDraft Preliminary ReportsDeepmala SamriyaNo ratings yet

- Audit Committee and Corporate Governance - CA Final Audit Question Bank - GST GunturDocument1 pageAudit Committee and Corporate Governance - CA Final Audit Question Bank - GST GunturAditiNo ratings yet

- Test Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsDocument5 pagesTest Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsRobinxyNo ratings yet

- Amendments of SADDDocument72 pagesAmendments of SADDmiti.mnacapsNo ratings yet

- Corporate Relationship Department,: Dated: 12th November, 2022Document38 pagesCorporate Relationship Department,: Dated: 12th November, 2022NRZXNo ratings yet

- Audit QuesDocument11 pagesAudit QuesVivek VermaNo ratings yet

- Dec'21 Module1 AnswersDocument70 pagesDec'21 Module1 AnswersVivek SaraogiNo ratings yet

- UntitledDocument14 pagesUntitledContra Value BetsNo ratings yet

- Attention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Document9 pagesAttention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Dharnis123No ratings yet

- Microsoft Word - Practice Paper Advanced Auditing Mock Test November 2016Document4 pagesMicrosoft Word - Practice Paper Advanced Auditing Mock Test November 2016Asim JavedNo ratings yet

- CAF-09 Audit CompleteDocument36 pagesCAF-09 Audit CompleteShehrozSTNo ratings yet

- Compulsory MCQS: (Just Select The Correct Answer, No Need For Reasoning)Document17 pagesCompulsory MCQS: (Just Select The Correct Answer, No Need For Reasoning)shivam wadhwaNo ratings yet

- CA Final Test Paper 3 16 Jan 22Document2 pagesCA Final Test Paper 3 16 Jan 22Rohit BajajNo ratings yet

- Corporate Governance 4 AbDocument3 pagesCorporate Governance 4 Absilvernitrate1953No ratings yet

- CFAP 6 AARS Winter 2020Document4 pagesCFAP 6 AARS Winter 2020ANo ratings yet

- Chapter 9Document5 pagesChapter 9Divyam sharma Roll no 175No ratings yet

- Exide: EIL/SEC/2020Document18 pagesExide: EIL/SEC/2020Aneesh ViswanathanNo ratings yet

- Varun Beverages L/Miced: Symbol: VBL Security Code: 540180 Subject: Regulation 30: Outcome of The Board MeetingDocument21 pagesVarun Beverages L/Miced: Symbol: VBL Security Code: 540180 Subject: Regulation 30: Outcome of The Board MeetingAkash SharmaNo ratings yet

- CAF 8 AUD Spring 2020Document5 pagesCAF 8 AUD Spring 2020Huma BashirNo ratings yet

- Corporate Law Auditors, Their Duties and LiabilitiesDocument17 pagesCorporate Law Auditors, Their Duties and LiabilitiesJayantNo ratings yet

- Final Audit Super 100 Questions - May 2023 ExamsDocument38 pagesFinal Audit Super 100 Questions - May 2023 ExamskalyanNo ratings yet

- Corporate Laws & Practices: RequirementsDocument3 pagesCorporate Laws & Practices: RequirementsReefat HasanNo ratings yet

- Paper 4 - LawDocument21 pagesPaper 4 - LawManish ChawlaNo ratings yet

- Audit and Assurance: Certificate in Accounting and Finance Stage ExaminationDocument3 pagesAudit and Assurance: Certificate in Accounting and Finance Stage ExaminationAdil AfridiNo ratings yet

- Audit Mtp2 DoneDocument11 pagesAudit Mtp2 Donegaurav gargNo ratings yet

- Ca Final (Advanced Auditing & Professional Ethics) Mock Test - IDocument18 pagesCa Final (Advanced Auditing & Professional Ethics) Mock Test - ISrinivas RevankarNo ratings yet

- Q2 ResltsDocument11 pagesQ2 ResltssaumikdebNo ratings yet

- RT#2 CAF-9 AA - Question PaperDocument3 pagesRT#2 CAF-9 AA - Question PaperWaseim khan Barik zaiNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Vaibhav Global Limited: Fax Regd. OfficeDocument21 pagesVaibhav Global Limited: Fax Regd. Officemohit_999No ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- HSTL Annual-Report 2021Document72 pagesHSTL Annual-Report 2021ums 3vikramNo ratings yet

- CORPO DIGESTS: Republic vs. Sun Life Gokongwei vs. SECDocument3 pagesCORPO DIGESTS: Republic vs. Sun Life Gokongwei vs. SECJustin CebrianNo ratings yet

- Sri Lanka Production Development PlanDocument10 pagesSri Lanka Production Development Planxinjian1230No ratings yet

- Q.7 What Is The Monetary Policy?Document2 pagesQ.7 What Is The Monetary Policy?MAHENDRA SHIVAJI DHENAKNo ratings yet

- Disqualifications From Endurance and Efficiency Events at Formula Student 2016 PDFDocument2 pagesDisqualifications From Endurance and Efficiency Events at Formula Student 2016 PDFekjNo ratings yet

- 2014 Flint Group SustainabilityDocument44 pages2014 Flint Group Sustainabilitydrweb19No ratings yet

- Bernas Vs CincoDocument4 pagesBernas Vs CincoInna LadislaoNo ratings yet

- BR Ch-2 Contract LawDocument12 pagesBR Ch-2 Contract LawROHITHNo ratings yet

- Guide To Importing and Exporting: Breaking Down The BarriersDocument78 pagesGuide To Importing and Exporting: Breaking Down The BarriersVamsi Krishna SivadiNo ratings yet

- Recognizing Opportunities and Generating IdeasDocument16 pagesRecognizing Opportunities and Generating IdeasRuMMaN_007No ratings yet

- GG 101 Introduction To The Design Manual For Roads and BridgesDocument15 pagesGG 101 Introduction To The Design Manual For Roads and BridgesDELIAL-ABABNo ratings yet

- Aml Directive enDocument41 pagesAml Directive enDziennik InternautówNo ratings yet

- de Jesus Vs GuerreroDocument7 pagesde Jesus Vs GuerreroJoel G. AyonNo ratings yet

- Pavan &Document8 pagesPavan &PAPPU RANJITH KUMARNo ratings yet

- Contract Review Turtle DiagramDocument1 pageContract Review Turtle DiagramManish PRAKASH (EA2252001010405)No ratings yet

- Russindo Corporation Group Hes Plan and Implementation PERIODE 2019Document14 pagesRussindo Corporation Group Hes Plan and Implementation PERIODE 2019Jusmanizah ZizaNo ratings yet

- CSR - Position PaperDocument2 pagesCSR - Position PaperFernie Villanueva BucangNo ratings yet

- TPP Factsheet Goods Market AccessDocument11 pagesTPP Factsheet Goods Market AccessNewshubNo ratings yet

- EnglishDocument72 pagesEnglishCreative Commons Korea100% (2)

- Opposition To Motion To DismissDocument24 pagesOpposition To Motion To DismissAnonymous 7nOdcANo ratings yet

- American Airlines V CA (TRANSPO)Document8 pagesAmerican Airlines V CA (TRANSPO)Nenzo Cruz100% (1)

- Gonzales vs. Rufino HechanovaDocument3 pagesGonzales vs. Rufino Hechanovamarc abellaNo ratings yet

- PhilGEPS MerchantsDocument1 pagePhilGEPS Merchantsarkina_sunshine100% (1)

- Unit I Commercial BanksDocument63 pagesUnit I Commercial BanksJoseph AnbarasuNo ratings yet

- Colgate Sustainability Report 2016Document124 pagesColgate Sustainability Report 2016Ioana CîmpanuNo ratings yet

- 341 1667 3 PBDocument12 pages341 1667 3 PBNANDA RAHMAHNo ratings yet

- 03 Meralco v. LucenaDocument2 pages03 Meralco v. Lucenaanon_614984256No ratings yet

- 1 - Formation of ContractDocument4 pages1 - Formation of ContractBeren RumbleNo ratings yet

- Telecommunications Regulation HandbookDocument379 pagesTelecommunications Regulation HandbookBayu Ramadhan Hidayatullah100% (2)

- The Challenge of Culture To International Financial Reporting Standards (Ifrs) ConvergenceDocument11 pagesThe Challenge of Culture To International Financial Reporting Standards (Ifrs) ConvergenceUbaid DarNo ratings yet

- Music Booking Agent Contract PDF TemplateDocument4 pagesMusic Booking Agent Contract PDF TemplateCarlos AndréNo ratings yet