Professional Documents

Culture Documents

English Version

Uploaded by

fatimaezzahraousriCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

English Version

Uploaded by

fatimaezzahraousriCopyright:

Available Formats

Finance Handbook

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

Purpose

The purpose of this handbook is to provide finance personnel with a reference document that can

be used as an organized “road map” to learn about Lear, understand finance’s role (especially

the plant controller’s role) and responsibilities and provide best practice examples.

Table of Contents

Section Topic Page

1. Introduction to Lear Corporation 4 - 10

I. Lear Global Finance Team Philosophy

II. High level Overview of Lear Corporation

Information included in this section presents the Lear Global Finance

Team philosophy and provides an overview of Lear Corporation (the

“Company”), the Company's products and the Company’s financial

processes. Corporate Compliance Program and the Code of Business

Conduct & Ethics are also included in this section.

2. Lear Accounting Practices (LEAP) Manual 11

3. Internal Control Over Financial Reporting 12 - 21

I. Sarbanes-Oxley Act (SOX)

II. Quarterly Attest

III. Balance Sheet Review

IV. Reserve Reviews

V. Code of Conduct Confirmations

VI. Disclosure Committee Reviews

The information included in this section provides the controller with

background regarding the Sarbanes-Oxley Act as well as a discussion on

Management’s responsibilities. This section also explains all the

Sarbanes-Oxley tools utilized at Lear and details the Plant Controller’s

responsibilities to ensure compliance with Sarbanes-Oxley.

4. Hyperion 22 - 23

I. Hyperion Financial Products Used by Lear

II. Hyperion Chart of Accounts / Training / Support Materials

5. Month-end Plant Close Process 24 - 26

I. General Reporting Responsibilities

II. Month-end Close Procedures

The information included in this section details the plant closing

schedule and related reporting requirements

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 2 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

6. Financial Statement Analysis and Forecasting 27 - 35

I. Forecasting

II. Actual Results Variance Analysis Guidelines

III. Chart of Accounts

The information included in this section explains how operational/financial

analysis should be performed, defines certain analytical terms, shows

techniques for capturing actual mix built by plant and promotes variance

analysis techniques (e.g., calculating volume, economic variances,

exchange, pricing).

7. Cash Management 36 - 38

8. Capital Markets 39 - 44

I. External Debt

II. Government Loans or Grants

III. Corporate Guarantees and Comfort Letters

IV. Leasing

V. Inter-company Lending and Borrowing

VI. Capital Requirements

9. Financial Risk Management 45 - 51

I. Financial Risk Management

II. Insurance Risk Management

III. Credit & Collections

10. Hedge Forecasting 52 - 55

11. Value Added Tax (VAT) and Other Indirect Taxes 56 - 59

12. Restructuring - Authoritative Guidance 60 - 64

13. PAR Process - ePAR System 65 - 68

14. Inventory Control 69 - 70

15. White Papers 71

This section includes an overview of the judgmental accrual

documentation process.

16. Engineering Change Control Process 72 - 75

This section includes an overview of the ECN process.

17. Non-Production Purchasing (MRO, Tooling & Capital) 76 - 80

I. Non-Production Purchasing - Responsibilities and Definitions

II. Non-Production Purchasing - Procedures

18. Audit Services 81 - 87

I. Audit Services Philosophy, Services and Processes

II. Keys to a Successful Audit

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 3 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

19. Unclaimed Property - Identification, Mitigation and Reporting 88

APPENDICES

A. Glossary of Lear Terminology 89 - 95

The information included in this section explains/defines Lear

acronyms/abbreviations.

B. Information Systems Support & Key Websites 96

This section includes links to key websites and contacts to provide

technical support and assist with any IT related issues.

C. Additional Helpful Information 97 - 98

This section includes links to templates for key accounting areas that

provide consistent application and presentation (best practice examples).

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 4 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

1. Introduction to Lear Corporation

Information included in this section presents the Lear Global Finance Team philosophy and provides an

overview of Lear Corporation (the “Company”), the Company's products and the Company’s financial

processes. Corporate Compliance Program and the Code of Business Conduct & Ethics are also included

in this section.

Questions related to this section should be directed to Carla Burney-Jones – Director, Financial Reporting

and Chief Compliance Officer and Bill O’Loughlin – FP&A Finance Director.

I. Lear Global Finance Team Philosophy

We are a cohesive, customer focused team with the highest level of integrity. We believe that

data-driven analysis results in fact-based decision making. We work in partnership with the

operations and corporate personnel to ensure that the Company achieves its financial and

operating commitments. We drive continuous process and systems improvements globally, while

maintaining strong controls.

We fully understand and embrace our fiduciary obligation to act in the best interest of all our

stakeholders. In carrying out all of our responsibilities, we strive to maintain the highest level of

credibility and transparency, while seeking to strike the optimal balance between minimizing risk

and maximizing economic value.

A. Financial Priorities

In evaluating our financial condition and operating performance, we focus primarily on earnings,

operating margins, cash flows and return on invested capital.

Our success in generating cash flow will depend, in part, on our ability to manage working capital

effectively. Working capital can be significantly impacted by the timing of cash flows from sales

and purchases. In addition, our cash flow is impacted by our ability to manage our inventory and

capital spending effectively.

We utilize return on invested capital as a measure of the efficiency with which our assets generate

earnings. Improvements in our return on invested capital will depend on our ability to maintain an

appropriate asset base for our business and to increase productivity and operating efficiency.

Our role in finance includes:

• Ensuring that the Company meets its commitments

• Serving as both financial and business leaders, partnering with operations

• Continuously improving our financial controls and infrastructure

• Developing and retaining a world-class finance team

• Always working to increase transparency and maintaining open dialogue, both

internally and externally, with respect to the Company’s performance

We are keenly focused on:

• Improving our Return on Invested Capital

• Growing our business profitably

• Generating cash

• Reducing debt

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 5 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

II. High Level Overview of Lear Corporation

A. General

The Company was founded in Detroit in 1917 as American Metal Products, a manufacturer of

seating assemblies and other components for the automotive and aircraft industries. Today, Lear

is a leading global supplier of complete automotive seating systems and components, as well as

electrical distribution systems and electronic components, including high-power and hybrid

electrical systems and components.

The Company serves all of the world’s major automakers, and Lear content can be found on more

than 400 vehicle nameplates. In 2016, Lear’s total sales were a record $18.6 billion, with 77% in

the Seating segment and 23% in the E-Systems segment. Lear ranked #154 in the latest Fortune

magazine survey. Lear's world-class products are designed, engineered and manufactured by a

diverse team of 150,000 employees at 243 locations in 37 countries.

Lear’s Vision is to consistently be recognized as:

• A Supplier of choice

• An Employer of choice

• The Investment of choice; and

• A Company that supports the communities where we do business

The Company’s Strategy is to invest in profitably growing the business, improve long-term

competitiveness and consistently return cash to shareholders, while maintaining a strong and

flexible financial position.

The Company’s Core Values are quality, innovation, efficiency, customer focus, diversity,

teamwork, integrity and community service.

Our success is driven by our dedication to providing the best possible products and services to

our customers, a philosophy of continuous improvement and outstanding teamwork.

We use our product, design and technological expertise, global reach and competitive

manufacturing footprint to achieve the following financial goals and objectives with the aim to

maximize shareholder value:

• Continue to deliver profitable growth, balancing risks and returns;

• Maintain a strong balance sheet with investment grade credit metrics; and

• Consistently return excess cash to our shareholders.

Seating Segment

Lear is a recognized global leader in complete automotive seat systems and key individual seat

components. The seating segment consists of the design, development, engineering, just-in-time

assembly and delivery of complete seat systems, as well as the design, development, engineering

and manufacture of all major seat components, including seat covers and surface materials such

as leather and fabric, seat structures and mechanisms, seat foam and headrests, as well as

seating-related electrical and electronic components (including software products).

Lear has the most complete set of component offerings of any automotive seating supplier and is

a market leader in every automotive producing market in the world. Further, we have expertise

and are building capabilities in seat comfort technologies, including heating and cooling. Overall,

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 6 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

our global manufacturing and engineering expertise, low-cost footprint, complete component

capabilities, quality leadership and strong customer relationships provide us with a solid platform

for future growth in this segment.

We estimate the global seat systems market at more than $64 billion in 2016. Based on

independent market studies and management estimates, we believe that we hold the #2 position

in seat systems assembly globally on the basis of revenue with strong positions in all major

markets. We believe that we are also among the leading suppliers of various components

produced for complete seat systems.

Our major competitors in this segment are Adient, plc, Faurecia S.A., Magna International Inc.,

Toyota Boshoku Corporation and TS Tech Co., Ltd., which have varying market presence

depending on the region, country or automotive manufacturer.

Key 2016 Seating Statistics:

• 88,700 Employees

• 160 Facilities

• 2017 to 2019 Sales Backlog = $2.1 Billion

• 1.0 Billion Parts Shipped

• 17 Million vehicle Seat Sets Delivered

• World’s Largest Supplier of Automotive Leather

E-Systems Segment

Lear is a leader in power management and signal distribution within the vehicle for traditional

vehicle architectures, as well as high power and hybrid electric systems. The E-Systems segment

consists of the design, development, engineering, manufacture, assembly and supply of electrical

distribution systems, electronic modules and related components and software for light vehicles

globally.

We also have connectivity hardware and software capabilities, including cybersecurity expertise,

that facilitate secure, wireless communication between the vehicle’s electrical and electronic

architecture and external networks, as well as other vehicles.

We estimate the global target market for our E-Systems business to be over $70 billion. Our major

competitors in electrical distribution systems include Delphi Automotive PLC, Leoni AG,

Sumitomo Corporation, TE Connectivity and Yazaki Corporation. Our major competitors in

electronic modules, including connectivity solutions, include Continental AG, Delphi Automotive

PLC, Denso Corporation and Harman International Industries, Incorporated (acquired by

Samsung Electronics Co. Ltd.).

Key 2016 E-Systems Statistics:

• 58,700 Employees

• 56 Facilities

• 2017 to 2019 Sales Backlog = $750 Million

• 9.2 Billion Parts shipped

• Produced 129 Million Wire Harnesses

• Processed 43 Million Printed Circuit Boards

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 7 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

B. SEC Filings, Annual Reports and Earnings Releases

By clicking on the following link, you can get the latest investor information to learn about the

Company, the Company’s products, and other reported information: Investors

Reviewing the latest 10-K (annual filing with the U.S. Securities & Exchange Commission (“SEC”))

may be the most beneficial way to obtain a comprehensive overview of the Company. Not only

does the 10-K include the latest audited consolidated financial statements and related disclosures

of Lear Corporation it also provides information relating to:

• Principle objectives of the Company and how we plan to meet our objectives

• Explanation of product operating segments

• Products and product technology

• Customers

• Joint ventures and minority interest

• Competitors

• Employees

• Significant Risk Factors

C. Corporate Compliance Program

Lear Corporation is committed to:

• Conducting business in accordance with applicable laws, rules and regulations and in

an ethical manner

• Obeying the letter and spirit of the law. This is the foundation on which our ethical

standards are built

All Employees must respect and obey the laws of the cities, states and countries in which we

operate.

Lear’s Corporate Compliance Program is designed to promote an ethical and compliant culture,

which in turn, minimizes the risk of criminal and financial liability to the Company.

Lear’s Compliance Program consists of various policies, including the Code of Business Conduct

and Ethics, conflicts of interest, anti-corruption, gifts and entertainment, among others. Lear has

a Compliance Committee consisting of senior management who meet regularly to provide

oversight to and assess the effectiveness of the program. In addition, compliance program

activities are reviewed with the Company’s Board of Directors.

Why is an effective Compliance Program important?

• Reduces risk of or potentially avoid criminal or civil actions brought against the

Company or its officers or directors by governmental agencies as a result of

misconduct

• Helps prevent unethical or illegal behavior, thereby reducing unnecessary costs

• Assists in identifying issues early, allowing the Company to efficiently address and

remediate any concerns (e.g., self-reporting); and

• Protects the Company’s reputation and business relationships with customers and

suppliers

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 8 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

• Other potential benefits include:

o Improved investor confidence and analyst ratings, as well as potential

market/sales expansion opportunities resulting from a stellar business

reputation

o Reduction in unfavorable audit and internal control findings

o Improved efficiencies/lack of waste

o Improved quality/product ratings

o Stakeholder/Shareholder Perspective

D. Code of Business Conduct and Ethics (the “Code”)

The Code is the foundation of the Compliance Program and serves as a key element of the

Company’s governance, risk management and compliance efforts. In general, the Code:

• Prohibits illegal, unethical or inappropriate behavior

• Communicates basic principles designed to help employees make more informed

ethical decisions; (i.e., not intended to be an exhaustive list of rules)

• Encourages and provides various means of reporting any observed or suspected

illegal, unethical or inappropriate behavior

For more information on the Code, please select the following link:

Lear's Code of Business Conduct and Ethics

Selected Topics under the Code:

Conflicts of Interest

• A conflict of interest is described as an activity that conflict with or have the appearance

of conflicting with the best interests of Lear and its stockholders

• A conflict situation can arise when an employee takes actions or has interests that

may make it difficult for the individual to perform work for the Company objectively and

effectively

• Examples of potential conflicts of interest include:

o An employee owns a business, and regularly answers their Lear phone number

with the name of their business

o An employee is involved in a vendor selection process and either a close friend

or a family member owns one of the competing vendors

o An employee involved in a vendor selection process receives a case of wine

from one of the competing vendors

o An employee provides consulting services to small businesses after hours

o An employee also works as an employee of a competitor, customer or supplier

• Unresolved conflicts of interest can also put you and Lear at risk for reputational

damage and/or financial losses

• Because of the risks involved, the consequences for failing to disclose a potential

conflict can result in disciplinary action, up to and including termination

• If you are involved in or become aware of a potential conflict of interest, please disclose

the situation to Human Resources, Corporate Compliance and/or the Legal

Department

• Prompt and full disclosure is always the appropriate first step towards identifying and

resolving any potential conflict.

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 9 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

Anti-Bribery (Foreign Corrupt Practices Act)

• Lear strictly prohibits the making of illegal payments to government officials

• Illegal payments include giving anything of value, directly or indirectly, to any

government officials in any country

• As U.S. law and laws in many countries prohibit these illegal payments, please

remember that the promise, offer or delivery of anything of value to any government

official would not only violate Lear policy, but may also be a criminal offense

Gifts and Entertainment

• The Gifts and Entertainment policy provides all Lear employees with guidelines and

procedures on the giving, accepting and reporting of Gifts and Entertainment

• The key provisions of this policy are:

o cash gifts are prohibited

o gifts cannot exceed $50 per person*, per occasion (please note that this limit

varies by country/region, so please check with regional compliance/legal for

further information)

o the value of giving or receiving Entertainment has been approved in advance

by your functional leadership

o under no circumstances should any gift or entertainment given or received

violate the Code and / or applicable laws and regulations

o Gift or entertainment given to government officials need to be reviewed and

approved by legal department

o Any gift or entertainment received is required to be logged into the online

Entertainment log

• As this policy cannot specifically address all possible situations, always consider the

context, nature and intent of the Gift or Entertainment

o Is it reasonable, appropriate and justified?

• For more information on Gifts and Entertainment, please select the following link:

Gifts and Entertainment Policy

Reporting Concerns

• This Policy is intended to encourage and enable Lear employees to raise concerns

without fear of retaliation

• This Policy describes and advises employees how to report a violation or concern

• It is Lear’s policy to fully investigate every Complaint of illegal/unethical behavior or

behavior that constitutes a violation of the Code

• Examples of Complaints that should be reported include:

o accounting, internal accounting controls or auditing matters

o compliance with applicable laws and regulations

o confidential information or data privacy concerns

o discrimination and/or sexual harassment concerns

o conflict of interest concerns involving any Lear employee

o fraud, theft or misuse of company assets including intellectual property

concerns

• Employees are encouraged to report what they perceive to be a violation of the Code

by using the Compliance and Ethics Line (“C&E”)

o The C&E line is a toll-free, 24-hour-a-day resource which enables employees

to report concerns anonymously, where prohibited, in their local language via

phone or the web

o The C&E line is staffed and managed by an outside provider

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 10 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

• Lear’s Complaint Reporting Policy describes and advises how to report a violation or

concern by either:

o Calling the Lear Ethics Hotline

o Using the online web-form

o Calling the Chief Compliance Officer or General Counsel

o Mailing or emailing a concern to the Chief Compliance Officer; or

o Notifying the Legal Department

• For more information on reporting concerns, please select the following link:

Complaint Reporting

Anti-Retaliation Policy

• No one who reports a Complaint in good faith shall suffer retaliation, or adverse

employment consequence as a result of submitting a Complaint

• A Lear employee who retaliates against someone who has reported a Complaint or

made a statement in an investigation process, in good faith is subject to discipline up

to and including termination of employment

• Examples of adverse employment consequences that will not be tolerated include:

o Exclusion from work-related decisions and activities

o Verbal abuse by a supervisor or other member of management

o Termination, demotion or threats to terminate or demote

o Denial of promotion, raise, assignment or transfer

o Suspension or reassignment of job responsibilities

o Threats of or actual physical harm to persons or property

o Any other material adverse impact

• For more information, please select the following link: Anti-Retaliation Policy

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 11 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

2. Lear Accounting Practices (LEAP) Manual

I. LEAP Manual

Amy Doyle, Chief Accounting Officer, is responsible for the accounting practices and policies documented

within LEAP and questions related to this section should be directed to her regional team members:

• Asia – Eva Zhu

• Europe – Bob Hooper

• Mexico – Carolina Flores

• South America – Marco da Silva

• U.S. & Canada – Amy Doyle

A. Overview

The LEAP manual contains Lear’s documented policies and procedures with respect to the

following areas.

• Financial Reporting

• Accounting

o Assets

o Liabilities and Stockholders’ Equity

o Income Statement

• Internal Control

• Corporate Governance

• Financial Planning

• Capital Expenditures

• Insurance

• Tax

• Treasury

• Travel

To view the LEAP manual, select the following link: Lear Accounting Practices Manual (LEAP)

B. Controller’s Responsibility

It is the responsibility of each plant controller to be familiar with each section of the LEAP manual

and ensure compliance with the requirements of the LEAP manual.

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 12 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

3. Internal Control Over Financial Reporting

Amy Doyle, Chief Accounting Officer, is responsible for internal control over financial reporting and

questions related to this section should be directed to her regional team members:

• Asia – Chong Kiat Yeo

• Europe – Daniel Spiegel

• Mexico – Mauricio Lorenzo Gamboa Trejo

• South America – Fabio Almeida

• U.S. & Canada – Tim Jordan – Seating, Aarika Gerstler – E-Systems

I. Sarbanes-Oxley Act (SOX)

A. Overview

SOX was enacted in 2002 and introduced new and expanded requirements for all U.S. public

company boards, management and external auditors.

Section 404 of SOX requires management and the external auditor to report on the adequacy of

the company’s internal control over financial reporting. Management is required to include in its

annual report on Form 10-K an internal control report which affirms the responsibility of

management to establish and maintain an adequate internal control structure and procedures for

financial reporting. In addition, the report includes an assessment as of December 31, of the

effectiveness of the internal control structure and procedures for financial reporting. The external

auditor is required to attest to, and report on, management’s assessment of its internal controls.

In response to SOX, Lear strengthened and enhanced its internal control framework based on

five criteria:

• The overall Control Environment, which sets the tone and is the foundation for all other

components

• Risk Assessments, which identify, analyze and manage risks early

• Control Activities, which help to ensure that management’s directives are executed

• Information and Communication, which affect management’s ability to make

appropriate decisions; and

• Monitoring, which assesses the quality of internal control performance over time

B. Financial Reporting Cycles

To facilitate SOX compliance, management has identified the following six cycles (and related

processes) that are key to accurate financial reporting, adopted a SOX monitoring process and

developed SOX tools:

• Revenue

o Sales and accounts receivable process

o Accounts receivable reserve process

o Cash receipts process

o Customer purchase and change order process

• Production

o Capital expenditures and disposition process

o Accounting for recoverable customer engineering and tooling process

o Inventory costing and management process

o Excess and obsolete inventory reserve (including customer claims) process

o Physical inventory process

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 13 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

• Expenditure

o Accounts payable (including purchasing, receiving and vendor discrepancies)

process

o Cash disbursements process

o Payroll process

• Accounting & Reporting

o Financial statement close process

o Asset impairment assessment process

o Income tax calculation process

o Property, plant and equipment depreciation process

o Commitments and contingencies estimation process

o Intercompany matching process

o Treasury

o Debt issuance, recording and monitoring process

• Information technology (IT)

o Change control and procedures

o System security

o System configuration change

o Problem management

o Data management

o Facilities

o Operations

C. Monitoring Approach

The SOX monitoring process uses a three-pronged approach to ensure the integrity of Lear’s

internal controls over financial reporting and IT general controls:

• Self-assessment and certification by all Lear plants, divisions and corporate functions

on a quarterly basis

• Internal process auditing and/or monitoring by internal audit

• External auditing by EY

D. Location Responsibilities

The SOX monitoring process from a location perspective is outlined below, as are the SOX tools,

which have been developed to assist with each location’s SOX compliance:

• Standard Control Matrix – A standard control matrix has been developed for

each process outlined above. Each standard control matrix lists the significant

risks to accurate financial reporting in the related process, as well as the key

controls, which mitigate each risk. Each key control has a control matrix

reference number, as well as an ICQ reference number (see below). The

standard control matrices can be accessed on the Lear homepage under

Departments – Sarbanes-Oxley (SOX)

• Process Narratives – A generic process narrative has been developed for each

process outlined above to assist the locations in documenting the internal control

environment related to each process. The generic narratives should be modified by

each location to reflect the actual processes at that location

o The modified narratives at each location should include all key controls (cross

referenced to the standard control matrix via the control matrix reference

number) within each process. The modified narratives should be reviewed and

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 14 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

updated for changes in risks, processes and/or systems as necessary in

conjunction with the completion of the ICQ (see below). The generic process

narratives can be accessed on the Lear homepage under Departments –

Sarbanes-Oxley (SOX)

o Internal audit (as well as the external auditors) will use the process narratives

to determine the design effectiveness of the internal control environment.

During a SOX audit, the auditor will “walk through” each significant process

from beginning to end to ensure that the process is adequately documented

• Internal Control Questionnaire (ICQ) – The ICQ lists the internal controls that should

be standard at each location. Each control has an ICQ reference number. Key controls

are cross referenced to the standard control matrix via the control matrix reference

number

o The ICQ is organized by the cycles outlined above. The ICQ for each cycle is

completed annually (with the exception of IT which is completed semi-annually)

based on the following schedule:

▪ Revenue – Q1

▪ Production – Q2

▪ Expenditure – Q3

▪ Accounting and Reporting – Q4

o To complete the ICQ, a self-assessment (including sample testing) is

performed. The self-assessment should involve the process owners (e.g.,

finance, IT, operations, purchasing). The sample testing should be

documented, and the documentation should be retained

o Each control listed in the ICQ is answered either “Yes,” “C/C” (compensating

control), “No” or “N/A” (not applicable) based on the results of the self-

assessment

▪ “Yes” indicates that the control is in place and operating effectively

based on the results of the self-assessment

▪ “C/C” indicates that although the control is not in place, a compensating

control is in place and operating effectively based on the results of the

self-assessment

- “C/C” responses require that the compensating control be

documented and approved by the regional SOX champion and

the global SOX champion

▪ “No” indicates that the control is not in place or the control is not

operating effectively based on the results of the self-assessment

- “No” responses require that a deficiency be documented,

including a description of the deficiency and remediation plan,

as well as the timing of remediation (among other things)

▪ All open deficiencies should be reviewed quarterly to ensure that

remediation is in accordance with the plan. Once remediated, controls

should be retested and deficiencies closed (assuming that retesting

supports that controls are in place and operating effectively)

▪ “N/A” indicates that the control is not applicable to the location. “N/A”

responses require an explanation as to why the control is not applicable

o The ICQ, including the documentation of compensating controls and

deficiencies and the explanation of controls that are not applicable, are

completed using the global SOX application, which can be accessed on the

Lear homepage under Departments – Sarbanes-Oxley (SOX) or at

sox.lear.com

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 15 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

• Certifications – On a quarterly basis, the finance, IT and operations leaders

for each location complete the following certification:

o “We are responsible for the design and operating effectiveness of internal

control over financial reporting at the location. The required sections of the ICQ

have been completed (including sample testing), all process narratives have

been reviewed and updated and any deficiencies and associated remediation

plans have been reported in the global SOX application.

We are not aware of any other deficiencies in the design or operation of internal

controls that could materially affect any location’s ability to record, process,

summarize and report financial information, other than those communicated by

us, internal audit or EY.

We represent that the financial statements had no significant misstatements

for the period when any controls were not functioning as expected. In addition,

there have been no changes in any location’s internal control over financial

reporting (including information technology general controls) that would cause

the originally effective design or operation of controls to now be ineffective.

In connection with our internal controls, we represent the following:

▪ The following cycles were reviewed using the Internal Control

Questionnaire (ICQ) during the assessment period

- “List” of cycles reviewed during the current quarter

▪ All sampling testing requirements have been met. Documentation of the

testing results is retained within the ICQ section of the SOX application.

▪ Compensating controls have been properly approved

▪ Currently reported deficiencies (identified in any period) have been

reviewed to ensure that remediation plans are current.”

o The quarterly SOX certifications are completed using the global SOX

application, which can be accessed on the Lear homepage under Departments

– Sarbanes-Oxley (SOX) or at sox.lear.com

E. Corporate Functions Responsibilities

Each function (accounting, finance, financial reporting, human resources, shared services, tax

and treasury) must update their respective process narrative for changes in risk, processes and/or

systems.

Identified exceptions and deficiencies, including a description of the issue and remediation plan,

as well as the timing of remediation (among other things), should be documented in the global

SOX application.

All open exceptions and deficiencies should be reviewed quarterly to ensure that remediation is

in accordance with the plan. Once remediated, controls should be retested and issues closed

(assuming that retesting supports that controls are in place and operating effectively).

Finally, each function should complete a quarterly SOX certification.

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 16 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

F. Management Responsibilities

The regional SOX champion prepares a quarterly risk assessment which summarizes the all of

the SOX deficiencies for the region by division and facilitates quarterly SOX certification by the

division finance, IT and operations leaders. In addition, the regional SOX champion provides

cycle-specific training to the locations on a quarterly basis.

The global SOX champion compiles, analyzes and reports to management and the audit

committee on the open deficiencies, as well as the overall internal control environment, on a

quarterly basis.

The CEO and CFO certify on a quarterly basis that (among other things) they are responsible for

establishing and maintaining internal control over financial reporting.

• These certifications are included as exhibits to the annual reports on Form 10-K and

the quarterly reports on Form 10-Q

• In addition, management issues an annual report on internal control over financial

reporting. This report indicates that management conducted an evaluation of the

effectiveness of internal control over financial reporting and that based on this

evaluation, management concluded that the Company’s internal control over financial

reporting was effective as of year-end

o This report is included in the annual report on Form 10-K

G. Lear Audit Services (LAS)

LAS performs testing on the behalf of management to evaluate the design and operating

effectiveness of internal control over financial reporting through financial/operational and

monitoring audits. If a location is selected for audit and internal audit identifies a control that is

either not in place or not operating effectively, an exception or deficiency will be documented,

including a description of the issue, in the global SOX application.

• The remaining documentation related to the issue should be completed, including a

description of the remediation plan and the timing of remediation (among other things),

by the location

• The exception or deficiency should be reviewed quarterly to ensure that remediation

is in accordance with the plan. Once remediated, the control should be retested and

the issue closed (assuming that retesting supports that the control is in place and

operating effectively)

H. External Auditors

EY must perform an independent evaluation of the design, implementation and effectiveness of

Lear’s internal control structure as of December 31 each year. If a location is selected for audit

and EY identifies a control that is either not in place or not operating effectively, an exception or

deficiency will be documented, including a description of the issue, in the global SOX application.

• The remaining documentation related to the issue should be completed, including a

description of the remediation plan and the timing of remediation (among other things),

by the location

• The exception or deficiency should be reviewed quarterly to ensure that remediation

is in accordance with the plan. Once remediated, the control should be retested and

the issue closed (assuming that retesting supports that the control is in place and

operating effectively)

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 17 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

II. Quarterly Attest

A. Overview

The quarterly attest process is used to document the accuracy and completeness of, as well as

any significant issues related to, a location’s accounting and financial reporting records. Internal

audit and EY review the quarterly attest process, on a test basis, when performing their audits.

B. Controller’s Responsibilities

On a quarterly basis, each location must complete and submit to division “Minimum Requirements

for Quarterly Attest Submissions” (see LEAP manual section 66.1, appendix C). Locations should

obtain any additional submission requirements from their division.

C. Management’s Responsibilities

Based on the locations’ submissions, each division must complete and submit to the corporate

controller’s office “Quarterly Attest Representation Letter” (see LEAP manual section 66.1,

appendix D), “Entities included in Quarterly Attest” (see LEAP manual section 66.1, appendix A)

and “Reportable Items” (see LEAP manual section 66.1, appendix B).

Based on the divisions’ submissions, the corporate controller’s office must prepare a global

summary of the reportable items, which is provided to EY.

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 18 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

III. Balance Sheet Review

Division finance performs a semi-annual balance sheet review at all locations. These reviews

ensure the following:

• Operating reports used in financial reviews are reconciled to HFM

• Variances from forecasted operating results are identified, investigated and evaluated

on a timely basis. The quality of the forecast need not be evaluated. LAS, EY and/or

others will want to confirm that management is monitoring operations. Year-over-year

actual results may be reviewed in addition to actual vs. forecasted results

• Evidence supports that internal controls over financial reporting are operating on a

continual basis and that the internal control structure (and related documentation) is

updated for changes in risk, processes and/or systems

The results of the balance sheet reviews must be summarized and retained for future review by

internal and external audit, as well as management. The summary must provide highlights of the

review, including action items and follow up plans. Additional review and documentation

requirements are established by each division.

Any exception or deficiency identified during the balance sheet review should be documented,

including a description of the issue, in the global SOX application. The remaining documentation

related to the issue should be completed, including a description of the remediation plan and the

timing of remediation (among other things), by the location. The issue should be reviewed

quarterly to ensure that remediation is in accordance with the plan. Once remediated, the control

should be retested and the issue closed (assuming that retesting supports that the control is in

place and operating effectively).

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 19 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

IV. Reserve Reviews

• White Papers (see section 15, “White Papers”)

• Reserve Rollforwards

o On a quarterly basis, each location must complete a rollforward of its reserve

accounts (i.e., A/R, inventory, customer, supplier, environmental, legal and

warranty). Each division reviews, analyzes and summarizes the rollforwards

of its locations

o The corporate controller’s office reviews, analyzes and summarizes the

rollforwards of the divisions. The global rollforward is reviewed with EY

o The reserve balances are reviewed with the audit committee semi-annually

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 20 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

V. Code of Conduct Confirmations

The compliance department surveys key employees as to their understanding of and compliance

with Lear’s Code of Conduct on an annual basis. Self-reported conflicts are documented,

investigated and resolved. The results of the survey are reviewed with the audit committee.

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 21 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

VI. Disclosure Committee Reviews

The disclosure committee meets on a quarterly basis (at a minimum) to discuss risks and the

related financial statement impacts, including disclosure of such risks in the financial statements.

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 22 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

4. Hyperion

Questions related to this section should be directed to key regional support champions, which are identified

on the Hyperion Team Site.

Hyperion is a Global Financial Systems application with the purpose of providing a common

source for the…

• Plants/Entities to enter and post both actual and projected financial information

• Divisions to review information about their plants/entities

• Corporate Financial Planning & Analysis (FP&A) team to globally consolidate, analyze,

and prepare financials for both internal and external use

I. Hyperion Financial Products Used by Lear

• FDM LIGHT: Financial Data Management (available through Prod–FDM)

• HFM LIGHT: Hyperion Financial Management Application (available through Prod–

Workspace or Prod–Excel)

• PPR: Hyperion Planning Application (available through Prod–Workspace or Prod–

Excel)

FDM LIGHT Application

• Used to load an entity’s activity during month-end close process from local general

ledgers to the HFM LIGHT application. General ledger account mappings and custom

dimension mappings are stored and maintained here

HFM LIGHT Application

• Repository of all Lear consolidated financial data for Actual, Forecast and Budget. All

currency translations, calculations and consolidation of data is completed in LIGHT

and stored in scenario specific categories (e.g., Actual, WrkFcst, Budget)

PPR Application

• Repository of all Lear program profitability data by individual Hyperion location. Data

is segregated by Commercial Sales, IC Sales, Material, Labor and OH/SGA. The data

is used as a key management reporting tool

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 23 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

II. Hyperion Chart of Accounts / Training Documentation / Support Materials

• Other pertinent information relating to Hyperion is located on the FP&A

Financial Systems Support Page: FP&A Financial Systems Support Page

• Information and resources include:

o Chart of Accounts

o Quarterly Financial Reporting Calendars

o Training Documentation and Application Manuals

o Application maintenance activity notes

o Support requests submission / Open Issue Log

o HFM base-entity listing

• All Hyperion support requests can be made through this site or by emailing Lear

Hyperion Support

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 24 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

5. Month-end Plant Close Process

This section details the plant closing schedule and related reporting requirements. Questions regarding this

information should be directed to your regional Finance Managers and Directors.

It is the controller’s responsibility to ensure that the ledgers are properly closed and reconciled at

the end of every month and that all reporting requirements are completed on time. Lear operates

on a fiscal calendar, so all month-end dates will be on a Saturday (except for December 31). The

specific timetable and requirements are provided by each of the respective operating divisions to

comply with the overall corporate reporting requirements. The specific reporting format will also

be provided by each of the operating divisions. For a general overview, listed below are some of

the key reporting responsibilities.

I. General Reporting Responsibilities

• Actual Results – Includes variance explanations, generally due the 4th business day

after close

• Monthly Forecast – Includes current month through December forecast with variance

explanations. Generally, due to your division one week prior to the close of the month

• Platform Profitability (PPR) – Full P&L reporting by major product line. Due monthly

for Actuals only

• Quarterly Attest – Controller sign-off and reconciliation of major accounts. Submitted

at the end of every quarter

• Project Status Report – Forecast of capital spending by quarter. Submitted on a

quarterly basis

• Online Improvement Plan – Includes current month through December forecast

• Other Divisional Reports – Headcount (Actuals uploaded by HR. Forecast uploaded

by Accounting Department), Purchase Savings, Six Sigma, Other Manufacturing

Metrics

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 25 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

II. Month-end Close Procedures

It is the Controller’s responsibility to oversee the monthly close process. There should be a

systematic process that captures all issues and results in properly stated financial statements.

The process should be well documented and include a checklist of items (including standard

journal entries) and tasks to be complete and the list responsible parties along with the expected

completion dates.

One of the key controls in the month-end process is to complete account reconciliations on all

significant accounts. This process should also be well documented and performed in a timely

fashion.

Below is a sample of some of the key areas of a typical close. As each facility or operating division

may have different requirements it is best to check with division management for more clarification

or a complete list.

General Close Procedures by Function:

• Material & Inventory Control

o Excess & Obsolete (“E&O”) stock review and provision and write-off

▪ See link for guidance preparing the E&O Inventory Analysis

Section 13.1 Product Costing and Inventory Valuation

o Review of Goods received and transfers to Production

o Review Scrap Reports for proper disposal

o Reconcile Inventory to Balance Sheet accounts – Raw Material, Work in

Process (“WIP”) & Finished Goods

o Review On Hand Adjustments

• Payroll

o Reconcile the Accrued Payroll Accounts to Payroll registers

• Treasury/Bank Accounts

o Ensure Bank Accounts are reconciled

o Petty Cash (If applicable) – reconciled & reviewed to ensure proper use

• Accounts Payable (“AP”)

o ERS exceptions

o Supplier Invoice Matching

o Accruals for goods received not invoiced and reconcile monthly against

receiving reports

o Reconcile the AP Control account to subledger

o Reconcile the vendors accounts (i.e., inventory items) monthly to supplier

statements

• Accounts Receivable (“AR”)

o Invoicing matching to delivery documents

o Reconcile Sales Accruals to Customer Self Billings

o Review discrepancy reports and reconcile monthly

o Ensure receipts are allocated on time to customer accounts

o Review Aged debtors reports monthly

o Provide for Bad Debts (potential uncollectible)

o Obtain proper approval for write-off of AR

o Reconcile the AR Control account to subledger

• Intercompany (“IC”)

o Ensure proper support documentation for IC charges

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 26 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

o

Formalize IC Service Agreement for fixed allocated charges (via

Headquarters/Legal)

o Reconcile IC Accounts monthly

• Accrued Liabilities (Customer and Supplier)

o All reserve should be based on known issue with Customer and/or Supplier

o Commercial and Purchase team should assist/provide the support to establish

the reserve

o Amounts recorded should be probable and reasonably estimable

o Supported by appropriate commercial documentation, historical trend analysis

or other detailed analysis

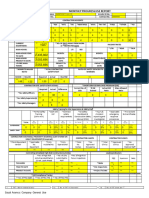

Attached below are two examples of the monthly closing activities checklist. If a checklist is not

already created for your location, it is important to create one similar to the one below (best

practice) to identify all activities that need to be completed, who is responsible for their completion

and when the activities are required to be performed/completed.

Month-End Close Checklist - Example 1 Month-End Close Checklist - Example 2

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 27 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

6. Financial Statement Analysis and Forecasting

The information included in this section explains how operational/financial analysis should be performed,

defines certain analytical terms, shows techniques for capturing actual mix built by plant and promotes

variance analysis techniques (e.g., calculating volume, economic variances, exchange, pricing). Questions

regarding this information should be directed to your regional Finance Managers and Directors.

Financial Statement Analysis and Forecasting

This section outlines the general terms, procedures, and documents relating to financial statement

analysis and forecasting. Further guidance and detail can be found in the LEAP Manual

(Link: Section: 75.1 Current Year Forecasting). Specific requirements, forms, and due dates are

provided by each of the respective divisions.

The general expectations of the plant controller are to prepare an annual one-year budget (by

month), prepare periodic forecasts for the current year and report actual results on a monthly

basis. The reporting and forecasting responsibilities include a full Profit & Loss Statement

(Income Statement), Balance Sheet, and Cash Flow Statement. It is the controller’s responsibility

to ensure that all known variables (assumptions) are taken into account and that the forecast

accurately reflects the expected business performance.

The controller must also provide detailed variance explanations of actual results from prior year,

prior forecast and plan. Each respective division will generally provide reporting formats and

specific requirements.

Each of these topics will be discussed separately below.

I. Forecasting

Terminology

• Calendar – Lear reports on a fiscal calendar with each quarter consisting of two 4 week

months, and ending with a 5-week month (4,4,5). All forecasting must take into

account the Lear Fiscal months. A Lear Fiscal calendar can be obtained from the

Corporate Business Planning group or Division office. It is also important to note that

customer planning volumes are reported on a calendar month and must be adjusted

to reflect the Lear Fiscal month.

• Forecast Periods - Lear’s forecast periods reflect the current year time frame. Lear’s

forecast consists of the actuals to date and the remaining forecast months for the

current year. Lear’s 1+11 Forecast is January’s actuals and February to December’s

forecast. The next forecast period is referred to as the 2+10 (2 months actual, 10

months forecast).

A. Profit and Loss Items

• Sales and Mix

Sales Volumes for the near term forecast should be based directly from customer

releases (typically 12 weeks of information). Longer term forecasts and plan should

be based on Corporate provided platform volume assumptions (available on the Lear

Intranet under Corporate Finance) or Divisional directed assumptions. Any significant

known differences should be reported to the respective Division.

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 28 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

Forecasted selling prices should be based upon customer Purchase Orders (“PO”). If

a PO is not received for the current engineering level, the forecasted price may be an

estimate. Estimates for these forecasted prices should be based on direction from the

appropriate Division(s). Price changes to incorporate Long Term Contracts should

also be based on direction from the appropriate Division(s).

• Product Costs

Forecasted manufacturing costs must be supported by the Bills of Material and

Routers used in developing Standard Costs. Locations with multiple end items may

wish to standardize by program, type of component, manufacturing process, and/or

trim level.

• Projected Cost Reductions and Engineering Changes

Known cost reductions and engineering changes are to be incorporated. Regular

reviews with the materials, engineering, and quality groups should occur to ensure all

known changes are incorporated. Detail should be kept by project in a manner that

can quantify the financial impact of changes from standard cost and potential volume

revisions.

Six Sigma, VAVE and Purchasing Savings should be included in forecasts. Any

variances from prior forecasts need to be explained in the variance analysis.

• Operating Performance and Overhead Costs

Operating performance indicators such as scrap rates and labor efficiencies should be

developed with the location’s operating departments and quantified for the forecast.

Departmental overhead expenses should be developed in conjunction with

departmental managers for their items on the MFE (manufacturing factory expenses)

report.

Overtime premium, indirect labor, and benefit costs should be revised based on

changes in the production schedule.

Depreciation Expenses should reflect the planned timing for placing the assets in

service based on the expected in service date.

All Other Overhead Costs and Operating Expenses, including unusual items such as

tooling gains and losses, should be noted as appropriate.

B. Balance Sheet Items

• Capital Expenditures

Forecasted Capital Expenditures should reflect the timing of asset purchases and their

placed in service dates. The amounts must tie to the amount shown on the Project

Status Report (PSR) submitted to the divisions.

• Fixed Assets and Accumulated Depreciation

Fixed Assets balances should show the current amounts and revisions for the

forecasted Capital Expenditures as noted above. Forecasted Depreciation Expenses

should be consistent with projected dates for placing new assets into service. The

Accumulated Depreciation balances should be verified for consistency with forecasted

Depreciation Expenses and tie to the fixed asset ledger or reporting system.

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 29 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

• Working Capital

Accounts Receivable projections are to incorporate expected customer payments and

billings given the expected revenue stream. Month-end cutoff dates need to be

reviewed relative to known payment dates.

Inventory estimates should be made in conjunction with the Materials Department and

reflect known business conditions.

Accounts Payable and Cash Overdrafts balances should consider past payment

practices, month-end cutoff dates, expected revenue changes, and any unusual

payments, such as Capital Expenditures and Tooling. Accounts Payable forecast

should be based on normal payment terms. CPS (Centralized Payment System)

vendors must be forecasted to terms. No holds of CPS vendors should be

forecasted.

Other Accrued Assets and Liabilities should reflect timing for payroll-related items,

utilities, taxes, long-term contracts, and other miscellaneous accruals.

C. Intercompany Balances

Intercompany balances should reflect the latest actual month reported (agreed to)

balances. Any changes need to be communicated to the reciprocating plant and

agreement reached on the balance to be used.

D. Other Assumptions

• Exchange Rates

As with actual results, the Current Year Forecast is to be entered into HFM in the

location’s functional currency.

The current exchange rates used for month-end closing should also be used for

forecasting purposes and will be pre-loaded into HFM. The last month’s actual rates

will be loaded throughout the forecast period. If a location has had significant exchange

rate changes from the budget, it may wish to prepare forecasts at both budgeted and

forecasted conversion rates to aid in answering follow-up questions.

• Income Tax Rate

The income tax rates used in the budget should also be used in the Current Year

Forecast unless otherwise directed by the Tax Department or BP&A.

• Other Assumptions

Assumptions for items such as Unknown Pricing, Long Term Contracts, Currency

Transaction and Translation, Benefit Accruals, must be consistent with accounting

policies in the LEAP. Assumptions for items not specifically covered by a LEAP policy

must be documented and agreed upon with Division. Recoveries for commercial

settlements should be consistently projected.

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 30 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

II. Actual Results Variance Analysis Guidelines

A. General

Variance reporting is a tool used to identify the causal factors related to changes in revenues and

costs between two periods. This technique is important because it translates accounting

information into business issues and events that can be acted upon by operating management.

The periods used for these comparisons are typically actual-to-budget, actual to prior year, actual

to forecast, and current forecast vs. prior forecast. Variances calculated generally fall into the

following categories: 1) volume and mix, 2) currency (f/x), 3) economics, 4) customer long term

agreements (LTA), 5) pricing 6) purchasing savings 7) manufacturing efficiencies (including Six

Sigma and Lean Manufacturing), 8) other.

Outlined below is an overview of generally accepted techniques in calculating the variance walk.

Further detail can be found in the LEAP Manual (section 75.1) or directly from the appropriate

Division.

• Volume / Mix

Volume and Mix variances reflect the revenue and cost impacts directly associated

with changes in shipments. Volume is calculated by multiplying the change in units

shipped from the base period by the base period per unit revenues. The associated

operating income is then calculated by taking the change in revenue multiplied times

the base period’s variable margin percentage.

Depending on the complexity of products (number of finished part numbers), the level

of detail used to calculate the volume / mix may vary. The methodology is the same

at all levels (part or platform). Volume can be defined as the change in units assuming

a standard mix assumption. Mix is then calculated as the change in individual units in

relation to the overall volume change. For example, if overall volume is increased 2%,

but a particular platform has increased 4%, then that platform would have an increase

in volume of 2% and an increase in mix of 2%.

If doing this analysis at a more summary level care must be taken to ensure that the

weighted average selling prices and variable margins are accurate.

Below is an example of a volume / mix calculation for a seat plant producing one

program:

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 31 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

"A" "B" "C" "D" "E" "F" Notice in

Unit Shipments (B - A) (C - B) (D + E)

Forecast Unit Variance Due to: column “E”

Volume at Linear Mix how manual

Model Budget Budget Mix Forecast Volume Change Total

cloth units

Power Cloth 20,000 21,302 22,000 1,302 698 2,000

were

Power Cloth Deluxe 22,000 23,432 23,500 1,432 68 1,500

Manual Cloth 21,000 22,367 26,000 1,367 3,633 5,000 substituted

Manual Cloth Deluxe 35,000 37,278 34,000 2,278 (3,278) (1,000) for manual

Sport Cloth 5,000 5,325 4,500 325 (825) (500)

Leather Power 3,000 3,195 2,900 195 (295) (100)

cloth deluxe

Total 106,000 112,900 112,900 6,900 0 6,900 units. This

"G" "H" "I" "J" resulted in an

(G x D) (G x E) (H + I) unfavorable

Budget Revenue Impact of Change

Per Unit Linear Mix Total mix shift as

Revenue Volume Change Vol & Mix shown in

$(000) $(000) $(000)

columns “I”

Power Cloth $500 $ 651 $ 349 $ 1,000

and “M.”

Power Cloth Deluxe $525 752 36 788

Manual Cloth $400 547 1,453 2,000

Manual Cloth Deluxe $475 1,082 (1,557) (475)

Sport Cloth $625 203 (516) (313)

Leather Power $1,200 234 (354) (120)

Total Revenue $ 3,470 $ (590) $ 2,880

"K" "L" "M" "N"

(K x D) (K x E) (L + M)

Budget Op Income Impact of Change

Per Unit Linear Mix Total

Variable Margin Volume Change Vol & Mix

$(000) $(000) $(000)

Power Cloth $ 50.00 $ 65 $ 35 $ 100

Power Cloth Deluxe $ 57.75 83 4 87

Manual Cloth $ 48.00 66 174 240

Manual Cloth Deluxe $ 61.75 141 (202) (62)

Sport Cloth $ 87.50 28 (72) (44)

Leather Power $ 180.00 35 (53) (18)

Total Profit $ 418 $ (115) $ 303

• Currency

Currency variances identify the financial effects of exchange rate changes between

two periods. This variance is calculated by multiplying the net revenue and cost

exposure in each currency by the percentage change in exchange rates. For example:

"B" (B X A)

Exchange Exposure (in $ U.S.) Exchange

$C $ U.S. Total Variance

Revenue 100,000 100,000 -

Material Cost 60,000 15,000 75,000 3,750

Freight 1,000 200 1,200 63

Direct Labor 5,000 5,000 313

Overhead 7,000 7,000 438

Other 500 500 31

Net Op. Income Exposure (73,500) 84,800 11,300 (4,594)

Budget Exchange Rate $ 0.80

Forecast Exchange Rate $ 0.75

Pecentage Change from Budget 6.25% "A"

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 32 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

• Economics

Material Economics - Cost changes compared with budget attributable to inflation

related cost increases on purchased parts and raw materials. These changes are

normally captured in standard cost systems as Purchase Price Variance (PPV).

Freight Economics - Variances in inbound and premium freight attributable to inflation.

(Note: variances due to increased frequency of freight shipments or air freight should

be classified as either volume or performance depending upon the event that is driving

the need for the change in freight cost.)

Labor Economics - Variances in direct labor, indirect labor, salaried labor, or fringes

associated with changes in wage and fringe rates or other contractual obligations as

the result of pay and benefit changes.

Other Economics - Variances from budget, after adjusting for volume factors, in cost

categories such as fuel and utilities, taxes and insurance.

• Purchasing Savings (Purchasing Performance)

Cost savings achieved by the Purchasing organization compared with the budget

commitment. These savings should be reported on a “volume adjusted” basis -- after

adjustments have been made to exclude the effects of volume and exchange as

discussed above. Generally, more advanced Purchasing Performance measurement

systems will track both annualized and calendarized Purchasing savings. This

allows for more sophisticated identification and tracking of “year-over-year”

Purchasing Savings Performance as shown in the example below:

Effective Savings

Annual Starting New Date of "A" "B" (A - B)

Volume Cost Cost Cost Change Annualized Calendarized Carryover

Part A 1,200 $ 1.00 $ 0.85 8/1/1997 $ 180 $ 75 $ 105

Part B 2,000 $ 1.20 $ 1.10 3/1/1998 $ 200 $ 167 $ 33

Performance Reporting

1997: New Calendarized Savings of $ 75.

1998: Total Savings of $272 = $ 167 of New Calendarized savings plus

$ 105 of carryover from 1997.

Generally, systems within the Company are not robust enough to address a

fundamental “gap” in Purchasing performance reporting. This “gap” is the difference

between the savings reported by the Purchasing organization, and the amounts

identified by the plants. There are various reasons why this “gap” exists, including:

use of existing stock, effective date differences on P.O.’s, unit volume differences

between the plant and purchasing group, and discontinued part numbers.

Accordingly, regular communication (e.g., monthly meetings) must occur between the

plants and Purchasing to resolve these reporting discrepancies.

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 33 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

• Tooling/Engineering - Piece Price Amortization

Each plant should forecast tooling and engineering expenses and the associated piece

price recovery in accordance with the Emerging Issues Task Force (“EITF”)

accounting standards as referenced in LEAP Section 14.1. In addition, each plant

should coordinate with its respective division office to maintain consistency with

current reporting practices.

• Pricing and Long-term Agreements (“LTA”) (productivity paid to the customer)

Pricing variances reflect the financial impacts of changes in selling prices. For

example, they should include the effects of price changes on a new model or re-pricing

actions. The effects of LTA revenue reduction changes should be reported as a

separate variance item because they are usually significant.

• Plant Cost Performance, Freight Performance

Plant Cost Performance Variances result from changes from budget in plant

manufacturing costs such as direct labor, and overhead, after adjusting for volume and

economics. Freight performance results from a change in the “rate of usage” of freight

that is not directly tied to a change in volume.

• Balance Sheet Effects (Non-recurring Items)

Non-recurring items (also known as 1-timers) generally relate to commercial or plant

issues that are not a normal part of regular day-to-day business operations. Typically,

as the issues are identified and the financial effects quantified, the items are carried

on an operation's balance sheet until the issue is resolved. Examples of non-recurring

events include:

o Exchange payment to / from customers or suppliers

o Interim versus final price settlements -- including retroactive lump-sum

amounts

o Inventory adjustments

o Material obsolescence

o Quality-related charges from customers or to suppliers

o Workers compensation accrual changes

o Tooling gains or losses

• Other

This line item would include the profit impact of all other events that do not easily fit

into any of the above categories.

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 34 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

III. Chart of Accounts

A. Key Statistical Accounts

• DSO_INT – Days Sales Outstanding (Internal)

The average of prior month gross accounts receivable and current month end gross

accounts receivable divided by last three months’ commercial sales annualized times

365.

(Current Month A/R + Prior Month A/R) / 2

X 365

Last Three Months (LTM) Commercial Sales X 4

• DSO_EXT – Days Sales Outstanding (External)

The average of prior year gross accounts receivable and current year gross accounts

receivable for current period divided by last twelve months’ commercial sales times

365. (Current Period A/R + Prior Year A/R) / 2 X 365

Last Twelve Months (LTM) Commercial Sales

• DMO_INT – Days Material Outstanding (Internal)

The average of prior month accounts payable and current month accounts payable

divided by last three months cost of goods sold annualized times 365.

(Current Month A/P + Prior Month A/P) / 2 X 365

Last Three Months (LTM) Cost of Goods Sold X 4

• DMO_EXT – Days Material Outstanding (External)

The average of prior year accounts payable and current year accounts payable for

current period divided by last twelve months cost of goods sold times 365.

(Current Period A/P + Prior Year A/P) / 2 X 365

Last Twelve Months (LTM) Cost of Goods Sold

• ATR_INT – Average Turnover Rate (Internal)

Last three months cost of goods sold annualized divided by the average of prior month

inventory and current month inventory.

Last Three Months Cost of Goods Sold X 4

(Current Month Inventory + Prior Month Inventory)/2

• ATR_EXT – Average Turnover Rate (External)

Last twelve months cost of goods sold divided by the average of prior year inventory

and current year inventory.

Last Twelve Months Cost of Goods Sold

(Current Period Inventory + Avg. Prior Year Inventory)/2

Finance Handbook – June 30, 2017

Return to Table of Contents Finance Handbook

Page 35 of 98

Feedback, content proposals and suggestions for improvement, please contact FinanceHandbook@spmail.lear.com

• RONA (Return on Net Assets)

Return that a company, project, plant, or division earns on the investment required to