Professional Documents

Culture Documents

Investment Analysis - Saraiva 636 7

Uploaded by

urban.rise.worksOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Analysis - Saraiva 636 7

Uploaded by

urban.rise.worksCopyright:

Available Formats

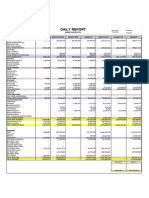

CB Saraiva 636

Equity return

1 2 3 4 5 6 7 YEARS

01/06/2024 01/06/2025 01/06/2026 01/06/2027 01/06/2028 01/06/2029 01/06/2030

TOTAL

Acquisition

TRUE TOTAL Acquisition 202 830 202 830 - - - - - -

Building Price 200 000 200 000 - - - - - -

Acquisition Stamp Duty 1 600 1 600 - - - - - -

IMT - - - - - - - -

Acquisition Fee 1 230 1 230 - - - - - -

Hard Costs

TRUE TOTAL Hard Costs 1 859 642 - 1 194 628 665 014 - - - -

Demolition 9 540 - 9 540 - - - - -

Parking below ground 243 270 - 243 270 - - - - -

Condominium room - - - - - - - -

Padel court - - - - - - - -

Pool 28 620 - 5 724 22 896 - - - -

Terraces 7 611 - 4 566 3 044 - - - -

Balconies 25 727 - 15 436 10 291 - - - -

Pateo 4 940 - 2 964 1 976 - - - -

Backyard 27 560 - 5 512 22 048 - - - -

Demolition Contigency 477 - 477 - - - - -

Construction 1 426 495 - 855 897 570 598 - - - -

Construction Contigency 85 402 - 51 241 34 161 - - - -

Soft Costs

TRUE TOTAL Soft Costs 261 560 113 697 124 770 23 093 - - - -

Notarial deeds & registries 1 500 150 - 1 350 - - - -

Architecture & engineering 32 368 22 658 9 710 - - - - -

Technical Studies 10 789 10 789 - - - - - -

Operative Management & Inspection 53 947 26 974 21 579 5 395 - - - -

Marketing - - - - - - - -

Project Facility costs (%/ construction) 10 789 - 10 789 - - - - -

Insurance (global) 15 000 - 15 000 - - - - -

Closing Costs & Lawyers 18 450 5 535 - 12 915 - - - -

Licenses & Taxes 33 333 30 000 - 3 333 - - - -

TRIU Tax 50 000 - 50 000 - - - - -

IMI TAX 200 - 100 100 - - - -

AIMI TAX - - - - - - - -

Development fee 35 183 17 591 17 591 - - - - -

TRUE TOTAL Costs 2 324 032 316 527 1 319 398 688 107 - - - -

Sales

Gross Sales 3 175 970 - 317 597 1 111 590 1 746 784 - - -

Comission 195 322 - 24 415 122 076 48 831 - - -

Disposal Fee 19 532 - 2 442 12 208 4 883 - - -

TRUE TOTAL Net Sales 2 961 116 - 290 740 977 306 1 693 070 - - -

TRUE Unlevered Cashflow 637 083 (316 527) (1 028 658) 289 199 1 693 070 - - -

Unleveraged IRR 20,3%

Total Profits 637 083

Profit Multiple 1,5x

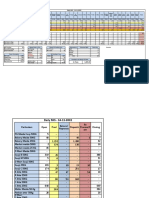

Bank Values

Acquisition Financing 0%

Hard Costs Financing 100,0%

Interests (spread + Euribor) 5,0%

Stamp Duty on interests 4,0%

Stamp Duty on Loan Credit 0,5%

Bank Fees 0,4%

Bank Financing

Loan 1 859 642 - 1 194 628 665 014 - - - -

Loan Repayment (1 859 642) - - (1 859 642) - - - -

% Repayment 100% 0% 0% 100% 0% 0% 0% 0%

Accumulated Loan Value - 1 194 628 - - - - -

Interests 59 731 - 59 731 - - - - -

Stamp Duty on interests 2 389 - 2 389 - - - - -

Stamp Duty on Loan Credit 9 298 9 298 - - - - - -

Bank Fees 7 439 7 439 - - - - - -

Levered Cashflow 558 226 (333 264) 103 849 (905 429) 1 693 070 - - -

Taxes+Comissions (115 976) - - (115 976) - - - -

Levered Cashflow after taxes 442 250 (333 264) 103 849 (1 021 405) 1 693 070 - - -

Levered IRR before taxes 28,2%

Total Profits 558 226

Profit Multiple 1,5x

Levered IRR after taxes 21,8%

Total Profits 442 250

Profit Multiple 1,3x

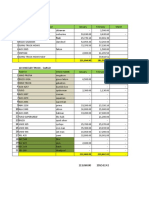

SHA Loan

Shareholders interest 10%

Maximum value to deduct 279 113

Total Loan (550 000) (550 000) (550 000) - - - -

Project Loan Estimate (464 390)

Real Loan (550 000) (550 000) - - - - - -

Real Loan Repayment 550 000 - - - 550 000 - - -

Interests (165 000) (55 000) (55 000) (55 000) - - - -

Acumulated interests OK (55 000) (110 000) (165 000) - - - -

Levered Cashflow before interests 393 226 (388 264) 48 849 (960 429) 1 693 070 - - -

Comission on Capital Raised 5% (27 500)

Taxes (IRC+Der.Mun) 23% (88 476)

Levered Cashflow 277 250 (388 264) 48 849 (1 076 405) 1 693 070 - - -

Equity return 442 250 (550 000) - 442 250 550 000 - - -

Loan (550 000) (550 000) - - - - - -

Loan Repayment 550 000 - - - 550 000 - - -

Profit 442 250 - - 442 250 - - -

Equity IRR 26,3%

Total Profits 442 250

Profit Multiple 1,8x

Cálculo Financeiro - CBS 636 1 de 1

You might also like

- Laurie Connell of RothwellsDocument9 pagesLaurie Connell of RothwellsAarthee SundaramNo ratings yet

- CAA UK December 2023 Air Transport Movements by AirportDocument2 pagesCAA UK December 2023 Air Transport Movements by AirportHarvey S.No ratings yet

- Investment Analysis - Saraiva 636 5Document1 pageInvestment Analysis - Saraiva 636 5urban.rise.worksNo ratings yet

- TURK PLAST (UPVC) 01-02-2021 OutstationDocument1 pageTURK PLAST (UPVC) 01-02-2021 OutstationicrcgisNo ratings yet

- General Ledgers (Admn Exp) 2011-12.Document207 pagesGeneral Ledgers (Admn Exp) 2011-12.Aamir HussainNo ratings yet

- Castrol DLP All India Eff 25mar2011Document1 pageCastrol DLP All India Eff 25mar2011anil_kumar1700No ratings yet

- Especie I II III IV V VI VII Viii Ix X XI XII AI BF TotalDocument3 pagesEspecie I II III IV V VI VII Viii Ix X XI XII AI BF TotalNikita PuertoNo ratings yet

- Chart Title: PhysicalDocument10 pagesChart Title: PhysicalEvelyn Agustin BlonesNo ratings yet

- QTY Tonage Polosan Assembly Assembly 2L Polosan Assembly Assembly 2LDocument1 pageQTY Tonage Polosan Assembly Assembly 2L Polosan Assembly Assembly 2LIbnu - CHCNo ratings yet

- CAA UK December 2023 Freight by Aircraft ConfigurationDocument2 pagesCAA UK December 2023 Freight by Aircraft ConfigurationHarvey S.No ratings yet

- RSH DailyReport 2022WR12023Document60 pagesRSH DailyReport 2022WR12023Adivia DragunsonNo ratings yet

- Daily Stock PositionDocument2 pagesDaily Stock PositionsaikiranNo ratings yet

- Fleet Management Funding Requirements 010420Document4 pagesFleet Management Funding Requirements 010420Tinashe pfumojenaNo ratings yet

- Kider Final Payment SoloDocument55 pagesKider Final Payment SoloAbel WonNo ratings yet

- Book 1Document27 pagesBook 1Muarleedharan RajanNo ratings yet

- Dredging Contractor Performance DataDocument8 pagesDredging Contractor Performance Dataorode franklynNo ratings yet

- Fps Daily Sell Out Report As of June 1-29-2023Document83 pagesFps Daily Sell Out Report As of June 1-29-2023Zed BanNo ratings yet

- Costs Per Unit May 2022Document18 pagesCosts Per Unit May 2022yokoyo2399No ratings yet

- Monotayud Precast Department CebuDocument9 pagesMonotayud Precast Department CebuJeffrey BeloyNo ratings yet

- Krishi Farm Naubise FPDocument5 pagesKrishi Farm Naubise FPRamHari AdhikariNo ratings yet

- SAMPLE Capital ExpenditureDocument1 pageSAMPLE Capital ExpenditureAmitNo ratings yet

- CAA UK December 2023 Air Transport Movements by TypeDocument2 pagesCAA UK December 2023 Air Transport Movements by TypeHarvey S.No ratings yet

- RECOUNTDocument103 pagesRECOUNTRex Jhong DayaNo ratings yet

- Safety Improvement Bigbag Tipping - Additional Fencing A1 20230919Document2 pagesSafety Improvement Bigbag Tipping - Additional Fencing A1 20230919Akhmad Fithroni Lubis HabibieNo ratings yet

- CAA UK December 2023 Aircraft MovementsDocument3 pagesCAA UK December 2023 Aircraft MovementsHarvey S.No ratings yet

- OC-CB-01 Rev DDocument192 pagesOC-CB-01 Rev DJorge Alejandro Fuentes AceitunoNo ratings yet

- (220606) Location of He (MS, Gam He)Document50 pages(220606) Location of He (MS, Gam He)elisa lantangNo ratings yet

- 333Document34 pages333Jamaladdim OmarovNo ratings yet

- Nascar11 VegasDocument55 pagesNascar11 VegasfclexNo ratings yet

- AR21 MaretDocument7 pagesAR21 Maretlusi sastriNo ratings yet

- EVNT 3G Project Progress 20100505 - 5 (1) .00PMDocument115 pagesEVNT 3G Project Progress 20100505 - 5 (1) .00PMthuandinhqhNo ratings yet

- Ssab - Q2 2021 - FDocument32 pagesSsab - Q2 2021 - FAlex NoNo ratings yet

- Cash Flow AnalysisDocument4 pagesCash Flow AnalysisVdvg SrinivasNo ratings yet

- Progress MD-2385 UPDATE 16 Oktober 2020-1Document6 pagesProgress MD-2385 UPDATE 16 Oktober 2020-1Yoga YuliantoNo ratings yet

- COMMISIONDocument1 pageCOMMISIONJohn WickNo ratings yet

- GASOLINE 2017 NewformatDocument53 pagesGASOLINE 2017 NewformatJonah RoldanNo ratings yet

- Department of Agrarian Reform R-3Document86 pagesDepartment of Agrarian Reform R-3abadfredNo ratings yet

- DCA CRI Medication Jan 2023Document1,047 pagesDCA CRI Medication Jan 2023fazulraby dawoodzayNo ratings yet

- Reconsilation Aggregate Upto Dec-2021Document42 pagesReconsilation Aggregate Upto Dec-2021Rajat SharmaNo ratings yet

- 02 FEBRUARY 2021 - Daily WW & STT Monitoring - CALVINS STOREDocument10 pages02 FEBRUARY 2021 - Daily WW & STT Monitoring - CALVINS STOREEvelyn Agustin BlonesNo ratings yet

- Name of ProjectDocument5 pagesName of ProjecthasbulrahmanNo ratings yet

- Cost of Rework - CurepipeDocument9 pagesCost of Rework - CurepipeANILNo ratings yet

- Format Balance SheetDocument22 pagesFormat Balance SheetAbhishek OjhaNo ratings yet

- Uli 2Document89 pagesUli 2Riyandi AcewNo ratings yet

- Oferta Educativa Economia 202451Document7 pagesOferta Educativa Economia 202451Julio Cesar Barradas GutierrezNo ratings yet

- OH6 Status On 31-07-23Document1 pageOH6 Status On 31-07-23Ajay KumarNo ratings yet

- Budget Planner PH - FINALDocument92 pagesBudget Planner PH - FINALkenji salongaNo ratings yet

- LTP - Working File B9 - Internal0628Document231 pagesLTP - Working File B9 - Internal0628sabna aliNo ratings yet

- Laporan Persediaan Obat Juli 2022Document506 pagesLaporan Persediaan Obat Juli 2022liandaNo ratings yet

- Income Tax Calculator FY 2022-23 (AY 2023-24) FormatDocument3 pagesIncome Tax Calculator FY 2022-23 (AY 2023-24) FormatAnkush SinghNo ratings yet

- Cheapest Call Girls in Paharganj 9599646485 Shot 1500 Night 6000 Booking Now Day/Night Doorstep Open 24/7 Hrs.Document1 pageCheapest Call Girls in Paharganj 9599646485 Shot 1500 Night 6000 Booking Now Day/Night Doorstep Open 24/7 Hrs.Billa SharmaNo ratings yet

- Contractors DataDocument9 pagesContractors Datahunain zafarNo ratings yet

- # of Contractors Employees April May Contractor Apr Wk1 Apr Wk2 Apr Wk3 Apr Wk4 May Wk1 May Wk2 TotalDocument9 pages# of Contractors Employees April May Contractor Apr Wk1 Apr Wk2 Apr Wk3 Apr Wk4 May Wk1 May Wk2 Totalhunain zafarNo ratings yet

- Teaching Hospital Balasore Column ScheduleDocument1 pageTeaching Hospital Balasore Column ScheduleTapan TapuNo ratings yet

- Column SceduleDocument1 pageColumn SceduleTapan TapuNo ratings yet

- Ipr2020 - Rosales, Josha IzzavelleDocument2 pagesIpr2020 - Rosales, Josha IzzavelleBaggyaro LaparanNo ratings yet

- Sus - Malaria: OP IP Sus Con D Sus Con D Sus Con D A B Dist. Fever CG Dengue Lepto HepatitisDocument2 pagesSus - Malaria: OP IP Sus Con D Sus Con D Sus Con D A B Dist. Fever CG Dengue Lepto HepatitisGusdanNo ratings yet

- Sales & Key Account ManagementDocument46 pagesSales & Key Account Managementamitmahar100% (2)

- Investment Analysis - Saraiva 636 6Document1 pageInvestment Analysis - Saraiva 636 6urban.rise.worksNo ratings yet

- Economics II Sheet 2Document6 pagesEconomics II Sheet 2Anushka KallaNo ratings yet

- Will Cha KWL Chart Handout VDocument3 pagesWill Cha KWL Chart Handout Vapi-412112868No ratings yet

- Financial Accounting For OnlineDocument137 pagesFinancial Accounting For OnlineAmity-elearning100% (1)

- Lenton Terminator: FeaturesDocument1 pageLenton Terminator: FeaturesHao LuoNo ratings yet

- Received Copy LogDocument4 pagesReceived Copy LogRegine LetchejanNo ratings yet

- EDIT PNF Sept 26 2014Document14 pagesEDIT PNF Sept 26 2014straywolf0No ratings yet

- Vietnam TodayDocument5 pagesVietnam TodayEsteemed AquarianNo ratings yet

- Mastercard Foundation Scholars Program Scholar Entrepreneurship FundDocument3 pagesMastercard Foundation Scholars Program Scholar Entrepreneurship FundHilario MacNo ratings yet

- Innovative Windoors (Hyd) : GST No.: 36DEQPM7309P1ZK Proforma InvoiceDocument1 pageInnovative Windoors (Hyd) : GST No.: 36DEQPM7309P1ZK Proforma InvoiceSHIVA KUMARNo ratings yet

- Petition of Ad Hoc Coalition - Exhibit ADocument93 pagesPetition of Ad Hoc Coalition - Exhibit ANew York PostNo ratings yet

- CMHA Presentation - January 19, 2022Document47 pagesCMHA Presentation - January 19, 2022WVXU NewsNo ratings yet

- C31 D32 M30 O7Document11 pagesC31 D32 M30 O7Cynthia SuJinNo ratings yet

- Jet Airways FinalDocument34 pagesJet Airways Finalruchi0070No ratings yet

- NRO Vs NREDocument3 pagesNRO Vs NREsushantNo ratings yet

- Regional Economic IntegrationDocument39 pagesRegional Economic IntegrationBikash Sahu100% (1)

- The Green AgendaDocument71 pagesThe Green AgendaJack CarneyNo ratings yet

- Exchange Rate 30 January 2024Document2 pagesExchange Rate 30 January 2024mail.bdoaa2022No ratings yet

- Workshop & Comparison On IarDocument16 pagesWorkshop & Comparison On IarKalyanjit NayakNo ratings yet

- UOB Personal Loan - Application FormDocument6 pagesUOB Personal Loan - Application FormmohdaziehanNo ratings yet

- PTB-STBT 28 Feb 2020Document9 pagesPTB-STBT 28 Feb 2020Monimoy DebNo ratings yet

- How Honda Localizes Its Global Strategy (Fernando)Document3 pagesHow Honda Localizes Its Global Strategy (Fernando)Tu Anh NguyenNo ratings yet

- Evolution of Investment BankingDocument2 pagesEvolution of Investment BankingAmritha AshokNo ratings yet

- Himachal Pradesh District Factbook - Bilaspur DistrictDocument32 pagesHimachal Pradesh District Factbook - Bilaspur DistrictDatanet IndiaNo ratings yet

- Escario Vs NLRCDocument10 pagesEscario Vs NLRCnat_wmsu2010No ratings yet

- Space MatrixDocument9 pagesSpace MatrixKrisca DepalubosNo ratings yet

- HistoryDocument23 pagesHistoryJanjan IruguinNo ratings yet

- 1Document313 pages1Mehdi MoNo ratings yet

- Oil & Gas Industry in IndonesiaDocument17 pagesOil & Gas Industry in IndonesiaSuleiman BaruniNo ratings yet

- 04 BLC Leaflet EnglishDocument2 pages04 BLC Leaflet EnglishAnonymous Of0C4dNo ratings yet