Professional Documents

Culture Documents

AG218 Sem 2 Tutorial 7 Questions

Uploaded by

jmerrylees15Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AG218 Sem 2 Tutorial 7 Questions

Uploaded by

jmerrylees15Copyright:

Available Formats

AG218

SEMESTER 2 WEEK 8 TUTORIAL

1. Why is it necessary to revalue a company’s assets before an acquisition?

2. Austin Plc. has acquired Dudley Ltd. for £8,000,000. At the point of acquisition

Dudley had share capital of £1,000,000 and retained earnings of £5,000,000. All the

assets at acquisition were held at their carrying value with the exception of

inventories which are considered to be worth £200,000 more than their carrying

amount.

Calculate the goodwill at acquisition.

3. Maclean Ltd. has acquired Harper Ltd. for £9,000,000. At the point of acquisition

Harper had share capital of £2,000,000, retained earnings of £6,000,000 and PPE

with a value of £4,000,000. All the assets at acquisition were held at their carrying

value with the exception of PPE which are considered to be worth £800,000 more

than their carrying amount. These items of PPE have a useful life of 10 years.

a. Calculate the goodwill at acquisition.

b. Calculate the value of PPE at the end of the year.

4. Angus Ltd. acquires Crieff Ltd. on 1 April 20X7 for £14,000,000 cash. At the point of

acquisition Crieff had retained earnings of £8,500,000. Below are the statements of

financial position of Angus and Crieff as at 31 March 20X8.

The carrying amount of Crieff’s assets at acquisition is considered to be equal to their

fair value with the exception of PPE; where items of PPE with a remaining useful life

of 5 years are considered to be worth £500,000 more than their carrying value.

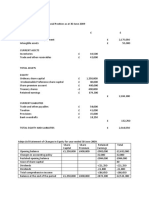

£’000 Angus Crieff

Property plant and equipment 19,000 7,000

Investment in Crieff 14,000 -

Current assets 9,000 5,000

TOTAL ASSETS 42,000 12,000

Share capital 5,000 2,000

Retained earnings 33,000 9,000

Current liabilities 4,000 1,000

TOTAL EQUITY + LIABILITIES 42,000 12,000

Prepare the group statement of financial position of the Angus group as at 31 March

20X8.

5. Outline some reasons why goodwill may be considered to be impaired.

6. Leeds Ltd. has acquired Bradford Ltd. for £12,000,000. At the point of acquisition

Bradford had share capital of £2,000,000 and retained earnings of £8,000,000. All

the assets at acquisition were held at their carrying value with the exception of

inventory which is considered to be worth £500,000 more than their carrying

amount. At the year-end goodwill is considered to be 15% impaired.

a. Calculate the goodwill at acquisition.

b. Calculate the value of goodwill at the end of the year.

7. Leopard Ltd. acquires Lion Ltd. on 1 July 20X8 for £15,000,000 cash. At the point of

acquisition Lion had retained earnings of £7,000,000. Below are the statements of

financial position of Leopard and Lion as at 30 June 20X9.

The carrying amount of Lion’s assets at acquisition is considered to be equal to their

fair value with the exception of:

PPE: where items of PPE with a remaining useful life of 5 years are considered to be

worth £800,000 more than their carrying value.

Inventories: Where inventories are considered to be worth £200,000 more than their

carrying value. All the inventories at acquisition had been sold by the year end.

At the year-end goodwill was considered to be 25% impaired.

£’000 Leopard Lion

Property plant and equipment 17,000 6,000

Investment in Lion 15,000 -

Inventories 4,000 1,000

Other current assets 7,000 4,000

TOTAL ASSETS 43,000 11,000

Share capital 6,000 2,000

Retained earnings 34,000 7,500

Current liabilities 3,000 1,500

TOTAL EQUITY + LIABILITIES 43,000 11,000

Prepare the group statement of financial position of the Leopard group as at 30 June

20X9.

You might also like

- AG218 Sem 2 Tutorial 6 QuestionsDocument4 pagesAG218 Sem 2 Tutorial 6 Questionsjmerrylees15No ratings yet

- Cpareviewschoolofthephilippines ChanchanDocument8 pagesCpareviewschoolofthephilippines ChanchanDavid David100% (1)

- FR 2018 Paper FinalDocument65 pagesFR 2018 Paper FinalshashalalaxiangNo ratings yet

- Week 2 - Exercise QuestionDocument2 pagesWeek 2 - Exercise Questionkk23212No ratings yet

- ACW366 - Tutorial Exercises 4 PDFDocument6 pagesACW366 - Tutorial Exercises 4 PDFMERINANo ratings yet

- Business Combination NotesDocument3 pagesBusiness Combination NotesKenneth Calzado67% (3)

- Business CombinationDocument1 pageBusiness CombinationNicki Salcedo0% (2)

- Business CombinationDocument3 pagesBusiness Combinationlov3m3No ratings yet

- Week 9 Liveonline QuestionDocument2 pagesWeek 9 Liveonline QuestionZHANG EmilyNo ratings yet

- AFAR - 07 - New Version No AnswerDocument7 pagesAFAR - 07 - New Version No AnswerjonasNo ratings yet

- ACW366 - Tutorial Exercises 6 PDFDocument7 pagesACW366 - Tutorial Exercises 6 PDFMERINANo ratings yet

- Bus Com Nvestment in Associates, Consolidated EtcDocument4 pagesBus Com Nvestment in Associates, Consolidated EtcAlaine Doble CPANo ratings yet

- Answer Activity 1 BuscomDocument3 pagesAnswer Activity 1 BuscomAngelie MacabudbudNo ratings yet

- ACCTG 14 Lesson 1 Introduction To Business Combination ExercisesDocument4 pagesACCTG 14 Lesson 1 Introduction To Business Combination ExercisesRUBIO FHEA J.No ratings yet

- Week 8 Liveonline QuestionDocument2 pagesWeek 8 Liveonline QuestionZHANG EmilyNo ratings yet

- 1 The Directors of Origami Plc. Have Decided To Merge Another Company, Technova Plc. and FormDocument4 pages1 The Directors of Origami Plc. Have Decided To Merge Another Company, Technova Plc. and FormŠhäx ÑăäNo ratings yet

- Accounting For Business Combinations Pre 7 - Midterm QuizzesDocument2 pagesAccounting For Business Combinations Pre 7 - Midterm QuizzesJalyn Jalando-onNo ratings yet

- Accounting For Business Combinations Pre 7 - Midterm QuizzesDocument2 pagesAccounting For Business Combinations Pre 7 - Midterm QuizzesJalyn Jalando-onNo ratings yet

- Straight ProblemsDocument12 pagesStraight Problemsnana100% (2)

- HO1 Partnership Formation and OperationDocument3 pagesHO1 Partnership Formation and OperationChristianAquinoNo ratings yet

- Revision Pack QuestionsDocument12 pagesRevision Pack QuestionsAmmaarah PatelNo ratings yet

- Consolidation at The Date of Acquisition Problems Problem IDocument2 pagesConsolidation at The Date of Acquisition Problems Problem ISean Sanchez0% (1)

- Chapter 1 - Question 1Document4 pagesChapter 1 - Question 1Sophie ChopraNo ratings yet

- Topic 10 - Practice ProblemsDocument2 pagesTopic 10 - Practice ProblemsAnna Mariyaahh DeblosanNo ratings yet

- BUSCOM ActivityDocument14 pagesBUSCOM ActivityLerma MarianoNo ratings yet

- B. P17,600,000 C. P26,200,000 D. P18,200,000Document2 pagesB. P17,600,000 C. P26,200,000 D. P18,200,000Wawex DavisNo ratings yet

- Business CombinationDocument10 pagesBusiness CombinationLora Mae JuanitoNo ratings yet

- Chapter 19 Exercises & ProblemsDocument10 pagesChapter 19 Exercises & ProblemsRiza Mae AlceNo ratings yet

- ACW366 - Tutorial Exercises 5 PDFDocument5 pagesACW366 - Tutorial Exercises 5 PDFMERINANo ratings yet

- PRACTICAL FINANCIAL ACCOUNTING - Volume 1Document33 pagesPRACTICAL FINANCIAL ACCOUNTING - Volume 1KingChryshAnneNo ratings yet

- Accounting For Business CombinationsDocument5 pagesAccounting For Business CombinationsJohn JackNo ratings yet

- Consolidated Accounts QuestionsDocument10 pagesConsolidated Accounts QuestionsGiedrius SatkauskasNo ratings yet

- Class 2 HomeworkDocument7 pagesClass 2 HomeworkAngel MéndezNo ratings yet

- FR 2018 Paper PrelimDocument12 pagesFR 2018 Paper PrelimshashalalaxiangNo ratings yet

- Lesson 3. CONSOLIDATED FINANCIAL STATEMENTSDocument5 pagesLesson 3. CONSOLIDATED FINANCIAL STATEMENTSangelinelucastoquero548No ratings yet

- Cfas Pfa 01Document194 pagesCfas Pfa 01Kimberly Claire Atienza100% (1)

- Chapter 1 - Statement of Financial Position: Problem 1-1 (IFRS)Document38 pagesChapter 1 - Statement of Financial Position: Problem 1-1 (IFRS)Asi Cas Jav0% (1)

- Quiz 1 - Midterm ReviewerDocument4 pagesQuiz 1 - Midterm ReviewerJack HererNo ratings yet

- Example Problems W Solutions in SFP & SCFDocument7 pagesExample Problems W Solutions in SFP & SCFQueen Valle100% (1)

- Exercise Answers - AcquisitionDocument26 pagesExercise Answers - AcquisitionJohn Philip L Concepcion100% (1)

- Business Combination 2Document3 pagesBusiness Combination 2Jamie RamosNo ratings yet

- HI 5020 Corporate Accounting: Session 8b Intra-Group TransactionsDocument16 pagesHI 5020 Corporate Accounting: Session 8b Intra-Group TransactionsFeku RamNo ratings yet

- 6 Advanced Accounting 2DDocument3 pages6 Advanced Accounting 2DRizky Nugroho SantosoNo ratings yet

- FS AnalysisDocument1 pageFS AnalysisJoeNo ratings yet

- Assignment Intangible Assets GoodwillDocument3 pagesAssignment Intangible Assets Goodwilldayannaaa0304No ratings yet

- Name: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationDocument2 pagesName: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationLiezelNo ratings yet

- Business Combination-Acquisition of Net AssetsDocument2 pagesBusiness Combination-Acquisition of Net AssetsMelodyLongakitBacatanNo ratings yet

- Acct 108 Accounting For Business Combinations Quiz 3 - Consolidated Financial StatementsDocument5 pagesAcct 108 Accounting For Business Combinations Quiz 3 - Consolidated Financial StatementsGround ZeroNo ratings yet

- Drill 5 - Business Com, Consolidted FS, Forex - For Print FSUU AccountingDocument5 pagesDrill 5 - Business Com, Consolidted FS, Forex - For Print FSUU AccountingRobert CastilloNo ratings yet

- Chapter-01 Introduction Accounting Principles SDocument10 pagesChapter-01 Introduction Accounting Principles SShifatNo ratings yet

- FAR Test BankDocument17 pagesFAR Test BankMa. Efrelyn A. BagayNo ratings yet

- Bus Com 12Document3 pagesBus Com 12Chabelita MijaresNo ratings yet

- BE - Stockholders' Equity ADocument5 pagesBE - Stockholders' Equity ALuis JoseNo ratings yet

- Activity 2 - Alaska Company - ADEVA, MKADocument3 pagesActivity 2 - Alaska Company - ADEVA, MKAMaria Kathreena Andrea AdevaNo ratings yet

- Finaltest Advanced2023 (N)Document3 pagesFinaltest Advanced2023 (N)JeonNo ratings yet

- BE - Stockholders' Equity QADocument4 pagesBE - Stockholders' Equity QALuis JoseNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Chap005-Consolidation of Less-Than-Wholly Owned SubsidiariesDocument71 pagesChap005-Consolidation of Less-Than-Wholly Owned Subsidiaries_casals100% (3)

- Poa Lessons NotesDocument26 pagesPoa Lessons NotesAliyah AliNo ratings yet

- Financial Management 3B LAO FinalDocument7 pagesFinancial Management 3B LAO Final221103909No ratings yet

- Women in Banking 40m (Empty)Document338 pagesWomen in Banking 40m (Empty)El rincón de las 5 EL RINCÓN DE LAS 5No ratings yet

- Quiz No. 3Document4 pagesQuiz No. 3abbyNo ratings yet

- AC1101 Syllabus StudentDocument3 pagesAC1101 Syllabus StudentJerson AmbalNo ratings yet

- Higher Secondary Accounts Syllabus NewDocument10 pagesHigher Secondary Accounts Syllabus NewBIKASH166No ratings yet

- Operating and Financial Leverage: Block, Hirt, and DanielsenDocument31 pagesOperating and Financial Leverage: Block, Hirt, and DanielsenOona NiallNo ratings yet

- Firms With Negative EarningsDocument10 pagesFirms With Negative Earningsakhil reddy kalvaNo ratings yet

- T. Y. B. Com Cost Accounting Sem V: Questions A B C D SolutionDocument16 pagesT. Y. B. Com Cost Accounting Sem V: Questions A B C D SolutionSatyam TiwariNo ratings yet

- Dissolution LiquidationDocument9 pagesDissolution LiquidationCha FeudoNo ratings yet

- ACCA SBR Technical ArticlesDocument60 pagesACCA SBR Technical ArticlesReem JavedNo ratings yet

- HandOut No. 3 ParCor Partnership DissolutionDocument9 pagesHandOut No. 3 ParCor Partnership Dissolutionnatalie clyde matesNo ratings yet

- T AccountDocument2 pagesT AccountNichole John ErnietaNo ratings yet

- Test Business and FinanceDocument1 pageTest Business and FinanceKarem Yessenia OCHOCHOQUE SÁNCHEZNo ratings yet

- Cash and Cash EquivalentDocument32 pagesCash and Cash EquivalentArbie D. DecimioNo ratings yet

- 2012 Paper F9 Mnemonics and Charts Sample Download v1Document55 pages2012 Paper F9 Mnemonics and Charts Sample Download v1Yashvin AlwarNo ratings yet

- Picarra, Sherilyn - PROBLEM 8-4Document2 pagesPicarra, Sherilyn - PROBLEM 8-4Sherilyn PicarraNo ratings yet

- Module 1 - Basic AccountingDocument61 pagesModule 1 - Basic AccountingGILBERT BANTANo ratings yet

- Business Mathematics AssignmentDocument4 pagesBusiness Mathematics AssignmentGhulam Muhammad BismilNo ratings yet

- Tugas Kelompok 9Document7 pagesTugas Kelompok 9Bought By UsNo ratings yet

- Preparation and Presentation of Financial Statements of IAS 1Document7 pagesPreparation and Presentation of Financial Statements of IAS 1Md AladinNo ratings yet

- ValuationExample 1Document20 pagesValuationExample 1dryftgNo ratings yet

- Interim Financial ReportingDocument37 pagesInterim Financial ReportingDebbie Grace Latiban LinazaNo ratings yet

- Topic 2: Manufacturing Cost Concept and ComponentsDocument7 pagesTopic 2: Manufacturing Cost Concept and ComponentsAnice WongNo ratings yet

- Financial Accounting Nestle Case StudyDocument12 pagesFinancial Accounting Nestle Case Studyscholarsassist100% (2)

- Danone - Interim Financial Report 2017Document39 pagesDanone - Interim Financial Report 2017Vonn KakNo ratings yet

- Question 1Document15 pagesQuestion 1Cale HenituseNo ratings yet

- Horizontal and Vertical Analysis of Maruti SuzukiDocument31 pagesHorizontal and Vertical Analysis of Maruti SuzukiAnushka GuptaNo ratings yet

- Charts of AccountsDocument7 pagesCharts of Accountszindabhaag100% (1)